In today’s rapidly evolving digital world, Automated Teller Machines (ATMs) continue to play a crucial role in financial services. Despite the surge in digital payments and the adoption of cashless transactions, ATMs remain an essential component of the global banking infrastructure.

Whether you’re in a bustling city or a remote town, chances are you’ll find an ATM nearby, offering a vital touchpoint for accessing cash and other banking services. But how has ATM usage evolved in the face of digital advancements? Let’s dive into the latest ATM statistics to explore global trends, market size, and the pivotal role these machines still play in our financial ecosystem.

Editor’s Choice

- Global ATM installations declined by 1.8% as digital payment adoption intensified across both developed and emerging markets.

- Over $13.6 trillion was processed in ATM cash withdrawals, reaffirming the persistent demand for physical currency.

- In developing economies, 84% of consumer transactions still rely on physical cash.

- Western Europe saw a 7.5% drop in ATM usage due to the continued growth of mobile and online banking.

- 30% of global ATMs supported cardless mobile withdrawals, up from 20% the previous year.

- Contactless ATM transactions surged by 19%, reflecting a sustained shift toward speed and hygiene-focused convenience.

Recent Developments

- Modular ATMs from NCR and Diebold Nixdorf reduced downtime by 32%, streamlining maintenance and upgrade cycles.

- Video-enabled ATM deployments rose by 13.6%, enhancing remote teller access and personalized service.

- Self-service kiosks in retail locations grew by 8.4% globally, expanding convenient cash withdrawal options.

- Bitcoin and crypto ATMs added 10,800 new installations worldwide, driven by increasing digital currency usage.

- Eco-friendly ATMs with solar power made up 22% of new deployments, supporting sustainable access in remote regions.

- ATM recycling programs repurposed 34% of decommissioned machines, advancing the industry’s sustainability goals.

- Hybrid ATMs accounted for 26.5% of the global market, integrating cash, digital, and crypto transaction capabilities.

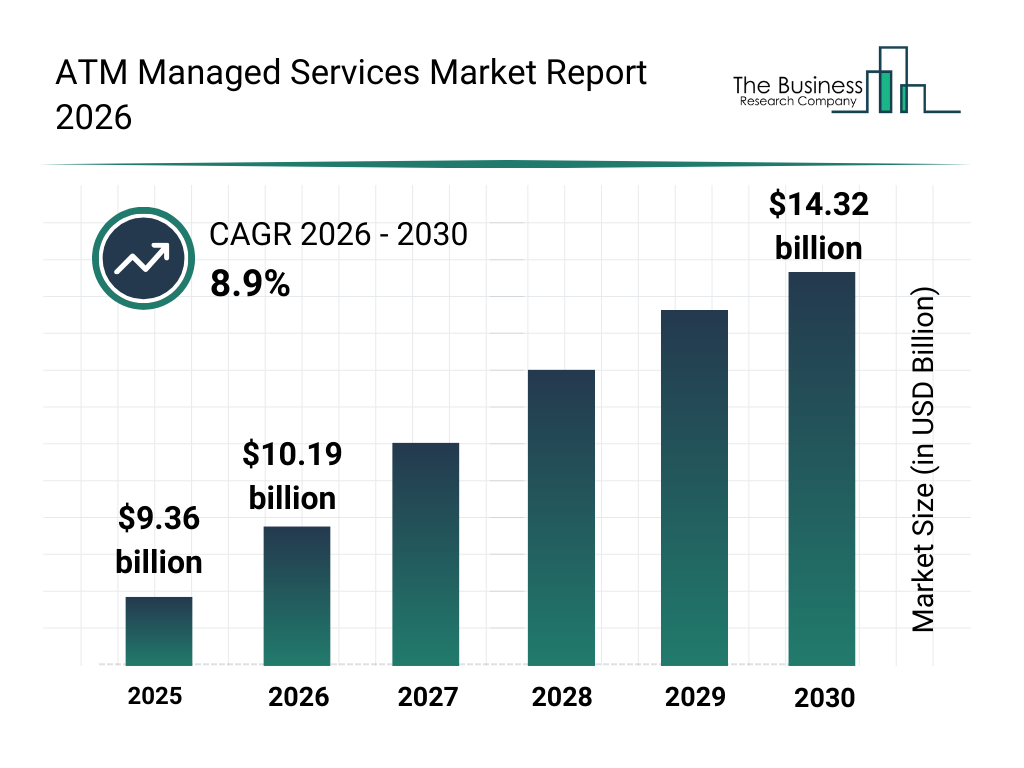

ATM Managed Services Market Growth Overview

- The global ATM managed services market was valued at $9.36 billion in 2025, highlighting strong baseline demand for outsourced ATM operations.

- In 2026, the market expanded to $10.19 billion, reflecting increased adoption of managed ATM solutions by banks and financial institutions.

- The market is projected to grow at a CAGR of 8.9% from 2026 to 2030, indicating steady long-term expansion.

