In the fast-paced world of digital payments, Checkout.com has emerged as a major player, revolutionizing how businesses process payments across the globe. With a focus on innovation, seamless integration, and customer security, Checkout.com has quickly gained ground on other payment platforms.

Businesses, particularly in e-commerce, continue to rely on their cutting-edge technologies to ensure smooth and secure transactions. This article will explore key statistics and significant developments highlighting Checkout.com’s impact and growth in the payment solutions industry.

Editor’s Choice: Key Milestones

- $40 billion valuation achieved by Checkout.com, reflecting its private-market value in 2025.

- The company’s AI-powered Intelligent Acceptance tool has generated over $10 billion in additional merchant revenue since launch.

- Checkout.com grew its merchant base by 60% to 500,000 active merchants worldwide.

- Integration of 80+ payment methods into its platform remains, enabling global merchant reach.

- Investment in AI and machine learning initiatives rose by 30%, continuing its innovation trajectory.

- Checkout.com states its fraud detection systems have blocked over $800 million in attempted fraud, based on internal risk modeling.

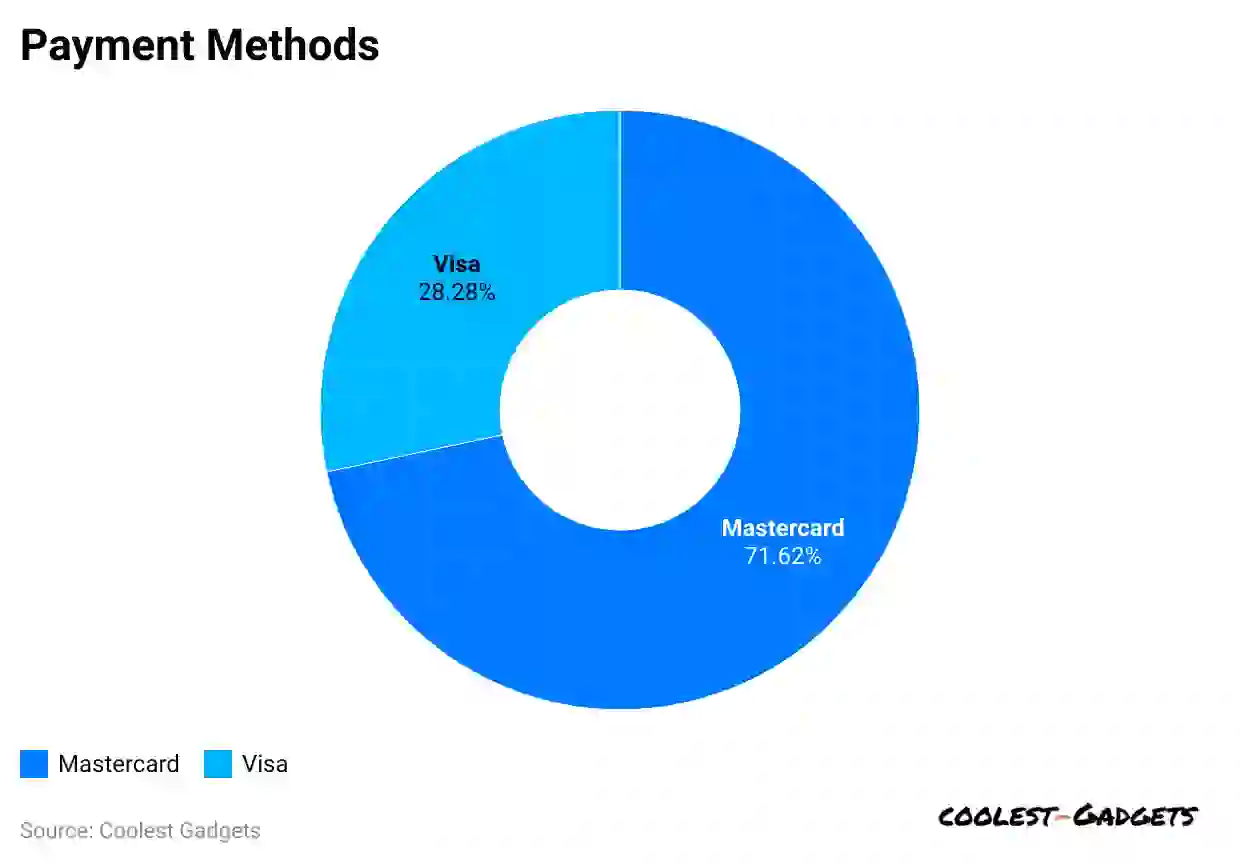

Payment Method Preferences

- Mastercard dominates with 71.62% of total payment method usage.

