The digital wallet GoPay is rapidly becoming a cornerstone of Indonesia’s cashless economy, enabling peer-to-peer transfers, bill payments and merchant check-outs in one seamless experience. For example, ride-hailing and food-delivery services use GoPay to settle payments in seconds, while small-business merchants integrate GoPay QR in villages and cities alike. In the retail sector, merchants see faster checkout times, and consumers enjoy fewer barriers to payment. Read on to explore how GoPay is performing across adoption, transaction volume, and profitability.

Editor’s Choice

- GoPay’s parent ecosystem, GoTo Group, reported Core-GTV growth of 43% YoY to IDR 102.8 trillion in Q3 2025.

- For the same quarter, Group net revenue rose 21% YoY to IDR 4.7 trillion.

- GoPay processed over 500 million transactions per month by September 2025, up ~54% year-on-year.

- The Indonesian digital payments market reached about $88.5 billion in 2023, with GoPay named among the major mobile-wallet players.

- 58% of Indonesians use GoPay regularly, and 71% have used it at least once.

- Digital payments (including wallets) accounted for 49.3% of e-commerce transaction value in 2024, with mobile wallets like GoPay having ~35%.

- The loyalty-program market in Indonesia (which GoPay participates in) is expected to grow 18.3% annually to reach $1.03 billion in 2025.

Recent Developments

- GoTo Group reported it had turned to an adjusted pre-tax profit of IDR 62 billion in Q3 2025, its first for the group.

- In Q3, GoPay’s financial services segment revenue rose ~55% YoY, largely driven by consumer-loan and payment-transaction growth.

- The standalone GoPay app (separate from the super-app) was rolled out to reach Tier-2 and Tier-3 cities, enabling access for lower-powered smartphones.

- The national QR code standard QRIS continues to expand, enabling GoPay to reach more merchants across rural and urban Indonesia.

- GoPay consumer loans reached IDR 5.7 trillion in Q1 2025.

- GoTo Group raised its full-year adjusted EBITDA guidance for 2025 to between IDR 1.8 trillion and IDR 1.9 trillion.

- Analysts note that GoPay is moving from expansion to margin improvement, with the fintech arm turning profitable ahead of schedule.

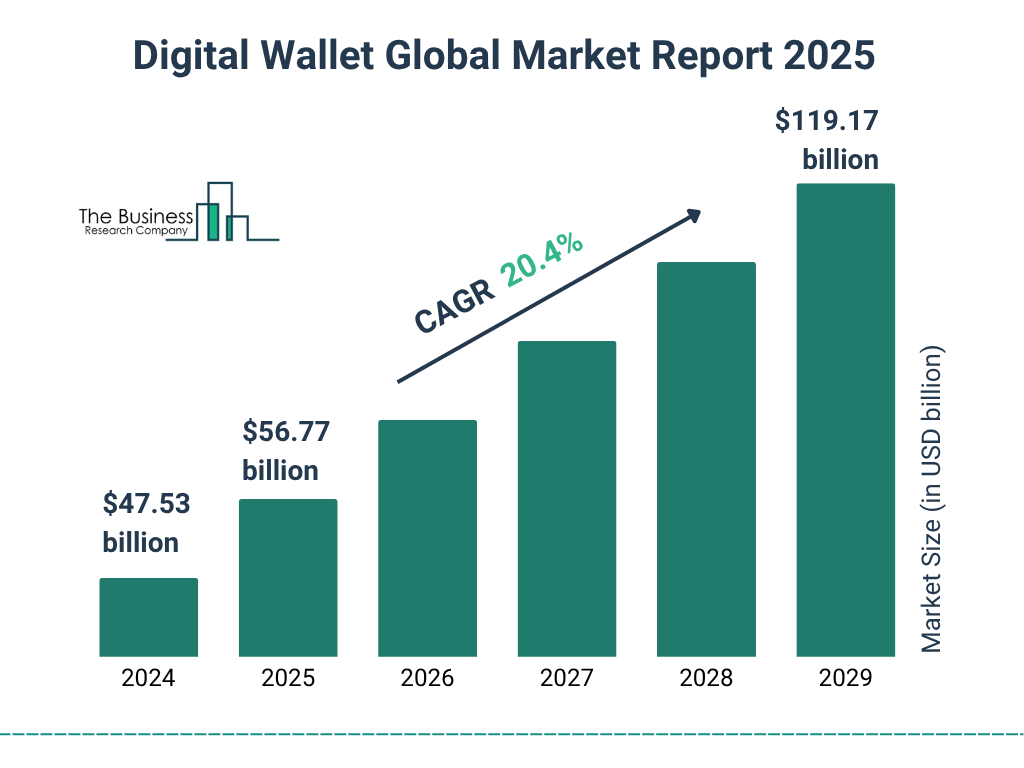

Digital Wallet Market Growth Highlights

- The global digital-wallet market was valued at $47.53 billion in 2024, marking strong early momentum.

