Cloud computing has become a foundation of modern banking infrastructure. Many banks are migrating core systems, customer services, and data workloads to cloud platforms, a shift driven by the need for flexibility, scalability, and speed. From streamlined operations in retail banking to enhanced risk management systems in large global banks, cloud migration is reshaping how financial institutions operate and compete. Explore the sections below to understand the scope, scale, and latest trends of cloud migration in banking.

Editor’s Choice

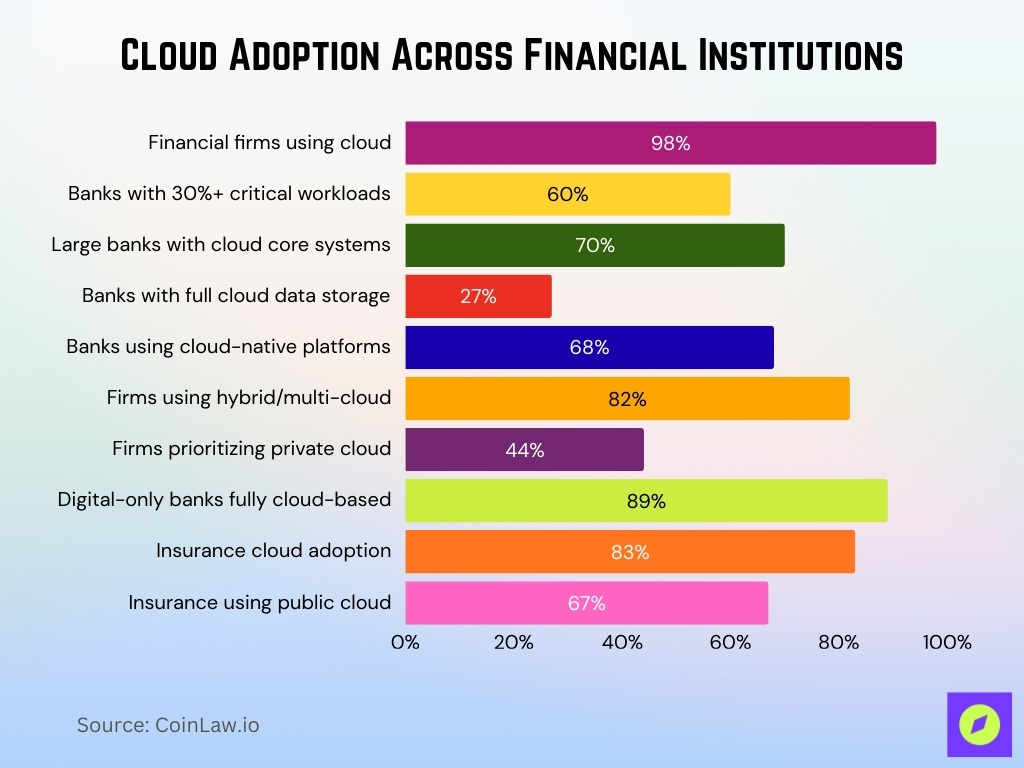

- 98% of financial services organizations report using some form of cloud in 2025.

- 60% of banks globally will have shifted at least 30% of their critical workloads to the cloud by 2025.

- Over half of banks now have mature cloud programs in place (as of 2025).

- Among financial institutions, hybrid‑cloud or multi‑cloud strategies are used by a large share by 2025.

- Only about 12% of financial institutions can be classified as “true cloud innovators,” leveraging mature platforms and cloud‑native architectures.

- Technology spending in banking has been increasing by roughly 9% per year on average, outpacing revenue growth (~4% per year).

Recent Developments

- According to a 2025 survey, more than half of banks globally now report they have mature cloud‑adoption programs.

- The push toward cloud is accelerating, and many banks intend to double the share of applications on cloud over the next 3 years (from ~30,40% now to as high as ~70%).

- In banking, hybrid cloud remains a prominent choice; a 2024 survey found 26.5% of banking executives named hybrid cloud as their preferred model.

- Recent literature suggests many banks are shifting core banking operations, not just peripheral services, to cloud environments, indicating a deeper transformation of legacy systems.

- However, only a small portion of financial services firms qualify as “cloud innovators”, about 12% globally, indicating that for most banks, full transformation remains a work in progress.

