Angel investing is not just a financial transaction; it’s a lifeline for budding entrepreneurs and a gateway to innovation. Imagine a startup founder with a groundbreaking idea but limited resources. This is where angel investors step in, providing not only funds but also invaluable mentorship and guidance. Angel investing continues to evolve, shaping industries and redefining entrepreneurial landscapes. Let’s dive into the latest statistics and trends to understand the profound impact of these financial visionaries.

Editor’s Choice

- The global angel investment market was valued at approximately $27.8 billion in 2024, with projections estimating $72.35 billion by 2033, growing at a CAGR of 11.3%.

- An estimated 66,000 active angel investors operated in the US, according to historical ACA data, with modest growth projected into 2025.

- Angel investment deal sizes typically range between $250,000 and $500,000, with syndicates often pushing that number higher in recent years.

- 32% women angel investors in 2025, showing a steady rise in diversity from earlier years.

- Angel-funded startups can achieve average returns of 2–3x over 5 years, though results vary significantly by sector and stage.

- 68% of angel investments in 2025 were directed toward technology, healthcare, fintech, and emerging AI sectors.

Global Seed and Angel Investment Trends Through

- In Q2 2024, seed and angel investment reached about $8 billion across nearly 5,500 deals.

- In Q3 2024, investment dipped to roughly $7 billion with deal volume down to 5,200.

- By Q4 2024, funding slightly recovered to around $7.5 billion, though deal count slipped further to 4,800.

- In Q1 2025, total investment held steady at $7 billion, while deal activity dropped to about 4,500.

- In Q2 2025, funding rebounded to nearly $8 billion, but the number of deals fell sharply to just 3,500, the lowest point in the period.

Demographics of Angel Investors

- Average age ~45 years in 2025, with continued growth among younger investors aged 30–40.

- ~78% of angel investors in 2025 have prior entrepreneurial experience, ensuring strong mentorship capacity.

- ~34% of new angel investors in 2025 are women, reflecting growing gender diversity.

- ~78% of angel investors in 2025 reside in urban tech hubs like San Francisco, New York, London, and emerging cities.

- ~13% are retired professionals in 2025, leveraging their networks and domain expertise.

- ~62% hold a graduate degree in 2025, often in fields such as business, tech, or finance.

- ~18% minority participation among angel investors in 2025, showing gradual improvements in inclusivity.

Investment Sectors and Preferences

- ~70% of angel investments in 2025 were concentrated in technology, healthcare, and fintech, with AI startups dominating the mix.

- Clean energy & sustainability startups raised ~$4.2 billion in 2025, reflecting growing climate-tech momentum.

- EdTech investments grew by ~40% in 2025, fueled by innovation in online learning and AI tools.

- Mental health & wellness startups received ~$1.3 billion in angel funding in 2025 as societal wellness became a priority.

- The gaming sector saw a ~20% surge in angel funding in 2025, with mobile gaming securing a large share.

- Agritech ventures captured ~$900 million in 2025, driven by ag-sustainability and precision farming innovations.

- Cybersecurity startups experienced a ~35% increase in angel funding in 2025, especially in North America and Europe.

