The blockchain gaming sector is carving out a distinct niche in the broader gaming industry by merging gameplay with tokenised economies and asset ownership. In one scenario, developers are structuring games so that players can trade NFTs (non-fungible tokens) earned in play for real-world value, and in another, investors are funding studios that build virtual worlds where land parcels behave like real estate. This convergence of entertainment and financial mechanics is shaping new revenue streams. Read on to explore detailed stats across market size, recent developments, and core revenue mechanisms.

Editor’s Choice

- $24.4 billion, the estimated global market size for blockchain gaming in 2025.

- CAGR ≈ 62.6%, projected growth rate for the blockchain gaming market from 2025 to 2033.

- 4.66 million average daily active wallets engaged in blockchain gaming in Q3 2025.

- Asia-Pacific ~28.7%, share of the blockchain gaming market in 2024.

- Play-to-earn (P2E) games make up ~62% of blockchain gaming revenue in 2025.

- 4.4%, decline in daily active wallets in Q3 2025 (vs prior quarter).

- Mobile segment ~55.2% share of the blockchain gaming market in 2025.

Recent Developments

- In Q3 2025, the blockchain gaming sector recorded 4.66 million active wallets per day, representing a 4.4% drop from the previous quarter.

- Despite the drop, blockchain gaming remained the dominant dApp category with 25% of all active wallets in the Web3 ecosystem during Q3 2025.

- Funding and user-activity levels in blockchain gaming fell by more than 60% year-on-year in late 2025, indicating a phase of correction.

- A number of high-profile blockchain game projects shut down or paused development, reflecting consolidation in the space.

- Several gaming chains and platforms saw relative growth; for example, Kaia network posted a 229% boost in active wallets during Q3 2025.

- More established chains like opBNB remained leaders in blockchain gaming wallet activity, with 1.05 million active wallets in Q3.

Top Gaming Blockchains

- opBNB leads with 1,050,000 average daily users and a 6% QoQ increase.

- Sei surges to 802,000 users, delivering an impressive 86% quarterly jump.

- Nebula | Skale records 647,000 users with a steady 15% QoQ rise.

- Kaia posts explosive growth, reaching 462,000 users and a massive 229% increase.

- Ronin shows strong momentum at 419,000 users with a 55% quarterly gain.

Market Share by Region

- The Asia-Pacific region held approximately 28.7% of the blockchain gaming market in 2024.

- A separate report estimated Asia-Pacific’s share at ~42.1% in 2025, indicating strong regional dominance.

- North America was reported to have a ~25.4% share in 2025 and was described as the fastest-growing region.

- For context, another report cited North America’s share at ~23.87% in 2022.

- Emerging markets (Southeast Asia, Latin America) are attracting attention owing to mobile penetration and P2E adoption, though reliable region-specific share data remains thin.

- Regional regulatory environments (especially in Asia) vary widely and impact growth potential.

Play-to-Earn (P2E) Revenue Statistics

- P2E games accounted for roughly 62% of blockchain gaming revenue in 2025.

- The global P2E market (a subset of blockchain gaming) is projected to grow from $2.7 billion in 2024 to $26.59 billion by 2034 (CAGR ~25.7%).

- In 2024, the North American P2E market was estimated to generate around $1 billion in revenue, holding ~37.4% share.

- Role-playing games (RPGs) captured over 34.7% of the P2E market in 2024.

- Mobile games contributed over 38.6% of the P2E market share in 2024.

- Although P2E has proven popular, growth in user activity and funding has slowed, with more emphasis on sustainability rather than speculative churn.

- Analysts warn that token-value volatility and regulatory uncertainty continue to pose risks to P2E revenue sustainability.

