The process of buying a car has evolved into a significant financial decision for many Americans, with loans being the primary method for financing these purchases. Over the past decade, the auto loan market has witnessed rapid growth due to rising vehicle costs, low interest rates, and a consumer shift toward financing. Whether you’re a first-time buyer or someone looking to refinance an existing car loan, understanding the key statistics behind this market can help you make informed decisions.

The dynamics of car loans are influenced not only by economic factors but also by consumer behavior and trends in vehicle pricing. Let’s dive into the essential stats and trends that are shaping the car loan industry today.

Editor’s Choice

- Americans owe about 8.9% of their total consumer debt in auto loans.

- Roughly 19.3% of U.S. borrowers now have monthly car payments above $1,000.

- Auto loans 90+ days delinquent reached 5.02% of balances in Q3 2025.

- Subprime and deep-subprime borrowers account for about 22.1% of outstanding U.S. auto loan debt.

- EVs made up 11.36% of new vehicle financing in Q3 2025, up from 10.14% a year earlier.

- Average interest rates in Q4 2025 were 6.7% for new car loans and 10.6% for used car loans.

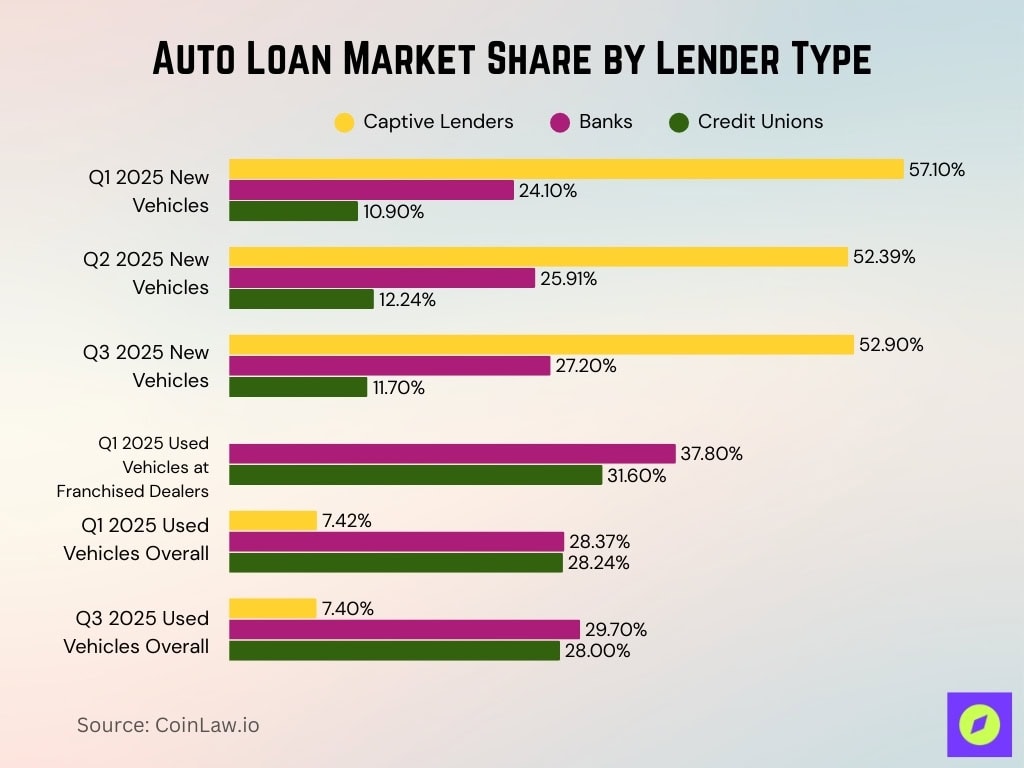

Auto Loan Distribution by Lender Type

- Captive lenders financed 57.1% of new vehicle loans in Q1 2025, while banks and credit unions financed 24.1% and 10.9%, respectively.

