HIVE Digital Technologies Ltd. (HIVE) operates at the intersection of bitcoin mining, high-performance computing (HPC), and AI infrastructure. As the firm scales its global footprint across Canada, Sweden, and Paraguay, its statistical profile is evolving rapidly. In mining, HIVE’s increasing hashrate and bitcoin production drive revenue growth and cost leverage, in infrastructure, its GPU-based AI & cloud services underscore its diversification into accelerated computing. The following sections unpack the key metrics, financial, operational, and market-driven, to provide a clear view of HIVE’s situation and forward momentum.

Editor’s Choice

- HIVE reported full-year FY2025 total revenue of $115.3 million, with Adjusted EBITDA of $56.2 million.

- In Q1 FY2026 (ended June 30, 2025), HIVE achieved revenue of $45.6 million and Adjusted EBITDA of $44.6 million.

- In October 2025, HIVE produced 289 BTC, up 147% year-over-year.

- Average global mining hashrate reached 21.9 EH/s in October 2025.

- The analyst consensus rating for HIVE is ‘Moderate Buy’, based on nine Buy ratings, one Hold, and one Sell, with an average price target of $8.00.

- HIVE’s HPC/AI-cloud revenue grew approximately 3× year-over-year in FY2025.

- HIVE is targeting installed mining capacity of ~25 EH/s by U.S. Thanksgiving 2025.

Recent Developments

- HIVE announced completion of its 100 MW Phase 3 Valenzuela expansion in Paraguay, bringing total operational capacity to over 24 EH/s.

- HIVE reported a 22% month-over-month increase in bitcoin production in August 2025 (247 BTC vs 203 BTC in July).

- Average fleet efficiency for HIVE in August was ~18.5 J/TH (joules per terahash).

- In September 2025, HIVE’s hashrate averaged 19.4 EH/s (peak 21.7 EH/s) while bitcoin production reached 267 BTC (+138% YoY).

- HIVE announced the acquisition of a 7.2 MW data center in Toronto for its BUZZ HPC business.

- On July 8, 2025, HIVE reported an 18% monthly bitcoin production increase tied to Phase 2 Paraguay expansion.

- Management indicated that bitcoin mining economics are approaching $60 per PH/s per day, given current pricing and hashrate.

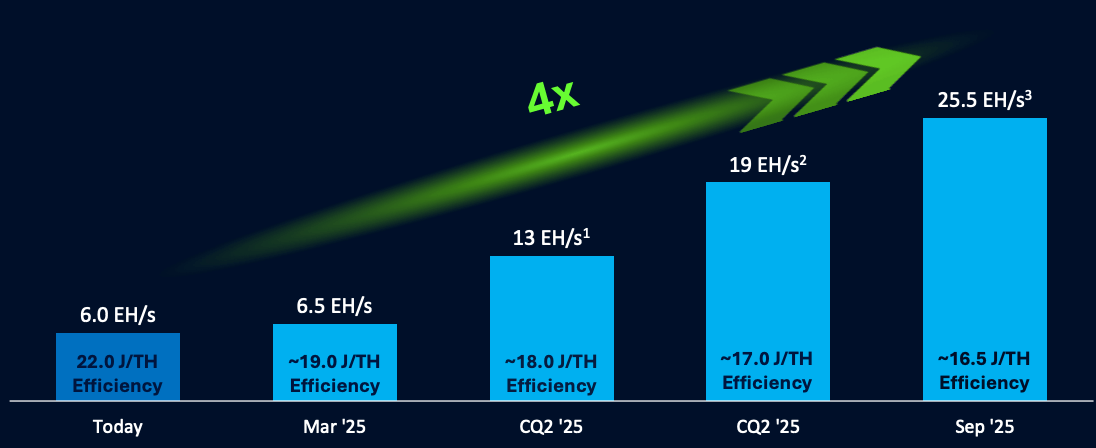

HIVE Projected Hashrate Growth and Efficiency

- Current hashrate is 6.0 EH/s with an efficiency of 22.0 J/TH as of today.

