AVAX One has purchased more than 13.8 million AVAX tokens, marking one of the largest institutional investments into the Avalanche ecosystem to date.

Key Takeaways

- AVAX One acquired 9.37 million AVAX tokens between November 5 and November 23, 2025, at an average price of $11.73, totaling approximately $110 million.

- The company’s total AVAX holdings now exceed 13.8 million, making it one of the largest institutional holders of Avalanche’s native token.

- Alongside its crypto strategy, AVAX One’s board approved a $40 million stock buyback, signaling strong confidence in its long-term outlook.

- Executives cited Avalanche’s potential as a high-speed, institutional-grade blockchain powering the future of global finance.

What Happened?

AVAX One, a Nasdaq-listed company focused on building a scalable digital asset treasury, has significantly expanded its Avalanche (AVAX) token holdings. Between November 5 and 23, 2025, the firm purchased over 9.37 million AVAX tokens for $110 million, pushing its total holdings to more than 13.8 million tokens.

Company executives said the move reflects both a strong belief in Avalanche’s long-term value and a desire to scale their presence in the fast-evolving decentralized finance (DeFi) sector.

🔺 AVAX One Treasury Update: Now Holding 13.8M+ AVAX

— AVAX One (AVX) (@avax_one) November 24, 2025

Between November 5 and 23, 2025, we acquired an additional 9,377,475 AVAX for an aggregate consideration of $110M, reflecting a weighted average purchase price of ~$11.73. This brings our total AVAX holding to over 13.8… pic.twitter.com/BehbS1BlRk

AVAX One’s Aggressive Treasury Strategy

AVAX One’s purchase represents one of the boldest treasury strategies seen in the crypto space in recent months. The company confirmed that this acquisition was a key part of its recently launched treasury initiative, coupled with a full corporate rebrand aimed at aligning with the Avalanche ecosystem.

- The 9.37 million AVAX acquired cost an average of $11.73 per token.

- Total investment amounted to approximately $110 million.

- AVAX One now holds over 13.8 million AVAX tokens.

- The company also initiated a $40 million stock repurchase program, underlining management’s belief in its market value.

Jolie Kahn, CEO of AVAX One, emphasized that these moves are strategic and forward-looking. She said:

She also hinted at further purchases, adding:

Confidence in Avalanche’s Future

AVAX One’s leadership is vocal about their confidence in the Avalanche blockchain, particularly in its potential to reshape global finance. Chairman of the Board Matt Zhang described the network as a “foundational technology” and said the market dip presented a perfect opportunity to accumulate more AVAX.

He also outlined a broader strategy that includes:

- Yield-generating strategies for existing AVAX holdings.

- Gradual market accumulation to expand holdings.

- A long-term vision to build an onchain financial economy powered by Avalanche.

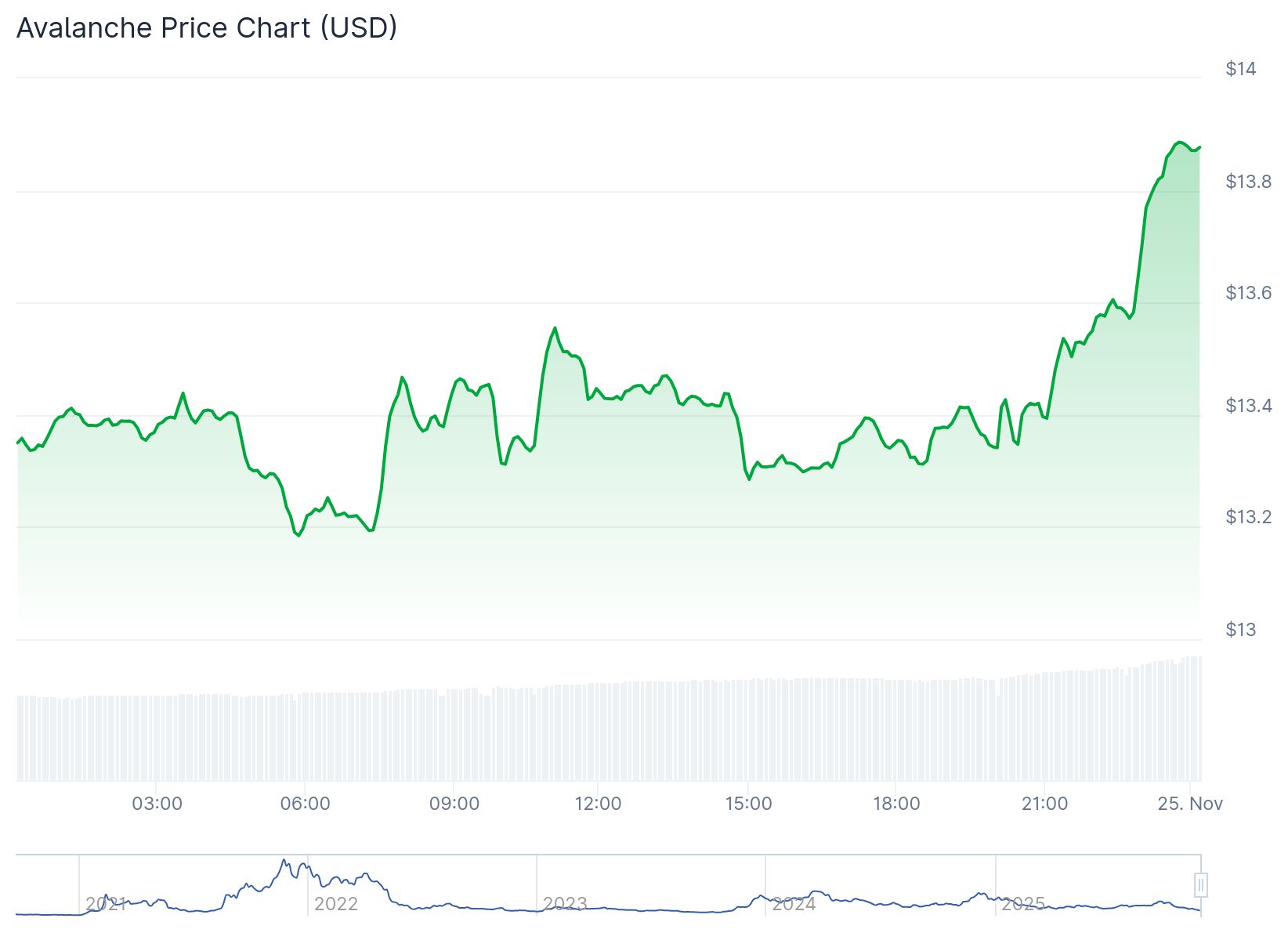

Avalanche Price Trends

As of November 24, 2025, AVAX is trading around $13.30, slightly up on the day but still down 12 percent over the past week. The token saw notable volatility in 2025, with lows around $15 in April and highs over $35 in September. Analysts are watching closely to see if renewed institutional demand like AVAX One’s could help lift prices above resistance levels at $14 and $15.

CoinLaw’s Takeaway

In my experience, big treasury plays like this don’t happen without deep conviction. AVAX One isn’t just betting on a token. It’s buying into an entire ecosystem and doing it during a dip, which tells me they see real long-term value here. I found it especially interesting that they paired this crypto purchase with a $40 million stock buyback. That’s a power move. It signals they’re not just confident in Avalanche but also in their own ability to ride out volatility and deliver shareholder value. If you’re watching how institutional players are navigating the crypto market, this is one of those moves worth paying attention to.