Cryptocurrency payments are steadily shifting from niche experiments to viable options for merchants. In markets ranging from U.S. tech firms to small e-commerce shops abroad, companies are exploring crypto acceptance to reduce transaction fees, reach new customers, and streamline cross-border trade. For example, a U.S. online retailer integrated Bitcoin payments to shave off 2% of typical card processing costs, while a Latin American remittance-based platform enabled merchants to accept stablecoins to avoid volatile local currencies. In this article, you’ll find up-to-date statistics, trends, and insights on merchant crypto adoption.

Editor’s Choice

- Bitcoin commands ~42% of all merchant crypto transactions in 2025, maintaining its dominance.

- USDT accounts for a significant share of merchant crypto payments, around 30–35%.

- The global cryptocurrency payments app market was valued at around $550–600 million in 2024.

- U.S. merchant crypto adoption is projected to rise significantly, potentially over 80% growth from 2024 to 2026.

- In 2023, business adoption of crypto payments grew by 55% year over year.

- Global crypto trading volume in 2024 exceeded several trillion dollars across all exchanges, though estimates vary and are typically under $20 trillion.

- The global crypto payment apps market is expected to grow at a 17%-18% CAGR (2025–2033).

Recent Developments

- In H1 2025, crypto commerce volume rose sharply, driven by better merchant onboarding tools.

- PayPal launched “Pay with Crypto,” allowing U.S. merchants to accept 100+ cryptocurrencies, converting them to its stablecoin by default.

- Stripe announced support for USDC payments via Shopify, making it easier for e-commerce shops to take stablecoins.

- The overall blockchain market (including payments) was projected to grow from $31 billion in 2024 toward $390 billion by 2030.

- Payment innovation is reshaping e-commerce strategies, with merchants adopting stablecoins and blockchain for faster, lower-cost cross-border payments.

- The merchant payments ecosystem report indicates that stablecoins and crypto payment rails will become more mainstream by 2025.

- Digital wallet usage in U.S. e-commerce has steadily increased, rising from ~15% in 2014 to ~38–40% in 2024.

- In some regions, merchant interest in embedding crypto payments into super apps is gaining traction.

