Imagine a world where traditional financial barriers no longer limit dreams. This is the promise of crowdlending, a rapidly growing financial model that connects borrowers and lenders through digital platforms. By cutting out intermediaries like banks, crowdlending has revolutionized how people access funding. The global crowdlending market is expected to soar, fueled by technological advancements, regulatory changes, and a shift in how we perceive lending.

Editor’s Choice

- The global crowdlending market size is projected to exceed $20.46 billion by end-of-2025 driven by a CAGR of around 15.5%.

- In many crowdlending platforms, small and medium-sized enterprises (SMEs) represent a significant portion of the borrower base, often exceeding 60%, but this varies by region and platform.

- Returns for crowdlenders can range from 5% to 12% annually, depending on the platform, risk tier, and borrower profile.

- The overall loan default rate across platforms has stabilized at 4-6% globally, aided by improved risk tools and analytics.

- Asia-Pacific leads in crowdlending growth with CAGR estimates ranging from 16% to 20%, driven by digital finance expansion.

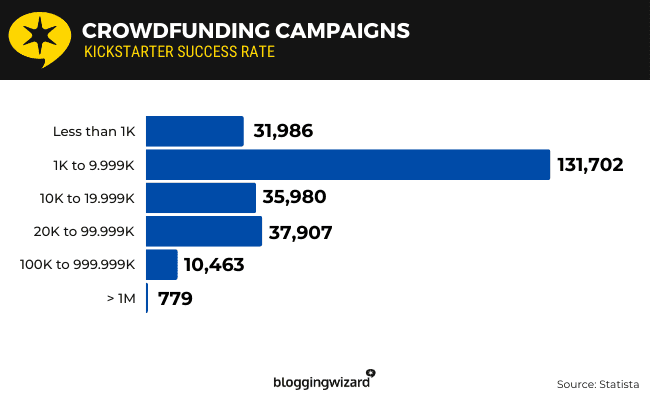

Kickstarter Crowdfunding Campaign Statistics

- 31,986 campaigns raised less than $1K, showing many projects attract only minimal support.

- The majority, 131,702 campaigns, secured between $1K and $9.999K, making this the most common funding range.

- 35,980 campaigns successfully raised between $10K and $19.999K, reflecting mid-tier project success.

- 37,907 campaigns reached between $20K and $99.999K, indicating strong traction for more ambitious goals.

- 10,463 campaigns raised between $100K and $999.999K, proving that large-scale projects do find substantial backers.

- Only 779 campaigns exceeded $1M, highlighting how rare it is to achieve blockbuster funding.

Global Market Size and Growth Projections

- The global market was valued at $20.46 billion in 2025.

- The US crowdlending (or related crowdfunding) market is expected to reach ~$7.0 billion in 2025, maintaining its leadership role.

- European platforms are showing steady expansion with major markets (Germany, UK, France) contributing over $4.5 billion annually by 2025.

- Emerging markets like Africa and Latin America are seeing rapid crowdlending growth, with year-over-year rates reported between 20–25% in fintech lending adoption.

- Adoption of alternative credit scoring (e.g., via social data, AI models) is boosting lending accessibility in underserved regions in 2025.

- Global investment in crowdlending startups reached approximately $1.2 billion in 2025, reflecting sustained but cautious investor confidence.

