Crypto regulation is evolving rapidly. New laws and shifting enforcement are reshaping how digital assets operate in the U.S. This transformation plays out in real‑world scenarios, from the creation of stablecoin frameworks to clearer oversight for decentralized platforms. Key outcomes: more compliance clarity for startups and improved protections for everyday crypto users. Read on to explore the full article.

Editor’s Choice

- 33 crypto‑related SEC enforcement actions in 2024, down from 46 in 2023, a 30 % decrease.

- In 2024, the SEC brought 33 crypto-related enforcement actions, down from 46 in 2023, a 30% decrease.

- 35 enforcement actions by the CFTC in 2024, a 59 % increase from 2023.

- $2.6 billion in SEC crypto‑related penalties and disgorgements in 2024, a 22 % increase.

- $1.7 billion in civil monetary penalties imposed by CFTC in 2024, a 38 % increase.

- 90 % of centralized crypto exchanges in North America are fully KYC compliant in 2025, up from 85 % in 2024.

- The GENIUS Act was passed in July 2025 to regulate stablecoins, defining reserves, audits, and federal oversight.

Recent Developments

- On July 18, 2025, the GENIUS Act was officially enacted, creating the first U.S. federal licensing framework for stablecoin issuers, mandating 1:1 backing, independent audits, and regulatory oversight.

- Executive Order 14178, signed in August 2025, permanently bans the Federal Reserve from issuing a retail Central Bank Digital Currency (CBDC).

- The SEC Crypto Task Force released a draft rulebook in August 2025, offering guidance on token classification, custody, and disclosure, with a public comment window open until October.

- On August 5, 2025, the CFTC initiated a cross-border collaboration pilot with six G7 regulators, focusing on DeFi transaction tracing standards.

- New York State proposed amendments to the BitLicense program, aiming to reduce application timelines from 6 months to under 45 days.

- Coinbase, Kraken, and Consensys announced new licensing approvals under the GENIUS Act, signaling smoother onboarding of stablecoin services.

- The IRS updated its crypto FAQ page to include new income thresholds for automatic audit triggers in crypto-to-fiat transactions.

- In late August 2025, Congress opened hearings on a national blockchain identity framework, linking KYC requirements with self-sovereign identity systems.

- Wyoming, Texas, and Florida introduced bills to align their crypto tax and reserve statutes with GENIUS Act provisions, streamlining dual compliance.

- The DOJ formally closed all cases filed under previous crypto enforcement units, including those against decentralized protocol founders.