Cloud Adoption by Institution Size and Type

- 98% of financial services organizations use some form of cloud services.

- 60% of banks have moved at least 30% of critical workloads to the cloud.

- 70% of larger banks host core banking platforms in cloud environments.

- 27% of banks have fully migrated organizational data storage to the cloud.

- 68% of banks globally use cloud-native platforms for core operations.

- 82% of financial firms adopt hybrid or multi-cloud strategies.

- 44% of financial firms prioritize private cloud for sensitive data.

- 89% of new digital-only banks launch with fully cloud-based infrastructure.

- 83% cloud penetration in the insurance sector, with 67% public cloud.

Regional Breakdown of Cloud Banking Market Expansion

- North America holds a 37% revenue share in the finance cloud market.

- Asia Pacific grows at the fastest 21.62% CAGR.

- U.S. public cloud revenue reaches $466 billion.

- China’s public cloud revenue at $90 billion.

- UK public cloud revenue is projected $39.4 billion.

- Germany’s public cloud revenue $40.5 billion.

- Japan’s public cloud revenue $19.9 billion.

Multi‑Cloud Strategies and Vendor Diversification

- A 2025 industry study found that 82% of financial firms now operate on a hybrid or multi‑cloud basis.

- 57% of financial services organizations in recent years report using a multi‑cloud approach.

- Multi‑cloud adoption rose sharply in 2025; one report shows enterprise multi‑cloud deployments increased by 37% compared to 2024.

- The shift toward multi‑cloud reflects risk‑management priorities, banks aim to reduce vendor lock-in and minimize impact from outages by diversifying providers and data‑center geographies.

- Nearly 64% report a preference for hybrid cloud models combining on‑premises infrastructure and public cloud to balance latency, compliance, and control.

- Investment in cloud infrastructure within financial services has grown by roughly 29.3% annually since 2021.

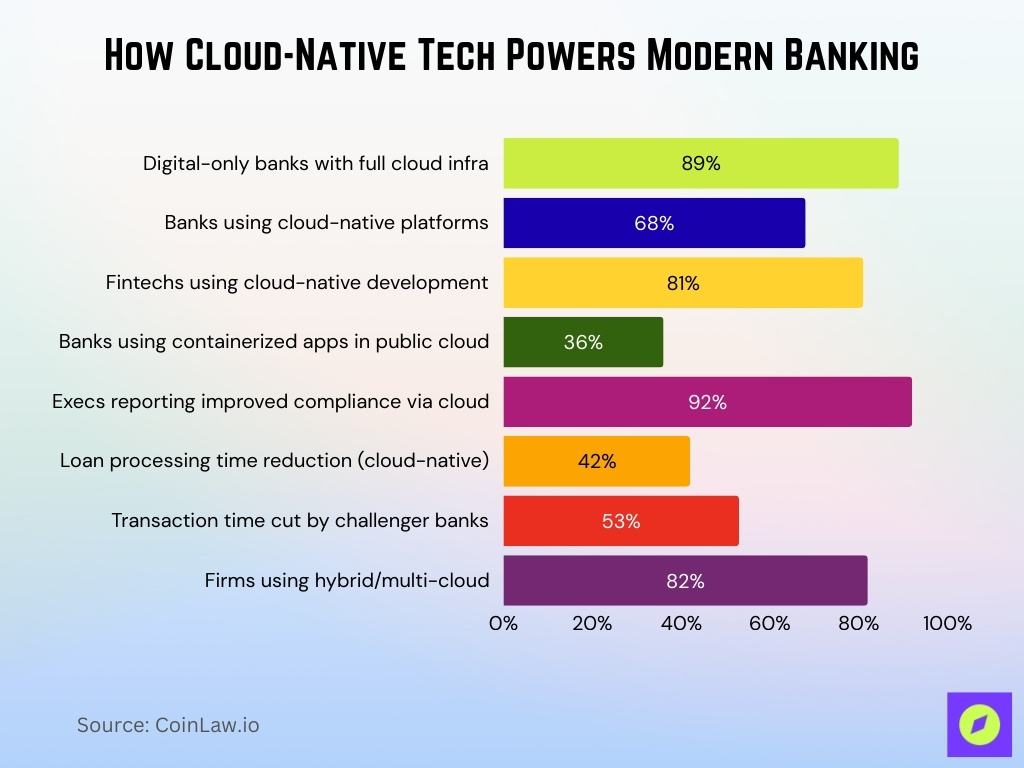

Cloud‑Native Adoption Among Digital‑Only and Challenger Banks

- 89% of new digital-only banks launch with fully cloud-based infrastructure.

