Many U.S. households confront rising financial pressure as inflation, debt burdens, and unexpected expenses converge. Every day, families, from young adults starting out to older homeowners, feel the pinch when costs rise, and savings erode. Real-world impacts appear in delayed home purchases, skipped medical care, or mounting credit-card balances. This article offers a data-driven look at those pressures. Continue reading to see how deeply these trends affect Americans today.

Editor’s Choice

- 73% of Americans report saving less for emergencies because of rising costs, interest rates, or price increases.

- Nearly 1 in 4 households (about 25%) lived paycheck to paycheck in 2025.

- Total household debt reached $18.59 trillion by Q3 2025, rising $197 billion (1%) from the previous quarter.

- In Q3 2025, credit card debt hit roughly $1.23 trillion, and student loan debt reached about $1.65 trillion.

- 51% of Americans say they “regularly stress out about money.”

Recent Developments

- Inflation cooled somewhat by early 2025. In March, the overall price index (PCE) rose 2.3%, while the consumer price index (CPI) rose 2.4%.

- Still, many households continue to feel inflation’s effects; price increases for groceries, utilities, and housing remain higher than pre-pandemic levels.

- According to a recent financial mobility survey, 68% of Americans say they feel financial stress, coinciding with a decline in readiness for emergencies.

- Consumer sentiment remains fragile despite modest improvements; many households remain wary about future expenses and cost uncertainties.

- Rising living costs have pushed a broader range of households, including the middle class, into financial vulnerability.

- As a result, some households are redefining “financial success” not as wealth accumulation but as becoming debt‑free.

- Higher costs and economic uncertainty are prompting more Americans to revisit priorities like savings, debt repayment, or delaying large purchases.

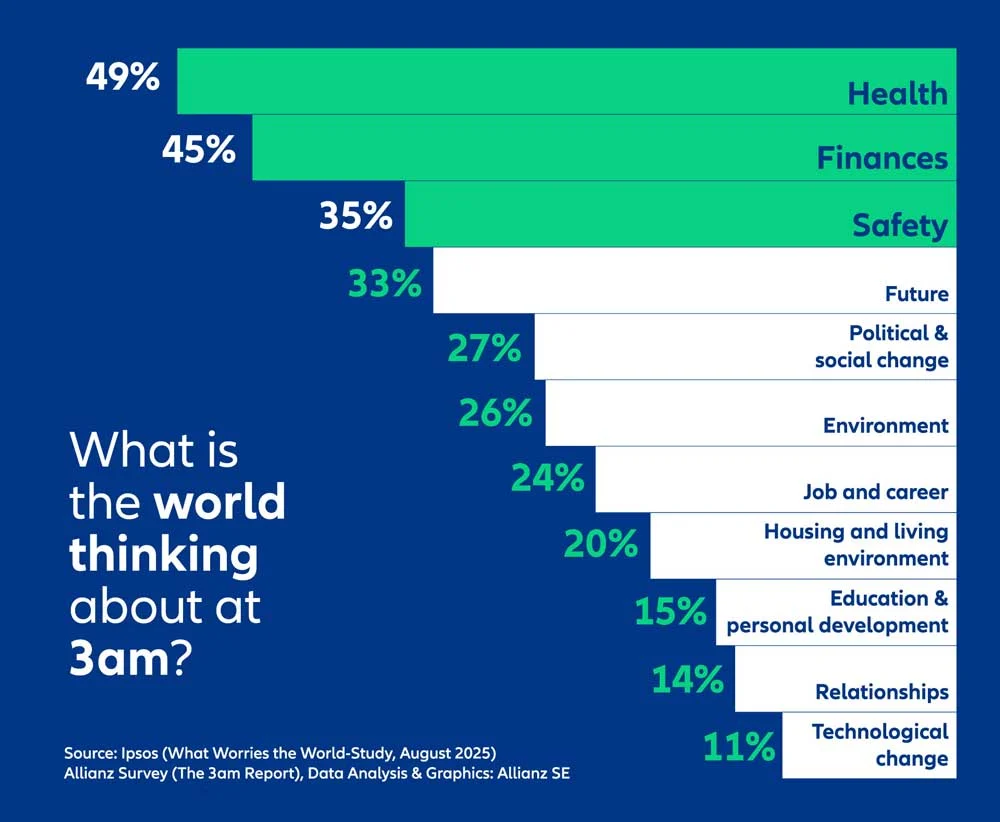

Top Global Worries at 3 AM

- 49% of people say health is their top late-night concern, making it the most common global worry.

