Cryptocurrency trading regulations are shifting quickly in 2025, impacting investors and markets worldwide. In the U.S., the GENIUS Act now enforces 1:1 collateral backing for stablecoins, while Europe’s MiCA framework has fully taken effect. These legal changes are already reshaping crypto’s role in payments and financial markets globally, from faster cross-border transfers to clearer consumer safeguards. Explore how data-driven insights from this evolving landscape can inform your decisions.

Editor’s Choice

- As of mid‑July 2025, the global crypto market cap surpassed $4 trillion for the first time.

- U.S. House passed three crypto bills, including GENIUS, Digital Asset Market Clarity, and Anti‑CBDC Acts.

- Only 40 of 138 jurisdictions globally were “largely compliant” with FATF crypto standards as of April 2025.

- Illicit crypto wallet addresses received $51 billion in 2024.

- Short‑term crypto gains in the U.S. are taxed at 10%–37%, long‑term at 0%–20%.

- In 2024, over $10 billion in crypto was lost to theft.

- Only 8% of Americans used digital currencies in 2024.

Recent Developments

- The GENIUS Act became law on July 18, 2025, setting historic stablecoin safeguards.

- House passed the Digital Asset Market Clarity Act and Anti‑CBDC Surveillance State Act, still awaiting Senate approval.

- The SEC withdrew a 2019 guidance limiting broker‑dealers in custodying digital assets.

- SEC clarified that protocol staking, certain stablecoin offerings, meme‑coin transactions, and proof‑of‑work mining are not securities.

- Trump administration introduced a 160‑page crypto roadmap, encouraging tokenized securities and financial integration.

- The UK’s FCA will lift its ban on retail access to crypto ETNs starting October 8, 2025.

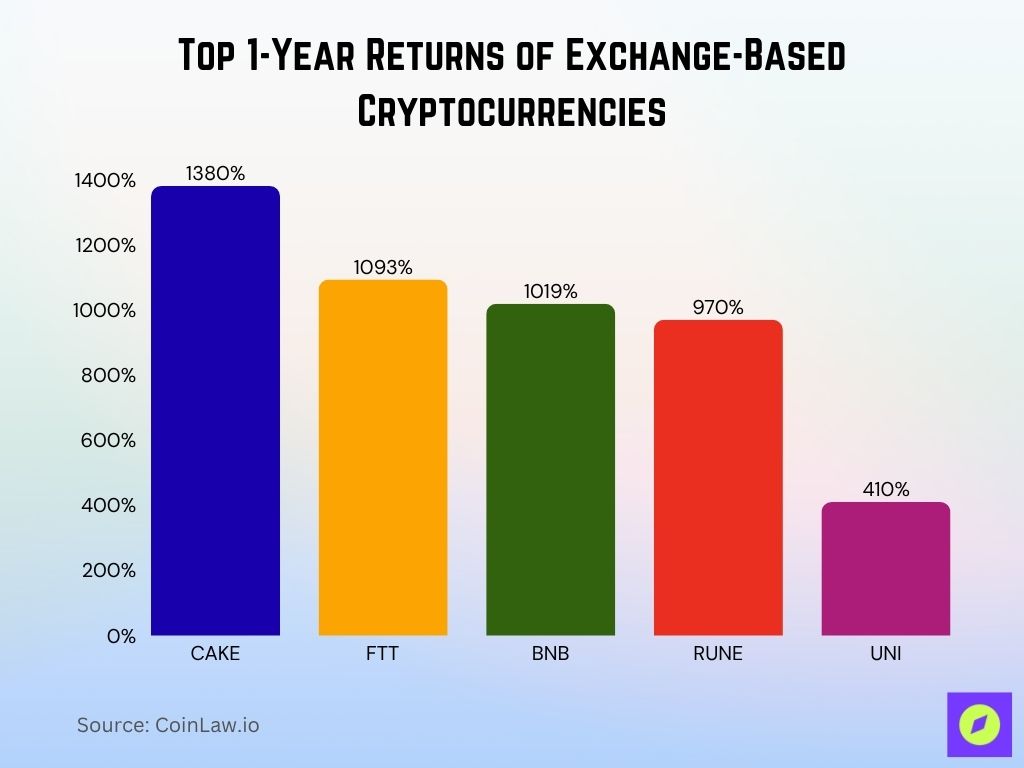

Top 1-Year Returns of Exchange-Based Cryptocurrencies

- CAKE delivered a massive 1380% return over the past year, leading all exchange-based cryptocurrencies in performance.

