Diners Club has long held a unique place in the world of payment cards. As one of the original charge card providers, its evolution has mirrored the transformation of global commerce, travel, and digital payments. Diners Club remains relevant through its integration with Discover Global Network, offering global access, travel perks, and corporate solutions. From international lounge access to growing acceptance in Asia-Pacific, Diners Club adapts to modern expectations. Whether you’re a traveller using airport lounges or a corporate team managing expenses, this data-rich article explores the reach and performance of Diners Club cards in today’s global payments ecosystem.

Editor’s Choice

- 1,700+ airport lounges globally are accessible to Diners Club cardholders.

- Diners Club cards are accepted in 190+ countries and territories.

- The network supports 1.2 million ATMs worldwide.

- Global transaction volume reached approximately $622 billion in 2024.

- Diners Club offers card issuance in 35+ countries through 40+ issuers.

- Diners Club’s global lounge program gives cardmembers access to 1,700+ airport lounges and experiences in 600+ cities across 140+ countries, aligning with its latest international fact sheet.

- Consumer adoption of instant payments hit 73%, reflecting future readiness of the network.

Recent Developments

- In 2024, Discover Global Network expanded acceptance through a partnership with NETS in Singapore, opening 130,000+ POS points.

- The integration continues enhancing Diners Club’s regional strength in Asia-Pacific.

- The Discover Global Network, which includes Diners Club, processed over $622 billion globally in 2024.

- Diners Club has re-emphasized its airport lounge and travel benefits as part of a global lifestyle strategy.

- New biometric payment trends show that 31% of global consumers are already using facial or fingerprint authentication for payments.

- The use of digital identity verification in payments is gaining traction, with 67% of users expressing interest.

- Diners Club’s enhanced fraud protection systems support real-time monitoring and tokenization.

- The brand’s positioning in 2025 remains aligned with international travel, digital payments, and mobile-first consumers.

- Lounge expansion, especially in emerging economies, is a strategic play for travel-heavy regions.

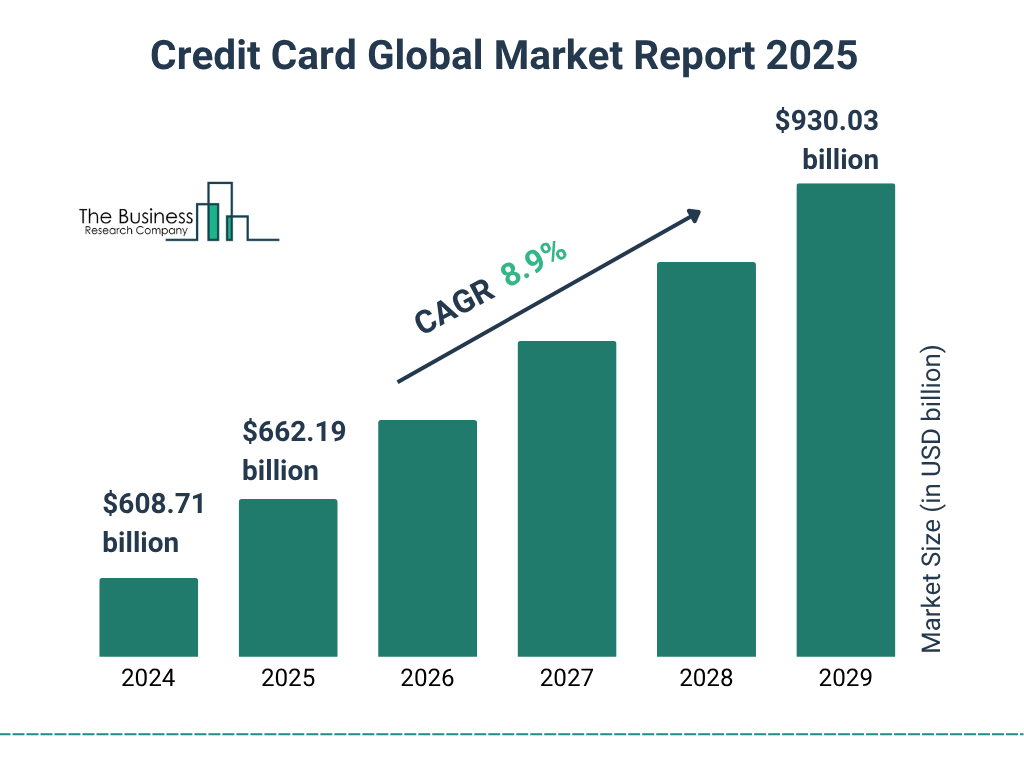

Credit Card Market Growth Highlights

- The global credit card market is projected to grow from $608.71 billion in 2024 to $930.03 billion by 2029.

