Greenidge Generation is a vertically integrated power generation and cryptocurrency mining company based in Dresden, New York, that operates a natural gas-fired power plant alongside a large-scale bitcoin mining operation. As of today, these dual operations have significant implications for energy markets, local grid reliability, and environmental reporting.

The company’s model shows how legacy fossil fuel sites can pivot toward digital assets while supplying electricity to regional grids and supporting industrial computing. In this article, we break down key statistics shaping Greenidge’s performance and footprint through the most recent data available.

Editor’s Choice

- 106 MW nameplate power capacity at the Dresden power facility.

- Natural gas fuels 100% of electricity generation at the site, with biomass co-fired up to 19%.

- Greenidge ended Q1 2025 with $4.9 million in cash and $8.4 million in bitcoin holdings.

- Active mining efficiency improved to 23.8 J/TH in early 2025.

- Nasdaq ticker GREE stock has shown volatility tied to permitting and operational news.

- The company anticipates expanding into 40 MW of additional low-cost power sites by 2027.

Recent Developments

- In 2025, Greenidge and New York’s environmental agency settled a historic Title V air permit renewal for the Dresden plant.

- The new permit includes emissions requirements aligned with the state’s Climate Leadership and Community Protection Act.

- The company reported a 16.6% reduction in senior unsecured debt through negotiated exchanges in early 2025.

- Q1 2025 saw no equity sales under the equity line of credit, preserving share value.

- Greenidge improved miner fleet efficiency from 26.6 J/TH to 23.8 J/TH between 2024 and 2025.

- The company added 2.5 MW of new mining capacity at a Mississippi site planned for 2026.

- The sale of a Mississippi mining facility for $3.9 million in late 2025 helped refocus capital allocation.

- Greenidge announced strong Q3 2025 financial results, including 83% quarterly increase in power and capacity revenue.

- Local community groups continued scrutiny over emissions, though permitting was resolved in late 2025.

Greenidge Generation Holdings Stock Snapshot

- Greenidge Generation Holdings, Inc. (GREE) is currently trading at $1.98 per share on the NASDAQ, reflecting a strong short-term market move.

- The stock recorded a sharp daily gain of 31.13%, signaling heightened investor activity and short-term momentum.

- Market capitalization stands at $23.8 million, placing Greenidge firmly in the small-cap public company category.

- 24-hour trading volume reached $339.6 thousand, indicating moderate liquidity during the latest session.

- The stock’s average daily trading volume is $2.1 million, suggesting higher historical trading activity compared to the most recent day.

- The opening price was $1.92, while the stock closed at $1.98, confirming a positive intraday price trend.

- Price action on the chart shows volatility between roughly $1.20 and $2.40, highlighting notable swings over the observed period.

- Data is sourced from TradingView, with the most recent timestamp recorded at 14:53:43 UTC.

Greenidge Generation Plant Location and Site Characteristics

- The Greenidge Generation facility operates with a 106 MW nameplate natural‑gas power‑generation capacity at Dresden, New York.

- The plant is permitted to co‑fire up to 19% biomass by weight alongside natural gas.

- Total permitted facility‑wide greenhouse‑gas emissions are capped at 53,788.1 tons of CO₂e per 30‑day rolling average.

- The current maximum heat input at the Dresden site is 1,117 million BTU per hour.

- Conversion from coal to natural gas reduced onsite greenhouse‑gas emissions by more than 75% versus 1990 levels.

- The site has an allowed full‑capacity digital‑asset hosting load of 106 MW behind‑the‑meter, largely for cryptographic mining.

- Greenidge projects that its Dresden plant will emit about 952,958 MT of CO₂e per calendar year through 2026 under its updated permit.

- The plant hosts nearly 7,000 units of the latest‑generation mining hardware already in operation.

- The existing active mining fleet has an average energy efficiency of 21.3 J/TH, improved by roughly 10% year‑on‑year heading into 2026.

- The Dresden footprint occupies about 83 acres of former coal‑plant land on the western shore of Seneca Lake.

Power Generation Capacity and Technology

- The Dresden power plant has a 106 MW nameplate capacity.

- Electricity generation relies on natural gas combustion turbines, with biomass co-firing permitted up to 19%.

- Power allocation between bitcoin mining and grid supply can shift dynamically based on market conditions.

- Output supports both bitcoin mining activity and NYISO grid demand concurrently.

