Imagine standing at an ATM, withdrawing your hard-earned money, only to later find your account drained by an unknown transaction. This scenario, though alarming, is becoming increasingly common as ATM fraud evolves into more sophisticated schemes. In recent years, financial criminals have harnessed technology to exploit vulnerabilities, causing significant losses for individuals and financial institutions alike. Understanding these risks and the statistics behind them is crucial for both awareness and prevention.

Editor’s Choice

- Continued rise in fraud incidents reported that U.S. shoppers lost $16.6 billion to fraud in the first three quarters of 2025, a 25% increase from the same period in 2024.

- Over 280,000 debit cards were compromised due to skimming in 2025, with nearly 3,400 financial institutions affected.

- 76.1% of individuals sentenced for credit card and other financial instrument fraud in the United States were male in 2025.

- Digital AI TM fraud, while still rare at 0.11% in 2025, is gaining ground due to advances in phishing techniques and AI-driven attacks.

- Older adults, especially those over 60, were more than three times as likely to fall victim to Bitcoin ATM scams compared to younger individuals in 2025.

- Scam-related fraud increased by 50% in 2025, outpacing other digital payment crimes.

Attempted Check Fraud by Deposit Channel

- Branch deposits accounted for the largest share of attempted check fraud at 51%, showing that traditional in-person channels still face the greatest risk exposure.

- Mobile deposits followed with 31%, reflecting the growing vulnerability of digital banking as mobile transactions continue to rise.

- ATM deposits represented 18%, a smaller but still significant portion, indicating ongoing concerns around skimming and physical device fraud.

- The data suggests that while digital channels (mobile + ATM) together make up nearly half of attempted check fraud value, branches remain the primary target due to higher-value checks and in-person deposits.

- Financial institutions may need to balance physical and digital fraud prevention, reinforcing both branch-level identity verification and mobile deposit authentication systems.

Global Trends in ATM Fraud

- Europe experienced a 32% rise in ATM fraud in 2025, driven largely by skimming and card cloning activities.

- Asia-Pacific countries reported over $650 million in ATM fraud losses in 2025, targeting outdated ATM systems.

- In Africa, fraud incidents doubled in 2025, primarily due to the lack of encrypted ATM networks.

- The adoption of EMV chip technology reduced ATM fraud by 30% in developed countries in 2025, but it remains underutilized in some regions.

- Cross-border ATM fraud increased by 13% in 2025, underscoring the need for international collaboration.

- Cyber-based ATM attacks surged by 21% in 2025, with malware posing a significant threat to ATM infrastructure.

ATM Skimming Devices

- Skimming devices were responsible for $1.58 billion in global losses in 2025, continuing the upward trend.

- Fraudsters now use advanced, 3D-printed skimmers in 2025, making detection more challenging for ATM operators.

- Wireless skimming tools increased by 46% in 2025, enabling criminals to access data remotely.

- Overlay skimmers accounted for 72% of skimming-related fraud in 2025.

- European countries reported a 29% drop in skimming incidents in 2025 due to stricter regulations and technology upgrades.

- Hidden cameras used with skimming devices to capture PIN entries remain a critical issue in older ATM networks in 2025.

- The introduction of anti-skimming jammers on ATMs reduced skimming attempts by 32% in North America in 2025.

