Imagine waking up one day and realizing you’re unable to work due to an unexpected injury or illness. How would you cover your living expenses or ensure financial stability? This unsettling thought underscores the critical role of disability insurance in safeguarding income against life’s uncertainties. The disability insurance industry faces significant changes, with growing awareness, evolving policies, and advancements in coverage options shaping its trajectory.

Editor’s Choice

- The age-sex-adjusted disability incidence rate in the US has hovered around 3.2–4.2 per 1,000 workers in recent years.

- Over 26% of working Americans are still expected to face a disability lasting longer than 90 days during their career.

- Group disability insurance plans continued to dominate in 2025, maintaining over 50% share of total policies sold.

- Telehealth adoption has been reported to significantly improve claim processing efficiency, though specific benchmarks like a 30% improvement vary by provider and lack uniform verification.

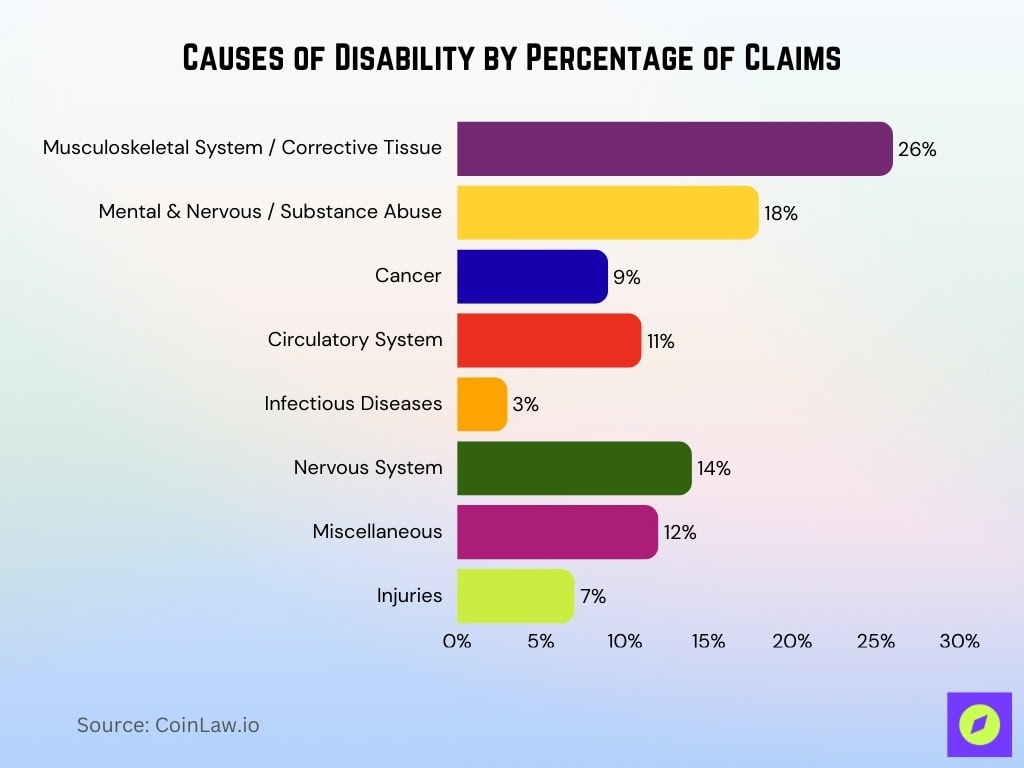

Causes of Disability by Percentage of Claims

- 26% of disability claims stem from musculoskeletal system and corrective tissue issues, making it the leading cause.

- 18% are attributed to mental, nervous, and substance abuse disorders, highlighting the impact of mental health.

- 14% of claims are due to nervous system conditions, including neurological disorders.

- 12% fall under miscellaneous causes, covering varied health complications.

- 11% are linked to the circulatory system, such as heart and vascular diseases.

- 9% of disability cases result from cancer, reflecting its serious long-term effects.

- 7% of claims are caused by injuries, including accidents and trauma.

- 3% are due to infectious diseases, a smaller yet notable share.

