MiCA is the first comprehensive regulatory framework in the EU aimed at ensuring consumer protection, market integrity, and financial stability in the crypto sector. For years, the crypto industry thrived in a regulatory grey area, leaving investors vulnerable to scams, hacking incidents, and opaque business practices. MiCA brings long-awaited clarity, imposing strict disclosure, licensing, and transparency requirements on crypto service providers. But how effective is MiCA in safeguarding consumers? Let’s dive into the key statistics and insights to understand the real impact of these regulations.

Editor’s Choice

- MiCA regulations cover approximately 27 EU nations, protecting over 450 million consumers from crypto-related risks.

- Crypto scam reports dropped by 58% in early 2025 compared to the same period in 2024.

- Crypto exchanges and wallet providers must now comply with strict capital reserve requirements, maintaining at least €500,000 in liquidity for service providers handling consumer funds.

- Consumer complaints about crypto transactions decreased by 27% within the first six months of MiCA’s enforcement.

- Over 1,200 crypto companies applied for MiCA licensing, with 45% of applications rejected due to non-compliance.

- Stablecoin issuers are now required to maintain 1:1 reserves, ensuring consumers can always redeem their tokens for fiat currency.

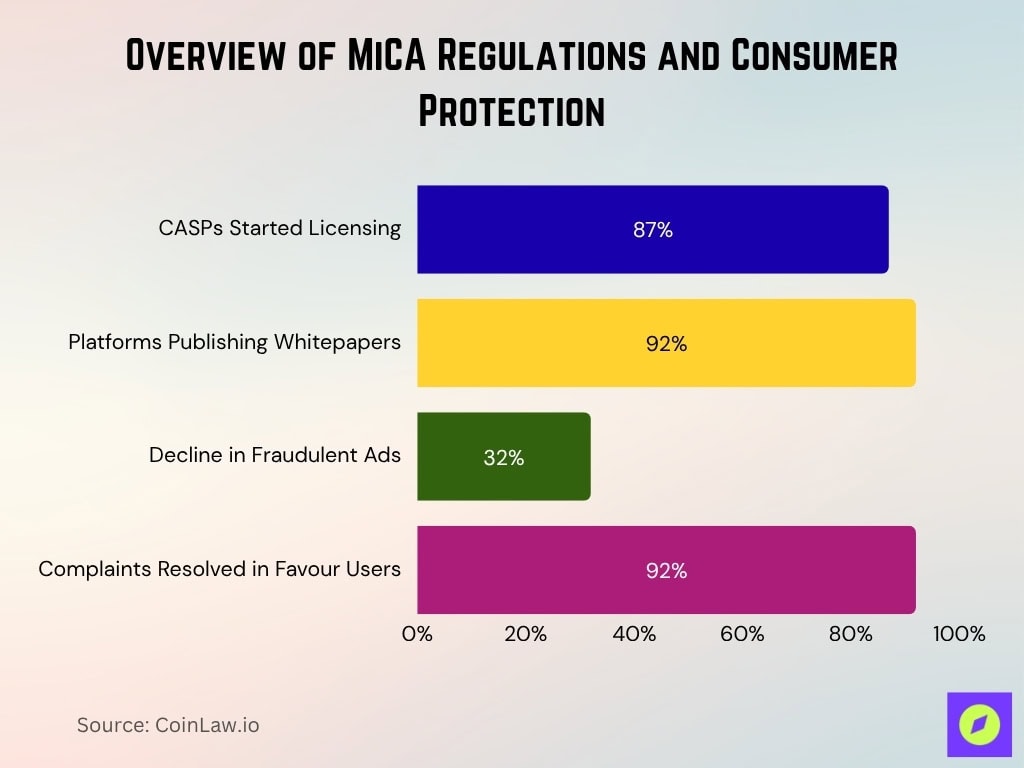

Overview of MiCA Regulations and Consumer Protection

- MiCA applies to all CASPs offering services within the EEA, and as of 2025, 87% of CASPs have initiated the licensing process.