- This reflects a Compound Annual Growth Rate (CAGR) of 8.9% over the five-year period.

- In 2025, the market size is expected to reach $662.19 billion, showing strong year-on-year momentum.

- The growth trajectory indicates accelerating adoption of digital credit payment solutions globally.

- The market is set to expand by over $321 billion between 2024 and 2029.

- This surge highlights increased consumer spending, digital integration, and financial inclusion across regions.

What Is Diners Club?

- Diners Club is a global payments card brand under Discover Global Network.

- Diners Club operates in over 190 countries globally for card acceptance.

- Issuing partners benefit from access to the Discover Global Network’s 378M+ cards and its global acceptance across 190+ countries and territories.

- Diners Club cardholders spent over $415 billion on the Discover Global Network in 2020.

- The average merchant fee for Diners Club transactions is around 1.7% of the transaction value.

- Diners Club offers travel benefits such as airport lounge access and travel insurance.

- Many Diners Club cards are charge cards that require full monthly payment.

- Diners Club integrates with multiple mobile payment systems and digital wallets.

- The network targets affluent, global consumers but is expanding to broader markets.

- On May 7, 2025, Diners Club donated up to $750,000 to World Central Kitchen based on cardholder transactions.

History Of Diners Club Cards

- Diners Club was launched in 1950 as the world’s first multipurpose charge card.

- By 1951, membership reached 42,000 with acceptance in major US cities.

- By 1960, Diners Club cards were issued in Hong Kong, Japan, Malaysia, and New Zealand.

- The first plastic Diners Club card was introduced in 1961.

- In 1981, Diners Club was acquired by Citicorp.

- In 2008, Discover Financial Services acquired Diners Club for $165 million.

- Diners Club’s network acceptance grew to over 185 countries and 8 million locations by 2008.

- The brand celebrates 75 years of operation in 2025, marking its fintech legacy.

- Diners Club pioneered the first corporate card program in 1975.

- Diners Club was one of the first to introduce travel insurance in the 1950s.

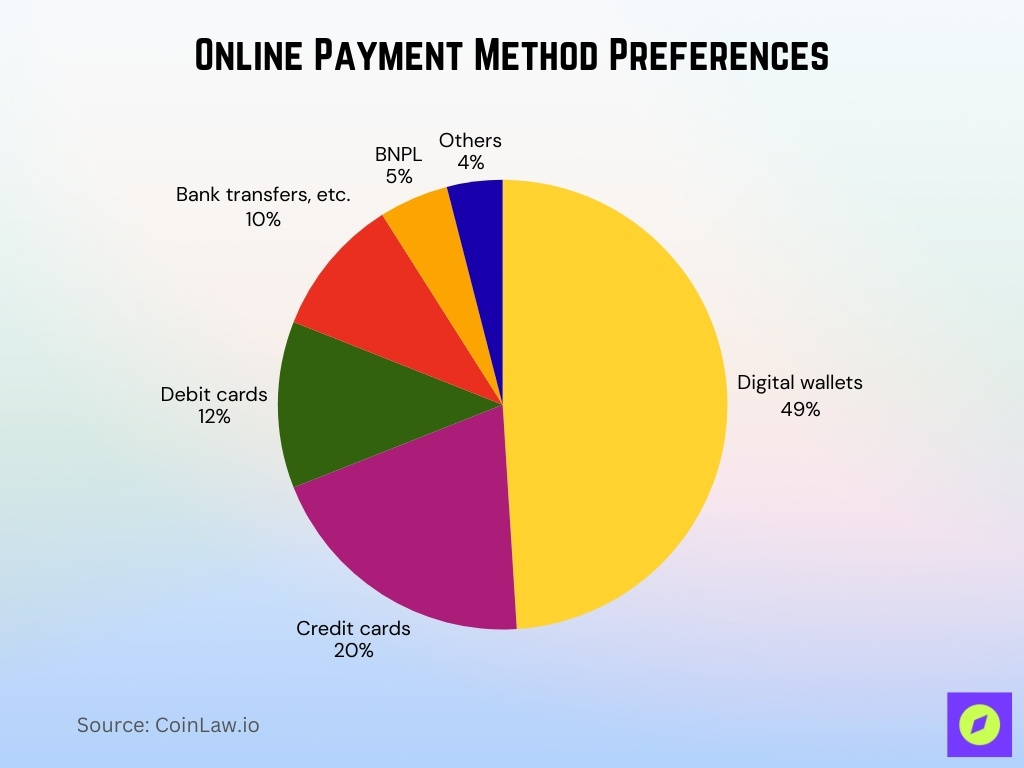

Global Online Payment Methods by Share

- Digital wallets (including Apple Pay, Google Pay, PayPal, etc.) dominate with an estimated 49% share of global ecommerce transactions.

