Imagine a world without mobile apps. Today, apps are integral to our daily routines, from ordering food and booking a ride to staying connected with friends. The global app market has exploded, and app developers, both big and small, are tapping into this growing goldmine. In recent years, the app economy has evolved rapidly, driven by increased smartphone usage, faster internet, and innovative monetization strategies. As the world becomes more digital, understanding the key metrics of app revenue is crucial, not just for developers but also for businesses and investors eyeing this booming industry.

Editor’s Choice

- Global app revenue projected to reach $613 billion.

- TikTok top-grossing app, generating over $2.3 billion worldwide.

- Mobile gaming apps account for around 52% of global mobile app revenue, making them the highest‑grossing app category worldwide.

- Subscriptions are dominant, with platforms like YouTube and Spotify earning over $13 billion.

- Google Play generates $65 billion in revenue, games 41%.

Recent Developments

- Subscription models account for 30% of global app revenue, driven by streaming, fitness, and productivity apps.

- Freemium models enable apps like Spotify and Duolingo to generate significant revenue through in-app purchases with large free user bases.

- In-app advertising is projected to reach $418.73 billion globally, led by social media apps like Facebook and TikTok.

- Gaming NFT market valued at $7.63 billion, growing at 25.14% CAGR.

- Super apps like WeChat and Gojek diversify revenue through payments, shopping, and entertainment in single platform.

- Ad-free premium experiences like YouTube Premium and Spotify see rising adoption with users paying for uninterrupted access.

iOS vs Android App Spending Insights

- On average, iPhone users spend $12.77 per app, nearly 2× higher than Android users, who spend $6.19 per app.

- In-app purchase spending on iOS reaches $1.07 per transaction, compared to just $0.43 on Android.

- iOS users generate approximately 106% higher per-app revenue than Android users.

- In-app purchases on iPhone deliver around 149% more revenue per transaction than Android.

- The data highlights iOS as the stronger monetization platform, despite Android’s larger global user base.

- Higher iOS spending reflects greater willingness to pay, stronger premium app adoption, and more effective in-app monetization strategies.

In-App Purchases vs. Ad Revenue: What Drives Profit?

- Global in-app purchase revenue hit $167 billion in 2025, growing ~10% YoY, showing strong spending even as overall downloads slow.

- Consumer spending on all mobile apps reached $155.8 billion in 2025, driven mainly by in-app purchases and subscriptions.

- In 2025, mobile games generated $81.8 billion in IAP revenue, while non-game apps brought $85.6 billion, marking a 21% increase in non-game spend.

- In-app advertising is expected to generate around $390 billion globally in 2025, making ads the largest single revenue stream.

- Ads accounted for roughly ~65% of total mobile app revenue in 2025, compared with ~33% from in-app purchases.

- Subscription revenue for apps surged, with paid subscriptions generating $120 billion in 2025 and average monthly subscription fees rising to $10.20.

- Apps using hybrid monetization show ~30% higher lifetime value (LTV) compared to those with just ads or IAP alone.

