Grayscale Investments has filed to convert its NEAR Protocol Trust into a spot ETF, marking a significant step in expanding its crypto investment offerings.

Key Takeaways

- Grayscale filed a Form S-1 with the SEC to convert the Grayscale NEAR Trust into a spot exchange-traded fund.

- The trust, which currently trades over-the-counter under the ticker GSNR, has about $900,000 in assets under management and is down nearly 45% since launch.

- If approved, the ETF will list on NYSE Arca, potentially giving broader investor access to NEAR Protocol.

- The move comes amid a tough altcoin market and growing investor interest in diverse crypto ETF products.

What Happened?

Grayscale Investments submitted a regulatory filing to the U.S. Securities and Exchange Commission on January 20 to convert its NEAR Protocol Trust into a spot ETF. The conversion would shift the trust from OTC trading to a NYSE Arca listing under the same ticker symbol, GSNR.

The trust was launched in 2021 and has since reflected the broader altcoin market downturn, with its net asset value falling roughly 45 percent. Still, Grayscale’s filing signals continued confidence in the long-term prospects of NEAR and the demand for diverse crypto investment products.

A cryptocurrency ETF by Grayscale filed, a conversion from an existing private fund they manage.

— ETF Hearsay by Henry Jim (@ETFhearsay) January 20, 2026

Grayscale Near Trust (NEAR)

Ticker of current fund: $GSNR

Fees: tba

Effective date: tba

NEAR coin:https://t.co/jjBPOR5n4Z

Grayscale NEAR fund:https://t.co/ttKoBjDj25

GSNR… pic.twitter.com/IqJbjlJyEf

Grayscale’s Strategic Push Into ETFs

Grayscale’s latest move aligns with its broader strategy of transforming its crypto trusts into fully regulated ETFs. This approach gained momentum in 2025, when the firm successfully converted multiple products like its Digital Large Cap Fund, Chainlink Trust, and XRP Trust into exchange-traded funds.

The NEAR Trust follows that same path. Initially launched as a private trust, then listed on the OTCQB market under GSNR, it now aims for the visibility and liquidity that come with a NYSE Arca listing.

The trust currently holds around $900,000 in assets, and Grayscale confirmed in the filing that it intends to rename the product as Grayscale NEAR Trust ETF once the conversion is approved. Although the product has not met its investment objective, the firm views ETF status as a potential step forward for investors seeking exposure to NEAR without direct ownership.

Details on Custody, Staking, and Infrastructure

The S-1 filing includes technical details about how the ETF would function. Grayscale clarified that staking is currently not enabled, as certain conditions must be met first. However, if permitted, the trust would adopt a “Provider-Facilitated Staking” model using vetted third-party validators. The trust would retain token ownership and receive staking rewards in NEAR.

The ETF will use the CoinDesk NEAR CCIXber Reference Rate to track spot prices. Its infrastructure includes major partners:

- CSC Delaware Trust Company as trustee.

- The Bank of New York Mellon as transfer agent and administrator.

- Coinbase Custody Trust Company LLC as custodian.

- Coinbase Inc as prime broker.

Grayscale also noted in the filing that fees and other structural details will be provided in future updates.

