The banking world is evolving rapidly, reshaped by technology and changing customer expectations. For Alex, a middle-aged professional juggling work and family, banking isn’t just about managing money; it’s about convenience, trust, and personalized service. Whether it’s using an app to pay bills or visiting a branch for a loan consultation, Alex represents the modern customer who demands seamless experiences across every touchpoint. Understanding the latest consumer banking satisfaction statistics today reveals how banks are adapting to these expectations, driving innovation, and securing loyalty.

Editor’s Choice: Key Findings in Consumer Banking Satisfaction

- 89% of US banking customers report satisfaction with their primary bank.

- 93% say trust or transparency is critical when choosing a financial institution.

- 89% use online or mobile banking regularly.

- Banking app satisfaction reached 669 out of 1000, showing improved user experience.

- 38% of customers would switch banks for better digital tools and services.

- Around 75% of Millennials and Gen Z prefer banks with both digital and in‑person options.

- 93% of customers rank security as their top priority when evaluating a banking provider.

US Banking Customer Satisfaction

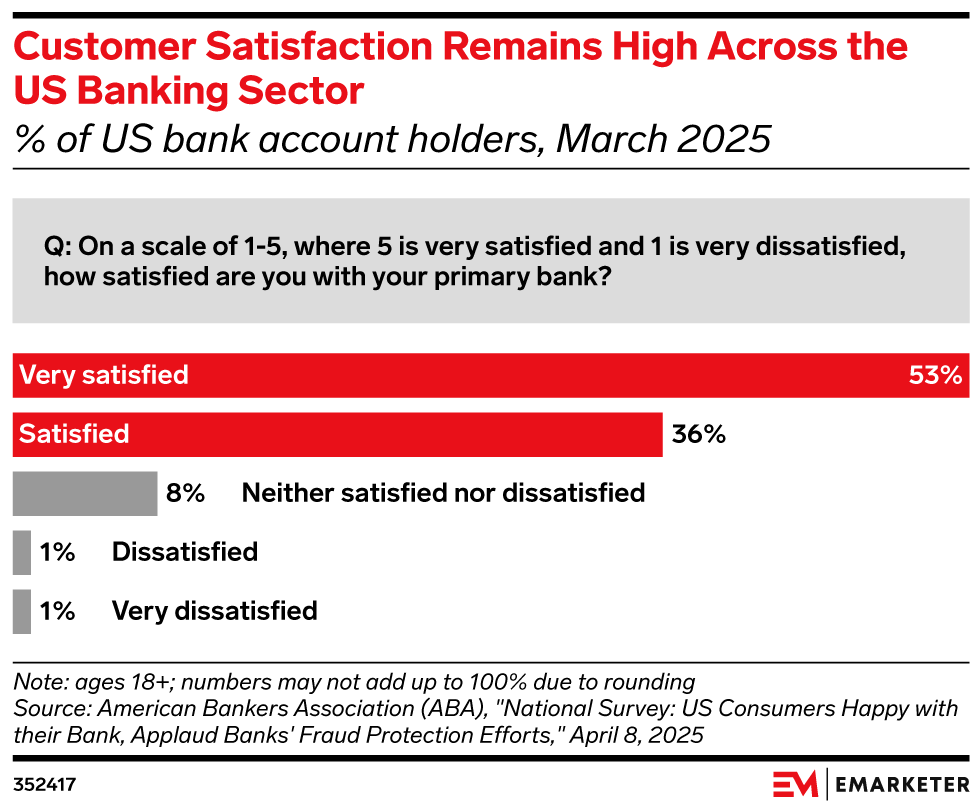

- 53% of US bank account holders said they are very satisfied with their primary bank.

- 36% reported being satisfied, showing strong overall approval.

- 8% felt neutral, neither satisfied nor dissatisfied with their bank.

- Only 1% expressed being dissatisfied with their primary bank.

- Just 1% were very dissatisfied, reflecting minimal negative sentiment.

