In the rapidly evolving world of finance, the integration of fintech into wealth management has redefined how individuals and firms manage assets. From AI-driven investment strategies to blockchain-enabled transparency, technology is reshaping client expectations and creating new growth avenues. This shift isn’t merely about adopting new tools; it’s about transforming the entire experience of wealth management to be faster, more accessible, and highly personalized. As we dive into the latest statistics, you’ll see how fintech is not only expanding but also empowering both wealth managers and their clients.

Key Takeaways

- 182% of Millennials and 88% of Gen Z investors show interest in robo-advisors, while overall U.S. adoption stands at 6%.

- 2There are 414 fintech unicorns worldwide valued above $1 billion, with a combined worth of $3.29 trillion.

- 366% of customers in 2025 expect full digitalization of banking services, reducing reliance on physical branches.

- 491% of financial institutions have started cloud migration in 2025, but only 11% operate fully scalable cloud platforms.

Global FinTech Industry Market Growth

- The global FinTech market is projected to grow from $280 billion in 2025 to $1.38 trillion by 2034.

- This represents a CAGR of 19.4%, signaling rapid and sustained industry expansion.

- Blockchain, AI, API, RPA, and other technologies will continue to drive innovation and adoption.

- The market is expected to more than quadruple in value over the next decade.

- By 2030, the market will surpass $680 billion, marking a key milestone in digital finance evolution.

- 2034 is forecasted to reach $1.38 trillion, cementing FinTech’s role as a cornerstone of the global financial system.

Adoption Rates Among Wealth Management Firms

- 74% of wealth management firms globally in 2025 use at least one fintech tool, showing a stronger shift toward technology integration.

- 94% of large firms with assets over $500 million have adopted digital platforms to engage clients, improve services, and streamline operations.

- 61% of smaller firms now use fintech solutions in 2025, driven by competitive pricing needs and enhanced client experience.

- 52% of firms adopted AI-powered analytics in 2025 to support data-driven investment decisions and improve portfolio management.

- 35% increase in blockchain adoption in 2025 secures transactions and enables transparent asset tracking.

- 63% of wealth managers in 2025 cite client demand for better digital solutions as the key driver of fintech adoption.

- Hybrid advisory models grew 42% in 2025, blending digital tools with human advisors to combine personalization and efficiency.

- 78% of firms in 2025 report that fintech integration improves client retention through more engaging, accessible services.

Impact on Client Engagement and Satisfaction

- 81% of clients using fintech platforms in 2025 report higher satisfaction from greater transparency and easier access to investment data.

- 58% of investors in 2025 feel more in control of their finances through fintech tools with real-time portfolio insights and updates.

- Client retention rates rose 15% on average for wealth management firms in 2025 using digital engagement platforms.

- Robo-advisory platforms in 2025 saw a 45% boost in user engagement thanks to AI-driven, personalized investment recommendations.

- 92% of millennial investors in 2025 prefer firms with mobile and online platforms, cementing tech’s role in retaining younger clients.

- Wealth managers using fintech in 2025 saw a 24% drop in churn rates due to the value of automated, customized services.

- 49% of clients in 2025 expect 24/7 access to their financial data, a demand that fintech platforms are meeting consistently.

- In-app messaging and live chat improved client communication for 71% of fintech-enabled firms in 2025, boosting trust and rapport.

- Predictive analytics in fintech in 2025 made 41% of investors feel more confident in investment decisions.

Key Disruptive Technologies in Wealth Management

- Artificial Intelligence leads as the top disruptor, influencing 73% of wealth management innovations.

- Generative AI follows closely at 71%, reshaping personalized investment strategies and client engagement.

- Cloud Infrastructure also holds a 71% adoption rate, enabling scalable and secure digital wealth solutions.

- Big Data powers 47% of industry advancements, driving deeper analytics and portfolio optimization.

- Blockchain/DLT impacts 38% of wealth management, enhancing transparency, transaction speed, and security.

Technological Innovations Driving Fintech Integration

- 84% of wealth management firms in 2025 use AI to enhance decision-making and automate routine tasks.

- Blockchain adoption grew 38% in 2025, boosting transaction security and transparency in asset tracking.

- Machine learning improved predictive accuracy by 42% in 2025, enabling better investment trend forecasting and recommendations.

- NLP-powered chatbots and virtual assistants increased client engagement by 51% in 2025, offering instant responses to queries.