- By 2027, the market size is estimated to reach about $11.10 billion, driven by rising ATM maintenance and monitoring needs.

- In 2028, the market is expected to grow further to approximately $12.10 billion, supported by cost optimization strategies in the banking sector.

- The market is forecast to hit around $13.20 billion in 2029, as financial institutions increasingly outsource ATM lifecycle management.

- By 2030, the ATM managed services market is projected to reach $14.32 billion, underscoring sustained global demand despite digital payment growth.

General ATM Statistics and Trends

- There are approximately 2.91 million ATMs globally, marking a 1.4% decrease from the previous year due to digital-first banking.

- Global ATM transaction volume reached 86.7 billion, showing a slight decline as cash access remains relevant.

- The average withdrawal per ATM transaction rose to $157, up 3.3%, as users reduce ATM visits.

- In the United States, 88% of households used an ATM, highlighting the persistent need for cash access points.

- Nearly 64% of banks worldwide adopted cash recycling ATMs, optimizing cash handling efficiency.

- ATM fraud losses declined to $1.5 billion, though skimming remains the most reported method despite security upgrades.

- ATM usage among soledr people rose by 16.5% over five years, driven by enhanced accessibility and user-friendly features.

ATM Usage and Cash Withdrawal Trends

- Around 30% of global consumer transactions still involve cash, reinforcing the ongoing relevance of ATM networks.

- Cardless ATM transactions rose by 17.8%, driven by the ease of mobile banking withdrawals without physical cards.

- Contactless ATM withdrawals increased by 19.4%, with widespread NFC adoption in North America and Europe.

- Cryptocurrency ATMs processed over $1.4 billion in transactions, with user growth exceeding 35% year-over-year.

- ATM visits dropped by 11.2%, but users made larger withdrawals per visit, favoring convenience over frequency.

- 87% of ATM transactions occurred outside traditional banking hours, reflecting rising demand for 24/7 cash access.

- In India and Brazil, 73% of the population used ATMs monthly, showing strong dependence on basic banking access.

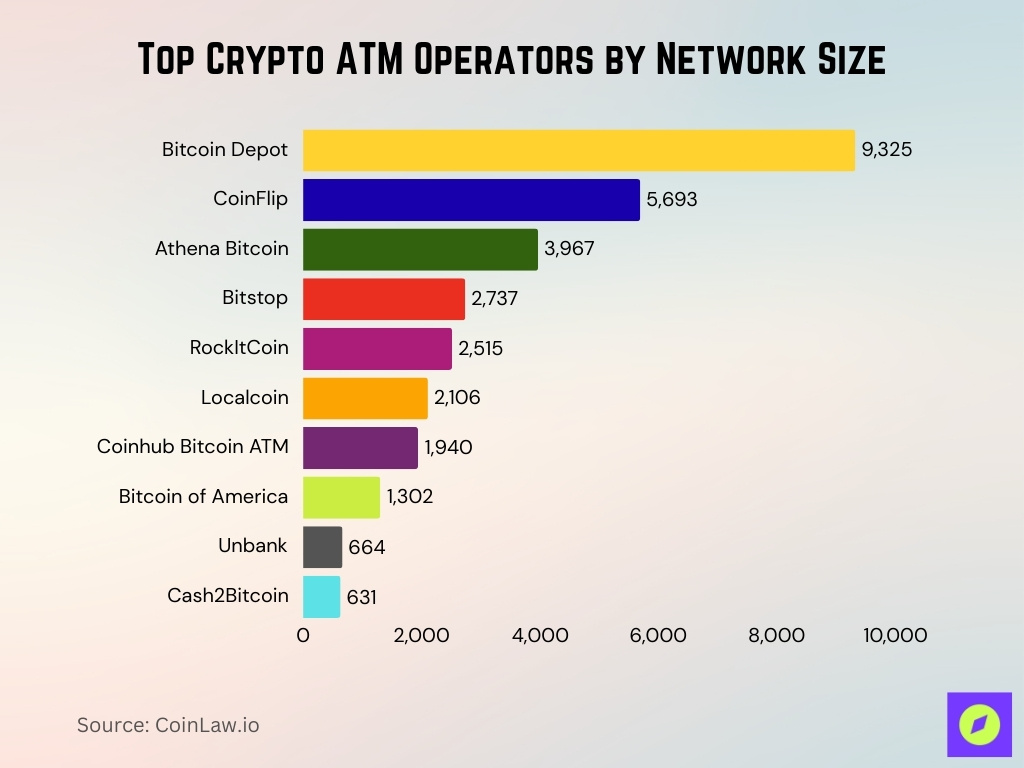

Top Crypto ATM Operators by Network Size

- Bitcoin Depot leads the global crypto ATM market with 9,325 ATMs, accounting for 23.5% of all crypto ATMs worldwide.

- CoinFlip ranks second, operating 5,693 ATMs, which represents 14.3% of the global crypto ATM network.

