Decentralized storage has moved from niche experiment to serious infrastructure debate. Organizations in finance and in healthcare are already piloting decentralized storage to reduce single‑point-of-failure risk and improve data sovereignty. Meanwhile, content delivery networks and blockchain applications integrate it to reduce bandwidth costs and ensure immutability. Let’s begin by highlighting key stats before diving deeper into market dynamics.

Editor’s Choice

- The global decentralized storage market was valued at $622.9 million in 2024 and is projected to grow at a CAGR of 22.4% from 2025 to 2034.

- A different forecast sees the decentralized cloud storage market rising from $506 million in 2024 to $577.24 million in 2025, at a CAGR of ~14.9%.

- In 2024, the medium‑scale (1 TB to 10 TB) storage segment held a 45.6% share of the decentralized cloud storage market.

- North America dominated in 2024, capturing ~35.2% of the market with revenue of $2.61 billion per one estimate.

- Protocol research shows the RedStuff erasure coding scheme enabling a replication factor of only 4.5×, reducing storage overhead for new decentralized designs like Walrus.

- In measurements of network size, IPFS & Filecoin peer snapshots from Mar–Apr 2025 were collected to assess evolution, underscoring active node growth.

Recent Developments

- Researchers introduced Walrus, a decentralized blob storage system using RedStuff, which supports 4.5× replication and self‑healing recovery.

- The BFT‑DSN design offers Byzantine fault tolerance by integrating storage‑weighted consensus with erasure coding, improving resilience.

- EC‑Chain, a storage optimization for permissionless blockchains, claims to reduce storage overhead by over 90% compared to native Ethereum Geth.

- The same source credits North America with a 35.2% share in 2024.

- A Codex Storage report estimates that global daily data generation now exceeds 400 million terabytes, fueling demand for more distributed storage.

- In a comparative snapshot study, IPFS and Filecoin networks were crawled across 50 days in 2024 and 2025 to measure peer growth and neighbor connections.

Key Market Trends in Decentralized Storage

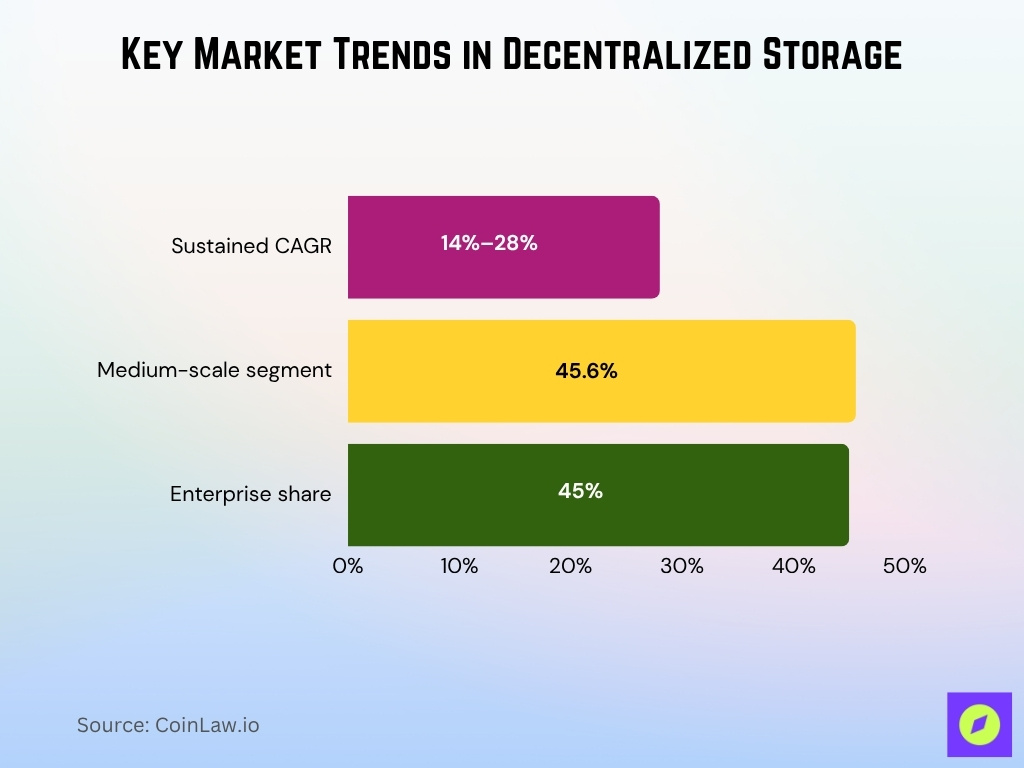

- Sustained double‑digit CAGR forecasts (14%–28%) indicate strong sector growth potential.

