Atomic Wallet has steadily grown into a compelling self‑custody wallet in the crypto space, combining ease of use, asset diversity, and native token incentives. Its appeal spans both retail users seeking a one‑stop portfolio solution and active traders needing in‑wallet swaps and staking. In real estate tokenization platforms or DeFi yield aggregators, for example, users often hold multiple chain assets and lean on wallets like Atomic to facilitate seamless swaps and participation. In cross‑chain gaming or NFT ecosystems, Atomic’s support across blockchains simplifies on‑chain moves. Read on to see the latest quantitative trends shaping Atomic Wallet.

Editor’s Choice

- Over 10 million total users are estimated as of early 2025.

- ~5 million mobile app downloads to date.

- Support for 1,000+ coins and tokens across multiple blockchains.

- Circulating AWC supply of ~10.6 million tokens.

- Daily AWC trading volume is often near zero (very low liquidity).

- In June 2023, a $35 million+ hack targeted Atomic Wallet users.

Recent Developments

- In 2025, a malicious NPM package (named pdf-to-office) was discovered targeting Atomic Wallet and Exodus to inject code.

- Atomic Wallet faced legal pressure after claims of a $100 million theft in 2023, with users alleging negligence.

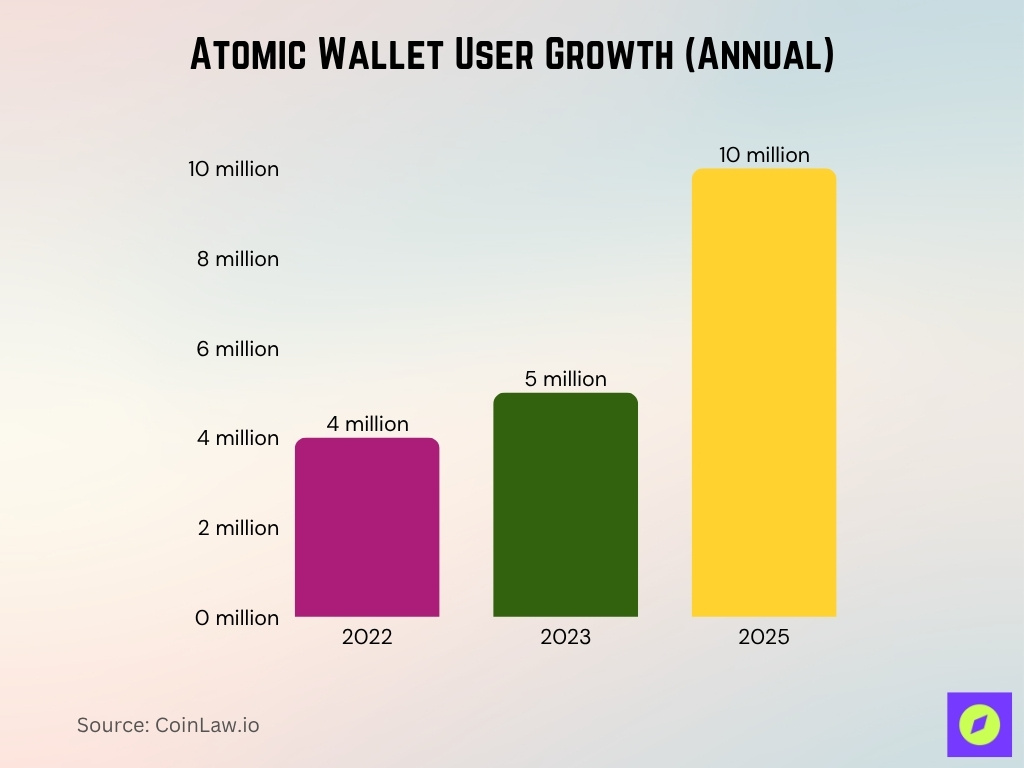

- The wallet’s roadmap shows annual user growth (e.g., 4M, 5M in prior cycles).

- Atomic’s design choices recently emphasize local-only private key storage to enhance security.

- They clarified that they do not support hardware wallets as of April 2025.

- The wallet continues to add chain support and staking capabilities (e.g., 7 new PoS assets in the prior cycle).

