Every year, Black Friday kicks off the holiday shopping season with enticing deals and doorbuster discounts. While this event is eagerly anticipated by shoppers, it also ushers in a surge in consumer spending and, inevitably, a spike in consumer debt. The stakes are higher than ever, with trends indicating a significant shift in spending patterns, payment preferences, and borrowing habits. This article delves into the statistics shaping consumer debt on Black Friday, helping you navigate the holiday season with informed insights.

Editor’s Choice

- $11.8 billion in online Black Friday sales marked a 9.1% increase from 2024, fueling debt accumulation.

- BNPL volume hit $747.5 million on Black Friday alone, up 8.9% year-over-year amid tightening credit.

- Holiday BNPL spending is projected to exceed $20 billion by year-end, an 11% rise from 2024.

- 41% of BNPL users missed payments in the prior year, with high-income borrowers most prone to late fees.

- Cyber Monday BNPL usage is forecast to surpass $1 billion ($1.04 billion), up 5% year-over-year.

- Klarna reported 45% YoY growth in BNPL volume from November 1 to Black Friday 2025.

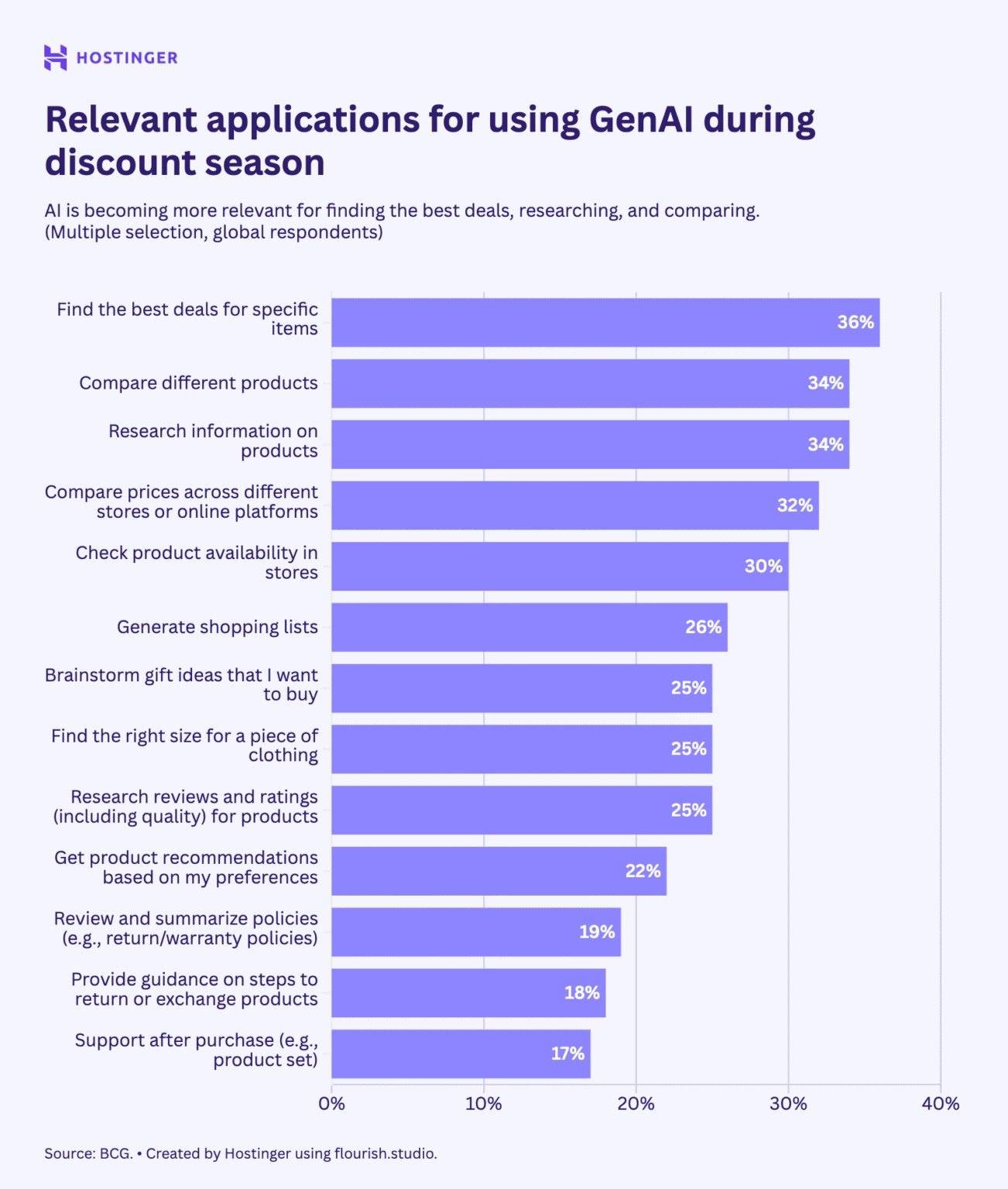

How Shoppers Use GenAI During Discount Season

- 36% of shoppers use GenAI to find the best deals for specific items.

- 34% rely on GenAI to compare different products before buying.

- 34% also use it to research product information during shopping.

- 32% turn to GenAI to compare prices across stores or platforms.