- By March 2025, hashrate is expected to rise to 6.5 EH/s with improved efficiency of ~19.0 J/TH.

- In CQ2 2025, HIVE targets 13.0 EH/s at an efficiency of ~18.0 J/TH in the first phase.

- A second CQ2 expansion pushes capacity to 19.0 EH/s with further efficiency gains to ~17.0 J/TH.

- By September 2025, HIVE projects will reach 25.5 EH/s at an efficiency of ~16.5 J/TH.

- The company anticipates a 4x increase in hashrate from current levels by Q3 2025.

- Consistent improvements in Joules per Terahash (J/TH) suggest ongoing hardware optimization and energy cost control.

Adjusted EBITDA

- For FY2025, HIVE posted $56.2 million in Adjusted EBITDA, representing 48.7% of total revenue.

- In Q1 FY2026, Adjusted EBITDA was $44.6 million, compared to a negative $8.0 million in Q1 FY2025.

- Q1 FY2026 gross operating margin increased to 35%, up from ~33% in the prior year quarter.

- Growth in Adjusted EBITDA is driven by mining hashrate expansion and higher HPC/AI revenue.

- In Q4 FY2025, revenue was $31.2 million for the quarter, providing a baseline for sequential improvement.

- Direct costs in Q1 FY2026 were about $29.8 million against revenue of $45.6 million (gross operating margin ~35%).

- The company cites fixed-rate hydroelectric power contracts in Paraguay as providing a low incremental cost of mining, thus supporting margin expansion.

- Adjusted EBITDA excludes non-cash items like coin-revaluation gains, ensuring comparability across periods.

Net Income and Profitability

- HIVE recorded a net loss of $3.0 million in FY2025 (ending March 31).

- In Q1 FY2026, the company turned a net income of $35.0 million, compared to a loss of $18.3 million in Q1 of the prior year.

- Net income improvement is driven by realized and unrealized gains on digital-currency holdings (e.g., $23.2 million gain in Q1) plus derivative asset gains.

- Gross operating margin in Q1 FY2026 was $15.8 million (~34.7% margin) compared to $10.7 million (~33%) in Q1 FY2025.

- HIVE ended Q1 FY2026 with ~$71.9 million in cash and digital-currency assets, bolstering financial flexibility.

- Operating income improvement reflects both higher revenue and disciplined cost control (notably power costs and fleet efficiency).

- However, profitability remains exposed to bitcoin price volatility and network difficulty trends.

- HIVE’s strategic aim to compound ROIC via scale-up of high-margin HPC services may enhance profitability over time.

