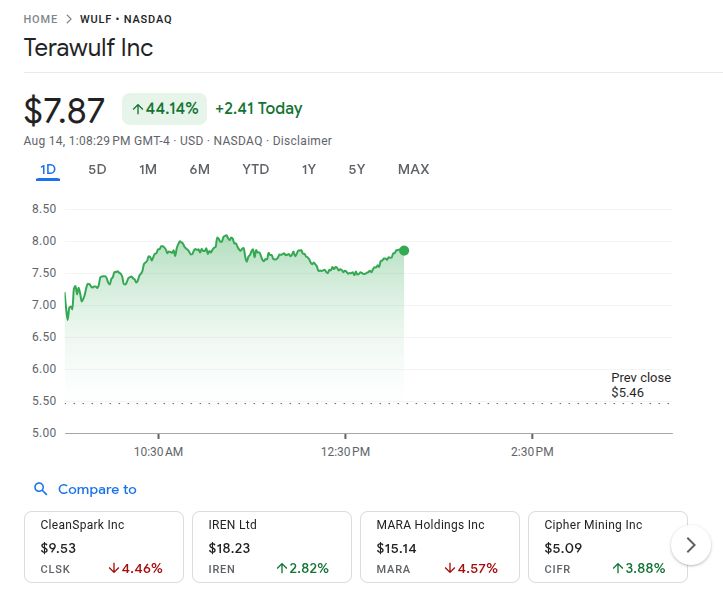

TeraWulf stock surged over 43% after announcing a massive AI hosting deal backed by Google, which now owns 8% of the company.

Key Takeaways

- 1TeraWulf signed a $3.7 billion, 10-year AI hosting agreement with Fluidstack

- 2Google will back $1.8 billion of the project’s financing and acquire 8% equity

- 3The Lake Mariner campus in New York will deliver over 200 MW of AI-ready infrastructure

- 4TeraWulf shares jumped more than 43%, trading at $7.83 following the news

What Happened?

TeraWulf, a U.S.-based bitcoin miner, announced a major strategic shift by entering the AI infrastructure market. The company revealed it has secured two long-term hosting deals with AI cloud platform Fluidstack and a powerful funding partner in Google.

TeraWulf’s stock jumped 43.38% to $7.83 after the announcement, marking one of its biggest one-day gains.

TeraWulf’s Big Pivot to AI

Traditionally known for cryptocurrency mining, TeraWulf is now entering the booming field of high-performance computing (HPC). The company signed two 10-year agreements with Fluidstack to provide colocation services at its Lake Mariner data center in Western New York. These deals will deliver more than 200 megawatts of IT load, generating $3.7 billion in contracted revenue, with potential to increase to $8.7 billion through two five-year extension options.

- The data center is equipped with dual 345 kV transmission lines, closed-loop water cooling, and ultra-low-latency fiber, making it suitable for liquid-cooled AI workloads

- The first phase, delivering 40 MW, is expected to go online in early 2026

- The full deployment is targeted for year-end 2026

Google’s Role and Investment

Google has stepped in as a major financial backer of the project. The tech giant will backstop $1.8 billion of Fluidstack’s lease obligations, helping to secure the necessary project debt financing. In return, Google will receive warrants for about 41 million shares, representing an 8% equity stake in TeraWulf.

This collaboration marks a significant step for Google in expanding its AI infrastructure footprint, especially as demand for cloud computing and generative AI continues to explode.

Strategic Significance and Market Response

TeraWulf leadership hailed the move as transformational. CEO Paul Prager called the partnership with Google and Fluidstack “a defining moment” for the company. CTO Nazar Khan noted that the data center was designed from the ground up to handle today’s most demanding workloads.

TeraWulf Signs 200+ MW, 10-Year AI Hosting Agreements with Fluidstack 🐺

,TeraWulf (@TeraWulfInc) August 14, 2025

TeraWulf will deliver over 200 MW of critical IT load at its Lake Mariner data center campus to Fluidstack. The agreements represent ~$3.7 billion in contracted revenue over the initial 10-year terms and…

Fluidstack President César Maklary echoed the sentiment, stating their joint efforts aim to deliver rapid, scalable AI infrastructure.

Analysts have reacted positively. Clear Street labeled the deal a “transformative agreement” that positions TeraWulf as a leading AI infrastructure provider. Although the firm advised watching for execution and funding, it gave the company a buy rating with a $9 price target.

Meanwhile, TeraWulf stock continues to rally, now trading at its highest level since January and up 165% from its April lows.

CoinLaw’s Takeaway

This is a huge win for TeraWulf. I love seeing a company that was previously boxed into one niche, like crypto mining, reinvent itself and land deals that completely change the game. Bringing Google onboard not only provides credibility, it opens doors to massive AI infrastructure opportunities. If they deliver on this buildout, TeraWulf could go from a speculative miner to a core player in AI hosting. It’s rare to see a pivot this bold, backed by this much capital, and supported by a partner like Google.