The Lightning Network (LN) is increasingly shaping the payments landscape for Bitcoin. In one case, a U.S. fintech firm integrated LN to enable sub‑second retail transactions, and in another case, an international remittance provider implemented LN to cut cross‑border fees and time. This article presents key statistics about LN usage today and invites you to explore how this layer‑2 network is performing and evolving.

Editor’s Choice

- The Lightning Network facilitated over 8 million monthly transactions in early 2025, with public Lightning volume surging 266% year-over-year despite a decline in public channel count.

- 99%+ payment success rate in well‑configured Lightning implementations.

- Merchant adoption share of Bitcoin payments via Lightning reached 15% by mid‑2024 and is continuing upward in 2025.

- Latency for a Lightning payment can be less than half a second in optimal routing conditions.

- The Lightning Network comprised approximately 16,000 nodes and around 75,000 active channels in early 2025, declining to ~52,700 channels by Q1 2025 due to channel consolidation and efficiency improvements.

- Exchange‑level integrations (e.g., by major U.S. platforms) saw Thunder Network adoption accelerate in 2024 and continue into 2025.

Recent Developments

- Merchant payments via Lightning nearly doubled to 15% from 2023 through mid-2024, continuing growth into 2025.

- Enterprise and institutional players launched Lightning-as-a-Service solutions in early 2025.

- Routing algorithm upgrades and node automation reduced payment failures and channel friction significantly in 2025.

- Major U.S. exchanges reported an over 80% reduction in on-chain fees for users after Lightning integration.

- Academic papers in 2025 formally verified Lightning Network’s security and fund safeguarding features.

- Regional Lightning adoption grew, with North America leading market share at 38% in 2024.

- Public Lightning volume surged 266% year-over-year in 2025 despite transaction count declines.

- Network topology consolidated to fewer nodes with larger channels, improving efficiency by 30% fewer channels per node since 2020.