- Credit cards rank second with an approximate 20% share, still vital but clearly trailing digital wallets.

- Debit cards hold around 12%, showing a smaller global footprint compared to wallets and credit cards.

- Bank transfers & account-to-account methods (including instant payment rails) contribute about 10% of online transactions worldwide.

- Buy Now Pay Later (BNPL) has grown significantly, reaching a 5% global share in online purchases.

- Other methods (like cash on delivery, vouchers, etc.) represent the remaining 4%, highlighting regional preferences and unbanked populations.

Key Diners Club Facts

- Diners Club cards are now accepted at millions of locations globally.

- The brand maintains 40+ issuing partnerships in 35+ countries.

- The ATM network exceeds 1.2 million units worldwide.

- Cards are available as consumer, corporate, prepaid, and co-branded versions.

- Diners Club offers access to 1,700+ airport lounges across 140+ countries.

- The global transaction volume reached $622 billion in 2024.

- Diners Club supports contactless payments, digital wallets, and biometric verification.

- Its issuing partners can customize card programs for local regulations and customer needs.

- Diners Club is used for both personal travel and corporate expense management.

- Its network is powered by Discover, Diners Club, and PULSE, ensuring reach and security.

Global Footprint And Acceptance

- Diners Club cards are accepted in 190+ countries and territories.

- The global ATM network offers access to over 1.2 million ATMs worldwide.

- Lounge benefits extend to 1,700+ airport lounges in 600+ cities globally.

- Singapore’s NETS added 130,000 POS terminals to Diners Club’s reach in 2024.

- Diners Club acceptance spans retail, hospitality, e-commerce, and transportation sectors.

- Discover Global Network supports Diners Club acceptance across millions of merchant locations.

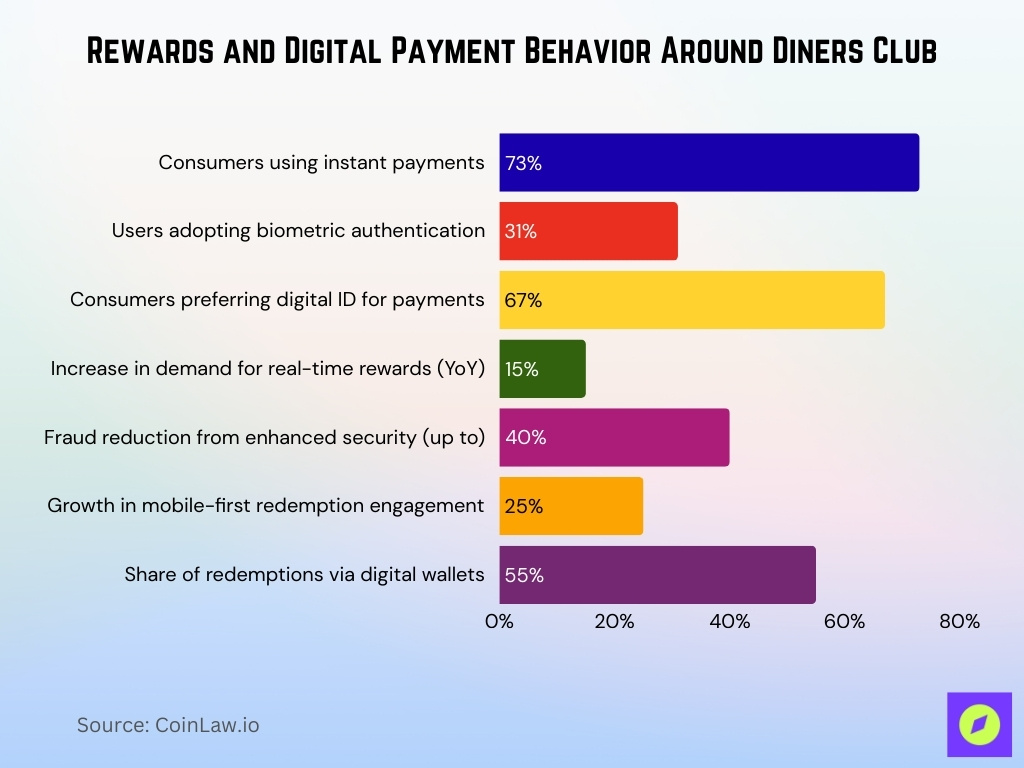

Rewards, Points, And Redemption Data

- 73% of consumers used instant payments in 2025.

