Bitget has surged from a derivatives-focused startup into a global exchange leader. The growth underpins real-world use cases, from tokenizing real-world assets for financial inclusion to powering high-frequency futures trading. Dive in to see how Bitget is reshaping crypto markets and user reach.

Editor’s Choice

- $2.08 trillion, total trading volume in Q1 2025.

- 159% spike, Q1 2025 spot trading growth QoQ.

- Bitget claims 120 million users as of early 2025, likely including app downloads and registered accounts.

- $2.8–$3 billion, 24-hour trading volume in mid-2025.

- While Bitget’s 24-hour volume surged in June 2025, most trackers such as CoinMarketCap ranked Binance and OKX higher, placing Bitget within the top 5 rather than second.

- Bitget claimed a 192% Proof of Reserves ratio and a $725 million Protection Fund in May 2025, as per its internal dashboard and monthly PoR updates, although third-party verification is limited

Recent Developments

- Bitget redefined its tokenomics by burning 30 million BGB in Q1 2025 and over 30 million more in Q2, tightening supply for price stability.

- The KCGI 2025 trading challenge set new records: 120,197 participants, 620 teams, and a $6 million prize pool, showcasing Bitget’s community engagement scale.

- Gracy Chen, CEO, positioned Bitget at the forefront of real-world asset tokenization and PayFi strategy, signaling the exchange’s shift toward inclusive finance.

- Launch of new features, Click-to-stream Bitget Live, USDC-pegged BGUSD stablecoin, and LINE Mini-dapp wallet integrations show growing service depth.

Overview of Bitget Exchange

- Founded in 2018, Bitget began with derivatives before adding spot and copy-trading features.

- By early 2025, it served 100 million users globally, reaching over 150 countries and regions.

- The platform pioneered social copy-trading, with 100+ million successful trades and $600 million in generated gains.

- Its native token, BGB, offers fee discounts, staking rewards, and access to exclusive launchpads.

- Bitget operates under Seychelles registration, with expanded VASP compliance in Poland, Lithuania, Bulgaria, El Salvador, and local platforms in Turkey, Vietnam, and the UK.

- Official global partnerships include LaLiga in Eastern, SEA, and LATAM markets, plus regional sports sponsorships, signaling strong branding influence.