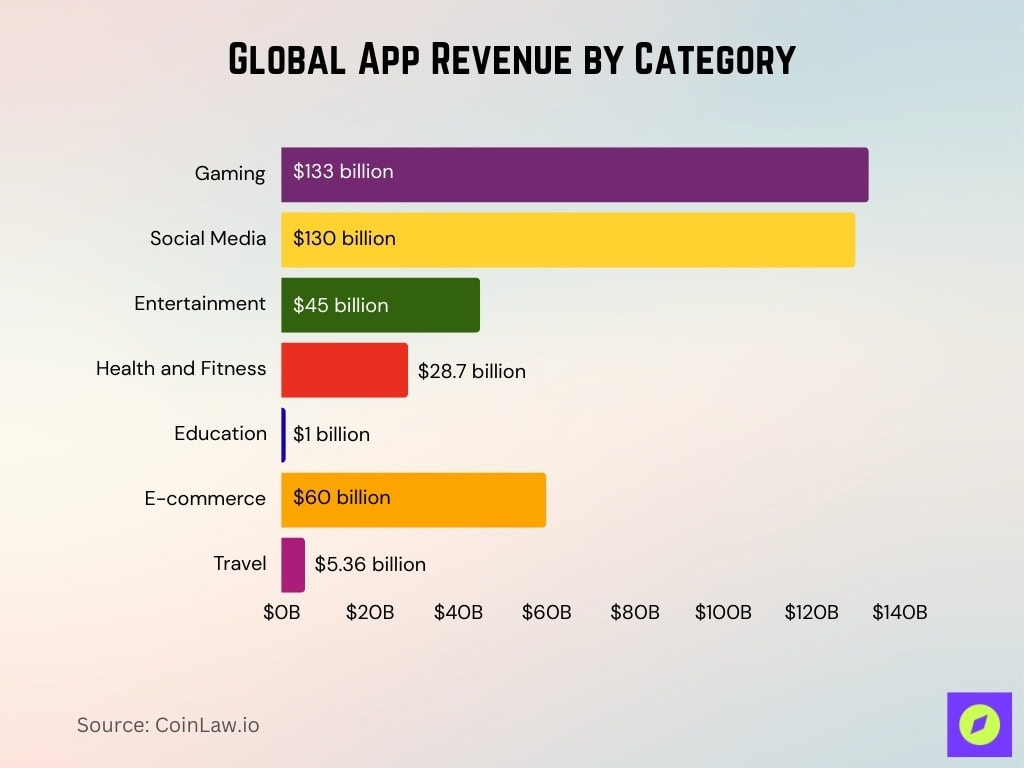

Revenue by App Category (Gaming, Social, Entertainment, etc.)

- Gaming apps generate $133 billion, accounting for 52% of total app revenue.

- Social media apps like Facebook and Instagram earn $130 billion primarily through advertising.

- Entertainment apps, including Netflix and Disney+, generate over $45 billion in subscription revenue.

- Health and fitness apps contribute $28.7 billion to the global market.

- Educational apps like Duolingo earn $1 billion, boosted by online learning demand.

- E-commerce apps such as Amazon and Shopify contribute over $60 billion through in-app purchases.

- Travel apps generate $5.36 billion, reflecting a continued industry rebound.

Emerging App Monetization Strategies

- 72% of developers implemented hybrid monetization (ads + IAP + subscriptions) in 2025, and hybrid models delivered ~30% higher LTV.

- Hybrid models for Android mid-core games achieved 146% ROAS by Day 90 versus 93% for IAP-only and 58% for ads-only.

- Hypercasual games with hybrid strategies saw a 28% higher ARPU ($0.60) compared to ads-only ($0.47) by Day 90.

- AI and generative AI apps earned approximately $1.3 billion in IAP revenue in 2024, a 180% YoY increase, reflecting rapid monetization growth.

- Subscription apps, despite being a small share of all apps, generated 45% of total app revenue, highlighting their disproportionate impact.

- Apps blending monetization models report 3–5× higher lifetime value per user than single method apps in 2025.

- Around 35% of apps mix subscriptions with consumables or lifetime purchases, with gaming at 61.7% adoption of hybrid models.

- Freemium and hybrid apps improved conversion rates by 20–30% through targeted in-app prompts and personalized offers.