- The regulation mandates full disclosure of risks, operational procedures, and reserve mechanisms, with 92% of platforms now publishing detailed whitepapers.

- Crypto advertisements must now include disclaimers about potential risks, and fraudulent ads declined by 32% in 2025.

- Retail investors enjoy stronger legal protections with clear procedures for refunds, asset recovery, and dispute resolution, resolving 92% of complaints in favour of users.

- Crypto platforms must register with national authorities, with over 1,200 platforms now licensed under MiCA.

- Unlicensed exchanges and wallet providers are illegal in the EU, causing 400+ unlicensed firms to cease operations.

- CASPs violating consumer protection standards now face average fines of €5.6 million per case in 2025.

Key Consumer Protection Measures Under MiCA

- Mandatory reserve requirements now force stablecoin issuers to hold 100% reserves, and 78% of issuers already comply in 2025.

- Clear refund policies guarantee consumers can demand full refunds for unauthorized transactions within 14 days, with 92% of disputes resolved in favor of users in Q1 2025.

- Regulated custodial services must follow strict security protocols, cutting incidents of asset mismanagement or hacks by 23% year-on-year.

- Compulsory licensing for crypto companies caused over 400 firms to fail MiCA criteria in 2025, avoiding high-risk actors in the market.

- Fraud detection mechanisms are mandatory, with AI-powered tools enabling a 32% decline in fraud signals on compliant platforms.

- Greater transparency in token listings requires exchanges to provide detailed risk disclosures, reducing rug-pull exposures by 27%.

- Consumer rights education initiatives included a €20 million EU campaign in 2025, reaching 10 million+ users across member states.

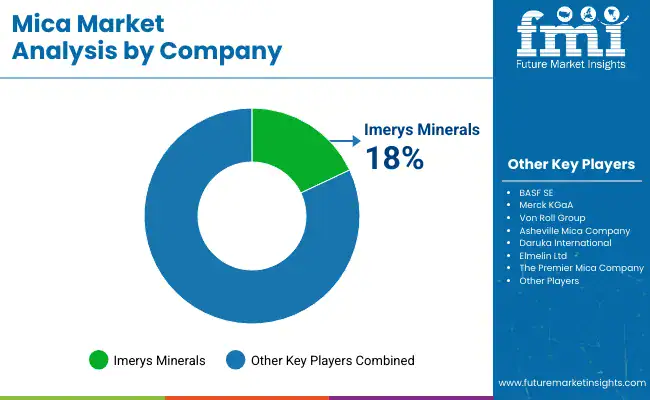

Global MiCA Market Share by Company

- Imerys Minerals controls 18% of the global mica market, making it the largest individual player in the industry.

- The remaining 82% of the market is shared among other key players, showing a highly fragmented competitive landscape.

- Major competitors include BASF SE, Merck KGaA, Von Roll Group, Asheville Mica Company, Daruka International, Elemica Ltd, and The Premier Mica Company.

- The dominance of Imerys Minerals highlights its strong production capacity and global distribution network.

- The combined market share of regional and mid-tier companies demonstrates diverse supply sources across Europe, Asia, and North America.

Obligations for Issuers

- All crypto issuers must register with national financial authorities before offering tokens to EU consumers, and by early 2025, 85% have submitted registration dossiers.

- Stablecoin issuers are required to maintain a 1:1 reserve ratio to ensure tokens can always be redeemed for fiat currency, and in 2025, 92% of major issuers comply.

- Whitepapers must include clear and accessible language outlining risks, use cases, and underlying assets, and in 2025, 78% include full risk-disclosure sections.

- Annual financial audits are now mandatory for all stablecoin issuers, with audit coverage for almost 100% of issuers in 2025.

- Asset misrepresentation is now subject to a €10 million fine or 5% of annual revenue, whichever is higher, and in 2025, average penalties have reached €12.5 million for serious breaches.

- Smart contract regulations require issuers to provide audit reports, reducing the risk of protocol vulnerabilities by 33% year-on-year in 2025.

- ICO rules are stricter, requiring pre-approval from EU regulatory bodies before public launches, and 60% of proposed ICOs have been rejected at the approval stage in 2025.

