In recent years, AI-powered robo-trading has transformed the financial landscape, capturing the attention of major institutions and individual investors alike. Picture this: a digital financial advisor available 24/7, analyzing vast amounts of data, making split-second decisions, and providing customized trading strategies – all without human intervention.

As AI technology continues to evolve, robo-trading is becoming more accessible, precise, and profitable. This revolution is not just a trend; it’s reshaping the entire financial services industry, setting new standards for efficiency, personalization, and innovation. This year is poised to be a landmark year for robo trading, as financial markets embrace AI’s potential for both retail and institutional investors.

Editor’s Choice: Key Milestones in AI‑Powered Robo Trading

- $1.26 trillion AUM globally in 2025 for robo-advisors, showing continued momentum.

- 85% of financial institutions will have integrated AI into operations by 2025.

- AI-driven trading systems are reported to reduce transaction costs by up to 40% in specific institutional trading environments, though actual savings vary by platform and asset class.

- 41% of Millennials and Gen Z investors in 2025 say they’d let an AI assistant manage their investments.

- Betterment manages over $45.9 billion in AUM, ranking behind Vanguard and Empower as of 2025.

- Marcus Invest platform has exited, with digital investing accounts transferred to Betterment.

Adoption Rates Among Financial Institutions

- A growing majority of large U.S. banks are adopting AI technologies for investment and trading; while AI usage is widespread, full-scale robo-advisor deployment remains more limited and varies by institution.

- In Europe, 68 % of financial institutions offer robo-advisory services, largely to attract younger clients and boost efficiency.

- Mid‑sized North American banks report a 35 % adoption rate for AI-powered robo-advisors.

- In Japan, 75 % of banks offer robo-advisory platforms.

- 20 % of insurance companies now employ AI-driven robo-advisors for wealth management.

- 65 % of top hedge funds integrate AI-driven trading systems alongside human decision-making.

- In the Middle East, 30 % of financial firms are exploring robo-advisory services.

Brand Shares in Robo Trading (BETA)

- Betterment and Wealthfront hold a combined $136 billion AUM, maintaining a strong presence in the US robo-advisor market in 2025.

- Vanguard Personal Advisor Services holds about 20% of the US market with its hybrid robo-advisory model.

- SoFi Invest has captured 12% of the millennial market, supported by its full-stack financial offerings.

- Charles Schwab accounts for roughly 15% of the US robo-advisory market, especially among high-net-worth clients.

- Stash and Acorns share about 8% of the US market, appealing to new investors with accessible, low-minimum platforms.

- Ant Financial leads in the Asia-Pacific region with an estimated 45% market share in robo-advisory services.

- Scalable Capital and Nutmeg each control approximately 10% of the European market in 2025.

Revenue per User

- Global ARPU in robo-trading is now about $85, due to enhanced AI-driven features and personalization.

- High-net-worth individuals generate roughly 4× more ARPU in robo-trading than retail clients.

- US ARPU is approximately $95, among the highest globally due to strong market penetration and premium service tiers.

- Millennials account for around 60% of robo-advisor revenue in North America, reflecting their preference for digital platforms.

- Subscription-based robo-advisors see ARPU growth of about 25% annually, driven by demand for AI-enhanced insights.

- Customized portfolio options boost ARPU by 18%, particularly among clients seeking tailored investment strategies.

- Robo-advisors with ESG investing generate roughly 15% higher ARPU, reflecting strong demand for sustainable options.

AI‑Powered Robo‑Advisors

- AI‑powered robo‑advisors now manage over $1.26 trillion in assets as of 2025, reflecting rapid adoption across investor demographics.

- Betterment now oversees $56 billion in AUM, showcasing its continued leadership in AI-driven features in 2025.

- BlackRock’s Aladdin platform supports institutional robo‑advisory services with $21.6 trillion in assets under management globally.

- 75% of AI robo‑advisors provide a customized risk assessment feature, enhancing client satisfaction by around 30%.

- AI‑driven robo‑advisors are expected to reduce management fees by 40% compared to traditional advisors by 2025.

- Wealthfront’s Path tool uses AI to deliver highly personalized planning, achieving approximately 20% more user engagement.

- Usage of AI robo‑advisors among women investors rose by 28%, driven by tailored service options.