- 68% of banks globally use cloud-native platforms for core operations.

- 81% of fintech firms adopt cloud-native development practices.

- 36% of banks use containerized applications in the public cloud.

- 92% of bank executives report improved regulatory compliance via cloud.

- Cloud-native banks reduce loan processing times by 42%.

- Challenger banks cut transaction times by 53% with cloud platforms.

- 82% of financial firms use hybrid/multi-cloud for flexibility.

Workload and Use Case Migration

- As of 2025, 60% of banks report they have moved at least 30% of their “critical workloads” to cloud environments.

- Adoption of Infrastructure-as-a-Service (IaaS) in finance reached $18.3 billion in 2025.

- Use of Platform-as-a-Service (PaaS) among financial institutions grew by 48% in 2025.

- 89% of financial institutions now use SaaS for services such as CRM, payments, and data analytics.

- The public‑cloud segment in banking and financial services (BFSI) is estimated to reach $92.7 billion globally.

- Banks increasingly migrate core banking applications, data processing, and customer‑facing platforms to the cloud.

- Cloud migration offers scalability and flexibility for risk modeling, analytics, fraud detection, and compliance reporting.

Operational Efficiency and Financial Performance Gains

- Cloud adoption reduces IT costs by 20–30%.

- Banks achieve 38% improvement in operational efficiency.

- Cloud migration cuts infrastructure costs by 27%.

- Loan processing times drop by 42% with cloud lending platforms.

- Transaction times reduce by 53% via cloud payment systems.

- Banks save $2.4 billion annually on on-premise maintenance.

- Cloud enables a 19% revenue increase through customer tools.

- Operational expenses decrease by 7.7% with cloud optimization.

- Fraud losses cut by $1.7 billion using cloud detection.

