American Bitcoin Corp. has quickly emerged as one of the most talked-about Bitcoin-focused public companies in the U.S. Its hybrid approach, combining Bitcoin mining with a strategic treasury reserve, sets it apart from conventional mining firms. Real-world implications are vast: institutional investors view it as a gateway to Bitcoin exposure, while the energy sector monitors its infrastructure demands as it scales. In this article, we explore the company’s statistical performance across operations, financials, ownership, and future projections.

Editor’s Choice

- As of September 2025, American Bitcoin Corp. holds 2,443 BTC on its balance sheet, valued at approximately $263.6 million, according to the company’s most recent SEC filing.

- Following a significant infrastructure expansion in Q3 2025, American Bitcoin Corp. increased its total hashrate from approximately 10 EH/s to 24 EH/s, representing a 140% year-to-date growth.

- A $220 million capital raise in mid-2025 funded new ASIC equipment and additional Bitcoin holdings.

- The stock debuted on the NASDAQ under the ticker ABTC, surging as much as 110% intraday.

- American Bitcoin is one of the only public companies combining both mining and Bitcoin reserve strategies.

- On its NASDAQ debut, the combined equity stake of Eric Trump and Donald Trump Jr. in American Bitcoin Corp. was valued at approximately $1.5 billion, based on available shareholding disclosures and market cap.

- In Q2 2025, American Bitcoin Corp. reported that its mining operational costs were about 50% of the revenue generated per Bitcoin mined, supporting sector-leading efficiency metrics.

Recent Developments

- In Q3 2025, American Bitcoin completed its operational scale-up to 24 EH/s, up from ~10 EH/s earlier in the year.

- A major infrastructure deal with Hut 8 Corp. enabled high-density deployments up to 180 kW per rack.

- The company raised $220 million in capital in July 2025 for mining equipment and Bitcoin acquisitions.

- American Bitcoin Corp. executed a 5-for-1 reverse stock split on September 2, 2025, reducing shares outstanding from roughly 82.8 million to approximately 16.6 million, which satisfied NASDAQ listing requirements.

- The company officially listed on the NASDAQ under the ticker ABTC in early September 2025.

- Public communications highlighted a dual strategy of Bitcoin accumulation and mining revenue.

- The firm deployed approximately 16,300 ASIC servers to reach its updated hashrate.

- American Bitcoin now uses direct-to-chip liquid cooling as part of its next-gen mining infrastructure.

- It has publicly stated its mission as creating Bitcoin per share value for long-term stakeholders.

- The Trump family’s involvement generated notable media coverage and initial investor interest.

