Generation Alpha, those born from 2010 through 2024, are emerging as one of the most financially engaged youth cohorts in history. Defined by their digital fluency and early involvement with money matters, these young consumers influence household spending and are beginning to shape financial trends that matter to brands, policymakers, and families alike.

In everyday life, Gen Alpha’s money habits show up in weekly allowances, digital spending via apps and games, and early saving behaviors many years before adulthood. In the classroom, educators and financial platforms are tailoring tools to help them learn budgeting skills sooner than previous generations. Dive into this article to understand the latest financial behavior statistics shaping Generation Alpha’s economic footprint.

Editor’s Choice

- 90% of Gen Alpha children in the U.S. earn some money through chores or positive reinforcement today.

- Typical annual spending money for Gen Alpha is around $1,100–$3,500 per child, reflecting different ways studies define “money available” versus strict weekly allowance amounts.

- 42% of total household spending in American homes is influenced by Gen Alpha.

- Nearly 48% of Gen Alpha teens have $1,000+ in savings.

- 51% of Gen Alpha teens own debit cards.

- 36% of Gen Alpha earn money from online selling or reselling.

- Around 21% of Gen Alpha say they started a side hustle or business.

Recent Developments

- Reports show Gen Alpha’s influence on household spending rose to 42% in 2025 in the U.S., largely in food and entertainment.

- Data indicate that kids today are more financially empowered than previous generations at the same age.

- Weekly pocket money averages roughly $45 for Gen Alpha children.

- High-income households see weekly allowances of around $100.

- Premium trends show early bank engagement, debit and savings accounts, by age 12–14.

- Digital-first money management (apps, prepaid cards) gains ground over cash for this generation.

- Research suggests Gen Alpha’s financial habits are influenced by parents who experienced economic turbulence.

- Financial brands note this cohort prefers visual and gamified financial tools.

- Savings behavior ties closely to early financial literacy initiatives.

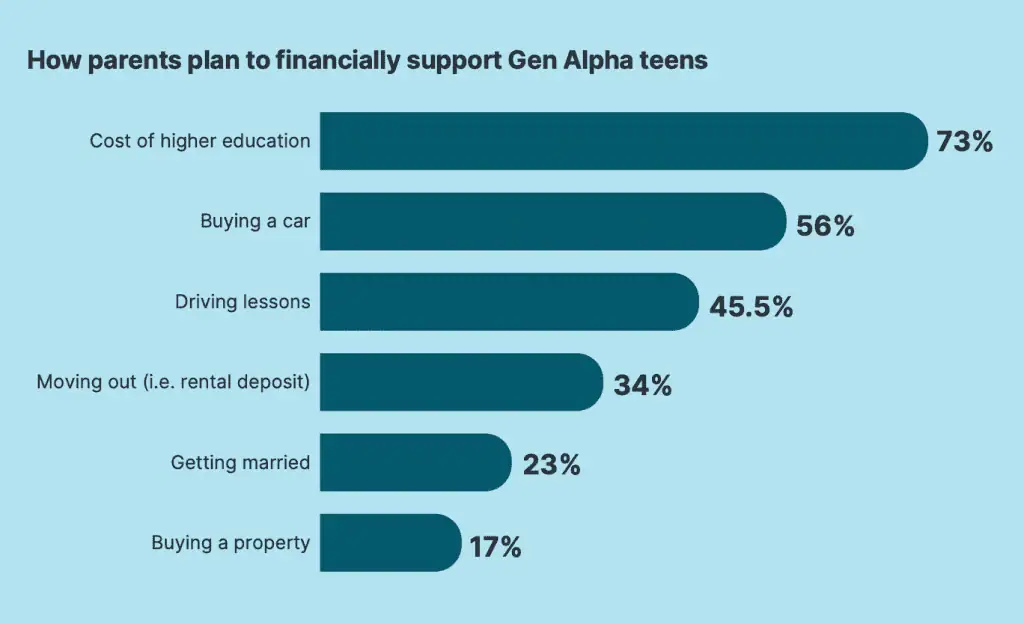

Parental Financial Support for Gen Alpha Teens

- 73% of parents plan to help with the cost of higher education.

- 56% plan to support their child in buying a car.

- 45.5% intend to pay for their teen’s driving lessons.

- 34% plan to help with moving out expenses (like rental deposits).

- 23% will support their child in getting married.

- 17% expect to contribute toward buying a property.

