Bankruptcy filings in the United States surged, reflecting growing financial stress among both consumers and businesses. As economic pressures mount, more households and companies are turning to the courts to restructure or discharge debt. This rise affects not just individual families, but also broader industries, from retail chains closing stores to small businesses seeking relief. Read on to explore the detailed numbers, trends, and what they mean for Americans and the U.S. economy.

Editor’s Choice

- Total U.S. bankruptcy filings reached 557,376 for the 12 months ending September 30, 2025, up from 504,112 the previous year.

- Non‑business (consumer and individual) filings rose to 533,337 in that period.

- Business bankruptcy filings rose to 24,039 in the same period, a 5.6% increase year over year.

- For calendar year 2024, total filings were 517,308, a 14.2% increase from 2023.

- Large corporate bankruptcies remain elevated: 117 major companies filed in the 12 months through mid‑2025, up from annual averages around 81.

- The steep increase in filings reflects rising economic strain among households and businesses under current macroeconomic headwinds, inflation, interest rates, debt loads, etc.

Recent Developments

- The 12‑month period ending June 30, 2025, saw 542,529 total filings, up from 486,613 the prior year, an 11.5% increase.

- As of September 2025, monthly filings continued to climb; total filings for that month were 49,182, up 16% from September 2024 (42,571).

- Within those, individual filings increased to 46,401 in September 2025, up from 40,100 a year earlier.

- Chapter 7 filings alone saw a sharp uptick, 28,772 filed in September 2025, a 19% increase year over year.

- Chapter 13 filings also rose, to 17,533, up 10% over September 2024.

- In that same period, business filings rose 4.5% to 23,043, while non‑business filings surged 11.8% to 519,486.

- Industry observers attribute the trend to mounting household debt and growing financial stress among small businesses, consistent with reports from 2024 showing increased bankruptcy activity.

- Meanwhile, large‑company bankruptcies continue to rise; a mid‑2025 report recorded 117 major companies filing for bankruptcy over the preceding 12 months, well above the 2005–2024 average.

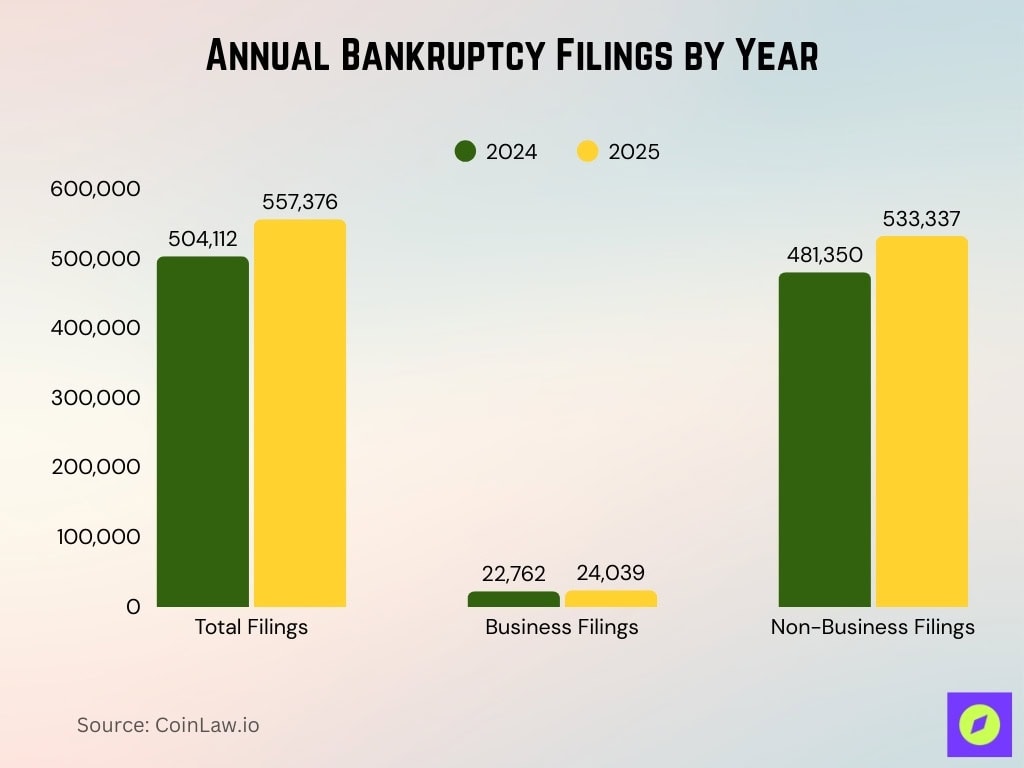

Annual Bankruptcy Filings by Year

- For the 12‑month period ending September 30, total filings reached 557,376 in 2025, compared to 504,112 in 2024.