- The medium‑scale storage (1–10 TB) segment commands ~45.6% share, reflecting demand from SMEs.

- Enterprises accounted for ~45% of the market share in 2024 under one projection, showing institutional uptake.

- Hybrid storage models are emerging, mixing centralized and decentralized layers to smooth the transition.

- Regional concentration remains, with North America and Europe controlling a large share of investment and deployment.

- Decentralized storage is increasingly bundled into Web3 and blockchain stacks, enhancing integration demand.

- Rising regulatory attention to data privacy, sovereignty, and anti‑monopoly pressure is pushing interest in alternatives to Big Tech clouds.

- Tools and protocols for node metrics, churn mitigation, and erasure coding are now central to platform differentiation.

Regional and Global Market Share

- In one forecast, North America led in 2024 with 35.2% market share, bringing in $2.61 billion in revenue.

- Some reports place the global market at $7.8 billion in 2024, suggesting regional shares differ based on methodology.

- Projections suggest that North America + Europe could contribute 65%+ of the market by 2030.

- The Asia-Pacific region is showing accelerating adoption but lags in infrastructure investment compared to the West.

- In 2025, the decentralized cloud storage segment is estimated at $577.24 million, with heavy concentration in developed markets.

- The medium-scale (1–10 TB) segment dominated ~45.6% share globally in 2024.

- Some niche markets in Latin America and Africa are testing localized storage nodes for latency and cost benefits.

- Regional regulatory regimes (e.g., GDPR in the EU, data localization in India) play a significant role in shaping where deployment takes place.

Major Decentralized Storage Platforms

- According to snapshot studies, IPFS maintained ~23,000 peers between 2024 and early 2025, Filecoin and Swarm showed varied peer count trends, and Storj remained relatively stable.

- Storj is frequently cited as a top decentralized cloud storage offering in 2025 in comparison tools and reviews.

- Arweave, Sia, and Filecoin are commonly included in surveys of blockchain‑based storage ecosystems.

- The DeStor 2024 report found that only 3% of IT decision makers view decentralized storage as equally or more reliable than traditional clouds.

- Among those considering adoption, 58% prioritized data security or scalability as decisive criteria.

- Some platforms (e.g., hello.app) attempt to use peer devices (phones, laptops) as nodes, hello.app reached ~200,000 active users by mid-2024.

Decentralized Storage Market Highlights

- The global decentralized storage market was valued at $622.9 million in 2024 and is projected to surge to $4.5 billion by 2034, reflecting a CAGR of 22.4%.

- The public cloud segment is expected to exceed $2 billion in market size by 2034, driven by enterprise demand for secure and cost-efficient data storage solutions.

- The enterprise segment captured a significant 45% market share, underscoring growing adoption among large organizations and data-intensive industries.

- North America dominated the market with a 40% share, supported by strong tech infrastructure, early blockchain adoption, and cloud migration initiatives.

Use Cases and Applications

- Archive and backup services use decentralized storage for long-term retention, offering up to 99.999% durability through global node distribution.

- Media distribution platforms using decentralized video hosting achieve 30–50% lower bandwidth costs and stronger resistance to takedowns.

- Over 60% of Web3 dApps store large-scale data like NFT metadata and high-res assets on decentralized storage to bypass blockchain limits.

- Content delivery networks (CDNs) with decentralized nodes deliver files with up to 20% improved latency via local caching.

- IoT and edge devices replicate sensor data in decentralized systems, boosting resilience and cutting hub reliance by over 40%.

- Disaster recovery plans use decentralized replication for business continuity, with geo-redundancy cutting downtime by nearly 35%.

- Legal and compliance archives store audit logs on immutable ledgers, lowering tampering risk by about 80%.

- Decentralized identity systems host identity proofs securely, with adoption surpassing 1,500 active deployments in 2024.

Security and Privacy Advantages

- Decentralization removes single points of failure, eliminating risks of breaches or corruption in traditional systems.

- Data sharding, encryption, and distribution cut exposure risk by over 75% from any single fragment.

- Built-in redundancy ensures availability even if 30% of nodes go offline, boosting fault tolerance.

- Users control encryption keys, keeping privacy intact in over 90% of decentralized storage cases.

- Peer-to-peer networks make takedowns costly by requiring fragment removal from dozens to hundreds of nodes.

- Zero-knowledge proofs and homomorphic fingerprints reduce data leakage by over 60% during verification.

- 62% of IT decision makers view decentralized storage as equally or more reliable than traditional clouds.

