Imagine walking through the aftermath of a virtual accident scene, assessing the damage in real time without ever stepping outside your office. This is not a distant future; it’s a reality for the insurance industry, which has embraced Virtual Reality (VR) as a revolutionary tool.

The blend of VR and insurance has opened doors to unprecedented ways of interacting with customers, managing risk, and preventing fraud. As we explore, you’ll see how VR is reshaping every facet of the insurance landscape, from customer engagement to training.

Editor’s Choice

- VR adoption in the insurance sector increased significantly, with nearly one-third of firms implementing immersive technology solutions for claims, training, and customer engagement.

- 40% of North American insurers have adopted virtual technologies, including VR, to enhance customer engagement.

- VR applications for claim assessment have cut on-site evaluation costs by up to 50%, enabling faster and more accurate processing.

- 65% of global insurers plan to increase their investment in immersive technologies, particularly VR, to improve risk modeling and enhance policyholder engagement.

- Immersive technologies, including VR, have been integrated into fraud detection strategies, contributing to measurable declines in fraudulent claim rates at select insurers.

- The global virtual reality market is forecast to grow to over $21 billion in 2025, representing a compound annual growth rate (CAGR) of approximately 26.8%.

- VR training improves knowledge retention by over 75% and reduces training time by 40%.

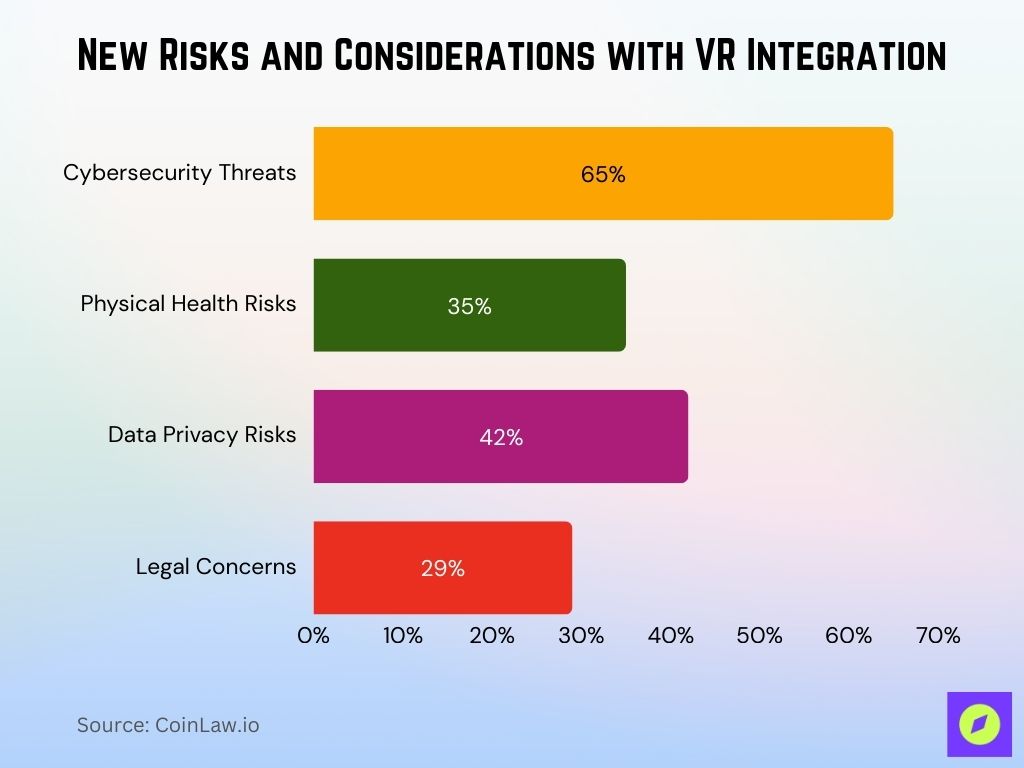

New Risks and Considerations with VR Integration

- Cybersecurity threats remain a top concern for insurers using VR, with 65% of companies reporting increased vulnerability to data breaches.

- Compliance with privacy regulations adds complexity, as 48% of insurers identify this as a major barrier to VR adoption.

- Potential health risks like eye strain and motion sickness have led 35% of companies to introduce mandatory break policies.

- Data privacy concerns have driven 42% of insurers to adopt secure transmission protocols during VR interactions.

- Legal issues surrounding virtual liability have prompted 29% of insurers to seek clearer guidelines for virtual incidents.

- VR integration has led 21% of companies to purchase additional VR-specific insurance policies.

- Employee training on VR ethics has expanded, with 56% of insurers including dedicated safety and compliance modules.

Next‑Generation Customer Engagement in VR Insurance

- Insurers using VR-enabled interfaces have reported a 30% improvement in customer satisfaction, driven by interactive experiences and real-time education.