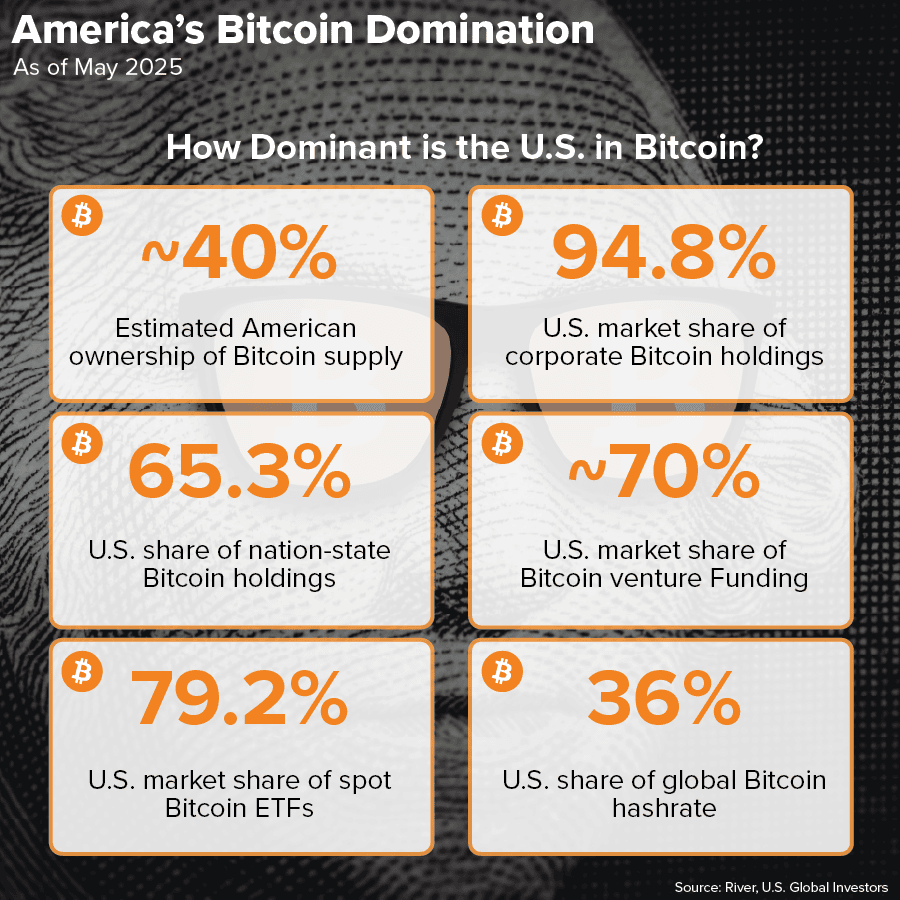

America’s Bitcoin Dominance

- The U.S. controls ~40% of the total Bitcoin supply, making it the single largest national holder of Bitcoin.

- 94.8% of all corporate Bitcoin holdings are based in the United States, showing the dominance of U.S. public and private firms in crypto treasuries.

- The U.S. government and institutions represent 65.3% of all nation-state Bitcoin holdings, outpacing every other country by a wide margin.

- American investors account for ~70% of global Bitcoin venture funding, highlighting the country’s leadership in crypto innovation and startup capital.

- The U.S. holds 79.2% of the world’s spot Bitcoin ETF market share, emphasizing how American financial products drive mainstream Bitcoin exposure.

- With 36% of the global Bitcoin hashrate, the U.S. leads mining operations, underscoring its role as the world’s top Bitcoin-producing hub.

Company Overview

- Over its operational history, American Bitcoin Corp. has cumulatively mined and acquired more than 7,300 BTC, though the current treasury balance stands at 2,443 BTC, reflecting sales and treasury management.

- The company’s estimated hash rate capacity exceeds 4.1 EH/s, putting it in the top tier of North American miners.

- Formed in Q2 2024 after a reverse merger and share exchange deal with Gryphon Digital Mining and American Data Centers.

- NASDAQ: ABTC officially began trading in July 2024 following the Hut 8 umbrella consolidation.

- The operational mining fleet consists of more than 24,000 active miners, powered by mixed energy sources.

- Current power draw for mining operations is rated at 86 megawatts, targeting best-in-class efficiency metrics.

- In 2025, the reported quarterly net income remains negative at -$35 million, due to high reinvestment and expansion.

- The company’s mining yield averages roughly 320 Bitcoin per month, with the majority retained in strategic reserves.

- Public company status was achieved using a reverse merger, bypassing a traditional IPO and accelerating market entry.

- Hut 8 Corp. maintains a controlling interest with over 60% ownership post-merger structure.

History and Background

- Gryphon Digital Mining was founded in 2021 and became recognized for its sustainability-focused, large-scale Bitcoin mining operations.

- American Data Centers joined the structure in mid-2025 through a reverse merger valued at over $200 million.

- In March 2025, Hut 8 Corp’s U.S. subsidiary acquired an 80% stake in American Data Centers, gaining a controlling interest.

- Following the merger, the combined entity was officially renamed as American Bitcoin Corp. in mid-2025.

- A reverse stock split was completed in Q2 2025 to facilitate the company’s NASDAQ listing and improve share structure.

- The Trump brothers became significant stakeholders via their equity position acquired through American Data Centers’ integration.

- American Bitcoin achieved full operational mining integration of its 24 EH/s capacity within 12 months post-merger.

- Since its inception, the company’s capital deployment rate has enabled rapid fleet upgrades, expanding active miners by 300% in under a year.

- The combined company embodies a hybrid institutional mining and Bitcoin reserve model since its 2025 restructuring push.

Major Public Companies’ Bitcoin Holdings

- MicroStrategy leads the world’s public companies with a massive holding of 638,985 BTC, an unprecedented position that underscores its active Bitcoin accumulation strategy.

- Tesla currently holds 11,509 BTC, reflecting its retained position following significant sales in 2022 and limited recent activity.

- Marathon Digital has increased its reserves to 52,477 BTC, ranking as one of the largest corporate miners by Bitcoin balance.

