The payments-technology firm Braintree has been quietly shaping the online commerce world for years. With backing from PayPal Holdings and a global footprint, its workforce size tells a story of scale, focus, and strategic direction. In industries ranging from e-commerce startups to major marketplaces, Braintree’s staffing levels reflect its ambition and role in the payments ecosystem. Let’s dive into how many people work at Braintree today, and why that matters for its business capability, growth, and competitive positioning.

How Many People Work at Braintree?

- Third-party sources estimate Braintree’s headcount to be between 5,000-5,500 as of late 2025.

- Braintree supports merchants in more than 45 countries and 130+ currencies.

- Braintree is part of PayPal’s enterprise payments business with $1.53 trillion payment volume in 2023.

- The majority of Braintree’s merchant-clients are small businesses (6,983 firms with 1-10 employees).

- The current growth trajectory reflects Braintree’s expanding global infrastructure and staffing scale.

Recent Developments

- As of September 2025, Braintree’s approximate revenue stands at $750 million.

- In 2023, Braintree (via PayPal) reported processing $1.53 trillion in payment volume.

- Market-intelligence profiles now classify Braintree within the 5,000–5,500 employees bracket, signaling substantial growth since 2023.

- Braintree’s merchant usage breakdown shows small firms (1–10 employees) dominate with 6,983 companies in that size band.

- Braintree’s revenue estimates fall in the $500–900 million band, aligning with its expanded workforce scale.

- This workforce expansion suggests Braintree remains central to PayPal’s payments infrastructure and global operations.

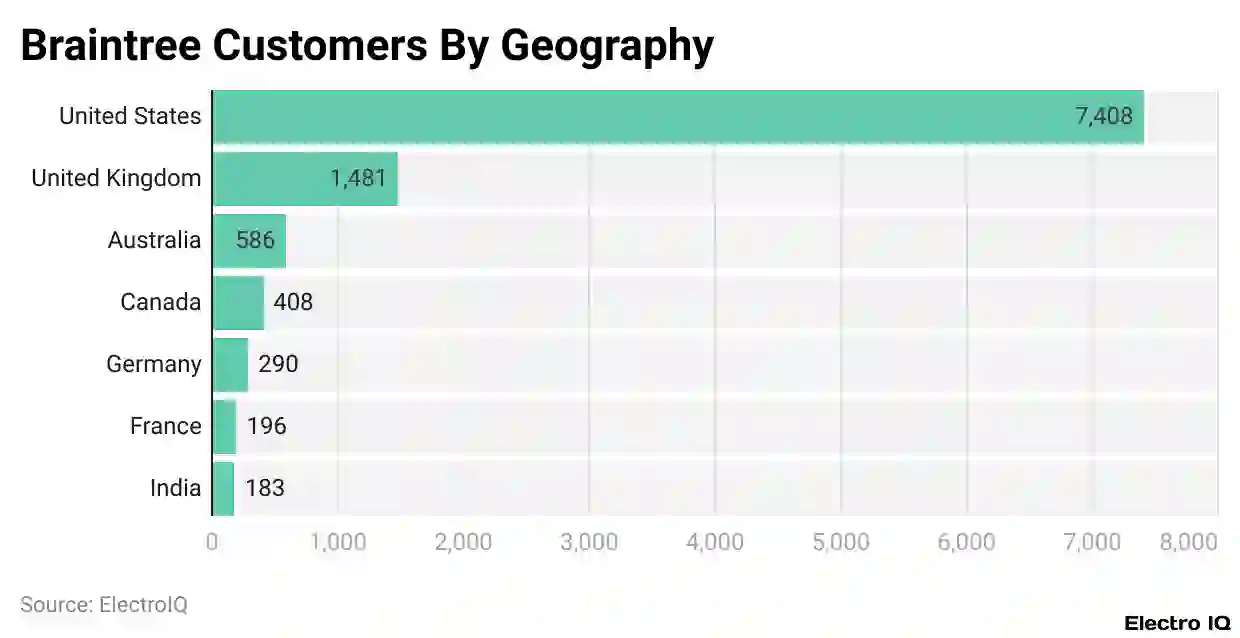

Braintree Customers by Geography

- The United States dominates Braintree’s customer base with 7,408 clients, highlighting its strong adoption among U.S. businesses.