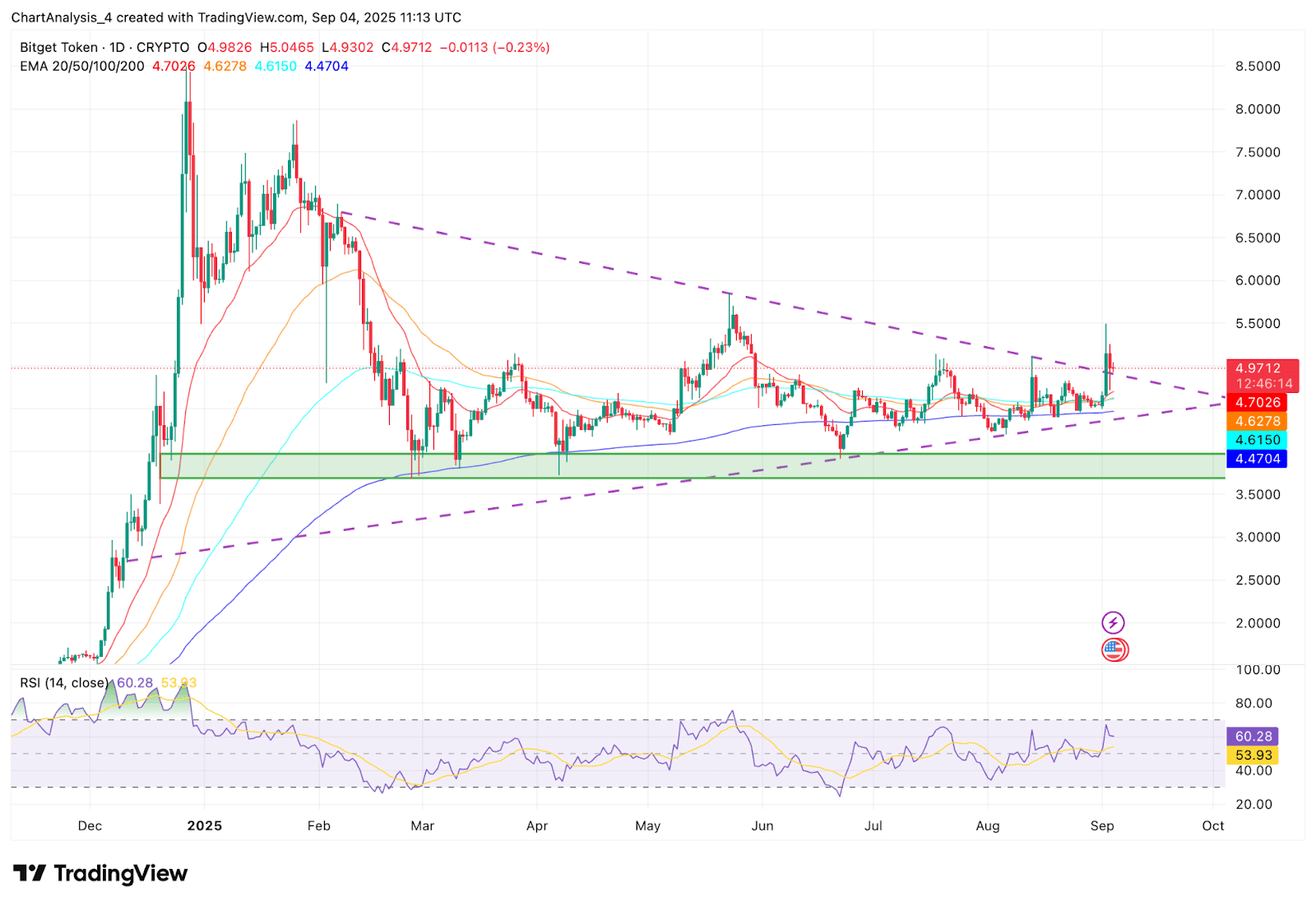

Bitget Token (BGB) Price Analysis

- The daily trading range hit a high of $5.05 and a low of $4.93.

- Key EMA levels show strong technical zones: EMA 20 at $4.70, EMA 50 at $4.63, EMA 100 at $4.62, and EMA 200 at $4.47.

- A major support zone is highlighted between $4.10 and $4.65, protecting downside risks.

- The descending resistance trendline caps price near the $5.5–$6 range, creating a wedge formation.

- The Relative Strength Index (RSI) is at 60.28, trending above its average of 53.93, signaling neutral-to-bullish momentum.

User Base and Global Reach

- Q1 2025 added 19.89 million new users, expanding the ecosystem to over 120 million total users.

- Back in early 2025, Bitget had already reached 100 million users, indicating rapid growth momentum.

- The platform spans 150+ countries and regions, showing broad global penetration.

- Its copy-trading drew 900,000+ followers with more than 100 million trades executed.

- Through regional localization and VASP licensing, Bitget operates in markets like Turkey, the UK, and Vietnam.

- Marketing via global partnerships like LaLiga and local sports figures increased brand visibility in key regions.

- The launch of the BGUSD stablecoin and LINE-dApp integrations broadened wallet appeal in Asia and Latin America.

Bitget Trading Volume Statistics

- Q1 2025 recorded $2.08 trillion total trading volume, with $387 billion in spot trading.

- Bitget’s reported 24-hour trading volume in mid-2025 hovered around $2.8–$3 billion, positioning it among the top 5 global crypto exchanges by volume.

- Spot trading in May 2025 hit $102.8 billion, up 32% month-on-month.

- In April 2025, Bitget held a 7.2% market share with $92 billion in spot volume, ranking third globally.

- BGB accounted for 44% of H1 2025 spot trading, trailing only BTC and ETH.

- The platform ranks first in aggregated ETH and SOL spot depth within 1% of mid-price, and second for BTC, reflecting deep liquidity on major pairs.

- Derivatives trading constituted approximately 90% of Bitget’s overall volume, consistent with patterns on similar exchanges.