DeFi (Decentralized Finance) Regulatory Landscape

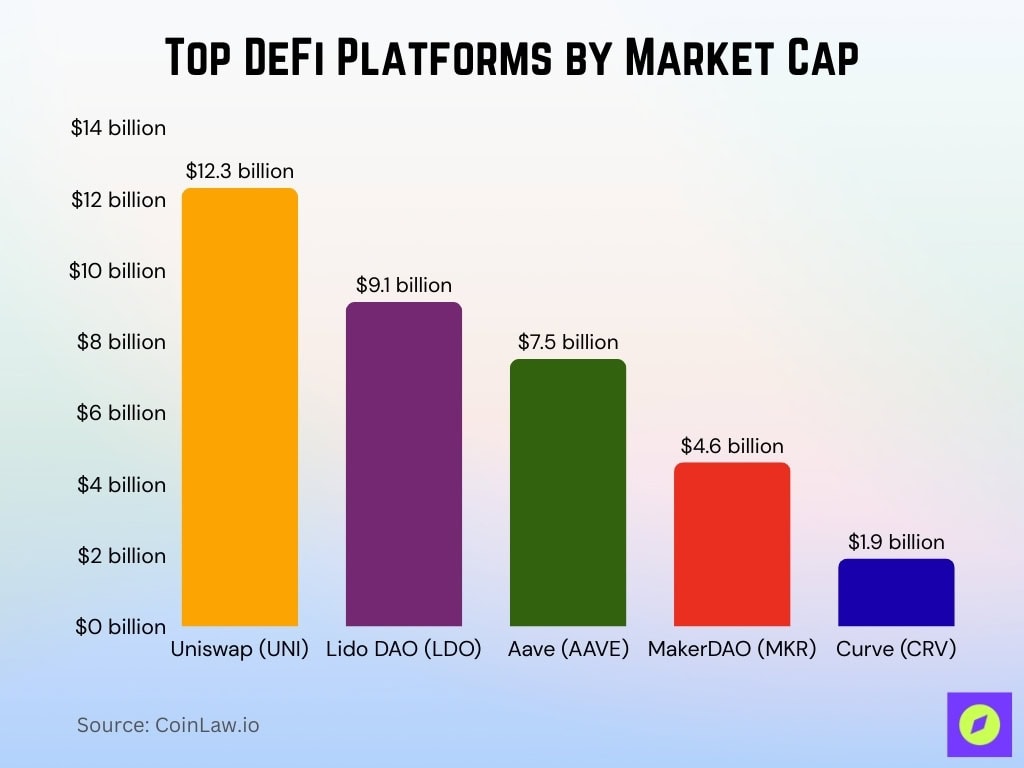

- Uniswap (UNI) leads with a $12.3 billion market cap, Aave (AAVE) holds $7.5 billion, Lido DAO (LDO) holds $9.1 billion, MakerDAO’s MKR holds $4.6 billion, and Curve (CRV) holds $1.9 billion.

- As of June 2025, the DeFi token market cap is $98.4 billion.

- The DOJ’s 2025 policy now limits developer liability, removing criminal risk for decentralized code authors, spurring confidence in DeFi innovations.

- Q2 2025 saw $6.7 billion in DeFi venture capital investment into infrastructure and compliance-centered protocols.

- DeFi Total Value Locked (TVL) is projected to reach $351.8 billion by 2031, indicating long-term growth expectations.

- Approximately $2.5 billion in DeFi platform revenue in 2025 is now subject to compliance-based disclosures.

- 43 countries had established DeFi regulatory sandboxes or frameworks by mid-2025.

- 31% of global DeFi volume now originates in jurisdictions with clear legal recognition of DAOs.

- Weekly DeFi interface activity in the U.S. averages about $18.6 billion, with over 9.7 million unique wallets interacting with DeFi protocols.

Overview of U.S. Federal Crypto Regulation

- The SEC shifted from “regulation by enforcement” toward structured rule‑making through a Crypto Task Force formed in January 2025.

- The DOJ announced it will no longer prosecute developers for writing decentralized code without criminal intent.

- A federal working group issued a report with 100+ regulatory and legislative actions covering crypto taxation, AML, and stablecoin rules.

- The GENIUS Act, signed July 18, 2025, mandates 1:1 backing of stablecoins and increases transparency.

- Executive Order 14178 (Jan 23, 2025) prohibits a U.S. CBDC and creates a framework‑setting group for digital assets.

- The Trump administration’s Crypto Summit signaled deregulatory shifts, banks can now hold crypto, and many enforcement actions were dropped.

- Under the administration, the SEC dismissed cases against major crypto firms, including Coinbase, Kraken, and ConsenSys.

Key U.S. Regulatory Agencies Involved

- SEC, the Crypto Task Force leads efforts to distinguish securities vs. non‑securities in crypto.

- FinHub and Cyber & Emerging Tech Unit enforce against fraud, manipulation, and hacks in crypto markets.

- CFTC increased enforcement actions by 59 % in 2024, focusing on fraud and unregistered platforms.

- DOJ rescinded prosecutions based solely on code development, and it disbanded its crypto enforcement team.

- The Treasury coordinated a working group proposing 100+ regulatory actions, including AML and stablecoin oversight.

- Department of Commerce is pioneering transparency by publishing GDP data via blockchain, signaling cross‑agency crypto usage.

- Federal Reserve & CFPB, while not regulations per se, EO 14178 bars Fed CBDC development and mandates a federal oversight structure.