- Cloud computing adoption reached 73% in 2025, allowing scalable data storage and faster large-scale processing.

- API-based integrations rose 49% in 2025, enabling seamless connectivity between third-party fintech tools.

- Data analytics tools boosted personalization by 58% in 2025, helping tailor portfolios to individual client needs.

- Augmented reality is used by 24% of firms in 2025 for immersive client portfolio reviews.

- Cybersecurity investments grew 46% in 2025, reflecting stronger priorities for protecting financial data.

- 9% of wealth tech innovators in 2025 are exploring quantum computing for complex financial modeling.

Gas Prices Are Dynamic

- Average Ethereum gas fees in 2025 range from 18 to 240 gwei, driven by network congestion and transaction type.

- DeFi transactions in 2025 cost about 55% more than standard transactions due to higher on-chain complexity.

- NFT activity spikes in 2025 led to a 29% jump in average gas fees, with minting and trading fueling demand.

- Layer 2 scaling in 2025 cuts gas costs by 35–72%, making it a top choice for frequent Ethereum users.

- Arbitrum and Optimism handle over 64% of Ethereum Layer 2 transactions in 2025, easing mainnet congestion.

- EIP-1559 continues to stabilize fees in 2025 by burning part of each transaction cost, keeping Ethereum deflationary.

- Gas fees are 22–41% lower during off-peak hours in 2025, reflecting reduced demand periods.

- Ethereum’s Proof-of-Stake in 2025 still sees fees driven mainly by transaction demand rather than validator costs.

- Tokenized gaming in 2025 pushes fees higher during peak playtimes, especially for popular blockchain games.

- Wallets like MetaMask and Trust Wallet in 2025 offer gas optimization, letting users choose speed or lower costs.