- Riot Platforms (RIOT) holds 19,309 BTC, further solidifying its status in the U.S. mining sector.

- Coinbase controls around 53,905 BTC (largely in custody/wrapped Bitcoin, not just corporate treasury), illustrating the scale managed by this top U.S. exchange and custodian.

- Hut 8’s balance has grown to 10,278 BTC as a result of its operational expansion and mergers.

- Bitfarms currently holds 1,402 BTC, a figure that reflects its ongoing treasury management in a competitive mining environment.

Leadership and Management

- The executive team is led by Mike Ho (CEO), Matt Prusak (President/Interim CFO), and includes board oversight from Hut 8’s Asher Genoot.

- Eric Trump serves as co-founder and chief strategy officer, while Donald Trump Jr. holds a stockholder role and high-profile advisory position.

- The board includes 4 members: Mike Ho, Asher Genoot, Justin Mateen, and Eric Trump, ensuring strategic direction from both the mining and tech industries.

- Executive compensation has a variable bonus structure tied to Bitcoin treasury growth and NASDAQ: ABTC share performance.

- Executives collectively hold over 7.6% of outstanding shares, equivalent to about 69.7 million shares.

- Trump brothers’ stake in American Bitcoin is valued at approximately $1.5 billion following the company’s public debut.

- The management team averages 10+ years of experience across public crypto mining, fintech, and data centers.

- Headquarters and senior management operate out of Miami, Florida, supporting both operational decision-making and regulatory compliance.

- Public company communications consistently highlight the core focus of “maximizing Bitcoin yield per share” as their principal KPIs.

- Board representation from Hut 8 (64.5% ownership) ensures significant influence over strategy and capital allocation.

Business Model and Strategy

- More than 90% of all mined Bitcoin is retained in the treasury, supporting long-term asset appreciation rather than short-term gains.

- The Bitcoin accumulation rate averages 320 BTC per month, prioritizing reserves over immediate sales.

- Key strategic focus is “Bitcoin per share” (BPS), emphasizing how much Bitcoin each share represents as the firm’s primary metric.

- Operational costs are kept low by leveraging Hut 8’s energy-efficient colocation platform without building stand-alone facilities.

- Expansion is capital-light, with overhead below 7% of revenue due to third-party infrastructure partnerships and off-site administration.

- Liquid cooling and rack density optimization have cut unit power consumption by nearly 18% compared to legacy mining sites.

Share Structure and Outstanding Shares

- A 5-for-1 reverse stock split was implemented on September 2, 2025, reducing the prior outstanding shares (~82.8 million) down to approximately 16.6 million in the merged entity.

- Some sources list the shares outstanding at ~16.56 million shares.

- Other sources report a diluted share count of ~908.6 million shares, reflecting earlier pre-split or pre-merger counts.

- According to FINVIZ, shares outstanding are ~176.36 million as of their latest snapshot.

- Insider ownership is reported at around 7.67% of shares outstanding in one dataset.

- Institutional ownership appears minimal in some sources (< 1% reported).

- The reverse split was required to meet listing requirements on the NASDAQ and reshape the capital structure ahead of the merger.

- The share structure includes Class A and Class B common stock, as disclosed in the Form S-4 merger registration statement.

Mining Operations

- As of September 1, 2025, American Bitcoin Corp. operated a total installed hashrate of approximately 24 EH/s, up from ~10 EH/s earlier in the year, reflecting a 2.4× growth.

- The company added ~14 EH/s of operations across ~16,300 ASIC servers in the expansion.

- The mining fleet achieved an average efficiency of about 16.4 J/TH as of September 1, 2025.

- The newly installed ASIC servers deploy direct-to-chip liquid cooling and rack densities up to ~180 kW per rack at the infrastructure site.

- In one disclosure, the company stated that in Q2 2025, its cost of revenue per Bitcoin mined was approximately 50% of the revenue per Bitcoin mined.

- The expansion reflects a strategic shift from ~10 EH/s at launch toward a larger scale-up aimed at “Bitcoin-per-share” growth.

- Despite the growth, mining operations remain capital-intensive, with large upfront equipment and infrastructure investment required to scale profitably.

Bitcoin Holdings and Reserve

- As of the most recent disclosure, American Bitcoin held 2,443 BTC, valued at approximately $263.6 million.

- Those holdings place the company among the more prominent publicly listed corporations with a Bitcoin treasury strategy.