- The United Kingdom ranks second with 1,481 customers, reflecting a solid presence in Europe’s fintech landscape.

- Australia follows with 586 customers, showing Braintree’s growing influence in the Asia-Pacific region.

- Canada records 408 customers, underscoring steady usage across North American markets.

- Germany contributes 290 customers, representing consistent growth within Europe’s tech-driven economy.

- France accounts for 196 customers, signaling emerging demand for Braintree’s payment solutions.

- India reports 183 customers, indicating early-stage but expanding adoption in one of the world’s fastest-growing digital markets.

Braintree’s Current Team (Key People)

- Juan Benitez – President, leads Braintree’s strategic operations within PayPal’s enterprise payments division, overseeing technology, compliance, and product growth since his tenure began in 2018.

- Allison Johnson – Chief Operating Officer, manages global operations and merchant services, ensuring the alignment of Braintree’s business units with PayPal’s enterprise standards.

- Chris Zadeh – Chief Technology Officer, directs engineering, platform architecture, and API development, focusing on reliability, scalability, and developer experience across Braintree’s payment systems.

- Erin Simpson – Chief Financial Officer, oversees global financial operations, forecasting, and cost optimization, ensuring sustainable profitability as the company scales its workforce.

- Michael Choma – Head of Product and Partnerships, responsible for merchant integrations, ecosystem partnerships, and strategic product expansion across global markets.

- Lauren Pacheco – Vice President of Risk & Compliance, leads teams managing fraud detection, financial crime prevention, and adherence to global payments regulations.

- David Hsu – Senior Director of Engineering (Payments Infrastructure), drives innovation in transaction routing, fraud automation, and large-scale payment optimization frameworks.

- Priya Nair – Head of People and Culture, champions diversity, inclusion, and global talent development, ensuring a unified culture across Braintree’s offices in Chicago, London, and Sydney.

- Mark Edwards – Global Head of Merchant Success, leads Braintree’s customer success teams that manage onboarding, integration support, and merchant retention strategies.

- Sarah Klein – General Counsel, oversees regulatory, privacy, and legal affairs, ensuring compliance across more than 45 countries and 130+ supported currencies.

Company Background and Ownership

- Braintree was founded in 2007 by Bryan Johnson.

- In 2013, it was acquired by eBay Inc., and in 2014, it became part of PayPal when PayPal was spun off.

- Headquartered in Chicago, Illinois, at 222 Merchandise Mart Plaza, Ste 800.

- As a division of PayPal Holdings, Braintree benefits from global payments scale, risk infrastructure, and developer tools footprint.

- Braintree’s product scope, mobile and web payment-processing, is designed for online merchants in 45+ countries and 130+ currencies.

- Third-party profiles consistently place Braintree in the 5,000–5,500 employees range.