Who Is Generation Alpha?

- Generation Alpha comprises children born from 2010 to 2024.

- Generation Alpha numbers nearly 2 billion globally.

- 2.5 million Gen Alphas are born weekly worldwide.

- Children aged 8-12 average 4 hours 44 minutes daily screen time.

- Teens aged 13-18 average 7 hours 22 minutes daily screen time.

- Gen Alpha holds $100 billion annual direct spending power.

- 77% engage in video gaming regularly.

- 93% of Gen Alpha gamers made in-game purchases recently.

- 94% in Asia-Pacific access financial accounts early.

- 52% of Gen Alpha gamers spend on mobile games.

- 63% of parents say children are more financially savvy early.

Gen Alpha Population And Economic Impact

- Gen Alpha reaches 2 billion globally.

- 2.5 million Gen Alphas are born weekly worldwide.

- They comprise 24.4% of the global population.

- US Gen Alpha totals 45.6 million members.

- Gen Alpha’s estimated direct spending power ranges from $28 billion to $101 billion annually in the U.S., depending on measurement scope.

- Average weekly allowance for Gen Alpha ranges from $45 to $67, depending on household income and age group.

- Households spend $1,300-$2,100 per child yearly.

- 91% generate their own income via chores or sales.

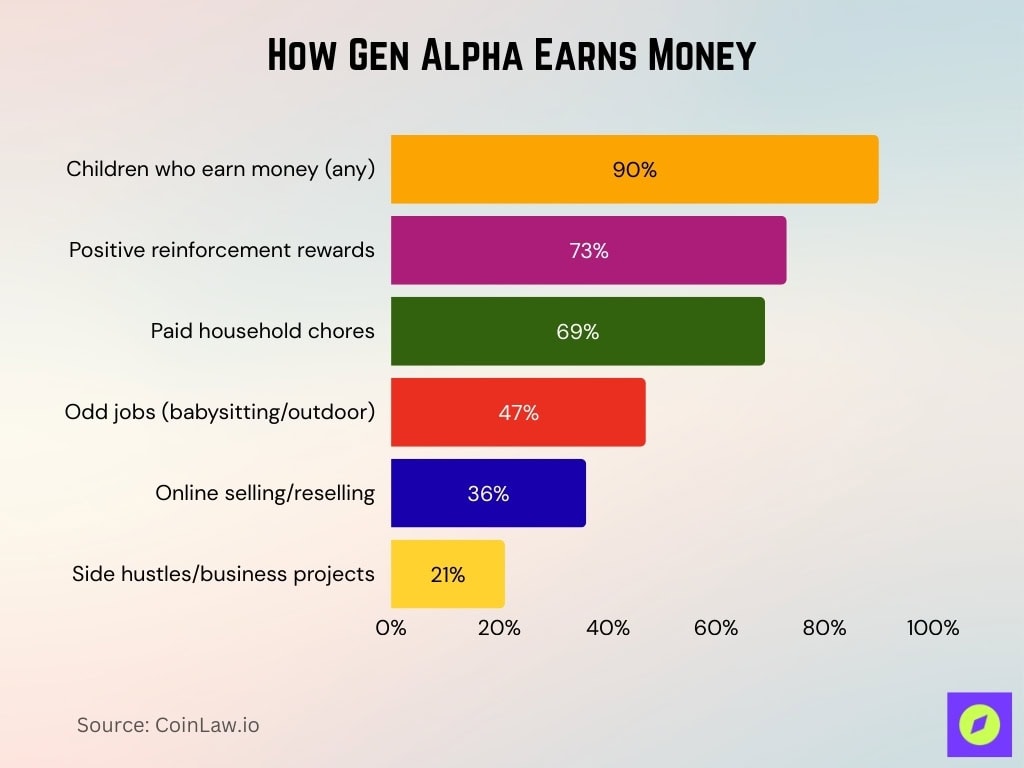

Earnings From Chores, Side Hustles, And Part-Time Work

- 90% of Gen Alpha children report earning money.

- 73% earn through positive reinforcement systems like behavior rewards.

- 69% perform household chores for money.

- 47% earn from odd jobs like babysitting or outdoor tasks.

- 36% earn through online selling or reselling old items.

- 21% have launched small side hustles or business projects.

Early Access To Money And Allowances

- Average monthly sums for older Gen Alpha teens (ages 15–16) show that 53% receive over $100/month, with nearly 14% getting more than $300/month.