Growth in Cryptocurrency Adoption Across the US

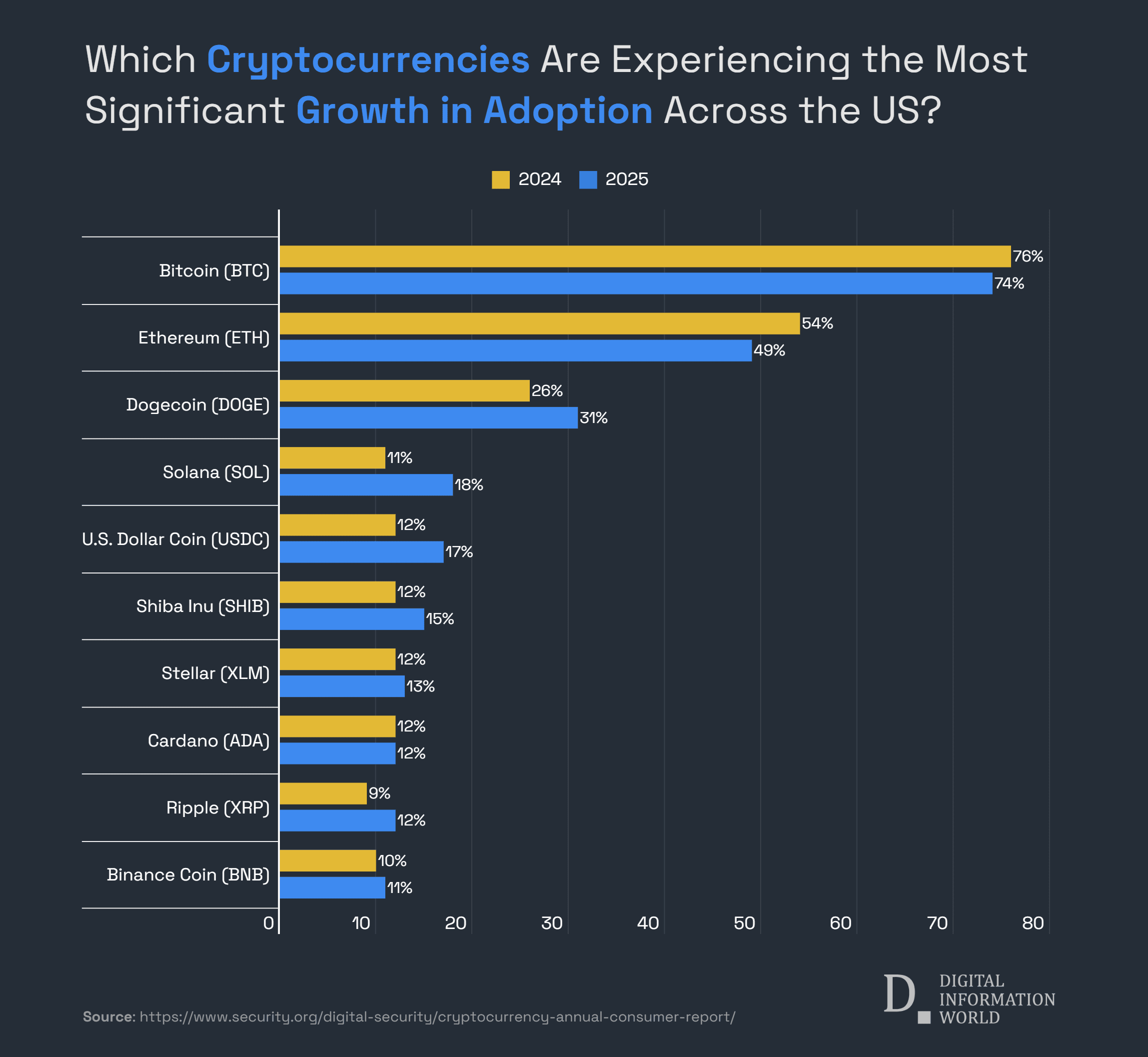

- Bitcoin (BTC) remains the most adopted with 76% in 2024 and 74% in 2025, showing slight stability at the top.

- Ethereum (ETH) adoption dipped from 54% in 2024 to 49% in 2025, indicating a modest decline in user preference.

- Dogecoin (DOGE) gained traction, climbing from 26% in 2024 to 31% in 2025, reflecting renewed retail interest.

- Solana (SOL) rose sharply from 11% in 2024 to 18% in 2025, marking one of the fastest-growing platforms.

- U.S. Dollar Coin (USDC) adoption increased from 12% to 17%, highlighting stronger demand for stablecoins.