- Athena Bitcoin manages 3,967 ATMs, giving it a 10.0% market share and placing it among the top three operators globally.

- Bitstop operates 2,737 ATMs, capturing 6.9% of the global market.

- RockItCoin controls 2,515 ATMs, representing 6.3% of total crypto ATM deployments.

- Localcoin runs 2,106 ATMs, accounting for 5.3% of the global crypto ATM market.

- Coinhub Bitcoin ATM operates 1,940 ATMs, holding a 4.9% market share.

- Bitcoin of America manages 1,302 ATMs, which equate to a 3.3% global share.

- Unbank operates 664 ATMs, representing 1.7% of the total market.

- Cash2Bitcoin runs 631 ATMs, capturing 1.6% of global crypto ATM installations.

Regional Insights

- Asia-Pacific leads the world in total ATM installations, with over 1.4 million machines in operation, comprising 50% of the global total.

- In North America, ATM installations declined by 5%, with banks focusing on consolidating ATM networks in favor of digital solutions.

- Latin America saw a 7% increase in ATM transactions, driven by economic instability and a preference for cash in countries like Brazil and Argentina.

- In Europe, Germany stands out with a significant reliance on cash, where 75% of point-of-sale transactions are still conducted using cash, despite the rise of digital payment solutions.

- Africa saw a 10% growth in ATM deployments, as financial inclusion efforts expand access to banking in rural regions.

- Middle Eastern countries like Saudi Arabia and the UAE saw cash withdrawals increasing by 8%.

- India maintains one of the largest ATM networks, with over 250,000 machines, and saw a 6% rise in ATM withdrawals, largely due to financial inclusion.

Solution Insights

- 16% of ATMs globally now support biometric authentication, such as fingerprint or facial recognition.

- ATM as a Service (ATMaaS) grew by 16.4%, enabling smaller banks to reduce infrastructure costs and enhance ATM uptime.

- Mobile-enabled ATMs accounted for 30% of global machines.

- Solar-powered ATMs expanded by 18%, particularly in rural Africa and South Asia, improving off-grid banking access.

- Blockchain-powered ATMs added 6,100 new installations, driven by the rising use of crypto withdrawals and deposits.

- Smart ATMs with video teller services are growing 7.2% CAGR through 2029, streamlining remote customer support.

- Contactless ATM installations reached 42% of all new ATMs, meeting the demand for NFC-based hygienic access.

Global ATM Services Market Share by Type

- Offsite ATMs dominate the market, accounting for approximately 37% of the global ATM services share, serving customers in high-footfall areas like malls, airports, and convenience stores.

- On-site ATMs hold an estimated 43% share, typically located within bank branches.

- Worksite ATMs make up about 13%, placed within business premises to provide employee convenience.

- Mobile ATMs contribute the smallest share at around 7%, but play a crucial role in rural or event-based deployments.

Impact of Digital Payment Systems on ATM Usage

- ATM usage declined by 5.7% across major economies like the US, UK, and Germany due to the growth of mobile payments.

- Peer-to-peer platforms like Venmo and Zelle reduced ATM visits by 22% among Gen Z, replacing routine cash withdrawals.

- Contactless payments led to a 10.8% drop in cash withdrawals in developed countries, driven by platforms like Apple Pay.

- QR code-based payments rose by 19.5% globally, further reducing ATM reliance in urban regions.

- In Sweden, ATM usage fell by 82% over the past decade, with 99% of transactions now cashless.

- CBDC pilots expanded to 18 countries, accelerating the global shift away from physical cash and ATMs.

- In Africa, over 80% of consumer transactions still use cash, keeping ATMs essential in underserved regions.

ATM Security and Fraud Prevention Trends

- Global ATM fraud losses reached $1.5 billion, showing a slight decline due to strengthened countermeasures.

- Skimming attacks accounted for 77% of ATM fraud cases, though EMV chip adoption continues to reduce risk in many regions.

- Biometric security is now deployed in 16% of ATMs worldwide, helping curb unauthorized access attempts.

- End-to-end encryption is present in 68% of new ATM installations, becoming a critical layer in consumer data protection.

Frequently Asked Questions (FAQs)

Approximately 2.9–2.95 million ATMs were deployed worldwide in 2025/2026.

ATM usage across major economies fell by approximately 5.7% in 2025.

Over half of global ATMs are now placed off‑site (not inside traditional bank branches).

Peer‑to‑peer apps contributed to a ~22% reduction in ATM visits among Gen Z users.

Conclusion

The ATM industry remains an essential part of the global financial landscape, even as digital payment systems and cashless transactions grow in prominence. ATMs continue to evolve, integrating new technologies such as biometrics, cryptocurrency access, and contactless transactions, which enhance security and convenience. While ATM installations may decline in developed regions, the demand for cash services in emerging markets and the growing adoption of smart ATMs indicate that the industry is far from obsolete. As we look to the future, ATMs will continue to bridge the gap between traditional banking and modern, digital-first solutions.