Trezor, the hardware wallet brand by SatoshiLabs, stands as a key player in crypto security. Today, its workforce size, hiring pace, and global footprint reflect its maturing status in a volatile industry. Whether deploying firmware updates or expanding its product line, Trezor’s team dynamics shape both innovation and trust in the hardware wallet market.

In real-world terms, an increase in employees allows Trezor to accelerate the development of features like passphrase protection and multiprotocol support. Also, a strong engineering and support team matters when responding to security incidents or coordinating with regulators. Read on to see the latest numbers, growth trends, and what they mean for Trezor’s future.

How Many People Work At Trezor?

- Trezor is estimated to have 175 employees as of 2025.

- That reflects an employee growth of about 34% over the past year.

- With an estimated revenue of $47.2 million and 175 employees, Trezor’s revenue per employee is approximately $269,500.

- Trezor’s estimated annual revenue is $47.2 million currently.

- On LinkedIn and Glassdoor, the company is categorized in the “51‑200 employees” size bracket.

- The headquarters is in Prague, the Czech Republic.

- Trezor’s industry classification is “Consumer Electronics”, “Hardware wallet/security device.”

Recent Developments

- Over the past year, Trezor’s headcount rose by approximately 34%, indicating an aggressive hiring phase.

- On Glassdoor, Trezor is still listed within 51‑200 total employees, suggesting growth has kept within that range.

- Trezor’s revenue estimates ($47.2 million) show that its financials are scaling roughly in line with employee growth, but profit margins or R&D costs are not transparent.

- Trezor’s product line (hardware + software) continues expanding, which likely requires bolstering firmware, UX, and support teams to handle broader blockchain compatibility.

- As of September 2025, Glassdoor lists Trezor’s culture and values rating at 4.6/5 and diversity and inclusion at approximately 3.9/5.

Trezor’s Current Team (Key People)

- Matěj Žák, CEO of Trezor. Previously Chief Product Officer, he was promoted to CEO in early 2023. Focuses on usability, product design, growth, and scaling.

- Marek “Slush” Palatinus, Co‑founder. Though no longer CEO, he remains in Trezor, guiding strategic, technical, and visionary direction for the company.

- Pavol Rusnák, Co‑founder. One of the original creators/founders of Trezor plays a continuing role, especially around technical leadership.

- Jiří Kroulík, Spokesperson. Acts as a public point of contact and handles messaging, media interactions, and external communications.

- Anusha Schindler, Marketing Manager. Leads marketing operations, branding, community engagement, and partnerships, often representing Trezor in external events.