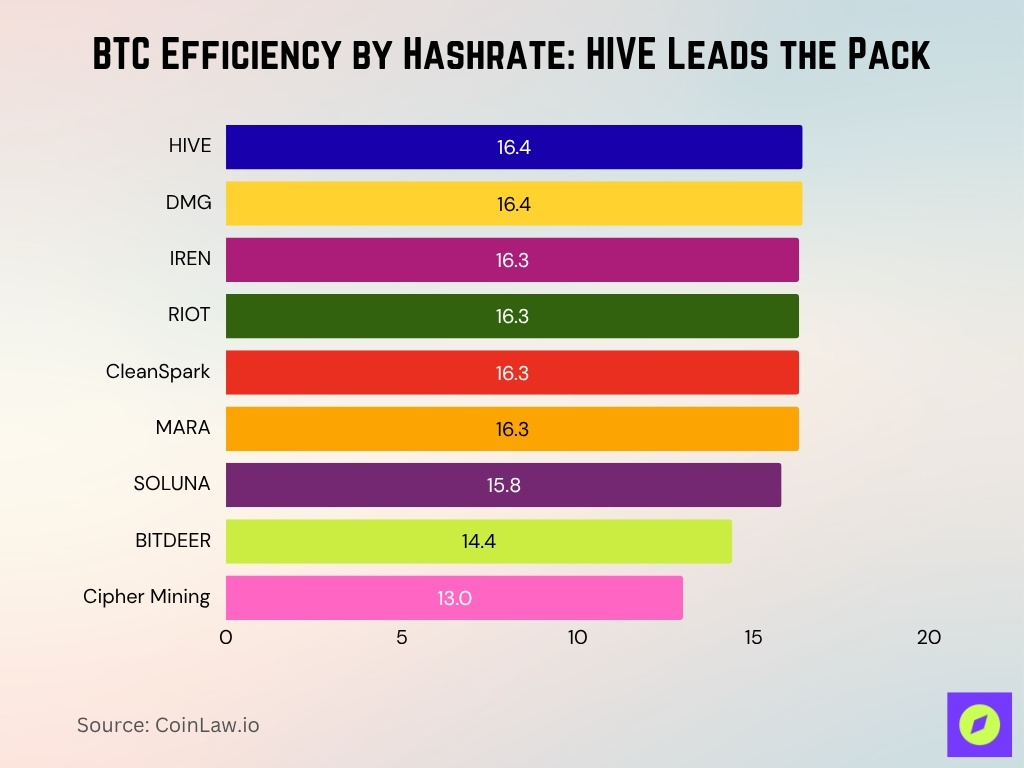

BTC Efficiency by Hashrate: HIVE Leads the Pack

- HIVE ranks #1 with 16.40 BTC mined per average active EH/s, showing top-tier mining efficiency.

- DMG matches HIVE with 16.40 BTC/EH/s, tying for the highest efficiency in May 2025.

- IREN, RIOT, CleanSpark, and MARA all follow closely with 16.30 BTC/EH/s, indicating strong but slightly lower productivity.

- SOLUNA mined 15.80 BTC per EH/s, staying competitive but trailing the top five.

- BITDEER achieved 14.40 BTC per EH/s, suggesting reduced output per unit of hashrate.

- Cipher Mining posted the lowest result, with just 13.00 BTC per EH/s, highlighting a possible performance gap.

- The spread from top to bottom is 3.4 BTC per EH/s, underscoring significant variation in operational efficiency across miners.

Earnings Per Share (EPS)

- In Q1 FY2026, HIVE reported a basic income per share of $0.19, compared with a basic loss per share of $0.17 in Q1 FY2025.

- The share count at the end of Q1 includes ~204.3 million common shares outstanding.

- Diluted EPS may differ due to options, RSUs, and warrants outstanding (~2.7 million options, ~9.9 million RSUs, ~3.2 million warrants).

- EPS improvement underscores the shift from loss-making to profitable quarters, aided by non-cash gains and operational expansion.

- For full-year FY2025, EPS remains negative given the net loss of $3.0 million.

- The company signals potential for EPS growth as hashrate scales and the HPC business expands.

- Market-expectation studies cite EPS improvement as a catalyst for share-price upside in HIVE.

Market Capitalization

- Analyst consensus price target suggests upside to ~$8.00 from current levels (~$4–5), representing ~+60% potential.

- Enterprise value (EV) estimates place HIVE’s EV at ~$369 million (TTM) as of mid-2025.

- The company’s market cap reflects its positioning as both a bitcoin miner and an AI/infrastructure business rather than a pure play miner.

- Market drivers include bitcoin price, network hashrate growth, government regulation, and energy cost dynamics.

- HIVE’s targeted 25 EH/s capacity by the end of 2025 is a key valuation lever in market sentiment.

- A “Strong Buy” consensus among analysts supports a favourable market capitalization trajectory.