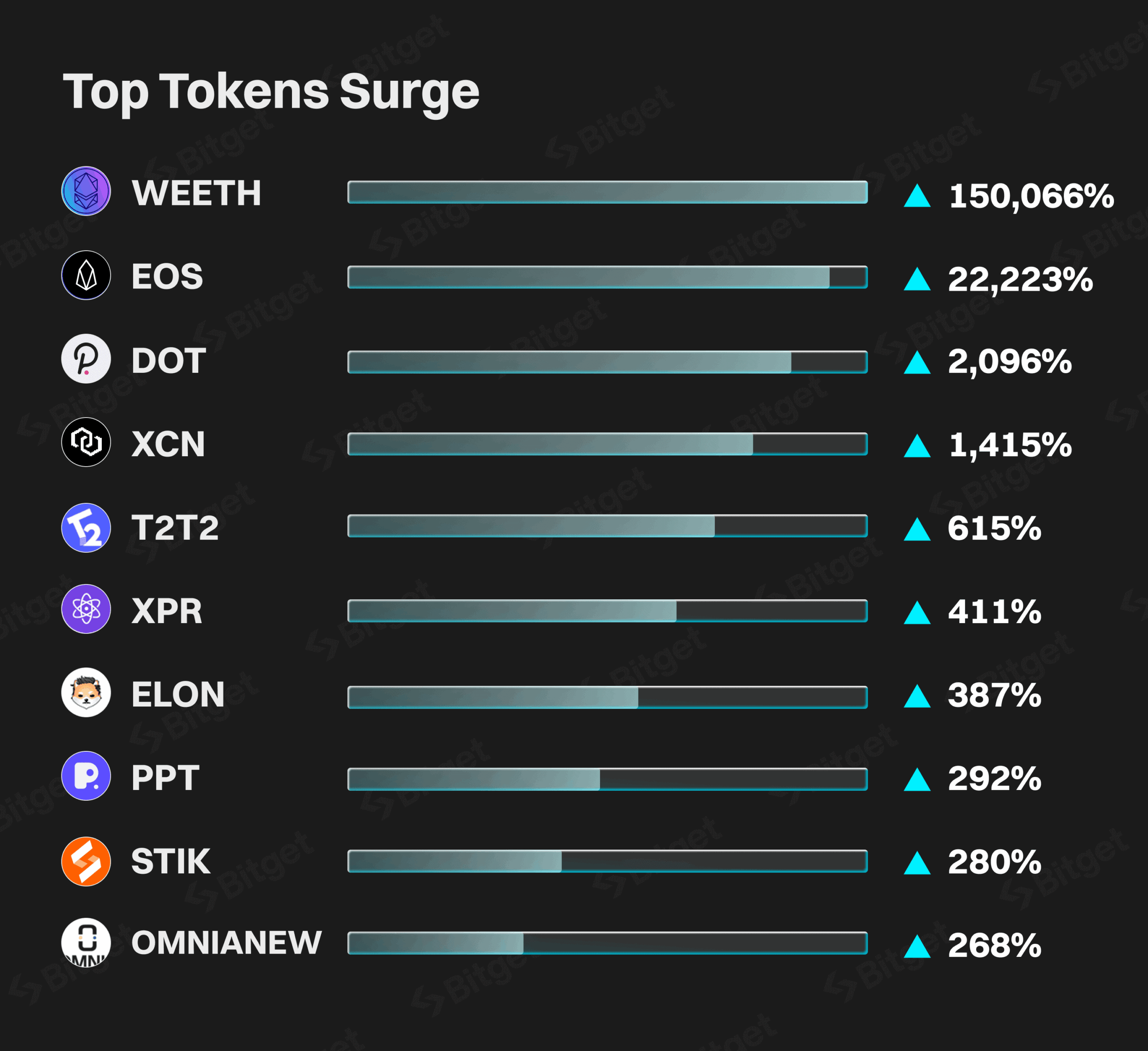

Top Token Surges on Bitget

- WEETH delivered a massive 150,066% surge, making it the standout performer.

- EOS skyrocketed by 22,223%, showing exceptional momentum.

- DOT posted gains of 2,096%, highlighting strong investor demand.

- XCN advanced by 1,415%, continuing its sharp upward trajectory.

- T2T2 rose 615%, marking significant growth.

- XPR increased by 411%, attracting notable market attention.

- ELON grew by 387%, showcasing solid price movement.

- PPT added 292%, keeping up with bullish trends.

- STIK climbed 280%, sustaining positive momentum.

- OMNIANEW gained 268%, rounding out the list of top surging tokens.

Spot Market Statistics

- Bitget offered 675 coins and 775 spot trading pairs as of mid-2025, ranking among the most extensive spot offerings on major exchanges.

- In May 2025, spot trading volume reached $102.8 billion, up 32% month-over-month.

- April 2025 saw $92 billion in spot volume, giving Bitget a 7.2% market share, positioning it third globally.

- Token BGB accounted for 44% of H1 2025 spot trading, trailing only behind Bitcoin and Ethereum.

- Spot volume ranged from $3.4–$4.7 billion daily, with total exchange reserves between $5.7B and $5.8B.

- Asset delisting activity included 35 pairs removed by July and 14 more delisted on August 29, 2025, to optimize the trading environment.