- Shiba Inu (SHIB) edged up from 12% in 2024 to 15% in 2025, keeping momentum among meme coins.

- Stellar (XLM) moved slightly higher, from 12% to 13%, showing steady niche adoption.

- Cardano (ADA) stayed flat at 12% adoption in both years, reflecting stagnant growth.

- Ripple (XRP) gained modestly, rising from 9% in 2024 to 12% in 2025.

- Binance Coin (BNB) saw a small increase from 10% in 2024 to 11% in 2025, showing consistent stability.

Federal Licensing Requirements for Crypto Businesses

- GENIUS Act requires stablecoin issuers to maintain 1:1 backing and undergo audits, establishing a licensing framework.

- FIT21 (passed House May 2024) proposes CFTC jurisdiction over decentralized assets and SEC over centralized tokens, clarifying licensing lines.

- DOJ and SEC reforms reduced enforcement threats for code-based innovation, lowering licensing burdens.

- Treasury’s working group outlined modern licensing schemes across AML, tax reporting, and stablecoin issuance.

- Banks allowed to hold crypto post Crypto Summit, potentially streamlining licensed custodial services.

- The blockchain-based release of GDP data by Commerce signals digital infrastructure for future licensing processes.

- Agencies are still developing licensing guidelines with input from industry via forums like the SEC Task Force.

State‑by‑State Crypto Regulation Differences

- States like Wyoming and Texas have crypto‑friendly frameworks, offering licensing structures and limited commodity regulation.

- Other states, such as New York, maintain the BitLicense model, one of the strictest regulatory regimes in the U.S.

- The GENIUS Act creates a federal baseline that may reduce state-by-state disparity.

- State-level AML, tax, and licensing requirements continue to vary, impacting where businesses choose to locate.

- Overall, state-level fragmentation persists, though federal laws are increasingly harmonizing oversight.

Finance Chiefs Discussing Cryptocurrency with Stakeholders

- 41% of CFOs discussed cryptocurrency with their Chief Information Officer (CIO), making it the most common stakeholder conversation.

- 37% engaged with their Board of Directors, showing crypto is increasingly a board-level priority.

- 34% of CFOs had discussions with both their Treasurer and Lenders/Banks, reflecting growing attention on financial and risk management.

- 33% spoke with Internal Audit, highlighting oversight and compliance considerations around crypto.

- 31% engaged with Third-Party Payment Vendors, underlining the operational impact of digital assets.

- 26% discussed crypto with their Audit Committee, signaling governance integration.

- Only 2% of CFOs reported no discussions about cryptocurrency with any stakeholders, showing near-universal engagement.

Crypto‑Friendly States

- Wyoming continues to lead with innovative laws for crypto custody and banking.

- Texas has welcomed crypto miners and blockchain firms with regulatory clarity and incentive programs.

- Federal actions like the GENIUS Act and EO 14178 may lessen the variance in state friendliness by setting national standards.

States with Strict Crypto Laws

- New York still enforces the BitLicense, one of the most restrictive frameworks, charging applicants up to $5,000 in application fees and requiring extensive compliance protocols.

- California, while crypto‑friendly, has proposed stricter money‑transmitter rules, expanding state-level oversight on digital asset transfers.

- Illinois enacted legislation in 2025, tightening stablecoin reserve requirements, mandating 100 % backing for any token issued or sold within the state.

- Florida canceled a crypto‑friendly bill in mid‑2025, signaling growing legislative caution.

- Pennsylvania advanced bills limiting mining operations and enforcing environmental compliance, reflecting regulatory restraints on crypto infrastructure.

- Montana, North Dakota, and other states have blocked or stalled crypto reserve legislation, curbing local industry expansion.

- Oklahoma allowed a bill to advance, though its licensing provisions remain under debate.

- Overall, 16 states introduced legislation related to strategic crypto reserves by early 2025, but with varying outcomes; some vetoed, others passed.

- New Hampshire signed HB 302, allowing state treasurers to invest in digital assets exceeding $500 billion market cap, though only Bitcoin qualified at the time.

- Several state proposals included heavy environmental and consumer protections, delaying approvals and tightening crypto use.