Trust and Loyalty Metrics

- 76 % of customers agree they feel a strong sense of trust in their primary bank.

- 68 % of consumers say consistent communication fosters greater trust in their financial provider.

- Banks with strong CSR programs enjoy a 30 % boost in customer loyalty.

- 42 % of customers expressed dissatisfaction with banks that failed to resolve security concerns promptly.

- 53 % of respondents would recommend their bank to friends or family based on trust alone.

- Retention rates among digital‑first customers are 15 % higher when they perceive their bank prioritizes data privacy.

- 81 % of loyal customers state that transparency in fee structures was a decisive factor in their continued engagement.

Digital Banking Experience

- 77% of consumers now prefer managing their bank accounts via mobile app or computer.

- 96% of customers rate their mobile and online banking experience as good or better.

- Banks offering live chat support report 88% satisfaction compared to 76% without it.

- Biometric security adoption continues to grow with widespread use of fingerprint and facial recognition.

- 85% of mobile banking users prioritize speed and reliability for overall satisfaction.

- U.S. digital banking users are projected to reach 216.8 million in 2025.

- The global neobank market is set to grow from $143 billion to $210 billion in 2025.

Digital Banking Satisfaction Scores

- Customers who are extremely dissatisfied scored just 0, reflecting minimal digital engagement at this level.

- Those who are dissatisfied rated their experience at 63, indicating room for improvement.

- Somewhat dissatisfied customers gave a score of 67, slightly higher than dissatisfied users.

- Customers who felt neutral scored 68, showing moderate satisfaction with digital banking.

- Somewhat satisfied customers rated their experience at 72, showing positive sentiment.

- Satisfied customers scored a strong 75, confirming the value of digital channels.

- Extremely satisfied customers gave the highest score at 81, highlighting the success of digital banking adoption.

Mobile Banking Apps and Online Banking

- 72 % of US adults report using mobile banking apps, showing strong continued adoption.

- Mobile app usage now accounts for 64 % of banking preferences.

- 65 % of customers rank user‑friendly design as the most critical feature of a banking app (original phrasing preserved).

- 28 % of customers abandon online banking platforms due to overly complex registration or login processes (original phrasing preserved).

- Banks with instant payment features in their apps saw customer satisfaction scores rise by 15 % (original phrasing preserved).

- 89 % of Gen Z and Millennials would not use a banking app that lacked biometric login features (original phrasing preserved).

- Banks offering customizable dashboards on online platforms experienced a 12 % increase in customer retention rates (original phrasing preserved).