Atomic Wallet User Statistics

- Over 10 million users globally as of 2025.

- ~5 million mobile app installs to date.

- In earlier cycles (2022, 2023), users grew from ~4M to 5M.

- User growth rate visible via web signals is modest; Atomic’s web traffic is relatively niche.

- As of 2022, Atomic Wallet’s team was estimated to include ~24 employees, based on LinkedIn and public directory listings.

- ~15% of AWC holders reportedly hold ~$100 worth of AWC.

Overview of Atomic Wallet

- Launched in 2017, based in Tallinn, Estonia.

- Operates as a non‑custodial wallet: the user keeps private keys locally.

- Supports more than 1,000 coins and tokens across major chains.

- Offers in‑wallet swaps (cross‑chain or same chain) for dozens of assets.

- Has built‑in staking, cashback, affiliate, and rewards tied to its native token AWC.

- Emphasizes decentralization and transparency in operations.

- The wallet adds custom token support (e.g., ERC‑20 contracts) to cover niche holdings.

Download and Installation Figures

- Atomic Wallet has achieved over 5 million downloads across platforms as of 2025.

- On Google Play specifically, it lists support for “over 300 cryptocurrencies” in its app description.

- On the App Store, its description also mentions “supports over 300 cryptocurrencies.”

- According to the internal stats page, Atomic is “trusted by 10,000,000 users worldwide.”

- Atomic’s “About Us” page reports 5M+ downloads as a baseline metric.

- In its public stats, Atomic claims “1000+ assets, 5M+ downloads” and “13 own nodes, 18 staking assets.”

- The download page shows availability across Windows, macOS, Ubuntu, Debian, Fedora, etc., broadening potential user reach.

- The fact that the iOS version sometimes becomes unavailable (temporarily) hints at app store restrictions or review delays affecting download counts.

Supported Cryptocurrencies

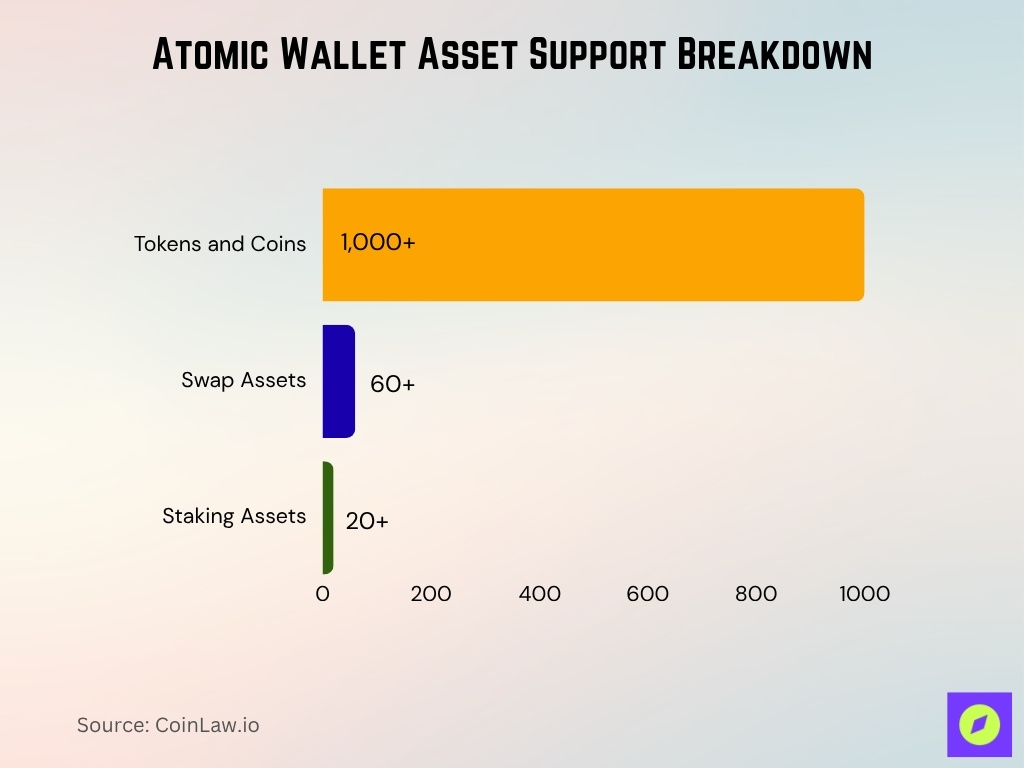

- Atomic supports 1,000+ tokens and coins across multiple blockchains.

