BillDesk has shaped India’s digital payment landscape for over two decades, providing a backbone for bill payments, utility settlements, and enterprise‑grade payment solutions. Its services power millions of transactions daily across utilities, telecom, insurance, banking, and e‑commerce, influencing how businesses and consumers handle recurring payments and large‑scale collections. As the digital‑payments market in India evolves rapidly, BillDesk’s numbers tell a story not only of scale, but also of shifting dynamics in growth, profitability and infrastructure. Read on to explore key statistics and trends defining BillDesk’s performance and broader market position.

Editor’s Choice

- Revenue from operations dropped to ₹2,334 crore in FY24, down from ₹2,678 crore in FY23, a 12.8% year‑on‑year decline.

- Net profit fell to ₹121 crore in FY24, from ₹142 crore in FY23, a 14.8% drop.

- The platform handles 4 billion+ transactions annually (as of March 2024).

- BillDesk supports 20,000+ billers (as of March 2024).

- The payment gateway processes 150 million+ API calls per day (as of March 2024).

- India’s payment‑gateway market is estimated at $2.07 billion in 2025, setting the context for BillDesk’s role in a growing industry.

Recent Developments

- As of March 2024, BillDesk’s revenue from operations fell to ₹2,334 crore, compared with ₹2,678 crore in FY23.

- Profit after tax (PAT) declined to ₹121 crore in FY24 from ₹142 crore in FY23.

- Operating costs saw shifts, bank fees and services (the largest cost component) accounting for 78.8% of total costs.

- Employee benefit expenses rose 22.4% to ₹300 crore in FY24.

- Total expenses reached ₹2,289 crore in FY24.

- Despite scale contraction, BillDesk held cash and bank balances worth ₹930 crore by end‑March 2024.

- BillDesk continues to serve a broad base of 20,000+ billers across utilities, DTH, insurance and other categories.

- The platform maintained high infrastructure usage, 150 million+ daily API calls.