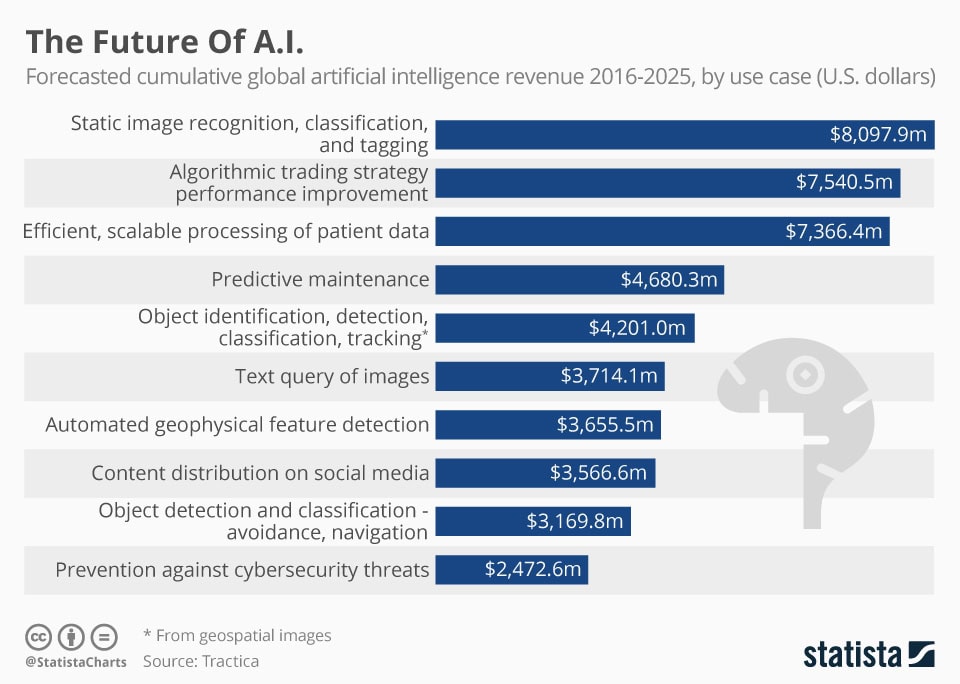

The Future of A.I. Revenue by Use Case

- Static image recognition, classification, and tagging will generate $8,097.9 million.

- Algorithmic trading strategy performance improvement will reach $7,540.5 million.

- Efficient processing of patient data is expected to bring in $7,366.4 million.

- Predictive maintenance is forecasted at $4,680.3 million.

- Object identification and tracking (from geospatial images) will generate $4,201.0 million.

- Text query of images is projected at $3,714.1 million.

- Automated geophysical feature detection will account for $3,655.5 million.

- Content distribution on social media is expected to reach $3,566.6 million.

- Object detection for avoidance and navigation will total $3,169.8 million.

- Cybersecurity threat prevention is forecasted at $2,472.6 million.

Key Advantages of AI‑Driven Robo‑Advisors

- Continuous 24/7 AI portfolio monitoring now enhances returns by about 15% annually.

- AI systems analyze over 1,000 data points per second, enabling faster and more precise investment decisions.

- Automated tax-loss harvesting saved investors an estimated $250 million, making it attractive for high-net-worth clients.

- AI robo-advisors charge lower fees, typically 0.20% to 0.30%, much lower than traditional advisors.

- ESG-focused AI options are expanding, with around 40% of robo-advisors offering sustainable investment choices.

- Predictive AI tools improve financial planning accuracy by approximately 32%.

- Real-time risk assessment features reduce portfolio losses by 12% during volatile market periods.

Impact on Wealth Management

- Around 80% of wealth management firms now offer AI-powered robo-advisory services to attract tech-savvy clients.

- AI robo-advisors help firms retain clients through lower fees and analytics, increasing client retention by 25%.

- The use of AI has contributed to a 30% boost in revenue for firms adopting robo-advisors.

- Robo-advisory platforms have expanded access, with 60% of users in the middle-income bracket.

- AI customization enables tailored services, leading to 18% higher client satisfaction.

- Hybrid robo-advisors combining AI and human input have grown by 40% as firms address complex needs.

- AI automation allows firms to reduce operational costs by 30%, improving overall profitability.

Artificial Intelligence in Trading Market Growth

- The AI in the trading market is expected to grow to $24.53 billion in 2025.

- The market is projected to expand steadily at a CAGR of 13.3% over the forecast period.

- By 2029, the global market size is forecasted to reach $40.47 billion.

Types of Robo‑Advisors

- Pure robo-advisors now represent about 68% of the market in 2025, appealing to cost-conscious investors.

- Hybrid robo-advisors have grown by approximately 40% year-on-year, catering to clients seeking both AI and human support.