- Atomic Wallet advertises anonymous swap support for 60+ crypto assets via integrated APIs, but does not publish a verified list or volume for these pairs.

- Offers 20+ PoS assets for staking use.

- It supports major chains like BTC, ETH, BNB, SOL, ADA, and others.

- Users can manually add custom ERC‑20 or BEP‑20 tokens via contract addresses.

- In past roadmap cycles, new chains added: BNB Chain, NEO3, USDC (TRC20), Terra, etc.

- Continually expanding support via updates and community feedback.

- The diversity of assets allows users to consolidate holdings from multiple protocols in one interface.

User Demographics and Geographic Distribution

- There is limited public disclosure of exact user demographics by Atomic Wallet.

- In broader crypto wallet trends, the U.S., Europe, and Southeast Asia hold significant adoption rates, implying Atomic’s users are likely concentrated in those regions.

- Tech listings suggest that many users are English-speaking, aligning with its global marketing focus.

- The PitchBook profile notes ~15,000 unique visitors weekly to its site, hinting at digital engagement concentrated in mature crypto markets.

- Tracxn describes Atomic Wallet as an app-based solution serving global digital asset users.

- User address data for its token (AWC) holders is publicly viewable on block explorers, estimates suggest 300,000+ AWC holders as per the “About Us” page.

- The Atomics stats page doesn’t break out country-level adoption, but the claim of “trusted by 10,000,000 users worldwide” implies significant cross‑region use.

- Reviews from TechPoint Africa show interest from African markets, suggesting uptake beyond just Western markets.

Atomic Wallet Coin (AWC) Statistics

- According to Atomic’s “About Us” page, there are 300,000+ AWC holders.

- The circulating supply and pricing are less publicly transparent; external trackers like CoinMarketCap or CoinPaprika may offer more detail (though not reliably updated by Atomic).

- In some forecasts, the highest projected price for AWC in 2025 is ~$0.67.

- AWC holder count (~300,000) implies a modest but engaged community relative to major tokens.

- Liquidity on AWC exchanges is notably low, with some tracking sites showing near-zero daily volume.

- The AWC community is often tied to wallet usage, staking rewards, and cashback programs.

- AWC functions as a utility token: cashback, staking, and affiliate rewards in Atomic’s ecosystem.

- The combination of token utility and wallet adoption helps to anchor interest in AWC beyond speculative use.