- Business filings grew from 22,762 in 2024 to 24,039 in 2025.

- Non‑business filings rose from 481,350 (2024) to 533,337 (2025).

- For calendar 2024, total filings were 517,308, up from 452,990 in 2023, a 14.2% increase.

- Business filings in 2024 (23,107) marked the highest annual number since the year ending 2017.

- Chapter‑by‑chapter breakdown (year ending December 31, 2024), Business filings under Chapter 7, Chapter 11, and Chapter 13 all rose compared to 2023.

- For non‑business filings in 2024, Chapter 7 filings increased 18.7%, Chapter 11 filings rose 10.9%, and Chapter 13 filings went up 7.2%.

- While 2024 and 2025 show rising numbers, total filings remain below peak levels seen before and during the early COVID‑19 era.

Business vs Consumer Bankruptcy Filings

- In the year ending September 2025, non‑business (consumer/individual) filings comprised the bulk, 533,337 out of 557,376.

- That accounts for roughly 95.7% of total filings in that period, i.e., businesses remained a minority of cases.

- Business bankruptcies, while smaller in number, increased by 5.6% year over year.

- Business filings, 24,039, reflect a return to higher corporate distress levels in 2025.

- In calendar 2024, business filings rose 22.1% (from 18,926 to 23,107).

Quarterly and Monthly Bankruptcy Filing Trends

- For the 12‑month period ending September 30, 2025, total bankruptcy filings reached 557,376, up from 504,112 the prior year, a 10.6% increase.

- In that same period, business filings rose to 23,043, from 22,060, a 4.5 % increase.

- Non‑business (individual/consumer) filings jumped to 519,486, compared to 464,553 in the prior period, an 11.8 % increase.

- Over the first nine months of 2025, total bankruptcy filings climbed to 423,053, up from 383,341 the previous year, a 10 % rise.

- Within that period, total individual filings rose 11 %, reaching 399,387 from 360,636.

- Chapter 13 individual filings during the first nine months of 2025 increased to 149,337, up from 143,240 in the same timeframe in 2024.

- These quarterly and monthly data illustrate a persistent upward trend in bankruptcy filings throughout 2025 across both consumer and business categories.

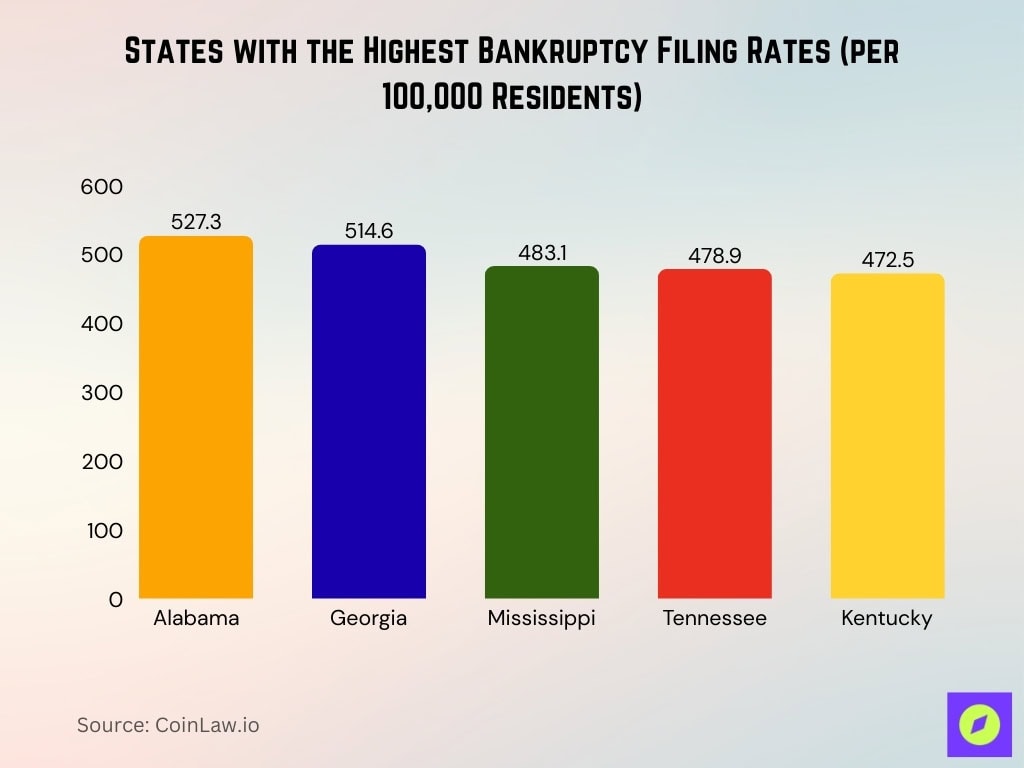

Bankruptcy Filings by State or Region

- Alabama leads with 527.3 filings per 100,000 residents in 2025.