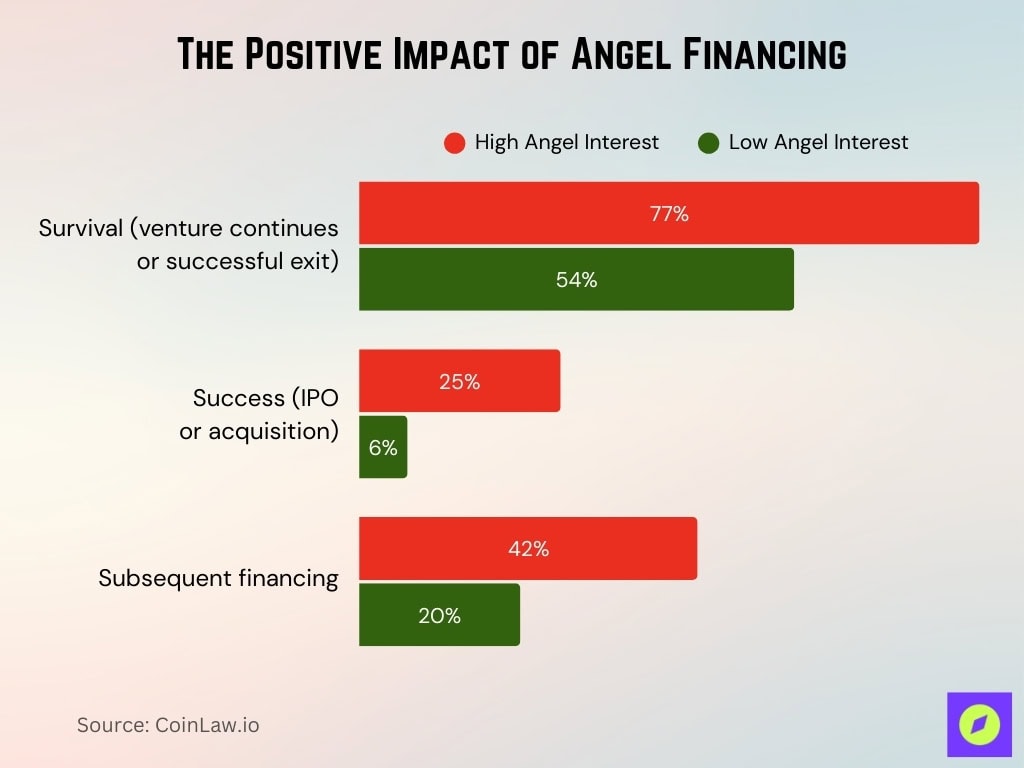

The Positive Impact of Angel Financing

- Ventures with high angel interest had a 77% survival rate, compared to 54% for those with low angel interest.

- The chance of IPO or acquisition was 25% with high angel backing, versus just 6% without it.

- Firms with strong angel involvement secured subsequent financing at a rate of 42%, more than double the 20% seen in low-interest ventures

Criteria for Angel Investors

- ~85% of angel investors in 2025 prioritize the founder’s vision and team competence over the product itself.

- Startups showing clear paths to scalability and market penetration secured about 72% of angel investments in 2025.

- Companies with early revenue streams attracted ~55% more funding in 2025 than those still in ideation stages.

- ~88% of investors in 2025 value a strong business plan with detailed financial projections as a critical decision factor.

- Investors heavily favored industries with growth rates above 10%, giving them preference in ~65% of deals in 2025.

- Startups with patent-pending technology or IP secured ~20% more funding than peers in 2025.

- Ethical and social impact initiatives influenced ~28% of angel investment decisions in 2025, especially among younger investors.

Involvement of Angel Investors

- ~72% of angel investors in 2025 take an active role in mentoring and guiding startups with financial and operational support.

- On average, angel investors devote 12 hours/month in 2025 to advisory roles with their portfolio companies.

- ~55% of investors in 2025 participate in multiple funding rounds, often increasing their stake in growth stages.

- ~82% of angels in 2025 leverage networking with other investors and VCs to expand their portfolios.

- Nearly ~42% of angel investors in 2025 serve on the boards of the startups they fund to maintain closer oversight.

- ~28% of angel investors in 2025 also offer extra support in marketing, hiring, and scaling operations.

- An increasing share of angel investors in 2025 are active in accelerators, broadening their exposure to diverse startup opportunities.

Success Rates and Returns

- The average IRR is ~24-28% in 2025, with top-quartile investments hitting ~35-40%.

- ~13% of angel-backed startups exited via acquisitions or IPOs in 2025, versus ~6% for non-angel-funded.

- ~75% of angel investors in 2025 reinvest their returns into new startups.

- ~60% higher survival rate in 2025 for startups backed by angels compared to those without external funding.

- Angel-funded companies reached profitability in ~3.5 years on average in 2025.

- ~17% higher returns in 2025 for portfolios diversified across sectors vs single-sector portfolios.

- Early-stage rounds delivered an average 3.5× return over 8–10 years for 2025 vintage deals.

Angel Investing by the Numbers

- ~400,000 angel investors globally in 2025, reflecting continued growth from 2023’s 370,000.

- In the US, angels backed ~70,000 funding deals totaling ~$28 billion in 2025.

- The median angel investment per deal rose to ~$30,000 in 2025, with syndicates occasionally contributing up to $3 million.

- The average portfolio size per angel investor grew to ~15 companies in 2025.

- ~50% of angel investments in 2025 were in the seed or pre-seed stage, emphasizing their critical role early on.