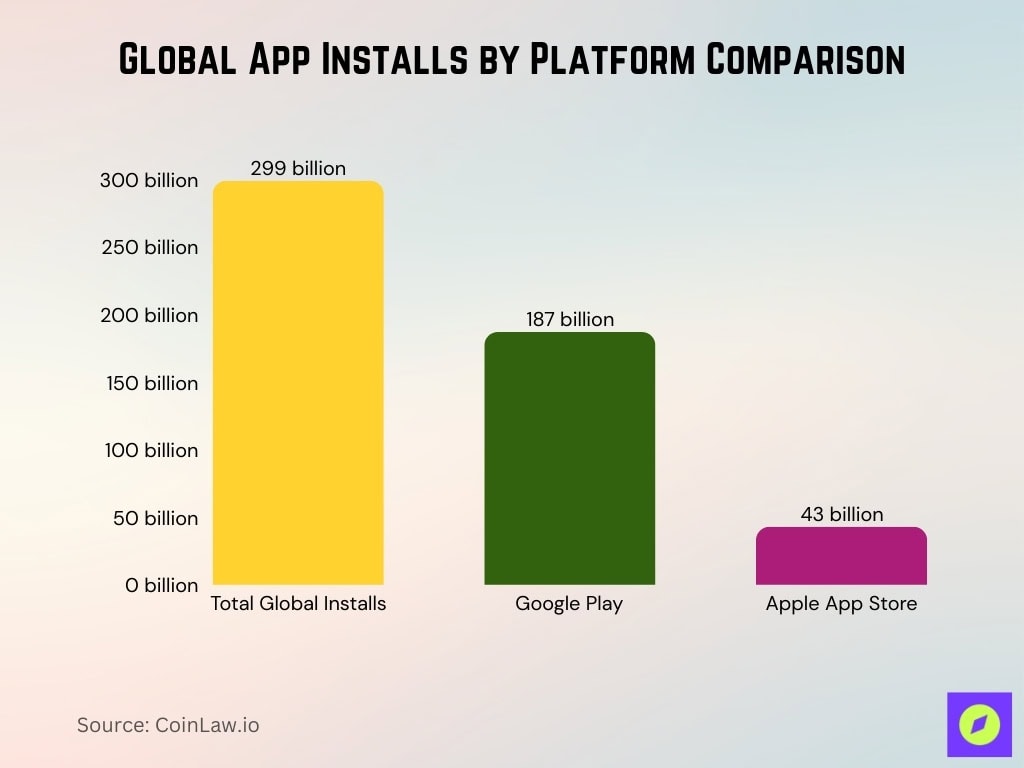

Projected Global App Installs: Google Play vs App Store

- Total app installs reach 299 billion, Google Play 187 billion, and App Store 43 billion.

- Forecasts project 299-300 billion combined installs across both stores.

- Google Play dominates with a 75-80% share of global downloads.

- App Store growth at 4.6% CAGR, reaching 43 billion.

- Emerging markets drive 135 billion Google Play downloads.

Future Forecasts of the Mobile Application Industry

- Global app revenue projected to reach $673.7 billion by 2027, with gaming the highest-grossing category.

- Asia-Pacific contributes over 40% of global app revenue, and India has the fastest growth.

- North America forecast to generate $86 billion in consumer spending, subscriptions dominant.

- In-app purchases are expected to comprise 65% of total app revenue.

- Metaverse and AR apps set to contribute over $50 billion by 2027 in gaming and social.

- Wearable tech apps are projected to generate a $265.4 billion market value.

- 5G expected to unlock $12.3 trillion global revenue opportunity across industries.