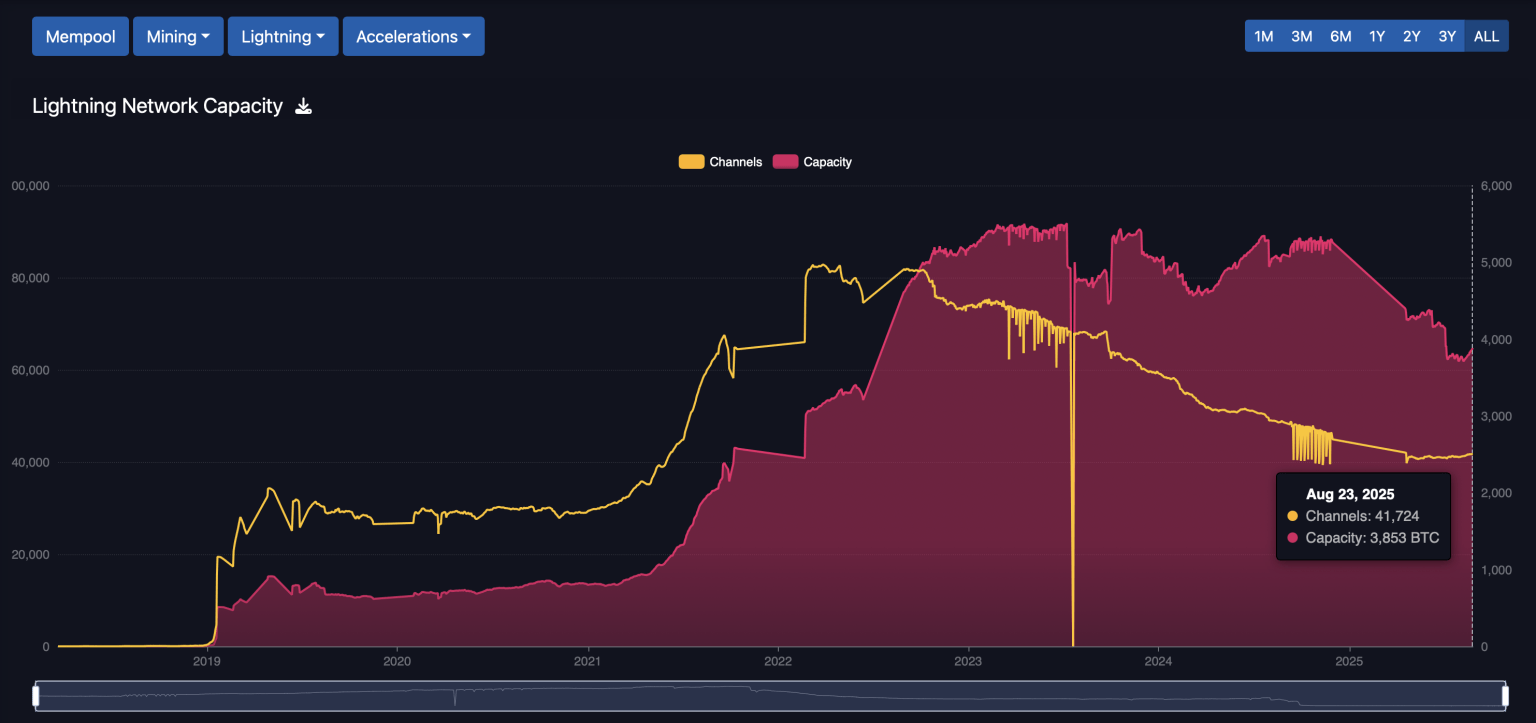

Lightning Network Capacity Snapshot

- 41,724 channels were active on the Lightning Network, highlighting widespread infrastructure despite volatility.

- 3,853 BTC in total network capacity, showing a decline from previous peaks but still supporting significant liquidity.

- The network has experienced a visible drop in capacity since its 2023 high, suggesting a shift toward fewer but higher-value transactions.

- Despite declining capacity, the channel count remained relatively stable, indicating continued network participation.

- This decoupling of capacity and channels may reflect a maturing user base and enterprise-level routing strategies.

Overview of the Bitcoin Lightning Network

- Despite a 20% decline in capacity by mid-2025, the network remains active in global merchant payments and apps.

- The network enables transactions with sub-second settlement under optimal routing conditions.

- Major Bitcoin wallets and exchanges currently support Lightning, used by over 15% of Bitcoin payments in Q2 2024.

- Average channel capacity grew by 214% over four years, with typical payments of about $9,000 per channel.

Payment Success Rates and Efficiency

- Lightning payments have achieved a 99%+ success rate in controlled deployments.

- A sample from August 2023 reported a 99.7% success rate across 308,000 transactions.

- In ideal setups, the settlement time for a Lightning payment can drop to under 0.5 seconds.

- On‑chain Bitcoin transactions during congestion may incur fees between $1‑$12 and take 10‑30 minutes, while LN reduces both time and cost significantly.

- The integration of smarter routing and liquidity monitoring in 2025 improves overall network reliability.

- Businesses report cost savings on payments of more than 80% when switching to Lightning vs on‑chain.