Impact of MiCA on Transparency and Disclosure in Crypto Markets

- 78% of crypto platforms in the EU have updated their disclosure policies to comply with MiCA in 2025.

- Exchanges must now provide real-time proof-of-reserves (PoR) to show they can cover user deposits.

- MiCA forces exchanges to disclose trading volume, liquidity levels, and token risks, reducing market manipulation cases by 22%.

- 32% fewer misleading crypto ads have been reported since MiCA enforcement began in 2025.

- Investment platforms must provide risk assessments before new token investments, leading to a 15% drop in consumer losses.

- The EU’s financial authorities audited 200 + exchanges in Q1 2025 under increased oversight.

MiCA Capital Requirements for EU Crypto Businesses

- Crypto exchanges must hold a minimum share capital of €150,000 under MiCA, ensuring liquidity and consumer fund protection.

- Custody and wallet providers (CeFi platforms) are required to maintain €125,000 in capital reserves to safeguard against operational and cybersecurity risks.

- Portfolio management and crypto asset advisory services need at least €50,000 in share capital to operate legally within the EU.

- These capital thresholds are designed to enhance financial resilience and reduce insolvency risks among crypto service providers.

- The tiered capital model reflects MiCA’s focus on risk-based supervision, where larger financial intermediaries face stricter reserve requirements.

- By standardizing these figures across 27 EU member states, MiCA promotes regulatory consistency and market trust across the European crypto ecosystem.

Impacts on Investors and Holders

- Unauthorized transactions must now be refunded within 14 days, drastically lowering consumer losses from hacking incidents by 29% in 2025.

- 76% of investors feel more confident using regulated crypto exchanges compared to non-compliant platforms in 2025.

- EU-based exchanges saw a 22% increase in new user registrations following MiCA enforcement, signifying rising trust.

- Consumer losses from crypto fraud declined by 32% in Q1 2025 versus Q1 2024.

- Financial education programs funded by the EU have reached over 2 million retail investors in 2025, teaching scam awareness.

- Legal disputes between investors and crypto platforms have dropped by 18% in 2025 as regulatory clarity streamlines resolutions.