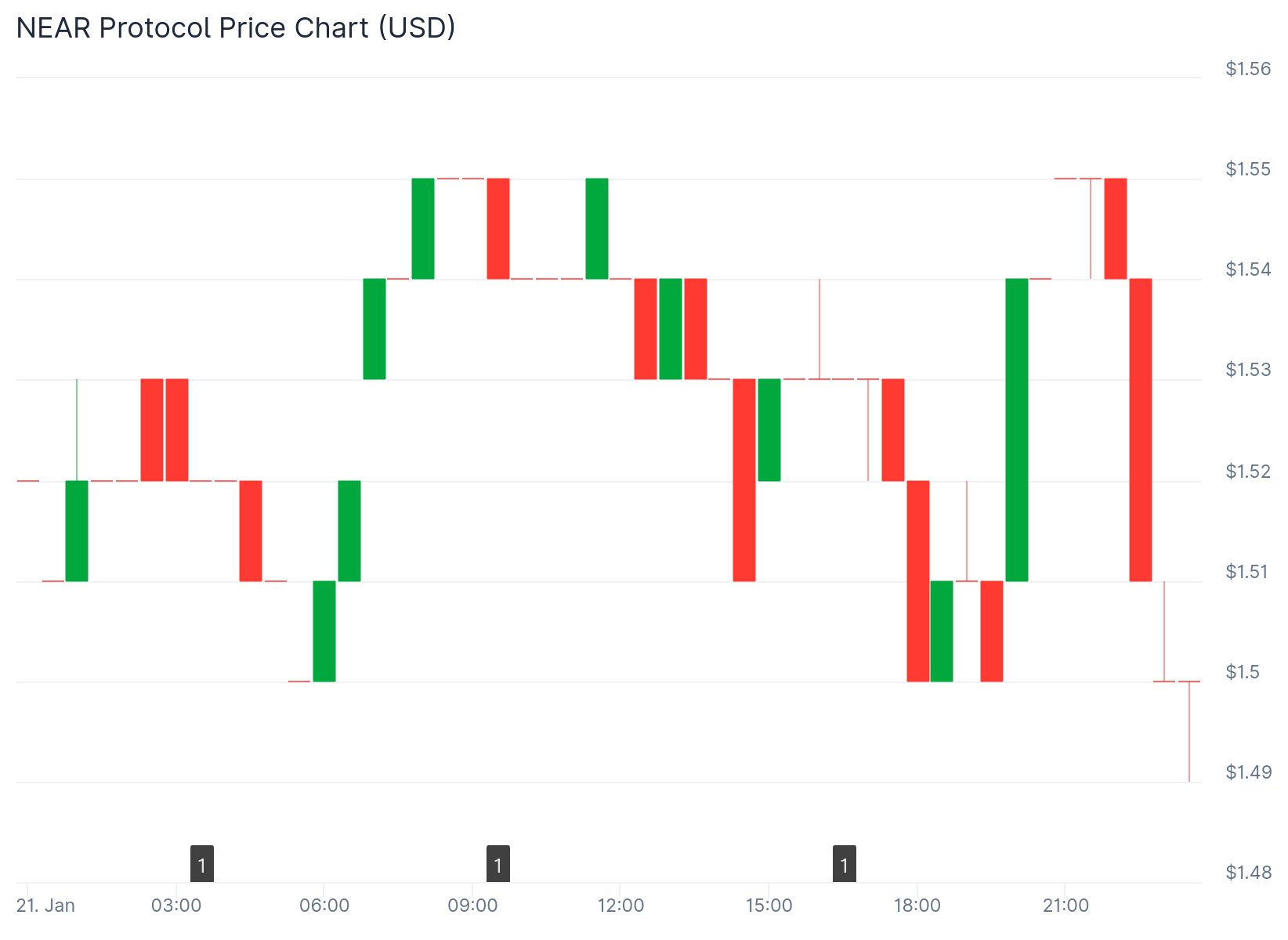

NEAR Token Price Reacts

Following the ETF filing, NEAR Protocol’s token price jumped over 3 percent, trading around $1.54 with a daily range between $1.50 and $1.60. Trading volume surged more than 22 percent over 24 hours, signaling renewed interest among traders even as the crypto market faced broader sell-offs.

Still, the token remains more than 90 percent below its 2022 peak above $20, underscoring the ongoing challenges in the altcoin space.

Growing Competition in Crypto ETFs

Grayscale’s filing adds to a growing list of crypto ETF applications. Asset manager Bitwise filed a similar request for a NEAR ETF in May 2025, and Grayscale itself has formed trusts tied to other tokens like BNB and Hyperliquid.

In December 2025, Bitwise submitted applications for 11 new strategy ETFs, including exposure to Aave, Starknet, Sui, Zcash, and others, reflecting the broader push to expand crypto investment options beyond Bitcoin and Ethereum.

CoinLaw’s Takeaway

I think Grayscale’s move speaks to a bigger trend: investors want more tailored crypto access, and firms are scrambling to meet that demand. While NEAR’s performance hasn’t dazzled lately, the idea of putting it into an ETF format shows that traditional finance is still hungry for innovation, even during market downturns. In my experience, these are the kinds of filings that set the stage for the next phase of adoption. It’s not just about Bitcoin or Ethereum anymore. This is about making more of crypto investable at scale, even if the timing is not perfect.