- 30% use GenAI to check product availability in stores.

- 26% leverage it to generate shopping lists.

- 25% use GenAI to brainstorm gift ideas they want to purchase.

- 25% turn to AI to find the right size for clothing items.

- 25% also check reviews and product ratings through GenAI.

- 22% rely on GenAI for personalized product recommendations.

- 19% use it to review or summarize policies, such as returns or warranties.

- 18% look for guidance on returns or exchanges using GenAI.

- 17% seek post-purchase support, like help setting up products.

Black Friday Spending Trends

- Black Friday 2025 spending is projected to reach $118 billion.

- Online sales accounted for around 60% of Black Friday spending, with mobile purchases driving much of this growth.

- In-store foot traffic declined 5.3% year-over-year, with 122 million visits nationwide.

- The average household budget for Black Friday 2025 increased to $900, a rise from previous years.

- Electronics comprised 45% of all Black Friday purchases, followed by clothing at 23%.

- Consumers aged 25 to 40 contributed to 55% of Black Friday spending, leading all age groups.

- Retailers offering 0% BNPL services observed a 30% higher conversion rate over non-BNPL competitors.

- Impulse buying accounted for 22% of purchases, with shoppers overspending by an average of $200.

- Average discounts across categories were 30%, with high-demand items like gaming consoles seeing up to 50% markdowns.