- 31% of users adopted biometric authentication for payments.

- 67% of consumers prefer using a digital ID for payments.

- Real-time reward systems saw a 15% increase in demand year-over-year.

- Discover Global Network supports flexible and customizable rewards programs.

- Enhanced security features reduce misuse by up to 40% in reward ecosystems.

- Merchants benefit from reward programs that provide immediate redemption options.

- Mobile-first redemption platforms grew by 25% in user engagement.

- Digital wallets integration accounts for 55% of reward redemptions.

Number Of Cardholders And Memberships

- Diners Club International has 40+ issuers in 35+ countries worldwide.

- The Discover Global Network serves over 378 million cards globally in 2024.

- Diners Club offers access to more than 1.2 million ATMs worldwide.

- The network is accepted in 190+ countries and territories.

- It has 40+ card issuers operating in 35+ countries, leveraging Discover Global Network’s shared infrastructure for global acceptance.

- Membership includes both individual consumers and corporate cardholders.

Merchant Locations And ATM Access

- Diners Club cards are accepted in 190+ countries and territories.

- Available at millions of merchant locations worldwide.

- Diners Club International gives cardmembers access to more than 1.2 million ATMs and cash access locations worldwide through its cash access network.

- ATM access significantly improves Diners Club’s global usability.

- The Discover-NETS partnership added 130,000+ POS terminals in Singapore.

- Regional expansion focuses on Asia-Pacific markets for growth.

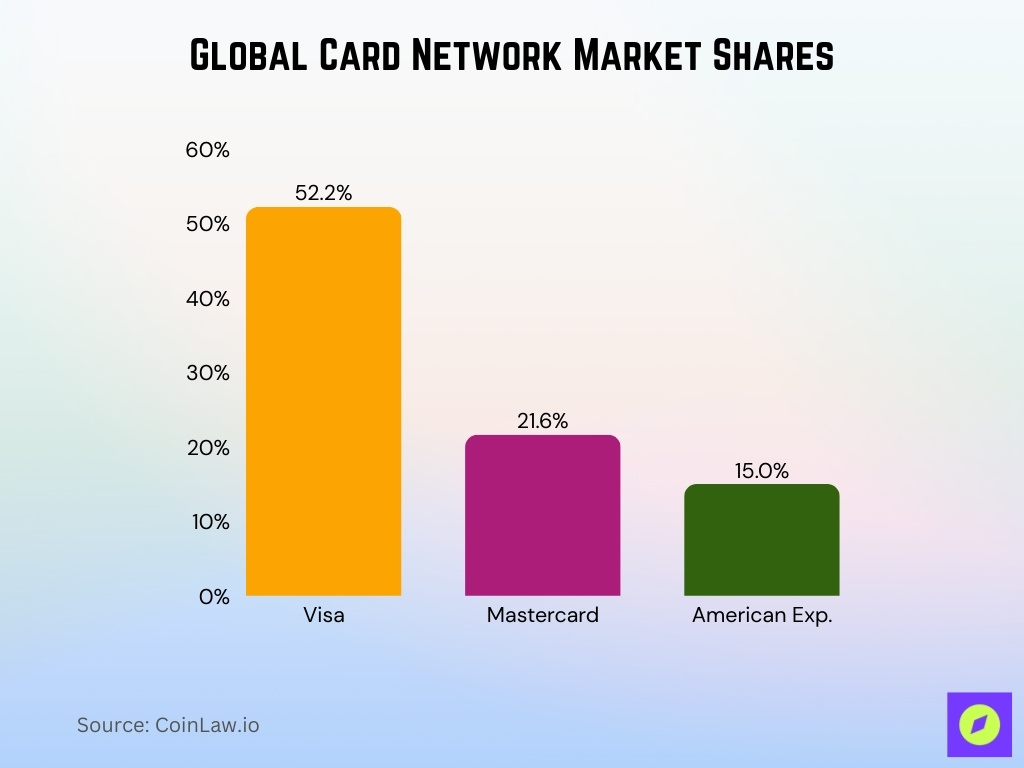

Acceptance Compared With Visa, Mastercard, And Amex

- Visa holds approximately 52.2% market share, Mastercard 21.6%, and American Express 15% globally.

- Diners Club has lower transaction volume but focuses on global travel perks and rewards.

- Visa and Mastercard have acceptance in over 200 countries and millions of merchants.

- American Express holds 25.1% of the global premium card market in 2025.

- Diners Club’s use case is more global and travel-focused rather than local retail.

