Grayscale has submitted an updated S-1 registration form to the U.S. Securities and Exchange Commission for its proposed Avalanche (AVAX) ETF, aiming for a listing on Nasdaq.

Key Takeaways

- Grayscale has revised its S-1 filing with the SEC to include new staking features and technical updates for the Avalanche ETF.

- Up to 70 percent of AVAX holdings may be staked, allowing the ETF to generate passive income through staking rewards.

- The ETF would trade under the ticker “GAVX” on Nasdaq, converting from the currently OTC-traded AVAXFUN.

- AVAX rallied over 9 percent on ETF optimism, but recent trading volumes show waning short-term enthusiasm.

What Happened?

Grayscale Investments has taken another step in its effort to launch a spot Avalanche ETF. The firm submitted a second amendment to its S-1 registration statement with the SEC, indicating further engagement with regulators and a deepening commitment to the Avalanche ecosystem. The updated filing introduces new technical features, particularly a strategy to stake AVAX holdings for rewards, which adds a passive income stream for potential investors.

Grayscale files updated S-1 with the U.S. Securities and Exchange Commission for an Avalanche (AVAX) ETF, seeking Nasdaq listing; AVAX up more than 9% over the past week.

— Crypto News by cry-pto.news (@cry_pto_news) December 24, 2025

📊 Market Data:

📉 AVAX: $11.947 (-2.68%)https://t.co/DLzQce48YG

Grayscale’s ETF Strategy Now Includes Staking

The standout change in the updated filing is Grayscale’s plan to stake up to 70 percent of the fund’s AVAX holdings. This move aims to enhance the ETF’s yield potential by generating staking rewards that would be distributed to shareholders. It marks a significant departure from traditional crypto ETFs that focus solely on asset appreciation.

Staking involves locking up tokens to help validate transactions on a blockchain network. In return, stakers receive periodic rewards. For Avalanche, which uses a proof-of-stake model, this could appeal to investors seeking income generation as well as price exposure.

Other key structural changes include:

- A clarified trust structure, naming Grayscale Investments Sponsors LLC as the sole sponsor.

- Updated tax disclosures, financials, and expanded risk language, reflecting SEC feedback.

- A note that the filing does not yet disclose management or staking fees, nor any fee waivers.

Regulatory Process Still in Motion

While the updated S-1 suggests forward movement, it does not guarantee immediate SEC approval. Experts view such amendments as part of the normal iterative process with regulators. The changes are seen as addressing SEC comments and technical compliance, rather than adding flashy new features.

Grayscale’s ETF would convert its existing OTC-traded Avalanche Trust (AVAXFUN) into a listed ETF on Nasdaq under the ticker “GAVX.” This would significantly increase accessibility and visibility for institutional and retail investors alike.

Rising Competition in AVAX ETFs

Grayscale is not alone in its ambitions. VanEck recently revealed its own Avalanche ETF plans, including a 0.30 percent management fee and Coinbase Crypto Services as its staking provider. Bitwise has also amended its AVAX ETF filing to include staking rewards. This highlights a broader institutional interest in staking-based ETF products.

