Imagine a world where physical wallets become obsolete, and transactions occur with a simple tap on your smartphone or a click of a button. This vision is no longer just a futuristic dream; it’s the reality we live in today. Digital payment infrastructure has revolutionized the way money moves, enabling seamless, contactless, and cashless transactions across the globe. Today, the evolution of digital payments is accelerating faster than ever, driven by innovation, consumer demand, and global adoption.

Editor’s Choice

- $11.55 trillion projected global digital payments transaction value in 2025.

- 80% of merchants worldwide now accept at least one form of digital payment.

- Apple Pay is estimated to process over $1.2–1.5 trillion globally in 2025, continuing its steady growth trajectory in mobile payments.

- The number of digital wallet users is expected to surpass 5.5 billion by the end of 2025.

- China leads the global digital payment market with over $3.5 trillion in transactions annually.

- In 2025, contactless payments are forecast to account for ~ 65% of all in-store payments globally.

Preference for Digital Wallet Use Among US Consumers

- 91% of consumers aged 18 to 26 prefer using digital wallets, showing the strongest adoption among younger adults.

- 59% of those aged 27 to 42 also favor digital wallets, reflecting growing mainstream acceptance among millennials.

- 50% of consumers aged 43 to 58 use digital wallets, indicating steady adoption even among older demographics.

- The data reveals a clear generational trend; younger users are leading the shift toward cashless and mobile payments.

Defining Digital Payments

- Digital payment transactions are executed through highly secure and encrypted networks, ensuring data integrity.

- Cryptocurrencies and blockchain-based payments now represent ~ 2% of total global payment volumes.

- Peer-to-peer (P2P) payment apps like Venmo and Zelle are seeing annual growth rates of ~ 25% in 2025.

- Digital payments increasingly integrate AI and machine learning, improving fraud detection by ~ 40%.

- By eliminating cash, digital payments reduce transaction costs by ~ 3% on average in 2025.

- The concept of Buy Now, Pay Later (BNPL) surged by ~ 50% in adoption rates during the past year.

Global Adoption Rates and Usage Statistics

- By 2025, about 67% of adults globally will use digital payments.

- India’s UPI processed a ~ 38% growth in transaction volume in 2025 compared to 2024, reaching new all-time highs.

- Europe’s digital payment penetration is estimated at ~ 85% in 2025, led by Scandinavian nations.

- The US e-commerce digital payment transaction volume is projected at ~ $1.4 trillion in 2025.

- The number of cashless businesses globally grew by ~ 35% in 2025, with small merchants driving much of the expansion.

- In Sub-Saharan Africa, over 50% of the population now uses mobile payment platforms in 2025.

- Global remittances facilitated via digital payments reached ~ $950 billion in 2025, with fee reductions averaging ~ 12%.

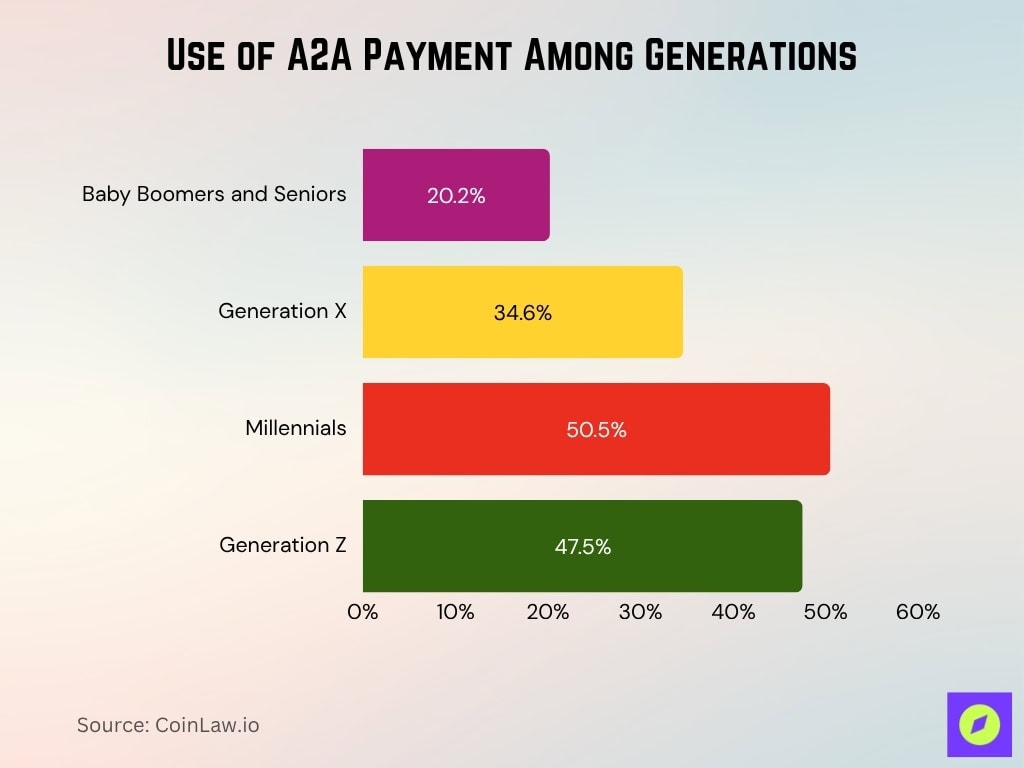

Use of A2A Payment Among Generations

- Millennials lead A2A (Account-to-Account) payment adoption, with 50.5% actively using these direct transfer methods.