- By 2025, the market size will have increased to $56.77 billion, showing continued adoption across regions.

- Projections place the industry at $119.17 billion by 2029, highlighting significant long-term scalability.

- The sector is expected to grow at a 20.4% CAGR, driven by rising mobile payments and expanding e-commerce activity.

- This sustained upward trend positions digital wallets as one of fintech’s fastest-growing segments.

GoPay Regional Adoption Rates

- A survey reported that 58% of Indonesians used digital payment methods in 2023, and it listed GoPay among the most popular platforms.

- As QRIS expanded nationwide, merchants increased QR-payment acceptance by more than 30% annually, boosting GoPay’s regional uptake.

- GoPay saw stronger growth in Tier-2 and Tier-3 cities after launching its lightweight standalone app.

- Urban regions show high adoption, while less-connected rural areas still hold strong growth potential.

- In Q4 2024, GoTo reported a 66% YoY increase in Core-GTV, signalling broader regional adoption beyond major cities.

- Indonesia’s $88.5 billion digital-payments market in 2023 underscores the large expansion opportunity for GoPay.

Transaction Volume Growth

- GoTo Group’s Core GTV (including GoPay and other fintech units) rose 43% YoY to IDR 102.8 trillion in Q3 2025.

- Total Group GTV for the same quarter reached IDR 176 trillion, marking 28% YoY growth.

- In Q1 2024, Group GTV increased 20% YoY to IDR 116.5 trillion, while Core GTV climbed 32% to IDR 54.6 trillion.

- By September 2025, GoPay surpassed 500 million monthly transactions, up roughly 54% from the prior year.

- In 2024, Indonesia processed IDR 650.6 trillion (~$39.5 billion) in QR payments, 335% YoY growth, with GoPay as one of the major contributors.

- The country’s mobile-payments market is projected to grow at a CAGR above 15% into the late 2020s, supporting further transaction expansion.

- The expansion of QRIS and m-POS solutions continues to digitise offline merchants, boosting GoPay’s person-to-merchant transaction activity.

