The online payments landscape continues to evolve rapidly, and one name stands out: CCAvenue. As a major payment gateway, CCAvenue supports millions of merchants and processes a high volume of transactions, enabling businesses to accept digital payments safely and efficiently. Its reach spans from small e‑commerce sites to large enterprises, making the platform a backbone of India’s and increasingly global digital commerce. Explore below for a detailed snapshot of CCAvenue’s recent performance and scope.

Editor’s Choice

- CCAvenue serves nearly 3 million merchants across its payment network.

- The platform claims support for 240+ payment options, covering credit cards, debit cards, net banking, wallets, and more.

- CCAvenue processes over 100 million transactions annually, as per the latest publicly available data.

- The parent company, Infibeam Avenues Limited, forecasts continued growth in digital payment adoption in 2025.

- The gateway offers multi‑currency processing, enabling merchants to transact internationally.

- CCAvenue maintains strong security compliance, including PCI‑DSS certification, which fosters trust among merchants and customers.

- Through its technology stack, for example, the Smart Analytics dashboard, merchants gain real‑time insights into transactions, helping them make data‑driven decisions.

Recent Developments

- Infibeam Avenues reported a 26.7% increase in operational revenue in FY25.

- Net profit in FY25 reached ₹160 crore, marking a 5% rise year-over-year.

- CCAvenue expanded operations to the US, UAE, Saudi Arabia, and Australia markets by 2025.

- Multi-currency payment processing supports 27 currencies for global merchants.

- Over 180,000 new merchants were activated on CCAvenue India in Q3 FY25.

- Mobile-friendly solutions include a responsive checkout and a dedicated merchant app launched in 2025.

- CCAvenue handles a Total Payments Value (TPV) of ₹8.67 trillion, up 23% YoY.

- The payments ecosystem has 4,900+ active competitors, including global and regional fintech firms.

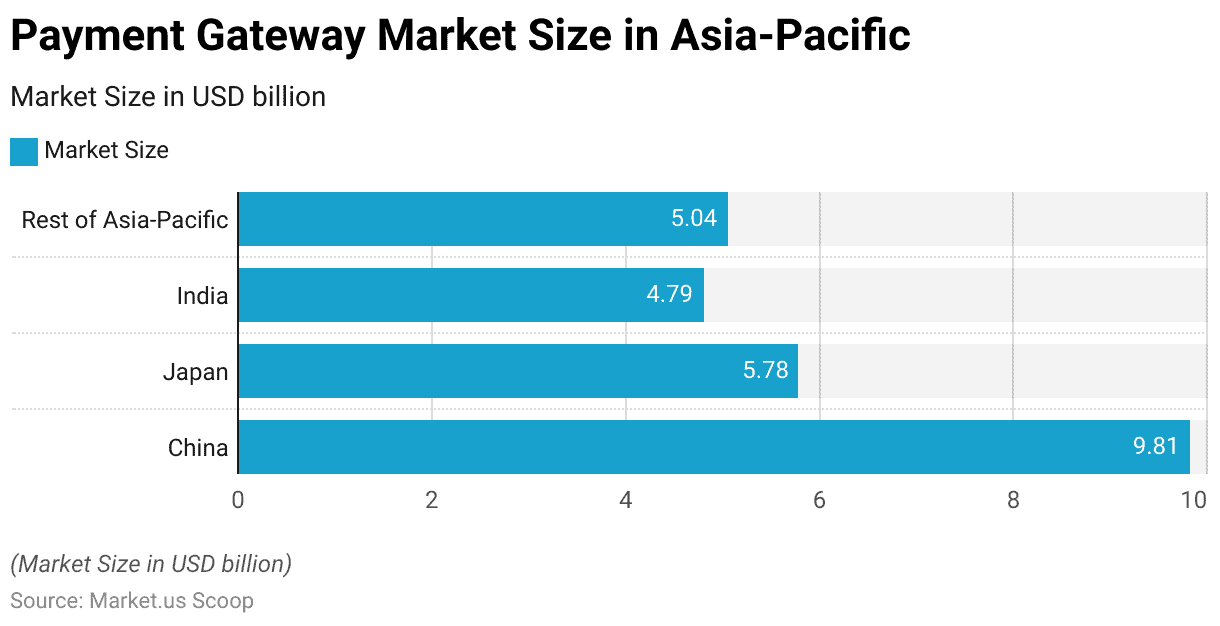

Asia-Pacific Payment Gateway Market Size Highlights

- China leads the region with a market size of $9.81 billion, reflecting its dominance in the Asia-Pacific digital payments space.