- Decentralized storage supports GDPR compliance, maintaining data sovereignty in over 70% of implementations.

Global Market Share Breakdown of Cloud Service Providers

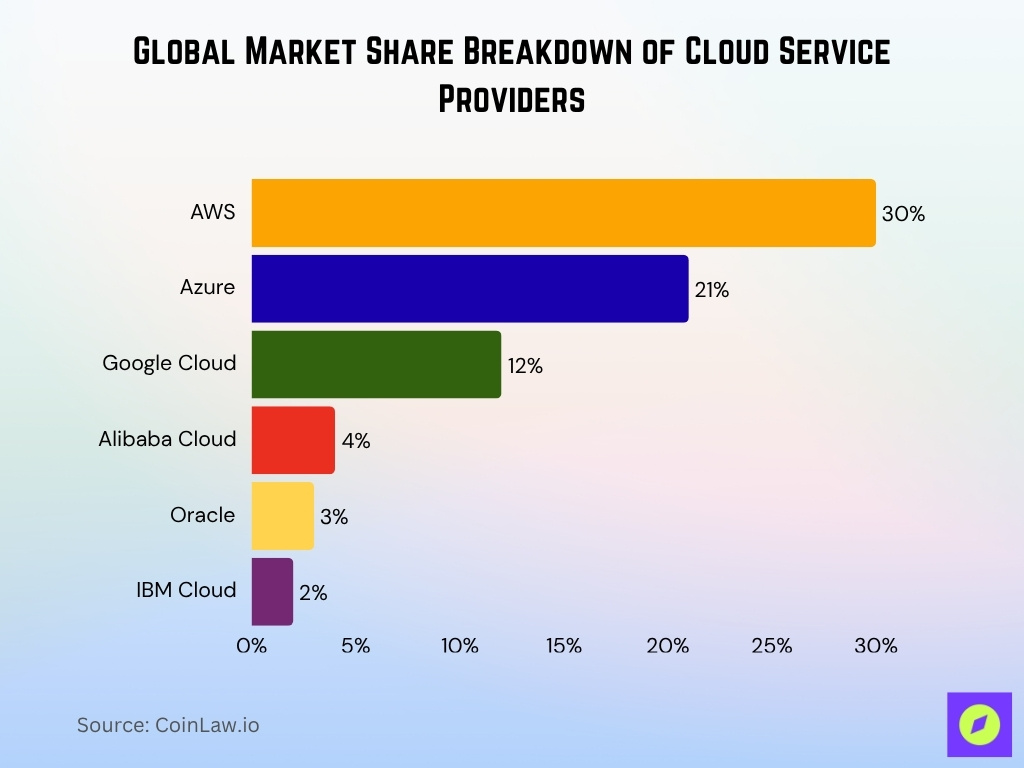

- AWS leads the global cloud market with a commanding 30% share, maintaining its dominance through vast infrastructure and service maturity.

- Microsoft Azure holds 21%, securing second place as enterprises adopt its hybrid and enterprise-focused offerings.

- Google Cloud captures 12% of the market, driven by strong performance in data analytics, AI, and multicloud strategies.

- Alibaba Cloud accounts for 4%, primarily powered by demand across Asia and its dominance in China’s cloud ecosystem.

- Oracle has a 3% market share, focusing on enterprise databases, financial services, and cloud-native workloads.

- IBM Cloud holds a modest 2%, targeting regulated industries with its hybrid cloud and AI-integrated services.

Cost Efficiency and Scalability

- Multiple forecasts show strong growth; the global market was $622.9 million in 2024, with a CAGR of 22.4% through 2034.

- Another model places the 2024 market at $7.4 billion, and projects growth to $61.2 billion by 2034 (~23.5% CAGR).

- A more conservative estimate, $506.17 million in 2024, rising to $577.24 million in 2025 (~14.9% annual).

- Platforms like Walrus, reducing replication overhead to 4.5×, contribute to lower storage cost per TB.

- Deduplication + efficient erasure coding schemes (e.g., FASTEN) can reduce redundancy cost by 15–25%.

Comparison: Centralized vs Decentralized Storage

- Decentralized storage is often 60–80% cheaper than centralized solutions, depending on provider, bandwidth, and access fees.