- FTT (FTX Token) followed closely with a 1093% return, reflecting strong exchange ecosystem growth.

- BNB (Binance Coin) saw an impressive 1019% surge, driven by Binance’s dominance in global trading volume.

- RUNE (THORChain) posted a 970% return, showcasing rising interest in cross-chain liquidity protocols.

- UNI (Uniswap) recorded a 410% gain, bolstered by its continued leadership in decentralized trading.

Global Regulatory Landscape Overview

- EU’s MiCA regulation became fully applicable by December 30, 2024, covering asset‑referenced tokens, e‑money tokens, and crypto‑asset service providers.

- Globally, only 29% of jurisdictions were largely compliant with FATF crypto standards by early 2025.

- Hong Kong passed its Stablecoins Bill in May 2025, with issuance licenses expected in early 2026.

- In the UAE, stablecoin regulations prohibit their use in retail without a license, with a new dirham‑backed stablecoin launching from April 2025.

- Bahrain launched a stablecoin issuance framework in July 2025, allowing fiat‑backed tokens and banning algorithmic stablecoins.

- El Salvador leads globally with comprehensive crypto laws and adoption of Bitcoin as legal tender.

Cryptocurrency Legality by Country

- Cryptocurrency is legal but not legal tender in the U.S., allowing trade and custody but not mandated usage.

- El Salvador was the first to adopt Bitcoin as legal tender and enact encompassing digital asset laws.

- In Europe, MiCA applies across all member states, providing legal consistency since December 2024.

- Hong Kong and the UAE are advancing regulated frameworks for stablecoin issuance.

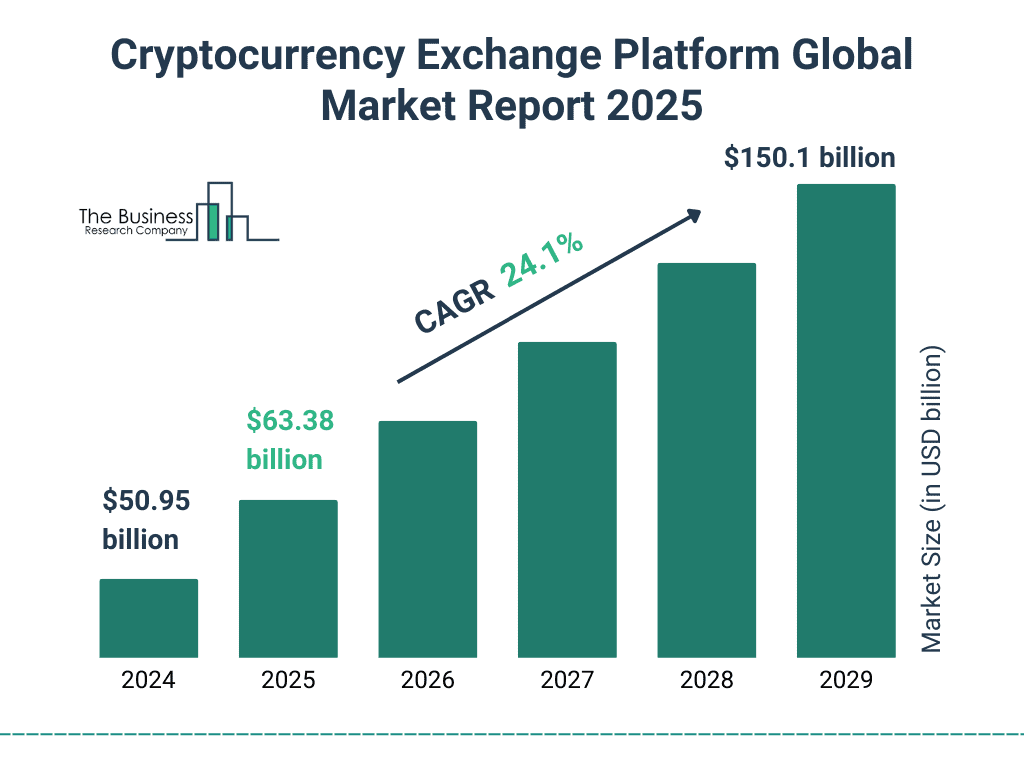

Cryptocurrency Exchange Platform Market Growth

- The global cryptocurrency exchange platform market is projected to grow from $50.95 billion in 2024 to $150.1 billion by 2029.