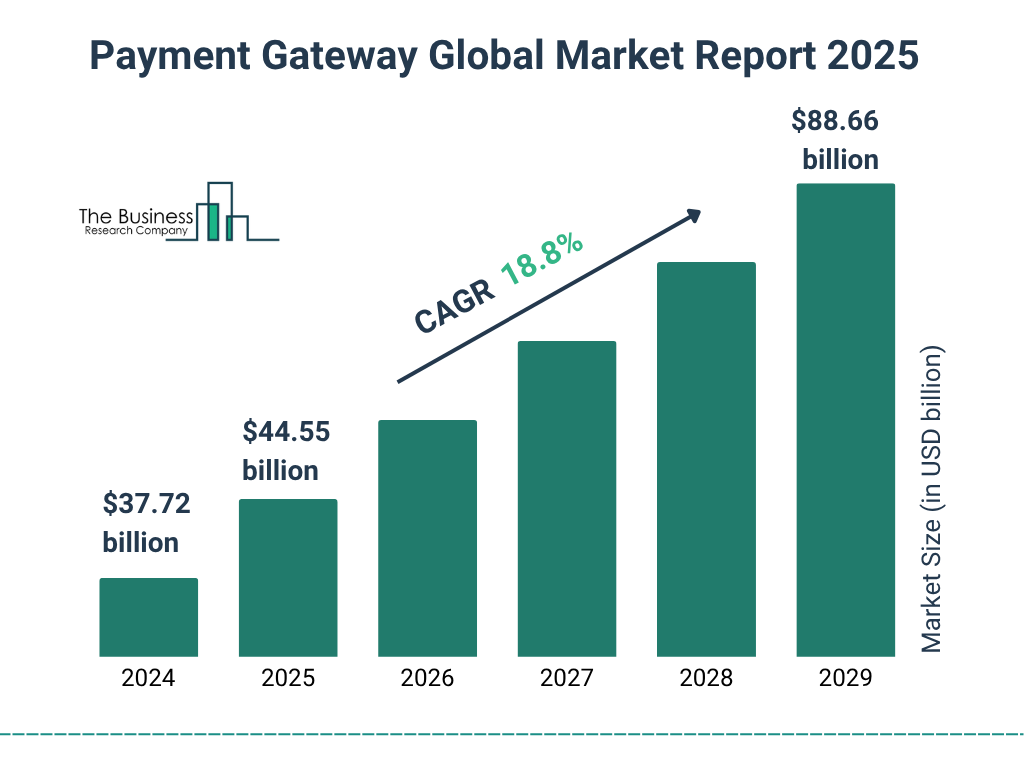

Global Payment Gateway Market Outlook

- The payment gateway market size is projected to grow to $88.66 billion by 2029.

- This reflects a compound annual growth rate (CAGR) of 18.8%, indicating robust global adoption of digital payment infrastructure.

- In 2025, the market is expected to reach $44.55 billion, showing a strong year-on-year growth from 2024.

- The projected market size in 2029 is more than double that of 2024, highlighting accelerated expansion across regions and industries.

- The upward trend is driven by e-commerce growth, mobile payments, and fintech adoption in both developed and emerging markets.

BillDesk User Base and Customer Segments

- BillDesk supports 20,000+ billers, including utilities, telecom, insurance, DTH, and other recurring‑payment services (as of March 2024).

- The platform claims to handle roughly 60% of online bill payments in India, giving it a dominant position among bill‑payment gateways.

- Its customer segments include banks, financial services, e‑commerce merchants, utility providers, and large enterprises.

- BillDesk’s mix includes both B2B clients (e.g., banks, enterprises) and B2C utilities/consumers via billers.

- Through its full‑stack platform, it offers recurring payments, bill settlement, loyalty‑program management, and prepaid account services (like PINS and top‑ups).

- The reach spans small billers (e.g. local utilities, subscription services) to national‑scale enterprises (banks, telecom, large utilities).

- BillDesk supports a wide variety of payment methods, including cards, net banking, wallets, and UPI, to cater for segments.

- Because of its broad user base and biller network, BillDesk plays a central role in enabling digital payment adoption even among traditionally under‑banked or offline‑oriented segments.

Revenue and Income Statistics

- FY24 operational revenue stood at ₹2,334 crore, a 12.8% decline from FY23’s ₹2,678 crore.

- In FY23, revenue from operations grew by 9.6% compared with FY22.

- Total consolidated revenue in FY24 (including non‑operating income) reached approximately ₹2,446 crore.

- In FY24, over 70% of operating revenue came from fees for processing and settling electronic transactions.

- Another ~16% of revenue came from managing loyalty programs for clients in FY24.

- The remainder came from the sale of products such as PINS, e‑top‑ups, and other operating activities.

- Non‑operating income (interest, financial‑asset gains, etc.) contributed ₹112 crore in FY24.

- As of March 31, 2024, total current assets were ₹2,612 crore, which included ₹930 crore in cash and bank balances.

