Imagine walking into a dentist’s office without worrying about the cost of treatments. For millions of Americans, this is a reality thanks to dental insurance, a cornerstone of healthcare coverage. Today, dental insurance is poised to witness significant evolution, driven by technological advancements, demographic shifts, and growing awareness about oral health link to overall well-being. This article dives into the current statistics, trends, and insights that define the dental insurance industry today.

Editor’s Choice

- The U.S. dental insurance market is valued at $97.7 billion in 2025.

- Approximately 80% of Americans had some form of dental coverage.

- Employer-sponsored dental plans account for 63.39% of market revenue.

- Preventive services are covered at 100%, restorative at 80% in most 2025 plans.

- Average individual dental insurance = $30/month, ranging from $8–$100.

- Employer-sponsored dental plans account for 63.39% of market revenue.

Top Reasons People Delay Dental Care

- 19.6% delayed treatment due to high out-of-pocket costs.

- 13.3% cited fear of pain as their main reason for postponing care.

- 13.1% said they lack dental insurance entirely.

- 9.5% mentioned that their dental plan doesn’t cover the needed procedures.

- 5.5% delayed care because they needed time off to recover.

- 4.2% were unable to proceed because their preferred dentist was out-of-network.

Demographic Insights

- 27% of U.S. adults, or about 72 million people, did not have dental insurance in 2025.

- Around 29% of Americans aged 65 and older had private dental coverage, while about 33% had no coverage at all.

- 24% of adults with current dental insurance reported gaining coverage in the past year.

- Plan selections among individuals aged 55 and above dropped to 24% in the 2025 enrollment period.

- Women accounted for 52% of plan selections in 2025, while men accounted for 48%.

- Adults earning less than $30,000 annually have a 38% rate of being uninsured for dental care.

- Hispanic individuals have the highest uninsured rate at 30% while Asian Americans have the lowest at 19%.

Coverage Insights

- Preventive services like cleanings and exams are covered at 100% in most plans in 2025, while restorative treatments (fillings, basic crowns) are often around 80% coverage.

- Orthodontic coverage is not universally offered; many plans require a rider or add‑on, and only about half of plans with orthodontic benefits cover adult treatment.

- Cosmetic dentistry coverage remains limited, with few plans (single‑digit %) including benefits for veneers or whitening.

- Dental plans with no annual maximum limits are rare, with most PPOs retaining maximums around $1,500‑$2,500 per year.

- Specialized senior plans nearly always include dentures and periodontal care, and most Medicare Advantage dental plans include basic periodontal services.