- Generation Z follows closely at 47.5%, showing strong engagement with modern, instant payment technologies.

- Generation X adoption stands at 34.6%, indicating growing comfort with digital financial tools.

- Baby Boomers and seniors report only 20.2% usage, reflecting a slower shift toward A2A payment systems.

- The overall data highlights a clear generational divide, with younger users driving the growth of seamless, bank-linked payment solutions.

Rise of Digital and Contactless Payments

- ~ 70% of global consumers prefer contactless payments over cash in 2025, citing speed and ease.

- By end-2025 contactless payments are projected to reach ~ $3 trillion in annual transaction value.

- In the US, ~ 75% of credit and debit cards will feature contactless capabilities in 2025.

- QR code payments in Asia surpassed ~ $1.8 trillion in 2025, driven by WeChat Pay, Alipay, and others.

- Retailers report ~ 25% faster checkouts with contactless options versus traditional methods.

- ~ 45% of millennials consider contactless payments essential when choosing a financial institution in 2025.

- The transportation sector sees ~ 98% adoption of contactless payment systems in urban areas globally in 2025.

Mobile Payments Adoption

- About 3.2 billion smartphone users are expected to use mobile payment apps in 2025.

- Google Pay and Samsung Pay collectively hold around 30% of the global mobile payment platform market in 2025.

- The average transaction value per mobile payments user is projected to surpass $3,500 annually by the end of 2025.

- Mobile payment penetration in developing countries increase by ~ 50% by 2025, driven by increasing internet access.

- The integration of biometric authentication in mobile payments has reduced fraud rates by ~ 25% globally in 2025.

- Mobile payments now account for ~ 30% of all e-commerce transactions in 2025.

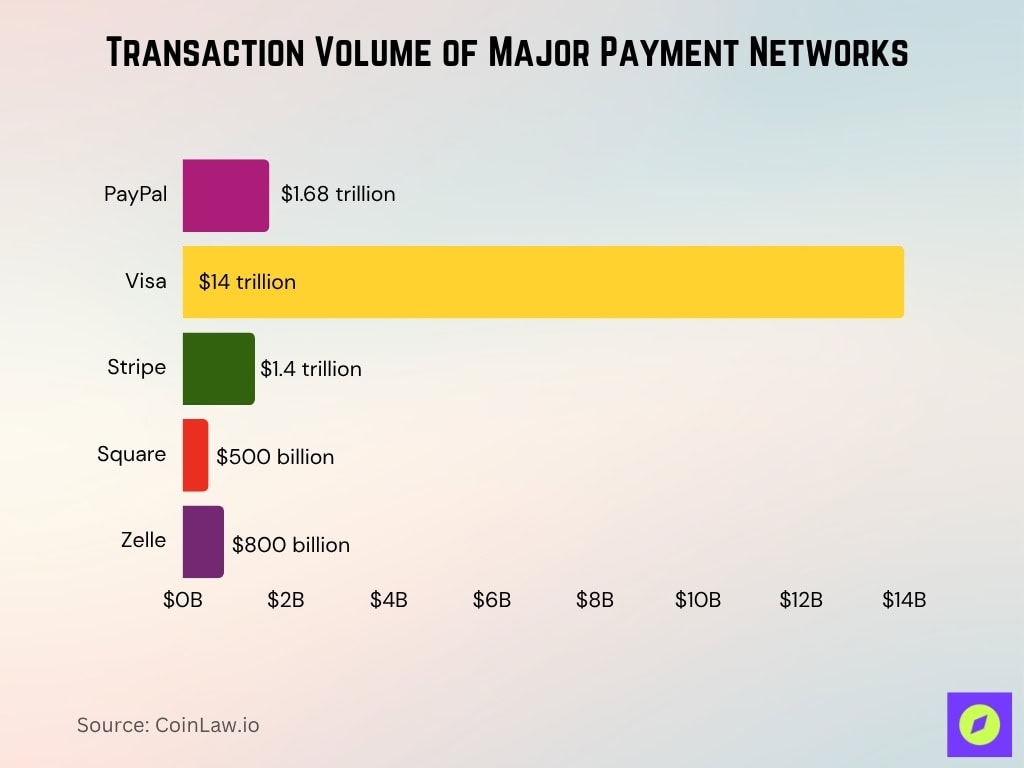

Market Share of Leading Digital Payment Platforms

- PayPal leads globally with ~ 434 million active users and processed ~ $1.68 trillion in transaction volume in 2024 and is growing into 2025.