- Median weekly spending money for Gen Alpha children is reported at $45 as of 2024.

- In higher-income households, weekly allowances can reach $100 or more.

- Parents often link allowances to chores and positive behavior incentives, reinforcing financial habits early.

- Gen Alpha’s allowance habits influence wider family spending patterns, with parents discovering brands through their children’s preferences.

- Regular allowance receipt correlates with plans for future entrepreneurship or side hustles among many Gen Alpha kids.

Spending Power And Annual Expenditure

- Average weekly allowance for Gen Alpha ranges from $45 to $67, depending on household income and age group.

- They influence 42% of total household spending decisions.

- 59% spend allowance money on snacks.

- 55% allocate allowances to toys across age groups.

- 30% spend on fast food and beverages.

- Households spend $1,300-$2,100 per child annually.

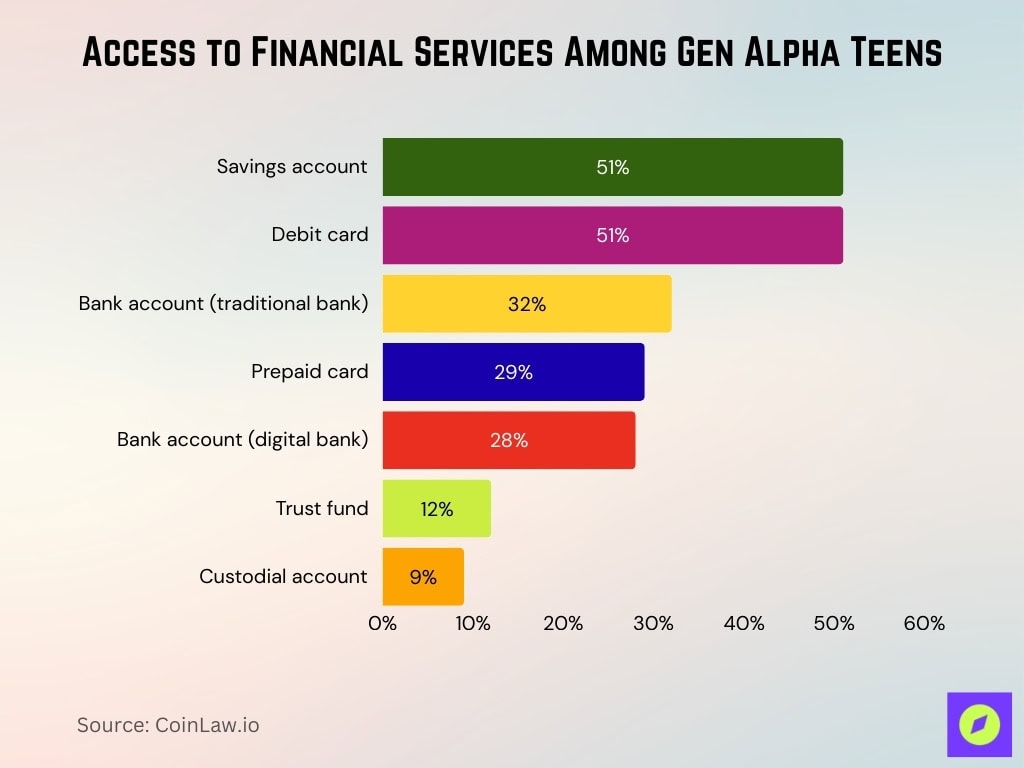

Access to Financial Services Among Gen Alpha Teens

- 51% of Gen Alpha teens have a savings account, showing early engagement with personal finance.

- 51% also use a debit card, indicating active participation in digital transactions.

- 32% have a traditional bank account, reflecting continued reliance on conventional banking.

- 28% are signed up with a digital bank account, signaling a shift toward app-based financial services.

- 29% use a prepaid card, providing flexibility without linking to a bank.

- 12% benefit from a trust fund, suggesting some level of long-term wealth planning.

- 9% have a custodial account, typically managed by parents for financial education or savings growth.

Everyday Spending Categories (Online And Offline)

- Ages 1–5 spend 64% on toys and 51% on snacks.

- Ages 6–10 allocate 70% to toys and 65% to snacks.

- Ages 11–14 spend 42% on apparel and 42% on electronics.

- 59% use allowance for snacks across all ages.

- 55% spend allowances on toys generally.

- 31% is allocated to electronics overall.

- 66% prefer in-store shopping over online.

