In the world of small businesses, access to capital is often the key to survival and growth. Over the years, business loans have become a lifeline for entrepreneurs aiming to expand their operations, weather financial storms, or simply keep up with the competition. This year brings new challenges and opportunities for businesses, with shifting loan trends and evolving financial landscapes. Whether it’s navigating through traditional bank loans or exploring alternative financing, small business owners need to stay informed to make sound financial decisions.

Editor’s Choice

- The total value of outstanding small business loans in the U.S. reached $1.08 trillion, marking a 2.4% year-over-year increase.

- Interest rates on small business loans ranged between 6.3% and 11.5% at banks.

- SBA guaranteed 85,000 loans totaling $45 billion in FY2025.

- 55% of approved applicants had personal credit scores of 700+.

- 65% of approved loans were for working capital needs.

- Online financing platforms for SMBs are valued at $4.43 billion.

Recent Developments

- Federal Reserve maintained the federal funds rate at 3.5%–3.75% in January 2026.

- The effective federal funds rate was recorded at 3.64% as of early February 2026.

- Fintech lenders handle a significant share of small business loan applications with real-time underwriting.

- Smaller targeted loans below six-figure thresholds represent a growing share of small business lending.

- Digital platforms enable faster approvals and flexible products for small businesses.

- ESG lending criteria now act as a formal credit risk layer in loan approvals.

- Lenders increasingly use ESG profiles to determine loan approval and pricing.

- Policy adjustments allow more non-bank participation in government-backed lending programs.

- Green incentives promote financing for energy-efficient equipment and sustainability projects.

- Small business credit growth shows mid-single-digit year-over-year gains entering 2026.

Small Business Loan Statistics

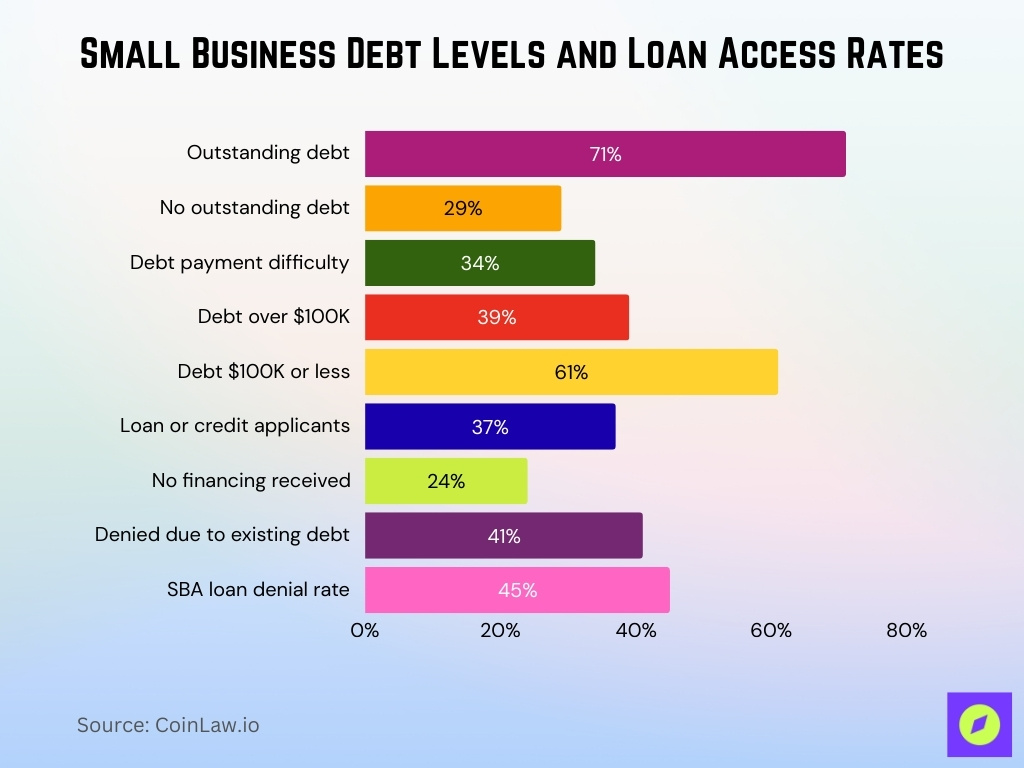

- 71% of small businesses had outstanding debt.

- 34% of small businesses reported challenges making debt payments.

- 39% of firms had more than $100,000 in outstanding debt.

- 61% of small businesses carried $100,000 or less in debt.

- 37% of small employer firms applied for loans or credit lines.

- 24% of applicants received no financing.

- 41% of denials cited too much existing debt.