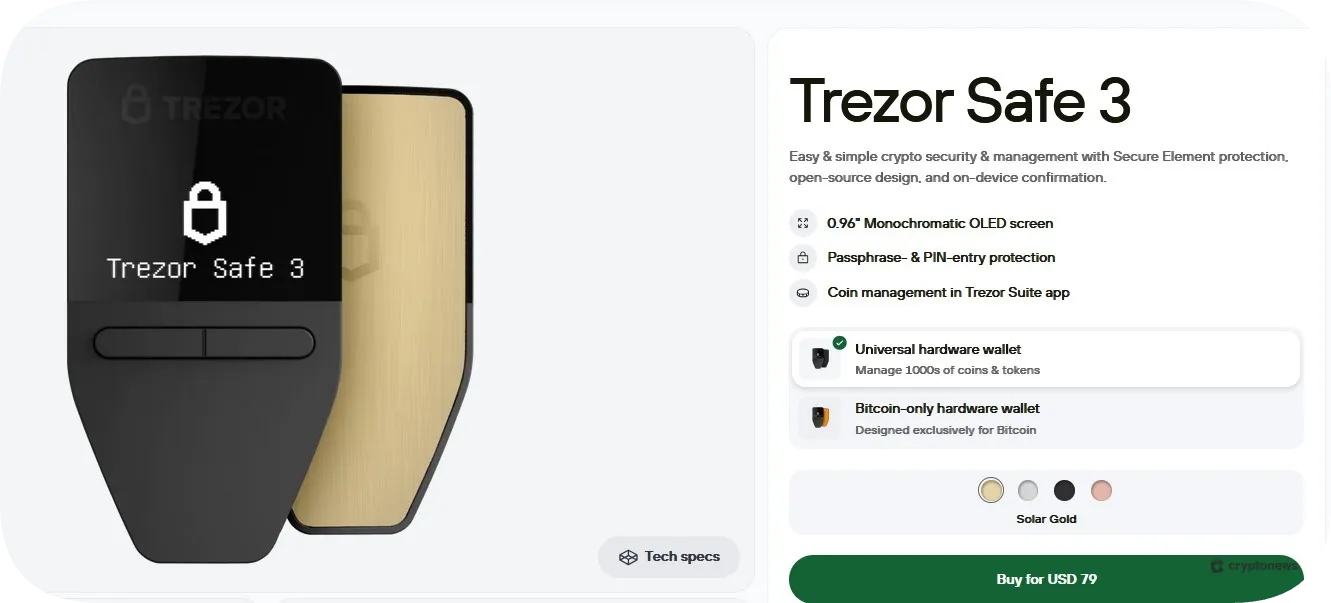

Trezor Safe 3: Key Features and Specs

- Trezor Safe 3 is a secure hardware wallet designed for simple crypto management and maximum protection.

- Features a 0.96-inch monochromatic OLED screen for easy on-device confirmation.

- Equipped with Secure Element protection to safeguard against physical attacks.

- Includes PIN-entry and optional passphrase protection for added security.

- Supports coin management via the Trezor Suite app, available on desktop and mobile.

- Available in two models:

- ✅ Universal Wallet that supports thousands of coins and tokens.

- 🟧 Bitcoin-only Wallet designed exclusively for Bitcoin users.

- Retail price starts at $79.

- Color options include Solar Gold, Black, White, and Rose Pink.

Workforce Overview

- The best estimate for the total number of employees in 2025 is about 175 people.

- Earlier reports (e.g., ContactOut) suggested Trezor had between 51 and 200 employees, which aligns with current estimates.

- Employee growth over the past year is ~34%, suggesting ~130 employees a year earlier.

- Revenue per employee (≈ $269,500) implies the company is maintaining reasonable headcount efficiency.

- Trezor is part of SatoshiLabs, which may have overlapping staffing, but Trezor’s headcount is specifically for the Trezor product operations.

- Roles likely cover hardware engineering, firmware, software (Trezor Suite), customer support, security, compliance, and general functions (HR, operations).

- The company’s employee base is small enough that small shifts (adding 20‑30 people) make meaningful percentage changes.

Employee Statistics by Year

- In ~2024, the estimated employee count was around 130, based on back‑calculating 34% growth to 175 in 2025.

- That implies in 2023, the workforce was smaller yet, perhaps around 100‑110 employees, though I found no definitive public source for those earlier values.

- On Glassdoor, the company size indicator has consistently been “51‑200” for several years, which implies sustained growth but not massive expansion (i.e., not into the thousands).

- Employee reviews have increased in number, giving more feedback on culture, work environment, and compensation, though not quantifying the number of reviews by year.