- 45% of respondents lie awake thinking about their finances, highlighting widespread financial anxiety.

- 35% worry about safety, including personal and community-level threats.

- 33% report being preoccupied with the future, reflecting uncertainty about what lies ahead.

- 27% are kept up by thoughts of political and social change, showing concern over societal instability.

- 26% cite the environment as a key source of nighttime worry, indicating rising eco-anxiety.

- 24% of people are concerned about their job and career, especially amid economic shifts.

- 20% stress over their housing and living environment, pointing to affordability and stability issues.

- 15% stay up thinking about education and personal development, particularly in competitive markets.

- 14% of respondents worry about their relationships, whether romantic, family, or social.

- 11% are troubled by technological change, including AI, automation, and digital disruption.

Financial Stress Trends

- In 2025, about 51% of Americans said they regularly worry about money.

- Only 46%–48% of U.S. adults have enough emergency savings to cover at least three months of expenses, leaving over half short of this basic safety buffer.

- Yet 30% of adults indicated they could not cover three months of expenses by any means.

- For households earning less than $25,000 annually, only 24% had saved enough for three months of expenses.

- Among households earning $100,000 or more, 75% had three‑month savings.

- The portion of households living paycheck to paycheck rose to roughly 25% in 2025.

- Financial stress appears across income levels, even among middle‑class households still facing inflation, debt, and uncertainty.

- A growing number of Americans now define financial success as being debt‑free, rather than accumulating wealth.

Impact of Inflation on Households

- 50% of middle-class households are concerned about affording daily essentials.

- 41% of middle-class households would use credit card debt for $5,000 unexpected expense.

- Median US emergency fund dropped to $500.

- 73% of Americans are saving less for emergencies due to inflation.

- 55% of middle-income Americans rate their finances as “not so good” or “poor”.

- 44% of middle-class households are in worse financial shape than a year ago.

- 8 in 10 Americans haven’t increased emergency savings since early 2025.

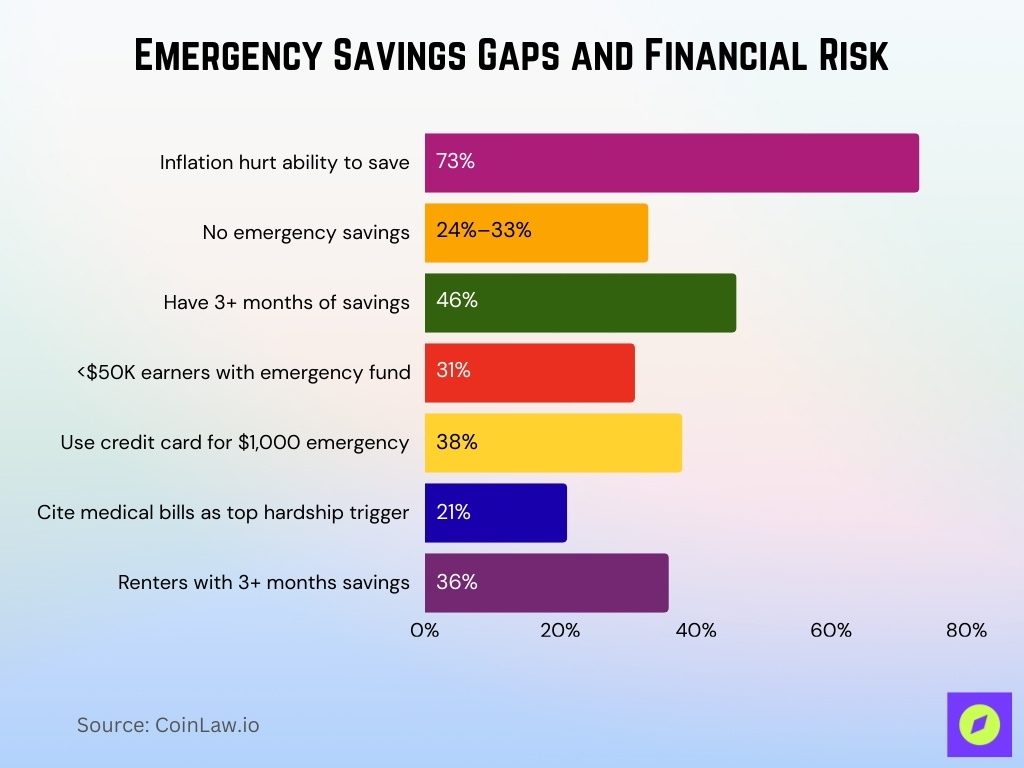

Emergency Savings and Financial Vulnerability

- 73% of Americans in 2025 say inflation has reduced their ability to save for emergencies.

