Imagine a world where paying for your coffee or grocery run is as simple as waving your wrist. That’s the promise of wearable payments technology, an innovation that merges convenience and cutting-edge tech. From smartwatches to fitness trackers, these devices are transforming how we think about payments, blending style, security, and utility. Let’s explore the latest statistics and trends shaping this dynamic market.

Editor’s Choice

- Market value of wearable payment technologies is now projected at $78 billion for 2025, growing at a CAGR of about 18.3%.

- Among smartwatch users, around 37% now use mobile payment services, reflecting the current global adoption rate.

- Gen Z and Millennials remain dominant users, comprising about 67% of wearable payment users.

- Fitness‑focused wearables maintained high integration, with approximately 42% of 2024 wearable payment devices being fitness trackers featuring payment capabilities.

- Security continues to be key, with biometric authentication still cited by about 92% of users as a trust factor.

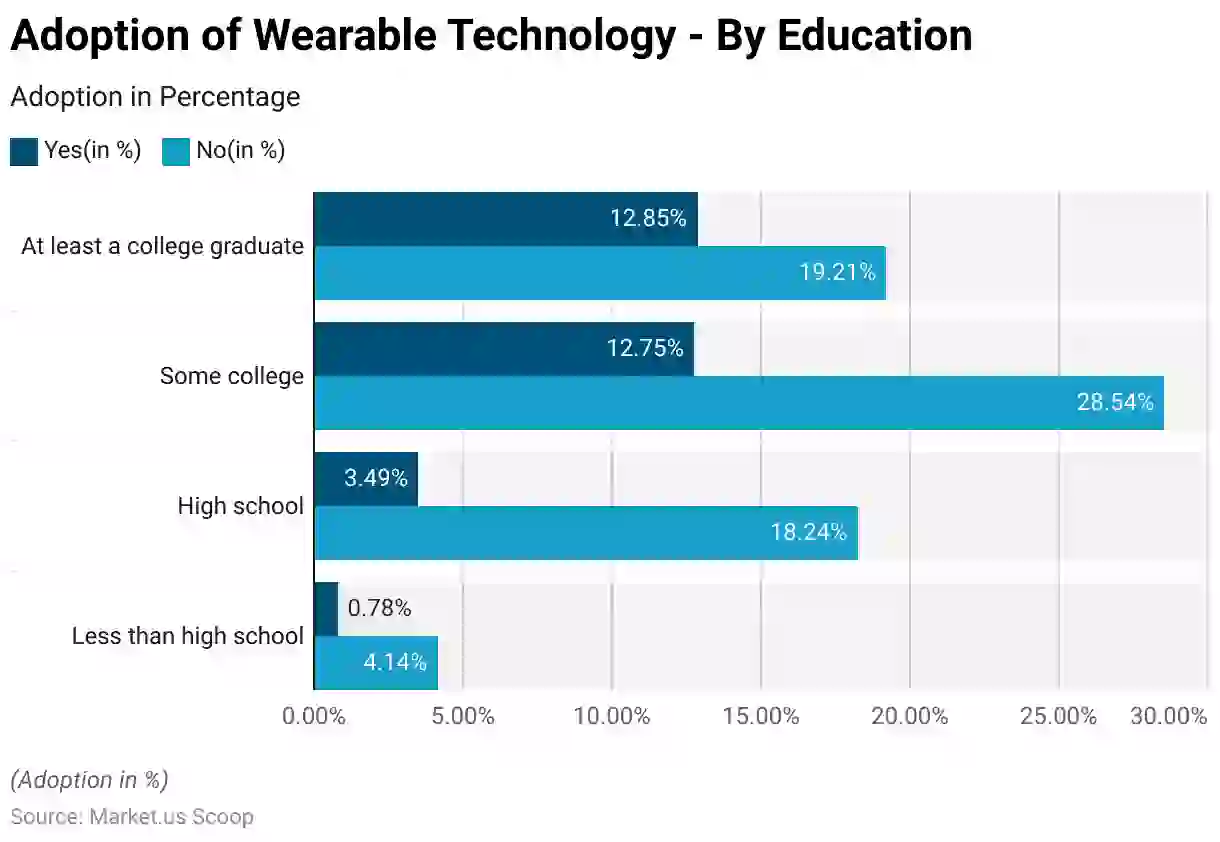

Adoption of Wearable Technology by Education

- At least college graduate users show 12.85% adoption, while 19.21% have not adopted wearable technology. This suggests that higher education correlates with above-average interest but also a sizable share of non-users.

- Some college-educated individuals display 12.75% adoption, with a much higher 28.54% opting out. This indicates mixed adoption behavior, with non-users clearly outweighing users in this segment.

- High school graduates record just 3.49% adoption, contrasted with 18.24% non-adoption. The numbers highlight a significant gap, showing limited penetration in this demographic.

- Less than a high school education reveals the lowest adoption rate at 0.78%, with 4.14% not adopting wearables. This demonstrates that lower education levels strongly correlate with minimal adoption of wearable technology.

Wearable Payments Devices Market Trends

- Global wearable payments device shipments, including fitness and smartwatches with payment capabilities, are projected to reach just over 570 million units in 2025.

- Hybrid smartwatches represented 15.1% of smartwatch shipments with payment functionality.

- Fitness-focused wearables with embedded payment tech account for around 42% of the market in 2025.

- Contactless payment compatibility remains widespread, with about 90% of new wearable devices supporting it in 2025.

- The luxury wearable segment saw a 32–35% YoY growth in payment-enabled devices, particularly in markets like Western Europe and the Middle East, driven by brand-led innovation.