- Japan follows with a $5.78 billion market size, driven by high-tech adoption and consumer e-commerce trends.

- The Rest of Asia-Pacific contributes $5.04 billion, highlighting strong regional diversity in digital transaction infrastructure.

- India’s market size stands at $4.79 billion, underscoring its rapid growth and increasing digital payment adoption.

CCAvenue Overview

- CCAvenue serves over 3 million merchants across multiple sectors.

- Infibeam Avenues, the parent company, reported Rs 3,774 crore in consolidated revenue for fiscal 2025, up 27% year-on-year.

- CCAvenue supports payments in 27 different currencies and 240+ payment options, including credit cards, net banking, UPI, and wallets.

- The platform connects with 55+ Indian banks for payment processing.

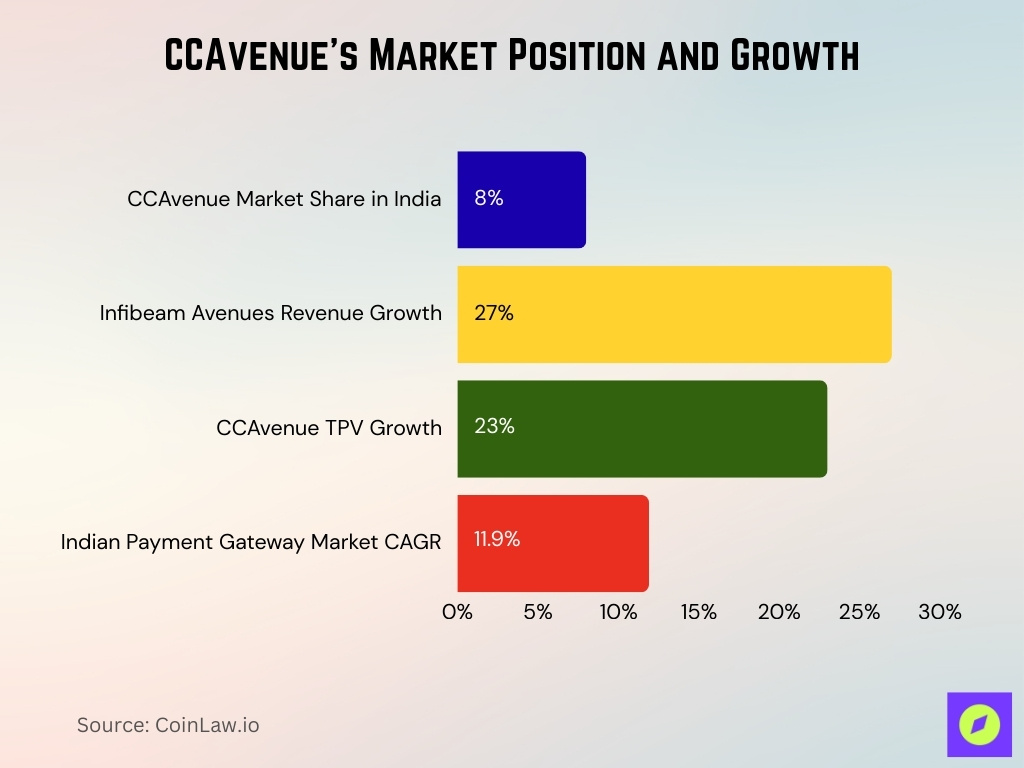

- Infibeam Avenues commands an 8% market share in India’s digital payments sector.

- CCAvenue’s transaction revenue per unit improved to 11.7 basis points in FY25 from 8.8 basis points in FY24.

- The proprietary FRISK fraud detection system maps transactions against a negative database covering over 90% of India’s merchants.