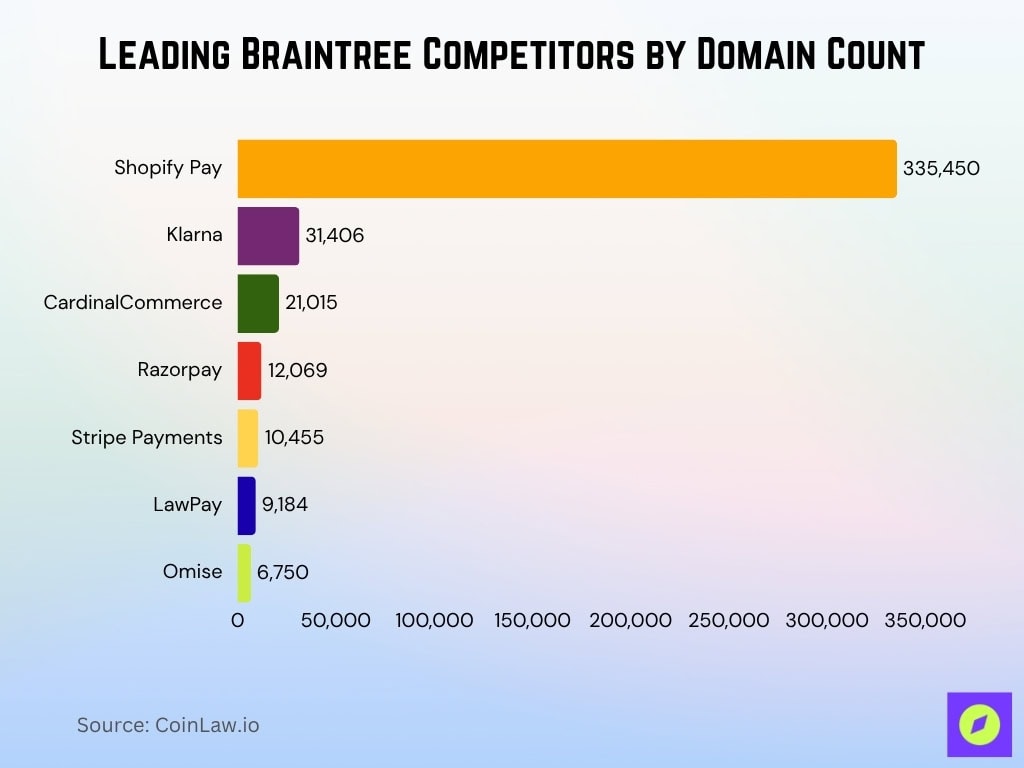

Leading Braintree Competitors by Domain Count

- Shopify Pay leads the market with 335,450 domains, showing its dominance among online retailers integrating native Shopify payments.

- Klarna follows with 31,406 domains, reflecting its strong global presence in buy-now-pay-later solutions.

- CardinalCommerce supports 21,015 domains, emphasizing its focus on authentication and security technologies.

- Razorpay powers 12,069 domains, driven by its expanding reach in India and emerging markets.

- Stripe Payments operates across 10,455 domains, highlighting its popularity among startups and digital-first businesses.

- LawPay serves 9,184 domains, carving a niche in legal and professional payment processing.

- Omise supports 6,750 domains, showing consistent traction across Southeast Asia’s fintech ecosystem.

Global Office Locations

- Braintree is headquartered in Chicago, Illinois, USA.

- Over 32,000 live websites currently use Braintree, including e-commerce and SaaS companies.

- The top country for usage is the United States.

- Major global markets include the United Kingdom, Germany, Australia, and Singapore.

- The expanded global headcount of 5,000-5,500 employees reflects an increase in regional offices and cross-functional international teams.

- Local offices are reportedly established in London, Sydney, Dublin, and Berlin to manage regional merchant operations.

- Regional hubs focus on regulatory compliance, fraud prevention, and merchant support.

- As part of PayPal, Braintree benefits from shared operational centers in North America, Europe, and Asia-Pacific.

- The increased global footprint demonstrates that Braintree’s growth is not just digital but organizational, emphasizing global accessibility and merchant integration.

Revenue Per Employee

- Braintree’s estimated revenue per employee is approximately $147,000, based on 5,000-5,500 employees and an estimated $750 million annual revenue.

- This figure reflects slightly lower efficiency per head than smaller fintech startups but aligns with mid-scale payment firms operating globally.

- Compared to 2023 levels, revenue per employee declined as headcount grew faster than top-line revenue.

- PayPal’s 2024 investor report indicates operational scaling and infrastructure build-out as causes for temporary margin compression.

- The current ratio suggests Braintree’s strategic reinvestment into workforce growth and global expansion.

- Revenue per employee remains competitive within enterprise payment divisions of large processors.

- Automation and process optimization efforts may raise this metric in 2026 as scaling stabilizes.

- Braintree’s balance between staff growth and revenue reflects its commitment to sustainable long-term scaling.

- Compared with peers like Stripe (≈ $180,000 per employee), Braintree’s ratio shows it is entering a mature growth phase.

- The metric provides insight into operational productivity and return on human capital investment.