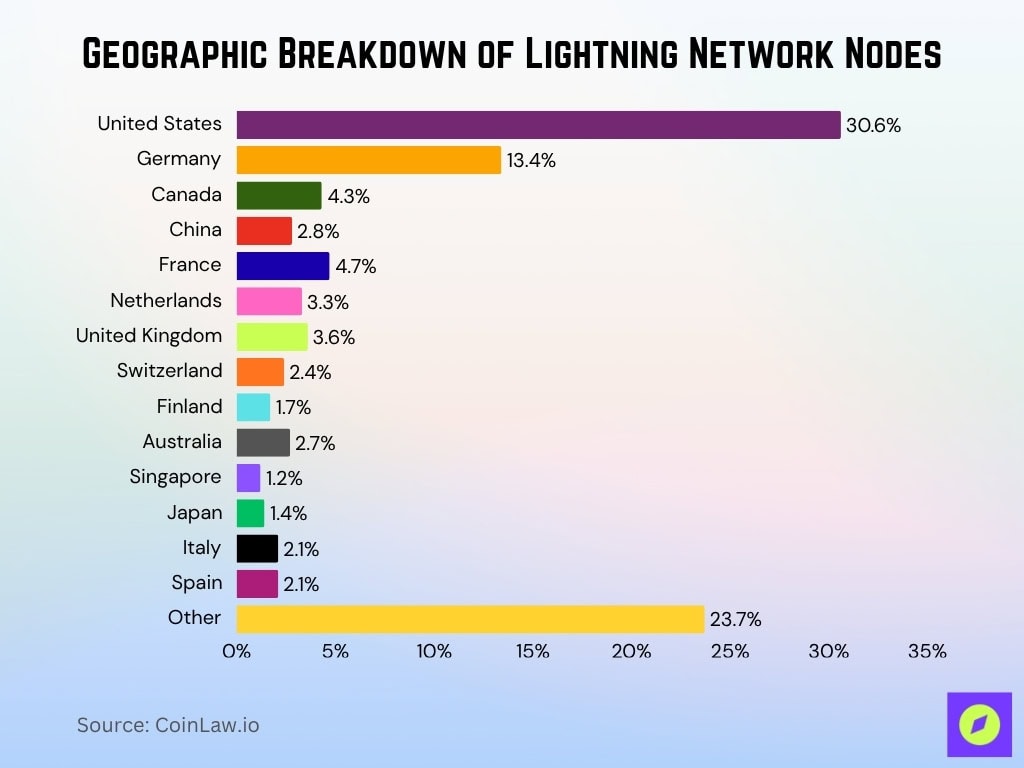

Geographic Breakdown of Lightning Network Nodes

- The United States leads with 30.6% of all Lightning nodes, reflecting dominant infrastructure and early adoption.

- Germany holds the second-largest share at 13.4%, showing strong support from Europe’s crypto community.

- France (4.7%), Canada (4.3%), and the United Kingdom (3.6%) round out the next top contributors.

- China accounts for 2.8%, despite regulatory constraints, indicating continued underground or cross-border activity.

- Mid-tier countries include the Netherlands (3.3%), Switzerland (2.4%), Italy (2.1%), and Spain (2.1%).

- Finland (1.7%), Australia (2.7%), Singapore (1.2%), and Japan (1.4%) show moderate but consistent participation.

- The “Other” category represents a significant 23.7%, highlighting widespread but fragmented global presence.

Merchant and Business Adoption

- Over 11.7% of Lightning payments on a major processor were via Lightning.

- Bitcoin payments routed through Lightning for merchants nearly doubled between 2023 and mid-2024.

- A Japanese marketplace processed over 100,000 Bitcoin payments in its first month after Lightning integration.

- Merchant adoption is strongest in North America and Europe, with Lightning seen as a key differentiator in 2025.

- SMB Lightning adoption in the U.S. rose by about 30% year-over-year among Bitcoin payment providers.

- Retail micropayments favor Lightning due to instant settlement and near-zero fees compared to on-chain Bitcoin.

- Square enabled Bitcoin payments for 4 million merchants with fee waivers through 2027 to boost Lightning adoption.