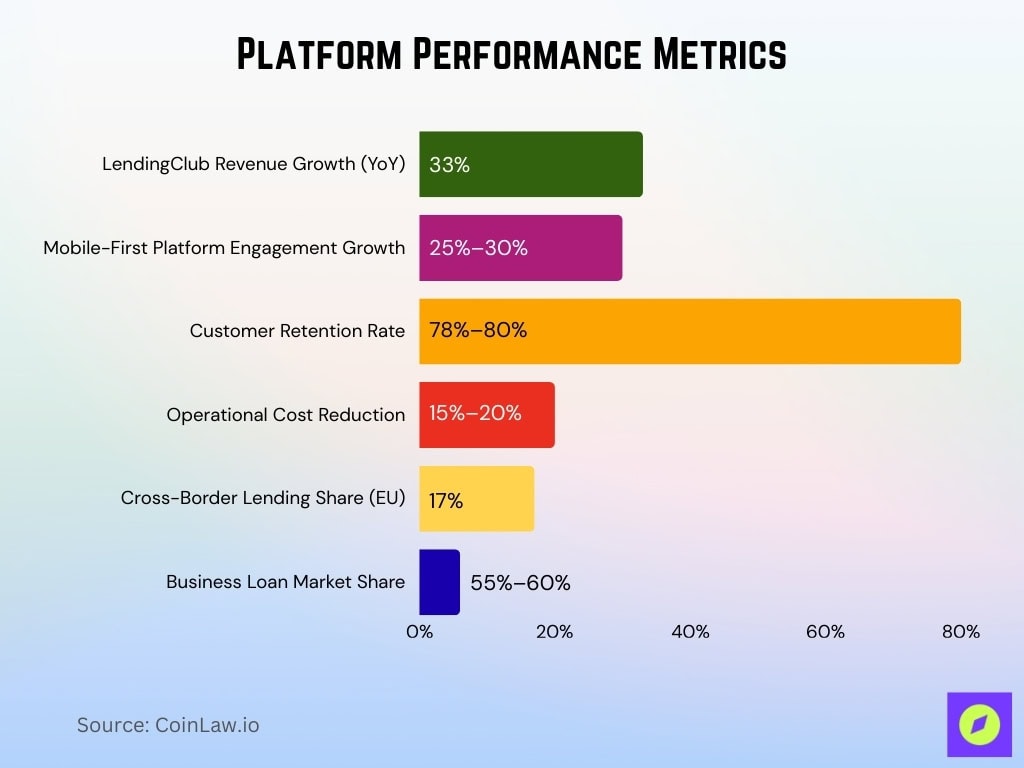

Platform Performance Metrics

- LendingClub reported 33% revenue growth year-over-year in 2025, powered by robust consumer lending and platform scale.

- Platforms offering mobile-first solutions saw user engagement rates climb 25-30% in 2025, reinforcing the need for seamless UX.

- Crowdlending platforms reported an average customer retention rate of 78-80% in 2025, signaling strong user loyalty.

- Platform operational costs dropped by 15-20% in 2025, thanks to deeper integration of blockchain, automation, and AI.

- Cross-border lending grew to approximately 17% of total volume in early 2025 under the ECSPR, showing expanding EU interoperability.

- Platforms focusing on business loans made up around 55-60% of total market volume in 2025, reinforcing the importance of SME lending.

Borrower and Lender Demographics

- Young borrowers aged 25-34 now make up ~42% of the total borrower base in 2025, continuing to lead in tech adoption.

- Around 58-62% of lenders are aged 35-55 in 2025, reflecting a continued preference for crowdlending as a mid-career investment.

- Women borrowers accounted for ~35% of total loans in 2025, showing improved gender inclusivity in lending.

- The average loan size for individual borrowers is now $6,000 in 2025, while for SMEs it averages $55,000.

- ~83% of borrowers in 2025 cite faster loan approval as their main reason for opting for crowdlending over traditional banks.

- Urban borrowers constitute ~72% of recipients in 2025, with rural penetration expanding, especially in developing regions.

- High-net-worth individuals (HNWIs) constitute ~25% of lenders in 2025, with average annual investments exceeding $120,000.

- The top borrower sectors in 2025 are e-commerce (~22%), renewable energy projects (~16%), and agriculture (~13%).

Loan Default Rates and Risk Assessment

- The global loan default rate is estimated at ~4.5% in 2025, reflecting continued improvement in risk management.

- Platforms using AI-driven risk assessment tools report about 20% lower default rates vs traditional scoring methods in 2025.

- Loans classified as high risk now make up only ~6–8% of total loans in 2025, down from prior years.

- Borrowers with credit scores above 700 represent roughly 65% of total loans in 2025, showing an emphasis on low-risk clients.

- Portfolio diversification remains strong with around 88% of lenders spreading their investments across at least five loans in 2025.

- The average recovery rate for defaulted loans is about 65% in 2025, aided by advanced debt collection strategies.