- 45% denial rate for SBA loans and lines of credit.

- 29% of small businesses reported no outstanding debt.

Financial Statistics

- Median revenue of small businesses reached $1.12 million.

- Average revenue across all U.S. small businesses stood at $1,221,884.

- 39% of small businesses had less than one month of cash reserves.

- 51.3% would use reserves within 48 hours for payroll obligations.

- 19.6% of businesses 5 years or younger carried 3–12 months cash.

- 86% of small business owners paid themselves under $100,000 annually.

- Solo entrepreneurs averaged $49,489 yearly revenue.

- Businesses with 1-4 employees generated $387,000 annually.

- 30% of small business owners took no salary, reinvesting in growth.

- 78% of solo businesses earned under $50,000 annually.

Small Business Loan Application

- 26.9% of small business loan applications were approved by major banks.

- 52% overall approval rate across small business lenders.

- 55% of approved applicants had personal credit scores of 700+.

- 22% of approved borrowers earned less than $500,000 annually.

- 65% of recipients sought loans for working capital.

- Short-term loans dominated approvals among financing types.

- Online lenders approved 70% of small business applications.

- Traditional bank approvals averaged a 10-day turnaround time.

- 22% of loan denials due to lack of collateral.

- 37% of small businesses applied for financing.

Top Reasons Why Small Businesses Fail

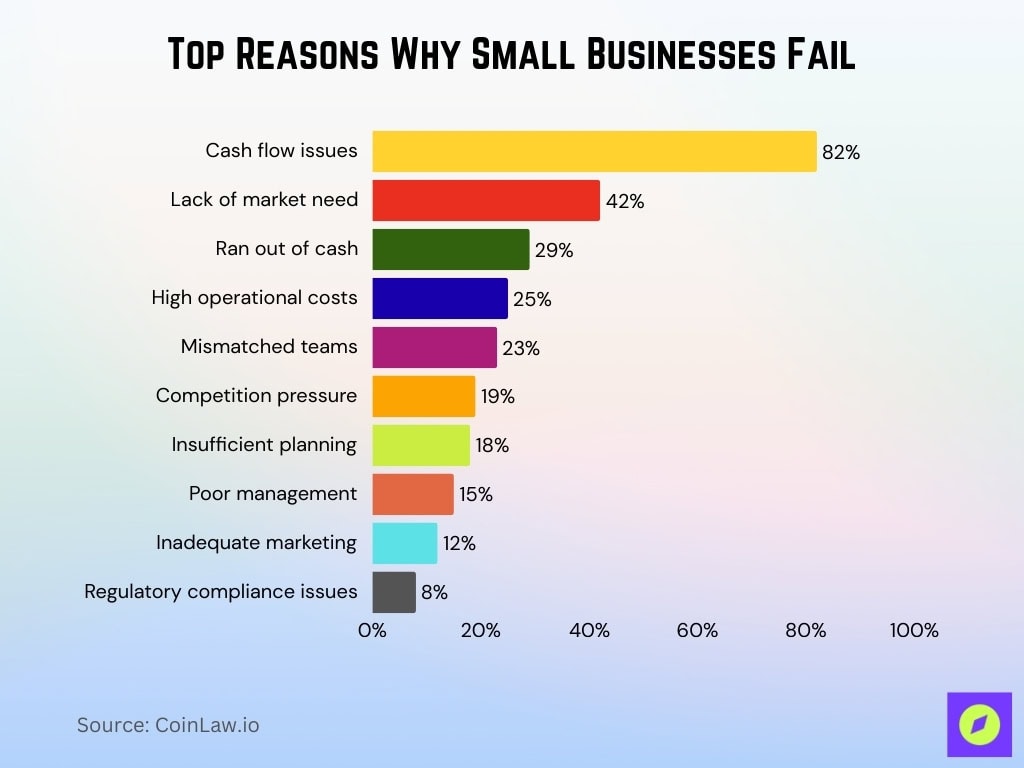

- Cash flow issues affected 82% of failed small businesses.

- Lack of market need impacted 42% of business failures.

- Running out of cash caused 29% of small business closures.

- Mismatched teams contributed to 23% of company failures.

- Competition led to the downfall for 19% of small businesses.

- Poor management practices affected 15% of failed businesses.

- Inadequate marketing reached only 12% of target customers.

- Regulatory compliance issues impacted 8% of closures.

- Insufficient planning caused 18% of early-stage failures.

- High operational costs overwhelmed 25% of small businesses.

Loan Demographics: Gender and Minority Insights

- Women-owned businesses had 36% loan approval rate, 15% lower than that of male-owned businesses.

- Minority-owned businesses were approved 13% less frequently than their white counterparts.