- Roughly 24%–33% of Americans report having no emergency savings at all, depending on the survey, highlighting a sizable group with zero financial cushion.

- Only about 46% of U.S. adults report having enough emergency savings to cover three months of expenses or more, underscoring widespread vulnerability to income shocks.

- Among households earning under $50,000, just 31% have a dedicated emergency fund.

- 38% of Americans would rely on a credit card to handle an unexpected $1,000 expense.

- Medical emergencies remain the top trigger for financial distress, cited by 21% of households facing sudden hardship.

- Renters are more exposed than homeowners; only 36% of renters have three months of emergency savings.

Household Debt and Delinquency Rates

- Total U.S. household debt reached $18.6 trillion in 2025, a year-over-year increase of about 3.5%.

- Credit‑card balances exceeded $1.23 trillion, driven by higher prices and increased reliance on revolving credit.

- The average credit card interest rate crossed 21% in 2025, intensifying repayment stress.

- Student loan debt stands at $1.65 trillion, with repayment resuming for most borrowers in late 2024.

- The share of U.S. credit‑card balances that became delinquent within the past year climbed to around 9%, indicating rising repayment stress even as overall delinquency remains historically moderate.

- Auto‑loan delinquencies reached 7.9% among subprime borrowers, reflecting strain from higher car prices and rates.

- Mortgage delinquencies remain relatively low at around 3.6%, supported by fixed‑rate loans locked in before rate hikes.

- Households carrying multiple forms of debt report significantly higher financial stress, especially when interest rates reset upward.

Financial Stress by Generation

- Gen Z adults (ages 18–26) report the highest stress levels, with about 62% saying money worries affect daily decisions.

- Millennials continue to feel pressure from housing and childcare costs; 58% say they feel financially strained in 2025.

- Gen X households face dual pressures from supporting children and aging parents, with 54% reporting high financial stress.

- Baby Boomers show lower stress overall, yet nearly 1 in 3 worry about outliving retirement savings.

- Student debt remains a key driver for younger adults, with over 40% of borrowers under 35 reporting repayment hardship.

- Housing affordability hits Millennials hardest; only 39% believe they can afford a home in their area.

- Gen Z is more likely to rely on family support, with 45% receiving financial help from parents in 2024–2025.

- Older generations report less day-to-day stress but greater concern about healthcare and long-term care costs.

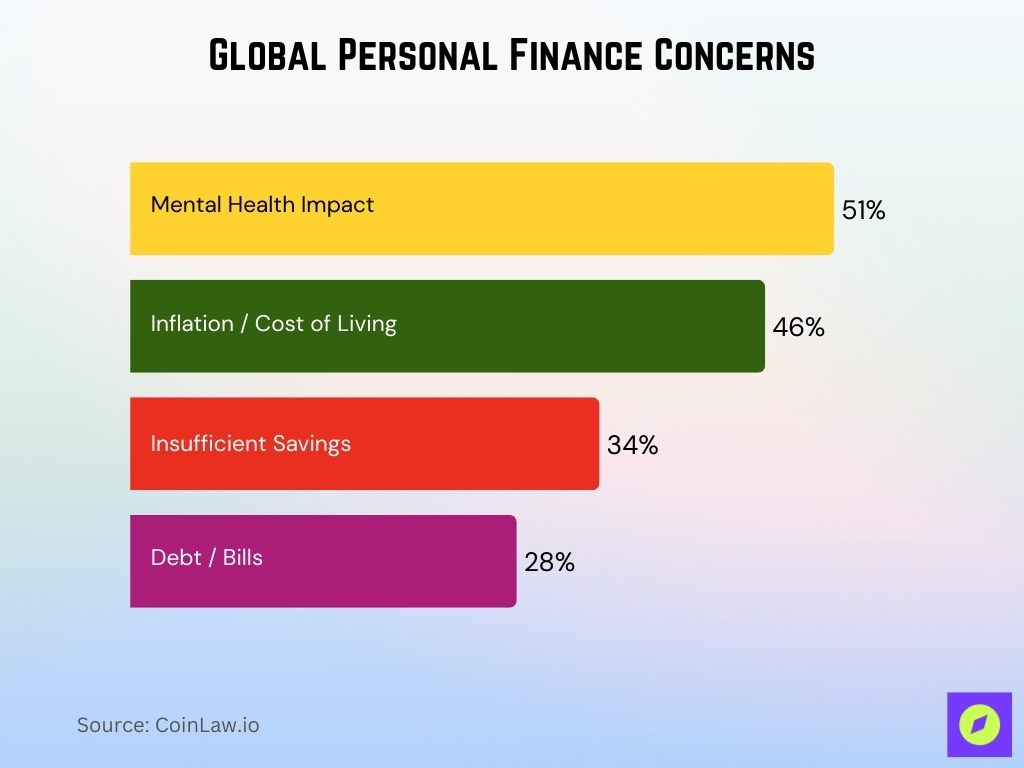

Global Personal Finance Concerns

- 51% of people say mental health impact is their top financial concern, underscoring how finances affect well-being.