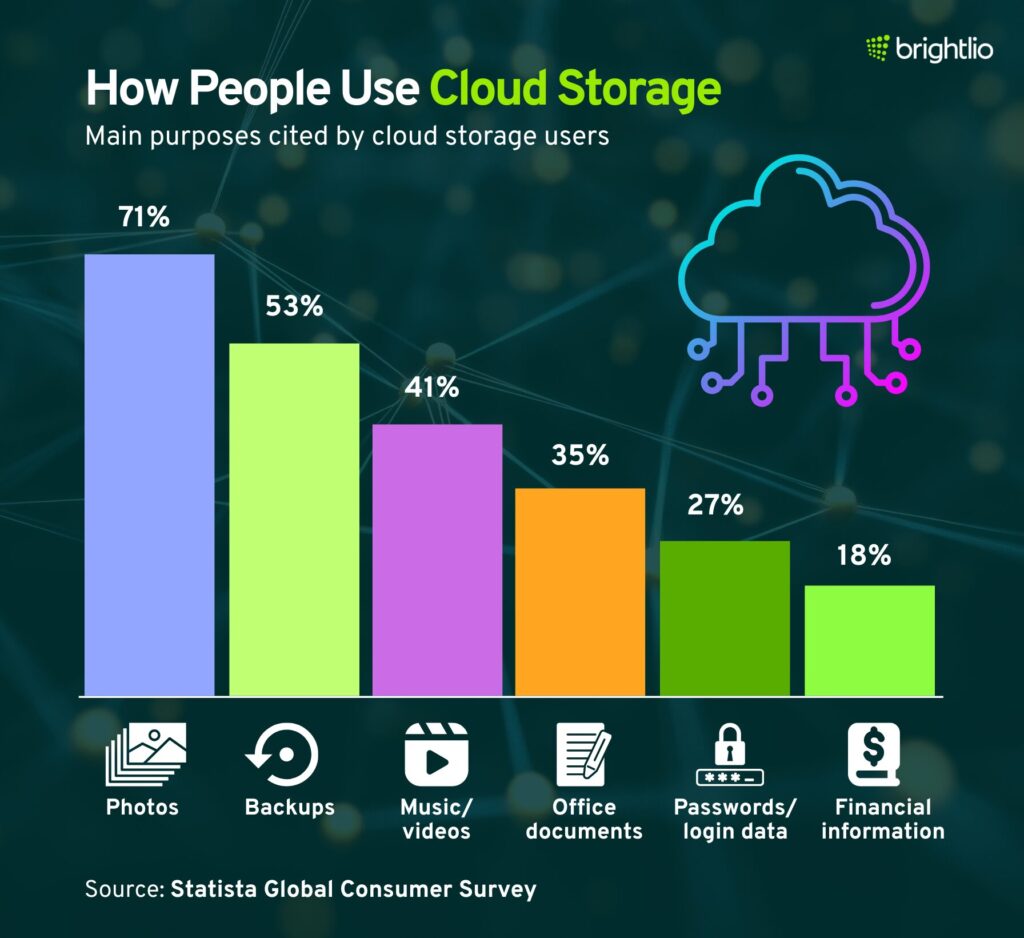

How People Use Cloud Storage

- 71% of users store photos, making it the top use case for cloud storage.

- 53% use cloud services for backups, highlighting data safety as a key priority.

- 41% save music and videos in the cloud for easy access and streaming.

- 35% store office documents, showing cloud usage in work and productivity.

- 27% rely on cloud storage for passwords and login data, reflecting security-conscious behavior.

- 18% use it to store financial information, the least common but sensitive use case.

Customer Experience and Cloud‑Driven Engagement

- 89% of institutions use SaaS-based CRM and analytics.

- 81% of banks prioritize cloud analytics for personalization.

- Cloud platforms boost customer satisfaction by 25%.

- 77% of banking leaders say personalization improves retention.

- 82% of financial providers report CRM satisfaction gains.

- 92% of executives note that cloud enhances compliance and service.

- Cloud enables 380 million more users for mobile banking.

- AI personalization lifts cross-selling by 20-30%.

- 76% of consumers prefer personalized brand interactions.

Security, Risk Management, and Operational Resilience

- The banking cloud security market reaches $36.17 billion.

- 59% of financial firms cite data security as the top concern.

- Cloud security in banking grows at a 17.40% CAGR.

- 82% of data breaches involve cloud-stored information.

- 51% of organizations report phishing as a key cloud threat.

- 70% prioritize compliance monitoring for cloud security.

- Cloud intrusions rose 75% from 2022 to 2023.

- 55% find cloud harder to secure than on-premises.

- Public cloud holds 62.4% banking security market share.