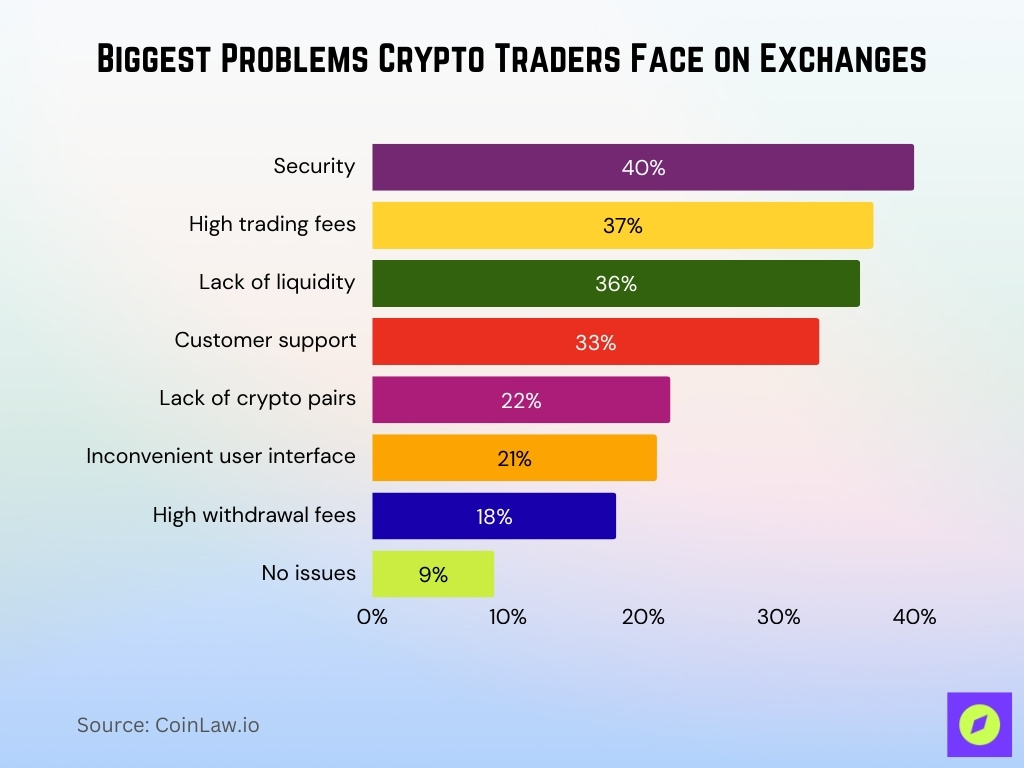

Biggest Problems Crypto Traders Face on Exchanges

- 40% of traders say security is the top concern on crypto exchanges.

- 37% are frustrated by high trading fees that cut into profits.

- 36% report a lack of liquidity, making trades harder to execute.

- 33% cite poor customer support as a major issue.

- 22% mention a limited selection of crypto pairs as a drawback.

- 21% are dissatisfied with inconvenient user interfaces.

- 18% are impacted by high withdrawal fees when moving funds.

- Only 9% of respondents say they have no issues with exchanges.

Trezor Team Size Growth Rate

- Trezor’s estimated workforce increased by ~34% from 2024 to 2025 (from ~130 to ~175 employees).

- That growth rate (≈34%) is well above many startup‑hardware/security companies, which tend to grow ~15‑25% annually in similar stages.

- Over the prior period (2023→2024), the implied growth (if beginning from ~100‑110 in 2023 to ~130 in 2024) is ~18‑30%.

- There is no public record of major layoffs in 2024‑2025 for Trezor, suggesting growth was net positive rather than recovery from cuts.

- For comparison, many tech hardware/security companies saw reduced hiring in 2024 due to macroeconomic pressures; Trezor’s rise stands out.

- Trezor’s revenue per employee (~$269,500) aligns with this growth, suggesting hiring has tracked business needs rather than speculative expansion.

- Because the total is still under ~200 people, each hire has a noticeable effect on percentage growth.