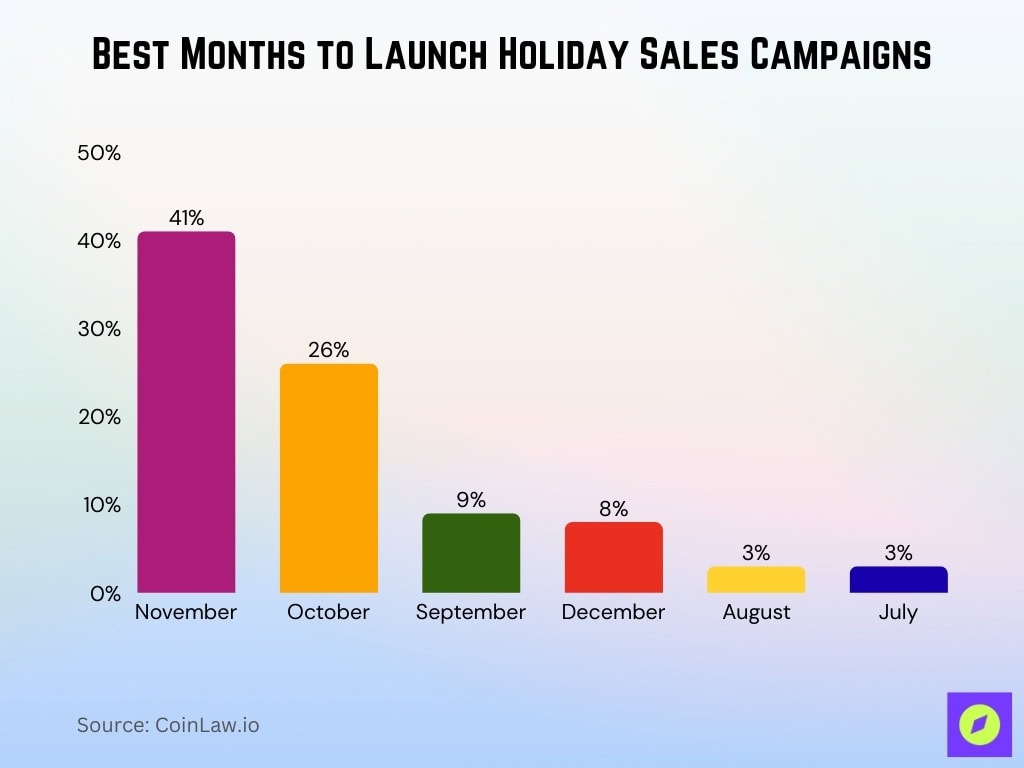

Best Months to Launch Holiday Sales Campaigns

- 41% of respondents say November is the ideal time to start holiday promotions.

- 26% believe October is the right month to kick off campaigns.

- 9% prefer launching as early as September.

- Only 8% think December is ideal, despite being the peak shopping month.

- Just 3% recommend starting in August or July.

Impact of Buy Now, Pay Later (BNPL) Services

- BNPL accounted for $747.5 million in Black Friday online spending, up 8.9% year-over-year.

- Klarna reported 45% YoY growth in BNPL volume from November 1 to Black Friday 2025.

- Cyber Monday BNPL usage reached about $1.04 billion, marking approximately 5% growth from 2024.

- 79.4% of Cyber Monday BNPL transactions occurred on mobile devices.

- Holiday BNPL spending projected to exceed $20 billion by year-end, up 11% from 2024.

- Adyen processed a 43% increase in online BNPL volume on Black Friday compared to the previous month.

- 41% of BNPL users reported late payments in the prior year, the highest among high-income borrowers.

- Apparel and electronics drove 60% of BNPL transactions during Black Friday 2025.

- Retailers with BNPL options saw 25% higher average order value during Black Friday sales.