Bank Customer Satisfaction with Digital Services Worldwide, by Country

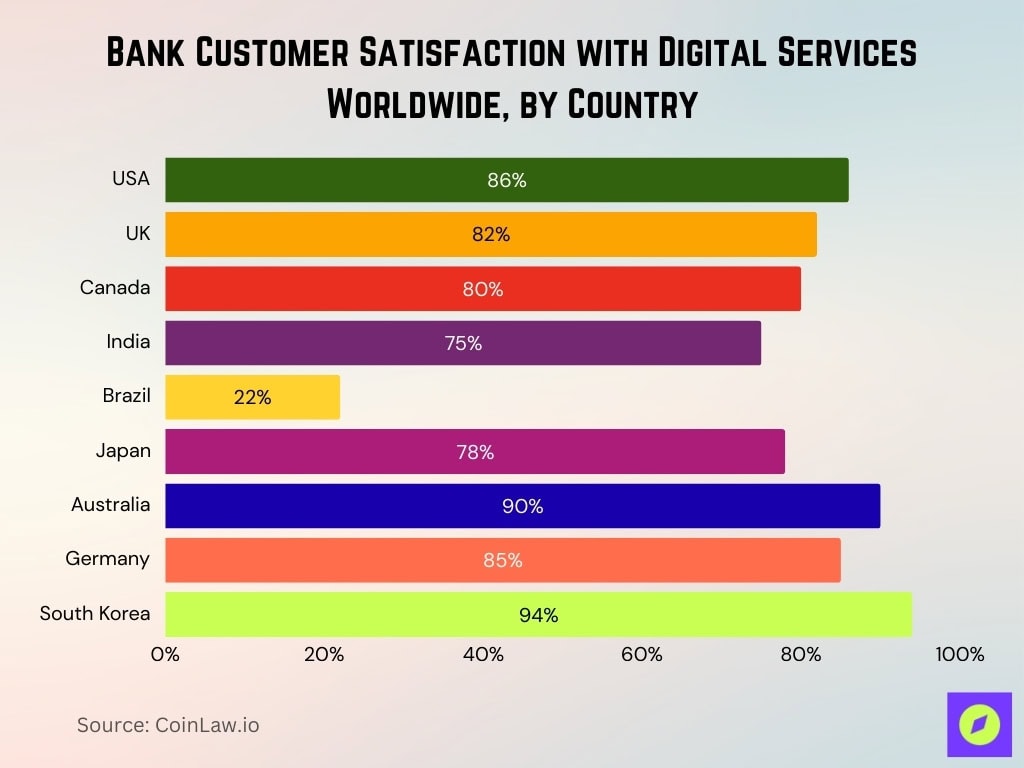

- The US leads in digital banking satisfaction at 86%, followed by the UK at 82% and Canada at 80%.

- In India, 75% of banking customers value local language support in digital services.

- Brazil saw a 22% surge in mobile app usage for banking, driven by stronger internet and smartphone access.

- Japanese banks reported 78% satisfaction due to digital wallets and QR-based payment systems.

- In Australia, 90% of customers cited fee transparency as the key driver of digital-only bank satisfaction.

- German consumers showed 85% satisfaction when real-time fraud alerts were integrated.

- South Korea has the highest mobile banking app usage, with 94% of customers actively using the service

Customer Service Quality

- 79 % of customers say a bank’s customer service quality strongly impacts their overall satisfaction.

- Banks offering 24/7 live chat support achieved 88 % satisfaction compared to 76 % for those without it.

- 41 % of customers switched banks in the past two years due to poor customer service.

- 58 % of customers rate speed of response as the most critical factor in service quality.

- 65 % of customers prefer resolving complex issues via human interaction, by phone or in‑branch.

- Institutions that followed up proactively on complaints saw a 20 % improvement in customer retention.

- Banks offering multilingual support achieved an 84 % satisfaction rating from non‑native speakers.

Providing Support and Advice Matters to Bank Customers

- 68% of customers say tailored financial advice improves their perception of their bank.

- Banks offering free financial literacy workshops saw a 25% increase in customer engagement.

- 47% of small business owners said proactive advice helped them navigate economic uncertainties.

- 59% of customers prefer banks that suggest cost‑saving measures based on spending habits.

- Satisfaction scores were 20% higher among customers receiving personalized loan repayment options.

- 44% of low‑income customers rely on banks for affordable credit counseling.

- 80% of Gen Z value advice on long‑term financial goals over immediate product offers.

Retail Bank Satisfaction Rankings

- Capital One leads with a score of 688, the highest among major retail banks.

- Chase follows closely at 684, showing strong customer approval.

- PNC ranks third with 680, slightly above its peers.

- TD Bank and U.S. Bank are tied at 674, both above the industry average.

- Bank of America scores 663, just below the top group but still competitive.

- The industry average stands at 657, serving as the benchmark.

- Citibank falls below average at 631, highlighting weaker customer satisfaction.

- Wells Fargo is the lowest-rated at 612, well under the industry norm.

Personalization at the Core of Customer Experience

- 70 % of customers now expect banks to offer personalized experiences and advice.

- Personalized bank experiences help boost customer retention and satisfaction.

- 80 % of customers are more likely to engage with brands offering personalized services.

- 53 % of customers expect their bank to use their data to personalize their experience.