Crypto Payments Highlights

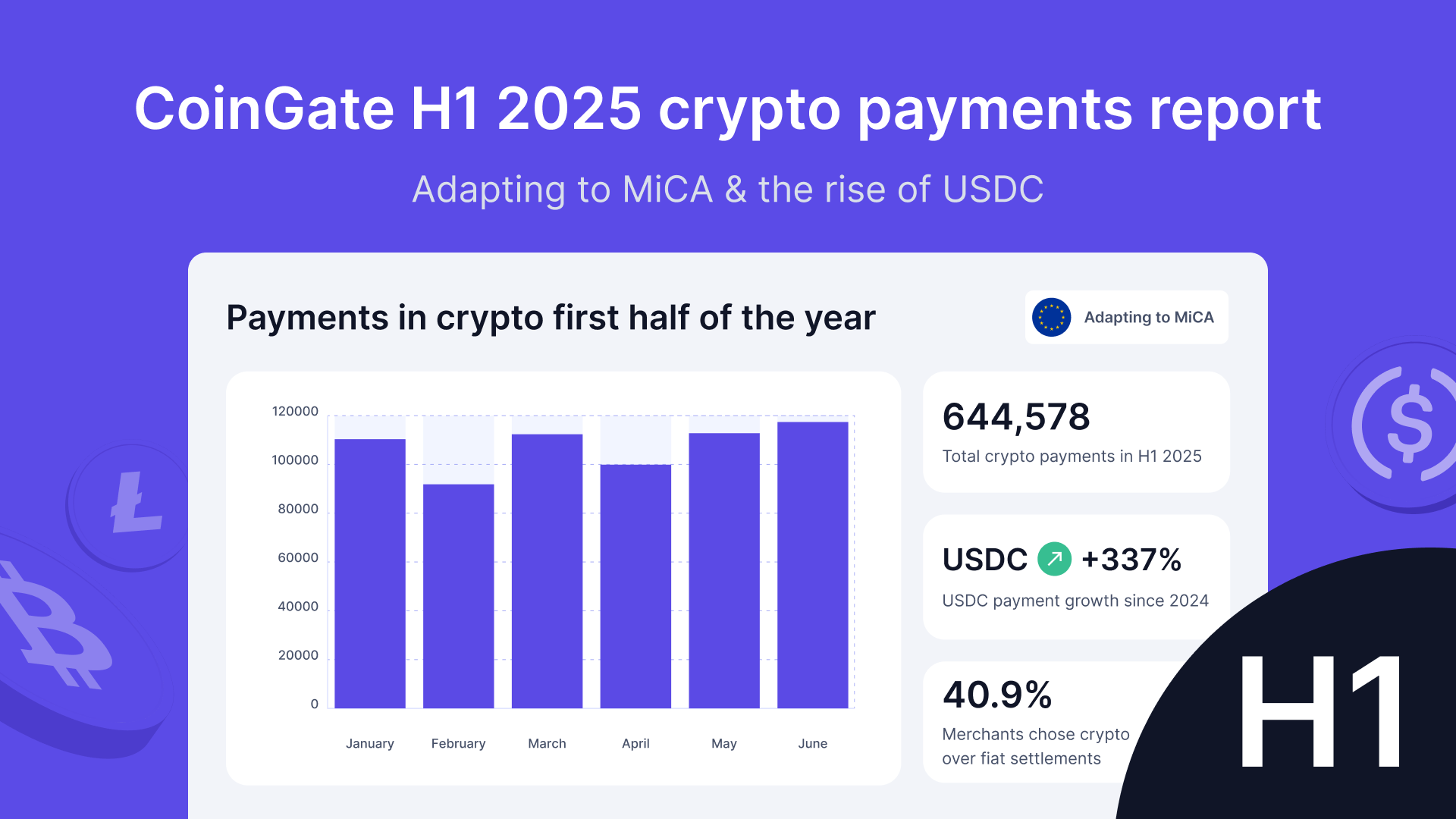

- 644,578 crypto payments were recorded across January to June 2025.

- +337% growth in USDC payments compared to 2024.

- 40.9% of merchants opted for crypto over fiat settlements.

- January 2025 saw approximately 110,000 crypto payments.

- February 2025 recorded around 90,000 crypto payments.

- March 2025 registered about 112,000 crypto payments.

- April 2025 had roughly 100,000 crypto payments.

- May 2025 reached nearly 110,000 crypto payments.

- June 2025 topped the chart with around 115,000 crypto payments.

Global Adoption Rate of Cryptocurrency Payments by Merchants

- The 2025 Chainalysis Global Crypto Adoption Index ranks the U.S. and India as leaders in crypto adoption broadly (on & off-chain).

- A significant share of that adoption includes merchant payments, especially in tech-savvy and crypto-friendly markets.

- In the U.S., crypto payment use is forecast to grow by 82.1% in two years (2024–2026), albeit from a low base.

- In 2024, global crypto trading volume darkens the context: $108 trillion of volume across all use cases.

- Among online merchants, an increasing minority now offer crypto as a checkout method, especially in digital goods categories (gaming, software).

- In emerging markets, merchant adoption tends to be higher in cross-border remittance corridors.

- Regions with favorable regulation (e.g., parts of Latin America) see faster merchant uptake than heavily regulated jurisdictions.

- Many merchants still integrate crypto through payment gateways or plugins rather than native support.

Demographic Breakdown of Merchant Crypto Payment Adoption

- Tech startups and SaaS companies are early adopters, particularly those serving global customers.

- E-commerce merchants with cross-border sales (digital goods, NFTs, subscription services) tend to adopt first.

- Merchants in crypto-tolerant jurisdictions (U.S., Brazil, parts of Latin America, Southeast Asia) show higher rates.

- Those with younger leadership (ages 30–45) are more open to crypto integration than older executives.

- Digital-native brands (gaming, web3 infrastructure) lead over traditional retail.

- Merchant adoption skews toward regions with weaker local currencies, where stablecoins offer hedging.

- Mid-sized merchants (annual revenue $1 million–$20 million) are more agile than legacy large corporations.