Crypto Ownership by Generation in the United States

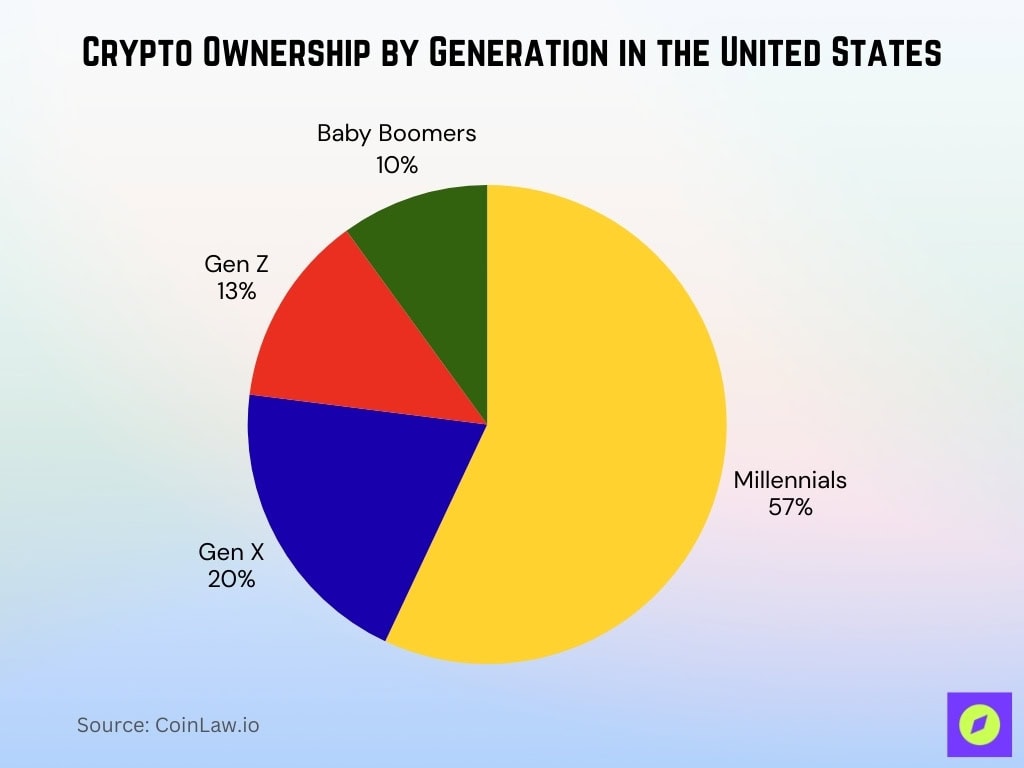

- Millennials lead with 57% of total crypto ownership, making them the dominant generation in the market.

- Gen X accounts for 20%, showing a strong mid-generation presence in crypto adoption.

- Gen Z holds 13%, reflecting rising interest among younger investors entering the space.

- Baby Boomers represent 10%, the smallest share, but still a notable portion of overall ownership.

Major Federal Legislative Developments

- The Clarity Act (2025) aims to define decentralized tokens as commodities (CFTC‑regulated) and centralized tokens as securities (SEC‑regulated), addressing asset classification confusion.

- The White House released Strengthening American Leadership in Digital Financial Technology on July 30, 2025, a 166‑page report urging a move from “regulation by enforcement” to clear statutory rulemaking.

- The Strategic Bitcoin Reserve was established via executive order on March 6, 2025, authorizing the Treasury to hold approximately 198,000 BTC forfeited or seized by the government.

- FDIC guidance FIL‑7‑2025, issued March 28, 2025, now permits FDIC‑inspected banks to engage in crypto‑related activities without prior approval, streamlining financial sector integration.

- Crypto Task Force launched on Jan 21, 2025, under Acting SEC Chair Mark Uyeda, signaling legislative intent to shift toward clear, consistent frameworks.

- The SEC dropped litigation against major exchanges, including Binance, Coinbase, Kraken, OpenSea, and Robinhood, as part of a deregulatory pivot.

- DOJ disbanded its crypto enforcement team in early 2025, a sweeping policy reversal affecting federal oversight.