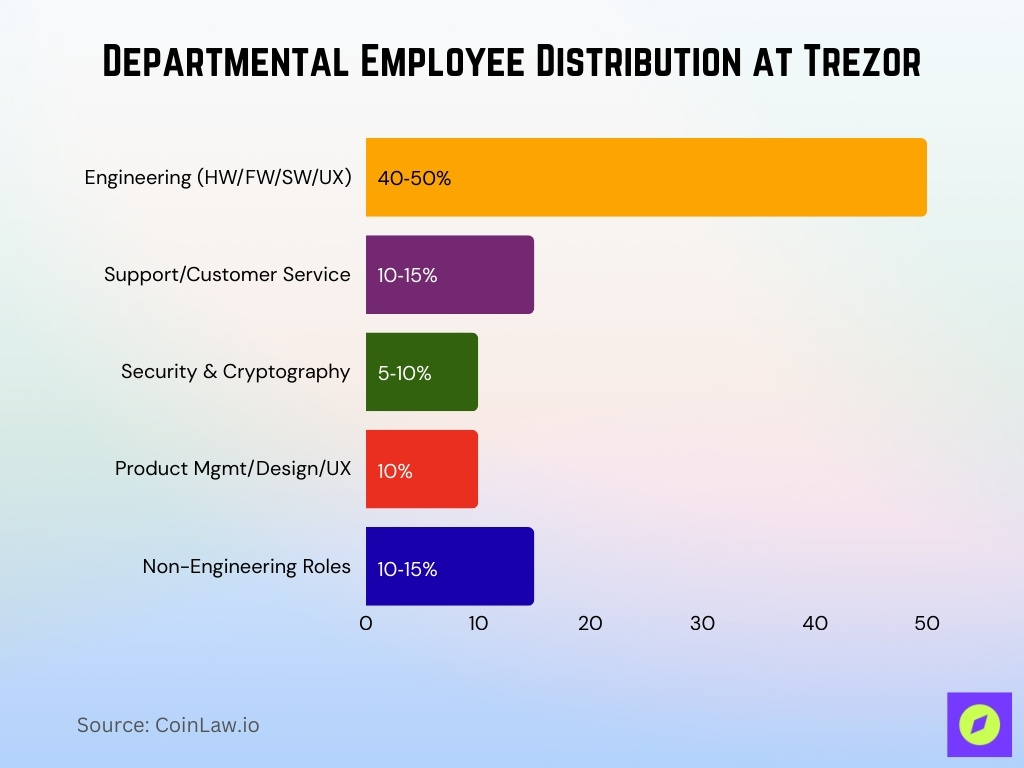

Trezor Employee Distribution by Department

- Key departments likely include Firmware/Hardware Engineering, Software/UX Development (for Trezor Suite), Security & Cryptography, Customer Support, Compliance / Legal / Regulatory, Operations / HR / Administration.

- Engineering roles probably account for the largest share, likely 40‑50% of the team in total.

- Support / Customer Service may be ~10‑15%, given that hardware wallet products require technical support.

- Security / Cryptography roles are likely somewhat significant but smaller in number (maybe 5‑10%), given Trezor’s strong security branding.

- Product management, design, and UX likely represent another ~10%.

- Non‑engineering roles (HR, operations, finance) likely make up ~10‑15%.

Diversity and Inclusion at Trezor

- In the broader tech/hardware realm, job seekers’ priority placed on DEI has risen; ~76% of job seekers say diversity is a key factor when choosing a job.

- For comparison companies, “diverse companies are 35% more likely to outperform their competitors.”

- Because Trezor operates in Europe (the Czech Republic), regional labor laws require certain inclusion/equality practices, which may affect hiring.

- Given remote role opportunities, there is potential to increase geographic/gender diversity.

- However, without published data, it’s unclear how far Trezor has progressed relative to those potentials.

Trezor Hiring Trends

- Trezor has been hiring more aggressively in 2024‑2025, reflected in the ~34% headcount increase.

- Job postings in engineering, firmware development, UX / UI, and customer support are appearing more often in online job platforms.

- Remote work options seem more common in recent job adverts, suggesting Trezor is tapping into global talent pools rather than only local hires.

- Trezor likely faces similar hiring challenges to other tech firms, competition for security/cryptography talent, and rising salary demands, especially in Europe.

- Hiring appears steady rather than reactive; no public record of mass layoffs or hiring freezes in 2025.

- The company’s size (still under 200) means each new hire likely brings significant impact.

- There is some indication that many roles are hybrid or allow flexibility, aligning with broader global trends.