- Infibeam onboarded over 500,000 new merchants in the first half of FY24.

- CCAvenue offers 24/7 merchant support for payment troubleshooting and integration issues.

- Weekly settlements are made for all payment amounts above ₹1000, ensuring timely merchant payouts.

Users and Merchant Statistics

- CCAvenue supports nearly 3 million merchants across its payment network.

- The platform offers over 240 payment options catering to diverse merchant needs.

- It processes more than 100 million transactions annually.

- Merchants range from small e-commerce retailers to large enterprises and B2B companies.

- Supports payments in 27 currencies for global and domestic customers.

- Enables payments via credit/debit cards, net banking, wallets, prepaid cards, and EMI.

- Operational in markets including India, the US, the UAE, and Australia.

- Merchant retention benefits from 24/7 customer support and security compliance certifications.

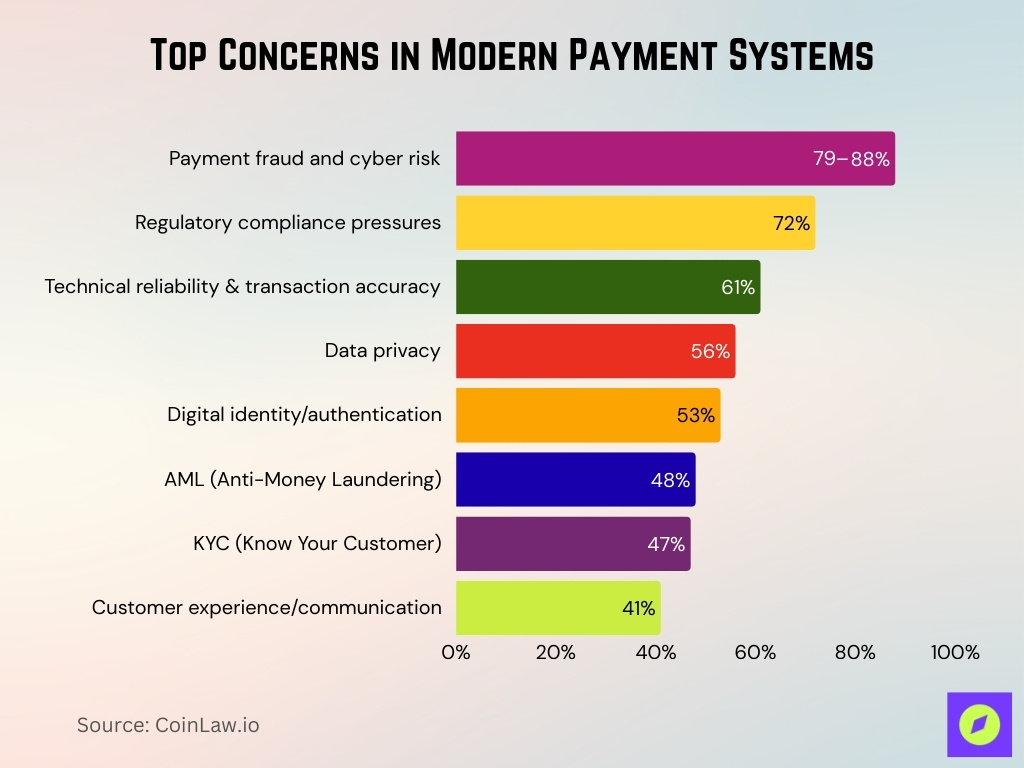

Top Concerns in Modern Payment Systems

- Payment fraud and cyber risk are the leading concerns, flagged by 79–88% of respondents, highlighting urgent security challenges in digital transactions.

- Regulatory compliance pressures were cited by 72%, showing the growing weight of legal obligations on payment service providers.

- Technical reliability and transaction accuracy raised concern for 61%, emphasizing the demand for flawless backend performance.

- Data privacy continues to be a major issue, with 56% identifying it as a critical challenge in safeguarding user information.

- Digital identity and authentication processes concern 53%, reflecting worries around identity theft and verification loopholes.

