In recent years, cryptocurrency has transformed from a niche digital asset to a mainstream financial tool, reshaping how people approach payments and online transactions. Crypto payment gateways, which facilitate these transactions by allowing businesses to accept digital currencies as payments, have been at the forefront of this revolution. With increased adoption by small businesses and large corporations alike, these gateways are not only providing a secure, seamless payment experience but are also opening doors to a global market without the complexities of traditional banking. As we look into the statistics surrounding crypto payment gateways, it’s clear that this industry is positioned for significant growth and technological advancements, setting a new standard for payment solutions worldwide.

Editor’s Choice

- The global crypto payment gateway market is estimated at $1.68 billion in 2025, with projections reaching $6.03 billion by 2035 (CAGR 13.6%).

- Approximately 35.2% of Americans still perceive cryptocurrencies as extremely risky, with little change reported in 2025.

- Mastercard reported a 20% increase in cross-border volume in Q4 2024 and continues to expand crypto offerings in 2025.

- There are now an estimated 420-430 million cryptocurrency holders globally, presenting a major market for businesses that embrace digital currencies.

- Block Inc. reported a gross profit of $2.31 billion in 2024, with continued growth momentum into 2025.

- Tether processes around $190 billion daily, with the total stablecoin market cap reaching about $246 billion in 2025.

Market Size

- Analysts estimate the global crypto payment gateway market at $2.02 billion in 2025, up from $1.4 billion in 2023, implying a CAGR of ~19.5%.

- North America leads the market with ~40% share in 2025, as tech-centric firms and consumers drive adoption.

- The European segment grows at ~20% CAGR, supported by evolving crypto regulations and tech innovation.

- The Asia-Pacific region holds ~25% share in 2025 and posts the fastest growth as regulators accept crypto payments.

- Latin America’s crypto gateway market grew ~35% year over year through 2024–2025, with Brazil and Argentina leading adoption.

- In 2025, the average crypto payment transaction fee stays at ~0.5%, far lower than the 2–3% typical for legacy gateways.

- By 2025, about 40% of global consumers will try crypto payment options at least once.

- Over 60% of U.S. crypto payment providers reported steady or rising revenues entering 2025, reflecting persistent demand.