Policy Types and Coverage Options

- Short‑term disability insurance typically covers disabilities lasting up to 6 months, with average benefits ranging from $500 to $5,000/month remains common in 2025.

- Long‑term disability insurance now often covers 50‑80% of pre‑disability income until retirement, with benefit durations exceeding 5 years in many cases in 2025.

- Employer‑sponsored group policies still cover over 60% of all disability insurance holders in 2025.

Cost of Disability Insurance

- The average premium for individual long‑term disability insurance is 1‑3% of annual income in 2025, reflecting age and occupation.

- Employer‑sponsored group plans now cost around $30‑$60/month per employee in many markets in 2025 as an affordable option.

- Gender‑based premium differences remain, with women paying about 15% more on average in 2025 due to higher claim risk and longevity.

- Premiums for policies with non‑cancelable clauses are about 10‑20% higher in 2025 than standard policies.

- Supplemental options such as catastrophic disability riders add roughly $25‑$50/month to premiums in 2025.

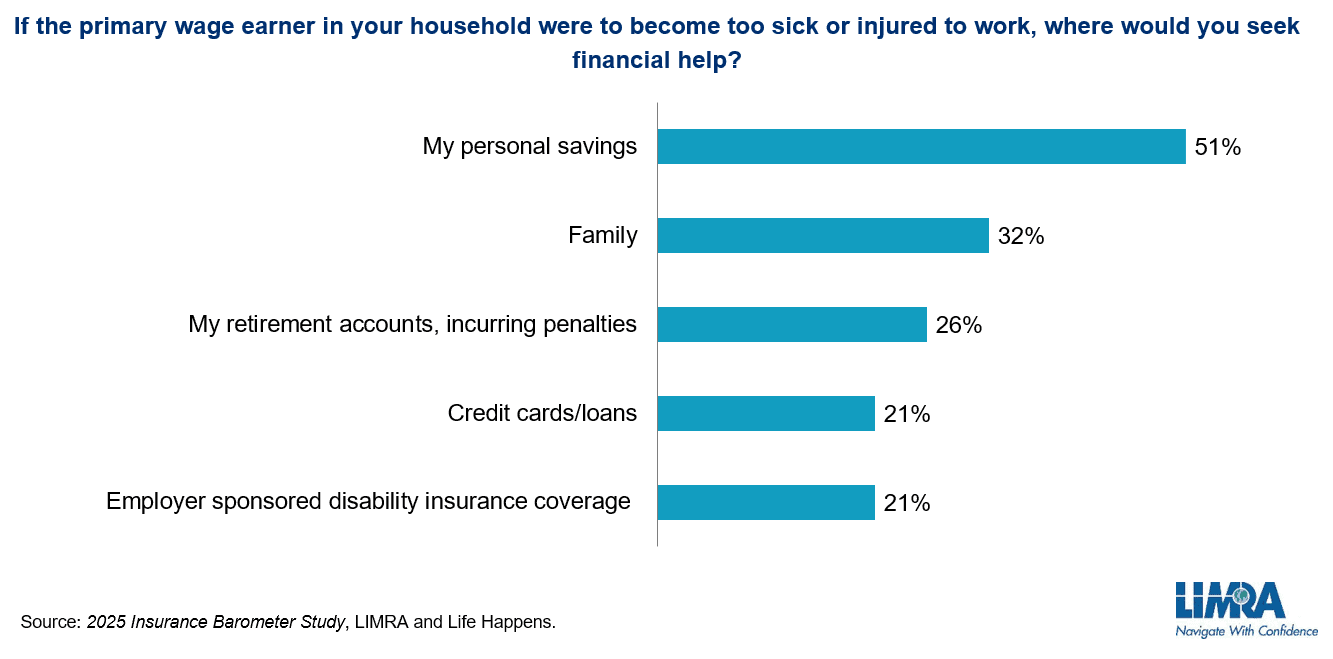

Where Households Seek Financial Help if the Primary Earner Becomes Disabled

- 51% of households would rely on personal savings as their first source of financial help.

- 32% would turn to family support when income is lost due to illness or injury.

- 26% would use retirement accounts, even if it means incurring penalties.

- 21% would depend on credit cards or loans, increasing potential debt burdens.