- Approximately 49% of newly launched payment wearables support multicurrency transactions, enabling seamless global use.

- IoT-connected features, such as smart home and smart transit integration, contributed to an estimated 12% incremental growth in wearable payment usage by 2025.

Adoption Rates and User Demographics

- Gen Z and Millennials now account for 67% of wearable payment users in 2025, affirming their continued dominance in adoption.

- Baby Boomers show growing involvement with a 12% increase in adoption by 2025.

- Individuals aged 35–44 remain the fastest‑growing segment with adoption rates rising by 28% in 2025.

- Urban users represent about 80% of global wearable payment usage in 2025, underlining urban concentration.

- Gender balance remains steady at approximately 51% male and 49% female wearable payment users in 2025.

- Asia‑Pacific continues to lead in new user growth with the addition of 120 million users in 2025.

- In the United States, 30% of wearable users made payments via their devices at least once per week in 2025.

Leading Devices and Manufacturers

- Apple Watch holds an estimated 22% global market share in 2025 despite a decline in sales.

- Samsung wearables account for around 9.5% of the global wearable devices market in 2025.

- Xiaomi saw a 135% increase in shipments, boosting its market position significantly in 2025.

- Huawei reported a 35% growth in smartwatch shipments in 2025.

- Visa, Mastercard, and major manufacturers now support contactless payments on approximately 85% of wearable devices.

- Fitbit Pay adoption likely rose by at least 15% in 2025, aligned with continued demand for health-focused wearables.

- Garmin Pay maintains global expansion, especially in outdoor and sports-focused segments.

Technology and Device Insights

- Biometric authentication (e.g., facial recognition) is projected to power 68 % of wearable payment transactions by 2025.

- NFC remains the primary technology, with NFC payment devices valued at approximately $59 billion in 2025.

- Battery life has continued to improve, with devices lasting up to 7 days on average, mirroring the 25 % improvement seen earlier.

- Voice-enabled payments are projected to grow by approximately 30% in global adoption by 2025, largely driven by integrations with smart assistants like Alexa and Google Assistant.

- Around 60% of wearable payment devices now use AI-driven personalization to enable dynamic spending controls and loyalty suggestions.

- Multi‑factor authentication support has grown to about 20 % of wearable devices, enhancing security.