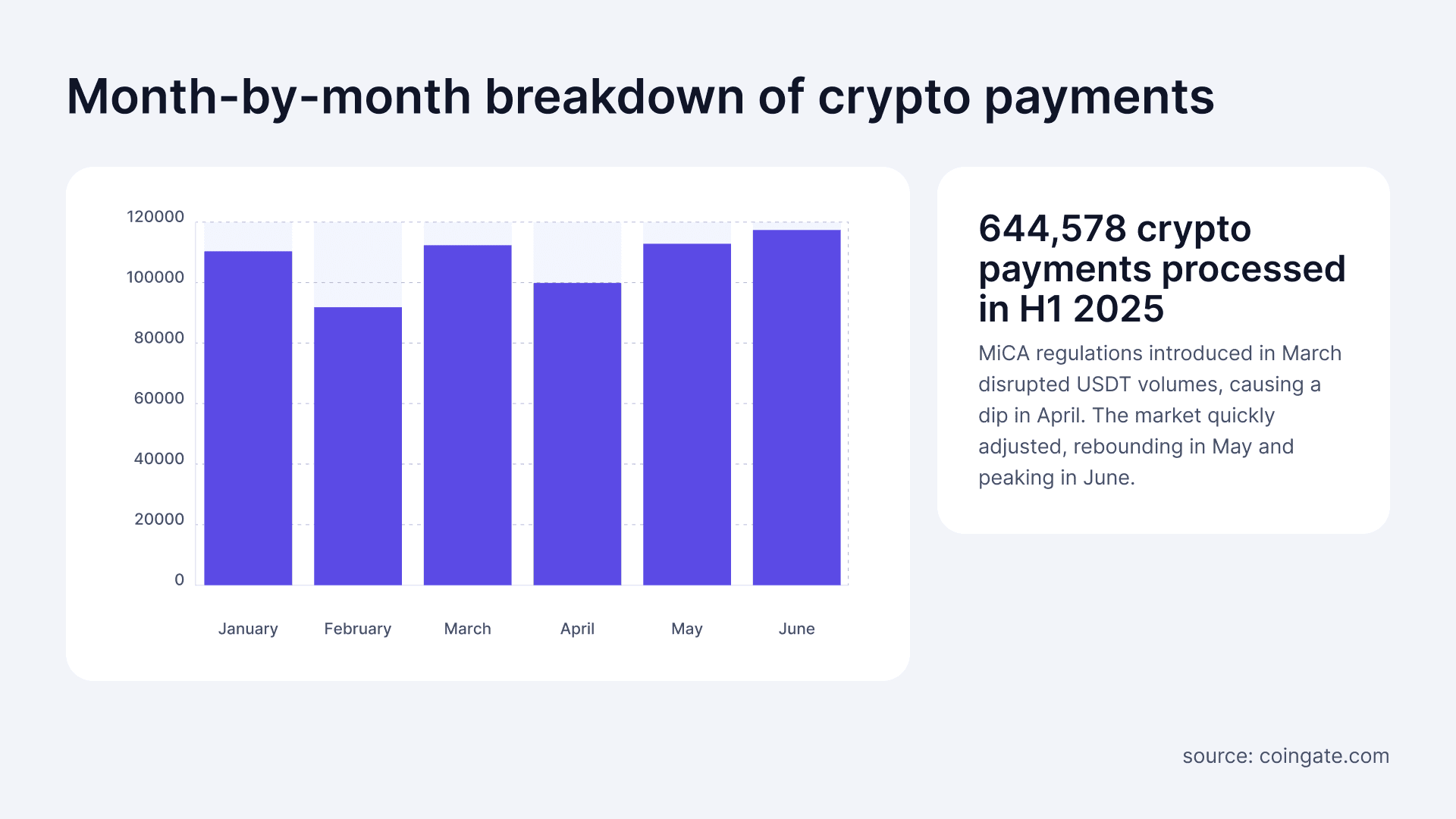

Month-by-Month Breakdown of Crypto Payments

- 644,578 crypto payments were processed in the first half of 2025.

- January saw about 110,000 payments, a strong start to the year.

- February dropped to around 90,000 payments, the lowest in H1.

- March rebounded with 111,000 payments before MiCA regulations hit.

- April dipped to roughly 99,000 payments due to the MiCA regulation‘s impact on USDT.

- May recovered quickly with 111,000 payments, showing strong market adjustment.

- June peaked at nearly 118,000 payments, the highest in H1 2025.

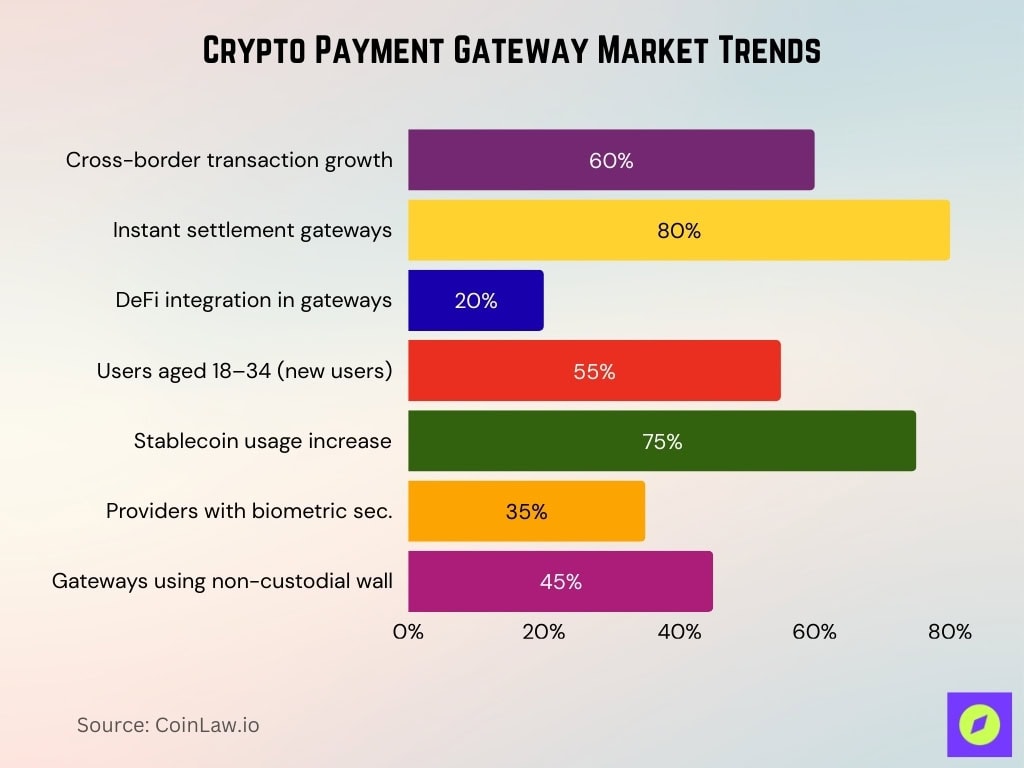

Market Trends

- Cross-border transactions surged by ~60% in 2025, as crypto gateways reduced currency conversions and banking fees.

- ~80% of crypto payment gateways enabled instant settlement in 2025, shortening fiat conversion time for businesses.