- Ancillary services (web hosting, payment plugins, API providers) support merchants in adoption.

Top Reasons Driving Crypto Payment Adoption

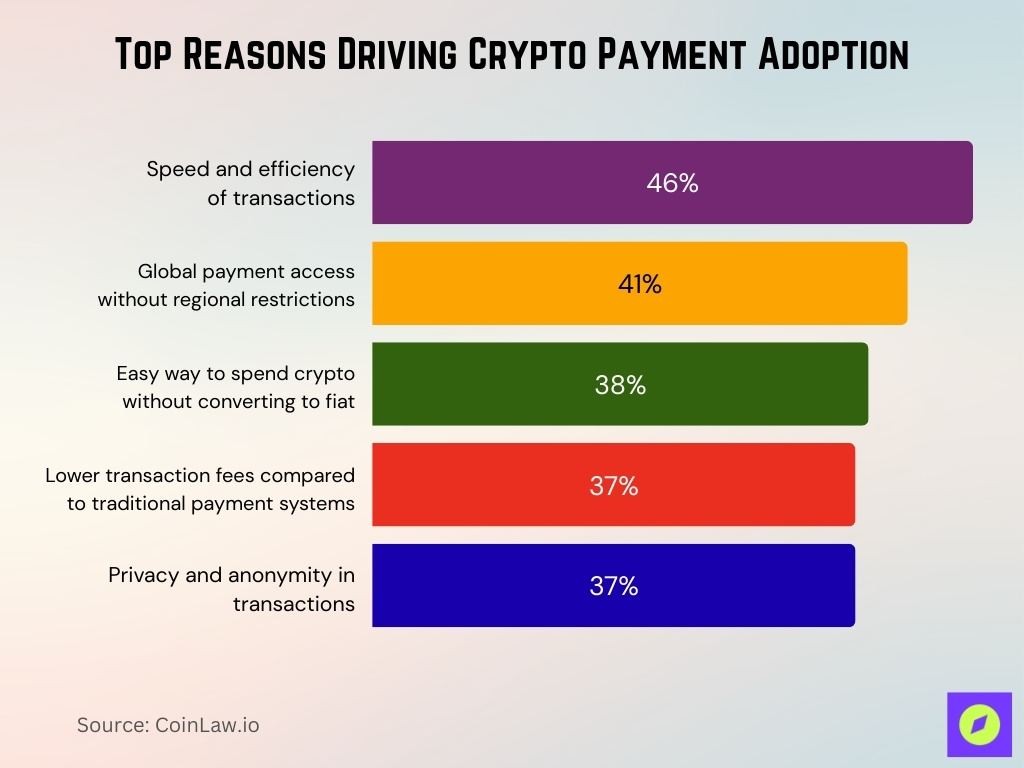

- 46% of users adopt crypto for its speed and efficiency in processing transactions.

- 41% appreciate the global accessibility of crypto without regional payment restrictions.

- 38% prefer the convenience of spending crypto directly without converting it to fiat.

- 37% are motivated by lower transaction fees compared to traditional payment systems.

- 37% choose crypto for its privacy and anonymity in transactions.

Cryptocurrency Payment Adoption Growth Trends

- Business acceptance of crypto payments grew by 55% year-over-year in 2023.

- In the U.S., the forecasted 82.1% growth in crypto payments over two years (2024–2026) indicates steep adoption potential.

- The crypto payment apps market was $556.9 million in 2024 and is expected to grow at a 17%-18% CAGR through 2033.

- Merchant infrastructure is improving (better APIs, plugins, gateways), enabling easier onboarding.

- More merchants convert crypto receipts into fiat instantly, reducing volatility risk.

- Stablecoins and layer 2 solutions are increasingly adopted to lower network fees.

- Regulatory clarity (in some markets) is encouraging merchant experimentation.

- Merchant-side metrics (conversion lift, reduced chargebacks) are motivating further adoption.

Business Size and Crypto Payment Integration

- Small and micro businesses more easily adopt via plug-in gateways (low overhead).

- Mid-sized businesses (annual revenue $1 million–$50 million) have the flexibility to pilot crypto payments.

- Large enterprises face complexity (regulation, treasury risk), so adoption is slower.