Application Insights

- Retail payments now account for 55 % of all wearable payment transactions in 2025, accompanied by a continued strong presence of public transit usage.

- An estimated 15 million users in 2025 will use wearable devices with integrated payment for health-related transactions, such as bill payments and insurance premium installments.

- Event ticketing payments via wearables have grown by about 40 % in 2025, fueled by partnerships with major sports and entertainment organizations.

- In hospitality, wearable payments continue to represent around 25 % of transactions at premium hotels and resorts globally in 2025.

- Charity donations via wearables rose by approximately 18 % through seamless contactless giving in 2025.

- Integration with cryptocurrency wallets remains niche at about 5 % of wearable payment use cases in 2025.

- Payments for smart home services like energy billing grew by around 30 % in 2025, reflecting broader IoT adoption.

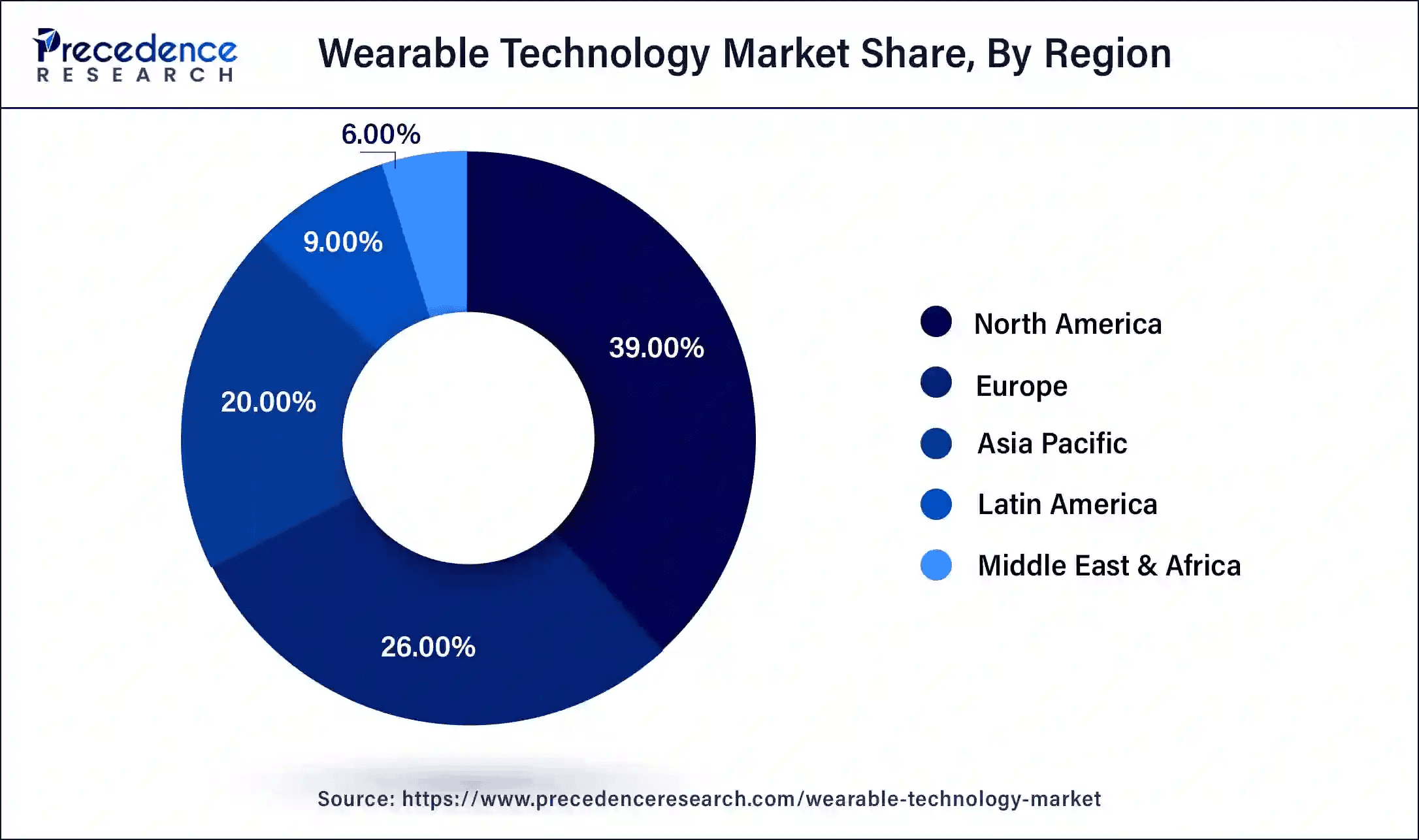

Wearable Technology Market Share by Region

- North America leads the market with a 39% share, making it the largest hub for wearable technology adoption. Strong consumer demand and tech-driven lifestyles drive this dominance.

- Europe follows with a 26% market share, showing steady adoption across both Western and Eastern markets. Regulatory support and high purchasing power contribute to its growth.

- Asia Pacific holds 20% of the global share, fueled by rising smartphone penetration and expanding middle-class consumers. This region is expected to see the fastest growth in the coming years.

- Latin America accounts for 9% of the market, reflecting early but promising adoption. Growth is supported by urban populations and the increasing affordability of devices.