- 21% would rely on employer-sponsored disability insurance coverage for support.

Supplemental Disability Insurance Needs

- In 2025, only 43% of working Americans owned any form of disability insurance.

- As of August 2025, the average monthly SSDI benefit for disabled workers was $1,445.72.

- The maximum monthly SSI benefit for individuals increased to $967 in 2025.

- For married couples, the maximum monthly SSI benefit rose to $1,450 in 2025.

Coverage Beyond Social Security Disability Insurance (SSDI)

- The average SSDI benefit in 2025 for disabled workers is about $1,445.72/month.

- The maximum SSDI benefit in 2025 is $4,018/month for those with a high earnings history.

- The average SSI benefit for individuals in 2025 is $967/month, and for couples $1,450/month.

- The Cost‑of‑Living Adjustment for SSDI/SSI in 2025 is 2.5%, increasing benefits compared to 2024.

Projected In-Force Growth Rates

- In 2025, growth is projected at 3.0% for Life, 3.8% for Long-term disability, and 4.0% for Short-term disability.

- In 2026, rates are expected to slow to 2.5% for Life, 3.4% for Long-term disability, and 3.8% for Short-term disability.

- In 2027, growth stabilizes at 2.6% for Life, 3.2% for Long-term disability, and 3.7% for Short-term disability.

Top Impacting Factors

- Digital tools and AI reduced approval times by 30% in 2025.

- Economic instability led 20% more workers to seek income protection through disability insurance in 2025.

- Employer-sponsored health plan premiums rose by approximately 6–7% in 2025 due to cost-of-living pressures.

Disability Insurance Market Drivers

- Only 43% of working Americans owned disability insurance in 2025.

- About 63% of employers believe their workers are very interested in short-term disability benefits.

- Around 80% of adults with disabilities had at least one chronic health condition in 2025.

- Approximately 77% of employees said that voluntary benefits, including disability insurance, boosted their financial confidence.

Disability Risk Odds for a 35-Year-Old Worker

- Workers with an average weight, nonsmoking habits, office/some physical work, average lifestyle, and good health history face a 24% chance for men and a 27% chance for women of experiencing a disability lasting at least three months.

- Workers who have a heavier weight, smokers, mostly in physical labor, with unhealthy lifestyles and poor health history, face a dramatically higher 74% chance for men and a 77% chance for women of becoming disabled for at least three months.

Regulatory and Legislative Developments

- California’s State Disability Insurance withholding rate increased to 1.2% in 2025, with maximum weekly benefits rising to $1,681.

- Washington state’s Paid Family and Medical Leave premiums increased to 0.92% in 2025, with employees contributing about 71.52%.

- As of 2025, twelve states and the District of Columbia have enacted mandatory Paid Family Leave programs.

- Connecticut expanded PFML eligibility in 2025 to include certain public school employees.

- Social Security Disability benefits were adjusted with a 2.5% cost-of-living increase in 2025.

Recent Developments

- As of 2025, 22 states have implemented telehealth payment parity, while 6 states have partial parity, and 22 states have no requirement.

- Medicare telehealth policy flexibilities have been extended through September 30, 2025.

- Top disability insurance providers ranked high in customer satisfaction surveys conducted in early 2025.

Frequently Asked Questions (FAQs)

The global disability insurance market is projected to reach $3.4 billion by 2034, growing at a CAGR of about 11.4% from 2025 to 2034.

The market size was about $4.56 billion in 2025, and is expected to grow to $7.08 billion by 2029, corresponding to a CAGR of ~11.7%.

About 46% of U.S. adults say they need some sort of disability insurance, but only 18% say they have it individually.

For long‑term disability, about 59% of workers in management/professional occupations have access, compared to only 10% for service workers.

Conclusion

The disability insurance industry is at a pivotal moment, evolving to meet the demands of a changing workforce and societal landscape. Rising awareness, technological advancements, and regulatory support are driving growth, but significant gaps in coverage remain. With an emphasis on flexibility, digital transformation, and mental health support, the sector is poised to offer more comprehensive solutions. Continued innovation and accessibility will be key to ensuring that disability insurance meets the needs of a diverse and dynamic population.