The global cryptocurrency exchange Bitget stands out not only for its rising trading volumes but also for its expanding workforce and global footprint. Bitget’s staffing growth mirrors the evolution of the crypto industry. In practical terms, this impacts both retail-trading platforms that require 24/7 customer support and institutional services that demand compliance and regional teams. For example, Bitget’s copy-trading service relies heavily on personnel to manage global user engagement, while its regulatory-compliance expansion in APAC requires region-specific staffing. The numbers behind these developments matter. Join us as we dive into Bitget’s team size, structure, and global distribution.

How Many People Work At Bitget?

- Bitget employs approximately 1,900 people from over 100 countries as of May 2025.

- Bitget has open job listings globally; for example, the firm disclosed 129 open positions worldwide in April 2025.

- Bitget’s 1,900+ employees are drawn from over 100 countries, with the team working primarily in remote format alongside regional offices in Dubai, Lithuania, and other strategic markets.

- Bitget lists its team as over 1,900 employees on its transparency report for Q1 2025.

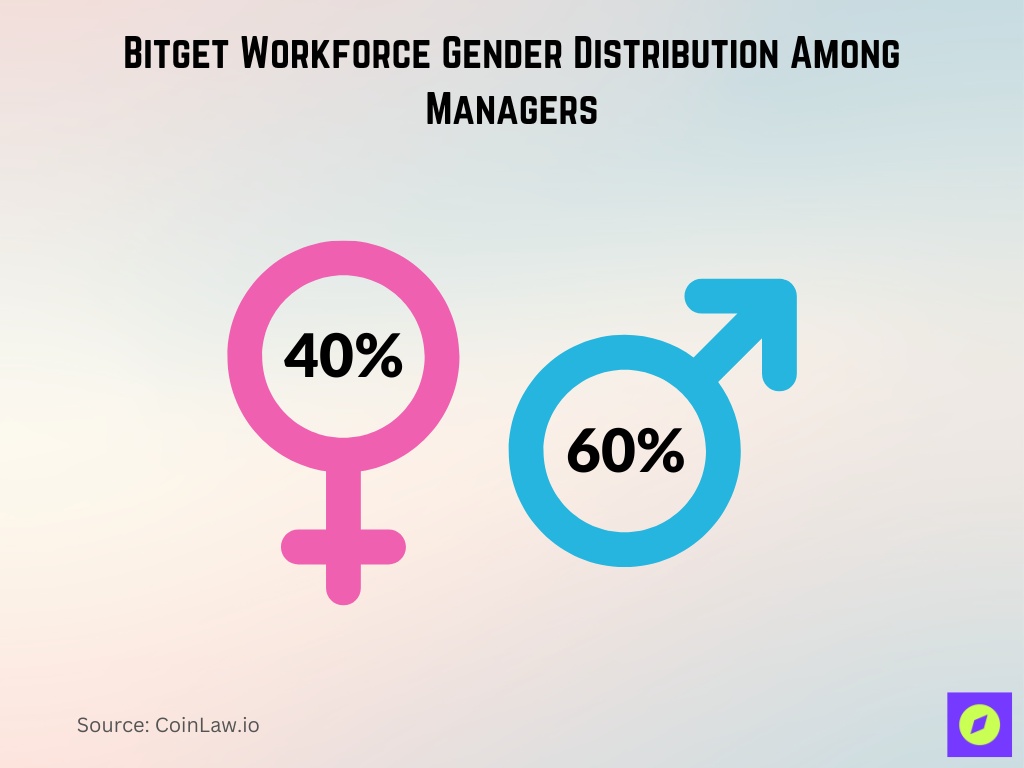

- 40% of managers are female, surpassing typical industry averages.

- One-third of applicants come from traditional finance.

Recent Developments

- Bitget’s compliance team has grown to over 70 professionals, representing a year-on-year doubling in compliance headcount to support global regulatory expansion.

- Earlier, in Jan 2024, Bitget reported a growth from 1,100 to 1,500 employees across 2023.

- Bitget’s primary format is remote, though part of the team works in the Dubai office.

- The company emphasises a “glocal” strategy (global + local) for combining global operations with local market teams.

- 20% of Gen Z/Alpha respondents show openness to crypto pensions.