- 46% worry about inflation and the rising cost of living, reflecting global economic pressure.

- 34% are stressed over insufficient savings, showing widespread financial unpreparedness.

- 28% cite debt and bills as a major source of financial strain, pointing to repayment burdens.

Financial Stress by Income Level

- Among households earning under $30,000, over 65% report feeling financially stressed “most of the time.”

- Middle-income households ($50,000–$100,000) show rising stress, with about 47% reporting difficulty keeping up with expenses.

- Even among households earning over $100,000, nearly 1 in 4 say inflation has strained their budget.

- Lower-income households spend over 60% of their income on necessities, leaving little room for savings.

- Rent consumes more than 35% of income for roughly half of low-income renters, increasing vulnerability.

- Households with volatile income report higher stress than those with stable wages, regardless of earnings level.

- Emergency expense readiness rises sharply with income, from 31% at lower incomes to 75% at higher incomes.

- Income inequality continues to shape financial stress, reinforcing gaps in savings, debt, and resilience.

Mental Health Effects of Financial Stress

- In 2025, 43% of U.S. adults say money negatively affects their mental health at least occasionally, causing anxiety, sleeplessness, depression, or persistent worry.

- A 2025 survey found 69% of those who report money-related mental health effects cite inflation and rising prices as a major cause.

- 76% of Americans report feeling isolated when managing money worries, and about 20% say their mental health has worsened over the past year due to financial stress.

- 69% of Americans feel financial uncertainty has made them feel depressed or anxious, up 8 percentage points from 2023.

- Among those under high financial stress, 41% say cost concerns keep them from seeking needed mental health care.

- Financial stress reduces workplace productivity, with some studies reporting a 34% increase in tardiness or absenteeism tied to financial anxiety.

- For many younger adults, especially within Gen Z and Millennials, frequent financial anxiety is common.

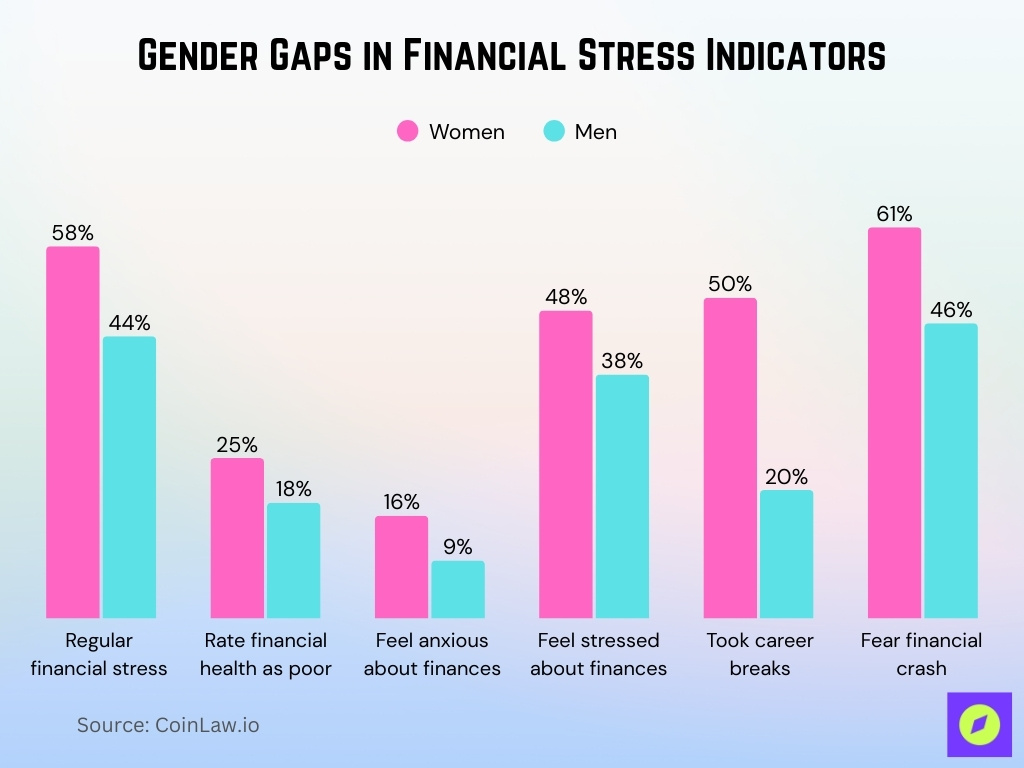

Gender Differences in Financial Stress

- 58% of women report regular financial stress vs 44% of men.