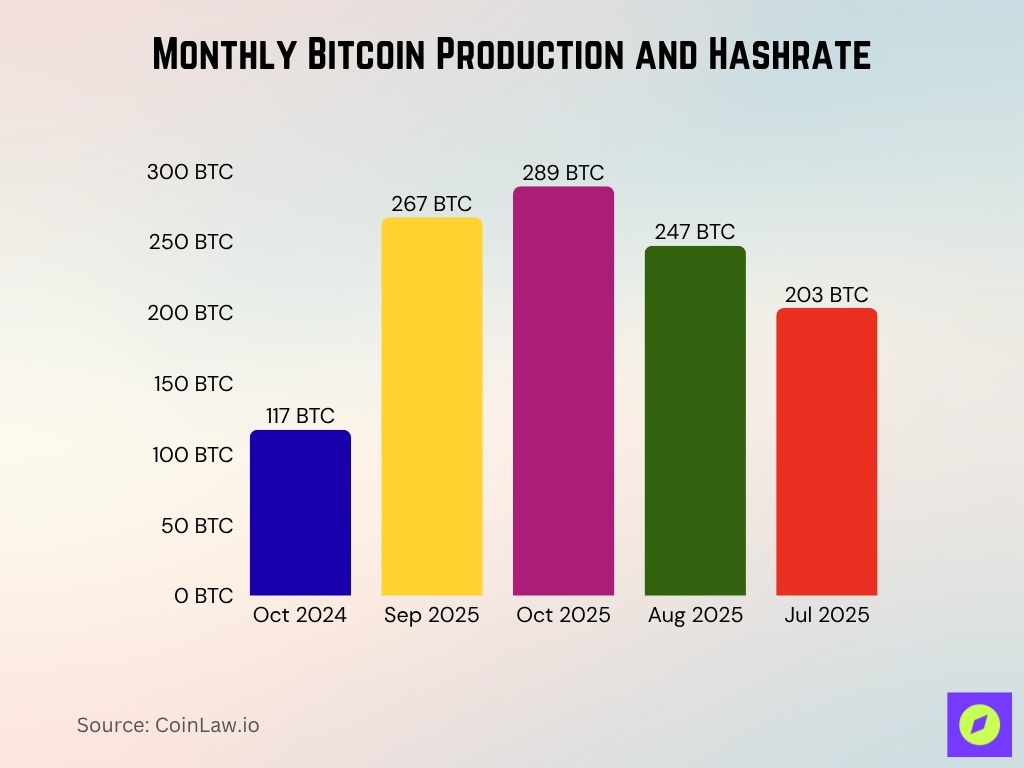

Bitcoin Production

- In October 2025, HIVE mined 289 BTC, up 147% year-over-year (from 117 BTC in October 2024) and up ~8% month-over-month (from 267 BTC in September).

- In August 2025, production reached 247 BTC (vs 203 BTC in July), representing a 22% month-over-month increase

- For October 2025, the company’s mining fleet averaged 21.9 EH/s (peak 23.6 EH/s) globally.

- Fleet efficiency in October 2025 was ~17.7 J/TH (joules per terahash)..

- At that time, the hashrate averaged 16.3 EH/s and peaked at 18.1 EH/s.

- The company expects to hit ~25 EH/s capacity by late 2025.

- In its FY2025 report, HIVE reported 1,414 BTC mined for the full year ended March 31, 2025.

- Mining operations are powered by green energy (hydroelectric sites) in Paraguay, which supports scalability and cost competitiveness.

Operating Margins

- In Q1 FY2026, the company reported a gross operating margin of ~35%, up from ~28.2% in Q4 FY2025.

- The company’s trailing-twelve-months (TTM) gross margin is reported at ~23.53%.

- Its operating margin for the TTM stands at ~0.42% according to financial data.

- The improvement in margin is attributed to higher hashrate, increased bitcoin production, and growth of high-performance computing (HPC) revenue.

- Direct cost of digital-currency mining was $ 26.8 million in Q1 FY2026 against mining revenue of $ 40.8 million.

- In the same quarter, HPC revenue of $ 4.8 million was achieved against direct costs of $ 2.1 million.

- Fixed-rate hydroelectric contracts in Paraguay support lower incremental cost, improving margin stability.

- The company targets fleet efficiency of ~17.5 J/TH for its mining operation, enhancing cost per terahash.

Balance Sheet Statistics

- As of June 30, 2025, HIVE reported total assets of approximately $628.7 million and total liabilities of ~$68.2 million.

- That gives a debt-to-equity ratio of about 6.2%, implying low leverage.