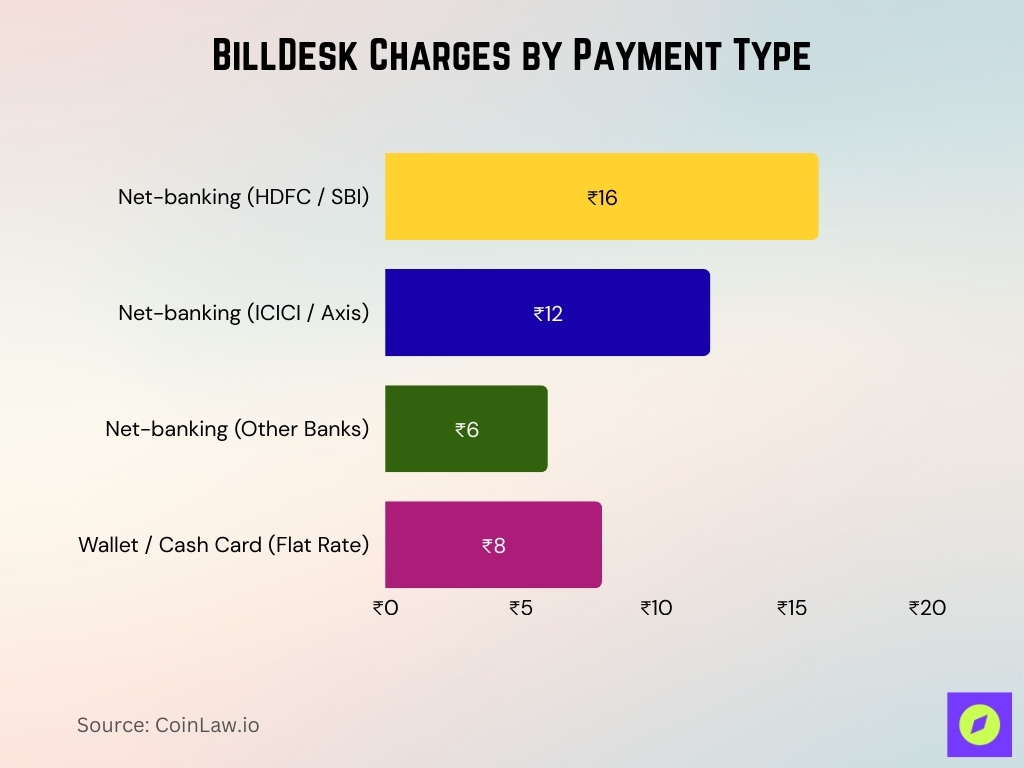

Fees, Take Rates and Unit Economics

- Net‑banking charges in one BillDesk schedule are shown as ₹16 for HDFC/SBI, ₹12 for ICICI/Axis, and ₹6 for other banks per transaction, indicating a fixed‑fee component.

- Wallet and cash‑card payments processed through BillDesk are sometimes priced at a flat ₹8 per transaction, contrasting with percentage‑based MDR on cards.

- Early estimates put BillDesk’s blended take rate at ~0.3% MDR on total payment volume (TPV) flowing through its gateway.

- With TPV reportedly growing at around 20% YoY, the low‑take‑rate model translated into “very healthy” profit margins in BillDesk’s early scale‑up years.

- Some merchant‑facing schedules show Visa/MasterCard debit card fees at 0.40% (≤₹2,000) and 0.85% (>₹2,000) per transaction processed via BillDesk.

- Credit card transactions routed through BillDesk can attract around 0.85% MDR for major networks like Visa/MasterCard/RuPay in certain pricing tables.

- Public filings show BillDesk’s revenue from operations at ₹2,442.8 crore in FY22, up 15% from ₹2,124.2 crore in FY21, despite pressure on margins.

- In the same year, BillDesk’s profit after tax fell 39% to ₹149.6 crore, highlighting the sensitivity of unit economics to rising expenses at a sub‑1% fee structure.

- Industry commentary notes BillDesk processed over ₹10 trillion TPV and ~4 billion transactions annually by FY23, making scale the key driver of its low‑MDR economics.

Profit and Margin Trends

- Profit after tax (PAT) dropped to ₹121 crore in FY24, down from ₹142 crore in FY23, a 14.8% decline.

- The decline in profit follows a decrease in operational scale and a simultaneous rise in certain costs (e.g., employee benefits).

- Bank fees and services remained the largest expense category, at 78.8% of total expenditure in FY24.

- Employee benefit expenses rose 22.4% in FY24 to ₹300 crore.

- Total expenses in FY24 reached ₹2,289 crore.

- On a per‑unit basis, BillDesk spent about ₹0.98 to earn every rupee in FY24.

- Declining revenue combined with rising non‑banking costs (like staff expenses) pressured operating margins.

- Despite these headwinds, the firm continues to maintain positive profitability and a healthy asset base, a sign of resilience amid evolving market dynamics.