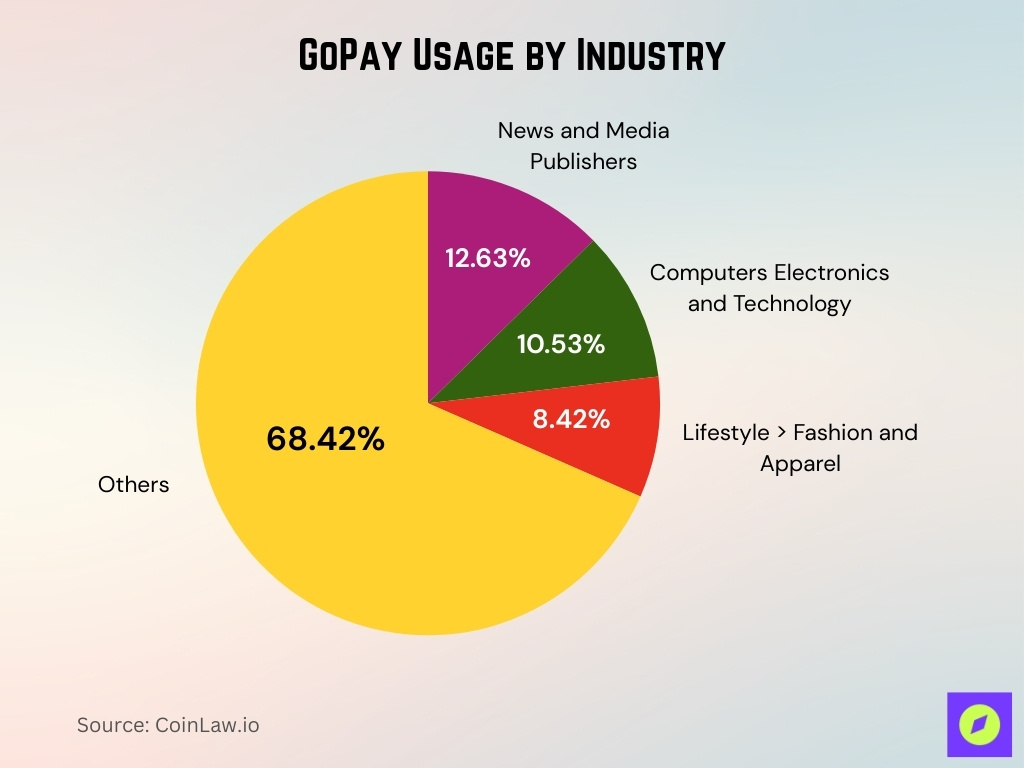

GoPay Usage by Industry

- News & Media Publishers make up 12.63% of GoPay usage, standing out as its strongest non-retail industry segment.

- Computers, Electronics & Technology account for 10.53%, reflecting strong adoption among tech-oriented businesses.

- Lifestyle & Fashion brands contribute 8.42%, underscoring GoPay’s appeal in consumer retail categories.

- Other industries collectively represent 68.42%, showing broad, diversified usage well beyond the top three segments.

Revenue and Profitability

- In Q3 2025, GoTo reported net revenue of IDR 4.7 trillion, up 21% YoY.

- In Q1 2024, gross revenues rose 18% YoY to IDR 4.2 trillion.

- GoTo achieved its first adjusted EBITDA break-even in Q4 2024, according to analyst reports.

- The fintech segment (including GoPay) was flagged as “on track to be EBITDA profitable by the end of 2025”.

- The loan-book component of GoPay (via GoTo) grew 172% YoY in a certain quarter, per a research note.

- Take-rate for fintech remains low (~1.0%) compared to other services in GoTo’s ecosystem, indicating scale remains the priority.

- Analysts project net revenue growth of 9-14% for GoTo in the period 2025-27, suggesting moderate margin expansion.

- The shift from pure transaction growth to improving profitability signals that GoPay is moving from customer-acquisition mode to monetisation mode.

GoPay Performance in Indonesia

- GoPay is accepted by over 900,000 merchants across Indonesia’s online and offline channels.

- 93% of SMEs using GoPay saw increased transaction volumes after onboarding.

- Approximately 58% of Indonesian consumers use GoPay regularly.

- GoPay’s customer satisfaction index in Jakarta ranks as “very satisfactory” based on user surveys.

- GoPay’s parent company, GoTo Group, drives wallet adoption through ride-hailing, food delivery, and marketplaces.

- GoPay usage combines high-frequency daily use and high-volume merchant checkouts across sectors.

- Major competitors include OVO and Dana, but GoPay leads in merchant acceptance and peer-to-peer reach.

- GoPay processed over 500 million transactions in September 2025 alone, reflecting strong adoption.