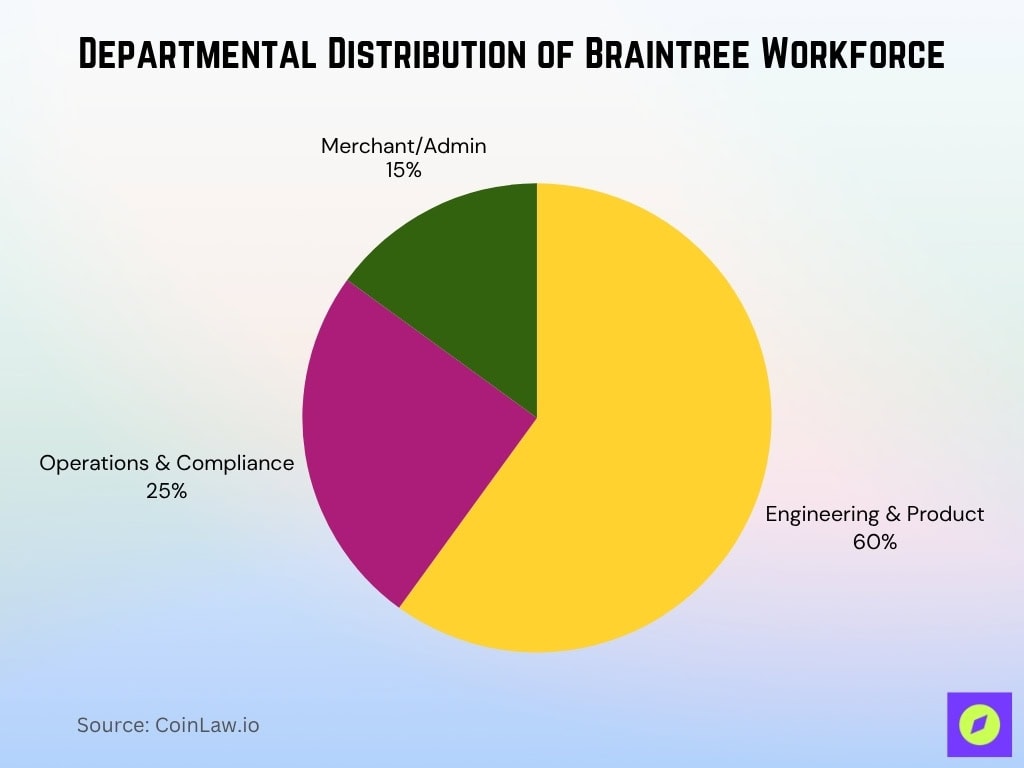

Employee Demographic

- Braintree’s workforce distribution suggests roughly 60% engineering and product roles, 25% operations and compliance, and 15% merchant success and administration.

- The company employs specialists in engineering, risk management, compliance, marketing, and product development across multiple continents.

- The workforce includes a mix of full-time employees and contractors, with about 30% remote or hybrid roles.

- The gender ratio has improved, with an estimated 42% female representation, consistent with PayPal’s inclusion targets.

- Median employee age is in the early 30s, reflecting a youthful, tech-driven culture.

- The expansion of workforce diversity includes greater representation from the APAC and EMEA regions.

- The company’s diversity and inclusion programs have become a key focus as it scales globally.

- The larger headcount allows greater internal specialization, with more defined team structures across geographies.

Employee Roles and Departments

- Engineering roles in Braintree dominate, especially around Web SDKs, Ruby on Rails, and payment gateway systems.

- Small and mid-sized companies (1–200 employees) make up over 80% of Braintree’s users, aligning with the staff’s focus on product specialists and engineers.

- Braintree’s fraud detection team operates with a fraud rate of 0.17% to 0.18% of revenue, well below the industry average.

- PayPal’s Braintree maintains an employee sentiment rating of approximately 3.7 out of 5 stars.

Hiring and Careers Statistics

- Braintree is actively hiring across engineering, risk, and data science functions as of November 2025.

- Senior engineering roles are notably listed in the Chicago, Austin, and Dublin offices.

- Around 30% of Braintree’s workforce operates remotely, supporting a hybrid work model.

- Employee tenure at Braintree averages 2 years and 1 month in 2025, reflecting fintech industry trends.

- Braintree’s workforce size of 5,000-5,500 allows for career mobility across PayPal’s divisions.