Position Among Indian Payment Gateways

- The Indian payment gateway market was valued at around $1.79–2.07 billion in 2024–2025 and is projected to reach about $4.1 billion by 2033 at a CAGR of roughly 9.7%.

- The market is projected to grow to $4.125 billion by 2033 with a CAGR of ~9.7% from 2025 to 2033.

- BillDesk powers 50%–60% of online bill payments in India, showing its dominant position in bill payments.

- BillDesk handles over 4 billion annual transactions with a throughput TPV exceeding ₹10 trillion as of FY23.

- The bill and recurring payment segment represents the majority of BillDesk’s revenue due to its focus on enterprise clients.

- Analysts refer to BillDesk as the “backbone” of India’s bill payments infrastructure due to its institutional strength.

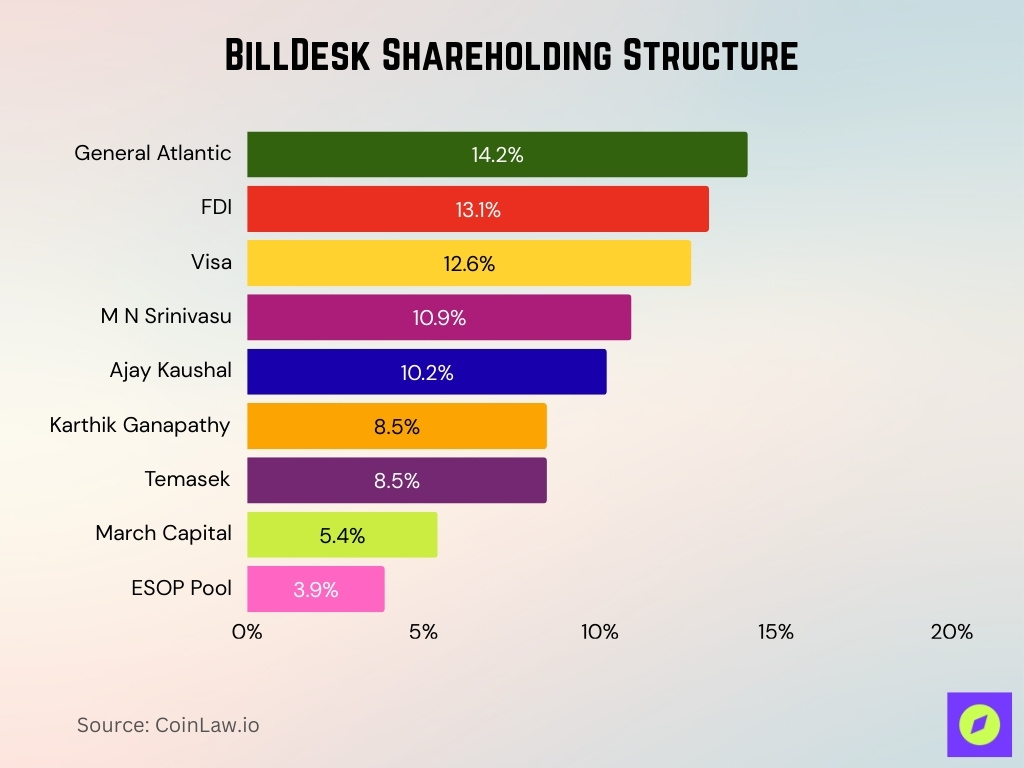

BillDesk Shareholding Structure

- General Atlantic is the largest stakeholder in BillDesk with a 14.2% equity share.

- FDI investors collectively hold 13.1%, reflecting strong international backing.

- Visa owns a significant 12.6% stake, highlighting strategic alignment with global payment leaders.

- M N Srinivasu, co-founder, holds 10.9%, making him the top individual shareholder.

- Ajay Kaushal, another co-founder, owns 10.2% of the company’s shares.

- Karthik Ganapathy, also a co-founder, controls 8.5% of equity.

- Temasek, a Singapore-based investment firm, holds 8.5%, reinforcing BillDesk’s institutional appeal.