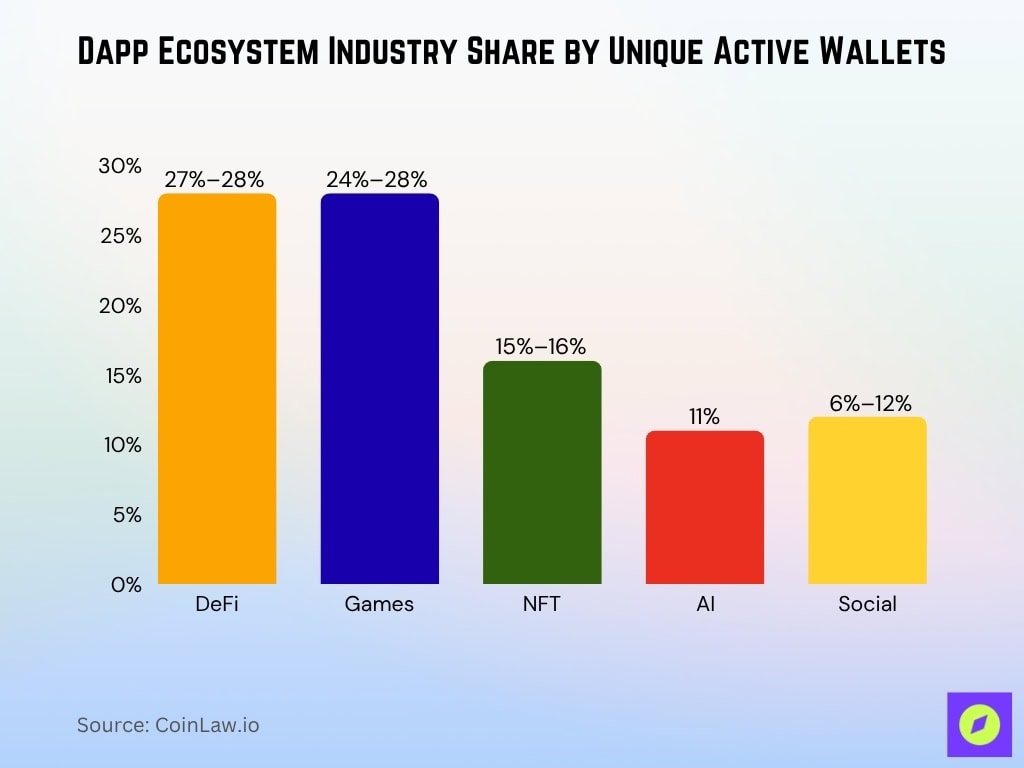

Dapp Ecosystem Industry Share by Unique Active Wallets

- DeFi leads the ecosystem with a 27–28% share, showing strong traction among Web3 users.

- Games remain a major driver of activity, capturing 24–28% of total UAW in Q3 2025.

- NFT dapps hold a solid 15–16% share, reflecting steady engagement across collectibles and digital assets.

- AI dapps account for 11%, highlighting growing but still emerging adoption.

- Social dapps show fluctuating activity with a 6–12% share depending on category and user trends.

Mobile vs. Desktop Revenue Breakdown

- Mobile gaming generated $92.6 billion in 2024, comprising 49% of the total gaming market.

- The mobile segment in blockchain gaming is projected to hold about 55.2% market share in 2025.

- Global mobile game revenue is expected to surpass $111 billion in 2025.

- Mobile in-app purchases revenue reached $150 billion in 2024, growing 13% year-over-year.

- Desktop (PC) gaming revenue accounted for approximately $43.2 billion in 2024.

- Over 73% of blockchain games in 2025 are designed for mobile platforms to maximize accessibility.

- PC gaming microtransactions made up 58% of the $37.3 billion PC gaming revenue in 2024.

Revenue from In-Game Asset Sales

- Globally, in-game purchases (microtransactions) account for ≈ 76% of all online gaming revenue in 2025.

- The gaming-NFT report indicates that the “in-game assets” segment held around 42% share in 2025 of the gaming NFT market.

- The broader mobile/desktop gaming industry saw average annual spend per gamer of about $$147 in microtransactions in 2025.

- Asset rentals and leasing in blockchain games grew by 35% in transaction volume during 2025.