- 34% of millennial policyholders in 2025 prefer using VR tools to understand complex policies, shifting how products are presented and sold.

- Insurers using VR in marketing see a 38% rise in online engagement as clients explore simulated risk scenarios and interact with virtual agents.

- Real-time policy customization via VR has reduced policy update requests by 25%, enhancing the customer experience.

- Policy simulation environments enable customers to visualize coverage in action, leading to a 40% improvement in retention rates among VR users.

- By 2025, 45% of insurance companies will have introduced VR into customer service workflows, reducing in-person support needs and cutting customer service costs by 30%.

- Interactive VR tutorials for policyholders have reduced customer onboarding times by 20%, offering a more intuitive way to understand coverage details.

Business Opportunities Enabled by VR in Insurance

- The VR insurance industry is projected to hit approximately $7.1 billion by 2028, driven by expanding use in interactive risk assessment, customer engagement, and fraud detection.

- Insurance providers using VR for risk assessment and policy testing report a 20% increase in market share as customers favor insurers offering immersive tools.

- VR-driven training for sales agents has led to 48% higher sales conversion rates, attributed to more effective immersive learning.

- VR-based disaster preparedness simulations boost policy purchase rates by 32% in regions prone to natural disasters.

- Remote inspections using VR and drone-based technologies have the potential to save insurers hundreds of millions in annual overhead, especially in high-frequency claim areas like property damage.

- Using VR to explain complex coverage scenarios improves customer understanding by 37%, leading to better retention of policy terms.

- The Asia-Pacific VR insurance segment is growing with a 17.5% CAGR through 2028, driven by investments in VR-enabled claims processing and policy customization.

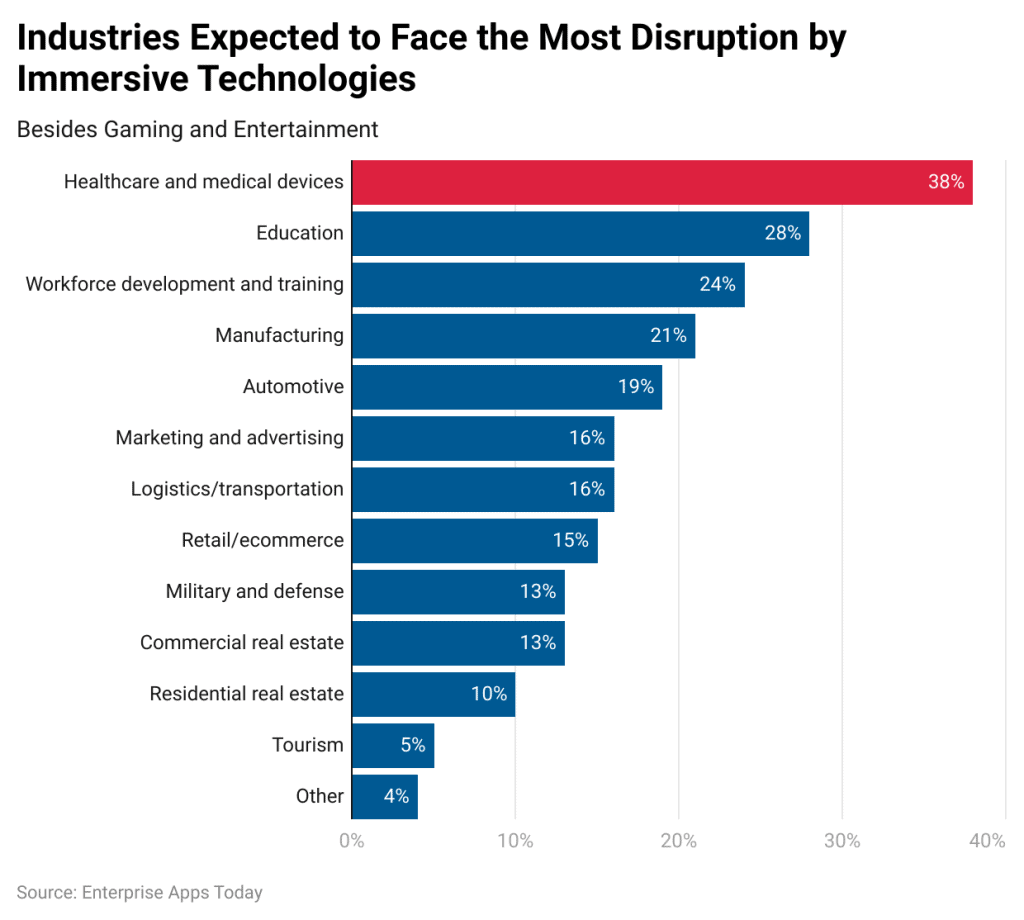

Industries Most Disrupted by Immersive Technologies

- Healthcare and medical devices lead with 38%, showing the highest potential for transformation beyond gaming and entertainment.