- March Capital, a venture investor, owns 5.4%.

- An ESOP Pool (Employee Stock Ownership Plan) represents 3.9%, allocated to employees.

Bill Payments and Utility Payment Volumes

- BillDesk processed over ₹10 trillion in total payment volume (TPV) in fiscal year 2023.

- The platform handled more than 4 billion transactions annually as of 2023, indicating vast scale.

- BillDesk supports a network of thousands of billers across utilities, telecom, insurance, and subscriptions.

- Its multi-channel integration enables consumers to pay bills via UPI, cards, net banking, and wallets, boosting volume.

- BillDesk’s legacy of over 20 years gives it extensive bill-payment data and infrastructure.

- Utility and recurring bill payments via BillDesk constitute a majority share of its transaction volumes.

- Digital payment volumes through BillDesk’s aggregator platform are expected to grow by over 15% annually with India’s digital push.

- BillDesk’s bill-payment volumes show less seasonality compared to retail e-commerce payments, providing revenue stability.

- Recurring payments on BillDesk’s network contribute to over 50% of its total revenue, highlighting their importance.

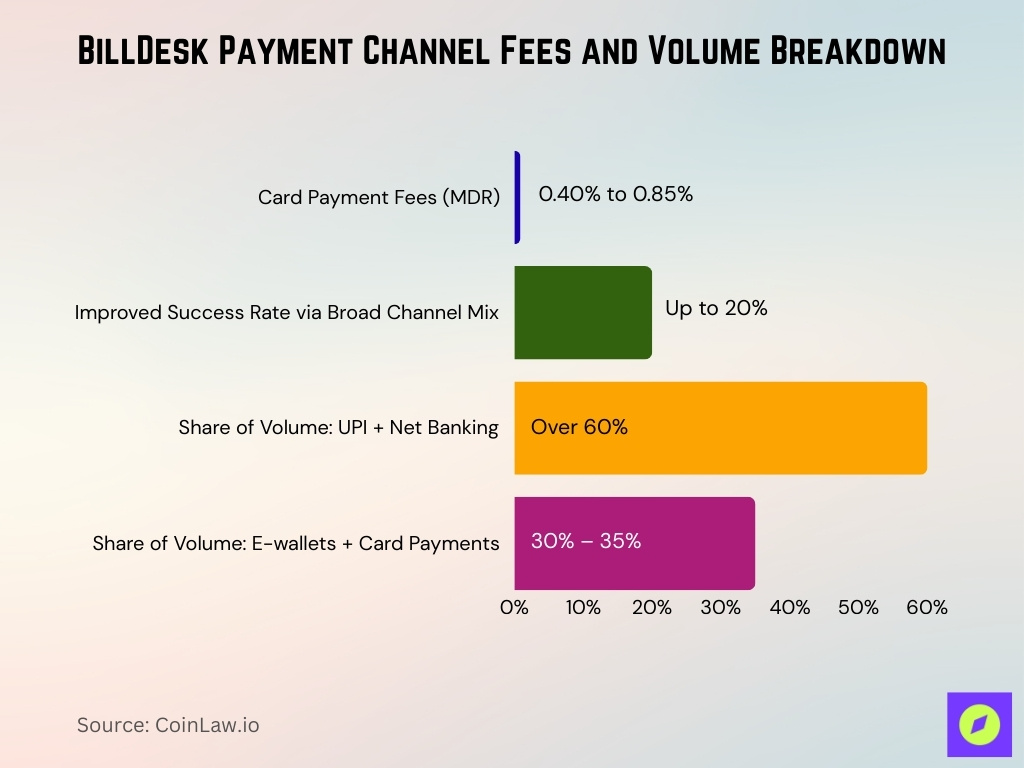

Payment Methods and Channel Mix

- Card payment fees on BillDesk range from 0.40% to 0.85% MDR, while some UPI and RuPay payments have 0% charges.