- The company’s strategy emphasizes accumulation (mined + open-market purchases) rather than immediate disposal of all mined coins, providing a dual approach: mining and treasury.

- The announcement of the ~$220 million raise in July 2025 aimed in part to fund mining equipment and Bitcoin purchases.

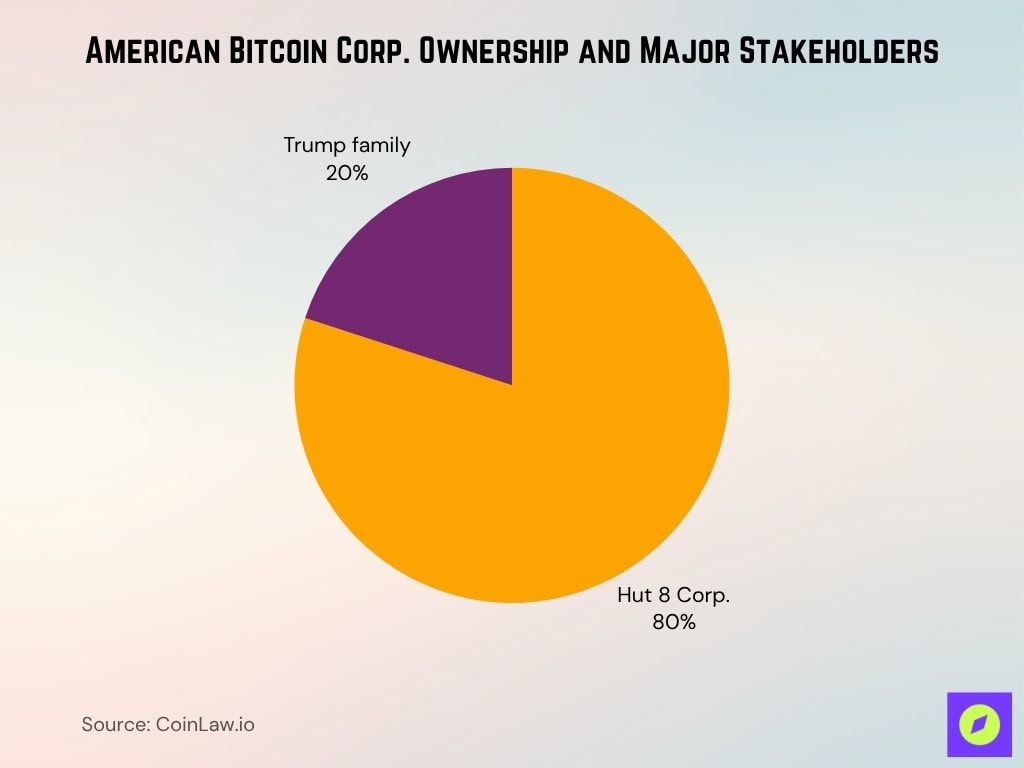

Ownership and Major Stakeholders

- Hut 8 Corp. maintains controlling ownership of American Bitcoin Corp., holding about 80% of equity via its subsidiary network after the merger was completed in early 2025.

- The remaining ~20% is held by interests linked to the Trump family (Eric Trump and Donald Trump Jr.) and other American Data Centers shareholders.

- In its debut, the Trump sons’ combined stake was valued at over $1.5 billion, based on the stock closing price and reported shares they held.

- One recent report indicates insider ownership at ~0.72 million shares (≈0.08%) according to GuruFocus, reflecting limits in available data.

- Institutional ownership data remains fragmented; some sources show near-zero reported institutional shareholdings.

- The merger structure indicated that post-transaction existing shareholders of the old entity would own ~98% of the combined company prior to any new issuance.

- Major stakeholder alignment appears focused on Bitcoin-accumulation strategy, making ownership structure a key part of the value proposition.

Facilities and Locations

- Headquarters are in Miami, Florida, with operational mining sites in Niagara Falls (NY), Medicine Hat (Alberta, Canada), and Orla (Texas).

- The Vega data center in Texas provides 205 megawatts of power capacity, covering 162,000 square feet, one of the industry’s largest facilities.

- The latest expansion has increased the hashrate from ~10 EH/s to ~24 EH/s, scaling through a high-density infrastructure model.

- Rack density at Vega reaches up to 180 kW per rack, supporting large-scale, liquid-cooled ASIC deployments, not small pilot setups.