- Latino-owned businesses experienced 25% approval rate, 10% below average.

- The average loan size for female entrepreneurs was $67,035 vs $80,140 for males.

- SBA 7(a) program allocated 35% of loans to minority-owned businesses, totaling $15.2 billion.

- Black-owned businesses showed the largest increase in loan applications.

- 20.8% of SBA 7(a) loan funds awarded to >50% women-owned businesses.

- 71.6% of 7(a) loan dollars went to male-owned businesses.

Small Business Loan Amounts by Loan Type

- Term loans averaged $110,000 as the most popular financing type.

- SBA 7(a) loans averaged $443,097 with $31.1 billion disbursed.

- Microloans averaged $13,000 amid growing demand.

- Lines of credit averaged $22,000, used by 60% for cash flow.

- Equipment financing loans averaged $110,000 for construction firms.

- Merchant cash advances ranged from $5,000 to $200,000 with >30% APR.

- Invoice factoring provided up to 90% of invoices, averaging $100,000.

- Short-term loans dominated, with an average size of $50,000.

- Working capital loans averaged $75,000 for 65% of recipients.

How Long Does It Take to Spend Business Loan Funds

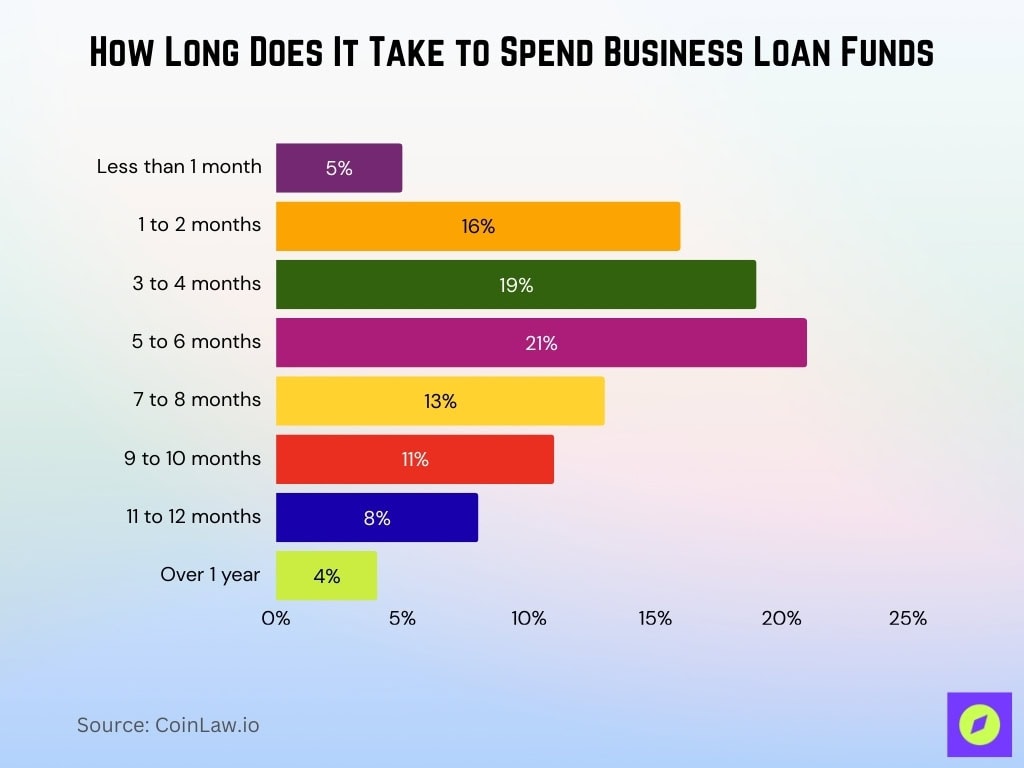

- 5% of businesses spent loan funds in less than 1 month.

- 16% used funds within 1–2 months.

- 19% took 3–4 months to fully utilize the loan.

- 21% spent the loan in 5–6 months, the most common timeframe.

- 13% took 7–8 months for fund usage.

- 11% needed 9–10 months to exhaust funds.

- 8% spent on loans in 11–12 months.

- 4% took over 1 year to use the loan.

Existing and Emerging Lending Trends

- Alternative lending platforms captured 52% of the small business lending market.

- 30% of online lenders use AI for loan approvals to reduce biases.

- The peer-to-peer lending market is valued at $1.2 billion.

- 10% of lenders adopted blockchain for secure loan processes.

- Green business loans increased 20% year-over-year due to incentives.

- 18% of small businesses used BNPL for operational expenses.

- SBA 7(a) loan demand rose with 2% limit increase.