- Tokenized in-game asset markets now account for 42% of total blockchain gaming revenue in 2025.

- Players exhibit 25% higher willingness to pay for blockchain assets with true resale ownership rights.

- Developers report 60% more stable revenue from asset sales compared to speculative token drops.

- Integration of asset sales with gameplay increased player engagement by 30% in leading blockchain games.

- Secondary market sales contribute to 20-25% of lifetime monetization per player in blockchain games.

- Guild model asset leasing comprises roughly 18% of blockchain game economy transactions in 2025.

- Direct in-game purchase of tokenized assets increased by 3.1x after integration of localized payment solutions.

- Play-to-earn games with asset sale models saw a 40% revenue increase in 2025 compared to traditional blockchain games.

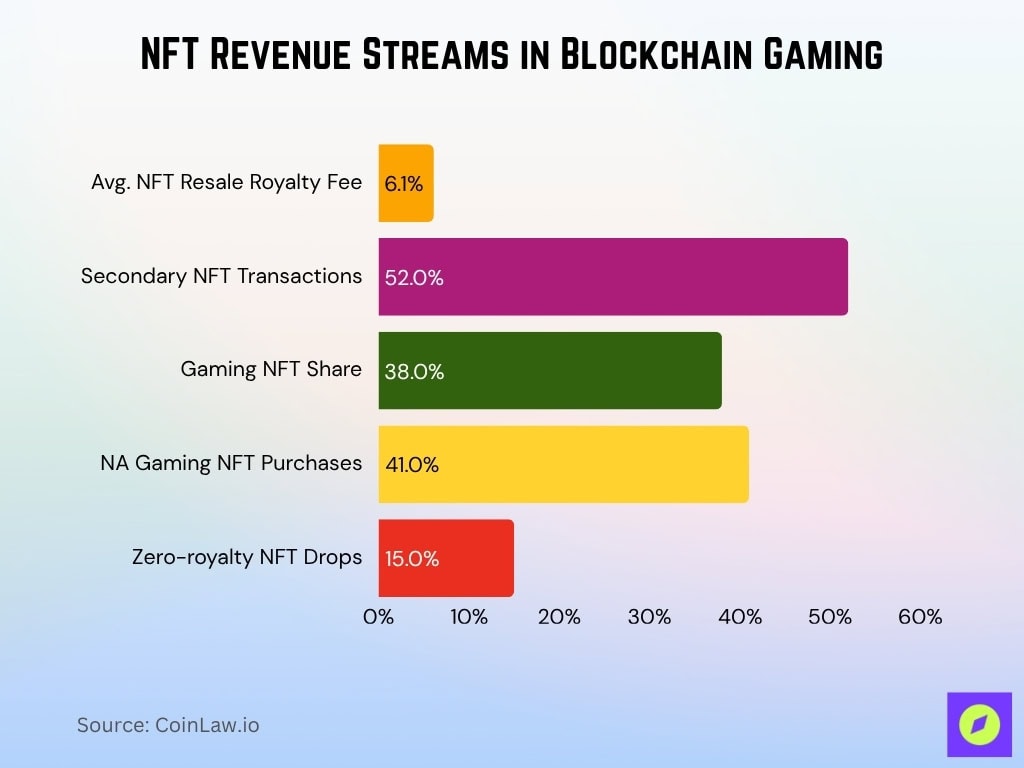

NFT Revenue in Blockchain Gaming

- On average, a roughly 6.1% royalty fee is being applied to NFT resale markets in 2025.

- Secondary NFT sales now constitute 52% of all NFT transactions in 2025.

- Gaming NFTs represent about 38% of total NFT transaction volume in 2025.

- The North America region contributes roughly 41% of global NFT purchases in gaming.

- Zero-royalty NFT drops make up around 15% of total new NFT releases in 2025.

- Ethereum-based creators earned over $$920 million in NFT royalties alone in 2025, indicating significant secondary market activity.

- NFT asset resale volumes in some blockchain gaming ecosystems reached hundreds of millions of dollars in 2025.