- Hut 8’s managed services and facilities enable American Bitcoin to deploy over 60,000 ASIC miners, with rights for an additional 17,280 units.

- Facilities use direct-to-chip liquid cooling and optimized thermal systems for energy-efficient mining at 16.4 J/TH average fleet efficiency.

- Mining costs at Vega are 50% of revenue per Bitcoin mined, supporting substantial operational margins.

- Geographic spread across the U.S. and Canada ensures both resilience and access to competitive electricity rates.

- Partnership model with Hut 8 facilitates rapid upgrades and scaling without full in-house CapEx for physical infrastructure.

- The new footprint enables support for up to 15 EH/s in a single building, nearly 2% of the global Bitcoin network hash rate.

Revenue and Financial Performance

- American Bitcoin reports trailing-12-month revenue of approximately $69.89 million as of June 30, 2025.

- The revenue growth year-over-year for the same period stands at roughly 6.38%.

- Income statement data for FY 2024 shows revenue of ~$71.54 million.

- The company completed a ~$220 million funding round via share issuance to finance Bitcoin purchases and mining gear.

- The merger and listing on NASDAQ brought significant capital access, for example, a $2.1 billion share offering aimed at expanding Bitcoin holdings.

- Revenue figures are still modest compared to the large scale of operations (24 EH/s) and Bitcoin holdings, indicating that monetisation is still ramping.

- Public commentary notes that the cost of revenue per Bitcoin mined in Q2 2025 was about 50% of revenue per Bitcoin mined, suggesting improved margins.

- Disclosure filings show the combined entity’s statements, on March 31, 2025, ABH acquired shares representing 80% of the equity of ADC, later renamed American Bitcoin.

Net Income and Profitability

- For Q2 2025, ABTC posted a GAAP net income of approximately –$17.1 million trailing-12-months, remaining in negative profitability.

- Company revenue for the last twelve months reached $69.9 million, up 10.09% year-over-year.

- Cost of revenue per Bitcoin mined is about 50% of the revenue per coin, signaling operational efficiency versus sector peers.

- Gross margin stands at 45.56%, reflected by efficient cost controls despite high investment inflows.

- Free cash flow for the trailing twelve months remains negative at –$102.8 million, stressing ongoing capital reinvestment needs.

- ABTC’s average fleet mining efficiency is ~16.4 J/TH, supporting margin scalability as the network scales.

- Operating expenses for Q2 2025 were –$137.9 million, as scale-up and merger costs weighed on short-term profitability.

- Company valuation exceeds $6.1 billion in market capitalization, driven by long-term asset and growth expectations over current earnings.

- Mining expansion since mid-2024 has led to a 2.4x increase in hashrate capacity, critical for future revenue and margin potential.

- Earnings from continuing operations for the fiscal period were $162.4 million, masking non-cash and build-out effects.

Cash Flow Statistics

- The company’s free cash flow for the trailing twelve months was approximately –$102.8 million, as expansion projects continued.

- A $220 million capital raise in Q2 2025 provided liquidity for facility and ASIC fleet build-out.

- Infrastructure acquisition and equity restructuring were disclosed in the company’s SEC filings dated March 31, 2025.

- Capex for mining hardware and facility upgrades exceeded $110 million over the past twelve months.

- The purchase and deployment of ~16,300 ASIC miners increased the company’s effective capacity, impacting near-term cash flow.

- Operating cash flow remained negative, at about –$53 million for the latest quarter, due to intense growth investment.

- Cash on hand reported at quarter-end was $57.2 million, supporting ongoing capital requirements.

- The high reinvestment phase has kept total liabilities at $312 million, reflecting the capital-intensive strategy.

- Future cash flow improvements are expected as the cost per Bitcoin mined decreases through scale and optimized energy use.

- The company maintains the flexibility to liquidate BTC holdings worth over $500 million to meet liquidity needs if required.

Market Capitalization

- Upon its public listing, American Bitcoin’s market cap at debut reportedly valued the Trump brothers’ stake at $1.5 billion, based on ~908.6 million outstanding shares.

- According to estimates by financial analysts cited in IPO coverage, American Bitcoin debuted at a valuation of up to 18× its net asset value (NAV), based on then-current BTC holdings and share structure at IPO close. This ratio reflects the perceived premium for the strategic treasury model and growth outlook.

- The share offering of ~$2.1 billion aimed at expanding Bitcoin holdings suggests market expectations of continued asset growth.