- Visa and Mastercard dominate with a 90% combined market share in global payment processing.

- Accepted in 190+ countries and territories with access to more than 1.2 million ATMs and cash access locations globally.

Issuing Partners And Markets

- Diners Club International operates with 40+ issuers across 35+ countries.

- Utilizes Discover and PULSE network infrastructure for global processing.

- Alliance models enable collaboration with local payment networks worldwide.

- The 2024 Singapore NETS partnership added 130,000+ POS terminals.

- The Diners Club network is part of the Discover Global Network, which supports 378 million+ cards and $622 billion in global spend in 2024 across Discover, Diners Club, and PULSE.

Network Volumes And Transaction Values

- The network processed $622 billion in transaction volume in 2024.

- Global card purchase value across major networks is projected to reach around $772.73 billion annually by the mid‑2020s, reflecting industry‑wide growth rather than Discover‑only volumes.

- This marked a 12.4% year-over-year growth in transaction volume.

- Diners Club volume grew 9% year-over-year in 2024.

- The Discover Global Network processed over 378 million cards globally in 2024.

- PULSE network dollar volume rose 7% driven by increased debit transactions.

- Corporate and travel sectors drive a substantial share of Diners Club transactions.

- The network supports transactions across 190+ countries and millions of merchants.

Consumer Card Statistics

- Consumer products include premium, prepaid, debit, and co-branded cards.

- Benefits cover ATM access, merchant acceptance, and travel perks.

- Accepted in 140+ countries with access to 1.2 million ATMs globally.

- The Discover Global Network underpins Diners Club’s payment infrastructure.

- Products are tailored for a wide range of consumer types and preferences.

- Expansion into Singapore added 130,000+ POS terminals in 2024.

- Cards are compatible with digital wallets and global e-commerce platforms.

- Diners Club cards serve more than just high-net-worth individuals.

- Consumer card transaction volume rose by 8% in 2024.

Cardholder Demographics And Profiles

- Digital-first users rose by 20% in new Diners Club regions in 2025.

- Interest in instant and biometric payments increased by 30% among cardholders.

- Cardholders include business travellers, digital natives, and expatriates.

- Product offerings support both budget-conscious and premium users.

- Travel perks contribute to a 25% higher card usage among global customers.

- Millennials and Gen Z make up 40% of new Diners Club cardholders.

- Diners Club expanded its demographic reach to 45+ countries in 2025.

- Cardholders rely 70% on digital channels for account management.

- 55% of users value concierge and lifestyle benefits highly.

- Corporate clients comprise 35% of the total cardholder base.

Fraud, Chargebacks, And Security Metrics

- Diners Club uses tokenization, encryption, and secure APIs for transactions.

- Real-time fraud analytics reduced fraud losses by 25% in 2024.

- Biometric verification is supported as a key fraud deterrent.

- Chargeback disputes are managed through global processor protections.

- Security protocols comply with PCI DSS industry standards.

- Shared network security reduces risk exposure by 30%.

- Contactless and digital wallet adoption increased transaction safety by 20%.

- Fraudulent activity rates are below 0.05% of total transactions.

- Chargeback rates remain under 0.1% globally.

- Machine learning models improve fraud detection accuracy by 15% annually.

Diners Club vs. Discover Network Statistics

- Diners Club operates on the Discover Global Network infrastructure.

- Shares security protocols, transaction processing, and merchant acceptance with Discover.

- Ranked among the top 15 fintech ecosystems globally in 2025.

- Issuers access a global footprint covering 190+ countries without custom builds.

- Consumers benefit from Discover’s over $350 million annual tech investments.

- Network processes over $622 billion in combined transaction volume annually.

- Diners Club cards enjoy acceptance at millions of Discover merchant locations.

- Discover Global Network supports 378 million cards worldwide as of 2024.

Frequently Asked Questions (FAQs)

Diners Club cards are accepted at over 55 million merchant locations globally.

The Diners Club / Discover Global Network gives access to more than 1.2 million ATMs worldwide.

Cardholders can access more than 1,700 airport lounges and experiences worldwide.

Diners Club saw approximately 15% growth in acceptance points in Asia.

Conclusion

Diners Club remains a specialized but meaningful player in the global payments space today. Its core strengths lie in global reach and a wide merchant and ATM network, which serve frequent travellers, corporates, and globally mobile consumers. Although its global market share trails behind giants such as Visa, Mastercard, and Amex, Diners Club’s value proposition centers on travel benefits, security features, and flexibility in card issuance. As payment technology, biometric adoption, and demand for instant payments rise, Diners Club, via its integration with Discover Global Network, appears well-positioned to adapt.