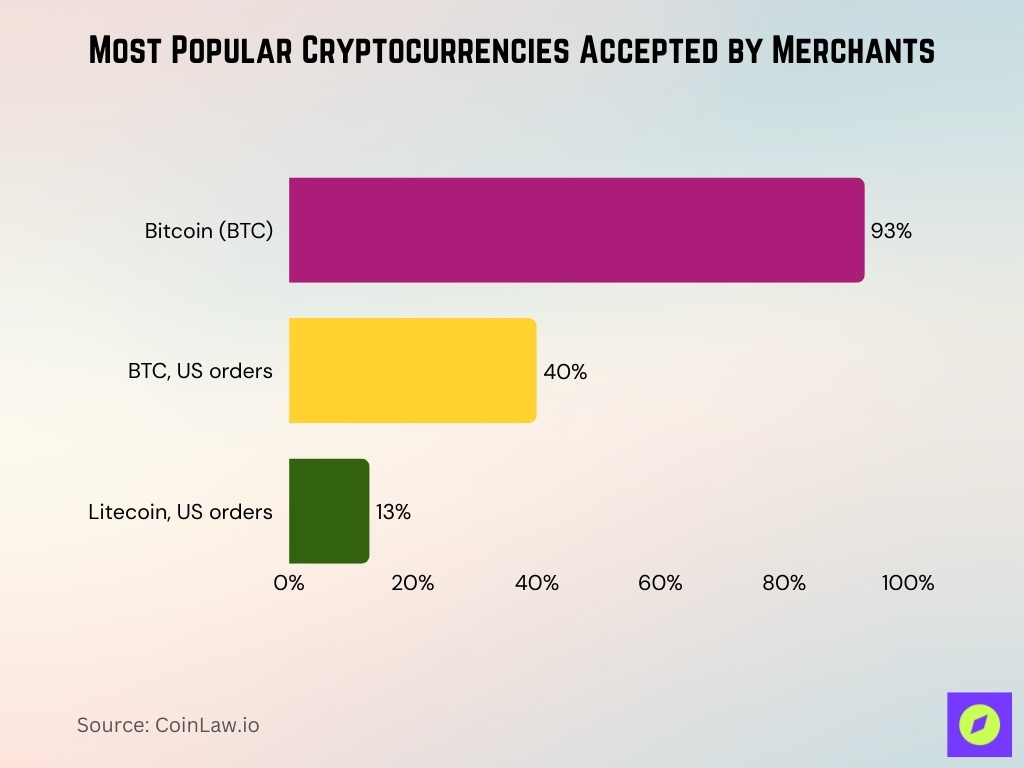

- Among firms that accept crypto, 93% accept Bitcoin as the primary currency.

- Over 75% of U.S. merchants plan to accept crypto within 2 years, but as of now, only ~5–10% actively accept it.

- Some large firms accept crypto only in specific markets or product lines, not across all operations.

- Smaller firms often convert crypto to fiat immediately to reduce exposure to volatility.

- Mid-sized merchants report that crypto adoption helps attract international customers.

- The scaling cost (systems, compliance) constrains large firms from full crypto integration quickly.

Most Popular Cryptocurrencies Accepted by Merchants

- Bitcoin (BTC) leads: ~93% of crypto-accepting businesses accept it.

- In the U.S. crypto shopping market, Bitcoin accounts for ~40% of purchases.

- Litecoin holds ~13% share in U.S. crypto orders.

- USDT (Tether) and USDC are increasingly used by merchants for stable, dollar-pegged payments.

- Ethereum (ETH) appears in many merchant acceptance lists due to its smart contract utility.

- XRP, BNB, and other altcoins appear less frequently but are supported in some payment gateways.

- Bitcoin continues to be the most used cryptocurrency in payment apps, accounting for around 40% of total transactions.

- Merchants accepting crypto often enable multiple coins to broaden appeal.

Major Brands and Enterprises Accepting Cryptocurrency Payments

- Microsoft accepts Bitcoin for certain services (e.g., Xbox, Azure).

- AT&T allows crypto payments via third-party integrations.

- Tesla has experimented with accepting Dogecoin.