- Georgia records 514.6 filings per 100,000 residents in 2025.

- Mississippi had 483.1 filings per 100,000 residents in 2025.

- Tennessee reports 478.9 filings per 100,000 residents in 2025.

- Kentucky sees 472.5 filings per 100,000 residents in 2025.

- The mountain region shows a 15.81% year-over-year increase in filings in Q1 2025.

Post‑Pandemic Bankruptcy Trends

- After a lull in filings in the immediate post‑pandemic years, bankruptcy filings rebounded; total filings in 2024 rose to 517,308, up from 452,990 in 2023, a 14.2 % increase.

- Business bankruptcies in 2024 surged 22.1 %, from 18,926 to 23,107, the highest level since 2017.

- Non‑business filings also grew, 494,201 in 2024 compared to 434,064 in 2023, a 13.9 % increase.

- The rebound suggests that many households and firms delayed filing during pandemic‑era relief (stimulus payments, moratoriums), but now face renewed financial strain.

- The rise in filings aligns with broader macroeconomic challenges, debt accumulation, rising interest rates, and inflation, adding stress on both consumers and businesses.

Bankruptcy Filing Rates per Capita

- One recent tracker estimates the bankruptcy filing rate will reach 167.5 per 100,000 residents in 2025, up from 149.5 per 100,000 in 2024.

- That represents a roughly 12.0% increase year over year.

- Over the four-year stretch from 2022 to 2025, the rate is projected to have grown from 113.6 to 167.5 per 100,000, an increase of about 47.5%, outpacing population growth.

- At 167.5 per 100,000, roughly 1 in every 597 Americans would file for bankruptcy in 2025 under that projection.

- As more data become available, per‑capita trends will help isolate regional economic strain beyond raw filing counts, a useful metric for policymakers and analysts.

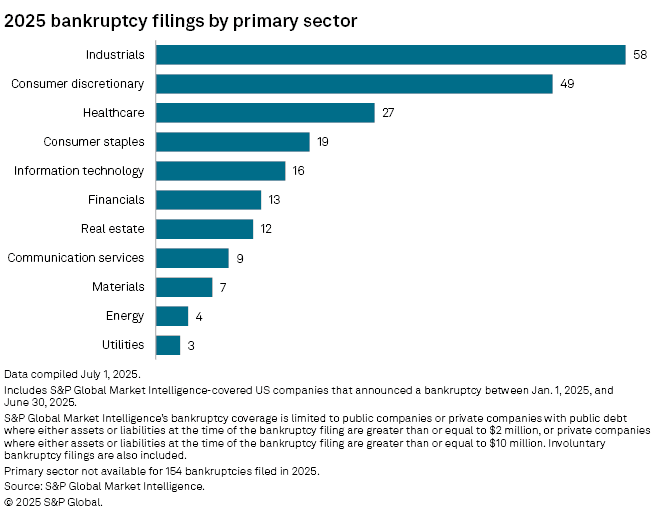

Bankruptcy Filings by Sector: Key Insights

- Industrials led all sectors with 58 bankruptcy filings, the highest of any category in the first half of 2025.

- Consumer discretionary companies followed closely with 49 filings, reflecting continued volatility in retail and lifestyle spending.

- The healthcare sector saw 27 filings, highlighting financial pressure even in essential service industries.

- Consumer staples logged 19 bankruptcies, indicating some stress in day-to-day goods providers.

- Information technology companies reported 16 filings, suggesting early signs of strain in tech amid tightening capital.

- Financials accounted for 13 filings, as some firms struggled with rising interest rates and market shifts.

- Real estate firms experienced 12 bankruptcies, driven by office space declines and commercial sector challenges.

- Communication services had 9 filings, amid slowing ad revenues and platform consolidation.

- Materials companies reported 7 bankruptcies, potentially tied to commodity price instability.

- The energy sector saw 4 filings, remaining relatively stable despite global disruptions.

- Utilities had the lowest count with 3 filings, reflecting their typically steady and regulated nature.

- An additional 154 filings were not classified by primary sector, indicating gaps in public data availability.