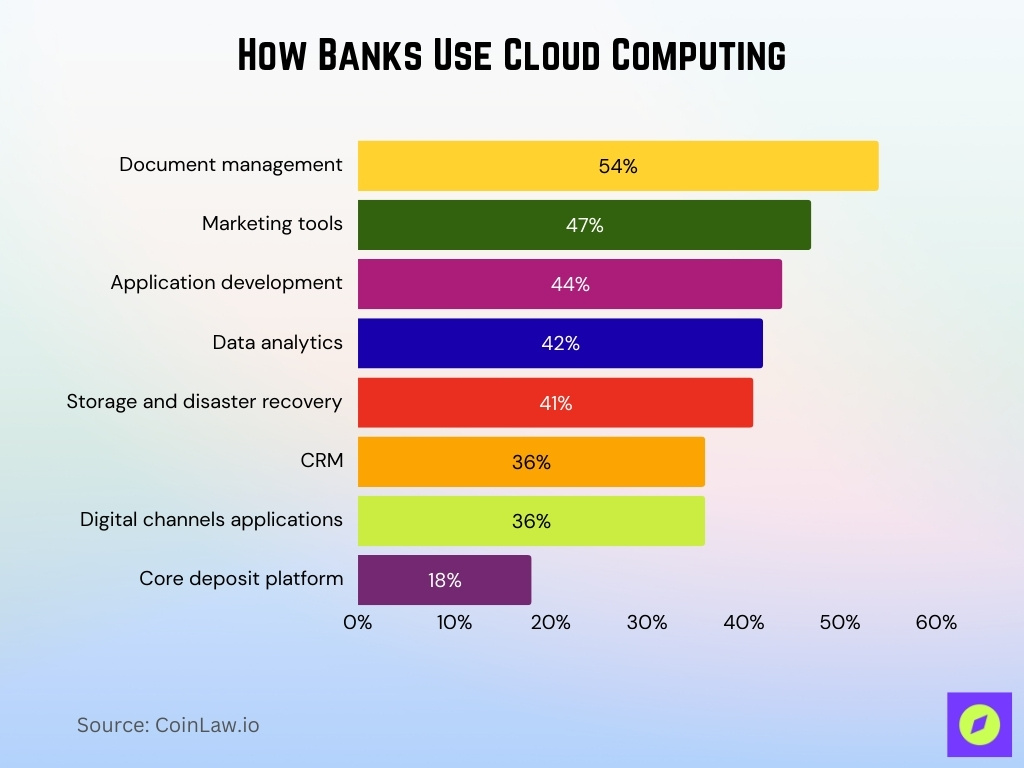

How Banks Use Cloud Computing

- 54% of banks use cloud computing for document management, the most common use case.

- 47% deploy marketing tools in the cloud to boost outreach and personalization.

- 44% rely on cloud for application development, enhancing agility and innovation.

- 42% use cloud platforms for data analytics to improve insights and decision-making.

- 41% leverage cloud for storage and disaster recovery, ensuring resilience.

- 36% use it for CRM systems, supporting better customer engagement.

- 36% also host digital channels applications like mobile and online banking.

- Only 18% have moved their core deposit platform to the cloud, showing hesitation around core systems.

Regulatory and Compliance Considerations

- Regulatory compliance challenges 65% of financial institutions.

- 78% of banks cite regulatory concerns as the top cloud barrier.

- 77% of banks rely on regulatory alignment tools.

- 59% adopt hybrid strategies for data sovereignty compliance.

- 70% of cloud providers offer compliance-ready architectures.

- 83% of organizations worry about data sovereignty risks.

- 52% of banks invest in cloud certification for compliance.

- 82% seek improved security through the cloud despite risks.

Challenges and Barriers to Cloud Migration

- 55% of banks cite legacy systems as the top migration barrier.

- 46% identify regulatory compliance as a major cloud obstacle.

- 54.2% face skill shortages and integration challenges.

- 69% fear risks in core system migration.

- 90% of businesses encounter data migration problems.

- 63% rely on pre-2000 code, limiting modernization.

- 80% of banks remain in nascent hybrid cloud stages.

- 50% experience budget overruns from dependencies.

- 30% modify architectures for data sovereignty.

Cloud Migration Strategies and Roadmaps

- 82% of financial firms adopt hybrid or multi-cloud strategies.

- 85% of institutions use multi-cloud and hybrid models.

- 92% success rate with phased migration strategies.

- 68% of banks use cloud-native platforms for core operations.

- 77% integrate regulatory tools into cloud planning.

- 80% start with disaster recovery as the first cloud workload.

- Hybrid cloud workloads increase 18% through 2025.

- 83% have multi-cloud strategies for compliance.

- 90% plan hybrid/multi-cloud by 2027.

Payments and Cross‑Border Services in the Cloud

- Cloud payment systems cut transaction times by 53%.

- 30% growth in cloud-based cross-border payment platforms.

- The cross-border payments market reaches $320.73 billion.

- 35% increase in BaaS for payment services.

- Cloud fraud detection saves $1.7 billion in losses.

- 20% growth in financial cloud APIs for payments.

- 39% market expansion for cloud cross-border services.

- ISO 20022 improves interoperability by 50%.

- 16-20% rise in cross-border volumes via cloud.

Frequently Asked Questions (FAQs)

About 98% of financial services organizations report using cloud services in 2025.

Roughly 60% of banks are expected to have shifted at least 30% of their critical workloads to the cloud by 2025.

Only 12% of financial services institutions globally are classified as true cloud innovators in 2025.

Around 82% of financial firms are using hybrid or multi‑cloud models as of 2025.

Conclusion

Cloud migration has become a central pillar for modern banking, offering scalability, flexibility, and a path to innovation. But the journey remains complex, and banks confront significant challenges in security, compliance, legacy‑system integration, cost control, and organizational change. Institutions that approach migration with phased roadmaps, hybrid or multi‑cloud strategies, robust security and governance frameworks, and careful vendor diversification stand to gain the most. Cloud‑powered payments, cross‑border services, and modern banking platforms point toward a future where banking is more agile, global, and accessible. For banks ready to evolve, cloud migration offers both a challenge and an opportunity, one that could define the next decade of financial services.