- Amazon indirectly supports crypto payments via third-party services (not directly).

- McDonald’s, Sheetz, in some regions, accept Bitcoin via crypto-enabled payment apps.

- Luxury brands (e.g,. Gucci) are piloting crypto acceptance in U.S. stores.

- Nonprofit organizations like the American Cancer Society accept crypto donations.

- Some airlines and travel platforms are testing crypto payment options in limited markets.

Adoption of Stablecoins and Layer 2 Solutions by Merchants

- Stablecoins like USDC and USDT reduce volatility risk, making adoption easier for merchants.

- McKinsey predicts stablecoin circulation could reach $2 trillion by 2028, up from ~$250 billion today.

- Many merchants settle received crypto into fiat immediately, thus mitigating volatility.

- Payment gateways increasingly support layer 2 networks (e.g., Lightning, rollups) to reduce fees and latency.

- Some gateways allow merchants to accept stablecoin payments directly, bypassing volatile assets.

- In 2024, settlement systems began bridging stablecoins into fiat rails seamlessly.

- The trend toward stablecoin usage gives crypto payments more predictability and acceptance.

- Merchant adoption of stablecoins is more pronounced in jurisdictions with weaker local currencies.

Crypto Payment Gateway Market Share

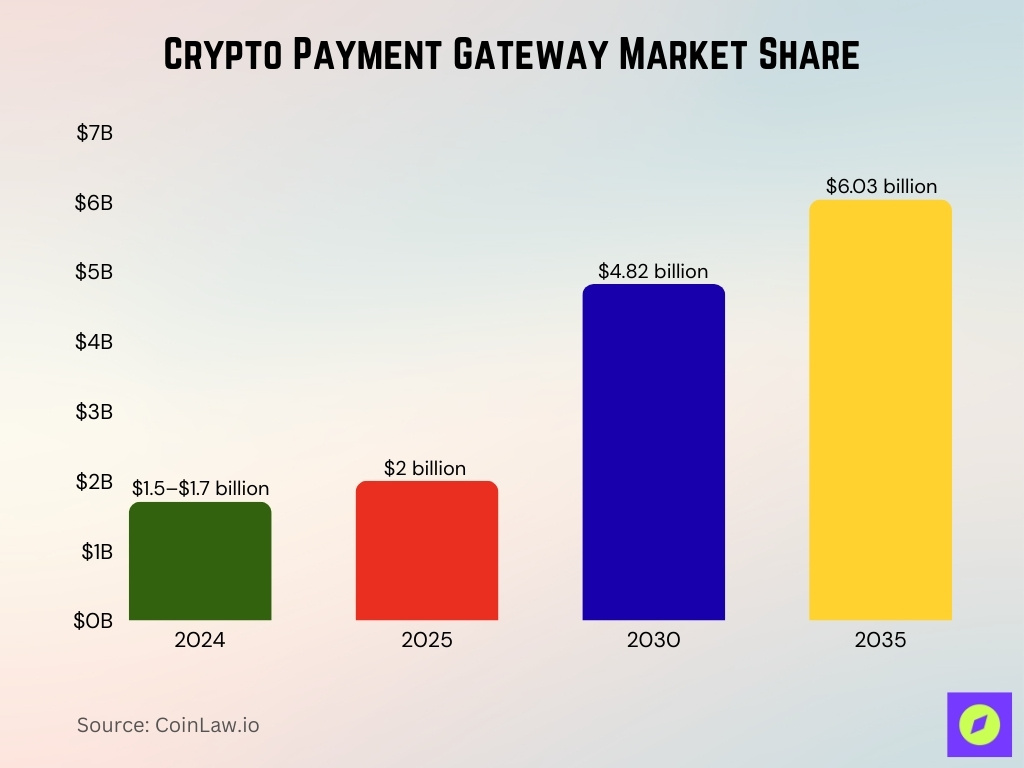

- The crypto payment gateway market was valued between $1.5-$1.7 billion in 2024.

- Projected growth anticipates ~$4.82 billion by 2030, with a CAGR of ~16.8%.

- A report places the 2025 market size at $2 billion with growth to $6.03 billion by 2035 (CAGR ~13.6%).