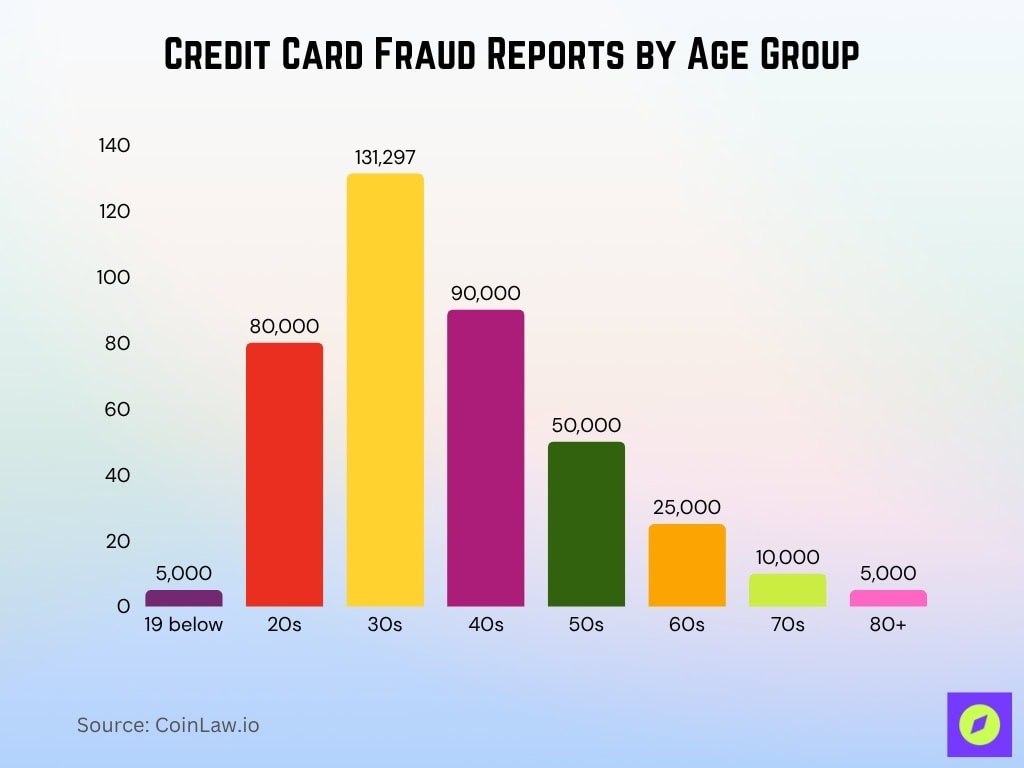

Credit Card Fraud Reports by Age Group

- People in their 30s reported the highest number of credit card fraud cases, with 131,297 reports, according to the Federal Trade Commission.

- Those in their 20s followed with approximately 80,000 cases, reflecting high exposure among younger adults using digital and mobile payments.

- Individuals in their 40s reported about 90,000 incidents, showing continued vulnerability despite greater financial awareness.

- The number of reports drops significantly after the 50s, with only around 50,000 cases for this group.

- Older age groups (60s, 70s, 80+) reported fewer cases, roughly 25,000, 10,000, and 5,000, respectively, possibly due to lower online transaction activity.

- Overall, the data highlights that younger adults (20s–40s) account for the majority of credit card fraud, driven by their higher engagement with e-commerce and digital banking.

POS Skimming Devices

- POS skimming saw a 16% rise in 2025, with fraudsters targeting retail outlets and gas stations.

- Over $780 million was lost globally due to POS skimming in 2025, reflecting a growing trend in card-present fraud.

- Fraudsters are leveraging Bluetooth-enabled skimming devices, which have increased by 33% year-over-year in 2025.

- Self-checkout terminals are a rising target, with 19% of reported POS skimming occurring at these locations in 2025.

- EMV chip card adoption in POS terminals helped reduce fraud by 24% in some regions, but non-compliance remains a vulnerability in 2025.

- Upgraded POS systems with tokenization technology are projected to reduce fraud by 22% in 2025.

- Consumer education on POS fraud prevention remains low, with 46% of users unaware of skimming risks at point-of-sale terminals in 2025.

Impact of ATM Fraud on Financial Institutions

- Reputation damage from ATM fraud incidents led to a 12% customer churn rate among affected institutions in 2025.

- Financial institutions reported a 37% increase in legal disputes related to fraud reimbursement claims in 2025.

- Insurance premiums for ATM fraud protection increased by 21% in 2025, reflecting the growing risk landscape.

- Collaborative efforts among banks and regulators helped reduce fraud cases by 15% in regions with unified prevention frameworks in 2025.

- Operational costs for fraud management rose by 26% in 2025, impacting smaller banks and credit unions disproportionately.

- ATM network upgrades cost institutions over $1.68 billion globally in 2025, a necessary step to combat emerging fraud tactics.

Card Skimming Fraud and Increasing Compromise

- Card skimming accounted for 60% of ATM fraud globally in 2025, making it a persistent concern for financial institutions.

- Europe reported a 19% decline in card skimming fraud in 2025, thanks to the widespread adoption of anti-skimming technologies.

- Developing countries experienced a 33% rise in skimming fraud in 2025 due to outdated ATM systems.