- As of March 31, 2025, the company had total assets of around $531.6 million and liabilities of around $82.5 million.

- Significant equipment deposits, as of June 30, 2025, equipment-deposit prepayments were ~$119.2 million.

- For the year ended March 31, 2025, the company recognised investments in marketable securities of ~$30.6 million as of June 30, 2025.

- The company’s change in functional currency to U.S. dollars took effect on April 1, 2024, which may affect the comparability of balance sheet figures.

- Leases, right-of-use assets were ~$5.3 million as of June 30, 2025, with lease liabilities current ~$2.86 million and non-current ~$2.68 million.

- The strength of the balance sheet gives the company flexibility for expansion in mining and HPC infrastructure.

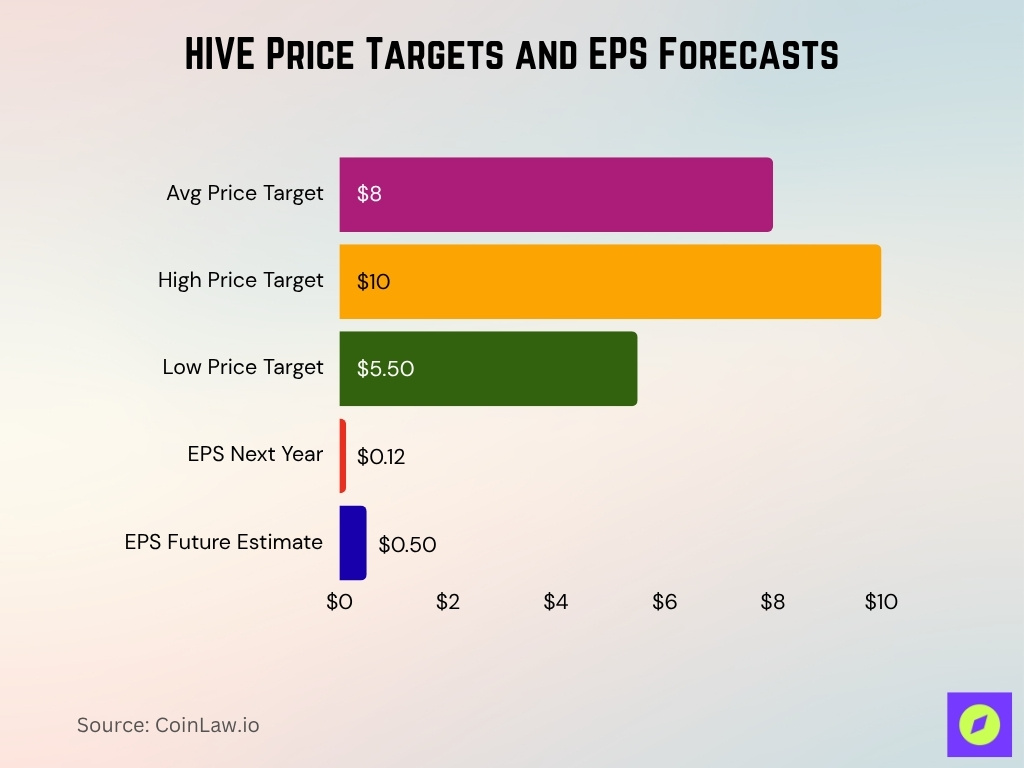

Analyst Ratings and Forecasts

- Analysts covering HIVE give a consensus rating of “Strong Buy” with an average price target of $8.00, implying ~66% upside from current levels.

- Some price-target ranges extend up to $10 (the highest estimate) and down to ~$5.50 (the lowest estimate) based on updated coverage.

- Analysts highlight HIVE’s hash rate expansion and AI/HPC diversification as key catalysts for future growth.

- Some caution remains; risks from bitcoin price volatility, regulatory shifts, and rising energy costs are cited as downside factors.

- According to MarketBeat, HIVE’s average price target recently rose to $8.00, with a “Moderate Buy” rating and some firms estimating up to $10.

- Estimated EPS improvement, from a negative EPS black as recent years to a projected EPS of $0.12 in the next year, then $0.50 further out.