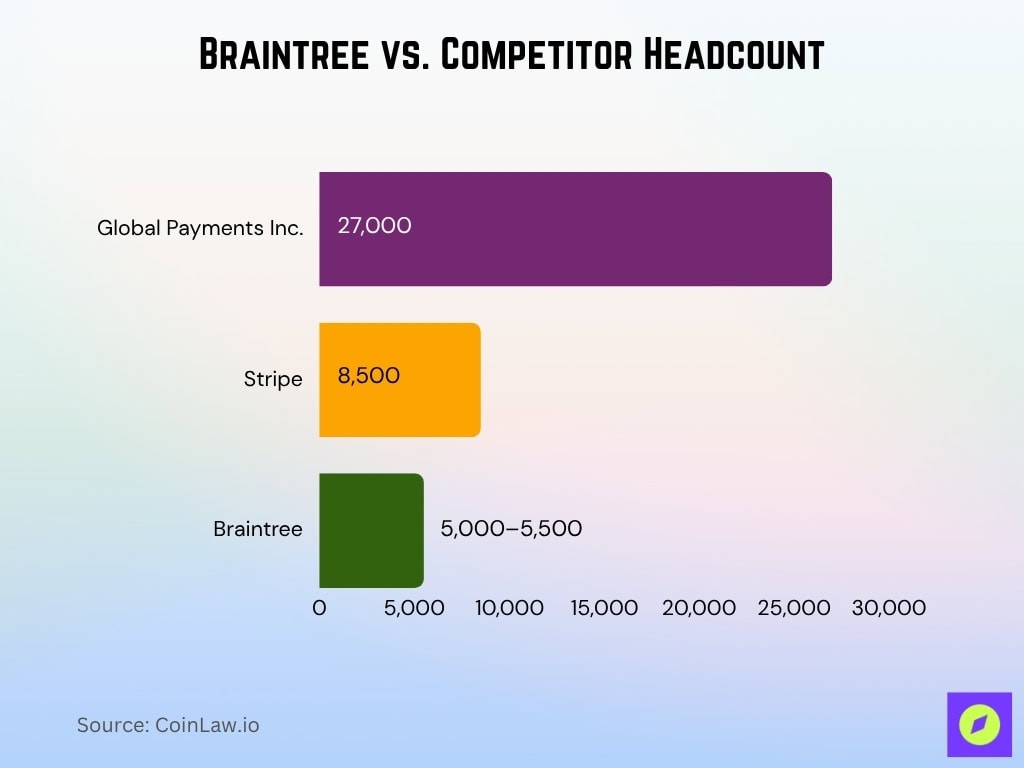

Comparison with Competitors in the Payments Sector

- Stripe, Inc. lists around 8,500 employees in 2025, higher than Braintree’s 5,000-5,500.

- Global Payments Inc. reports approximately 27,000 employees, showing the size gap with enterprise processors.

- Braintree sits in the mid-tier range among payments firms by headcount.

- Its moderate staffing level aligns with specialization rather than scale-focused growth.

- Braintree serves merchants in 45+ countries and supports 130+ currencies, comparable to peers in geographic reach.

- Larger processors may have greater support staff, while Braintree’s headcount remains concentrated in product and infrastructure.

- Braintree’s revenue per employee of $147,000 suggests efficient operations relative to competitors with heavier staff ratios.

- PayPal’s shared infrastructure enables Braintree to remain lean while maintaining enterprise-grade service levels.

- For a US audience, this size signals that Braintree operates as a focused payments technology provider rather than a full-service merchant acquirer.

- The data suggest Braintree prioritizes innovation and agility over raw scale, positioning it competitively within PayPal’s fintech ecosystem.

Implications of Headcount for Business Scale and Capability

- The company supports merchants in over 200 markets worldwide with a distributed workforce.

- PayPal’s unbranded payment processing segment, including Braintree, grew volume by about 2% in late 2024.

- Automation and APIs reduce reliance on large customer support teams, improving cost efficiency by about 15-20%.

- Braintree balances operational scale and cost-efficiency with an operating margin of approximately 14.2% in recent quarters.

- The staffing structure supports 24/7 merchant support and local regulatory compliance globally.

Frequently Asked Questions (FAQs)

Braintree’s platform (via PayPal) processed $1.53 trillion in payment volume in 2023.

A source lists 6,983 companies with 1–10 employees using Braintree.

Growjo estimates revenue per employee at $162,500.

Conclusion

Braintree’s employee headcount highlights a company that is global in scope yet focused in scale. Across engineering, product, merchant services, and risk functions, the firm builds a payments infrastructure that powers millions of merchant transactions. When compared with larger players in the payments sector, Braintree’s measured size signals specialization and technological focus rather than raw expansion. For businesses and professionals alike, Braintree represents a globally integrated yet agile organization.