- Only 23 % of consumers believe their bank currently offers tailored financial advice.

- Customers receiving personalized recommendations, including loan offers and dashboards, are 20 % more likely to engage.

Embracing the Omnichannel Approach

- 79 % of customers use more than one channel for banking, emphasizing the need for an omnichannel strategy.

- Banks with seamless transitions between digital and in‑person experiences achieve 20 % higher customer satisfaction.

- 48 % of customers find starting a process online and finishing it in‑branch significantly enhances their experience.

- Institutions offering video conferencing with banking advisors see a 17 % increase in customer trust.

- 67 % of consumers value having both digital tools and in‑branch expertise available.

- 34 % of Baby Boomers say they would switch banks if branch locations were reduced without digital support improvements.

- Banks integrating social media as a support channel experience a 21 % boost in engagement with younger customers.

Balancing Digital and Human Touch in Banking Services

- 71 % of customers still prefer human advisors for high‑value financial decisions.

- 57 % of Millennials and 65 % of Gen Z consumers desire human interaction for complex banking issues.

- Banks with dedicated relationship managers for priority customers see a 22 % rise in retention rates.

- 82 % of customers believe digital tools should enhance, not replace, human service.

- Offering AI‑assisted support that complements human interactions results in a 16 % satisfaction boost.

- 45 % of Baby Boomers rely on in‑person banking for major transactions.

- Banks blending digital tools with human advisors achieve 88 % satisfaction scores.

Fee Structures and Transparency

- 54% of customers say hidden fees are their main source of dissatisfaction with their bank.

- Banks that provide detailed fee breakdowns at account setup see 30% fewer complaints.

- 70% of customers would switch to banks with no hidden fees, even if maintenance costs were higher.

- Institutions offering customizable fee packages achieve 15% higher retention rates.

- 36% of Millennials prefer subscription-based banking fees over traditional models.

- 84% of customers rate banks that proactively disclose overdraft policies as trustworthy.

- Banks introducing low-cost student accounts saw a 40% surge in new customer registrations.

Prioritizing Security in the Digital Banking Era

- 81% of customers trust their primary bank to keep their data secure.

- Biometric verification systems reduced fraudulent account access by 35%.

- AI-driven fraud detection systems helped banks report 30% fewer cybercrime incidents.

- 68% of customers feel more confident when two-factor authentication is offered across services.

- 52% of Millennials and Gen Z rank cybersecurity as a deciding factor in choosing digital banking.

- Institutions offering real-time fraud alerts saw a 25% boost in customer trust.

- 40% of customers are willing to pay more for banks with premium security features.

Recent Developments

- In 2025, 75% of large banks will have fully integrated AI strategies.

- Digital-only banks grew their customer base by 18% due to improved user experience and transparent fees.

- Global cybersecurity spending is projected to reach $212 billion in 2025.

- Partnerships with decentralized finance platforms rose by 22%, reshaping the banking ecosystem.

- Sustainability-linked banking products saw 15% growth as eco-conscious demand increased.

- Blockchain-based cross-border payments reduced transaction times by 40%.

- Employee upskilling in digital banking technologies reached a 30% adoption rate among major institutions.

Frequently Asked Questions (FAQs)

89% of U.S. banking customers report being satisfied or very satisfied with their primary bank.

The overall satisfaction score rose by 11 points, from 644 in 2024 to 655 in 2025.

U.S. banks scored 80 on the American Customer Satisfaction Index in 2025.

17% of consumers are likely to switch financial institutions in 2025, rising to 37% if a better alternative exists.

Conclusion

Consumer banking satisfaction reflects a delicate balance between innovation, personalization, and trust. Banks excelling in digital tools while maintaining human connections have seen record-high satisfaction rates. Security, transparency, and omnichannel strategies are no longer optional but essential for retaining loyal customers. As the financial landscape continues to evolve, institutions that prioritize customer-centric innovations will lead the way into the future of banking.