- Bitget supports listings of 800+ tokens and 800+ spot pairs, adding 85 new tokens in early 2025.

Futures Market Statistics

- Bitget averaged $750 billion in total monthly volume in H1 2025, and derivatives comprised nearly 90% of activity.

- April 2025 futures volume was $92 billion, lifting market share from 4.6% to 7.2%, ranking Bitget third globally in derivatives.

- In Q2 2025, Bitget held 11.45% of the global derivatives market share, surpassing peers like Bybit and OKX.

- Bitget claims institutional-level execution with BTC slippage of 0.0074% and altcoin spreads under 0.5%.

- As of mid-2025, 688 futures trading pairs were live on the platform.

- ETH/USDT was the most active futures pair in 24-hour volume, generating over $9.3 billion.

- Bitget’s futures open interest reached an estimated $25.25 billion in mid-2025.

Bitget Price Prediction

- The current price is projected to be around $4 to $5, forming the base level.

- By 2026, Bitget could reach an average of $11, with a high of $15 and a low of $6.5.

- In 2028, the price forecast shows an average of $23, a potential high of $30, and a low near $14.

- By 2030, Bitget may average $33, with a potential high of $41 and a low of $24.

Margin Trading Metrics

- The default margin trading fee is 0.1% for both maker and taker orders.

- Traders can earn up to a 20% fee discount by using BGB to settle trades or by reaching VIP status.

- Maximum leverage offers up to 10× for isolated margin and 3× for cross margin, depending on pairs.

- As of August 18, 2025, Bitget decoupled loan interest from futures funding rates for select coins like ASR, CTSI, BAND, etc., improving margin flexibility.

- Bitget launched isolated spot margin trading for new pairs, including ES/USDT in July and SXT/USDT in May 2025.

- The platform supports funding rate arbitrage strategies, earning 1% every 8 hours on a $50,000 leveraged position.

- Leveraging/liquidation tiers, for a $1M position with 0.50% maintenance margin, traders must hold at least $5,000 to avoid liquidation.

- Maintenance margin rates were adjusted, raising minimums for large positions, e.g., 0–10k USDT moved from 0.66% to 1.00%, 10k–40k from 1.00% to 1.50%.

Most Active Trading Pairs

- BTC/USDT was the top spot pair in 24-hour volume, exceeding $1.35 billion.

- On the futures side, ETH/USDT led trading, with over $9.3 billion in volume over 24 hours.

- BGB captured a substantial share, 44% of H1 2025 spot volume, highlighting its ecosystem importance.

- Altcoin liquidity on Bitget outperformed major players, with tight 0.3–0.5% spreads, topping CoinGecko’s 2025 rankings.

- Bitget’s order-book depth for ETH and SOL pairs ranked among the highest in 2025.

- Delisted pairs (e.g., LOOM/USDT, various tokens in August) suggest ongoing portfolio management of traded assets.

- Futures open interest hovered around $25.25 billion.

- Updated pairs for margin trading, such as ES/USDT and SXT/USDT, reflect Bitget’s evolving asset lineup.

Security and Protection Fund

- Average Protection Fund value in April 2025 was $561 million, with daily lows at $496 million and highs at $617 million.

- In May 2025, it reached a high of $725 million and averaged $673 million, with a low near $613 million.

- June saw the fund rise, highest value $716 million, the lowest $655 million, average of $687 million.

- July 2025’s Protection Fund peaked at a record $779.7 million, with a monthly average close to $746 million. It closed July 31 at $752 million.

- The fund maintains a steady balance of 6,500 BTC, regardless of market swings.

- Originally established in 2022 with $300 million, the fund has more than doubled its size.

- The combination of robust Proof of Reserves and a substantial Protection Fund provides dual-layer security for user assets.

Asset Listings and Supported Coins

- Bitget listed over 800 tokens and offered 800+ spot and 400+ futures trading pairs by early 2025.

- Mid-2025 listings included 675 coins and 775 spot pairs.

- The futures side had 688 trading pairs available.

- In May 2025 alone, Bitget added 85 new tokens and launched three Launchpool projects.

- Recent listings include Fragmetric (FRAG) via Launchpool and tokenized assets via Ondo Finance.

- Bitget Wallet started offering trading of tokenized real-world assets, including stocks and ETFs, expanding the asset base.

- New spot margin pairs like ES/USDT and SXT/USDT highlight continued asset expansion.

- Delisted assets such as LOOM/USDT and batches of tokens in mid-2025 demonstrate ongoing curation.