Global Crypto Wallet Ownership Rate

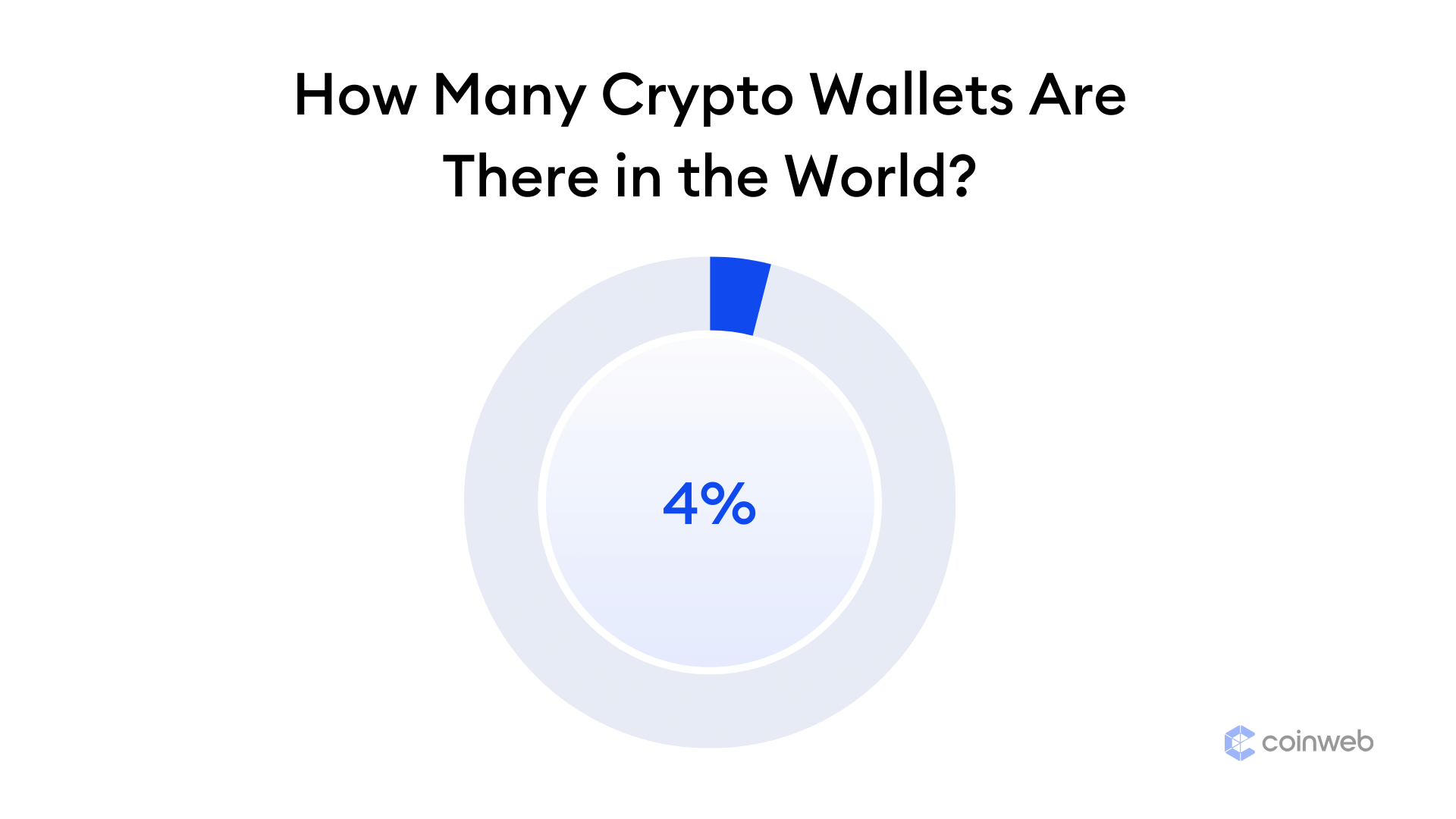

- Only 4% of the world’s population currently owns a cryptocurrency wallet.

- This figure highlights that crypto adoption remains in its early stages despite strong industry growth.

- With global digital asset usage expanding, this 4% penetration rate suggests significant untapped potential for future wallet adoption.

- As blockchain infrastructure and regulations mature, analysts expect the ownership rate to climb steadily over the next few years.

Asset Management Features

- Atomic Wallet supports 1,000+ tokens and coins on multiple chains.

- Users can add custom ERC‑20/BEP‑20 tokens via contract address inputs.

- The wallet displays real-time balances and price valuations in fiat.

- Transaction history is consolidated in one dashboard, across coins and chains.

- Users can sort the portfolio by value, amount, or percent change.

- Atomic supports cashback on certain in-wallet swaps (up to 1%).

- The wallet interface allows users to filter assets by favorites or network type.

- The dashboard UI is optimized for clarity, often praised in reviews for ease of use.

Built-in Exchange and Swap Volume

- Atomic allows anonymous swaps of 60+ crypto pairs using in-wallet exchange functions.

- The wallet advertises cashback of up to 1% on some swap operations.

- The swap infrastructure often relies on partners and APIs, with fees embedded in rates.

- Reviews warn that swap rates may be higher than centralized exchanges.

- Swap volume figures are not officially published; external trackers often show low or sporadic volume for many pairs.

- Because Atomic is non‑custodial, swaps occur on-chain or via routing and bridges.

- Swap volume is sensitive to market conditions; during low volatility, usage may be minimal.

- The number of active swaps per day likely trails those of large DEXs or centralized exchanges, given Atomic’s niche.