- The market size in 2025 is forecasted at $63.38 billion, reflecting steady demand despite regulatory shifts.

- A compound annual growth rate (CAGR) of 24.1% is expected over the forecast period.

- By 2026, the market is anticipated to surpass $80 billion, continuing its upward trajectory.

- Growth accelerates sharply from 2027 onward, driven by broader institutional adoption and clearer regulation.

- This 5-year span shows nearly a 3x increase in market value, signaling robust long-term confidence in crypto exchange infrastructure.

Key Regulatory Statistics and Trends

- Global crypto market cap rose above $4 trillion post‑GENIUS Act.

- Illicit crypto flows reached $51 billion in 2024, per FATF, highlighting criminal misuse.

- Over $10 billion was lost to theft in 2024, a sign of persistent security gaps.

- U.S. tax reporting tightened, brokers must now file Form 1099‑DA for crypto sales from 1 January 2025.

- Global jurisdictions with stablecoin consumer‑protection laws rose to 43%.

Taxation of Cryptocurrency Trading

- U.S. crypto gains taxed as property, short‑term at ordinary income (10%–37%), long‑term at 0%–20%.

- In 2025, 0% long‑term rate applies up to $48,350 for single filers, and 15% kicks in above that.

- From January 2025, crypto brokers must report digital asset sales via Form 1099‑DA.

- Crypto taxed as income when earned (mining, staking, airdrops), at ordinary rates.

- Exchanging between cryptocurrencies or to stablecoins triggers taxable events.

- IRS treats any transfer reporting on a tax return, requiring a “Yes/No” response regarding digital assets.

- Crypto theft and loss remain prominent, $10 billion lost in 2024, and users must still report disposals.

Public Confidence in the Safety and Security of Cryptocurrency

- Among all informed adults, only 7% said they are very confident in crypto’s safety, while 34% were somewhat confident.

- A significant 26% of informed adults are very unconfident, with another 33% being somewhat unconfident.

- Among never-owners, 41% reported being very unconfident, and only 2% expressed very high confidence in crypto security.

- 36% of never-owners are somewhat unconfident, while 21% feel somewhat confident.

- In contrast, current crypto owners are more positive, with 47% feeling somewhat confident and 13% saying they are very confident.

- Only 13% of owners said they are very unconfident, compared to 27% who are somewhat unconfident.

Anti‑Money Laundering (AML) & Know Your Customer (KYC) Compliance

- 90% of centralized crypto exchanges are fully KYC compliant in 2025, up from 85% in 2024.

- Global market‑wide KYC compliance stands at 79%, indicating stronger regulatory alignment.

- In North America, 95% of exchanges require full identity verification for all users.

- Only 41% of Latin American exchanges are fully KYC compliant, despite rising scrutiny.

- Crypto laundering volume grew 23% year-over-year from 2023 to 2024.

- Mid‑2025 thefts already exceed $2.17 billion, matching all of 2024’s losses.

- If trends hold, stolen funds may reach $4 billion by year‑end 2025.

- Blockchain AML/KYC adoption soared from 62% in 2023 to ~90% in 2025.

- AI-powered AML systems are now used by nearly 90% of financial institutions, contributing to up to 40% fewer false positives.

Licensing and Registration of Crypto Exchanges

- Over 40 U.S. states have introduced or advanced crypto‑related legislation in the 2025 session.

- Some states now require crypto kiosk operators to disclose terms clearly and use blockchain tracing.

- States like North Dakota mandate that virtual currency kiosk operators carry a money‑transmitter license.

- Exchanges such as Bitpanda and Crypto.com shifted operations toward regulated zones and MiCA readiness to reduce enforcement risks.

- Paxos is now applying for a national trust bank charter, aiming to broaden regulatory oversight.

- Being regulated boosts credibility, licensing confirms compliance with AML/KYC, reduces legal risks, and appeals to investors.

Global Cryptocurrency Adoption Compared to Other Payment Platforms

- Roughly 7% of the world’s population uses cryptocurrency, equating to 560 million users worldwide.