Liquidity and Market Depth

- Bitget topped altcoin liquidity rankings, with spreads between 0.3–0.5%, outperforming Binance and OKX.

- BTC slippage for large trades averaged 0.0074%, while altcoins saw spreads of 0.3–0.5%, geared toward institutional traders.

- Bitget’s maximized execution depth and low slippage enhanced performance for derivative markets.

- Exchange reserves ranged from $5.7 billion to $5.8 billion, reinforcing liquidity buffer strength.

- Tokenized RWA assets listing added new liquidity corridors, especially in tokenized stocks and ETFs.

- Depth rankings and tight spreads reflect targeted liquidity provisioning strategies across major assets.

- Removal of underperforming pairs likely improved overall depth and efficiency.

Fees Structure and Discounts

- Standard margin trading fee is 0.1% for both maker and taker trades.

- Users can claim up to 20% off fees with BGB or VIP status, totaling 40% in possible savings.

- Fiat deposit fees range between 4%–8% when sourced via Simplex or Banxa.

- Fee tiers vary by VIP level and trading volume, with maker/taker differentiation.

- Referral codes (e.g., vb2025 or other codes) can grant Bonus USDT and additional fee discounts.

- Loyalty incentives like fee reductions encourage token holding and trading continuity.

- Launchpool and campaign incentives may waive or reduce fees temporarily on new listings.

- Margin funding arbitrage allows users to offset fee costs through yield strategies.

Exchange Reserves and Proof of Reserves

- As of August 22, 2025, Bitget’s overall reserve ratio stood at an impressive 188%, well above the 100% benchmark.

- As of August 2025, Bitget’s BTC Proof of Reserves ratio was self-reported at 365%, based on wallet disclosures.

- Bitget’s ETH and USDC reserves were reportedly twice the user holdings as of mid-2025, per PoR dashboards.

- USDC reserves were also double user holdings, 172,087,642.62 USDC vs. 86,012,252.81 USDC, reflecting a 200% ratio.

- In May 2025, total reserve ratio clocked in at 192%, BTC ~416%, ETH 157%, USDT 105%, USDC 281%.

- In June 2025, Bitget’s Proof of Reserves showed 199% overall coverage.

Bitget Copy Trading Statistics

- Bitget’s copy trading reportedly exceeded 1 million followers in Q2 2025, based on internal tracking and promotional campaigns.

- Copy trading volume in Q1 2025 reached $9.2 billion, marking a 36% quarter-on-quarter increase.

- The platform continues to highlight its social trading credentials, making it one of the most widely adopted features across exchanges.

- Copy trading supports both spot and derivatives, with UI tools and metrics aiding user choice.

- Bitget consistently promotes transparency and performance metrics for elite traders to boost follower confidence.

- The continued influx of followers and profit growth signals rising trust and adoption of Bitget’s copy trading framework.

Strategic Partnerships and Sponsorships

- Bitget holds a high-profile global partnership with LaLiga in Eastern, Southeast Asian, and Latin American regions.

- It collaborates with UNICEF in a blockchain education initiative targeting 1.1 million beneficiaries by 2027.

- The exchange has previously sponsored Juventus FC and its women’s team, and partnered with Turkish sports stars like Buse Tosun Çavuşoğlu, Samet Gümüş, and İlkin Aydın.

- Bitget’s brand exposure edges across global sports and social impact, reinforcing its trust positioning.

- These alliances span football leagues, youth educational programs, and regional sports icons, helping cultivate global recognition.

Regulatory Compliance and Licenses

- Bitget operates under Seychelles registration, with strategic VASP licenses in Poland, Lithuania, Bulgaria, and El Salvador.

- It maintains localized platforms in Turkey, Vietnam, and the UK to meet regional regulatory demands.

- The exchange also has established offices in Dubai and Bahrain, enhancing its international compliance posture.

- Despite global growth, Bitget faces regulatory challenges; for example, its website has been blocked in the Philippines since August 1, 2025, due to a lack of local registration, although its apps remain accessible.

- Bitget monitors and adapts to dynamic markets, proactively seeking licenses and regional alignment.

Conclusion

Bitget emerges as a powerhouse built on transparency, security, and innovation. Its consistent over-collateralization, with Proof of Reserves well above 100%, paired with a growing Protection Fund, underscores a commitment to asset safety. The platform’s robust copy trading growth, strategic global partnerships, and adaptive regulatory compliance framework reflect an exchange that’s built for resilience and trust. As Bitget continues to broaden access and deepen liquidity, its trajectory signals a forward-looking exchange where users can trade, learn, and engage with confidence.