SEC Actions and Enforcement Statistics

- From January 1 to January 17, 2025, the SEC filed more than 40 enforcement actions, indicating a brisk early enforcement pace.

- As of Q1 2025, 71 % of U.S.‑based crypto exchanges are under active investigation by the SEC or CFTC, a sharp indicator of heightened scrutiny.

- In 2024, SEC enforcement resulted in $2.6 billion in investor restitution orders, the highest to date.

- The SEC saw 46 enforcement actions in 2023, a record high and 53 % increase from 2022.

- In 2022, penalties against crypto firms totaled $242 million in settlements.

- In 2021, the SEC imposed $2.35 billion in penalties related to crypto.

- The new approach under Paul Atkins, replacing “regulation by enforcement” with a task force, is reshaping the agency’s posture.

CFTC Oversight and Enforcement Statistics

- In 2024, the CFTC filed 35 enforcement cases against digital asset entities, up 59 % from 22 in 2023.

- Combined, the SEC and CFTC levied over $4.3 billion in penalties on crypto firms between 2023 and 2024.

- In early 2025, the CFTC rewarded a whistleblower approximately $700,000, showing ongoing enforcement incentivization.

- On May 29, 2025, the CFTC added 43 unregistered foreign entities to its RED List, enhancing oversight.

- The agency also issued fraud charges in May 2025 against an individual and firm in Syracuse, NY, signaling state-level action.

- The CFTC convened a global regulators roundtable in London on July 14, 2025, highlighting cross-border coordination.

- Overall, the CFTC continues expanding its jurisdiction and resources in virtual-asset regulation.

Recent IRS Crypto Tax Reporting Changes

- As of 2025, there’s increased IRS enforcement of crypto tax reporting, including more frequent 1099‑K requests for digital asset transactions.

- The IRS issued new guidance on gift and inheritance tax treatment for crypto assets in June 2025.

- Crypto-to-crypto trades are now taxed as property‑to‑property exchanges, subject to capital gains.

- The IRS plans to audit 15 % of high‑value crypto accounts (over $10,000 held or transacted), starting late 2025.

- Crypto wallets are now required to report activity exceeding $10,000 per annum.

- Penalties for under-reporting crypto gains now escalate to up to 25%, with interest as per the standard tax code.

- The IRS has begun collaborating with FinCEN to cross-check suspicious transaction reports related to crypto.

Anti‑Money Laundering (AML) and KYC Compliance Trends

- 71% of U.S. crypto exchanges are under investigation by either the SEC or CFTC as of Q1 2025, reflecting increased AML and KYC scrutiny.

- In early 2025, hacks accounted for 63% of crypto crime losses, phishing and rug pulls made up most of the rest.

- US authorities seized $2.5 million in crypto tied to fraud schemes, reinforcing AML enforcement.

- On‑chain analysis firms estimate criminal activity made up 0.15% of crypto transactions in 2021, totaling $14 billion.

- A single Bybit theft of $1.5 billion in Ether in early 2025 remains the largest crypto heist on record.

- Enforcement now includes cross-agency collaboration between DOJ, FBI, IRS, and FinCEN to reduce laundering risks.

- Industry has responded by raising the share of centralized exchanges with full KYC compliance to ~90% in 2025.

- FDIC guidance (FIL‑7‑2025) now enables banks to provide licensed custodial crypto services without prior approval, expanding institutional entry.

- Following enforcement pullbacks, major exchanges like Coinbase, Kraken, and OpenSea face fewer licensing hurdles due to dropped investigations.

- Wyoming, Texas, and other states continue offering crypto‑friendly licensing, though specifics vary significantly.

- The SEC Task Force has begun issuing guidance to fintech innovators on registration thresholds and filing pathways.

- Treasury’s digital asset working group is drafting licensing proposals covering AML, taxes, and stablecoin issuance, but not yet been finalized.

- Overall, licensing frameworks remain in flux, with federal and state rules still forming post-2025 legislative momentum.

Stablecoin Regulatory Developments

- The GENIUS Act, enacted on July 18, 2025, requires stablecoins to be backed one-to-one by U.S. dollars or low‑risk assets, with audits and transparency provisions. It passed the Senate 68–30 and the House 308–122.