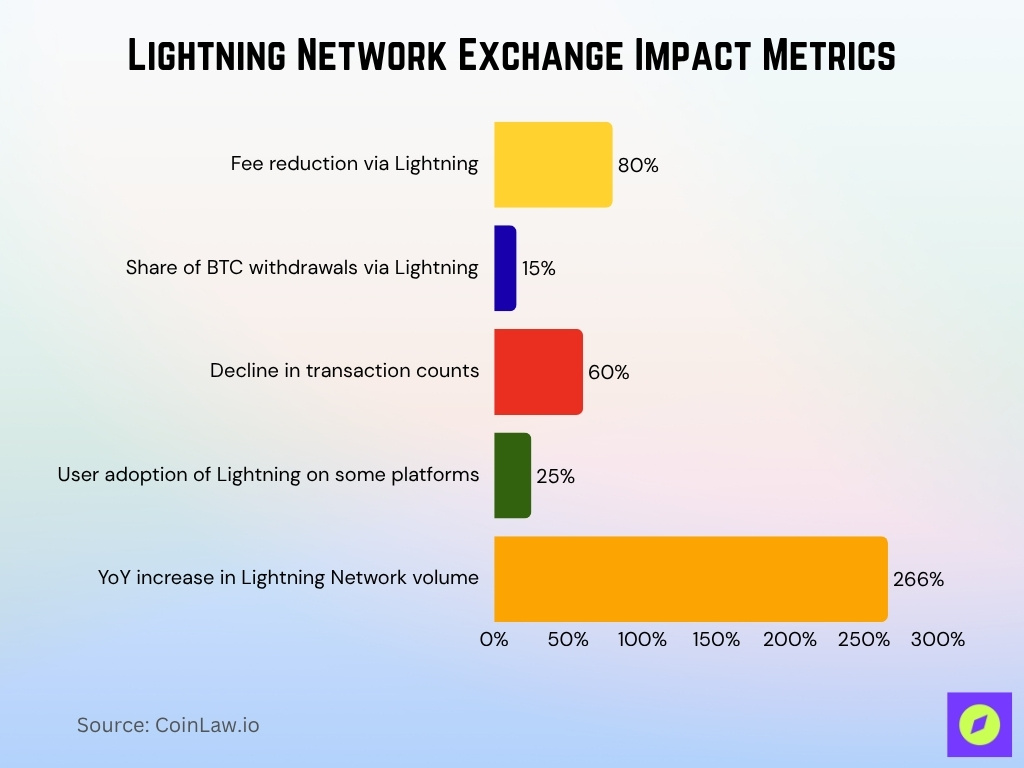

Lightning Network Integration by Exchange

- Several major exchanges integrated Lightning deposits and withdrawals by early 2025, enabling transfers with over 80% lower fees.

- Approximately 15% of Bitcoin withdrawals on a major exchange were routed via Lightning by mid-2025.

- Exchanges saw transaction counts fall by 60% but transaction volumes increased due to high-value Lightning transactions.

- Some platforms report 25%+ user adoption of Lightning for Bitcoin transfers where available.

- Exchange integrations contributed to a 266% year-over-year volume surge on the Lightning Network in 2025.

- Withdrawal times on exchanges dropped from 10–30 minutes to seconds after enabling Lightning.

- Public Lightning network capacity was around 4,132 BTC with 16,294 nodes and 41,118 channels in 2025.

Enterprise Adoption and Use Cases

- Usage patterns show volume surged 266% year‑over‑year (in one data set) while transaction counts declined, indicating a shift to higher‑value enterprise flows.

- Enterprise use‑cases now include cross‑border remittances, subscription services, micropayments for digital goods, and embedded wallet wallets integrating Lightning rails.

- One African fintech company uses Lightning for low‑cost remittances, targeting underbanked users while leveraging Bitcoin’s settlement layer via Lightning rails.

- Some enterprise pilots report cost savings of >50% in payment‑processing fees when switching from legacy rails to Lightning‑enabled infrastructure.