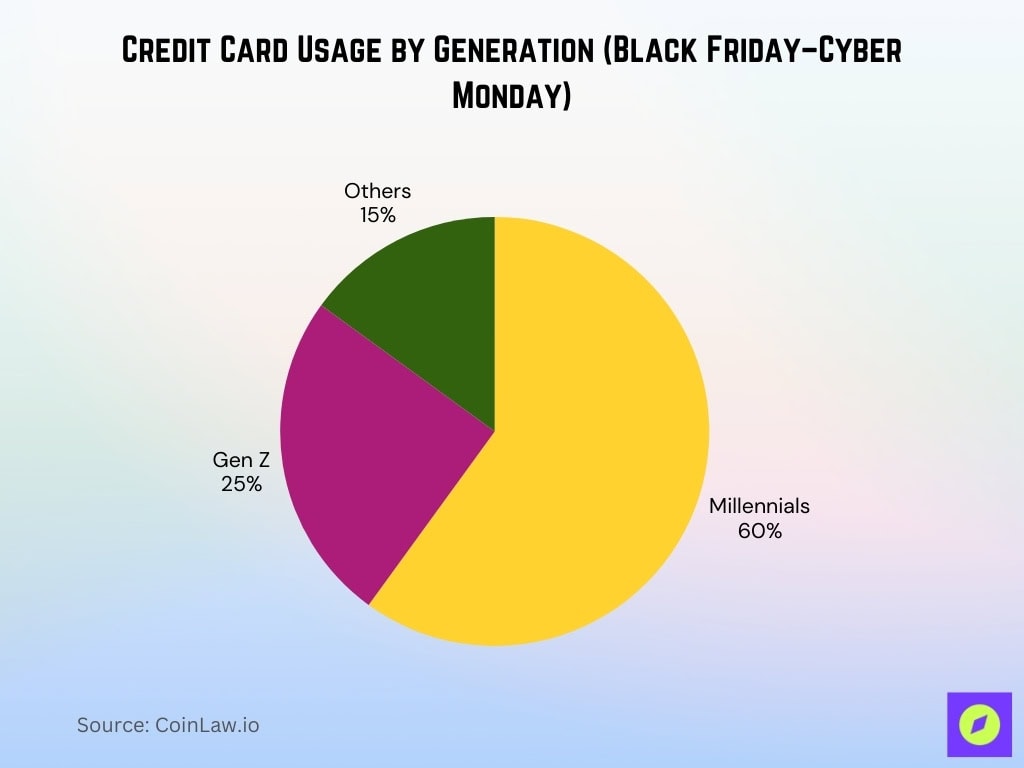

Credit Card Usage and Debt Accumulation

- Millennials showed the highest credit card usage at 60% during Black Friday-Cyber Monday period.

- Gen Z contributed 25% of credit card spending despite BNPL preference on Black Friday.

- Credit cards remained primary for 45% of Black Friday shoppers in 2025, trailing BNPL growth.

- Total U.S. credit card debt hit a record $1.23 trillion in Q3 2025, up 5.75% year-over-year.

- Black Friday retail sales grew 4.1% year-over-year per Mastercard SpendingPulse, capturing all payment types.

- Credit card balances per borrower averaged $6,618 at the start of 2025, up 1.2% from 2024.

- 72% of consumers shopped unfamiliar sites using credit cards, raising fraud exposure risks.

- Holiday credit card delinquencies expected to rise 8% in Q1 2026 from Black Friday debt.

Financial Management Strategies During the Holiday Season

- Prepaid card usage surged 32% for mobile wallets, helping Gen Z avoid overspending.

- Gift cards became the preferred payment for 27% of shoppers, up 14% from 2024.

- Cashback apps offered up to 21.6% returns on Black Friday purchases, like Amazon.

- Budgeting apps saw increased downloads with shoppers setting hard holiday limits.

- 80% of planned holiday gift spending occurred by Cyber Monday.

- 39% of total holiday spending is planned across Cyber Week in 2025.

- Average expected holiday spend dropped 10% YoY to $1,595 per household.

- 96% of last year’s gift card buyers planned repeat purchases for the 2025 holidays.

- Shoppers prioritized essentials with tighter budgets due to rising inflation.