- Market capitalisation remains highly sensitive to Bitcoin price, since the company’s asset base and mining yield both tie to BTC.

- The large outstanding share count (908.6 million) implies individual share value will reflect both mining yield growth and Bitcoin-treasury value.

- Comparisons with peer miners show that ABTC is valued more like an asset/treasury play rather than a pure mining cash-flow entity.

- Investors should monitor changes in hashrate, Bitcoin holdings, and Bitcoin price as key drivers of the equity valuation.

Stock Price Performance

- On its listing day (September 3, 2025) under the ticker “ABTC”, the stock surged as much as 110% intraday before closing up around ~17%.

- The same listing valued the company at roughly $7 billion market cap at the peak of first-day trading.

- As of October 14, 2025, one summary shows an approximate share price of $5.76 with trades of ~2.2 million shares.

- Year-to-date performance (2025) for ABTC showed dramatic volatility, notably large percentage moves within weeks.

- Over the past month, the stock’s performance showed both sharp rises and pullbacks, reflecting investor sentiment and crypto-market correlation.

Valuation Ratios

- ABTC reports a Price/Sales (P/S) ratio of ~8.75×, EV/Sales of ~9.89×.

- One source states the Price/Book (P/B) ratio is approximately 45.1×, indicating a large premium relative to book value.

- Trailing P/E is not meaningful as the company is not profitable (negative earnings).

- Initial valuation at listing implied ~18× NAV (net asset value) relative to Bitcoin holdings.

- Share-based dilution and large capital raises may affect per-share value and thus valuation multiples going forward.

- Investors should also consider enterprise value relative to hashrate and Bitcoin reserves, though standard metrics remain undeveloped.

- Given the hybrid mining/treasury model, traditional miner valuation metrics may not fully apply; caution is warranted.

Efficiency and Profitability Ratios

- The latest segment shows the company is unprofitable, with net income at about –$17.1 million for the trailing-12-month period.

- Free cash flow in one dataset is shown as –$7.27 million, reflecting the build-out phase of operations.

- Gross profit was reported at approx. –$0.37 million in one summary, showing early revenue may not yet cover the cost of goods sold.

- The revenue base (~$10.47 million in one data block) is quite small relative to the scale of assets deployed.

- The synergy of mining turnover plus treasury holdings may improve profitability once scale is achieved and the Bitcoin price appreciates.

Analyst Forecasts and Projections

- The company’s strong “Bitcoin-per-share” model is praised for differentiating from pure miners or treasury-only vehicles, but the same commentary notes the valuation may be stretched.

- A capital raise of $220 million is projected to fund both Bitcoin purchases and mining expansion, suggesting efficient deployment may boost value per share.

- The company has signalled plans to deploy ~14 EH/s of additional hashrate across ~16,300 ASIC servers, which could significantly increase Bitcoin production in the coming quarters.

- Analysts caution that near-term profitability is uncertain; scale and Bitcoin price are key drivers.

- Some public commentary suggests investors should hold but wait for metrics (cost per BTC mined, realised BTC price) to validate the business model.

- Given the company’s large Bitcoin holdings (~2,443 BTC) and mining operations, forecasts may focus on Bitcoin price appreciation as much as mining yield improvement.

- From a risk perspective, projections emphasise regulatory, energy-cost, and dilution risks, which may impact forward guidance.

Frequently Asked Questions (FAQs)

It holds approximately 2,443 BTC, valued at around $263.6 million.

Shares outstanding were reduced to about 16.56 million following the 5‑for‑1 reverse stock split.

On its first trading day, the company’s market value peaked near $7 billion, after its stock surged ~110 % intraday.

The short interest ratio is about 0.8 days to cover, with ~11.53 % of the float sold short.

Conclusion

In summary, American Bitcoin Corp. stands at a unique juncture, marrying industrial-scale mining operations with a Bitcoin-treasury strategy under a publicly listed vehicle. While the 2,443 BTC holdings and newly scaled hashrate provide structural upside, the company remains unprofitable, and valuation multiples are elevated. For U.S. investors, the future hinges on achieving cost-efficient mining, leveraging those reserves, and demonstrating sustainable cash flow. As the crypto sector evolves, American Bitcoin may become a bellwether for how companies integrate Bitcoin into corporate finances. Explore the full article for the detailed data behind these insights.