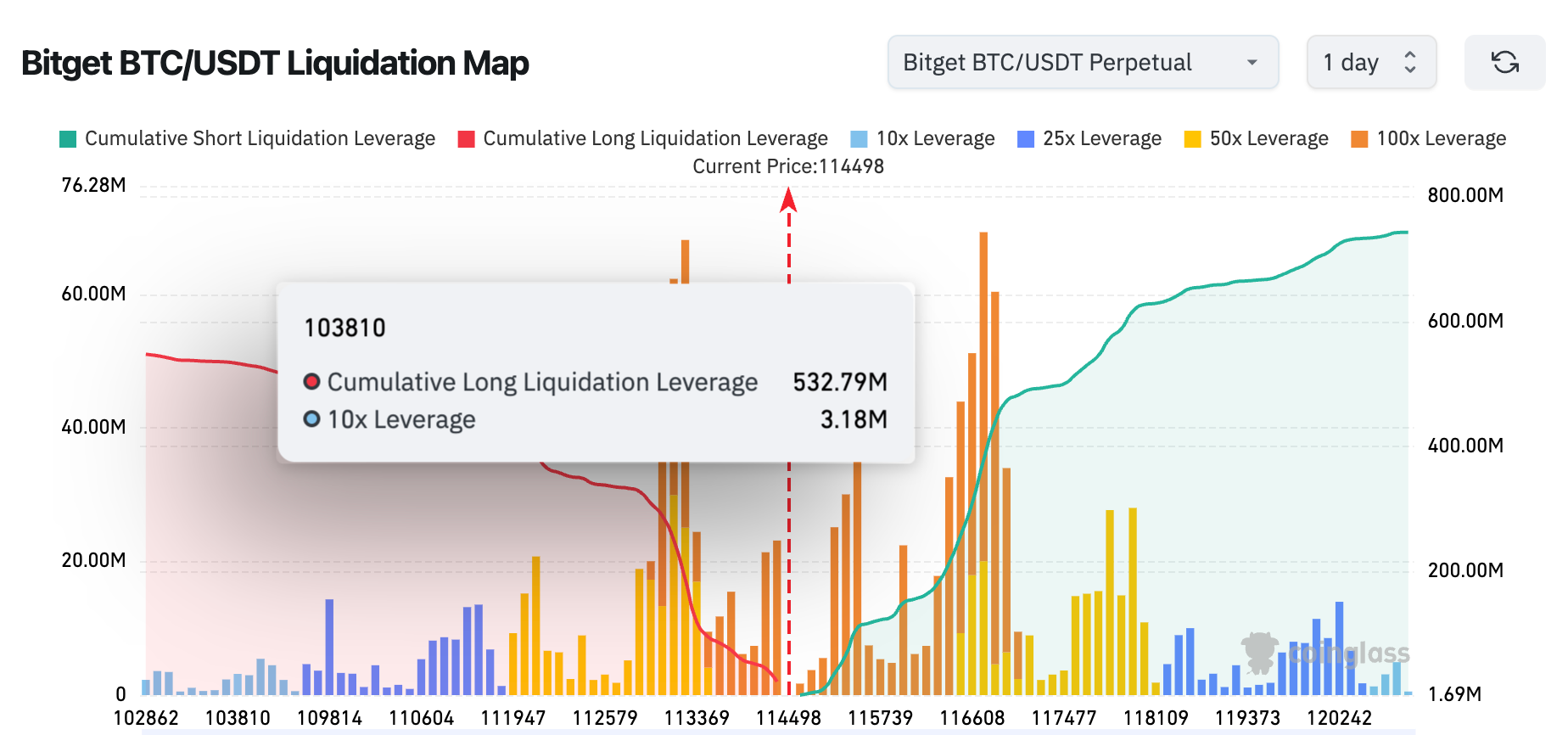

Bitget BTC/USDT Liquidation Overview

- Cumulative Long Liquidation Leverage reached $532.79 million near the $103,810 price level, indicating heavy long exposure at lower ranges.

- 10x Leverage positions totaled about $3.18 million, showing moderate leverage concentration among traders.

- The current BTC/USDT price stood at $114,498, marking a strong rebound zone above liquidation clusters.

- Cumulative Short Liquidation Leverage peaked near $800 million, reflecting significant short-side risk as prices climbed.

- Cumulative Long Liquidation Leverage declined toward $40 million, suggesting fewer liquidations as the price moved upward.