Lightning Network Fees and Cost Efficiency

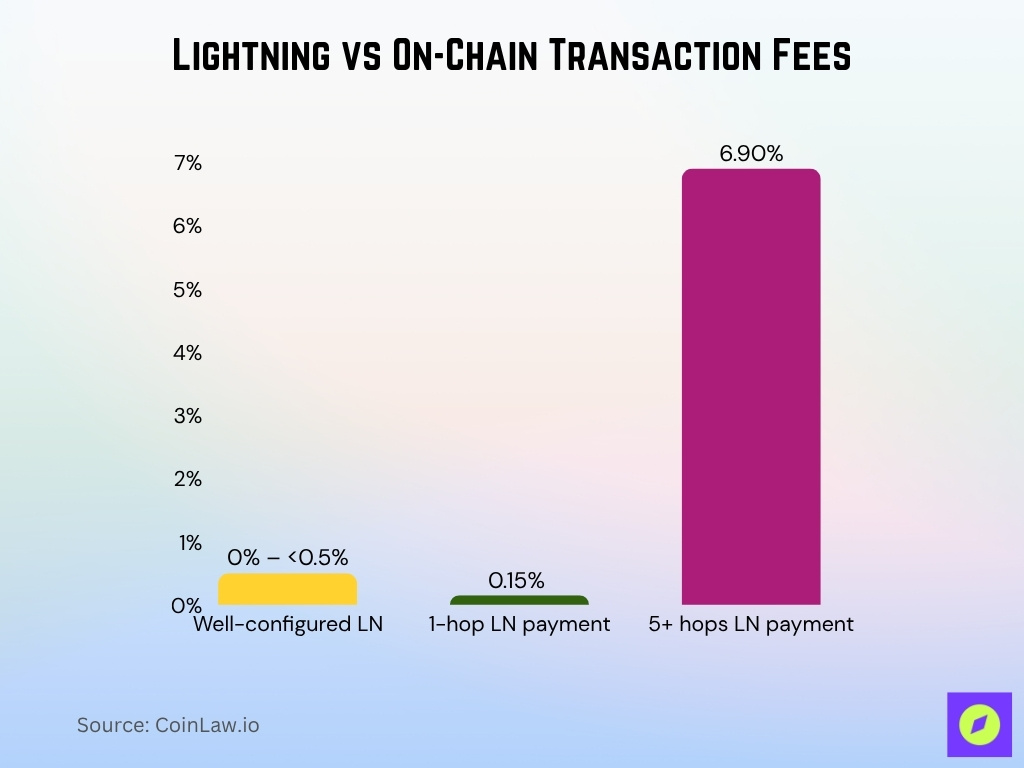

- According to a 2024‑2025 report, users in well‑configured channels could see fee rates as low as 0% or under 0.5% for Lightning payments.

- One sample set from Voltage shows that for 1‑hop payments, the average fee was ~0.15%, for 5+ hops, ~6.90%.

- For transactions over 1,000,000 satoshis (~$1,000), fees ranged approximately. $0.39 to $1.27 in one dataset.

- Traditional on‑chain Bitcoin transactions in 2025 cost, on average, ~$1.74.

- One study noted a 266% increase in transaction volume on Lightning while count decreased, pointing toward cost‑efficient routing of higher value flows.

- For many merchants and users, switching from on‑chain Bitcoin to Lightning has reduced settlement cost by more than 80% when used for smaller payments.

- Even though capacity fell by ~20% in one public metric, fee‑efficiency and successful‑payment rates remained strong, reflecting improved channel management rather than degradation.

Lightning Network Applications and Products

- Lightning micro-tipping on social platforms facilitated over 3.6 million zaps in six months.

- Public Lightning network capacity hit around 5,358 BTC ($509 million) by January 2025.

- Use cases include micropayments, B2B APIs, and stablecoin remittance corridors, using over 70% stablecoin flows in 2025.

- Non-custodial wallets embedding Lightning support enable instant user transactions with minimal on-chain interaction.

- Stablecoins like USDT launched on Lightning in early 2025, allowing price-stable payments with Lightning speed.

Decentralization and Network Topology

- The Lightning Network had approximately 12,664 public nodes, 43,938 channels, and 4,103 BTC capacity in a recent snapshot.

- The average channels per node dropped by about 30% between 2020 and 2024, signaling consolidation.

- The node-capacity Gini coefficient rose to around 0.97 in 2025, showing high inequality in capacity distribution.

- A small fraction of hubs control a disproportionately large share of Lightning’s liquidity and routing.

Future Outlook and Projections

- Lightning could handle over 30% of all BTC transfers for payments and remittances by the end of 2026 if current growth continues.

- Stablecoin and asset issuance integration via Taproot Assets may expand Lightning’s use beyond BTC denominations globally.

- Advances like multi-path payments and channel splicing aim to boost payment success rates to nearly 100% under optimal conditions.

- Enterprise adoption is expected to grow notably in cross-border remittances, content monetization, and IoT micropayments.

- Public network capacity may stabilize between 3,500 and 4,800 BTC, with private channels adding unseen capacity.

Frequently Asked Questions (FAQs)

Approximately 12,648 nodes.

About 43,763 channels.

Median base fee is 1 satoshi (~$0.00098).

Conclusion

The Lightning Network is clearly moving beyond theory toward real‑world application. Products and services built on Lightning now support micropayments, global remittances, digital content monetization, and enterprise rails. At the same time, the network’s topology is evolving, node consolidation and capacity shifts reflect maturing infrastructure, even as decentralisation questions persist. Challenges remain; liquidity management, regulatory clarity, and centralisation risk are front‑of‑mind, but the outlook is promising. If Lightning continues its steady trajectory, it may become the backbone of Bitcoin’s payment layer and a compelling alternative to traditional settlement systems.