- Visa accounts for 28.28%, showing a significantly lower share.

- The gap between Mastercard and Visa stands at over 43 percentage points.

- Mastercard’s high usage may reflect broader merchant acceptance or user incentives.

- Visa, while second, still maintains strong relevance in consumer transactions.

- The data suggests a clear preference for Mastercard among users and merchants.

- Useful for understanding brand dominance in digital and physical payment channels.

- Indicates potential areas of market competition and loyalty program success.

- Can guide fintech platforms on which payment gateways to prioritize.

- Highlights how payment behavior trends may influence future financial product design.

General Checkout.com Statistics

- 45 % year‑on‑year net revenue growth reported in 2024, underlining continued momentum into 2025.

- The platform now operates in over 150 countries, with domestic acquiring licenses across major regions.

- Global headcount grew by 15 % in 2025, following strong growth from the previous year.

- The AI‑powered Intelligent Acceptance system optimizes tens of thousands of transactions per minute, driving an additional $9 billion in merchant revenue since launch.

- More than 40 merchants now process over $1 billion annually using the Checkout.com network.

Merchant Adoption and Payment Volumes

- Over 300 new enterprise merchants were onboarded in 2024, reflecting Checkout.com’s ongoing acquisition momentum.

- More than 40 merchants now process over $1 billion annually, showing strong high-volume adoption.

- Cross-border payment processing volumes exceeded $100 billion, driven by global e-commerce demand.

- Around 40% of clients come from emerging markets, including Latin America and Southeast Asia.

- Retail and e-commerce account for about 60% of total payment volume, highlighting sector dominance.

- Average payment volume per merchant rose by 35% to reach $20 million annually, indicating growth.

- Fraud and AI-powered tools helped prevent over $2 billion in fraudulent transactions, enhancing security.