- The map highlights increased liquidation density between $112K–$116K, mostly driven by 25x to 100x leveraged trades.

Bitget’s Current Team (Key People)

- Gracy Chen (Chief Executive Officer): Appointed CEO in May 2024. She joined Bitget as Managing Director in 2022 and helped lead a fourfold increase in the user base during her tenure.

- Vugar Usi Zade (Chief Operating Officer): Responsible for global go-to-market execution and operational scale. He joined the leadership team prior to the full-scale remote-first build-out.

- Hon Ng (Chief Legal Officer): Joined in August 2024 with over 20 years of regulatory and global counsel experience. He oversees Bitget’s global licences and compliance framework.

- Min Lin (Chief Business Officer): Appointed to drive regional expansion and strategic market entries, leveraging experience in global markets and digital assets.

Workforce Growth Statistics

- In 2022, Bitget had around 200 employees.

- By early 2023, Bitget had grown to over 1,100 employees.

- By the end of 2023 and into 2024, Bitget grew from 1,100 to around 1,500 employees.

- As of early 2025, Bitget reports 1,900 employees.

- Bitget’s open positions globally (129 jobs) indicate ongoing staff expansion as of April 2025.

- The rapid staffing increase signals a strategic focus on global expansion, regulatory compliance, and product innovation.

Hiring and Expansion Trends

- Bitget’s AI recruitment system reduced average hiring time by 38%, cutting the process from 48 days to approximately 30 days as of March 2025.

- The 2025 Global Graduate Program onboarded 30 early-career pros.

- The Bitget Builders initiative included 5,000+ participants spanning 55+ countries.

- The Dubai office launch targets hiring 30–60 new staff in two years for Middle East expansion.

- Bitget’s Lithuania hub focuses on compliance staff recruitment for European scaling.

- Employee attrition rates fell by 15% after integrating AI recruitment tools.

- About 33% of Bitget’s job candidates have a banking background.

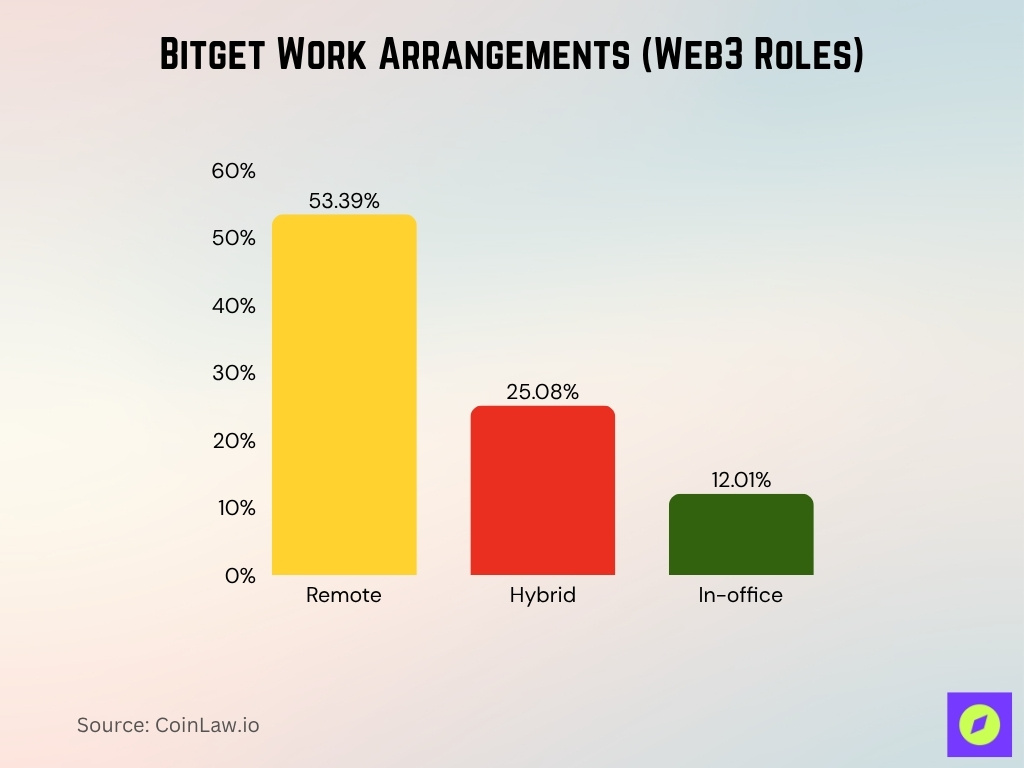

Remote vs Office Employees

- In 2025, 53.39% of Web3 roles are fully remote, and 25.08% hybrid, while only 12.01% require long-term in-office presence.