- The Middle East & Africa capture 6% of the global share, marking the smallest regional market. Despite low penetration today, emerging digital infrastructure is set to boost adoption.

Key Market Dynamics and Challenges

- Security concerns remain a major barrier, with around 64 % of consumers citing data breach risks as a concern in 2025.

- Regulatory complexity still hampers adoption, particularly in developing markets where barriers persist.

- Device cost continues to deter approximately 30 % of potential users, especially in budget-conscious segments.

- Partnerships between fintechs and wearables manufacturers continue to rise, improving interoperability.

- The lingering impact of the pandemic still supports demand for contactless payments through wearables.

- Sustainability factors, such as eco‑friendly materials, influence about 10 % of consumer preferences.

- Manufacturers face tough competition, with about 50 % of new wearable payment devices now launched at competitive price points.

Security and Privacy Considerations

- Biometric security is now featured in approximately 80% of wearable payment devices, offering robust protection against fraud.

- Tokenization ensures that sensitive payment data is not stored on devices, lowering the risk of data theft.

- End-to-end encryption is now standard on about 90% of new wearable payment devices, securing transactions across platforms like Apple Pay, Samsung Pay, and Fitbit Pay.

- Around 62% of consumers trust wearable payments due to authentication features like multi-factor authentication.

- Compliance with data privacy regulations has improved, with manufacturers increasing user data control by approximately 20%.

- Concerns remain, with 35% of non-users citing fears of hacking or unauthorized access as a top reason for avoidance.

- Education campaigns have improved user confidence, with 50% more users reporting awareness of security features.