- PayPal has approximately 429 million users, making it a major digital payment competitor but still trailing cryptocurrency adoption numbers.

- American Express has about 140 million users, significantly fewer than both crypto and PayPal.

- Cryptocurrency’s user base is now larger than PayPal’s by over 130 million and four times the size of American Express’s.

- The data highlights how crypto has already outpaced some of the largest traditional payment networks in terms of global reach.

Consumer and Investor Protection

- Chainalysis flags over $2.57 billion in potential crypto wash‑trading in 2025, fooled investors with false demand signals.

- Scam losses in the U.S. hit $9.3 billion in 2024, and crypto was a major channel.

- Global scam-related losses across all financial systems totaled in the hundreds of billions in 2024, with crypto-related scams accounting for a notable but smaller share than $1 trillion.

- Illicit crypto activity, including scamming, Darknet markets, and laundering, remains diverse across asset types.

- North Korea‑linked crypto thefts amounted to $1.34 billion in 2024, comprising 61% of stolen funds.

- Wash‑trading and scams particularly harm retail investors, who bear outsized risks.

Cryptocurrency Exchange Reporting Rules

- Blockchain-based AML/KYC adoption among crypto exchanges and financial institutions is estimated to be approaching 90% in 2025, according to industry compliance surveys and FATF monitoring reports.

- AI‑driven AML tools, widely adopted by end‑2025, reduce detection errors and enhance protection.

- Several state laws now require clear communication of fees and terms, especially for kiosks.

- KYC compliance is increasingly a deciding factor for institutional users; 67% cite it as essential.

- 58% of U.S. crypto users favor platforms that mandate KYC for added safety.

Bitcoin Ownership by Travel Frequency

- Only 11% of people who travel less than once annually own Bitcoin.

- 25% of individuals traveling 1–4 times per year report owning Bitcoin.

- The highest ownership rate is among frequent travelers, with 33% of those traveling 5 or more times annually holding Bitcoin.

- Data suggests a positive correlation between travel frequency and Bitcoin ownership, possibly linked to greater exposure to global payment options and digital finance.

Stablecoin Regulation Statistics

- The U.S. Senate passed the GENIUS Act in June 2025, enacting requirements like 1:1 reserve backing, regular disclosures, and audits for issuers over $50 billion.

- The stablecoin market is valued at around $248 billion, with frequent legislative backing poised to reshape the industry.

- Stablecoins recorded $8.5 trillion in transaction volume and a market cap exceeding $200 billion.

- 90% of businesses say stablecoins are powering modern payments.

- 71% in Latin America use stablecoins for cross‑border payments, and in North America, 88% see regulation as an enabler.

- 48% cite speed as the top advantage of stablecoins, and infrastructure readiness is affirmed by 86% of firms.

- Tether, with $156 billion in circulation, faces significant pressure under GENIUS due to opaque reserves.

CBDC (Central Bank Digital Currency) Regulatory Statistics

- Global CBDC infrastructure investment reached $5.6 billion in 2025, up 25% from 2024.

- 48 countries are aligning their CBDC frameworks with FATF and other international standards.

- 75% of countries with live CBDCs now require digital identity verification for transactions.

- India’s e‑rupee pilot soared by 334%, from ₹2.34 billion to ₹10.16 billion (~$122 million) in circulation by March 2025.

- The EU expects its CBDC to be fully ready by 2025, with programmable money capabilities under development.

Future Cryptocurrency Investment Plans

- 49% of respondents said Yes, they plan to invest in cryptocurrency within the next 1–2 years.

- 46% of respondents said No, indicating they have no plans for near-term crypto investment.

- The results show nearly half of the surveyed individuals are considering entering or expanding their presence in the crypto market soon.

- This data reflects growing interest in cryptocurrency, despite ongoing market volatility and regulatory uncertainty.

Regulatory Differences Across Major Regions

- In the EU, MiCA has been fully operational since December 2024, prompting exchanges like OKX, Crypto.com, and Bitpanda to secure licenses in Germany and Malta.

- The UK approved only 4 out of 29 crypto license applications through the FCA in 2024, signaling slower regulatory progress.

- The FCA will allow retail access to crypto ETNs starting October 8, 2025, marking a major consumer-access shift.

- Australia’s crypto regulation is lagging, despite adoption strength; 15% of Australian investors hold crypto, the highest among developed nations.