- The average hiring process was reduced to 30 days from ~48 days, highlighting a streamlined, remote-capable process.

- The shift to remote-first allows Bitget to draw talent globally without relocation demands.

- Remote work advantages include reduced commuting stress and increased efficiency.

- Despite the remote model, Bitget has opened regional offices, indicating a hybrid approach.

- Bitget staff rate “Work/Life Balance” at 3.5 out of 5 stars.

- The remote/hybrid model supports rapid scaling and global time-zone coverage.

Employee Benefits and Culture

- Bitget holds an overall rating of 3.8 out of 5 stars, with 71% of employees recommending working there.

- Compensation & Benefits score ~3.9, Work/Life Balance ~3.5.

- Benefits include medical insurance, hospitalization leave, and compassionate leave.

- Graduate and Builders programmes highlight Bitget’s investment in talent development.

- Bitget lists its core values as Users first, Integrity and honesty, Open communication, and Deliver results.

- Corporate culture emphasises pragmatism and results orientation.

- Employees note global exposure, flexibility, and a rapid growth pace as key traits.

Company History and Milestones

- Bitget was founded in 2018 in Singapore and later registered in Seychelles.

- The company expanded beyond derivatives in 2022 and reached ~1,500 employees by 2024.

- The company secured regulatory licences in El Salvador and BSP Philippines in 2025.

- The Universal Exchange model, launched in Q3 2025, unified all trading services.

- Regional hubs were established in Dubai, Lithuania, and other markets.

- CSR initiatives like Blockchain4Her and Blockchain4Youth expanded globally.

Team Professional Development

- About 40% of managers are female, reflecting leadership diversity.

- The company emphasises potential over experience for early-career hires.

- “Blockchain4Her” supports training and mentorship programmes for women in Web3.

- New hires rotate across product, growth, and engineering departments.

- AI-driven recruitment cuts hiring time by ~30-40%.

- Employees engage across APAC, the Middle East, and Europe for global exposure.

- Bitget invests in continuous learning, mentorship, and crypto fundamentals.

- Internal AI tools improve data-driven skillsets and workflow efficiency.

Comparison with Other Crypto Exchanges

- Its spot-market share reached ~8.9%, ranking #3 globally.

- Bitget averaged monthly trading volumes of $750 billion, mostly derivatives.

- Bitget’s hybrid model differentiates it from KuCoin and Bybit.

- Institutional participation accounts for ~50% of derivatives and ~80% of spot volume.

- Bitget’s user base grew from ~100 m to 120 m in 2025.

- Liquidity rankings show #1 for ETH and SOL spot depth, #2 for BTC.

- Bitget’s workforce growth from 200 to 1,900 employees outpaces most rivals.

User Base and Trading Volume Growth

- Q2 2025 saw the user base grow from ~100 million to ~120 million, representing a 20% quarter-over-quarter increase.

- In May 2025, Bitget added over 500,000 new users, with 2 million in Q2.

- Total trading volume in Q1 2025 reached $2.08 trillion, with spot trading up 159%.

- In May 2025, volume surged by 21% MoM and futures rose 26%.

- From 2023 to 2025, cumulative derivatives volume was $11.5 trillion.

- Copy-trading followers exceeded 1 million with profits of $27 million shared in Q2 2025.

- Growth reflects strong demand from both retail and institutional segments.