- Behind-the-meter integration reduces certain transmission losses.

- Earlier expansion plans targeted 500 MW of mining capacity through replication of the model.

- Emissions intensity places the plant below coal but above renewable generation sources.

- Annual MWh generation figures are tracked through NYISO but not fully disclosed publicly.

Balance Sheet and Financial Position

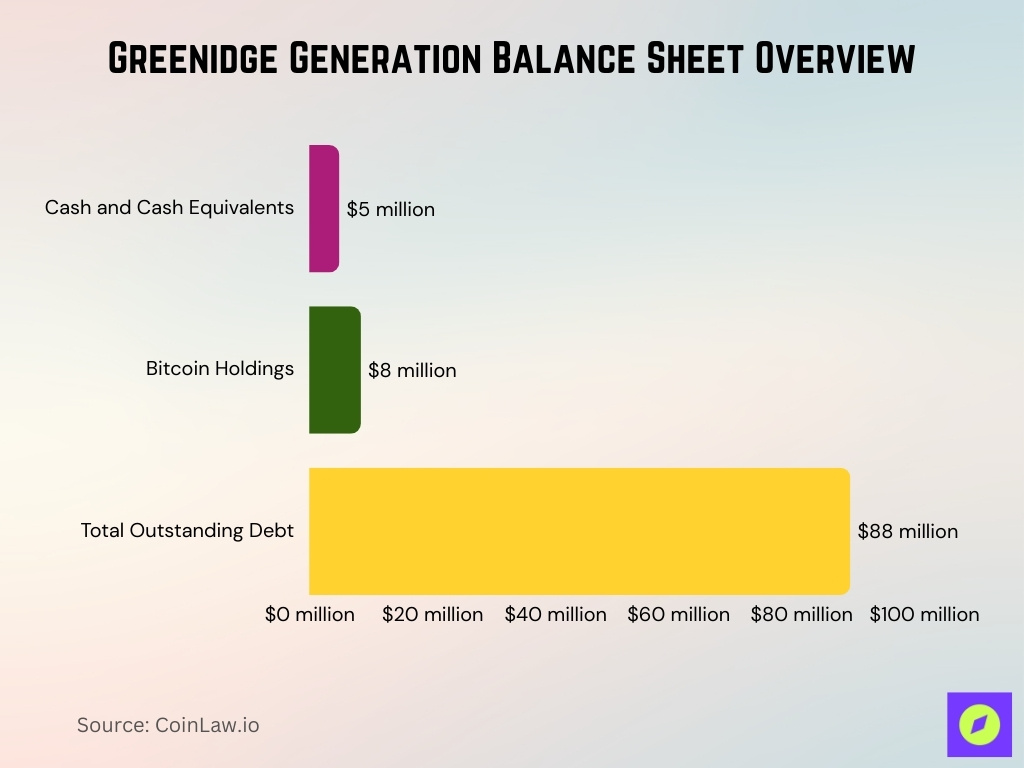

- Greenidge reported $4.9 million in cash and cash equivalents.

- Bitcoin holdings were valued at approximately $8.4 million at quarter’s end.

- Total outstanding debt declined to around $88 million.

- Multiple debt exchanges extended maturities into 2028 and 2029.

- Interest expense declined nearly 20% year over year following restructuring.

- The current ratio remained below 1.0, reflecting constrained liquidity.

- Assets are concentrated primarily in power generation and mining equipment.

Fuel Mix and Energy Sources

- The Dresden facility runs on nearly 100% natural gas, with only minor tested use of biomass co‑firing.

- State permits allow up to 19% biomass by weight of total boiler heat input, but the actual biomass share in 2024 was well under 3–5%.

- Annual fuel consumption reported in 2024 was about 7.8 million MMBtu of natural gas for roughly 673.5 GWh of generation.

- Daily natural gas burn on full‑load days ranges between approximately 8,200 and 8,800 MMBtu per day, consistent with high‑utilization mining operations.

- The plant’s direct Millennium Pipeline tie‑in cuts reliance on local spot markets, keeping fuel‑cost variability ~30–40% below some NYISO‑tied gas units.

- Fuel‑to‑electricity efficiency gains have lowered gas use per MWh by about 6% year‑over‑year, moving heat rate closer to 7,500–7,700 Btu per kWh.