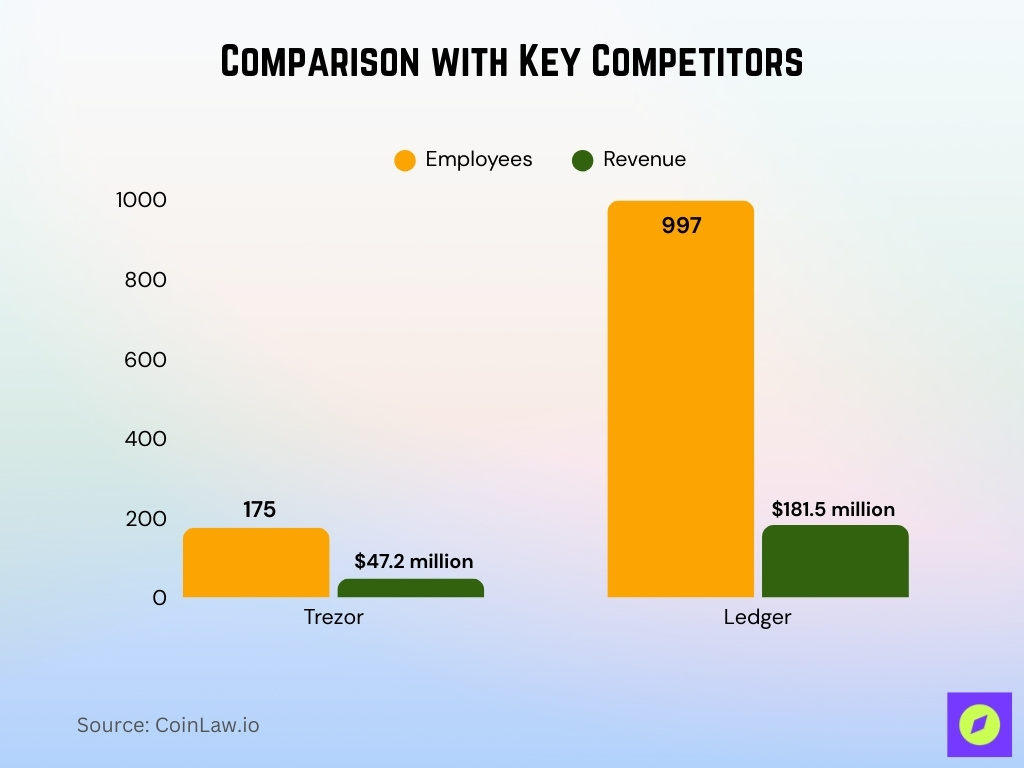

Comparison With Other Crypto Companies

- Ledger Wallet has about 997 employees as of 2025, far more than Trezor’s 175 employees.

- Ledger’s annual revenue is approximately $181.5 million, almost 4× Trezor’s (~$47.2 million).

- Ledger saw a slight decline in headcount in the past year (−2%), unlike Trezor’s ~34% growth.

- Market share, while Trezor is among the well-known hardware wallet brands, Ledger generally leads in unit sales and geographic distribution.

- In the context of revenue per employee, Trezor (~$269,500) surpasses many larger firms in efficiency. Ledger’s revenue per employee is lower (approx $182,000).

- Other prominent hardware wallet/crypto security players (e.g., Tangem) are expanding product lines and features.

- Larger firms like Coinbase (~8,800+ employees) dwarf Trezor in employee size, but also handle many more lines of business.

Company Culture and Work Environment

- Glassdoor rates Trezor culture & values at 4.6/5, among the highest categories for the company.

- Diversity, Equity & Inclusion rating is lower, ~3.9/5, indicating room for improvement in that area.

- Employees report that strong work/life balance and flexible hours are positively viewed.

- Reviewers mention a flat and informal structure, and access to senior leadership is easier than in larger firms.

- Some complaints, as Trezor has grown, processes (communication, operational formalism) are sometimes said to lag behind.

- The open‑source nature of parts of Trezor’s firmware/software is widely praised in culture reviews for transparency.

- The company location (Prague) tends to attract European talent, although remote options allow for a wider geographic spread.

Notable Milestones and Expansion

- Trezor launched the original hardware wallet (Model One) in 2014, marking a foundational product for the company and the hardware wallet industry.

- “Wrapping up 2023, A year of growth and innovation at Trezor” describes product line advancements, broader firmware ecosystem improvements.

- The open‑source firmware and software ecosystem continues to expand, with community contributions being a key feature.

- Trezor has celebrated more than 10 years in the hardware wallet market as of 2024.

- The hardware wallet market, of which Trezor is among the leaders, is expanding fast, global market size estimated at $511.46 million in 2024 and a forecast reaching $7,131.67 million by 2033.

- More devices and models are released over time (Model Trezor One, Safe series, etc.), supporting more coins/blockchains, and enhanced security features.

Impact of Trezor’s Team on Product Development

- With around 175 employees, Trezor has sufficient manpower to accelerate firmware updates, enhance device security, and expand compatibility with blockchains.

- The engineering, security, and firmware teams are likely major drivers behind product features that users care about, secure chips, open‑source code, passphrase handling, and the user interface.

- The growth rate (~34%) implies Trezor is investing in scaling its product roadmap rather than plateauing.

- Remote and hybrid hiring means broader talent pools, more specialized skills available.

- Strong culture (work/life balance, informal structure) may contribute to higher employee satisfaction and thus lower turnover, positively affecting product continuity.

- Milestone achievements (10-year anniversaries, market growth) tend to energize R&D and public trust, indirectly helping product adoption.

- Feedback from users and the community (since firmware/software is open source) can more directly feed into product improvements.

Frequently Asked Questions (FAQs)

About 175 employees.

Approximately 34% growth year‑over‑year.

Around $269,500 per employee.

Roughly $47.2 million per year.

“51‑200 employees” size bracket.

Conclusion

Trezor today is no longer a small niche player; it’s a lean, fast‑growing company with ~175 employees, strong revenue per head, and a roadmap pushed forward by its engineering and security strengths. Compared to giants like Ledger, Trezor trades scale for nimbleness, emphasizing culture, flexibility, and open‑source credibility. While it doesn’t dominate employee count or global footprint, its impact on product innovation and trust in crypto security is very visible.