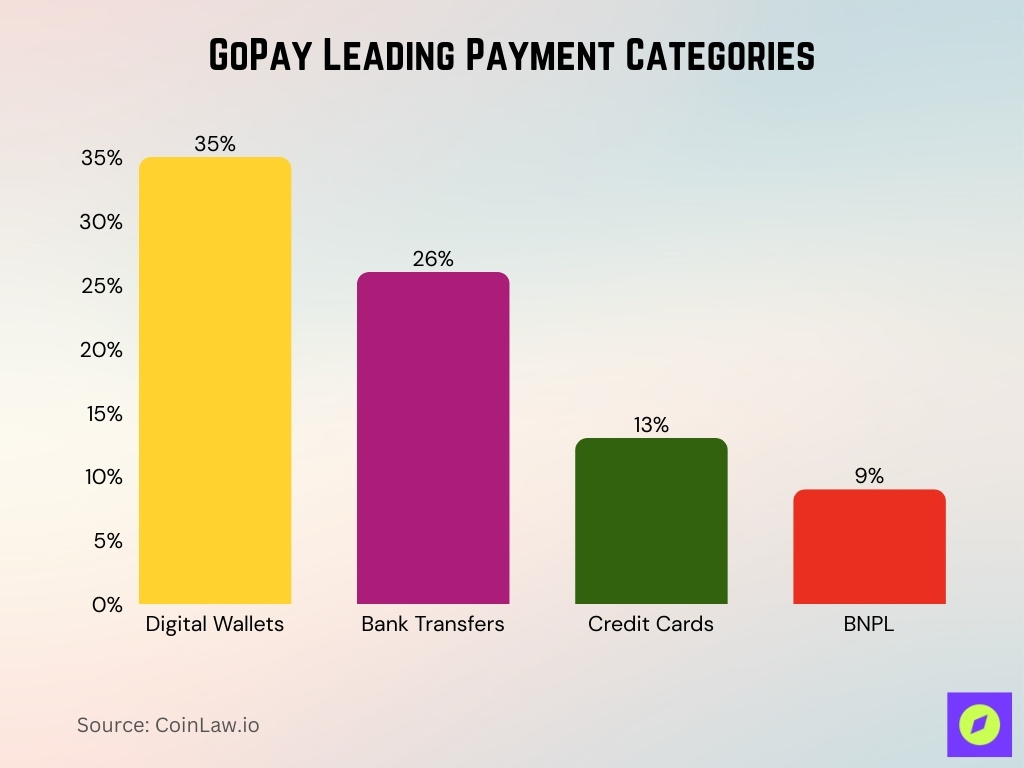

Leading Payment Categories

- Digital wallets account for 35% of Indonesia’s e-commerce payment volume in 2025.

- Bank transfers make up about 26% of e-commerce payment volume in Indonesia.

- Credit cards represent around 13% of payment volume in Indonesian e-commerce.

- BNPL (buy-now-pay-later) usage is approximately 9% of Indonesia’s e-commerce payments.

- The BNPL market value in Indonesia is projected to reach $8.59 billion in 2025.

- GoPay serves over 900,000 merchants across Indonesia for digital payments.

- QRIS-based payment volume surged by 154.86% annually as of April 2025.

- GoPay processed over 500 million transactions in September 2025 alone.

- Mobile wallets, including GoPay, account for over 60% of daily transactional spend among Indonesian urban consumers.

- Indonesia’s e-commerce market is forecasted to reach $94.5 billion in 2025, with digital wallets leading payment methods.

Competitive Position (vs. other e-wallets)

- 71% of digital-wallet users in Indonesia have used GoPay, giving it a broad national reach.

- Around 58% of users continue to use GoPay regularly, keeping it in a leading market position.

- Indonesia’s digital-payments market is estimated at roughly $110 billion.

- GoPay remains ahead in merchant acceptance and P2P payments, especially among street vendors and micro-merchants.

- Its merchant network also gains from Indonesia’s QRIS standard, which streamlines wide-scale payment acceptance.

Merchant Network Statistics

- Over 900,000 merchants across online, micro, and retail sectors accept GoPay.

- Analysts value Indonesia’s merchant-acquiring market at about $110 billion in 2025.

- More than 30 million MSME outlets accept QR payments through QRIS as of 2024.

- About 55% of SMBs reported higher revenue after integrating GoPay.

- Micro-vendors and street-food stalls increasingly offer GoPay QR checkout for offline payments.