- Risk-sharing mechanisms like insurance-backed loans now cover ~15% of high-value loans in 2025, enhancing lender protection.

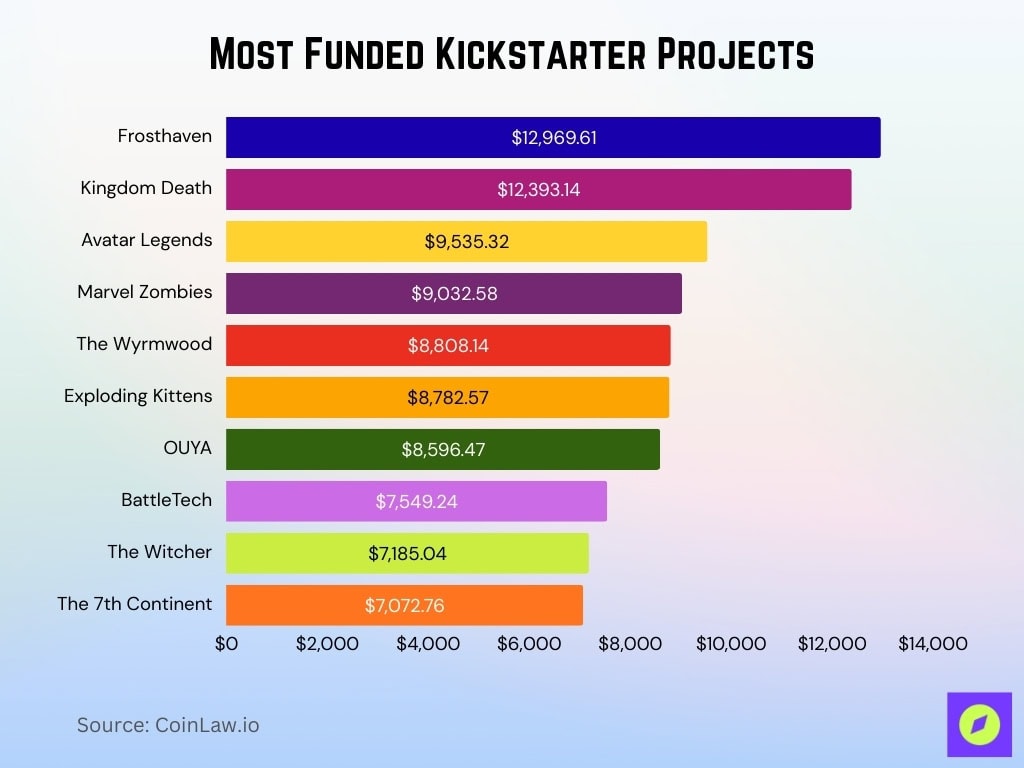

Most Funded Kickstarter Projects

- Frosthaven became the top-funded project with $12,969,610, leading all Kickstarter campaigns.

- Kingdom Death secured $12,393,140, showing the strong appeal of niche gaming communities.

- Avatar Legends raised $9,535,320, highlighting the popularity of tabletop RPGs.

- Marvel Zombies attracted $9,032,580, proving the power of established entertainment franchises.

- The Wyrmwood campaign earned $8,808,140, driven by high-quality gaming accessories.

- Exploding Kittens reached $8,782,570, a viral success story in casual card games.

- OUYA, a gaming console, raised $8,596,470, demonstrating early demand for indie hardware.

- BattleTech secured $7,549,240, appealing to strategy and mech gaming fans.

- The Witcher campaign collected $7,185,040, leveraging the popularity of its franchise.

- The 7th Continent raised $7,072,760, cementing its position as a hit in board gaming circles.

Key Companies and Market Insights

- LendingClub surpassed $80 billion in total loans issued by 2025, marking continued growth since its $70 billion milestone.

- In Europe, Funding Circle remains a leader with cumulative loans exceeding £16-17 billion in 2025.

- Zopa in the UK continues its evolution toward full digital banking in 2025, expanding its product offerings and user reach.

- Kiva, the nonprofit platform, has served more than 5 million borrowers by 2025 across developing regions.