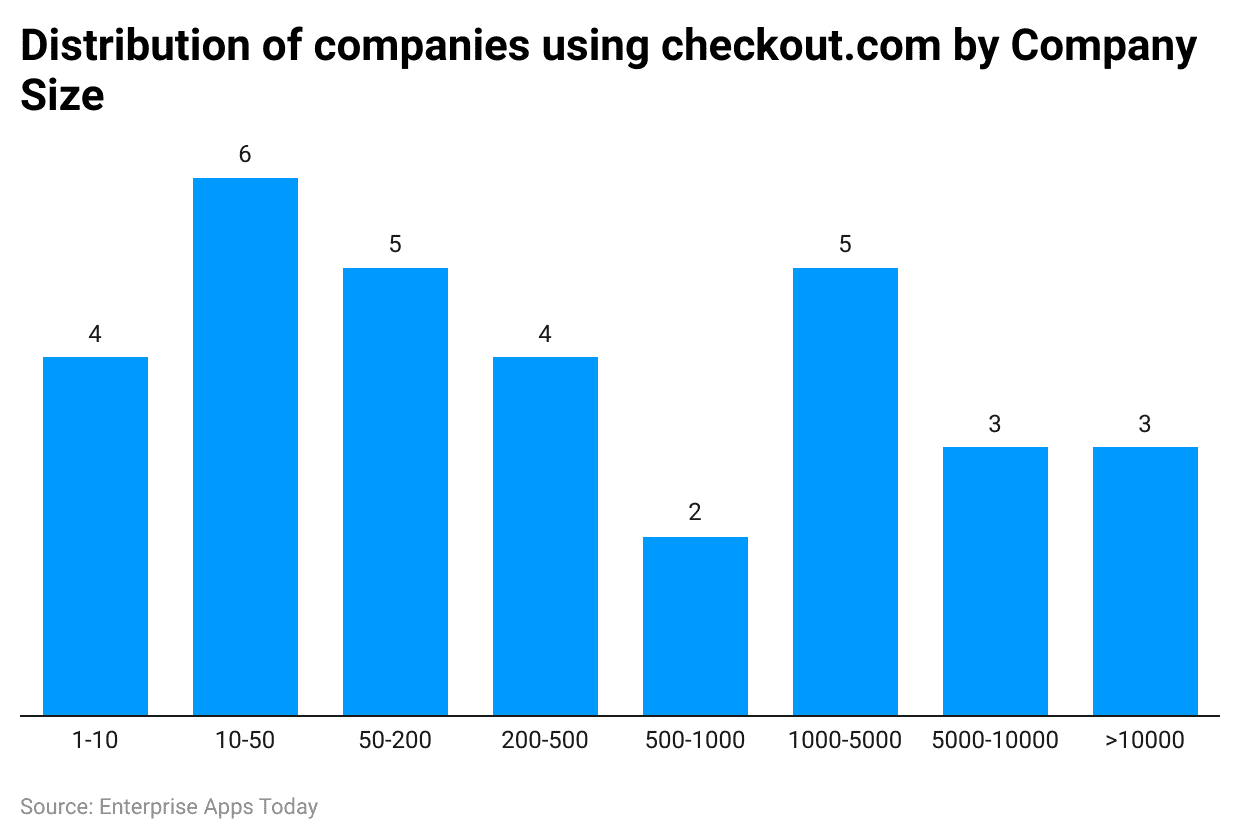

Company Size Distribution Using Checkout.com

- Companies with 10–50 employees are the most common users, making up 6 of the total.

- Both 50–200 and 1000–5000 employee companies follow closely, each with 5 users.

- Smaller businesses with 1–10 employees and mid-sized firms with 200–500 employees each account for 4 companies.

- Large enterprises with over 10,000 employees also appear in the mix, totaling 3 companies.

- Companies sized 5000–10000 employees contribute 3 users, showing Checkout.com’s reach in large-scale firms.

- 500–1000 employee companies are the least represented, with just 2 users.

- The distribution indicates that Checkout.com is used by a broad range of company sizes, not just small startups or large enterprises.

- The platform appears particularly strong in serving SMEs and mid-market firms, with 10–200 employee segments being dominant.

- Its adaptability may reflect scalable pricing, API flexibility, and multi-region support.

- The presence of large companies (5000+ employees) shows Checkout.com’s ability to handle high-volume, enterprise-grade payment needs.

Technological Innovations and AI Integration

- Checkout.com’s Intelligent Acceptance system boosted transaction approval rates by 6 % at Sunbit in 2025.

- The Intelligent Acceptance engine, using AI and network data, has contributed to over $10 billion in additional merchant revenue.

- The machine learning engine within Fraud Detection Pro scans billions of transactions to block sophisticated fraud and reduce false declines.

- Checkout.com applies real-time AI-driven optimizations to maximize conversion rates and minimize manual interventions.

- Predictive analytics help merchants forecast peak traffic periods and avoid performance bottlenecks during high-volume events.

- The company’s ML-powered fraud tools prevent billions in fraudulent charges and evolve dynamically as fraud patterns shift.

- AI-assisted support tools streamline merchant inquiries, substantially reducing response times and improving service efficiency.