- As of August 2025, over $250 billion is held in stablecoins, heightening legislative attention to their systemic effects.

- A study warns that stablecoins carry an annualized “run risk” of 3.3% to 3.9%, far above FDIC‑backed deposit risk, implying a 1-in-3 chance of a crisis within a decade.

- U.S. banks are warning that stablecoin interest programs may prompt up to $6.6 trillion in deposit withdrawals, disrupting credit and consumer services.

- The White House clarified that stablecoins must not misrepresent federal deposit insurance or government backing, and both federal and state consumer protections now explicitly apply.

- Private stablecoin issuance is being favored over a Fed-issued digital dollar, reflecting U.S. preference for commercial innovation over centralization.

- Stablecoin infrastructure is already being explored by major corporations, such as Mastercard, Amazon, and Walmart, anticipating adoption growth post the GENIUS Act.

Central Bank Digital Currency (CBDC) Legislation and Statistics

- The Anti‑CBDC Surveillance State Act (H.R. 1919) passed the House in July 2025, barring the Federal Reserve from issuing a retail CBDC or maintaining accounts for individuals.

- Executive actions from President Trump also halted all development of a retail CBDC, making the U.S. unique among major economies in rejecting such issuance.

- Meanwhile, the U.S. participates in Project Agorá, a cross-border wholesale CBDC exploration with six other central banks, focusing on interbank payments.

- Analysts underscore the CBDC design’s impact on law enforcement capabilities and the need for investigative evolution should a U.S. CBDC emerge.

- These developments illustrate a nuanced U.S. stance, rejecting domestic retail CBDC, while engaging cautiously in cross-border monetary digital testing.

Consumer Protection and Investor Risk Data

- The CFTC chair warned that the $3 trillion crypto market remains at risk of scams, fraud, and collapse without firm regulation.

- Consumer Reports flagged that the CLARITY Act may exempt many tokens from SEC oversight, raising protection concerns despite legal clarity.

- Political momentum for reduced oversight has heightened calls for balanced regulation, protecting investors without stifling innovation.

- A Brookings report urges policymakers to anchor regulation in fairness, safety, and accountability to safeguard the public long term.

- Security.org’s 2025 consumer survey (nearly 2,000 Americans) reveals mixed sentiments toward crypto adoption and regulatory trust.

- FDIC’s March 2025 guidance confirms that licensed banks may provide crypto services without prior approval, under existing safety standards.

- The Consumer Financial Protection Bureau (CFPB) is reviewing open banking rules, a move with implications for consumer data rights in crypto-linked services.

Global Cooperation and Cross-Border Enforcement Trends

- On July 14, 2025, the CFTC held a global regulators roundtable in London to coordinate cross-border DeFi and crypto enforcement efforts.

- The U.S. remains an advocate for stablecoin dominance and broader dollar supremacy amid global digital currency competition.

- Project Agorá highlights U.S. cooperation in wholesale CBDC research with partner central banks.

- U.S. legislation continues shaping global finance norms; for example, the GENIUS Act signals a commitment to private-sector stablecoin leadership.

- Studies reveal stablecoin fragility that could ripple across global markets, raising systemic risk concerns internationally.

- Regulatory sandboxes, comprising 43 countries, show growing global experimentation in DeFi frameworks.

- Diverging approaches, Europe’s MiCA, U.S. federal preference for private issuance, and cross-border CBDC research, underscore evolving global pluralism in digital asset policy.

Conclusion

This year marks a pivotal shift in U.S. crypto regulation. Federal moves, from the GENIUS Act’s stablecoin standards to the rejection of a domestic CBDC, signal growing regulatory clarity and commitment to private innovation. DeFi markets are expanding, token cap up 38%, and investor flows remain robust despite evolving enforcement. Tax authorities are honing reporting rules, while agencies facilitating AML, consumer protection, and interagency cooperation are reshaping oversight. Global collaboration continues via forums like Project Agorá and regulatory roundtables.

As federal and state frameworks mature, investors, firms, and developers face both opportunities and responsibilities. Navigate the new regulatory terrain with clear guidance, informed by abundant data and anchored in innovation, not ambiguity.