- Upstart, using AI for credit modeling, achieved ~50% growth in its user base in 2025.

- SoFi, known for student loans, entered home and auto lending in 2025 and added over 600,000 new users.

Average Deal Size

- The global average loan size is now about $14,000 in 2025, rising from $12,500 in 2024.

- For SME borrowers, the average deal size is roughly $60,000 in 2025, used for expansion and working capital.

- Individual borrowers now typically secure loans averaging $5,500 in 2025 for education, healthcare, or debt consolidation.

- Crowdlending platforms focused on real estate report average deal sizes near $160,000 in 2025, driven by housing demand.

- The largest average deal sizes are seen in Europe at ~$25,000 per loan in 2025, followed by North America at ~$22,000.

- Peer-to-business lending platforms record average deal sizes of about $75,000 per deal in 2025, higher than P2P consumer lending.

- Women-led businesses in 2025 secure average deal sizes of around $35,000, reflecting increased support and access.

Regulatory Environment and Compliance

- North America introduced ~18 new regulations in 2025 focused on enhancing transparency and investor protection.

- The European Union continues enforcing the European Crowdfunding Service Providers Regulation (ECSPR) with full harmonization across 27 states by 2025.

- China’s tightening rules have resulted in the closure of ~75% of P2P platforms by 2025, leaving only ~15-20 fully compliant platforms.

- In the US, platforms are required under updated SEC / federal guidelines to provide detailed borrower creditworthiness disclosures in 2025.

- Regulatory backing for green financing has grown, with tax incentives now covering ~20% of crowdlending capital raised for renewable energy in 2025.

- In India, the RBI has raised the required minimum capital reserves to ₹3 crore in 2025 for platforms to strengthen financial stability.

- Blockchain-based platforms now represent ~20% of platforms in 2025, leveraging pro-regulation trends to enhance compliance and transparency.

- Global platforms in 2025 now allocate about 12% of their operating budget towards compliance measures, rising from earlier years.

Recent Developments

- The global market size has now surpassed $20.46 billion in 2025, marking a pivotal growth milestone.

- Funding Circle rolled out a new fractional-investment feature in 2025 with minimums from £5–£10, boosting accessibility for small lenders.

- LendingClub announced a deeper partnership with AI firms in 2025 to integrate predictive analytics and matching algorithms, improving borrower-lender pairing.

- Microloans for green projects grew by ~30% in 2025, reflecting stronger alignment of crowdlending with sustainability goals.

- Cross-border lending platforms rose to ~17% of total lending volume in 2025, driven by demand in underserved markets.

- Kiva expanded into 7 new countries in Africa in 2025, impacting an additional ~1.5 million borrowers.

- A record $1.2 billion in venture funding flowed to crowdlending startups in 2025, underscoring continued investor confidence.

- The first widely adopted crowdlending insurance product was launched in 2025, enabling lenders to insure portions of their portfolios against default.

Frequently Asked Questions (FAQs)

$176.5 billion in 2025 with a projected 25.73% CAGR to $1.38 trillion by 2034.

Cumulative credit of about £16 billion to 110,000+ businesses as of 30 June 2025.

+32% originations to $2.4 billion, +33% total net revenue to $248.4 million, and +156% net income.

Fewer than 30% of licensed platforms were operating cross-border in early 2025.

€396 million in 2024 and €70+ million in Q1 2025, more than double year over year for the quarter.

Conclusion

The crowdlending industry is at a transformative juncture, characterized by rapid technological advancements, growing global adoption, and enhanced regulatory frameworks. Platforms are leveraging AI, blockchain, and big data to drive efficiency while addressing critical challenges like risk management and compliance. As crowdlending continues to bridge the gap between borrowers and lenders, its role in fostering financial inclusion and democratizing credit cannot be overstated.

From average deal sizes to key innovations, every aspect of the industry signals robust growth and adaptation. Whether you’re an investor seeking lucrative returns or a borrower exploring alternatives to traditional finance, crowdlending offers opportunities shaped by trust, technology, and transparency. The future of lending is here, and it’s crowdlending.