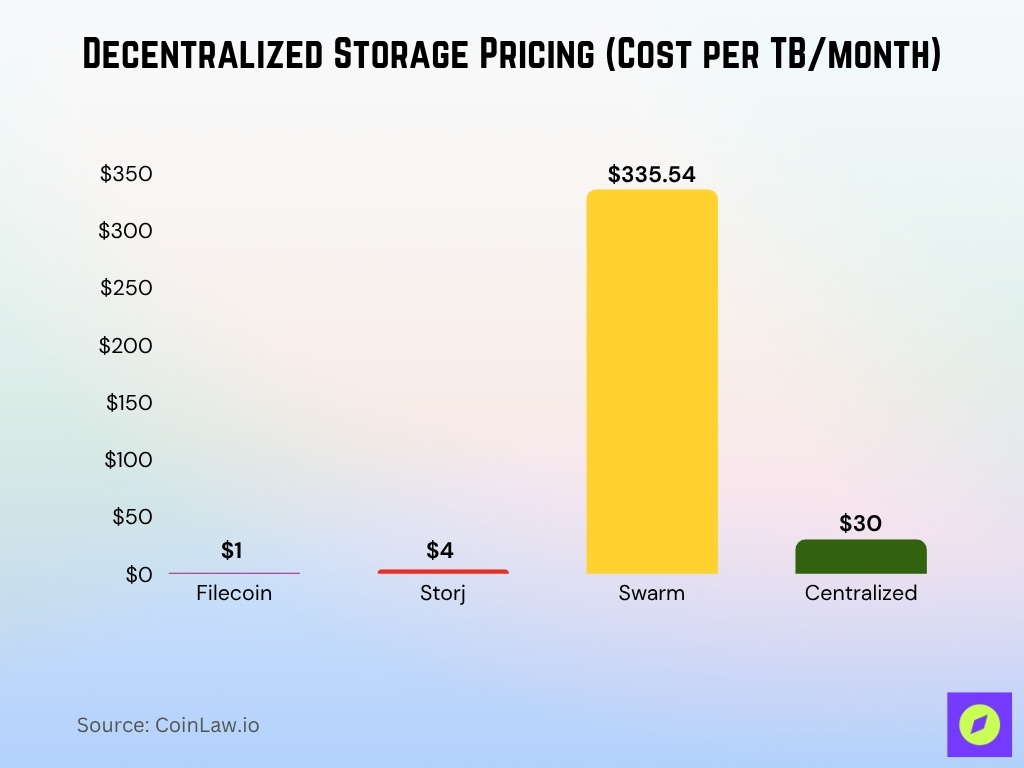

- In one benchmark, Filecoin offered storage at under $1 per TB per month, compared to centralized providers charging ~$30 per TB.

- Storj offers a middle-ground pricing at ~$4 per TB per month, far lower than typical cloud rates.

- In contrast, Swarm reportedly charges ~$335.54 per TB per month, which is far higher even than centralized alternatives.

- Centralized clouds incur high egress and data transfer fees (often 50–85 % of the total bill) in scaling scenarios.

Challenges and Limitations

- Node heterogeneity in decentralized storage often results in uneven performance, variable availability, and increased latency for end users.

- Repair and recovery processes can incur bandwidth overheads of up to 20%, delaying data consistency and increasing network traffic.

- Token volatility can cause storage costs to fluctuate by more than 150% within a single year, leading to revenue unpredictability for both users and service providers.

- Up to 5% of data shards may become inaccessible simultaneously during correlated node failures, posing a risk to data durability.

- Legal and compliance challenges persist, particularly as over 60% of decentralized storage nodes span multiple international jurisdictions with differing regulations.

- With more than 25 major competing protocols, market fragmentation hinders network-wide interoperability and dampens positive network effects.

- User trust remains low; over 70% of enterprise IT leaders cite a lack of SLAs and clear guarantees as a barrier to decentralized storage adoption.

- Adoption inertia is strong, with nearly 60% of organizations reporting centralized storage as less risky and easier to manage compared to decentralized alternatives.

Frequently Asked Questions (FAQs)

The market is forecast to grow at a CAGR of 22.4% from 2025 to 2034.

The global market valuation is predicted to exceed $4.5 billion by 2034

One estimate values decentralized cloud storage at $577.24 million in 2025 (from $506.17 million in 2024).

IPFS maintained approximately 23,000 peers between 2024 and early 2025.

Conclusion

Decentralized storage today is no longer a speculative niche; it’s showing signs of market maturity, significant cost advantages, and integration with the broader Web3 ecosystem. Yet it still must overcome challenges around reliability, governance, and user experience. As more enterprises pilot use cases and protocols refine tokenomics and performance, the divide between centralized and decentralized storage may narrow, or even shift. In the end, the real test will be which systems deliver practical, dependable, scalable storage at fair cost. Dive into the full article to see how each technology, platform, and business driver plays a role in this evolving frontier.