- Analyst sentiment underscores the dual-track growth model (mining + AI/infra) as a differentiator versus pure-play miners.

Geographic Operations and Expansion

- HIVE operates in three main jurisdictions: Canada, Sweden, and Paraguay.

- In Paraguay, the company has deployed three 100 MW green campuses (the latest Valenzuela Phase 3) to support its mining expansion.

- The Paraguay operations are fed by hydroelectric power via the Itaipú Dam region, offering stable, renewable energy.

- The company’s non-mining operations are in Canada and Sweden, converting mining sites into Tier III+ AI/HPC data centres.

- HIVE’s operations in Sweden are part of the conversion of existing infrastructure for AI-cloud and HPC services.

- The target global mining capacity by the end of 2025 is ~25 EH/s, with expansion beyond that to ~35 EH/s during 2026.

- The geographic diversification provides resilience to region-specific regulatory or energy supply risks.

- Management highlights that the global rollout supports both scale in mining and scale in AI/HPC operations.

High Performance Computing (HPC) Statistics

- HIVE’s HPC business (under its BUZZ HPC division) reported $4.8 million in revenue in Q1 FY2026, up ~59.8% sequentially.

- Direct costs for the HPC segment in that quarter were ~$2.1 million, yielding favourable segment margins.

- The company states it is scaling its HPC division “five-fold over the same period” (i.e., in the next few years).

- The conversion of bitcoin mining infrastructure to Tier-III AI/data-centre capacity is underway, supporting the HPC strategy.

- Management emphasised that demand for GPU-based compute services is driving this metric.

- The company reported triple growth (“3× growth”) in AI GPU revenue in FY2025.

- The global HPC market trend provides tailwinds for HIVE’s expansion in that segment.

- The combination of mining plus HPC diversification positions HIVE to capture demand beyond crypto-only infrastructure.

AI Infrastructure and Cloud Services

- HIVE’s FY2025 total revenue was $115.3 million, combining digital-currency mining and HPC/cloud services.

- AI cloud earnings in FY2025 tripled to $10.1 million from $3.4 million in FY2024.

- Digital currency mining revenue was approximately $105.2 million, down 5.2% year-over-year due to Bitcoin halving impacts.

- HIVE mined 1,414 Bitcoins in FY2025, forming a significant part of its revenue base.

- The company’s GPU fleet scaled to 5,000 GPUs under its HPC/AI cloud business.

- HIVE’s annualized Bitcoin mining ARR more than tripled to $315 million after the Bitcoin halving.

- Construction underway for data centers supporting up to 2,000 NVIDIA GPUs in the EU, with plans for up to 6,000 GPUs globally by 2026.

- The AI data center in Toronto is being upgraded to Tier 3 with 7.2 MW capacity, serving GPU clusters and cloud computing.

- HIVE uses primarily renewable hydroelectric energy for its sites, including power from the Itaipu Dam.

- Adjusted EBITDA for FY2025 was $56.2 million, representing 48.7% of total revenue.

Sustainability and Renewable Energy Usage

- HIVE declares it operates on 100% renewable hydroelectric power, particularly at its Paraguay site, powered by the Itaipú Dam.

- The company’s mining fleet reached an average efficiency of 17.7 J/TH (joules per terahash) as of November 2025, aiding lower energy consumption.

- HIVE’s target is to achieve fleet-wide efficiency of 17.5 J/TH by late 2025.

- The new Paraguay expansion adds 100 MW of hydroelectric-powered infrastructure, increasing total renewable infrastructure footprint to 540 MW across three countries (Paraguay 400 MW; Canada & Sweden 140 MW).

- HIVE has set science-based targets, a ~42% reduction in Scope 1 and 2 emissions by 2030, aligning with the 1.5 °C goal.

- Energy cost advantage, by operating in Paraguay with hydroelectric power, HIVE achieves one of the industry’s lowest incremental mining costs.

- The integration of AI/HPC data-centers and renewable energy helps HIVE position itself as a “green” infrastructure company, enhancing its ESG appeal.