- North America reportedly holds ~40% of the gateway market share.

- In 2025, the crypto gateway segment is expected to grow from $1.69 billion to $2.0 billion (CAGR ~18.9%).

- Gateways differentiate by region, supported blockchains, fiat conversion, compliance, integration ease, and risk management.

- Major gateway providers (e.g., BitPay, Coinbase Commerce, OpenNode) compete on liquidity, fees, and jurisdiction coverage.

- Some gateways focus on stablecoin settlement or layer-2 channels to reduce on-chain costs and volatility risk.

Cross-Border Payments and International Merchant Adoption

- The global cross-border payments market (traditional + crypto) approached $1 quadrillion in 2024.

- Currently, crypto payments constitute a small fraction (≈ 3%) of total cross-border volume, particularly via stablecoins.

- Some forecasts expect stablecoin share in cross-border flows to grow toward 20% over the next 5 years.

- Estimates suggest stablecoin-based remittances may account for approximately 2–3% of cross-border payment volumes, especially in emerging markets.

- Merchants selling internationally (e-commerce, digital services) increasingly enable crypto settlement to reduce forex friction.

- Payment rails integrating crypto and fiat paths allow merchants to accept crypto but settle in local currency.

- Projects like Ripple’s cross-border initiatives and partnerships (e.g., in Africa) push crypto use among merchants abroad.

- Some merchants in developing markets adopt crypto payments to bypass banking limitations, high remittance fees, or currency controls.

- However, regulatory and compliance burdens across jurisdictions slow universal adoption.

Impact of Crypto Payments on Merchant Revenue and ROI

- An older case study cited merchants seeing 327% ROI after integrating Bitcoin payments.

- Many merchants adopt crypto payments to reduce traditional processing fees and chargebacks.

- A Deloitte-linked survey found 85% of merchants believe enabling crypto payments helps reach new customers.

- 77% of merchants in that same survey cite lower transaction costs as a reason to accept crypto.

- Carat Insights indicates 25% of crypto users say the lack of merchant acceptance limits their spending, so acceptance could unlock latent demand.

- Merchants anticipate that customer demand for crypto will grow: ~83% expect increased interest in digital currencies within 12 months.

- However, only 4% of merchants (in some older surveys) currently accept crypto, highlighting adoption gaps.

- Because many merchants convert crypto into fiat immediately, the volatility impact is minimized, allowing ROI benefits to focus on fees and market reach.

Merchant Perspectives on Accepting Cryptocurrency Payments

- ~64% of merchants indicate customer interest in using digital currencies for payments.

- ~85% expect crypto payments to become ubiquitous in their industry within 5 years.

- In a UK merchant survey (2025), 72% say high transaction fees pose a major challenge.

- In that same survey, 66% cite regulatory & compliance burden as a concern.

- 85% of PSPs and merchants cited regulatory uncertainty as a major barrier to adopting digital asset payments.

- Some merchants worry about volatility, settlement risk, and customer experience frictions.

- Merchants often require that crypto payments can be reconciled, audited, and integrated into existing ERP/finance systems.

- Several merchant statements emphasize the need for trusted, regulated gateways and transparency in processing fees.

- Many express that adoption is a strategic differentiator in competitive markets, especially among tech-savvy consumer segments.

Frequently Asked Questions (FAQs)

Bitcoin leads with ~42% of all merchant crypto transactions in 2025.

The global crypto payment apps market is expected to grow at a 17%-18% CAGR (2025–2033).

USDT (Tether) holds around 33% of merchant crypto payment transaction volume, making it the second most used asset after Bitcoin.

U.S. crypto payment adoption is projected to surge 82.1% between 2024 and 2026.

Conclusion

The data and trends show that merchant adoption of cryptocurrency payments is gaining traction, especially in cross-border, e-commerce, and technologically agile sectors. Gateways, stablecoins, and regulatory frameworks are maturing, which lowers friction for more merchants to experiment. Still, volatility, compliance burdens, integration hurdles, and regulatory uncertainty remain key inhibitors. Over the next few years, merchant crypto payments may transition from niche pilot projects to mainstream options, especially where cost savings and global reach matter.