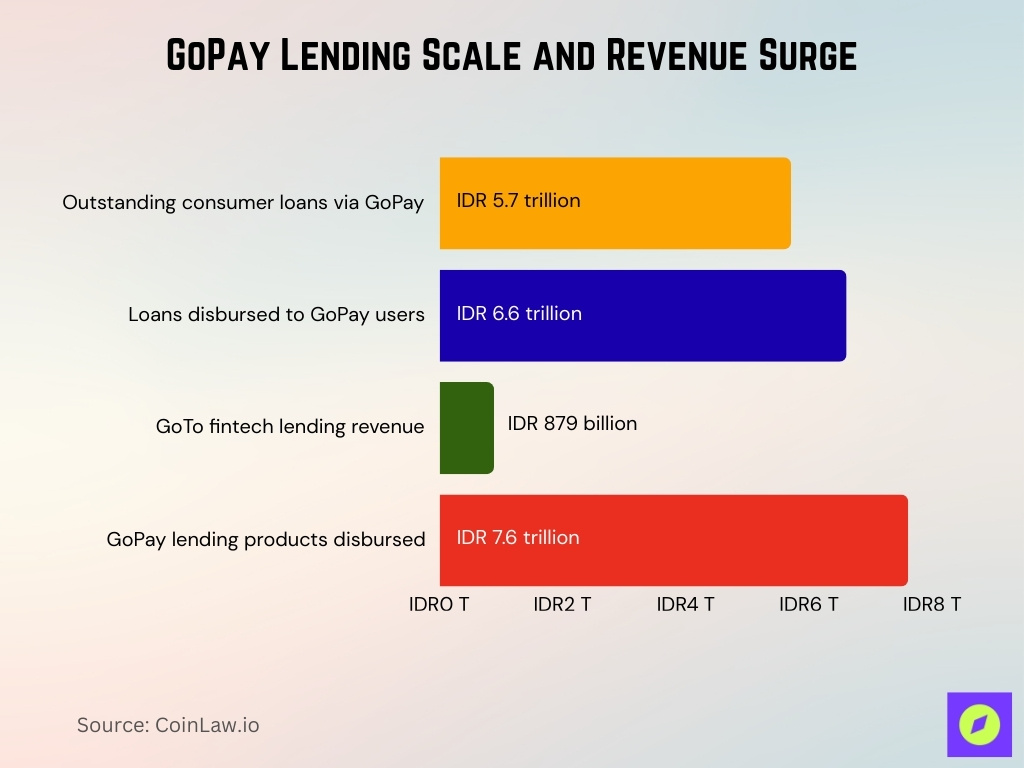

GoPay Lending and Pay Later Adoption

- Outstanding consumer loans via GoPay reached IDR 5.7 trillion in Q1 2025, marking a 108% YoY increase.

- Loans disbursed to GoPay users rose 96% YoY, with outstanding principal reaching IDR 6.6 trillion by mid-2025.

- GoTo Group’s fintech division reported lending revenue of IDR 879 billion in Q2 2025, reflecting 130% YoY growth.

- GoPay lending products disbursed IDR 7.6 trillion as of September 2025, representing a 76% increase.

- Indonesia’s embedded-finance sector is projected to reach $8.82 billion in 2025, expanding at 11.3% annually.

- The Indonesian BNPL market is expected to hit $8.59 billion in 2025, growing at 13.5% per year.

GoPay Security and Compliance Achievements

- GoPay uses advanced security features, including PIN protection, biometric verification, and real-time alerts.

- QRIS national standard processed over 2.6 billion transactions worth IDR 262.1 trillion in Q1 2025, supporting GoPay compliance.

- GoPay users rate service quality attributes like transaction timeliness and information availability very positively.

- Industry commentary highlights GoPay’s encrypted, secure, and regulated transaction framework.

- Indonesia’s FinTech market is valued at $19.15 billion in 2025, with increasingly strong regulatory oversight.

User Satisfaction and Loyalty Rates

- GoPay users in Jakarta rated satisfaction highly across five key dimensions: content, accuracy, format, ease-of-use, and timeliness.

- These five factors explain 68.6% of the variance in overall user satisfaction.

- GoPay’s Customer Satisfaction Index (CSI) stands at 82.35%, rated as “very satisfactory.”

- Feature quality, ease of use, and promotions directly influence user loyalty according to university student research.

- Indonesia’s loyalty and rewards market, including GoPay, is projected to reach $1.03 billion in 2025 with 18.3% annual growth.

GoPay Integration and Payment Methods

- GoPay is accepted by 900,000+ merchants across Indonesia’s online and offline channels.

- QRIS interoperability enables payments at any merchant supporting participating e-wallets.

- Users access QR checkout, P2P transfers, bank top-ups, in-app payments, and embedded credit.

- The Gojek–Tokopedia ecosystem allows one-tap payments across mobility, delivery, and commerce.

- Expansion of the standalone GoPay app extends reach into Tier-2 and Tier-3 cities.

- E-wallet payments represent 60%+ of daily urban purchase volume in Indonesia as of 2025.

Frequently Asked Questions (FAQs)

Over 500 million transactions.

Rp 6.6 trillion, up 90% YoY.

71% of respondents.

$1.03 billion, growing at about 18.3% annually.

Conclusion

GoPay is clearly extending its trajectory from rapid adoption to deeper monetisation. In particular, lending growth, transaction volume expansion, and strong user-satisfaction metrics show that scale, together with ecosystem integration, are driving momentum. At the same time, technology features, merchant network expansion, compliance, and loyalty initiatives combine to make GoPay more than just a digital wallet; in fact, it is a platform of financial services. Consequently, for US and global observers of digital-wallet trends, GoPay offers a key example of how wallet operators can pivot from payments toward embedded finance.