- HIVE emphasises converting mining-shell infrastructure into Tier III+ AI/HPC centres powered by renewable energy, reducing stranded-asset risk.

Strategic Partnerships and Acquisitions

- HIVE completed the acquisition of a 7.2 MW data centre in Toronto in September 2025 via its subsidiary BUZZ HPC, expanding its Canadian footprint.

- The Toronto facility upgrade from Tier I to Tier III standard supports HIVE’s AI/HPC growth strategy.

- HIVE signed a definitive agreement for an additional 100 MW hydroelectric-powered campus at Yguazú, Paraguay (Phase 3), enhancing its mining and infrastructure capacity.

- The Yguazú acquisition from Bitfarms Ltd. escalated HIVE’s mining capacity by 317%, from 6 EH/s to a projected 25 EH/s in 2025.

- Strategic partnership with Bell Canada via its Bell AI Fabric initiative supports sovereign AI cloud services in Canada, powered by HIVE’s infrastructure.

- Acquisition and partnerships align HIVE’s dual-engine growth model (Bitcoin mining + AI/HPC) with diversified infrastructure assets.

- HIVE also upgraded its ASIC miner fleet (e.g., Bitmain’s S21+ Hydro) to improve energy efficiency and asset utilisation.

- These strategic moves support HIVE’s ambition to secure a larger share of the global Bitcoin network while adding higher-margin AI/compute services.

Stock Price Performance

- As of early November 2025, HIVE shares traded around $4.60.

- The stock’s 52-week high ranged up to ~$7.81, while the low was near $1.25.

- The price-to-earnings (P/E) ratio is negative (≈ -21.65) due to recent losses; no dividend is currently paid.

- Recent share gap-up, On Nov 10, 2025, shares opened at $5.04 after a previous close $4.70, reflecting increased volume and positive sentiment.

- The stock’s beta is high (~2.65), reflecting elevated volatility tied to crypto cycles.

- Institutional ownership is rising; for instance, JPMorgan Chase increased its position in HIVE by 26.4%, as disclosed in their Q2 2025 13F filing.

- Overall, stock performance remains tied to Bitcoin price moves, hashrate growth, and the execution of HIVE’s infrastructure expansion.

Recent Milestones and Expansion Plans

- HIVE achieved 24 EH/s of global mining capacity as of October 2025 and produced 289 BTC that month.

- The Yguazú Paraguay site has reached or is close to 300 MW of capacity as part of its Phase 2 build-out.

- HIVE is on track to reach 25 EH/s by U.S. Thanksgiving 2025, per company commentary.

- Its target for 2026, 35 EH/s of hashrate and 5× growth in its HPC/AI segment.

- The company acquired important infrastructure, such as the 7.2 MW Toronto data centre, and repurposed mining shells into Tier III+ HPC facilities.

- HIVE’s strategic framework includes targeting > $300 million revenue and a deeper global footprint beyond 2025.

- Infrastructure milestones include advancing fleet efficiency (target 17.5 J/TH), securing green-power contracts, and scaling GPU-based AI services.

Frequently Asked Questions (FAQs)

Installed capacity of 25 EH/s, with operational hashrate surpassing 24 EH/s, supported by 300 MW of power capacity in Paraguay.

Exceeds 2% of the global Bitcoin network.

Growth of about 283% year-to-date to 23 EH/s capacity

Average target around $8.00, with a consensus rating of “Moderate Buy” (nine Buy ratings, one Hold, one Sell) at the time of reporting.

Conclusion

HIVE Digital Technologies stands at the convergence of green bitcoin mining and AI/HPC infrastructure growth. Its ambitious targets, expansion into Tier III+ data-centres, and a pivot to higher-margin AI workloads, provide a compelling narrative. However, its future performance remains closely linked to bitcoin price cycles and execution of its infrastructure roll-out. The dual-engine strategy, backed by renewable energy and infrastructure expansion, positions the company for potential upside, but it carries the typical risks of high-growth, high-volatility operations.