- Asia-Pacific NFT market share in gaming is projected between 30% and 35%, growing fastest.

- NFT resale and royalty streams are becoming a larger share versus primary mint sales, shifting value.

- The NFT market’s annualized trading volume is expected to land between $5 billion and $6.5 billion in 2025.

Demographics of Blockchain Gaming Revenue

- In 2025, the total population of blockchain gamers reached approximately 102 million, representing a 72% year-on-year increase.

- Among blockchain gamers in 2025, 71% are aged between 18 and 34.

- Female participation in blockchain gaming rose to 34% in 2025, up 4 percentage points from the prior year.

- In the U.S., 54% of blockchain gamers already own cryptocurrency, and 82% express interest in using it for in-game purchases.

- Among blockchain gaming players, 32% reportedly earn over $$100 per month from P2E games or NFT trading in 2025; top earners exceed $$600 monthly.

- Over 83% of blockchain gamers participate in communities such as Discord, Telegram, or Reddit, driving engagement and asset trading.

- The United States, India, and China together account for about 62% of the global blockchain gamer base in 2025.

- Retention remains strong in blockchain gaming, approximately 52% of players remain active 90 days after onboarding.

- Wallet integration is widespread; about 93% of blockchain games in 2025 offer wallet support such as MetaMask or Phantom.

Partnerships and Investment in Blockchain Gaming

- In 2025, the blockchain gaming sector raised only $$293 million in investment, a sharp drop from $$1.8 billion in 2024.

- In Q1 2025, gaming-related venture capital amounted to just $$91 million, representing a 71% quarter-on-quarter decline.

- Despite lower funding, the number of deals increased by 35% in Q1 2025, suggesting investor interest is shifting toward earlier-stage infrastructure rather than large consumer games.

- Around $565 million was raised by a major blockchain-gaming/VC firm (Animoca Brands) in 2022, illustrating earlier exuberance.

- Institutional interest in virtual land and GameFi ecosystem infrastructure remains high, even as funding flows contract.

- Some major deals are shifting toward opportunities in the underlying infrastructures (Layer-2, scaling solutions) rather than individual games.