Market Reaction: Early Rally, Then Pullback

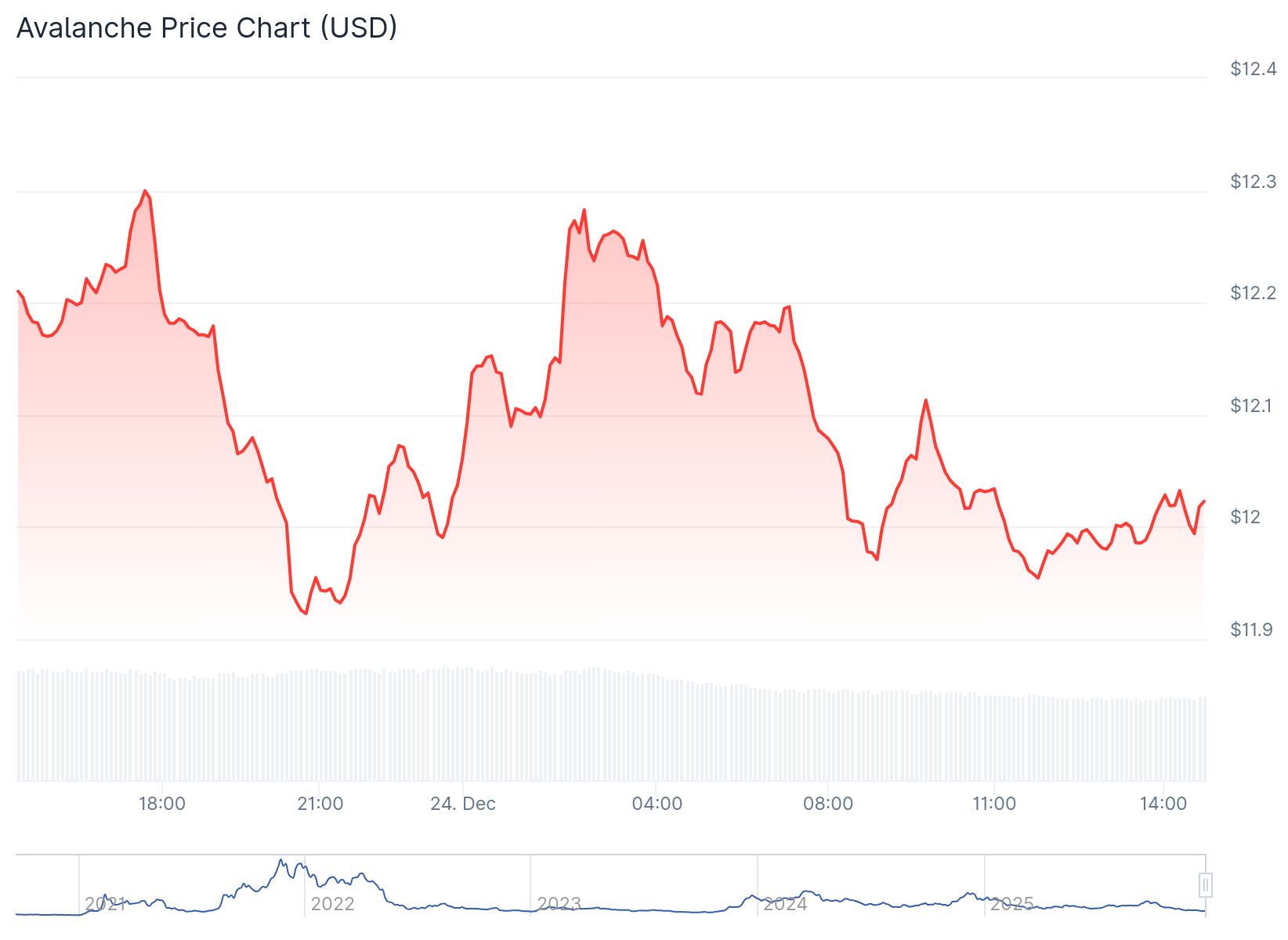

AVAX’s price surged more than 9 percent over the past week, driven by ETF-related excitement. However, the token has since slipped by over 2.5 percent in the past 24 hours. It is currently trading around $12.08, with volume down nearly 18 percent, signaling cooling enthusiasm.

Derivatives market data supports this shift:

- AVAX futures open interest fell by over 2 percent, with notable drops on Binance, OKX, and Bybit.

- CoinGlass data shows a growing sell sentiment, suggesting traders are dialing back bullish bets in the short term.

CoinLaw’s Takeaway

In my experience watching ETF developments, Grayscale’s update feels more like a strategic chess move than a PR stunt. Including staking is a smart value-add that can differentiate the ETF, especially in a crowded and competitive crypto ETF space. That said, the SEC is still playing hardball, and approval could take months or more. If you’re an investor eyeing AVAX or crypto ETFs, this filing is encouraging but not yet game-changing. Still, the fact that both Grayscale and VanEck are doubling down on Avalanche shows serious belief in the protocol’s long-term viability.

Hover or focus to see the definition of the term.