A spot Dogecoin ETF from Bitwise may soon hit the market as the firm moves to bypass traditional SEC review using a special regulatory provision.

Key Takeaways

- Bitwise filed its spot Dogecoin ETF under Section 8(a), allowing automatic approval if the SEC does not act within 20 days.

- The ETF would hold real Dogecoin, with Coinbase Custody and BNY Mellon managing its assets.

- Grayscale has also amended its Dogecoin ETF filing, signaling rising institutional interest in meme-coin exposure.

- DOGE’s price remains under pressure despite the ETF news, impacted by whale selloffs and bearish technicals.

What Happened?

Bitwise Asset Management has taken a bold step toward launching the first U.S. spot Dogecoin ETF. The company removed the delaying clause from its S-1 registration, triggering a 20-day countdown under Section 8(a) of the Securities Act. If the U.S. Securities and Exchange Commission does not intervene, the ETF could automatically go live around November 26.

This move reflects Bitwise’s growing confidence that the regulatory environment is now more open to single-asset crypto ETFs, especially after the successful debuts of Solana, Litecoin, and Hedera ETFs in recent weeks.

Looks like Bitwise is doing the 8(a) move for their spot Dogecoin ETF, which basically means they plan on going effective in 20 days barring an intervention. pic.twitter.com/y8jyxbYKXQ

— Eric Balchunas (@EricBalchunas) November 6, 2025

Bitwise’s ETF Play: Bypassing the Wait

Bitwise’s latest filing signals an aggressive strategy to push meme coin ETFs into the mainstream. The Section 8(a) provision allows a filing to become effective automatically within 20 days, unless the SEC takes formal action to delay or deny the application.

This approach is not typical for ETF launches, but it is completely legal. Bloomberg ETF analyst Eric Balchunas described it as a tactic used when companies believe the SEC is unlikely to interfere quickly. Bitwise likely sees the window of regulatory silence as an opportunity to proceed.

The proposed ETF would:

- Hold real DOGE as the underlying asset.

- Use Coinbase Custody for crypto storage.

- Assign BNY Mellon to manage cash components.

- Track the CF Dogecoin-Dollar Settlement Price.

- List on NYSE Arca (pending ticker and fee details).

If approved, this ETF would allow investors to gain exposure to Dogecoin’s spot price without having to directly hold the token themselves.