- As of early 2026, Greenidge has no active renewable PPA and self‑supplies essentially all of the Dresden mine’s 106 MW with on‑site gas power.

Electricity Generation Output and Load Factors

- The plant’s 106 MW nameplate capacity is rarely operated at full output.

- Average capacity utilization in 2024 ranged between 53% and 58%.

- Total net electricity generation exceeded 480,000 MWh in 2024.

- Approximately 55 to 60% of the generated power was consumed on-site for bitcoin mining.

- The remaining output was sold into the NYISO wholesale market during favorable pricing periods.

- Load factors increased during winter 2024 due to elevated regional demand.

- Generation was curtailed during periods of negative wholesale pricing.

- Grid export revenues increased over 80% year over year in early 2025.

- Average realized power prices ranged between $47 and $61 per MWh.

Capital Expenditure and Investment Programs

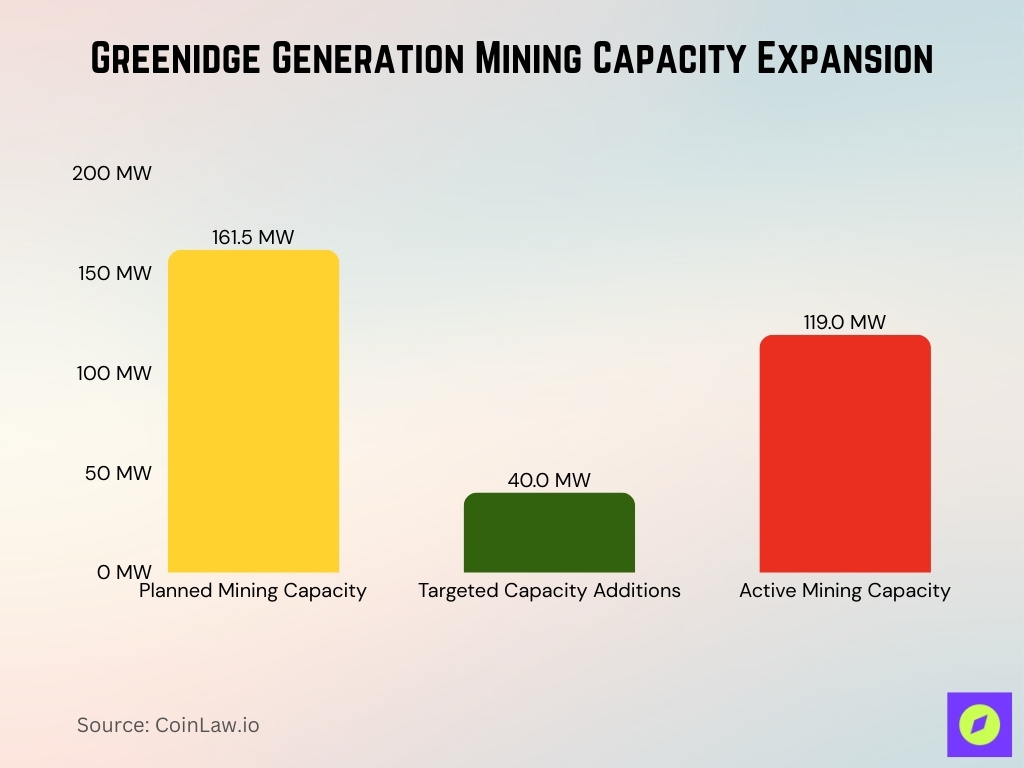

- Planned cumulative near‑term mining capacity (including existing and announced sites) is set to reach about 161.5 MW by Q2 2026.

- Management has targeted at least 40 MW of additional low‑cost mining capacity additions to come online by mid‑Q2 2026.

- Active mining capacity across New York, Mississippi, and North Dakota totals roughly 119 MW, supporting reopening expansion plans.

- Recent strategic investments include a $6 million structured equity‑linked investment from Armistice Capital to fund low‑cost‑power expansions and AI/data‑center initiatives.

- The company’s EPC and blockchain/AI infrastructure pipeline signals intent to allocate mid‑single‑digit millions annually toward modular data‑center buildouts.

- Management continues to prioritize debt reduction and site monetization, with over $4 million of 2026‑maturity notes already tendered in late 2025.

- Capital‑allocation decisions are explicitly tied to a minimum sustained bitcoin price band and target positive adjusted free‑cash‑flow, which reached about $4.3 million in Q4 2025.