- Anti-Money Laundering (AML) protocols challenge 48% of stakeholders, indicating ongoing friction in meeting compliance and monitoring standards.

- Know Your Customer (KYC) requirements affect 47%, revealing concerns about onboarding, user verification, and compliance costs.

- Customer experience and communication round out the list at 41%, showing that usability and trust remain essential for adoption.

Transaction Volume and Growth Rates

- For FY2025, Total Payment Value (TPV), settled across its payment businesses, reached ₹8.67 lakh crore, up 23% from FY2024.

- In Q4 FY25, TPV reached ₹2,416 billion, marking a 7% year‑over‑year rise.

- On a quarterly basis, the net take‑rate improved to 11.7 bps in FY25, up from 8.8 bps in FY24.

- In FY24, TPV rose 58% YoY from ₹4.4468 lakh crore to ₹7.0434 lakh crore.

- India’s payment‑gateway market value reached $2.07 billion in 2025, supporting broader TPV growth.

- During Q2 FY25, TPV rose 14% YoY to ₹2,038 billion.

- Growth was driven partly by the adoption of digital PoS and offline payment solutions like TapPay.

- Expansion into international payments added incremental TPV.

Revenue and Financial Performance

- In FY2025, consolidated gross revenue reached ₹3,726 crore, up 26% from FY2024.

- Profit After Tax for FY25 totalled ₹160 crore, a 5% increase over the prior year.

- Infibeam Avenues Q4 FY25 revenue was ₹1,161 crore (₹11,605 million).

- Consolidated gross revenue for Q4 FY25 also stood at ₹11,605 million, up 62% YoY, with PAT up 53%.

- EBITDA in Q4 FY25 rose 25% YoY to ₹779 million, while net revenue grew 28%.

- FY2024 marked record highs, revenue ₹3,171 crore, up 62%, EBITDA ₹2526 million, up 41%, PAT ₹1478 million, up 56%.

- Net revenue in FY24 rose to ₹428 crore from ₹328 crore in FY23.

- Revenue supports expansion into domestic and international payments, including UPI initiatives.