- In Q2 2025, captives’ share of new-vehicle financing was 52.39%, followed by banks at 25.91% and credit unions at 12.24%.

- In Q3 2025, captives held 52.9% of new-vehicle financing, with banks at 27.2% and credit unions at 11.7%.

- For used vehicles in Q1 2025, banks held 37.8% of loans at franchised dealers, followed by credit unions at 31.6%.

- In Q1 2025, overall used financing, banks captured 28.37%, credit unions 28.24%, and captives 7.42%.

- In Q3 2025, banks led used-vehicle financing with 29.7%, while credit unions held 28% and captives 7.4%.

- Across all auto loans in 2025, captives accounted for 26.63% of loans, with banks and credit unions also holding significant shares.

Impact of Economic Factors (Inflation, Rates, Auto Prices)

- In Q2 2025, average auto loan rates were 6.80% for new cars and 11.54% for used, keeping borrowing costs historically high despite easing inflation.

- The federal funds rate is now 3.5–3.75% after three cuts in 2025, yet auto APRs remain elevated due to inflation and credit risk pricing.

- Forecasts suggest average auto loan APRs around 7.1% in 2026, with a potential low near 6.8%, only slightly lower than late‑2025 levels.

- The average new‑vehicle transaction price was about $49,814 in November 2025, briefly exceeding $50,000 in September, showing persistent sticker-price pressure.

- Used‑car prices remain elevated in the mid‑$20,000s, limiting relief for budget‑constrained borrowers.

- The average nationwide monthly car payment climbed roughly 9% over two years to about $687, driven by higher prices and loan amounts.

- Auto loan balances reached about $1.57 trillion in 2025, with year‑over‑year growth slowing to 0.30% as high rates and prices cooled demand.

- Edmunds data show average new‑vehicle loans near $43,894 at 6.6% interest with $722 monthly payments, while used loans average $29,995 at 10.6% with $569 payments.