- Contactless card technology has reduced skimming vulnerabilities by 23% in 2025, especially in urban regions.

- Cloned card fraud increased by 24% in 2025, indicating a shift towards high-tech skimming methods.

- Skimming devices now use ultra-slim profiles, making them harder to detect for both users and ATM operators in 2025.

Consumer Awareness and Protection Measures

- Despite the risks, 42% of consumers are unaware of basic ATM security tips in 2025, such as covering the keypad when entering a PIN.

- Only 57% of US cardholders use mobile banking alerts to monitor suspicious transactions in real-time in 2025.

- Fraud awareness campaigns reduced incidents by 18% in areas where they were actively promoted in 2025.

- 89% of fraud victims reported delays in reimbursement in 2025, highlighting a gap in financial institution support.

- Consumer education programs about fraud prevention are expected to grow by 29% in 2025, emphasizing proactive security measures.

- Consumers who opt for contactless payment methods experienced 53% fewer fraud incidents compared to traditional methods in 2025.

- Freezing compromised accounts within minutes prevented losses for over 3.2 million consumers globally in 2025.

The Role of Automation in Fraud Prevention

- Automated fraud detection systems identified 79% of suspicious transactions in real-time during 2025.

- Machine learning algorithms reduced false positives in fraud detection by 24% in 2025, saving banks millions in operational costs.

- Biometric authentication adoption increased by 34% in 2025, significantly reducing fraud at modern ATMs.

- AI-driven anomaly detection systems flagged $930 million in potential fraud transactions in 2025, preventing large-scale losses.

- Integrated blockchain technologies are being piloted in 2025 to enhance transactional security, showing promising early results.

- Automation tools have enabled 24/7 fraud monitoring in 2025, reducing downtime for investigating potential threats.

- Future projections suggest a 41% increase in automation-driven fraud prevention by 2026 as technology continues to advance.

Recent Developments

- ATM Jackpotting Arrests: In 2025, Venezuelan nationals were arrested in the U.S. for conducting ATM jackpotting attacks, using malware to force ATMs to dispense cash, with losses exceeding $187,000 in recent incidents.

- Increase in Bitcoin ATM Scams: The FBI reports scams involving Bitcoin ATMs cost Americans nearly $250 million in 2024, and losses are on pace to increase in 2025.

- Significant Financial Losses: Payment card fraud losses worldwide reached $35.6 billion in 2025, with the U.S. accounting for 43% of these losses.

- Legislative Actions Against Crypto ATM Fraud: U.S. senators introduced the Crypto ATM Fraud Prevention Act in 2025 to combat the rising number of scams associated with cryptocurrency ATMs.

Frequently Asked Questions (FAQs)

Global ATM fraud losses are estimated to reach $2.4 billion in 2025.

ATM fraud cases in the US have surged by 600% since 2019.

Card skimming accounts for nearly 60% of reported global ATM fraud cases in 2025.

The global ATM fraud prevention market is projected to reach $5.2 billion by 2026 with a CAGR of 9.4%.

Conclusion

ATM fraud remains a critical concern for consumers and financial institutions alike as technology evolves. The ATM fraud underscores the importance of proactive measures, from robust consumer education to advanced fraud prevention tools. While innovations like contactless ATMs and automated fraud detection are making strides, increased collaboration and global standardization are essential for long-term protection. As this year progresses, staying informed and vigilant will be key to mitigating risks and ensuring a secure financial future.

MQMaggie Q

Great article Barry. I always try to stay on top of these things to protect my family’s money learning about skimming devices was super helpful.

JKJeff K

While the section on ATM fraud’s impact on financial institutions is comprehensive, I believe it underestimates the broader economic implications. Financial losses from fraud are merely the tip of the iceberg. We also need to consider the erosion of consumer trust, which can have far-reaching effects on the financial ecosystem. The direct costs are quantifiable, sure, but the indirect costs, such as increased security measures and insurance premiums, can accumulate quickly. Moreover, as institutions pass these costs onto consumers, we could see shifts in consumer behavior towards more cashless transactions. This shift, while potentially reducing ATM fraud, may introduce new vulnerabilities in digital payments. It’s a complex issue that requires a multi-faceted approach, integrating stronger regulatory frameworks, advanced technologies, and consumer education.