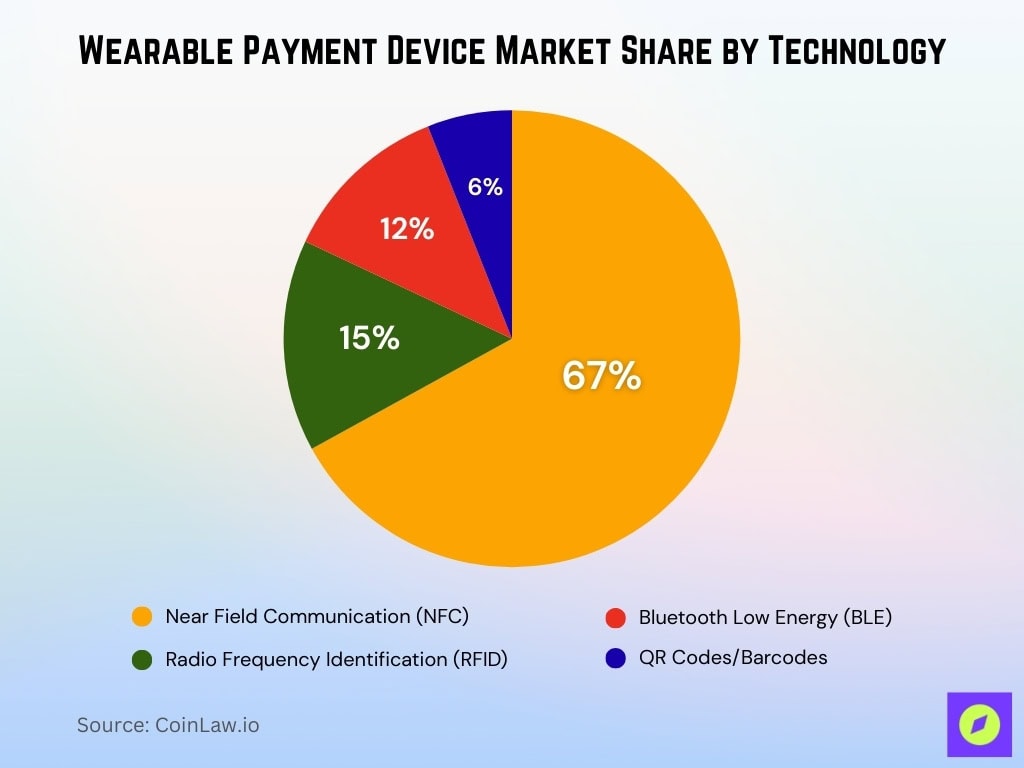

Wearable Payment Device Market Share by Technology

- Near Field Communication (NFC) dominates the market with a massive 67% share, making it the backbone of wearable payment devices. Its speed, security, and wide merchant acceptance drive its global leadership.

- Radio Frequency Identification (RFID) accounts for around 15% of revenue share, used heavily in closed-loop environments like transit and event ticketing. It plays a strong role in specific use cases despite limited scalability.

- Bluetooth Low Energy (BLE) holds about 12% of the market, enabling seamless device-to-device connectivity. Its share reflects growing adoption in health wearables and fitness trackers that integrate payment features.

- QR Codes and Barcodes represent approximately 6% of market share, popular in emerging markets due to low-cost deployment. Although smaller, they offer simple adoption paths where NFC or BLE infrastructure is limited.

Recent Developments

- Apple ended its own Buy Now, Pay Later service, Apple Pay Later, and shifted to integrations, with CaixaBank in Spain launching installment payment options for Apple Pay users in 2025.

- Samsung expanded wearable peer-to-peer payments through its partnerships with platforms like PayPal, now available in 20+ new markets by 2025.

- Garmin Pay now supports cryptocurrency wallets for wearable payments at select retailers, marking deeper crypto integration in 2025.

- As of 2025, Fitbit is piloting insurance premium payments through fitness trackers, partnering with select U.S. health providers.

- Visa and Mastercard pilot projects in the Middle East and Africa boosted wearable payment adoption by 12 % in 2025.

- Public transit networks in cities like Singapore, London, and Dubai now offer real-time fare adjustments through wearable-enabled contactless systems.

- R&D investments by leading manufacturers rose by approximately 25 % in 2025, focusing on enhanced NFC chips, solar charging, and voice-enabled payments.

Conclusion

The evolution of wearable payment technology underscores the shift toward seamless, secure, and integrated payment solutions. Security innovations, user-friendly features, and expanding global adoption highlight this sector’s potential to redefine consumer transactions.

As wearables become essential accessories, the combination of biometric security, AI-driven personalization, and IoT integration positions these devices as indispensable tools in modern life. Despite challenges like device costs and data privacy concerns, continuous innovation and global collaborations signal a promising future. For consumers and businesses alike, wearable payments represent not just convenience, but the next step in the evolution of digital commerce.