Borrower Demographics

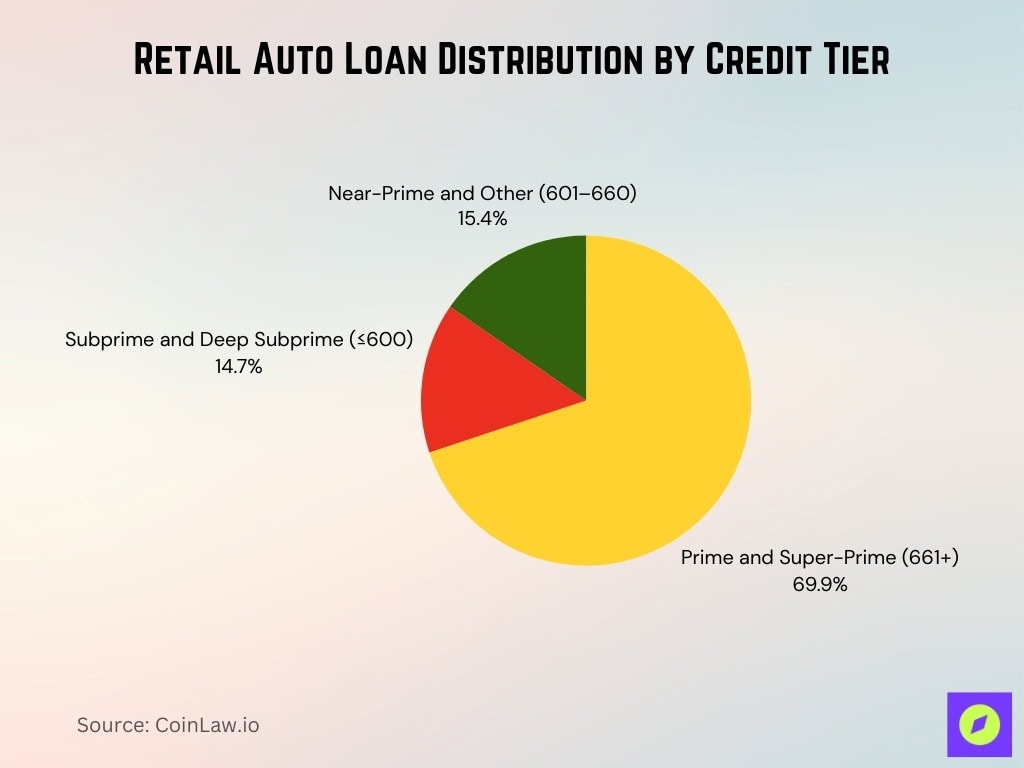

- Borrowers with prime or super-prime (661+) credit scores make up 69.9% of retail vehicle financing, while subprime and deep subprime (≤600) account for 14.7%.

- Americans ages 30–49 took out $83.6 billion in auto loans in Q3 2025, versus $72.5 billion for those 50+ and $27.6 billion for ages 18–29.

- Average auto loan balances in 2025 range from $17,180 for the Silent Generation to $27,836 for Gen X, with 40.9%–71.3% of adults carrying auto debt.

- Millennials represent the largest share of new auto demand, with 31% planning to purchase a vehicle between late 2024 and early 2025.

- Auto loans average $20,893–27,836, depending on age group, contributing to an overall average debt load of $104,755 per adult by mid‑2025.

- About 80.67% of new cars and 35.48% of used cars are financed, with average borrower credit scores of 754 and 691, respectively.

- Deep subprime borrowers (300–500) faced average interest rates of 15.85% on new and 21.60% on used auto loans, showing large cost gaps by credit tier.

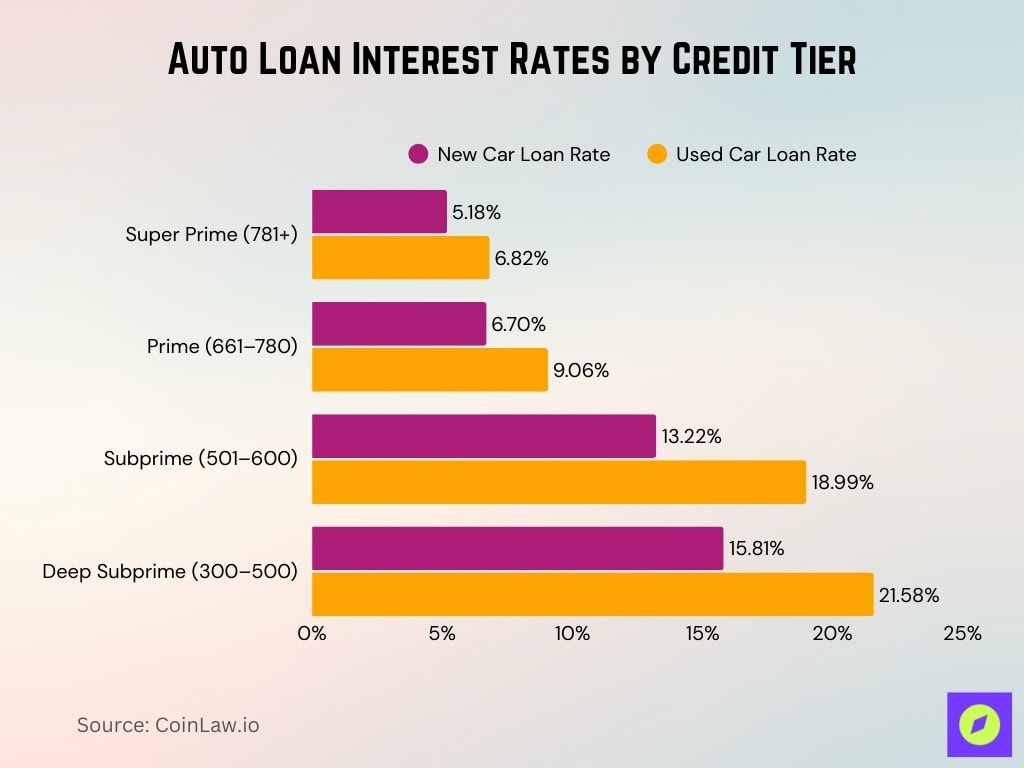

Auto Loan Interest Rates

- Super prime borrowers (781+) saw average rates of 5.18% on new car loans and 6.82% on used car loans in Q1 2025.