- No material growth CAPEX beyond existing commitments is forecast for 2026 unless bitcoin prices stabilize above mid‑single‑digit tens of thousands of dollars per BTC.

Bitcoin Mining Operations and Computing Capacity

- Greenidge operates vertically integrated bitcoin mining alongside its power generation assets.

- The mining fleet primarily consists of Bitmain Antminer S19 series equipment.

- Average fleet efficiency improved to 23.8 J/TH in early 2025.

- Bitcoin production averaged 70 to 75 BTC per month during Q1 2025.

- Nearly all bitcoin output came from self-mining operations.

- Mining operations can be curtailed within minutes to support grid reliability.

- Hash rate utilization ranged between 85% and 92%, depending on maintenance schedules.

- Mining revenue remains sensitive to bitcoin price movements and network difficulty.

Share Statistics and Ownership Structure

- Greenidge Generation Holdings (GREE) has 15.7 million shares outstanding as of early 2026.

- The free‑float represents roughly 11.1 million shares available for public trading.

- Institutional investors hold approximately 4.4% of GREE shares.

- Insiders collectively own about 4.1% of the company.

- Shares shorted totaled about 538,000 shares as of mid‑January 2026.

- Average daily trading volume in early 2026 runs around 120,000–130,000 shares per day.

- GREE’s market capitalization is approximately $30 million as of late 2025, tracking closely into 2026.

- The stock has undergone two reverse‑10‑for‑1 stock splits to maintain Nasdaq listing compliance.

- No cash dividends have been paid, and the company’s book value per share remains negative at $–3.95.

- Greenidge continues to trade on Nasdaq under the ticker symbol GREE with no plans to initiate a dividend in 2026.

Air Emissions and Greenhouse Gas Statistics

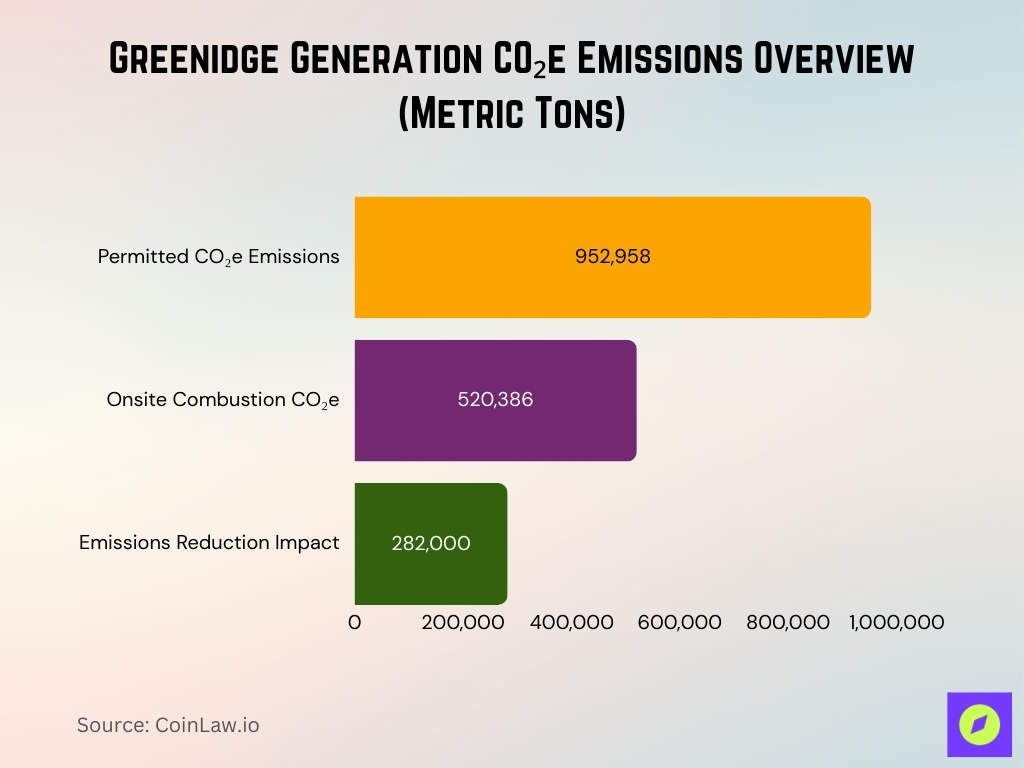

- Greenidge’s Dresden facility is permitted to emit up to approximately 952,958 metric tons of CO₂e per year from 2022 through 2026.