Causes and Drivers of Bankruptcy Filings

- Credit card debt surged to $1.21 trillion by mid-2025, driving filings.

- Credit card delinquency rates hit 14.1% for balances 30+ days overdue in 2025.

- Lower-income households faced 22% delinquency rates on credit cards in 2025.

- Household debt reached a record $18.59 trillion in Q3 2025.

- Personal filings rose 10.8% amid high interest rates and inflation in 2025.

- Business filings increased 5.6% due to soft demand and rising costs in 2025.

- Mega bankruptcies numbered 17 in H1 2025, the highest since 2020.

- Filings grew 13.1% in 12 months ending March 2025.

- Inflation and interest rates squeezed budgets, fueling a 11.5% rise by June 2025.

Bankruptcy Filings and Macroeconomic Conditions

- Chapter 7 filings increased 19.8% amid economic pressures in 2025.

- Chapter 13 filings rose 8.3% due to inflation and high rates in 2025.

- Auto loan delinquencies hit 1.6% 60+ days past due by July 2025.

- Subprime auto delinquencies reached 6.65% in October 2025.

- Corporate bankruptcies totaled 371 in H1 2025, the highest since 2010.

- Mega bankruptcies numbered 17 in H1 2025, up from the 2020 peak.

- Filings grew 13.1% in 12 months ending March 2025.

- Chapter 11 filings increased 16.96% in Q1 2025 vs 2019.

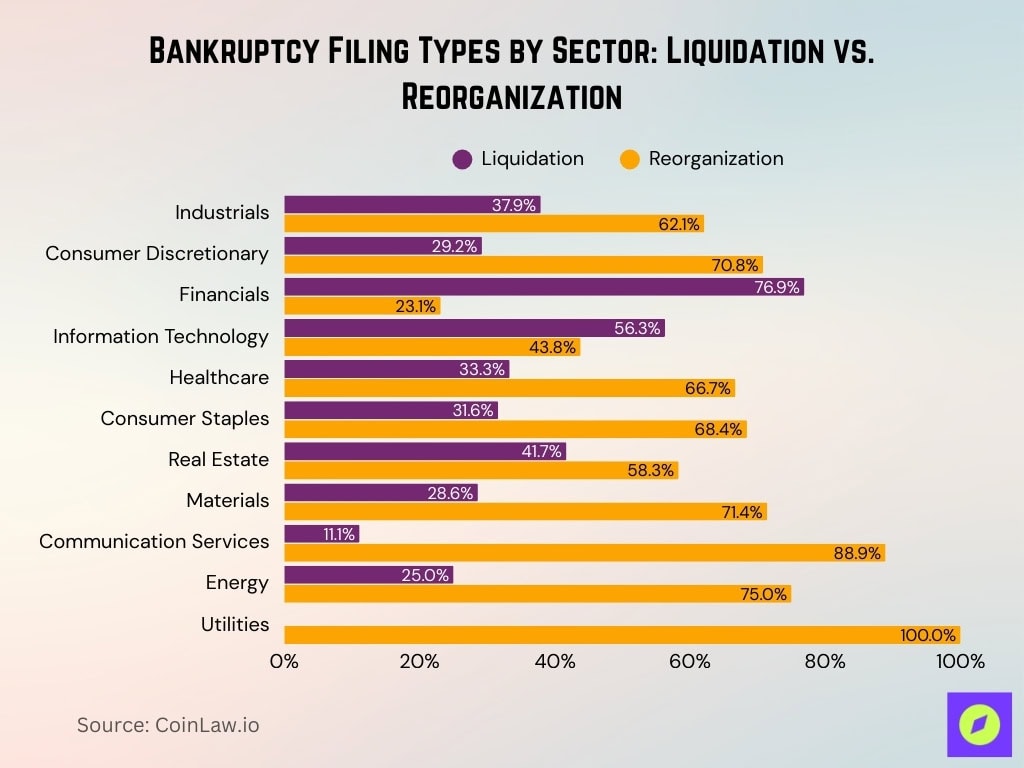

Bankruptcy Filing Types by Sector: Liquidation vs. Reorganization

- Industrials saw 62.1% of bankruptcies proceed through reorganization, with 37.9% through liquidation.

- Consumer discretionary filings leaned heavily toward reorganization at 70.8%, compared to 29.2% liquidation.

- The financial sector stood out with 76.9% of cases classified as liquidation, the highest among all sectors.

- Information technology had a near-even split, with 56.3% liquidation and 43.8% reorganization.

- Healthcare companies filed 66.7% of cases as reorganization and 33.3% as liquidation.