- Visa processed ~ $14 trillion in global payments in 2025, maintaining dominance among card networks.

- Stripe saw its transaction volume grow to ~ $1.4 trillion and continues rising.

- Square processed about ~ $500 billion in 2025, driven by the expansion of point-of-sale systems.

- Zelle handled roughly ~ $800 billion in payments in 2025, reflecting continued strong peer-to-peer growth.

- In China, Alipay and WeChat Pay together manage ~ 92% of mobile payments in 2025.

- Cryptocurrency payment platforms like Coinbase Commerce increased market share by ~ 20% in 2025 amid rising digital currency acceptance.

Security Measures and Fraud Prevention

- Global cybersecurity spending in the digital payments sector reached ~ $212 billion in 2025.

- Biometric authentication is used in ~ 70% of digital payment platforms in 2025.

- Fraudulent digital transactions decreased by ~ 35% globally in 2025 thanks to AI-based monitoring systems.

- Tokenized payments have reduced the risk of data breaches by ~ 34% in 2025.

- Multi-factor authentication adoption by payment platforms grew by ~ 40% in 2025, enhancing account security.

- The average loss per digital fraud incident dropped to ~ $2,500 in 2025.

- Real-time fraud detection systems now process over ~ 1.2 billion transactions daily in 2025, identifying suspicious activity in milliseconds.

Key Market Indicators

- The digital payments industry is projected to grow at a ~ 13.6% CAGR between 2025 and 2033, reaching ~ $32 trillion by 2033.

- Over 75% of fintech companies worldwide are now investing in digital payment technologies in 2025.

- Small businesses adopting digital payment solutions report a ~ 22% increase in sales compared to those relying solely on cash in 2025.

- While cryptocurrency acceptance is rising, recent surveys suggest that fewer than 10% of global brick-and-mortar stores accept crypto as of 2025, with higher concentrations in tech-forward markets.

- Digital payment providers spent over $7 billion on cybersecurity enhancements in 2025 to better protect user data.

- Real-time payments account for ~ 25% of global digital payment volumes in 2025, up from 17%.

- Gig economy workers increasingly rely on digital payments, with ~ 70% preferring platforms like PayPal and Stripe for receiving payments in 2025.

The Benefits of Digital Payments

- The use of digital payments has reduced cash-related theft by ~ 45% among small businesses in 2025.

- ~ 75% of consumers find digital payments more convenient than traditional methods in 2025.

- Businesses adopting digital payment options report a ~ 20% increase in sales in 2025.

- Cryptocurrency payments for cross-border transactions reduced fees by ~ 35% on average in 2025.

- Contactless payments remain preferred by ~ 70% of users in 2025 as they minimize health risks.

- Digital transactions save consumers about 25 minutes per transaction in 2025 compared to cash or checks.

- Digital receipts and invoices helped reduce ~ 600,000 tons of paper waste globally by 2025.

Recent Developments

- Visa and Mastercard invested ~ $2.2 billion in real-time payment systems by 2025 to enhance global accessibility.

- Blockchain-based payments grew by ~ 30% in 2025, offering faster and cheaper cross-border solutions.

- Amazon Pay is integrated with over 750 new merchants by 2025, expanding its retail footprint.

- The introduction of CBDCs by nations like China, Nigeria, and more reshapes the role of digital payments in national economies in 2025.

- Digital wallet super apps such as Paytm and Cash App increased their user bases by ~ 25% in 2025.

- AI chatbots are now integrated into ~ 85% of digital payment platforms in 2025, providing real-time user assistance.

- The rise of DeFi is expected to drive ~ $300 billion in payment volume by 2025.

Frequently Asked Questions (FAQs)

Real-time payments hit 266.2 billion transactions in 2023, equal to 19.1% of all electronic transactions, and are projected to reach 27.1% by 2028.

UPI processed 20.01 billion transactions worth ₹24.85 lakh crore in Aug 2025 and 19.63 billion worth ₹24.90 lakh crore in Sep 2025.

137 countries are exploring CBDCs, with 72 in advanced stages, 49 running pilots, and 3 fully launched.

Digital wallets account for about 66% of global e-commerce transaction value in 2025.

Conclusion

Digital payment infrastructure continues to redefine the global financial ecosystem. With unprecedented growth, innovations, and regulatory advancements, the industry is creating a seamless, secure, and inclusive financial experience. The widespread adoption of digital payments is not only transforming commerce but also improving accessibility and financial health for billions worldwide. As technological advancements push the boundaries further, the future of digital payments looks promising, revolutionizing how the world transacts.