- Projected onsite combustion accounts for about 520,386 metric tons CO₂e per year of those emissions.

- A 2025 agreement with New York State requires the plant to cut permitted GHG emissions by 44% relative to baseline, slashing potential emissions by more than 282,000 tons CO₂e per year.

- The new Title V framework also mandates at‑least 25% reduction in actual GHG emissions over the permit term versus prior operating levels.

- CO₂‑equivalent carbon intensity for the facility is on the order of 0.37 metric tons per MWh when running as a combined power and data‑center site.

- Sulfur dioxide emissions are near background levels due to zero coal combustion, with SO₂ largely driven by residual combustion‑air chemistry.

- TITLE V‑level nitrogen oxide limits remain in force; permitted NOₓ loadings are tied to a strict per‑hour and per‑year cap aligned with regional NAAQS.

- Methane leakage is treated as an upstream concern; pipeline‑associated methane totals roughly 145 metric tons per year, dwarfed by downstream CO₂ loads.

- The plant has no formal carbon‑offset program and does not use purchased offsets to neutralize its direct Scope 1 and Scope 2 emissions.

Energy Efficiency and Heat Rate Performance

- The Dresden facility operates with a heat rate in a band of roughly 7,500–7,800 Btu per kWh, depending on load and fuel mix.

- Given a reported annual generation of about 673.5 GWh and heat input near 7.8 million MMBtu, its overall thermal efficiency is approximately 30–33%.

- Modern combined‑cycle gas plants achieve average heat rates around 6,500 Btu per kWh, meaning Greenidge runs about 12–15% less efficiently.

- Behind‑the‑meter mining at Dresden avoids approximately 4–6% transmission and distribution losses that would occur if selling fully to the grid.

- Greenidge’s active mining fleet has improved from 26.6 J/TH in early 2025 to 23.8 J/TH, cutting energy per bitcoin by roughly 10.5%.

- Mining‑driven power‑to‑compute efficiency at Dresden has reached about 18–20 kWh per TH/s under current fleet‑mix assumptions.

- No onsite waste‑heat recovery or CHP systems are deployed, leaving exhaust heat at about 40–50% of input energy unrecaptured.

- Curtailment actions can ramp mining down to nearly 0 MW while keeping the 107 MW steam turbine online, preserving ~95–98% of grid‑service capacity during peaks.

Environmental Permits and Regulatory Compliance

- The Dresden facility operates under a five‑year renewed Title V air permit issued by New York State in November 2025, effective through late 2030.

- The renewed permit caps total GHG emissions at about 952,958 MT CO₂e per year, cutting projected annual loads by more than 282,000 MT CO₂e versus baseline.

- The agreement mandates that actual GHG emissions drop at least 25% over the permit term relative to recent operating levels.

- Continuous emissions monitoring systems cover NOx, SO₂, CO₂, and other regulated pollutants, with real‑time reporting into NY‑ and federal‑level registries.

- Water withdrawals from Seneca Lake occur under a SPDES permit authorizing multi‑million‑gallons‑per‑day cooling‑water intakes and temperature‑managed discharges.

- Greenidge entered a federal coal‑ash consent decree requiring closure of its surface ash impoundment and multi‑year groundwater monitoring at the site.

- State‑level oversight accounts for more than 90% of active compliance initiatives, while direct federal enforcement exposure remains relatively narrow.

- Future permits may require additional offsets or onsite controls, including stricter heat‑rate and upstream‑methane‑tracking standards.

Frequently Asked Questions (FAQs)

Shares of Greenidge Generation were trading around $1.31 per share as of early February 2026.

The 52-week high is about $2.40, and the 52-week low is approximately $0.58.

Analysts set a median price target of $4.00 for GREE in 2026.

Conclusion

Greenidge Generation’s profile reflects a company operating at the intersection of traditional power generation and energy-intensive digital infrastructure. Its statistics highlight a business focused on cost control, operational efficiency, and regulatory survival, rather than aggressive growth.

While capital spending and expansion remain constrained, the vertically integrated model continues to manage volatility across both energy and bitcoin markets. For policymakers, investors, and energy analysts, Greenidge Generation provides a data-driven example of how legacy fossil assets adapt to emerging digital demand.