- DeFi integration expanded to ~20% of gateways that offered decentralized finance payment options.

- ~55% of new crypto gateway users in 2025 were aged 18–34, with Gen Z and Millennials driving adoption.

- Use of stablecoins in gateway transactions rose by ~75% in 2024–2025, as businesses favored stable payment rails.

- ~35% of providers integrated biometric security to boost transaction security for users.

- Adoption of non-custodial wallets by gateways reached ~45%, reflecting demand for user control of assets.

Major Players in the Crypto Payment Gateway Market

- BitPay processed 3.8 million transactions in 2025 with an average transaction size of $390, marking ~22% YoY growth.

- Coinbase Commerce supports ~8,000 merchants in 2025 and saw ~20% increase in transaction volume over the past year.

- Binance Pay handles ~600,000 transactions per month in 2025, strengthening its role in global crypto payments.

- CoinGate saw a ~35% increase in merchant adoption in 2024–2025, particularly across European SMEs.

- NOWPayments, operating as non-custodial, achieved double-digit growth (≈ 15%) in 2025, appealing to privacy-focused users.

- Alchemy Pay now operates in 70+ countries in 2025, evolving toward a global financial hub with expanded services.

- Crypto.com Pay processed ~$1 billion in transactions in 2025, bolstered by its loyalty and rewards integration.

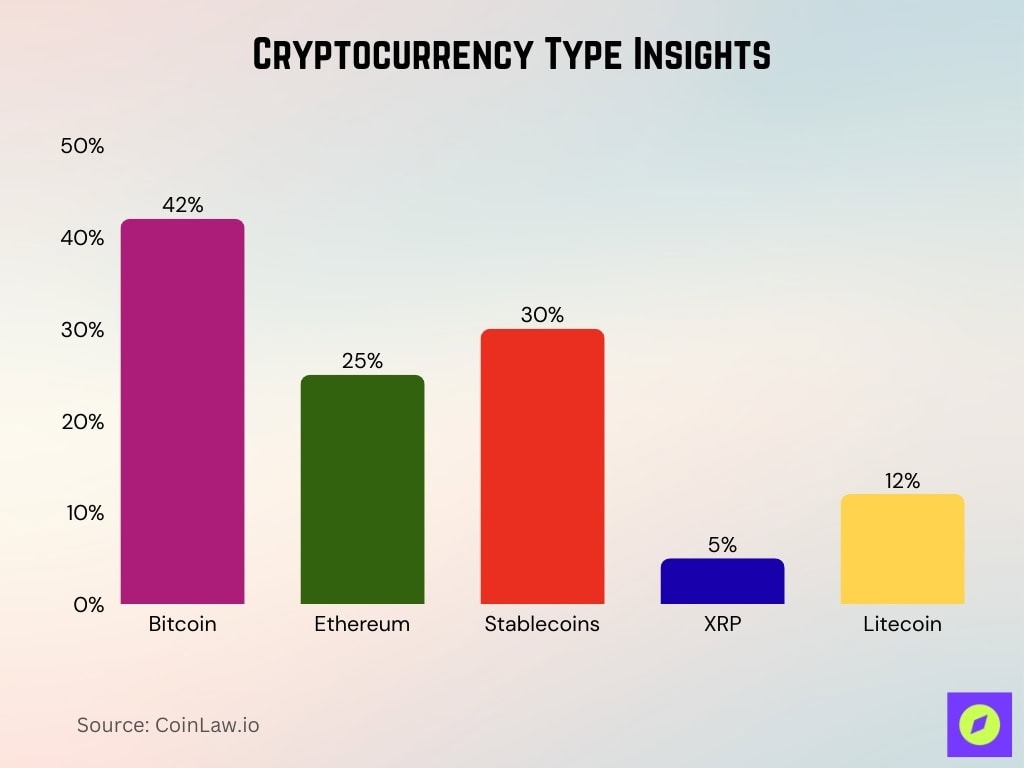

Cryptocurrency Type Insights

- Bitcoin now accounts for about 42% of crypto payments in 2025, still the dominant choice in payment gateways.

- Ethereum captures around 25% of crypto gateway transactions in 2025, thanks to its DeFi and smart contract utility.

- Stablecoins (e.g., USDT, USDC) make up ~30% of crypto payment volume in 2025, favored for their price stability.

- Ripple’s XRP holds about 5% share in cross-border crypto payments in 2025.

- Litecoin (LTC) transaction volume rose ~12% in 2025 as a faster, lower-fee option.

Payment Type Insights

- Peer-to-peer crypto payments have grown ~50% in 2025, driven by demand for direct, middleman-free transfers.

- E-commerce crypto payments account for ~70% of total volume in 2025, fueled by digital shopping and cross-border ease.