- Prime borrowers (661‑780) paid average rates of 6.70% for new car loans and 9.06% for used car loans in Q1 2025.

- Subprime borrowers (501‑600) faced average rates of 13.22% on new car loans and 18.99% on used car loans in Q1 2025.

- Deep subprime borrowers (300‑500) paid average rates of 15.81% for new car loans and 21.58% for used car loans in Q1 2025.

- As of early 2026, the average auto loan rate for a 60‑month new car loan is 7.01%.

- In Q1 2025, average interest rates were 6.73% for new car loans and 11.87% for used car loans.

- Top credit unions are advertising new auto loan APRs as low as 3.89% and used auto APRs starting at 4.79%.

- Leading online platforms list starting APRs around 3.39% for highly qualified borrowers on new auto loans.

New vs. Used Car Financing Trends

- New vehicles accounted for 43.3% of all automotive financing in Q1 2025, while used vehicles made up 56.7%.

- The average new‑vehicle loan amount reached $42,332 in Q3 2025, versus $27,128 for used vehicles.

- Average monthly payments were $748 for new‑car loans compared with $532 for used‑car loans in Q3 2025.

- Average interest rates stood at 6.56% for new‑car loans and 11.40% for used‑car loans in Q3 2025.

- Typical loan terms were 69.07 months for new‑car loans and 67.43 months for used‑car loans, showing only a small gap in payoff time.

- New‑vehicle loans with 73–84‑month terms climbed to nearly 30% of originations, while used‑vehicle loans in that band reached 27.22%.

- Loans longer than 85 months represented 2.31% of new‑vehicle and 1.06% of used‑vehicle originations, highlighting growing reliance on ultra‑long terms.