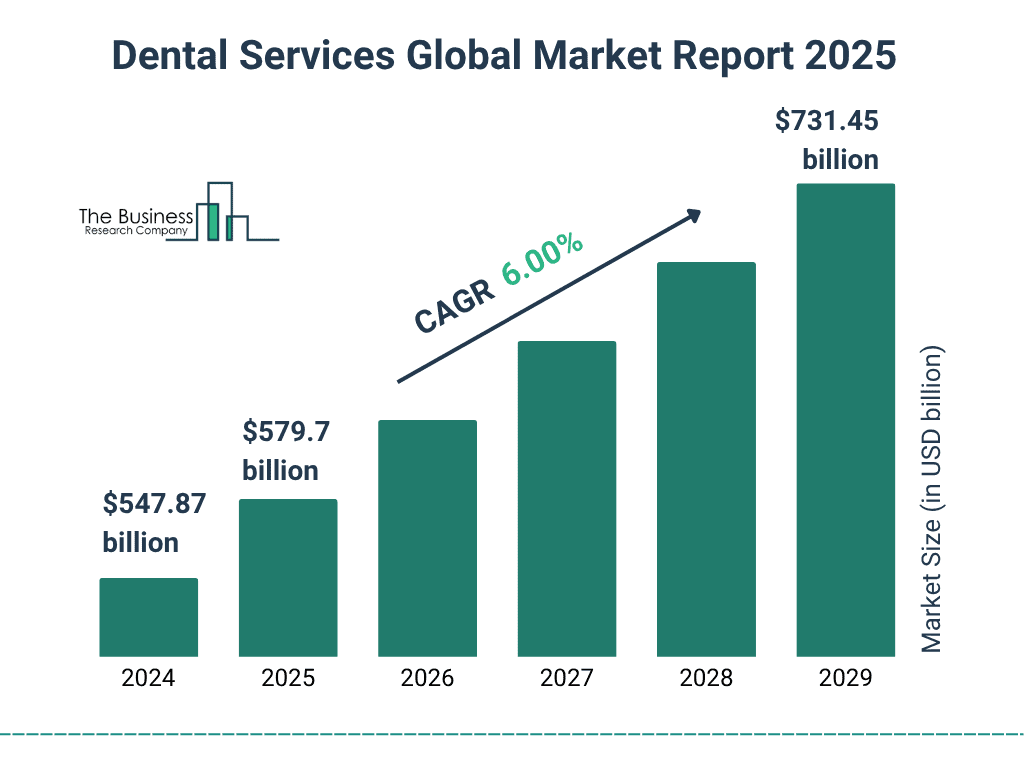

Global Dental Services Market Growth

- It is projected to reach $579.7 billion in 2025, showing steady expansion.

- By 2029, the market is expected to hit $731.45 billion.

- This reflects a CAGR of 6.00% over the 5-year period.

- The global trend indicates rising demand for dental care, driven by aging populations and improved access to services.

U.S. Dental Insurance Market Analysis

- The U.S. dental insurance market size is $97.7 billion in 2025.

- Individual plans are growing longer term at a CAGR of about 6.60% from 2025 to 2032.

- Private insurers dominate with around 63.39% revenue share from employer‑sponsored/group policies.

Procedure Insights

- Preventive care procedures account for around 50‑55% of dental insurance claims in 2025.

- Restorative treatments (fillings, crowns, etc) represent about 30‑35% of claims in recent years, reflecting continued focus on disease management.

- Dental implant procedure usage is growing: about 3 million Americans have dental implants as of 2024‑25.

Growth Factors and Market Opportunities

- The global dental insurance market is projected to reach approximately $253.72 billion in 2025, with sustained growth across emerging markets.

- The U.S. dental insurance market is $97.97 billion in 2025 and expected to grow to $209.46 billion by 2034 at a CAGR of 8.84%.

- The Asia-Pacific region is the fastest-growing dental insurance market with a projected CAGR of 10.8% through 2030.