- Offering a broad channel mix helps reduce payment drop-offs, improving transaction success rates by up to 20% in some cases.

- Over 60% of BillDesk’s transaction volume is driven by UPI and net banking as preferred payment channels.

- The platform’s e-wallet and card payment mix contributes approximately 30%-35% of total transaction volume.

- BillDesk supports multiple payment methods, including debit/credit cards, net banking, e-wallets, and UPI.

- It allows integration of multiple bank accounts via UPI AutoPay, card mandates, and net banking for bill payments.

- BillDesk enables both one-time and recurring payments, expanding its coverage from utility bills to subscription cycles.

- BillDesk services a diverse customer base across urban, semi-urban, and rural areas, requiring flexible payment solutions.

- Its multi-channel approach supports faster digital payment adoption in previously underbanked regions of India.

API Performance and Infrastructure Scale

- BillDesk handles approximately 150 million API calls per day across its payment and bill-payment services.

- Its platform supports over 4 billion transactions annually, reflecting robust infrastructure capacity.

- BillDesk integrates with thousands of banks and billers, enabling large-scale settlements and reconciliations.

- Enterprise clients and major utilities rely on BillDesk’s system, which boasts uptime exceeding 99.9%.

- Founded in 2000, BillDesk’s infrastructure has grown steadily to handle India’s digital payment surge.

Funding, Valuation and Unicorn Status

- BillDesk’s valuation in 2025 is approximately $1.59 billion, maintaining its fintech unicorn status.

- The company first reached unicorn status in 2018 after a major funding round.

- BillDesk attracted global investor interest even before the cancelled acquisition deal by Prosus PayU.

- The proposed acquisition valued BillDesk at $4.7 billion, reflecting a premium for scale and legacy.

- The 2025 valuation represents a downward re-rating from 2021-2022 peaks, influenced by tech market corrections.

M&A Deals and Cancelled Acquisitions

- Prosus‑backed PayU had agreed to acquire BillDesk for about $4.7 billion, but the transaction was automatically terminated in October 2022 after certain conditions precedent were not fulfilled.

- The deal cleared the Competition Commission of India (CCI) on September 5, 2022.

- Prosus terminated the acquisition agreement on October 3, 2022, citing unfulfilled conditions.

- The breakup fee was reportedly between $50 million and $100 million.

- Cancellation was influenced by a sharp correction in global tech and fintech valuations.

Geographical Presence and Coverage in India

- BillDesk operates across urban, semi-urban, and rural India, serving diverse billers and merchants.

- Founded in 2000, it has deep penetration in legacy sectors like utilities, telecom, and government services.

- Its biller network enables payments used by a significant portion of India’s 1.4 billion population.

- BillDesk handles payments for thousands of billers spread across 27+ Indian states and union territories.

- Its infrastructure supports settlements for bill payment volumes exceeding 4 billion transactions annually.

Frequently Asked Questions (FAQs)

BillDesk’s revenue from operations in FY24 was ₹ 2,334 crore.

By the end of FY24, BillDesk’s total current assets were ₹ 2,612 crore, including ₹ 930 crore in cash and bank balances.

Bank fees and services accounted for 78.8% of BillDesk’s total expenditure in FY24.

BillDesk has reportedly raised around $186 million in funding (as per its latest company profile).

Conclusion

BillDesk remains one of India’s oldest and most resilient digital‑payments platforms. Despite a dramatic halt in acquisition ambitions and a reset in valuation, it retains unicorn status, reflecting the strength of its core business model rooted in recurring bill payments, enterprise clients, and broad geographic coverage. Its stable compliance record and lack of reported outages underline consistent operational reliability even as global fintech markets fluctuate.

While the failed merger with PayU illustrates how macroeconomic valuation cycles shape strategic outcomes, BillDesk’s continued independence may offer flexibility as digital‑payments adoption accelerates across sectors. For businesses, regulators, and industry observers, BillDesk continues to stand as a benchmark of legacy stability and sustained performance in a rapidly shifting payments ecosystem.