- Consumer staples followed a similar pattern: 68.4% reorganization vs. 31.6% liquidation.

- Real estate companies filed 58.3% for reorganization, with 41.7% opting for liquidation.

- The materials sector recorded 71.4% reorganization cases, while 28.6% were liquidated.

- Communication services overwhelmingly filed for reorganization at 88.9%, with only 11.1% in liquidation.

- Energy sector filings were 75% reorganization and 25% liquidation.

- Utilities posted a unique case with 100% of filings categorized as reorganization and 0% liquidation.

Bankruptcy Filings and Interest Rate Cycles

- Credit card APRs averaged 21.39% in Q3 2025, fueling delinquencies.

- Filings surged 23.5% year-to-date in 2025 due to high rates.

- Corporate bankruptcies hit 686 in 2024, the highest since 2010.

- Chapter 7 filings rose 19.8% amid elevated interest rates in 2025.

- Mega bankruptcies reached 17 in H1 2025, blamed on high rates.

- Chapter 13 filings increased 8.3% from borrowing cost pressures in 2025.

Household Debt and Personal Bankruptcy Statistics

- U.S. household debt surpassed $17.5 trillion in 2024, driven by credit cards, auto loans, and mortgages, all areas experiencing rising delinquency rates.

- Credit‑card balances rose to $1.13 trillion by Q4 2024, with delinquency rates climbing among younger borrowers.

- Auto loan balances reached $1.62 trillion, with more than 7% of borrowers 90+ days delinquent, contributing to increased Chapter 7 filings.

- Medical debt continued to burden households, with roughly one in five U.S. adults carrying unpaid medical bills in 2024–2025.

- From January–September 2025, personal bankruptcy filings climbed to 399,387, an 11% increase over the previous year.

- Chapter 7 personal filings totaled 249,152 during the same period, a 15% year‑over‑year increase.

Small Business Bankruptcy Statistics

- Subchapter V elections hit 223 in November 2025, up 23% from 2024.

- Mom-and-pop bankruptcies reached record highs under Subchapter V in 2025.

- Subchapter V filings totaled 1,183 in H1 2025, down 4% from 2024.

- August 2025 Subchapter V elections rose 17% to 200 from 2024.

- September 2025 Subchapter V decreased 40% to 210 from the prior year.

- April 2025 Subchapter V increased 4% to 218 from 2024.

- Commercial Chapter 11 filings up 20% to 825 in November 2025.

- January 2025, commercial Chapter 11 rose 16% to 539 filings.

Large Corporate Bankruptcy Case Statistics

- 117 large companies filed bankruptcy in 12 months to mid-2025, up 44% from the average.

- 32 mega bankruptcies with over $1 billion in assets in the past 12 months through H1 2025.

- 17 mega bankruptcies in H1 2025, the highest half-year since 2020.

- 655 large corporate bankruptcies through October 2025, on pace for 792 yearly high.

- 371 corporate filings in H1 2025, the highest first half since 2010.

- Private equity backed 70% of large $1 billion+ liability bankruptcies in Q1 2025.

- 63 corporate bankruptcies in June 2025, with 5 over $1 billion in liabilities.

Outcomes of Bankruptcy Cases and Discharge Rates

- Chapter 7 discharge rate held at 95.2% for cases filed in 2025.

- Chapter 13 completion rate stayed at 38.7% through H1 2025.

- Chapter 7 cases closed in an average of 4.8 months in 2025.

- Subchapter V confirmation rate reached 72% in 2025 filings.

- Chapter 11 confirmation averaged 85.3% for small cases in 2025.

- Large Chapter 11 cases saw 62% asset sales vs reorganization in 2025.

- Average Chapter 11 duration hit 14.2 months for complex 2025 cases.

Frequently Asked Questions (FAQs)

533,337 non‑business filings, representing roughly 95.7% of total filings.

249,152 Chapter 7 filings, representing a 15% increase over the same period in 2024.

542,529 total filings, an 11.5% increase compared with the prior 12‑month period.

Conclusion

Bankruptcy filings today continued their sharp upward trajectory as households and businesses faced sustained financial pressure from rising debt, elevated interest rates, and lingering post‑pandemic challenges. Consumers struggled with record‑high credit card balances and auto loan delinquencies, while businesses, especially small firms, navigated higher operating expenses and more expensive financing.

Large corporate bankruptcies also climbed, signaling broader structural stress across key industries. Although bankruptcy offers a path to financial reset, the rising volume of cases underscores the need for stronger economic stability, improved financial literacy, and more accessible debt‑relief solutions.