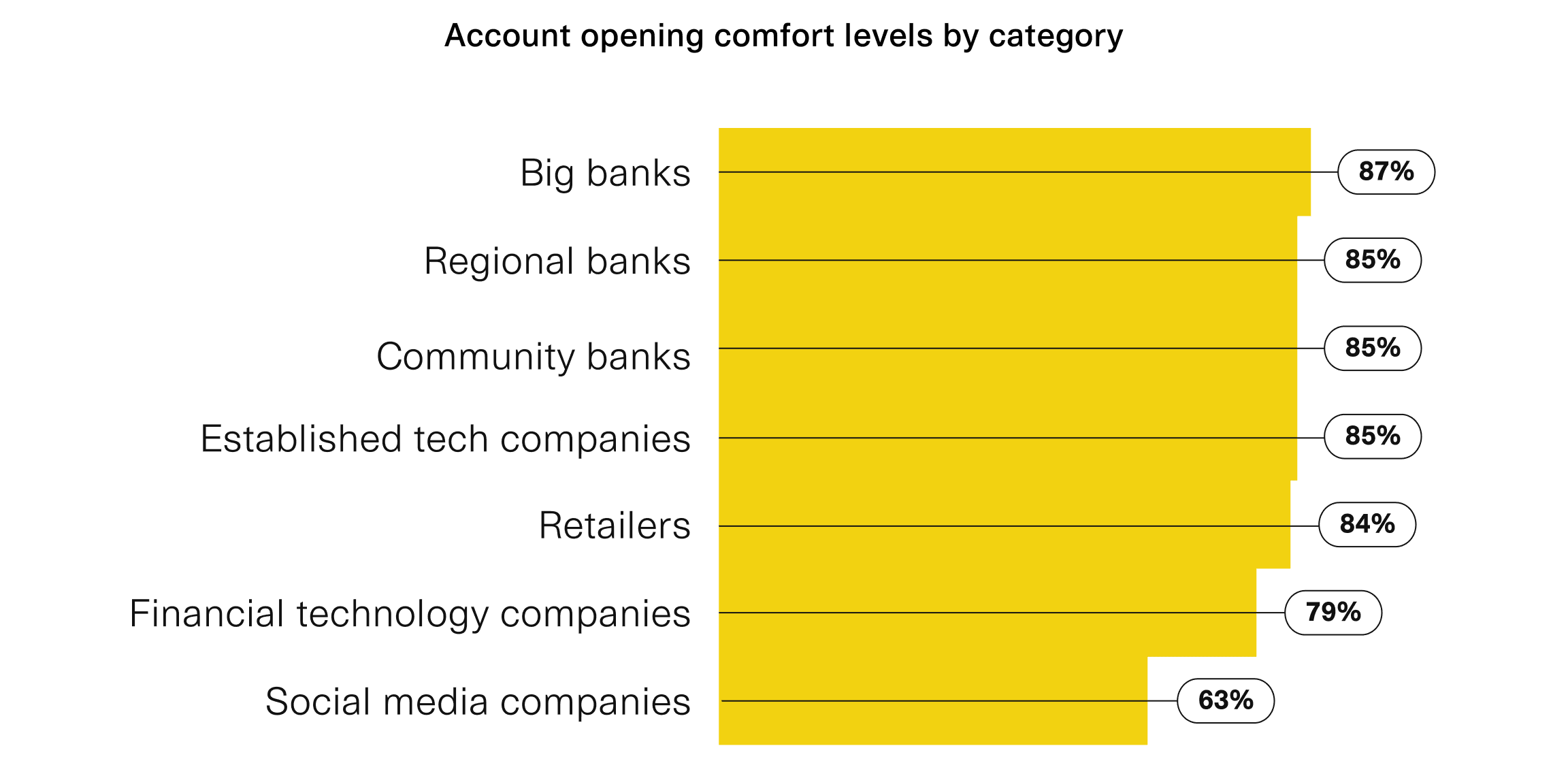

Account Opening Comfort Levels by Institution Type

- Big banks rank highest in customer comfort, with 87% feeling confident opening accounts.

- Regional banks, community banks, and established tech companies share an equal trust level at 85%.

- Retailers also hold strong consumer trust, with 84% comfortable opening accounts.

- Financial technology companies (FinTechs) gain trust from 79% of customers.

- Social media companies have the lowest trust, with only 63% comfortable opening accounts.

Ethereum Gas Prices After The Merge

- The Ethereum Merge shifted the network to Proof-of-Stake (PoS), which has reduced its energy consumption by approximately 99.95%.

- Despite the Merge, Ethereum gas prices have remained relatively high during peak times, with fees still spiking to over 100 gwei in periods of high demand.

- Transaction finality on the PoS Ethereum network improved, reducing block times to around 12 seconds, which has marginally helped to stabilize fees.

- Layer 2 solutions gained more traction post-Merge, as users sought cheaper alternatives for Ethereum-based transactions, pushing Layer 2 adoption to a record 58%.

- Validators now replace miners in processing Ethereum transactions, increasing network security while reducing environmental impacts.

- The average gas fee dropped by 15% in the months following the Merge, though this was influenced more by market conditions than the technical changes alone.

- Staking rewards for validators on the PoS network averaged around 5-7% APY, attracting significant interest in staking as a passive income strategy.

- Ethereum’s energy consumption dropped from around 70 TWh per year to approximately 0.01 TWh due to the shift to PoS.

- Decentralized finance (DeFi) users accounted for about 40% of Ethereum transactions post-Merge, keeping gas prices elevated during high activity periods.

- Improved network stability post-Merge has led to greater interest in Ethereum as a base layer for DeFi and NFTs, despite continued gas fee challenges.

Strategies to Reduce Gas Costs

- Batching transactions has become a popular strategy to lower gas costs, with users saving up to 30% by combining multiple transactions into one.

- Utilizing Layer 2 scaling solutions like Arbitrum and Optimism can reduce gas costs by up to 70% by processing transactions off the Ethereum mainnet.

- Gas tokenization, which allows users to mint tokens when gas prices are low and redeem them when prices rise, has provided a 15-20% reduction for frequent users.

- Scheduled transactions help users take advantage of lower gas fees during off-peak hours, often saving between 20-40% depending on network congestion.

- Rollup technologies such as zk-Rollups and Optimistic Rollups have cut transaction fees by an average of 40-60%, providing cost-effective alternatives for high-frequency traders.

- Transaction bundling via smart contracts can significantly reduce gas usage by consolidating multiple steps into a single transaction.

- EIP-4844, a proposed Ethereum improvement aimed at reducing data costs on the network, is projected to lower gas fees by up to 50% once implemented.

- Using fee prediction tools like Eth Gas Station or GasNow helps users estimate optimal times to transact, potentially saving 10-15% in fees.

- Layer 1 alternatives, including blockchains like Polygon and Binance Smart Chain, offer lower transaction fees and are compatible with Ethereum, providing flexibility and savings.

- Priority gas fees set by wallets allow users to choose lower-cost options for non-urgent transactions, with potential savings of 20-25% for patient users.