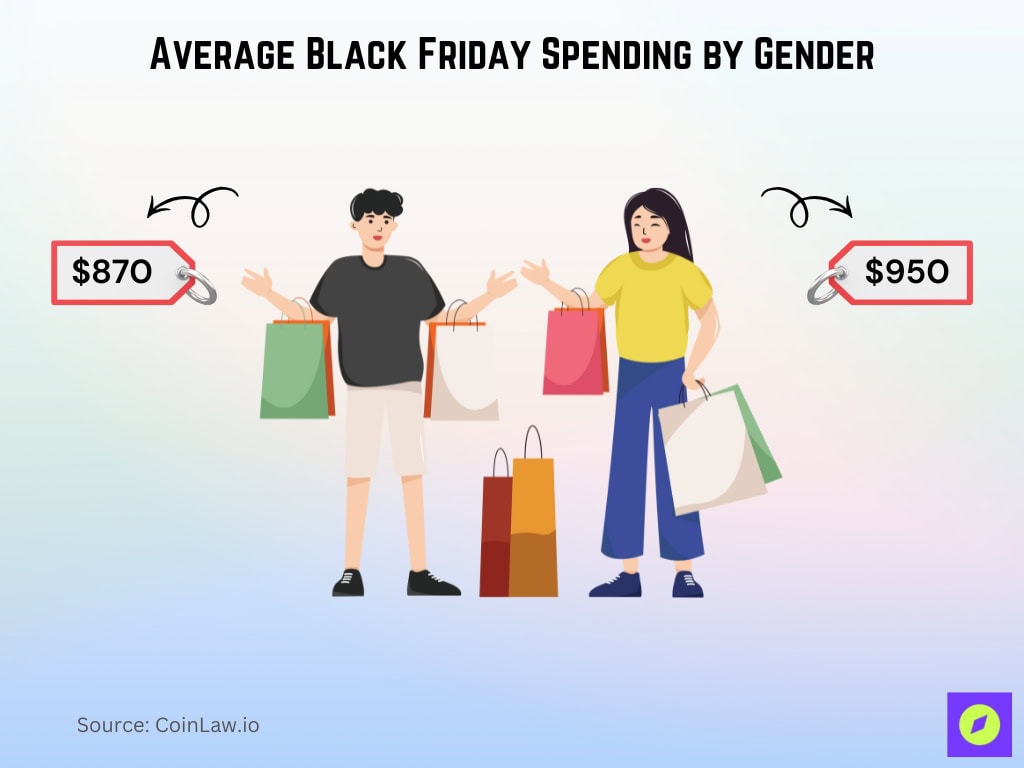

Demographic Variations in Holiday Spending and Debt

- Women spent an average of $950, compared to $870 for men, during Black Friday.

- Millennials accounted for 55% of Black Friday spending in 2025, while Baby Boomers contributed 18%.

- Households earning under $50,000 were responsible for 30% of Black Friday-related debt.

- Urban shoppers spent 25% more on average during Black Friday than rural shoppers.

- Single individuals averaged $700 in holiday debt, compared to $480 for married couples.

- Black Friday participation was highest among Hispanic households at 82%, followed by African Americans at 75%.

- Consumers in California, Texas, and Florida made up 40% of national Black Friday sales.

- College-educated consumers had a 65% BNPL adoption rate, compared to 40% for those without degrees.

- Shoppers aged 18–24 were most likely to use short-term loans for Black Friday purchases.

- Gen Z spending fell 22.5% in 2025, with expected holiday spend at $1,357.

Recent Developments

- Black Friday 2025 online sales reached a record $11.8 billion, up 9.1% from 2024.

- AI-driven marketing boosted Black Friday conversion rates by 40% through personalized ads.

- Over 3 million consumers used virtual reality platforms for shopping deals in 2025.

- Data breaches increased by 15% during the 2025 holiday season, raising cybersecurity investments.

- Carbon-neutral Black Friday initiatives influenced 15% of consumers to select sustainable options.

- Digital wallets accounted for 33% of Black Friday POS payments, up from 21% last year.

- Shipping delays affected 20% of online orders, causing some consumers to return to physical stores.

- Retail bankruptcies surged in early 2025, with notable closures like Forever 21 and Rite Aid.

- Experiential shopping integrating AR is predicted to dominate Black Friday 2026.

- Community gift-buying initiatives drove 10% of shoppers to support local artisans and small businesses.

Frequently Asked Questions (FAQs)

BNPL services contributed around $747.5 million in online Black Friday purchases, reflecting an 8.9% increase from the prior year.

Retail bankruptcies rose significantly in 2025, with notable closures like Rite Aid and Forever 21, reflecting broader economic strain despite record sales.

Klarna reported 45% year-over-year BNPL volume growth from November 1 to Black Friday 2025.

Conclusion

Consumers are becoming more savvy about their spending habits, leveraging technology and financial tools to reduce the impact of holiday debt. However, the growing reliance on credit cards and BNPL services signals a need for caution. While innovative shopping methods like AI personalization and VR experiences are reshaping the landscape, the fundamentals of financial planning remain critical. Striking a balance between enjoying holiday sales and maintaining financial stability will define the shopping season for millions.