- The U.S. fosters innovation with a pro-crypto shift and federal clarity after moving away from “regulation by enforcement”.

- China continues its crackdown, intensifying bans on private cryptocurrencies while expanding its digital yuan push.

- Unlike China, some countries in Central Asia, such as Uzbekistan and Kyrgyzstan, allow crypto trading, though limitations apply in others.

- A World Economic Forum study highlighted how regions like Singapore, Switzerland, the UAE, Gibraltar, Hong Kong, the UK, the EU, the US, and Japan each take distinct regulatory paths.

Regulatory Impacts on Market Capitalization and Trading Volume

- The U.S. GENIUS Act and EU MiCA implementation have contributed to over $4 trillion global crypto market cap in mid‑2025.

- Regulatory clarity under MiCA drew more institutional flows, and Europe saw a noticeable uptick in crypto ETN interest after regulation was fully applied.

- Australia’s slower regulatory framework puts its market growth at risk, despite strong investor interest and infrastructure.

- In the U.S., the new White House roadmap and executive orders are boosting institutional participation and market trust.

Enforcement Actions and Legal Cases

- Notable legal battles in the U.S. include SEC v. Ripple, SEC v. Coinbase, Blockchain Association v. IRS, and Bitnomial v. SEC, cases critical to defining future regulatory boundaries.

- The shift away from aggressive enforcement under the new administration signals greater reliance on legislative clarity over enforcement shaming.

Top Cryptocurrency Trading Volume

- Bitcoin dominates trading activity with a massive 90% share.

- Ethereum holds the second-highest volume at 50%, showing strong market presence.

- Dogecoin ranks third with 45%, reflecting sustained interest from retail traders.

- Binance Coin captures 36% of total trading volume.

- USD Coin and Tether record 27% and 26% respectively, highlighting stablecoins’ role in trading liquidity.

- Solana has 21% trading volume share, outpacing Cardano’s 18%.

- Data shows Bitcoin’s dominance far exceeds other cryptocurrencies, with over 1.8x the volume of Ethereum.

Compliance Costs for Crypto Businesses

- As PwC reports, businesses globally face various compliance efforts, state licensing in the U.S., MiCA implementation in the EU, and strict stablecoin frameworks in the Middle East, all adding regulatory overhead.

- Crypto firms are seeking licensed banking partners or trust charters (e.g., Paxos in the U.S.) to navigate heightened compliance costs effectively.

Decentralized Finance (DeFi) Regulation Statistics

- From 2017–2022, crypto losses linked to crime totaled at least $30 billion, with one-third (~$10 billion) attributed to DeFi platforms.

- In DeFi attacks, 52% targeted technical vulnerabilities at the protocol level, causing 83% of total financial damages.

- Market misconduct, like rug pulls and oracle attacks, is common in DeFi, with academic analyses warning about regulatory blind spots.

Cross‑Border Trading and International Regulation

- The EU allows multiple-country issuers but risks reserve depletion across borders under MiCA.

- Hong Kong’s Stablecoins Bill, effective August 2025, mandates KYC for every token holder, raising cross-border privacy and adoption concerns.

- Countries adopt diverse approaches, from the U.S.’s innovation-friendly stance to China’s state-controlled CBDC push, creating fragmentation in cross-border crypto flows.

Future Regulatory Trends in Cryptocurrency Trading

- The U.S. is pursuing a national crypto roadmap to support tokenized securities, sandbox environments, and banking integration.

- In the UK, with only 51 crypto firms registered, a “second mover advantage” is expected if prompt regulatory action follows.

- Emerging markets, such as the UAE and Bahrain, are offering rapid stablecoin frameworks, suggesting regional experimentation ahead.

- DeFi governance and smart contract audits are gaining regulatory attention, suggesting the next wave of oversight.

Conclusion

Regulatory evolution in crypto trading is shaping a new global narrative. The EU’s MiCA and the U.S. GENIUS Act deliver much‑needed clarity, while regions like Hong Kong and Bahrain experiment with stablecoin models. Enforcement and legal outcomes in the U.S. will continue to set precedents. DeFi remains a volatile frontier, awaiting coherent oversight. As the industry evolves, navigating these regional differences, enforcement trends, and compliance pressures becomes essential for business resilience and investor confidence.