WealthTech Deal Activity by Country

- The United States dominates WealthTech deals with 39% of all transactions in Q1 2025.

- The United Kingdom follows at 11%, showing strong but smaller deal activity compared to the US.

- India accounts for 8% of global WealthTech deals, reflecting its growing fintech sector.

- Japan holds 4% and France 3%, indicating more limited market activity.

- The Rest of the World represents a significant 35%, showing that innovation and investments are globally dispersed.

- In total, 174 WealthTech deals were recorded in Q1 2025, marking robust sector activity worldwide.

Understanding Gas in Ethereum

- Gas fees are transaction costs on the Ethereum network, measured in gwei (a fraction of ETH), required to perform operations like token transfers or smart contract execution.

- Each transaction requires a specific amount of gas based on its complexity; for instance, a simple ETH transfer uses 21,000 gas units, while complex smart contracts can use over 500,000 units.

- Gas prices fluctuate according to network demand, with higher demand leading to higher fees as users compete for limited block space.

- Ethereum’s EIP-1559 update in 2021 introduced a base fee and a tip system to prioritize transactions, aiming to make fees more predictable.

- Miners (pre-Merge) and validators (post-Merge) play a critical role in processing transactions, collecting fees for including transactions in blocks.

- The base fee in EIP-1559 is burned (removed from circulation), creating a deflationary mechanism for ETH that has reduced the token supply by over 1 million ETH since implementation.

- Gas fees also serve as a security layer for Ethereum, discouraging spam and malicious transactions by imposing a cost for network use.

- Gas limits are user-specified and determine the maximum fee a user is willing to pay, which, if set too low, can cause transaction failures.

- Average gas costs differ depending on transaction types: for example, DeFi operations and NFT minting often incur higher fees due to their complexity and popularity.

- Ethereum’s Layer 2 solutions are designed to handle transactions more efficiently, using less gas and offloading some traffic from the main network.

Concerns About Ethereum Gas Fees

- 63% of Ethereum users in 2025 still worry about transaction affordability due to persistently high gas fees.

- Peak network demand in 2025, such as major NFT drops, drove gas prices up by 280%, making transactions costly for many.

- Small transfers in 2025 remain uneconomical, forcing users to shift to cheaper Layer 2 networks or alternative chains.

- DeFi platforms in 2025 still face fee-related barriers, limiting participation from smaller investors.

- Gas fees in 2025 can swing 25–40% within hours, hurting transaction predictability and user strategies.

- Post-Merge Proof-of-Stake in 2025 has cut Ethereum’s energy use by over 99%, easing prior environmental concerns.

- Despite wider Layer 2 adoption in 2025, network-wide fee reductions remain inconsistent.

- Ethereum PoS upgrades in 2025 bring improvements, but many users say fee relief is slower than they expected.

- Cross-chain bridges in 2025 offer cheaper transfers, but interoperability challenges persist.

- The Ethereum community in 2025 continues to push for more efficient scaling and lower transaction costs.

Recent Developments

- RBC, TD Bank, and CIBC in 2025 posted stronger-than-expected profits, with RBC wealth management income up 52% and TD up 25% on strong capital markets growth.

- HSBC in 2025 is cutting about 1,050 jobs at its China Pinnacle unit to address growth challenges and reduce operational costs.

- Standard Chartered in 2025 reported a 21% profit rise, announced a $1.8 billion share buyback, and committed $1.7 billion over five years for expansion.

- Ellevest in 2025 is ending its automated investment service and moving accounts to Betterment, signaling continued robo-advisory consolidation.

- VanEck in 2025 invested $2 million in FinChat, integrating AI-driven tools to speed up investment presentation creation and client response times.

Conclusion

As fintech continues to reshape wealth management, Ethereum and blockchain technology play a pivotal role in providing efficient, transparent, and accessible financial solutions. The past year has seen significant progress in technological innovations, regulatory adaptations, and investment growth, positioning fintech as a catalyst for democratizing wealth management. However, challenges such as high Ethereum gas fees and the complex regulatory landscape remain barriers to broader adoption. Moving forward, strategies like Layer 2 scaling and gas optimization techniques are essential in making blockchain more accessible for everyday users, while future upgrades and innovations promise further improvements in cost and performance. As the sector evolves, both wealth management firms and individual investors are likely to benefit from a more streamlined, tech-driven approach to financial growth and security.