Top Staking Assets and Yields on Atomic Wallet

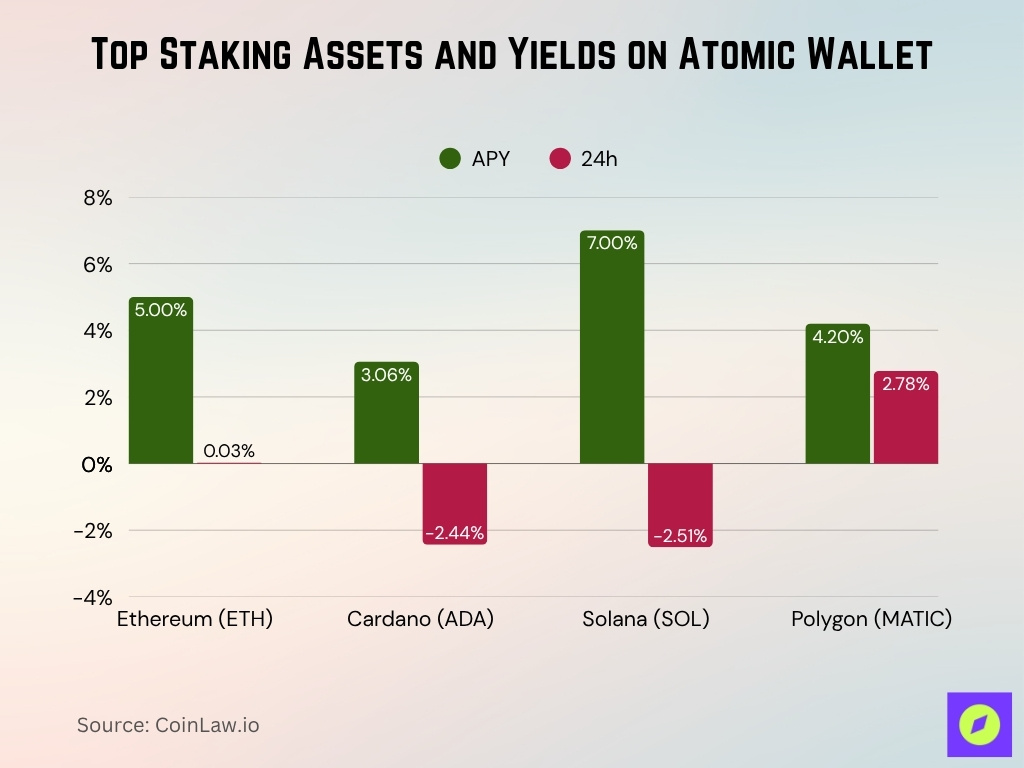

- Ethereum (ETH) offers an APY of 5%, showing steady growth with a +0.03% price change in 24 hours.

- Cardano (ADA) provides an APY of 3.06%, though it saw a -2.44% dip in the past 24 hours.

- Solana (SOL) leads with the highest APY at 7%, despite a -2.51% 24-hour decline.

- Polygon (MATIC) offers a 4.2% APY, posting a +2.78% daily gain, signaling renewed staking interest.

- These figures show that Atomic Wallet supports major PoS assets with varying yield rates and short-term market performance.

Staking and Earning Statistics

- Atomic Wallet supports staking for multiple PoS assets (e.g., SOL, ADA, NEAR, etc.).

- For SOL, Atomic offers a 7% APY rate for staking up to a capped amount (e.g., 100,000 coins).

- Staking APRs for other coins vary by network, often ranging from 4% to 15%.

- Atomic does not charge additional staking fees beyond network fees.

- Staking contributions are user-controlled; stake, unstake operations use typical network gas.

- The wallet currently supports 18 staking assets as per “About Us”.

- The existence of “own nodes” (13) helps support staking infrastructure.

- Staking uptake is likely proportional to wallet adoption in PoS ecosystems (e.g., higher in ADA, SOL users).

Security and Privacy Measures

- Atomic Wallet is non‑custodial: user’ private keys and seed phrases remain on their own device, not on Atomic’s servers.

- Atomic explicitly states it does not store or have access to private keys, passwords, or wallet data.

- Sensitive data (e.g., wallet database, seed) is encrypted locally on the device.

- Atomic has no built‑in two‑factor authentication (2FA) support, which some security‑focused users view as a gap.