- Digital loan platforms processed 75% of small business applications.

- Fintech lenders doubled over five years for faster approvals.

Alternative Financing Options

- Crowdfunding is used by 10% of small businesses on platforms like Kickstarter.

- Revenue-based financing reached $9.81 billion, up 70.1%.

- Merchant cash advances offered quick funding with 20-40% APR fees.

- Factoring and invoice financing accounted for 15% of alternative methods.

- Angel investors funded the tech and healthcare sectors most heavily.

- 18% of businesses utilized BNPL services for expenses.

- Small business grants increased from state and federal sources.

- Venture debt provided flexible non-dilutive capital to startups.

- 25% of small businesses chose online alternative lenders.

Breakdown of Credit Score Factors

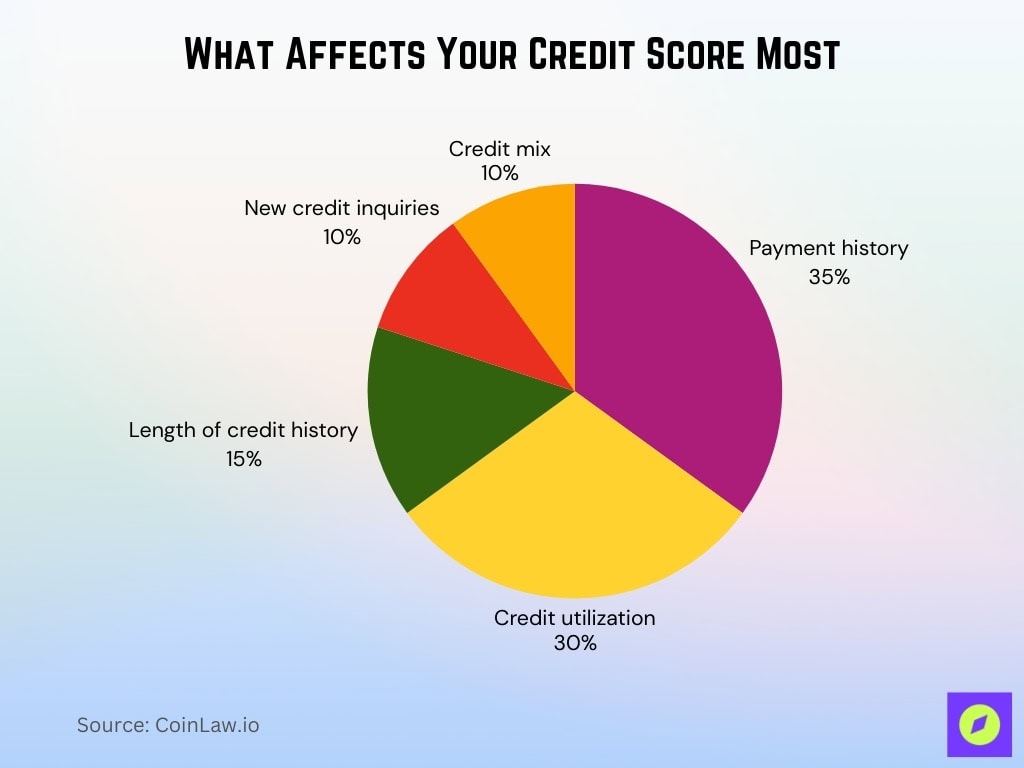

- 35% of a credit score is based on payment history.

- 30% influenced by amounts owed relative to credit limits.

- 15% depends on the length of the account history.

- 10% affected by new credit inquiries and accounts.

- 10% shaped by credit mix diversity.

- Payment history remains the most influential factor at 35%.

- Utilization ratio under 30% weight impacts scores heavily.

Frequently Asked Questions (FAQs)

Approximately 65% of approved small business borrowers reported using loan funds for working capital needs in 2026.

Around 52% of small business applicants in recent Federal Reserve‑related data received the full amount of loan funding requested.

The U.S. small business loan market was estimated at over $1.4 trillion as of early 2026.

Nearly 22% of approved small business borrowers in 2026 had under $500,000 in annual revenue.

Conclusion

Small businesses are navigating an ever-changing lending landscape. Whether they seek traditional loans, explore alternative financing, or utilize emerging financial technologies, access to capital remains crucial for growth and sustainability. By understanding current trends in lending, interest rates, and risk mitigation strategies, small business owners can better position themselves for success.

The rise of digital banking, AI-driven loan approvals, and alternative funding sources provides promising opportunities, but businesses must also be mindful of potential risks and ensure they have the right financial strategy in place. As the small business sector continues to evolve, staying informed and adaptable will be key to navigating the financial challenges and opportunities of the coming year.