- B2B crypto gateway payments rose ~55% year over year into 2025, as firms seek lower forex costs and faster settlement.

- Subscription services make up ~12% of crypto transactions in 2025, as more platforms accept crypto for recurring billing.

- Mobile usage dominates with ~87% of crypto transactions in 2025 processed via apps, underlining mobile’s central role.

- Instant settlement is now offered by ~80% of gateways in 2025, enabling near-immediate conversions.

- POS systems integrated with crypto grew ~35% in 2025, especially in markets with mature adoption like the U.S., Japan, and Germany.

Technological Innovations and Security Measures

- Blockchain scalability improvements cut processing times by ~25% in 2025, making crypto gateways increasingly competitive.

- ~70% of gateways adopted AI-driven fraud detection in 2025, improving real-time threat identification.

- ~97% of gateways standardized two-factor authentication (2FA) in 2025, reinforcing transaction security.

- ~35% of payment gateways used smart contracts in 2025 to automate verification and reduce intermediaries.

- ~20% of gateways integrated zero-knowledge proofs (ZKPs) in 2025, offering privacy without exposing user data.

- ~75% of gateways implemented multi-signature wallets in 2025, requiring multiple approvals for high-value transactions.

- ~10% of gateways explored quantum-resistant encryption in 2025 as a safeguard against future quantum threats.

Countries with the Highest Crypto Ownership Rate

- UAE leads with the highest crypto ownership rate at 25.3%.

- Singapore follows closely with 24.4%, making it a strong hub for crypto adoption.

- Türkiye has a notable ownership rate of 19.3%, reflecting high retail participation.

- Argentina stands at 18.9%, driven by inflation-hedging demand.

- Thailand records 17.6%, showing strong regional adoption in Southeast Asia.

- Brazil follows with 17.5%, highlighting Latin America’s growing crypto interest.

- Vietnam posts 17.4%, supported by active retail and remittance usage.

- USA has a 15.5% ownership rate, showing steady mainstream growth.

- Saudi Arabia comes in at 15%, reflecting increased regional investments.

- Malaysia closes the top 10 with 14.3%, showcasing steady adoption in Asia.

Regulatory Landscape and Compliance

- ~30 countries globally had adopted clear regulatory frameworks for crypto payments by 2025, with the EU’s MiCA rules emerging as a leading standard.

- The United States saw a ~25% increase in state-level crypto business policies by 2025, easing crypto gateway deployment.

- ~90% of gateways enforce AML and KYC compliance in 2025, aligning with global regulatory expectations.

- In Japan and South Korea, regulatory clarity enabled ~30% of large firms to integrate crypto payments by 2025.

- Brazil’s regulatory reforms led to ~20% of businesses offering crypto payment options by 2025.

- India’s digital asset tax regime limited adoption, with only ~8% of businesses using crypto payments in 2025.

- UK guidelines treating stablecoins as e-money spurred ~12% of local firms to explore crypto payments by 2025.

Recent Developments

- Mastercard saw ~9.5% earnings growth in 2025 and expanded its crypto offerings by launching a crypto debit card and integrating a Crypto Credential verification system with partners like Crypto.com and MetaMask.

- Block Inc. processed $183 billion in spending over 12 months in 2025 (up ~16%) and reached ~57 million monthly users on Cash App by mid-2025.

- U.S. crypto payment users are projected to surge by ~82% between 2024 and 2026, signaling strong adoption momentum.

- The global digital payment gateway market is anticipated to hit $205.9 billion by 2030, driven by growth in e-commerce and mobile payments.

- Platforms such as NOWPayments, CoinGate, and Cryptomus rank among the top crypto payment gateways in 2025, offering merchants robust multi-crypto acceptance and integration.

Frequently Asked Questions (FAQs)

The market is projected at $1.6847 billion in 2025, reaching $6.03 billion by 2035 at a 13.6% CAGR.

Binance Pay processed 300 million transactions totaling $230 billion by mid-2025.

Alchemy Pay supports payments in 173 countries across cards, mobile wallets, and bank transfers.

Global merchant acceptance rose to over 16,000 businesses by mid-2025 from about 11,000 in mid-2024.

Bitcoin accounts for about 42% of merchant crypto transactions, and stablecoins for about 30–35% of volume.

Conclusion

Crypto payment gateways continue to evolve rapidly, driven by technological innovation, increasing adoption, and regulatory clarity. With businesses and consumers alike recognizing the benefits of faster, more secure, and cost-effective transactions, the future of crypto payment gateways looks promising. From innovations in blockchain security to partnerships with mainstream financial services, crypto gateways are positioning themselves as a key component of the global payment landscape. With crypto payment volume set to grow significantly, these gateways stand as a bridge between traditional finance and the digital economy, supporting the next wave of financial inclusion and cross-border commerce.