- Lack of hardware wallet integration is another trade‑off; users can’t use cold storage devices in concert with Atomic.

- In 2023, Atomic Wallet was linked to a large hack where around $100 million in user assets were allegedly stolen.

- Atomic claims that most security breaches result from user device compromise (malware, keyloggers, phishing) rather than backend servers.

- Atomic emphasizes privacy by requiring no identity verification or account registration when creating a wallet.

- Their privacy policy states they collect minimal data and only what is necessary to deliver services.

- Atomic has launched a security bounty program to encourage reporting of vulnerabilities.

Historical Milestones and Growth Timeline

- Atomic Wallet was launched in 2017, positioning itself early in the era of multi‑asset wallets.

- Over the years, it expanded from supporting a few assets to 1,000+ tokens and coins.

- The integration of staking features was added to broaden usability beyond simple holding.

- Atomic gradually unveiled built‑in swap and fiat on‑ramp features (via third parties) to reduce friction in acquiring assets.

- In 2023, one of its most significant incidents emerged: the large hack of user funds, which became a focal point in its risk narrative.

- Post‑hack, Atomic increased transparency efforts, publishing blog posts about security enhancements and vulnerabilities.

- The roadmap periodically lists chain expansions and upgrades (e.g., new staking assets, node infrastructure).

- Over time, its user base grew from modest numbers to the 10 million-user range referenced in 2025 metrics.

Fees and Cost Structure

- Atomic Wallet is free to download and use, with no subscription or membership fees.

- Network (blockchain) fees still apply for all transactions; these go to miners/validators.

- For swaps, Atomic charges 0.5% plus partner commission, which is factored into the rate you see before executing.

- When buying crypto via fiat in the app, Atomic charges a flat 5% fee, with a $10 minimum per operation.

- There are no additional fees for sending or receiving assets beyond network fees.

- Atomic does not charge staking fees beyond what the underlying network or validator charges.

- Fees in the app (swaps, fiat purchase) tend to be higher than rates on centralized exchanges, due to convenience margins.

- Some users in forums highlight the opacity in how much of the fee is markup vs network cost.

Comparison with Other Crypto Wallets

- Compared to Trust Wallet, Atomic is similar in being non‑custodial, but Trust supports broader DApp integration and is open source.

- Unlike Exodus, Atomic supports a far greater number of chains and tokens (1,000+ vs ~280+).

- Where MetaMask is focused on Ethereum / EVM ecosystems, Atomic offers multi‑chain support (Bitcoin, Solana, etc.).

- Atomic lacks hardware wallet support, which many wallets like Ledger + wallet apps provide; this is a disadvantage for high‑value holders.

- Some wallets charge lower fees for swaps or integrate DEXs more transparently, but Atomic’s built‑in exchange tends to carry higher margins.

- Wallets such as Trust Wallet or Coinbase Wallet may have better community, more integrations, or more support for dApps.

- In terms of security architecture, fully open‑source wallets allow external audits; Atomic’s partial closed‑source parts limit independent verification.

- For casual users, Atomic strikes a strong balance of features vs complexity. For advanced users, more specialized wallets or modular setups may yield better tradeoffs.

Frequently Asked Questions (FAQs)

Atomic Wallet claims over 10 million users globally as of 2025.

The wallet reports ≈ 5 million downloads across iOS and Android.

Atomic Wallet supports 1,000+ coins and tokens across multiple blockchains.

Users lost at least $35 million in the 2023 hack, with some analyses suggesting losses creeping beyond $100 million total.

Conclusion

Atomic Wallet stands as a mature player in the non‑custodial wallet space, offering broad asset support, staking, and in‑wallet swaps while placing custody firmly in users’ hands. Its security model emphasizes local control and encryption, though gaps, the absence of 2FA, and the lack of hardware wallet integration remain challenges. Users benefit from straightforward fee structures and flexibility, though power users may find more optimized alternatives elsewhere.

In comparing Atomic to wallets like Trust Wallet, Exodus, or MetaMask, the trade‑offs become clear: depth of features, transparency, and security all matter. If you’re evaluating whether Atomic Wallet suits your needs, the full article ahead delves deeper into usage patterns, growth trends, and real‑world metrics you’ll want to see.