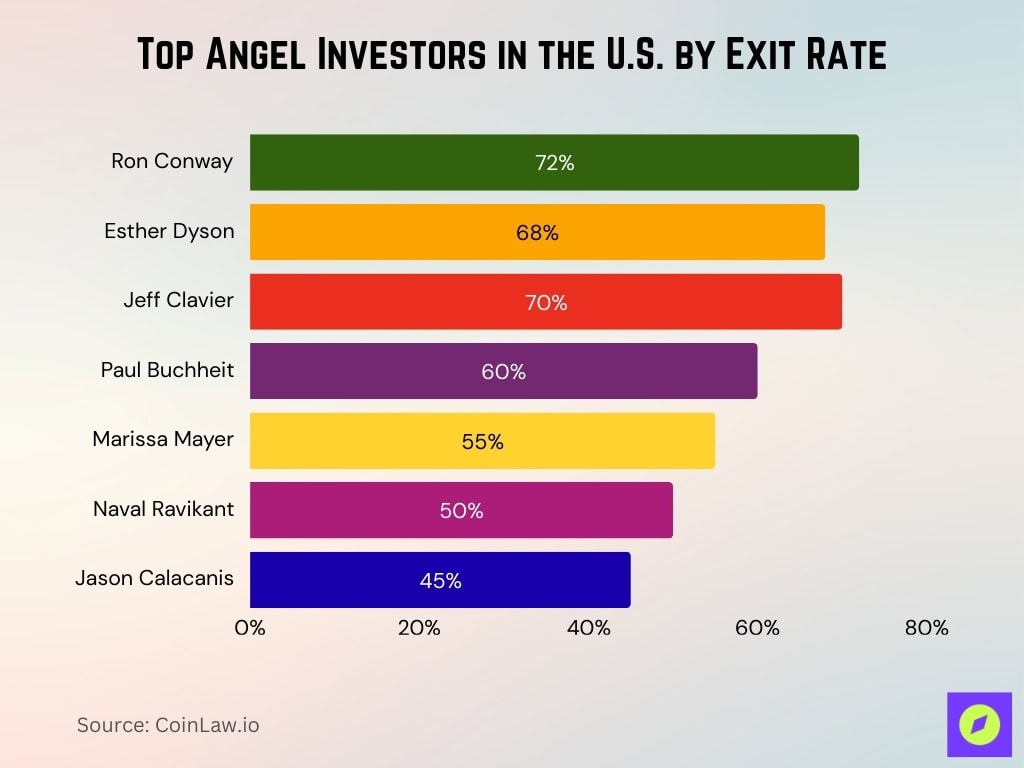

Top Angel Investors in the U.S. by Exit Rate

- Ron Conway now holds an exit rate of ~72% in 2025, including investments like Airbnb and Google.

- Esther Dyson achieves an exit rate of ~68% in 2025, focusing on healthcare and biotech.

- Jeff Clavier posts a ~70% exit rate in 2025 with exits like Fitbit and Mint.com.

- Paul Buchheit maintains a ~60% exit rate in 2025 with emphasis on tech ventures.

- Marissa Mayer records a ~55% exit rate in 2025 in AI-driven startups.

- Naval Ravikant holds a ~50% exit rate in 2025 with strength in earlystage tech.

- Jason Calacanis reports a ~45% exit rate in 2025 from investments including Uber and Robinhood.

Angel Investment Portfolio Size vs. Returns

- Portfolios of 10+ startups delivered an average return of ~3.5× in 2025 compared to about ~2.6× for smaller portfolios.

- Portfolios diversified across industries earned ~20-25% higher returns in 2025 than single-sector portfolios.

- Investors allocating 20-30% of their portfolios to high-growth startups saw ~12-15% uplift in annual returns in 2025.

- The most successful portfolios in 2025 balanced seed and Series A investments to manage risk and enhance upside.

- Larger portfolios reduced downside: ~88% of investors with 15+ startups achieved positive returns in 2025.

- Portfolios with at least one unicorn exit generated ~5× higher returns in 2025, underscoring high-impact hits.

- Reinvesting dividends into new startups resulted in ~20% higher cumulative returns over a decade by 2025.

Impact on Startup Ecosystems

- Regions with active angel networks achieved a ~22% higher survival rate for startups in their first five years in 2025.

- Angel-funded startups accounted for ~42% of tech patents filed in 2025, underscoring their innovation contributions.

- University-based angel networks helped launch ~18% of startups in 2025, promoting stronger academia-industry ties.

- Cities with thriving angel ecosystems like Austin, Berlin, and emerging hubs saw ~35% faster startup ecosystem growth in 2025.

- Economic development agencies partnered with angel groups in 2025 to facilitate ~$3.5 billion in co-investments globally.

Recent Developments

- Angel investment syndicates grew by ~30% in 2025, reflecting an even stronger preference for collaborative funding.

- AI & machine learning startups captured ~25% of total angel investments in 2025.

- RegTech and compliance startups raised about $1.0 billion globally in 2025.

- Regulatory updates in 2025 expanded angel accreditation and increased the pool of eligible investors by ~15%.

- Climate-tech startups attracted ~$2.5 billion in 2025, reflecting heightened environmental investment interest.

- AngelList Syndicates facilitated ~45% more deals in 2025, underscoring the rise of online platforms in angel investing.

- Crowdfunding integrated with angel networks raised ~$800 million globally in 2025, combining small and large investments.

Frequently Asked Questions (FAQs)

$27.83 billion in 2024, projected to $72.35 billion by 2033 at 11.3% CAGR.

Investments fell 6% year over year in 2024 after a 33% drop in 2023.

£1.255 billion in 2023, a 13% decline vs 2022 across 38 countries measured.

358 Business Angel Networks are active across 37 countries.

Conclusion

Angel investors remain the cornerstone of innovation, transforming industries while driving economic growth. The angel investing ecosystem becomes more diverse, inclusive, and globally interconnected. With sectors like AI, climate tech, and healthcare dominating the landscape, the opportunities for impactful investments are boundless. For startups, engaging with angel investors means accessing funds and gaining mentorship and strategic direction. Meanwhile, for investors, this domain offers a unique blend of high returns, networking opportunities, and the chance to fuel tomorrow’s transformative ideas.

Angel investing is no longer just an avenue for financial growth; it’s a platform for shaping the future.