- 48% of 11–14-year-olds discover products via influencers.

- 30% of older kids spend on beauty or skincare products.

Digital Shopping And In-App Purchases

- 21% of Gen Alpha teens make in-game purchases, apps, or downloads weekly.

- 30% purchase digital items a few times monthly.

- 93% of Gen Alpha gamers buy in-game items like gear or currency.

- 52% of Gen Alpha and Gen Z make in-game purchases.

- 66% prefer in-store, but online convenience grows with age.

- 48% of 11–14-year-olds discover products via influencers online.

- 56% learn about brands first on YouTube.

- 50% of Gen Alpha have digital wallet access.

- 36.2 million US Gen Alpha are internet users with smartphone access.

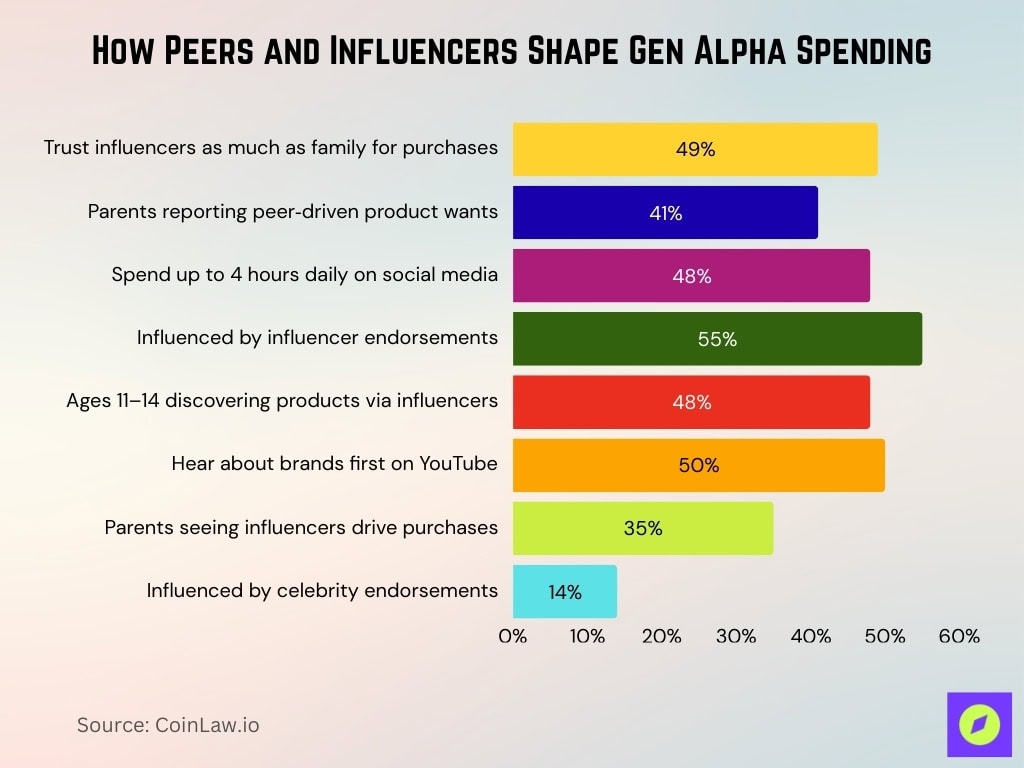

Influence Of Peers, Influencers, And Social Media On Spending

- 49% of Gen Alpha trust influencers as much as family for purchases.

- 41% of parents report Gen Alpha wanting products due to friends.

- 48% of Gen Alpha spend up to 4 hours daily on social media.

- 55% of Gen Alpha are influenced by influencer endorsements.

- 48% of Gen Alpha ages 11-14 discover products via influencers.

- 50% of Gen Alpha hear about brands first on YouTube.

- 35% of parents cite social media influencers influencing purchases.

- 14% of Gen Alpha swayed by celebrity endorsements.

Use Of Buy Now, Pay Later (BNPL) And Credit-Like Tools

- 7% of US Gen Alpha over age 13 actively use BNPL services.

- 59% of the adjacent Gen Z cohort currently utilizes BNPL payment options.

- 47.4% of all BNPL users nationwide belong to the Gen Z generation.

- 51% of young consumers prefer BNPL options over traditional credit cards.

- 49% of American adults report having used BNPL at least once.

- 15% of US adults under age 45 adopted BNPL in recent months.