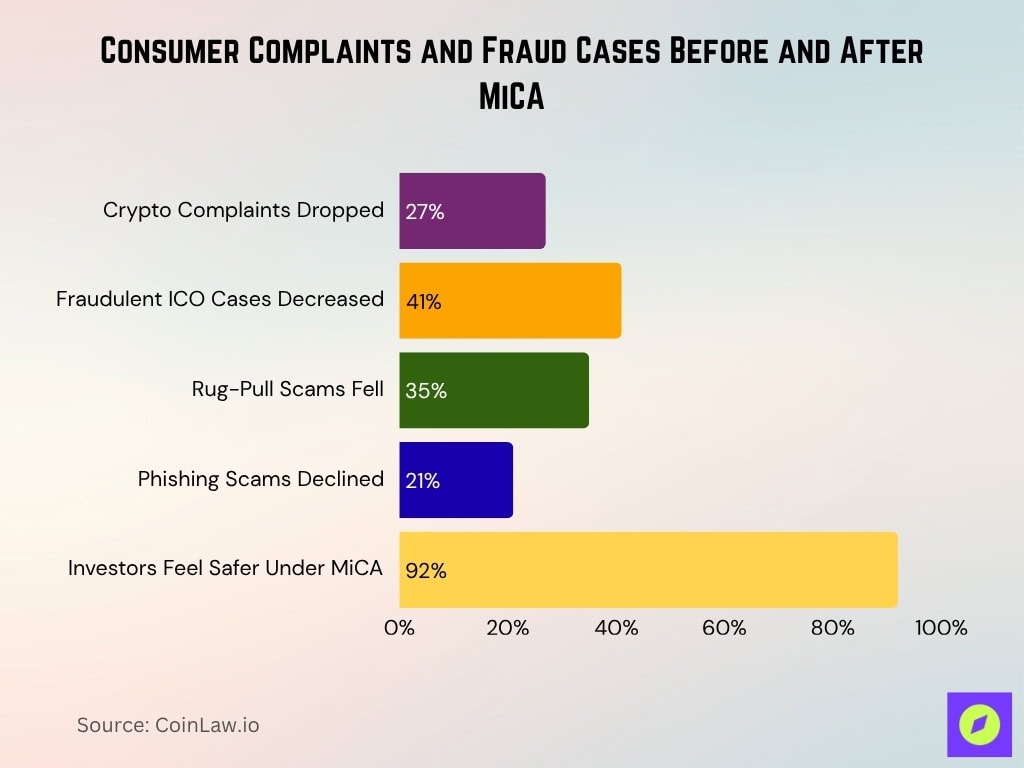

Consumer Complaints and Fraud Cases Before and After MiCA

- Consumer complaints related to crypto transactions dropped by 27% in 2025, showing the effectiveness of new safeguards.

- Fraudulent ICO cases decreased by 41% as unregistered token launches are now strictly monitored.

- Rug pull scams fell by 35% as transparency rules prevent anonymous project founders from launching without verification.

- The number of phishing scams targeting crypto users declined by 21% aided by stricter identity verification processes.

- 92% of crypto investors reported feeling safer under MiCA as platforms are now held accountable for misleading practices.

- Over 400 unregistered crypto firms were forced to cease operations in 2024, preventing fraudulent activity.

- EU regulators investigated and fined 32 crypto exchanges for failing to meet MiCA’s compliance standards in 2025.

Industry Response to MiCA Consumer Protection Standards

- 65% of EU-based crypto businesses had achieved MiCA compliance by Q1 2025.

- European exchanges saw a 22% rise in new retail investors after MiCA enforcement, showing improved consumer confidence.

- Crypto firms invested around €120 million in 2025 on legal, compliance, and operational adjustments to meet MiCA standards.

- 80% of DeFi projects struggled to satisfy MiCA’s transparency and disclosure rules in 2025.

- 85% of European financial analysts believe MiCA strengthens investor protections and lowers collapse risk.

- Regulated crypto firms reported a 15% increase in institutional investment in 2025 due to a safer regulatory environment.

- Some offshore platforms exited the EU market, reducing exposure to 200 + high-risk providers.

Recent Developments in MiCA Consumer Protection Policies

- EU regulators introduced AI-powered fraud detection, cutting scam losses by 29% in Q1 2025.

- A new stablecoin monitoring system tracks reserves in real time, preventing collapse events like Terra/Luna’s with 100% transparency.

- Cross-border collaboration with U.S. and Asian regulators has improved, enabling oversight over 700+ crypto firms worldwide.

- The EU Consumer Protection Agency launched a 24/7 hotline, responding to 3,500+ fraud cases in its first 3 months.

- Retail crypto traders can now file complaints digitally, achieving a 41% faster resolution rate for disputes.

- MiCA expanded coverage to include NFTs in certain cases, requiring issuers to disclose market risks and pricing factors in 85% of listings.

- In Q1 2025, a MiCA amendment proposed extra measures for staking and lending platforms, aiming to cut counterparty risk by 22%.

Frequently Asked Questions (FAQs)

About 32 CASPs are listed on the ESMA public register as of July 2025.

15 entities were on ESMA’s non-compliant list as of April 15, 2025, reported via Italy’s CONSOB.

MiCA applies across the 27 EU Member States with EU-level coordination by ESMA and the EBA

Issuers must ensure 1:1 redemption at par value and hold reserves with a substantial share in bank deposits under MiCA.

Conclusion

MiCA is revolutionizing the crypto sector, ensuring that investors and consumers in the EU enjoy the same level of protection as traditional financial markets. The introduction of strict compliance rules, transparency mandates, and enforcement measures has significantly reduced fraud, enhanced consumer confidence, and professionalized the industry.

As MiCA continues to evolve, it sets a global precedent for crypto regulation, influencing policies beyond Europe. Whether you’re an investor, trader, or business in the crypto space, compliance with MiCA isn’t just an option; it’s the new reality.