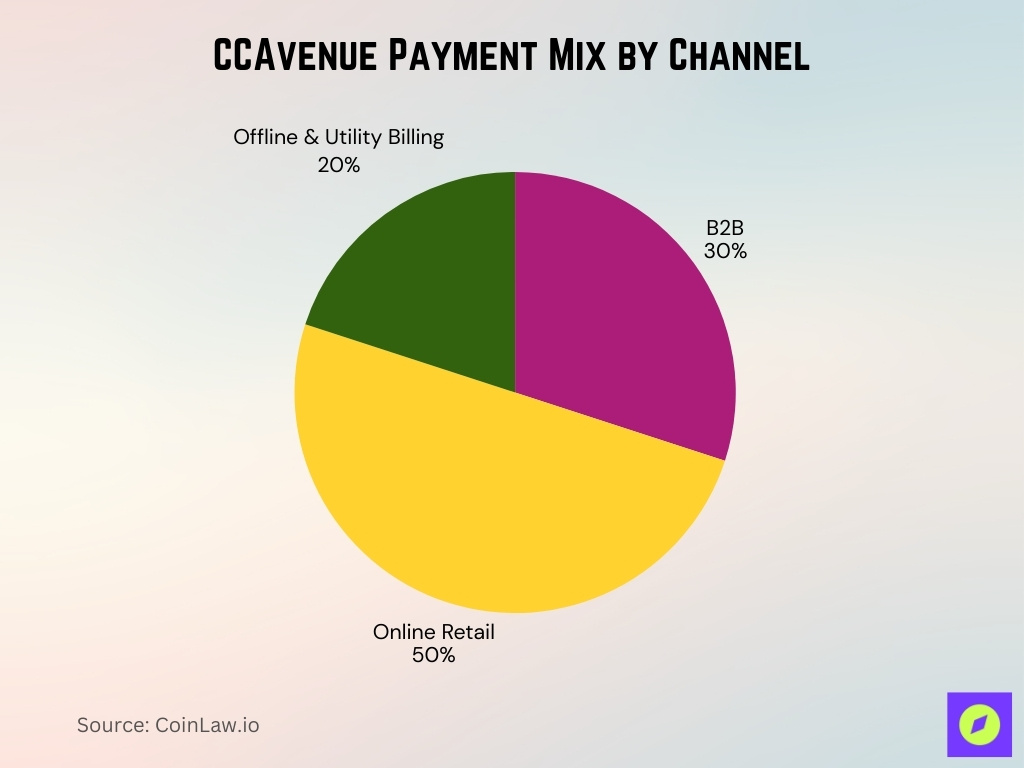

Customer Demographics and Segmentation

- Mix includes 30% B2B, 50% online retail, and 20% offline and utility billing.

- CCAvenue serves over 60% MSMEs alongside large enterprises.

- FY25 merchant growth was driven by a 45% increase in MSME sign-ups.

- International merchants account for 12% of total transactions.

- UPI transactions represent 64% of transaction volume, shaping merchant use.

- SME onboarding time reduced by 25% due to streamlined processes.

- Exporters and omnichannel sellers make up 18% of the merchant base.

- Adoption expanded into tier 2 and tier 3 cities, reaching 35% of total merchants.

- Sectors include retail, travel, healthcare, education, and government, with diverse vertical coverage.

- SaaS and service operators contribute 10% to transaction volumes on the platform.

Popular Payment Methods on CCAvenue

- CCAvenue supports over 200 payment methods, including cards, wallets, UPI, and EMI.

- The platform is PCI-DSS compliant version 3.2.1 for secure transactions.

- UPI accounted for 64% of India’s payment gateway transaction volume in 2024.

- TapPay SoftPoS increased acceptance at over 50,000 offline retailers nationwide.

- Supports major international card networks with payments in 27+ currencies.

- B2B payments include large-value net banking, eNACH, and invoicing options.

- Subscription billing supports recurring payments via tokenization and eNACH.

- Fraud prevention tools have improved transaction success by over 15%.

- Contactless NFC payments through TapPay facilitate faster merchant checkout.

- Wallet payments account for an estimated 15–20% of transaction volumes on Indian payment platforms, with CCAvenue’s share likely within this range depending on the merchant base and sector.

Competitors and Market Position

- Key competitors include Razorpay, PayU India, BillDesk, Instamojo, and Paytm Payments Bank.

- CCAvenue supports over 200 payment methods with multi-currency and offline TapPay support.

- Market growth CAGR is projected at 10% to 12% over the next 5 years.

- SoftPoS adoption grew to over 34.5 million merchants globally by 2027.

- CCAvenue’s omnichannel SoftPoS attracts retail merchants moving beyond online-only.

- Infibeam Avenues reported a 27% revenue surge in FY25 despite competition.

- CCAvenue holds a competitive edge in enterprise and B2B payment solutions.

- API-first gateways create pressure, but CCAvenue maintains robust integration features.

- TapPay-enabled offline payments cover 50,000+ retailers across India.

CCAvenue Market Share

- CCAvenue holds approximately 8% market share of India’s digital payments ecosystem.

- Infibeam Avenues reported a 27% revenue growth in FY25, reaching Rs 3,774 crore.

- CCAvenue’s Total Payment Volume (TPV) grew by 23% year-over-year in FY25.

- Indian payment gateway market is projected to grow at a CAGR of around 11.9% through 2030.

- India’s payment gateway market size is estimated at $2.07 billion in 2025.

- The platform ranks among the top 5 gateways alongside Razorpay, PayU, BillDesk, and Paytm Payments Bank.

- B2B and enterprise payments contribute to 30% of CCAvenue’s transaction volume.

- SME and international merchant growth expanded the total addressable market by 40% in FY25.

Strategic Partnerships and Alliances

- CCAvenue partnered with Ujjivan Small Finance Bank, Janata Sahakari Bank, and SNG Co-operative Bank in 2025.

- Partnership with Sutex Co-operative Bank enabled 100,000+ merchants to accept multi-currency and direct debit payments.

- Collaboration with ShopSe India introduced BNPL (Buy Now Pay Later) across millions of merchant websites.

- White-label gateway services provided to 20+ major banks and financial institutions.