Dogecoin’s Price vs ETF Optimism

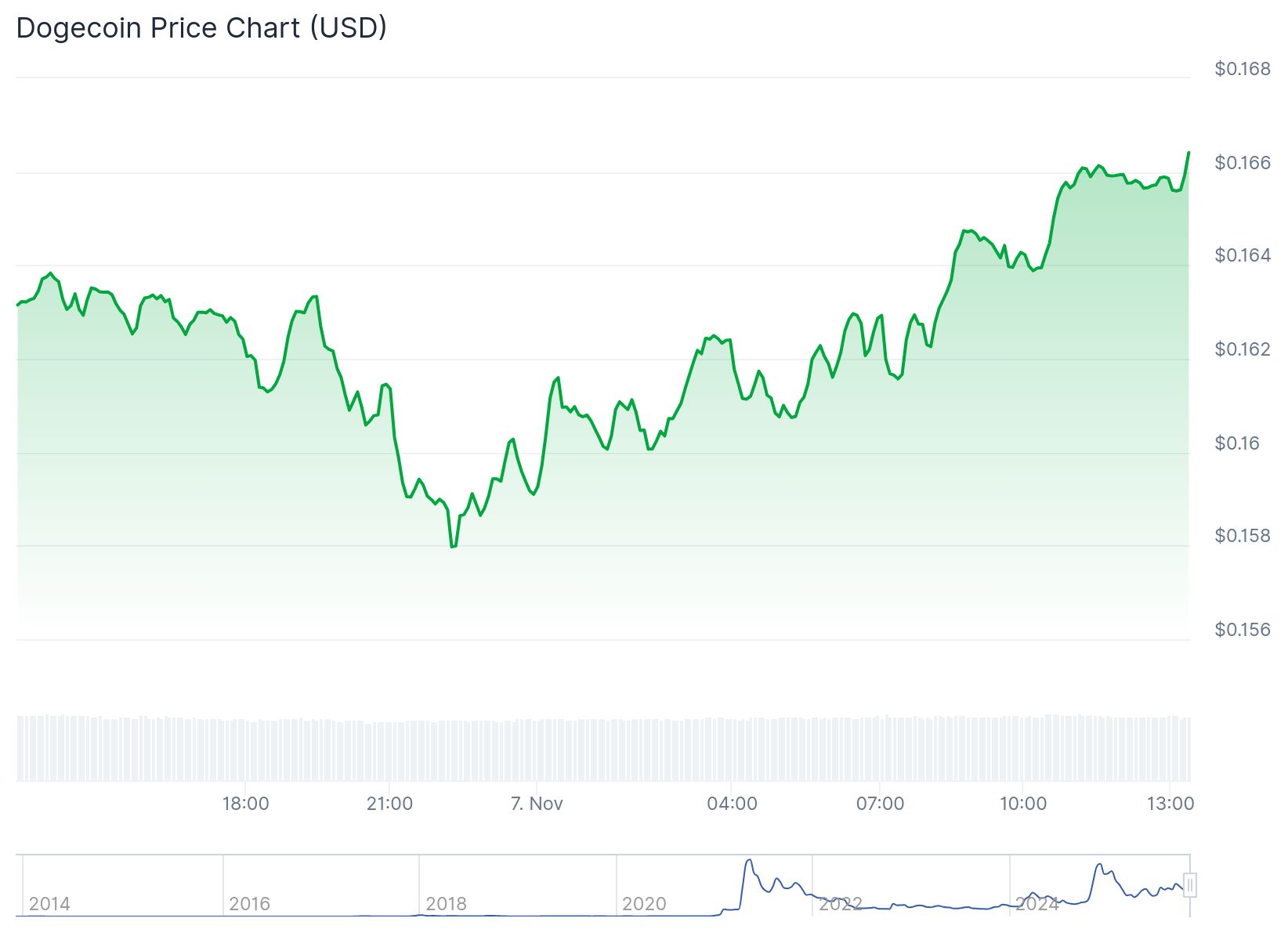

Despite growing ETF anticipation, Dogecoin’s price has stumbled. DOGE has dropped nearly 11% in the past week, trading around $0.163. Analysts point to whale activity, with over 1 billion DOGE (worth roughly $440 million) moved by large holders in just 72 hours.

The price broke key support levels, falling to $0.1590 during peak selloff hours. Although a late-session rebound lifted DOGE to $0.1631, resistance remains strong around $0.1674.

Key technical signals include:

- RSI recovery from near-oversold territory.

- MACD flattening, indicating slowing downside momentum.

- 12% decline in futures open interest, showing weak speculative appetite.

- Negative funding rates on Binance.

This tug-of-war between ETF-driven hype and bearish technical pressure highlights the market’s mixed sentiment.

Grayscale Joins the Race

Adding to the momentum, Grayscale has amended its own spot Dogecoin ETF filing, also opting into the 8(a) countdown route. Multiple issuers now appear aligned in using this pathway to bypass lengthy SEC reviews.

Bloomberg analysts believe there is over a 90% chance that several Dogecoin ETFs will be trading before the end of 2025, fueled by the SEC’s apparent willingness to allow crypto products under passive approval mechanisms.

CoinLaw’s Takeaway

I think what Bitwise is doing here is more than just launching another ETF. They are testing the SEC’s willingness to let crypto ETFs enter the market without dragging their feet. In my experience watching this space, the 8(a) approach is a power move. It puts the onus on the SEC to react quickly or let the fund slip through without a formal ruling.

Bitwise knows how to ride momentum. After the massive success of their Solana ETF, it’s clear they want to dominate meme coin investing too. If this DOGE ETF launches smoothly, we could see a flood of similar filings for meme coins and beyond.