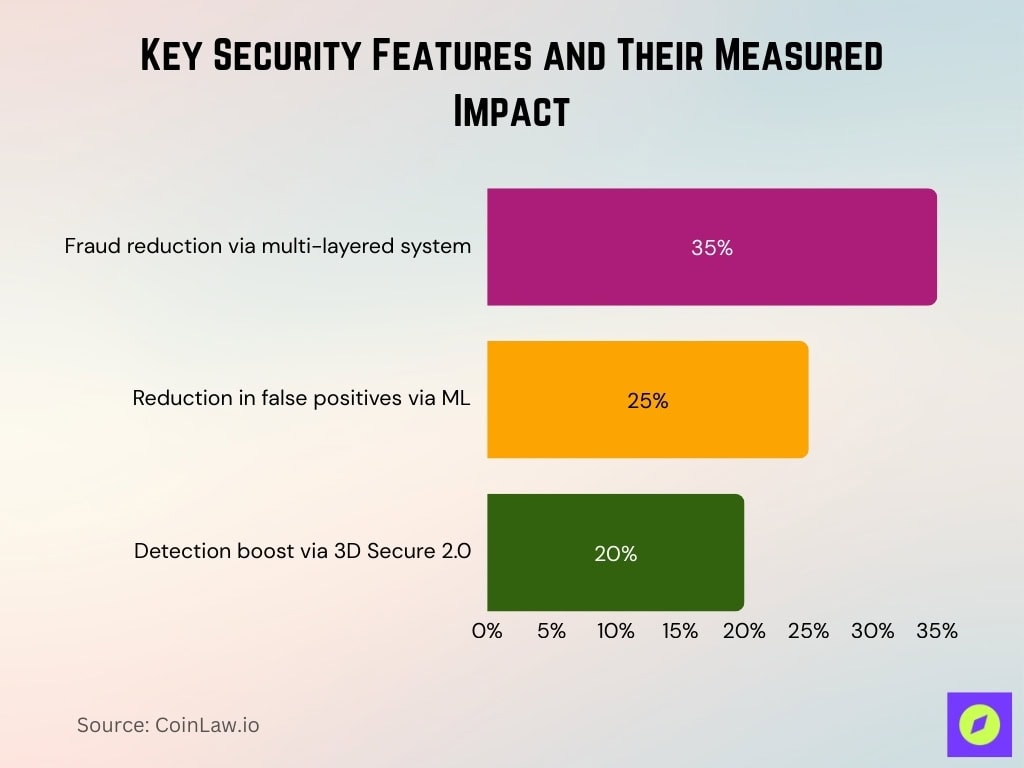

Fraud Prevention and Security Enhancements

- A multi‑layered fraud protection system helped reduce fraud by 35% for merchants.

- Machine learning algorithms adapt in real time to detect suspicious behavior, lowering false positives by 25%.

- Implementation of 3D Secure 2.0 improved fraud detection effectiveness by 20%.

- Advanced security features blocked over $800 million in potentially fraudulent transactions.

- Tokenization masks sensitive payment data, ensuring full compliance with industry standards.

Regional Leadership and Market Penetration

- The US became Checkout.com’s fastest-growing region with over 80% year-on-year revenue growth and a new direct acquiring launch in Canada.

- Expansion efforts continued in Southeast Asia and Latin America, reinforcing prior momentum and merchant adoption.

- Payment volume in the UAE increased by 176%, with a 388% rise in Pay-to-Card funding transactions across MENA.

- North America maintained strong performance, with the US leading regional transaction volume gains.

- The company expanded in Saudi Arabia and Japan, becoming the first global provider to directly integrate with Visa and Mastercard in Japan.

Industry Breakdown of Checkout.com Users

- Financial Services leads with 13 companies, making it the top industry using Checkout.com.

- Information Technology and Services follows closely with 11 companies, highlighting strong adoption in the tech sector.

- The Internet industry ranks third, contributing 9 companies to the platform’s user base.

- Computer Software firms account for 7 companies, showing continued reliance on modern payment APIs.

- Marketing and Advertising companies make up 6 users, pointing to growing demand for integrated payment tools.

- Retail businesses using Checkout.com total 4, likely benefiting from e-commerce and BNPL integrations.

- Leisure, Travel, and Tourism contribute 3 companies, showing recovery and digitalization post-COVID.

- Niche industries like Design, Cosmetics, and Investment Banking each account for 2 companies.

- The data reflects Checkout.com’s broad sector appeal, from finance and tech to lifestyle and services.

- Strong presence in digital-first industries suggests the platform is tailored for high-growth, scalable use cases.

Recent Developments

- Checkout.com ended 2024 with 45% year-on-year net revenue growth and entered 2025 with profitability.

- The company is projected to grow 30% in net revenue during 2025 and expand headcount by 15% globally.

- More than 40 merchants now process over $1 billion annually through Checkout.com’s network.

- On Black Friday 2024, 67 merchants processed over $10 million each in one day.

- The Intelligent Acceptance tool now optimizes over 26,000 transactions per minute and has delivered $9 billion in added merchant revenue.

- Checkout.com launched the Checkout Business Account to provide same-day settlements and improve cash flow for businesses.

- Meta Shops are being phased out of in-app checkout, prompting merchants to shift to external website checkouts by August 2025.

- Checkout.com has raised approximately $1.83 billion in total funding across several rounds, including its latest Series D.

Conclusion

Checkout.com continues to lead the charge in reshaping digital payments globally. With its focus on innovation, regional expansion, and robust fraud prevention tools, the platform is well-positioned to continue its growth. As more businesses turn to seamless, secure, and scalable payment solutions, Checkout.com remains a top choice for enterprises looking to stay competitive in the fast-evolving payments landscape.