- Partnerships target expansion in SME and rural segments, boosting financial inclusion.

- Integration with over 60 cooperative banks enhances trust among merchants.

- Alliances support cross-border commerce capabilities for international merchants.

- Ujjivan Small Finance Bank partnership provides over 200 payment options and 24/7 support.

Notable Clients and Case Studies

- Sutex Co-operative Bank processes multi-currency and direct debit payments for 100,000+ merchants.

- Clients span sectors including retail, travel, hospitality, SaaS, and utilities with broad industry adoption.

- Enterprise clients use CCAvenue for managing vendor payments, payouts, and recurring billing solutions.

- International merchants leverage CCAvenue’s multi-currency and cross-border payment capabilities in 27+ currencies.

- SME onboarding time reduced by up to 98% through automated and frictionless integration processes.

- CCAvenue’s B2Biz platform streamlines payments for marketplaces, covering hospitality and FMCG sectors.

- Over 23.5 million transactions processed in the UAE through CCAvenue.ae, supporting 5,000+ merchants.

- SaaS and service sector clients contribute to 10% of transaction volumes with subscription billing features.

CCAvenue Technology and Security

- CCAvenue is PCI DSS 3.2.1 compliant, ensuring secure payment processing.

- Solutions offered include SoftPoS, TapPay, TokenPay, and dynamic routing.

- Launched CommerceAI, an AI-powered payment orchestration platform in 2025.

- iFrame checkout supports merchants without PCI infrastructure for compliant payment integration.

- TapPay converts NFC devices into payment terminals, reducing hardware costs by up to 60%.

- White-label solutions include fraud prevention and risk management for 20+ banks.

- Supports payments in 27 international currencies via global infrastructure.

- Dynamic routing improves transaction success rates by 15-20%.

- TokenPay enhances security through payment tokenization in 95% of transactions.

Regulatory Compliance and Certifications

- CCAvenue maintains PCI DSS 3.2.1 certification for secure payments.

- Parent company holds a perpetual BBPS license for regulated bill payment services.

- CCAvenue has RBI in-principle approval to operate as a payment aggregator.

- Compliance framework reduces regulatory risk for 90% of partnered merchants and banks.

- Infrastructure meets data security, authentication, and fraud control standards mandated by regulators.

- White-label bank gateways ease regulatory compliance for over 20 financial institutions.

- BBPS compliance supports nationwide regulated bill payments through CCAvenue.

- Compliance framework positions CCAvenue for growth amid evolving regulatory landscapes.

- Security measures have cut fraud incidents by over 25% annually.

Recent Updates and Announcements

- In 2025, CCAvenue launched CommerceAI, an AI-powered automated payment platform.

- Expanded partnerships with over 10 co-operative and small finance banks in 2025.

- Multi-currency and direct-debit services with Sutex Bank are activated for 100,000+ merchants.

- BNPL and EMI payment options increased to cover over 25% of total transactions.

- Mobile app downloads surpassed 1 million with 4.5-star user ratings.

- SoftPoS adoption grew by 40% YoY, enhancing merchant offline payment acceptance.

- PCI DSS 3.2.1 compliance reaffirmed throughout 2025, reinforcing security standards.

- White-label bank gateway solutions expanded to support 20+ financial institutions.

- Transaction ecosystem transition underway, aiming for omnichannel, multilateral payment solutions.

- Monthly transaction volume crossed ₹700 billion by Q3 2025.

Frequently Asked Questions (FAQs)

Nearly 3 million merchants.

$2.07 billion.

11.9% CAGR

CCAvenue has had one funding round, Series A, raising $6.7 million.

Conclusion

CCAvenue continues to evolve, not merely as a payment gateway, but as a full‑fledged payment ecosystem. Through strategic alliances with banks and fintech partners, robust technology and security infrastructure, and recent innovations like CommerceAI and SoftPoS, it remains highly relevant across merchants, from small retailers to large enterprises. Its growing industry recognition and compliance credentials further reinforce trust among partners and users alike. As digital payments expand in India and beyond, CCAvenue appears well-positioned to capture future growth.