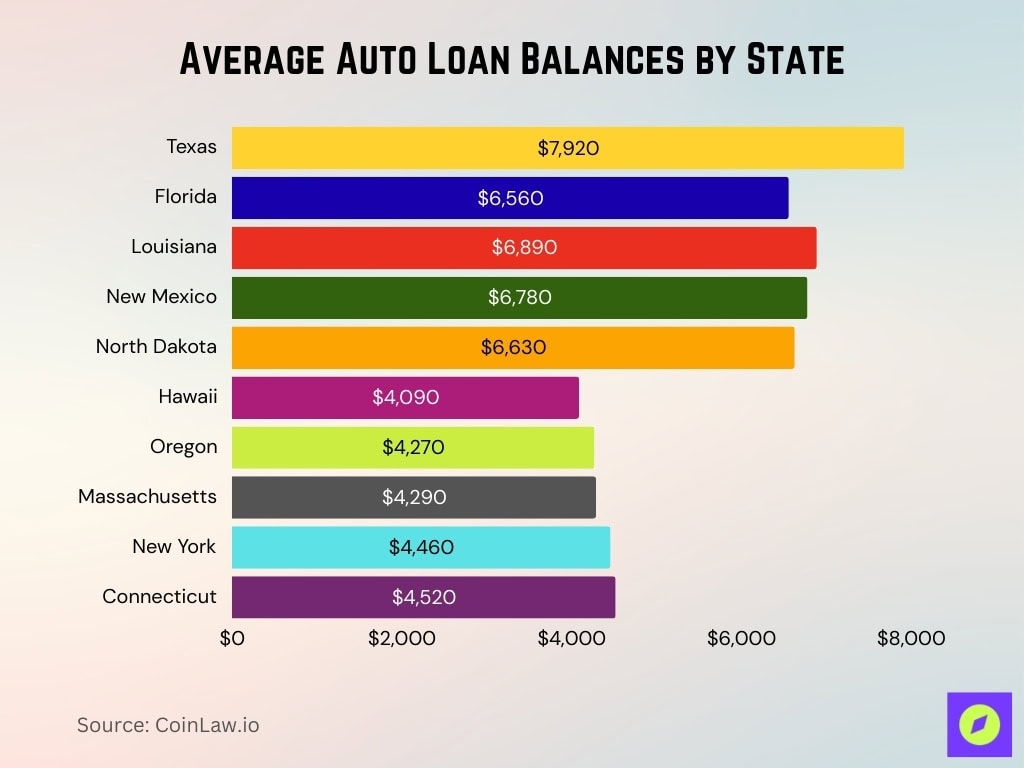

States with the Highest and Lowest Car Loan Balances

- Texas has the highest average car loan balance at $7,920, paired with an average delinquency rate of 7.92%.

- Florida’s average car loan balance is $6,560, alongside an average delinquency rate of 6.54%.

- Louisiana drivers carry an average car loan balance of $6,890, among the highest in the country.

- New Mexico’s average car loan balance stands at $6,780, reflecting elevated vehicle financing costs.

- North Dakota has an average auto loan balance of $6,630, ranking in the upper tier nationally.

- States with the lowest average balances include Hawaii at $4,090 and Oregon at $4,270.

- Massachusetts reports a low average auto loan balance of $4,290, followed by New York at $4,460 and Connecticut at $4,520.

Technological Innovations in Car Loan Processing

- Digital auto loan originations rose 29% year over year, with online channels now handling roughly 60% of new applications.

- Around 50% of financial institutions use AI in production for credit decisions, reducing loan decision times by 20–30% and credit losses by 5–10%.

- AI-driven credit assessment cuts underwriting costs by up to 50% and credit losses by as much as 15x in some lender case studies.

- Lenders using intelligent decisioning platforms report up to 50% of auto loan approvals automated, significantly speeding funding times.

- End-to-end digital loan workflows (e-signatures, e-docs, e-title) now account for an estimated 65–70% of auto loan originations.

- Since 2020, digital auto lending adoption has increased by 165%, making digital channels the dominant route for auto finance.

- Blockchain-based solutions in vehicle finance are projected to reduce operational costs, with the market growing at a 6.2% CAGR through 2032.

- Mobile-first digital lending channels drive global growth in digital lending, a market forecast to exceed $37 billion annually over the next decade.

Recent Developments

- EVs accounted for 11.36% of new vehicle financing in Q3 2025, up from 10.14% a year earlier.

- More than 56% of new EVs were leased in Q3 2025, up from just over 46% the prior year.

- EVs made up roughly 25% of all new vehicle leases by Q3 2025, up from under 18% in Q3 2024.

- The average new auto loan amount climbed to $42,332 in Q3 2025, with the average monthly payment rising to $748.

- The average used auto loan amount increased to $27,128, with the average monthly payment edging up to $532.

- New‑vehicle loans with 73–84‑month terms reached nearly 30% of originations, while terms over 85 months rose to 2.31%.

- Used‑vehicle loans with 73–84‑month terms rose to 27.22%, and loans over 85 months reached 1.06% of originations.

Frequently Asked Questions (FAQs)

The average monthly payment is $748 for new cars and $532 for used cars in Q3 2025.

Average loan amounts are $42,332 for new vehicles and $27,128 for used vehicles in Q3 2025.

About 80.67% of new cars and 35.48% of used cars are financed.

Roughly 5.1% of Americans with auto loans are delinquent on at least one account.

Conclusion

The car loan market continues to evolve, influenced by economic factors, technological advancements, and shifting consumer preferences. Rising interest rates, increasing vehicle costs, and the demand for electric vehicles are shaping the landscape of auto financing. Borrowers are becoming more reliant on digital tools and innovations like AI-powered loan processing, while lenders adjust to the growing complexities of the market. As economic uncertainty looms, staying informed about trends and rates will be crucial for consumers and lenders alike.