- 25% of women rate their financial health as poor, vs 18% of men.

- 16% of women feel anxious about finances vs 9% of men.

- 48% of women feel stressed about finances vs 38% of men.

- 50% of women took career breaks vs 20% of men.

- 61% of women fear financial crash vs 46% of men.

Economic Factors Driving Household Stress

- 26% of US households spend more than they earn.

- 1 in 4 US households live paycheck to paycheck.

- Average US household debt reached $104,755.

- Total US household debt hit $18.59 trillion in Q3 2025, up $197 billion (1%) from the prior quarter.

- 27% of consumers are pessimistic about household finances.

- Credit card delinquency rose 2.55 percentage points.

- Student loan new delinquency increased 1.56 percentage points.

- 50% of households have no discretionary income.

- 15% cite the economy as a major stress source.

- 41% struggle with $1,000 emergency expense.

Measuring Household Financial Stress

- 43% of adults say money negatively impacts mental health.

- 54% report financial anxiety three or more days per week.

- 87% experience financial stress at least once a week.

- 69% feel depressed and anxious from financial uncertainty.

- Median emergency savings stands at $500.

- 48% can cover $2,000+ emergency from savings.

- 33% have no emergency savings fund.

- Roughly 14%–15% of U.S. credit‑card debt is at least 30 days past due or in collections, reflecting a meaningful share of balances under serious strain.

- 90-day delinquency rate reached 3.04%.

- Around 4%–5% of total U.S. household debt is in some stage of delinquency, a relatively low share compared with past cycles, even as card‑specific stress intensifies

Consequences: Reduced Consumption, Delayed Investments, Poverty Traps

- 60% of homebuyers are uncertain about timing purchases.

- 75% of prospective buyers are waiting for price drops.

- 55% of households carry credit card debt cycles.

- 24% went into debt to cover rent payments.

- Financially stressed workers lose 7-8 hours of productivity weekly.

- Stressed employees take 3.5 extra sick days yearly.

- 40% of job turnover is linked to financial stress.

- 1 in 4 households live paycheck to paycheck.

- 33% of Gen Z cut back on food spending.

- 11% of credit card balances are over 90 days overdue.

Policy and Macro-Economic Context Affecting Household Stress

- NFCC Financial Stress Forecast rose to 6.1.

- Total household debt hit a record $18.59 trillion.

- Household debt grew $197 billion in Q3.

- Debt-to-income ratio reached 81%.

- Household debt-to-GDP fell to 68.3%.

- 40% recession probability for 2025.

- 3% inflation rate in September.

- Unemployment rate climbed to 4.3%.

- Federal funds rate at 3.75%-4.00%.

Link Between Financial Stress and Broader Economic Stability

- 73% of employees barely afford expenses beyond basics.

- Financial stress costs employers $3,922 per employee yearly in lost productivity.

- Stressed employees lose 156 hours annually handling finances at work.

- 1 in 5 employees admit financial concerns hinder job performance.

- US GDP growth projected at 1.8% amid household stress.

- 52% of $100k+ earners still report financial stress.

- Financially stressed workers are 9x more likely to have workplace conflicts.

- 40% of workers delay retirement due to financial instability.

- Stressed employees are 2x more likely to seek new jobs.

Frequently Asked Questions (FAQs)

About 24% of U.S. households lived paycheck to paycheck in 2025.

Roughly 29% of lower‑income households are living paycheck to paycheck in 2025.

47% of U.S. adults said money negatively affects their mental health.

75% of Americans say they are more careful with their finances in 2025.

Conclusion

Financial stress continues to shape the lives of millions of U.S. households, not just through numbers on a balance sheet, but through very real impacts on mental health, daily choices, and long-term economic opportunities. With mounting debt, volatile incomes, rising costs, and insufficient savings for many, households remain vulnerable to both expected and unexpected shocks. At the same time, these pressures ripple out, influencing consumption patterns, economic growth, social inequality, and national resilience. Understanding these dynamics matters not just for individual families, but for policymakers, employers, and society as a whole.