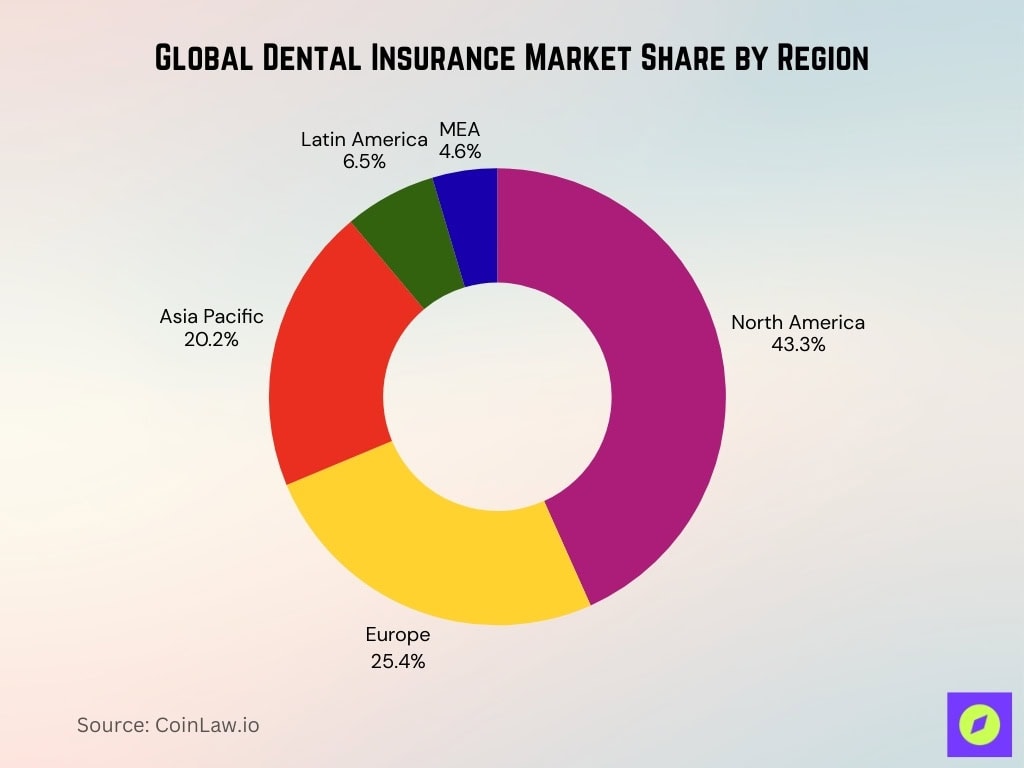

Global Dental Insurance Market Share by Region

- North America holds the largest share at 43.3% of the global dental insurance market.

- Europe comes next with a market share of 25.4%.

- Asia Pacific accounts for 20.2%, reflecting a growing adoption of dental coverage.

- Latin America represents 6.5% of the market.

- Middle East & Africa (MEA) holds the smallest share at 4.6%.

Market Restraining Factors

- High out‑of‑pocket costs remain a major barrier, with 28% of insured adults in 2025 saying dental and vision costs limit access to care.

- Among adults earning under $30,000, 38% are uninsured for dental care, indicating limited awareness and financial access.

- About 15% of dental insurance claims were denied in 2025 due to issues such as incomplete information or coding errors.

- More than 80% of adults believe the lack of standardization in state dental insurance coverage creates confusion.

- About 44% of U.S. adults say it is difficult to afford health care costs, including dental services, signaling risk for market stability.

Leading Providers and Market Share

- Delta Dental remains a market leader serving 80 million Americans and holding about 30% market share.

- Together, Cigna and UnitedHealthcare account for a significant share, estimated at 30–40%, of private dental insurance enrollments in the U.S. market.

- Private insurers collectively dominate with around 63.39% revenue share in employer‑sponsored/group dental plans.

- The U.S. dental insurance market is valued at $97.7 billion in 2025.