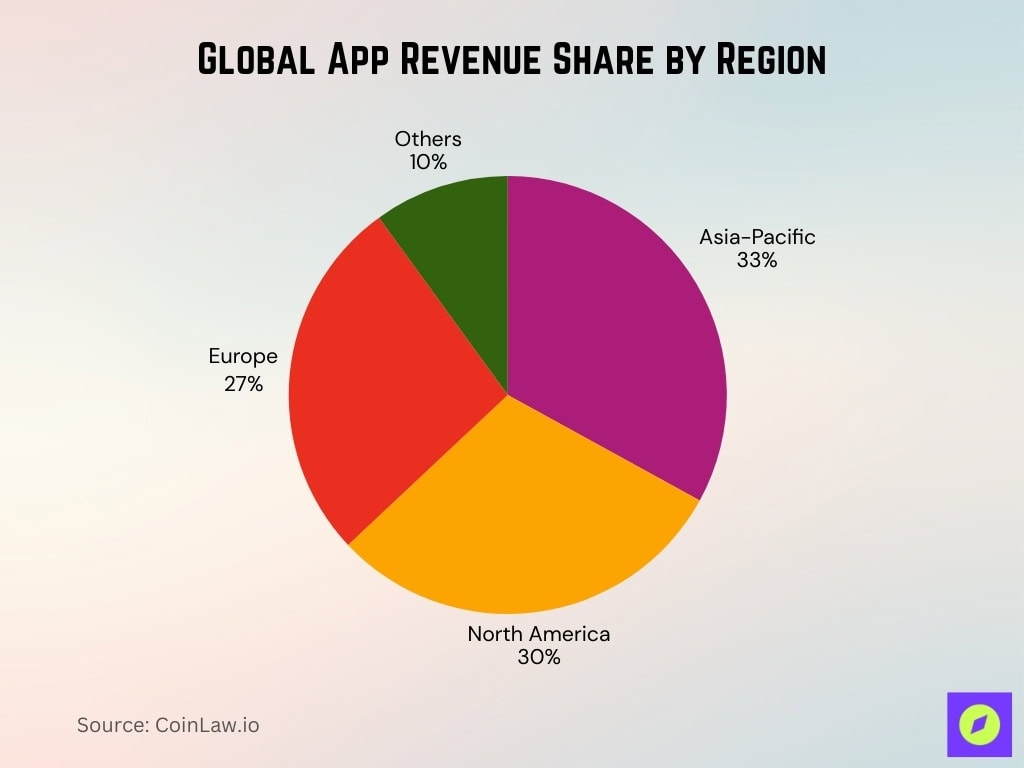

Key Regional Insights (Asia, North America, Europe)

- Asia-Pacific largest app revenue market, contributing 33% globally, with China driving 60% of regional earnings.

- North America generates 30% of total app revenue, fueled by high US consumer spending.

- Europe contributes 27% of global app revenue, with growth in Germany and France.

- India sees 17.8% YoY app revenue growth driven by mobile users and smartphones.

- Japan generates over $20 billion in app revenue, particularly in gaming.

- Latin America app revenue rises 27%, contributing $8.5 billion, led by Brazil and Mexico.

- Africa and the Middle East record 28.3% revenue growth to $6.8 billion.

AI App Revenue Growth

- Intelligent apps market valued at $63.42 billion, growing at 33.23% CAGR.

- AI app sector is projected to hit $18.8 billion by 2028 from $1.8 billion in 2024.

- AI app market grows by $32.26 billion at 44.9% CAGR 2025-2029.

- Generative AI apps revenue reaches $34 billion at 40% CAGR.

- AI apps revenue surged to $3.3 billion full-year estimate, 51% YoY growth.

- OpenAI projects $29.4 billion in revenue, ChatGPT mobile $1.35 billion.

- AI software market is expected to grow to $190 billion by 2026.

Frequently Asked Questions (FAQs)

Global consumer app spending is expected to reach $233 billion by 2026.

98% of global mobile app revenue comes from freemium apps.

The global mobile app market is projected to reach about $1,230.23 billion by 2035.

Global users are expected to spend 4.5 trillion hours in apps by 2026.

Conclusion

The app economy has evolved into a multi-billion-dollar industry with endless growth opportunities. As consumers continue to rely on their mobile devices, app developers are finding innovative ways to monetize their products. From gaming to social media, every category shows potential for increased revenue. With new revenue models like subscriptions and in-app purchases gaining traction, the app economy is on track to break new records in the coming years. Staying ahead of trends such as AR, the metaverse, and wearable tech will be key for developers and businesses seeking to capitalize on this rapidly growing market.