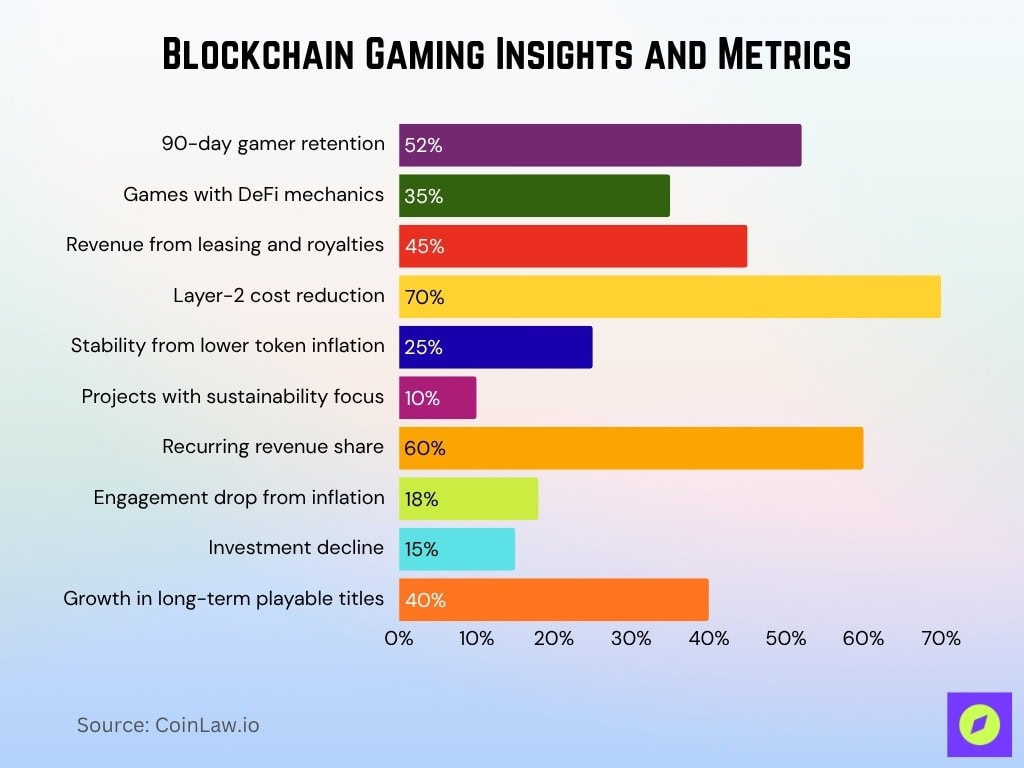

Sustainability and Revenue in Blockchain Gaming

- Only 52% of blockchain gamers remain active after 90 days, showing retention challenges in 2025.

- About 35% of blockchain games incorporate DeFi-style mechanics like staking and yield.

- GameFi projects are generating 45% of revenue from leasing models and secondary-market royalties.

- Developers optimize for Layer-2 solutions, reducing transaction costs by up to 70%.

- Titles reducing token-reward inflation report 25% higher player economy stability.

- Research shows that less than 10% of blockchain gaming projects address environmental sustainability.

- Recurring revenue models account for 60% of total income in leading blockchain games.

- Player engagement drops by 18% when token inflation mechanisms are too aggressive.

- Sustainable monetization concerns cause new investment in blockchain gaming to decline by 15% in 2025.

- Playable long-term game experiences increased by 40% in blockchain game releases in 2025.

Regulatory Impact on Revenue Growth

- Regulatory uncertainty is cited as a constraint by 28% of blockchain gaming companies in 2025.

- Average daily active wallets in blockchain gaming were 4.66 million in Q3 2025, down 4.4% from the previous quarter.

- About 45% of blockchain games will integrate game-specific tokens in 2025, raising classification questions.

- Regions with clearer regulations, like Singapore, see tokenized gaming adoption growing 30-40% faster.

- App store policies restrict crypto game listings, with 30% fewer new blockchain games approved in major stores.

- KYC/AML compliance requirements affect player entry in regulated markets, reducing participation by 15-20%.

- Governments scrutinize play-to-earn schemes, with 35% of top titles undergoing tax/labor law reviews.

- Regulatory clarity is rated as a top growth factor by 52% of blockchain gaming developers.

- EU’s MiCA regulation enforcement from Q4 2025 increases compliance costs by 12-15% for game developers.

- Blockchain gaming revenue growth slowed by 10-12% in markets with ambiguous regulations in 2025.

Blockchain Gaming vs. Traditional Gaming Revenue

- The global video-game market is projected to $200 billion in 2025.

- Digital distribution accounts for about 95% of traditional game sales in 2025.

- Traditional games mainly use upfront purchases, subscriptions, and DLCs for revenue.

- Blockchain gaming relies on over 60% on asset sales, token economies, and trading.

- Traditional gaming monetization models provide 85% more predictable revenue than blockchain games.

- Revenue volatility in blockchain gaming is approximately 3x higher than in traditional titles.

- Around 12% of traditional publishers are experimenting with blockchain or NFT integration in 2025.

- Blockchain gaming revenue is about 4% of the $522.5 billion global games market in 2025.

Frequently Asked Questions (FAQs)

≈ 55.2%.

≈ 69.1%.

$24.4 billion.

Conclusion

The revenue landscape of blockchain gaming presents a mixed picture, with rapid expansion in player participation and novel monetization models, yet meaningful scale compared to traditional gaming remains modest. Demographics show younger, crypto-savvy players driving growth, investment, and partnerships are tightening as sustainability and regulatory clarity become central. Comparisons with mainstream gaming highlight both opportunity and the distance to go. Developers, investors, and industry watchers should focus on durable game design, sound tokenomics, and regulatory preparedness to capture revenue potential.