- 41% of 16-24 year olds embrace BNPL for online purchases.

- 52% of surveyed Americans currently engage with BNPL platforms.

- 65% of Gen Z consumers plan to increase BNPL usage going forward.

Savings Rates And Average Balances

- Nearly 48% of Gen Alpha teens have saved over $1,000 from part-time work and allowances.

- A significant portion of teens hold savings accounts or similar holding vehicles, reflecting early engagement with saving.

- Socioeconomic background influences savings levels, with higher-income teens far more likely to have larger balances.

- Roughly 19% of teens have $2,100–$5,000 saved, particularly in wealthier households.

- About 25.5% of teens from lower-income homes have saved $100–$500.

- Bank and digital accounts are common savings vehicles, with over half of teens holding one.

Short-Term Savings Goals (Toys, Gaming, Entertainment)

- 55% of Gen Alpha kids spend their allowance on toys.

- 59% of Gen Alpha allowance spending targets snacks alongside toys and entertainment.

- 34% of Gen Alpha kids allocate allowance to entertainment purchases.

- 31% of Gen Alpha allowance goes toward electronics like gaming gear.

- 70% of Gen Alpha ages 6–10 use allowance for toys.

- 42% of parents provide Gen Alpha kids with regular allowances to fund short-term fun goals.

- 76% of kids report that money apps boost confidence in saving for desired items.

- 90% of Gen Alpha kids prefer earning money for short-term goals over receiving it.

- 64% of the youngest Gen Alpha (ages 1–5) direct allowance to toys.

Long-Term Savings Goals (Education, First Car, Home, Retirement)

- 24% of Gen Alpha save for their first car.

- 19% of Gen Alpha save for college or higher education.

- 11% of Gen Alpha save for their first home.

- 6% of Gen Alpha save for retirement.

- 51% of UK Gen Alpha teens hold over £1,000 in savings.

- 11% of UK Gen Alpha teens hold over £10,000 in savings, including trusts.

- 94% of UK Gen Alpha teens have some form of savings.

Emergency Savings And Financial Resilience

- 20% of Gen Alpha save explicitly for emergencies.

- 25% of adults lack an emergency fund, unlike Gen Alpha peers.

- 46% of adults do not plan to start an emergency fund.

- 94% of UK Gen Alpha teens have some form of savings.

- 51% of UK Gen Alpha teens hold over £1,000 in savings.

- 20% of Gen Alpha kids started saving for emergency funds.

- 34% of Gen Z have no emergency savings.

- 73% of Americans save less for emergencies due to inflation.

Financial Literacy Levels And Confidence With Money

- 76% of parents influence Gen Alpha’s saving habits.

- 81% of Gen Alpha trust parents most on money topics.

- 63% of Gen Alpha parents say kids are more financially savvy.

- 64% of Gen Alpha aged 10-14 feel happy thinking about money.

- 55% of Gen Alpha are confident in achieving financial goals.

- 28% of UK Gen Alpha teens use digital bank accounts.

- 94% of APAC Gen Alpha have access to financial accounts.

Interest In Investing, Crypto, And New Asset Classes

- 94% of UK Gen Alpha teens hold savings.

- 51% of UK Gen Alpha teens save over £1,000.

- 47% of Gen Alpha aged 10-13 know cryptocurrency.

- 14% of US non-owners plan to purchase crypto in 2025.

- 79% of German 10-14-year-olds who earn money own crypto.

- 50% of parents give Gen Alpha investment access

Frequently Asked Questions (FAQs)

Nearly 48% of Gen Alpha teens have saved over $1,000.

Roughly 53–58% of Gen Alpha teens receive regular allowances, depending on age and income level.

About 53% of Gen Alpha teens in the UK and 28% in the U.S. have traditional bank accounts.

Gen Alpha children influence approximately 42% of household spending decisions in the U.S. as of 2025.

Conclusion

Gen Alpha’s financial behavior today represents a blend of early habit formation and digital engagement. From short-term savings for games and toys to meaningful emergency funds and long-term goals, many children display habits once seen only in adults. Parental guidance remains central, and technology plays a growing role in shaping attitudes toward money. Peer and influencer influences add nuance, while increasing interest in investing signals a generation thinking beyond the present. As this cohort continues to mature, their money mindset will influence not only household economics but also financial markets and education systems. The trends explored here offer a roadmap to understanding how the youngest consumers today might shape money management tomorrow.