- Self-service robo-advisors saw a nearly 45% increase in user engagement in 2025, offering more control to users.

- Goal-based robo-advisors manage around $350 billion in assets, focusing on long-term financial objectives.

- Socially responsible robo-advisors expanded by about 30%, meeting growing demand for ethical investing.

- Retirement-focused robo-advisors now account for 30% of the market, offering tailored retirement planning features.

- Micro-investing robo-advisors grew by roughly 55% in 2025, targeting younger investors with low entry points.

Performance Metrics and Return on Investment

- Some AI-powered robo-advisors have reported average annual returns in the 7–10% range, though performance varies by portfolio allocation, market conditions, and investor risk profile.

- Betterment and Wealthfront have consistently achieved 7–10% annual ROI over the past five years.

- Vanguard’s robo-advisory services maintain a client retention rate of 92%, supported by solid returns and low fees.

- Portfolio rebalancing algorithms boost user ROI by 15%, keeping strategies aligned with market trends.

- Tax-loss harvesting features enhance user net returns by roughly 1.5% annually.

- Schwab Intelligent Portfolios boasts an 84% satisfaction rate, credited to consistent returns and diversified options.

- ESG-focused robo-advisors have demonstrated a 20% higher ROI, driven by strong, sustainable investment performance.

AI Trading Platform Market Share by Region

- North America leads with 38% of the global market.

- Europe accounts for 25%, showing strong adoption.

- Asia Pacific also holds 25%, reflecting rapid growth in emerging economies.

- Latin America contributes 7% to the market.

- Middle East & Africa (MEA) makes up 5%, the smallest regional share.

Technological Advancements and Innovations

- Machine learning applications in robo-advisory platforms have shown up to 25% improvement in certain predictive models, such as risk tolerance assessment and portfolio optimization.

- NLP-driven communication boosts client engagement by 30%, making interactions more effective.

- Blockchain integration enhances data security and transparency in robo-advisory services.

- 45% of robo-advisors use AI-powered sentiment analysis to adjust portfolios based on market trends.

- 80% of robo-advisors now offer predictive analytics for improved financial forecasting.

- Real-time AI monitoring reduces response times to market changes by 50%, benefiting active investors.

- Voice-activated robo-advisors are expected to launch in 2025, enabling investment management via voice commands.

Regulatory Landscape and Compliance

- The EU’s MiFID II review, effective as of 28 March 2024, requires member states to complete national transposition by 29 September 2025.

- The SEC has updated rules requiring internet-only robo-advisers to operate through an interactive digital platform, with compliance due by 31 March 2025.

- In the Asia-Pacific region, countries like Singapore and Japan are rolling out AI‑specific financial regulations to ensure safer robo-advisory adoption.

- AML rules now mandate that robo-advisors incorporate risk management algorithms to detect and prevent suspicious activities.

- Under MiFID II regulations in Europe, robo-advisors must deliver transparent client reporting, including comprehensive Key Information Documents (KIDs).

- In India, SEBI is formalizing the regulatory framework for robo-advisory services to encourage innovation while maintaining investor protections.

- Australia’s ASIC has extended fiduciary standards to cover robo-advisors, requiring them to meet responsible digital advisory practices.

Recent Developments

- Betterment added a real-time AI-powered financial advice feature, boosting user engagement by 30%.

- SoFi rolled out fractional share investing to make robo-advisory services more accessible to a broader demographic.

- Goldman Sachs enhanced Marcus Invest to enable integration of external accounts for a unified financial overview.

- Wealthfront formed a partnership with Greenlight to extend investment services tailored to teens and young adults.

- Charles Schwab upgraded its platform with predictive market insights, resulting in a 15% increase in active user frequency.

- Vanguard adopted AI to enhance retirement portfolio customization, leading to a 10% gain in retirement plan participation.

- Stash launched AI-driven personalized risk assessment tools, improving user experience and portfolio precision.

Conclusion

AI-powered robo-trading stands at the forefront of financial innovation, promising increased accessibility, customization, and efficiency. The growth trajectory is robust, driven by advancements in machine learning, predictive analytics, and natural language processing. Robo-advisors are not only reshaping wealth management but are also setting new standards for data-driven decision-making and investment personalization.

While challenges around data privacy, ethical considerations, and regulatory compliance persist, the future of robo-trading appears bright. With continued technological enhancements, robo-advisors are well-positioned to redefine the financial landscape, providing both novice and seasoned investors with smarter, more resilient ways to grow their wealth.