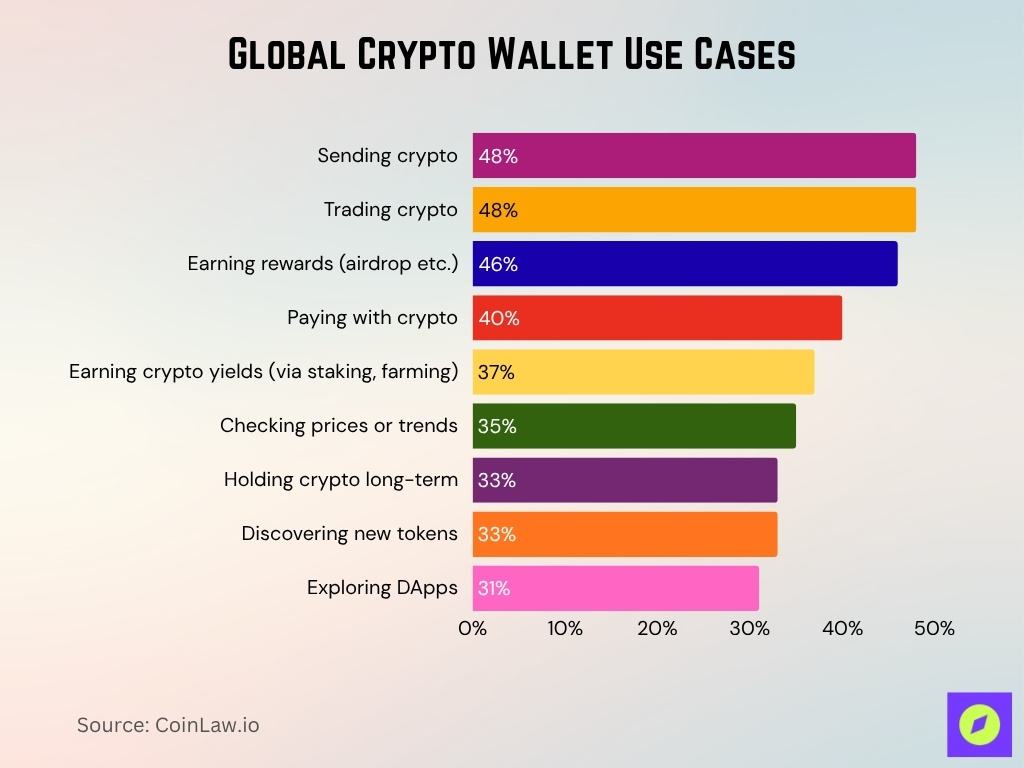

Global Crypto Wallet Use Cases

- Sending crypto is the top use case, cited by 48% of global users, showing wallets remain essential for peer-to-peer transfers.

- Trading crypto is equally popular at 48%, emphasizing how many users treat wallets as gateways to decentralized exchanges.

- Earning rewards from activities like airdrops or loyalty programs attracts 46% of users, reflecting growing engagement with incentive-driven ecosystems.

- Paying with crypto ranks at 40%, showing real-world spending adoption continues to expand through payment integrations.

- Earning yields via staking and farming appeals to 37% of users, underlining the ongoing search for passive income opportunities.

- Checking prices or trends is done by 35%, highlighting wallets’ role as all-in-one monitoring tools.

- Holding crypto long-term remains key for 33% of users, signaling continued investor confidence in digital assets.

- Discovering new tokens engages another 33%, pointing to strong interest in exploring emerging projects.

- Exploring DApps rounds out the list at 31%, showing growing curiosity in decentralized applications beyond basic trading and transfers.

Partnerships and Sponsorships

- Bitget holds a multi-market partnership with LaLiga covering Eastern, Southeast Asia, and Latin America.

- Collaborations with UNICEF seek to benefit 1.1 million people by 2027.

- In Q3 2025, Bitget sponsored four MotoGP™ Grand Prix events.

- The exchange’s sponsorships span women’s football, esports, and motorsport worldwide.

- Bitget’s deal with Ondo Finance enables access to tokenised U.S. stocks.

- Strategic partnerships drive brand recognition and regulatory credibility.

- Sponsorship efforts help build cultural legitimacy for Bitget.

- Collaborations are aimed at bridging CeFi–DeFi ecosystems for users.

Frequently Asked Questions (FAQs)

Around 129 open positions worldwide at a point in time.

Added 4.89 million CEX users and 15 million Bitget Wallet users in Q1 2025, expanding to over 120 million total users (nearly 20% growth)

1,900 employees across 60 countries and regions.

Conclusion

In summary, Bitget’s staffing, growth, global reach, and structural strategies reflect an exchange that is scaling aggressively while balancing global diversity, regulatory alignment, and product innovation. The company has moved rapidly into the top tier of exchanges, both in terms of market share and execution quality. Bitget’s focus on professional development, deep partnerships, and inclusive culture signals that the human-capital side of the business is as strategic as its trading infrastructure.