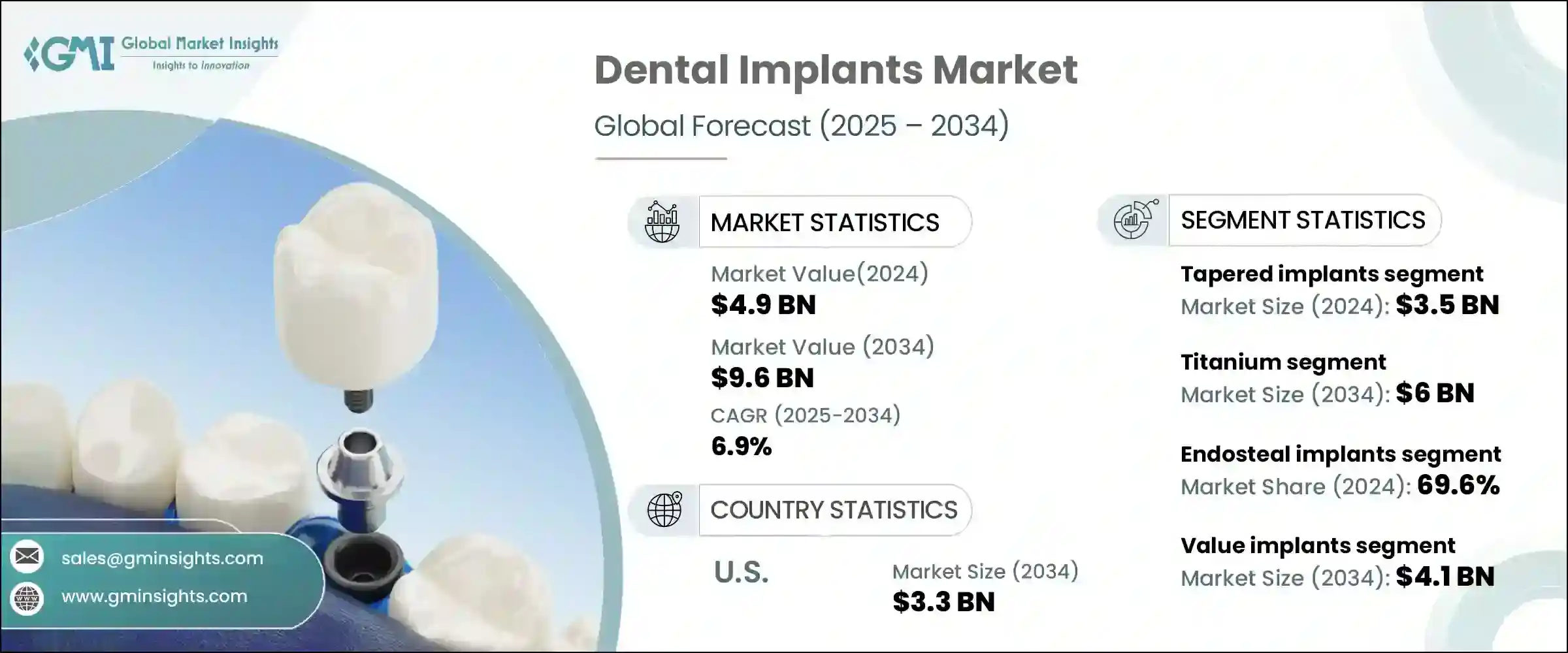

Dental Implants Market Outlook

- It is projected to reach $9.6 billion by 2034, reflecting a CAGR of 6.9%.

- The tapered implants segment alone accounts for $3.5 billion.

- The titanium segment is forecast to hit $6 billion by 2034.

- Endosteal implants dominate with a 69.6% market share.

- The value implants segment is expected to grow to $4.1 billion by 2034.

- The U.S. market size for dental implants is projected at $3.3 billion in 2034.

Technological Advancements

- Teledentistry adoption is rising rapidly, with more than one-third of dental plans offering virtual consultation options.

- Mobile apps for policy management and claim tracking are used by 62% of policyholders in 2025, offering real‑time updates and convenience.

- AI-enhanced claim processing has shown time reductions of up to 25% in leading insurers’ trials.

- A small but growing number of insurers, estimated at around 5%, are beginning to offer wellness incentives tied to connected oral health devices.

- Chatbots and virtual assistants are enabling response times to drop by 30% in customer service settings.

Regulatory Environment

- Pediatric dental services remain an Essential Health Benefit under the ACA in 2025, thus requiring dental coverage for children in Marketplace health plans.

- In 2025, about 54% of eligible Medicare beneficiaries are enrolled in Medicare Advantage plans that may offer dental benefits.

- States may soon be allowed to include routine non‑pediatric dental services as part of their EHB‑benchmark health plans starting plan year 2027.

- For standalone pediatric dental plans in New Mexico in 2025, cost‑sharing limits are set at $425 for one child or $850 for two or more children.

- Over 90% of U.S. counties have one or two insurers dominant in Medicare Advantage offerings, raising concerns about competition and transparency.

Recent Developments

- ACA Marketplace enrollment reached 24.2 million people selecting a plan during the 2025 open enrollment period.

- The global teledentistry market is valued at about $2.45 billion in 2025 and expected to grow significantly through 2029.

- More than 30% of dental consultations in North America were conducted virtually in recent reports, indicating growing usage of remote dental care.

- Median proposed health insurance premiums in ACA plans increased by 7% for 2025 across many states.

- Enrollment through Health Insurance Marketplaces has more than doubled since 2020, rising by about 12.9 million people to reach 24.3 million in 2025.

Frequently Asked Questions (FAQs)

The U.S. dental insurance market is valued at approximately $97.97 billion in 2025 and is projected to reach $209.46 billion by 2034, growing at a CAGR of about 8.84%.

About 27% of U.S. adults, equivalent to around 72 million people, do not have dental insurance.

Dental claim denial rates typically range from 8% to 15%, often due to missing information, improper coding, or coverage exclusions.

Among U.S. children ages 0‑18, 53% had private dental benefits, 38% had benefits through Medicaid/CHIP, and 8% had no dental benefits.

Individual dental insurance plans cost on average $30 per month, with some plans as low as $8 and others up to about $100 per month.

Conclusion

The dental insurance industry today is a dynamic landscape driven by innovation, regulatory changes, and evolving consumer needs. While challenges like high costs and complex claims persist, growth factors such as technological advancements, expanded coverage options, and increasing consumer awareness are reshaping the sector. The industry is well-positioned to support oral health on a broader scale. As stakeholders continue to adapt to emerging trends, dental insurance is set to become even more integral to overall healthcare in the years ahead.