- Education follows at 28%, highlighting how immersive tech is reshaping learning environments and student engagement.

- Workforce development and training hold 24%, as companies adopt VR and AR for upskilling and simulations.

- Manufacturing accounts for 21%, benefiting from virtual prototyping and process optimization.

- Automotive stands at 19%, using immersive tools for design, testing, and customer experiences.

- Marketing and advertising at 16%, alongside logistics/transportation also at 16%, are leveraging immersive campaigns and operational efficiencies.

- Retail and e-commerce record 15%, integrating immersive shopping experiences to boost customer engagement.

- Military and defense share 13%, equal to commercial real estate at 13%, where simulations and virtual planning are gaining ground.

- Residential real estate at 10%, supported by virtual property tours and immersive sales tools.

- Tourism is lower at 5%, but immersive travel previews are emerging as a niche.

- Other industries make up 4%, reflecting early-stage adoption and experimentation.

Business Opportunities Enabled by VR in Insurance

- The VR insurance industry is projected to reach $7.1 billion by 2028, driven by expanding applications in interactive risk assessment, customer engagement, and fraud detection.

- Insurance providers using VR for risk assessment and policy testing report a 20% increase in market share, as customers favor insurers offering immersive tools.

- VR-driven training for sales agents delivers 48% higher sales conversion rates, thanks to more effective immersive learning.

- VR-based disaster preparedness simulations boost policy purchase rates by 32% in regions prone to natural disasters.

- Remote property inspections using VR save the industry an estimated $320 million annually in travel costs.

- VR explanations of complex coverage scenarios improve customer understanding by 37%, enhancing policy retention.

- The Asia‑Pacific VR insurance market is growing at a 17.5% CAGR through 2028, fueled by investments in VR-enabled claims processing and customization.

Customer Preferences and Perceptions of VR in Insurance

- 76% of policyholders believe VR-enhanced insurance interactions are more engaging than traditional methods, particularly in policy reviews and claim explanations.

- 42% of millennial and Gen Z customers are more likely to choose insurers offering VR tools for policy customization and claims support.

- Among new policyholders, 64% find VR tutorials easier to understand than text-based explanations.

- 45% of U.S. consumers would consider switching to a provider offering VR simulations for a more immersive understanding of coverage.

- Insurers using VR for onboarding saw customer onboarding times drop by 18%, thanks to simplified, immersive learning.

- 60% of policyholders express interest in virtual risk assessment tools that help visualize and mitigate potential hazards.

- Customer satisfaction scores improved by 30% for insurers using VR-powered claims assistance, as policyholders find VR-guided support more transparent and trustworthy.

Percentage of American Adults with Life Insurance by Generation

- Baby Boomers lead at 57%, the highest share of adults holding life insurance policies.

- Gen X follows closely at 55%, showing strong adoption among middle-aged adults.

- Millennials stand at 50%, with half of this generation carrying life insurance coverage.

- Gen Z lags at 36%, reflecting the lowest adoption rate among younger adults.

Efficiency Gains Through VR Training Programs

- VR training programs for new hires report a 75% information retention rate, compared to just 10% from traditional methods.

- VR-based adjuster training has reduced time to competency by as much as 60%, accelerating onboarding and lowering costs.

- 82% of employees engage more with VR training than conventional training, citing better retention and hands-on learning experiences.

- Using VR for compliance training results in a 25% decrease in compliance errors, as immersive scenarios help clarify complex regulations.

- Insurers achieve notable savings with VR training, leveraging reductions of up to 52% in training costs when scaled across large groups.

- Soft skills training in VR boosts productivity by 10–15% while also improving customer satisfaction.

- VR training programs for claims handling enhance processing efficiency by 22%, as immersive practice improves workflow understanding.

Impact of VR on Insurance Claim Processing

- VR-driven claim assessments can cut processing time by up to 50%, as adjusters use virtual tools to inspect and evaluate claims remotely.

- 34% of major insurance firms have adopted VR for initial claim assessments, reducing reliance on in-person evaluations and expediting settlements.

- Policyholders using VR-supported claim submissions report 20% higher satisfaction due to reduced wait times and streamlined processes.

- VR simulations allow adjusters to reconstruct accident scenes, enhancing assessment accuracy and reducing dispute rates by 18%.

- VR tools in claim processing reduce clerical errors by 25%, as adjusters gain a clearer, more accurate view of damage and liability.

- VR-assisted damage evaluations have cut down on supplementary claims by 12%, as initial assessments become more thorough.

- VR-based claims processing has saved insurers approximately $150 million annually by enabling faster and more remote claim handling.

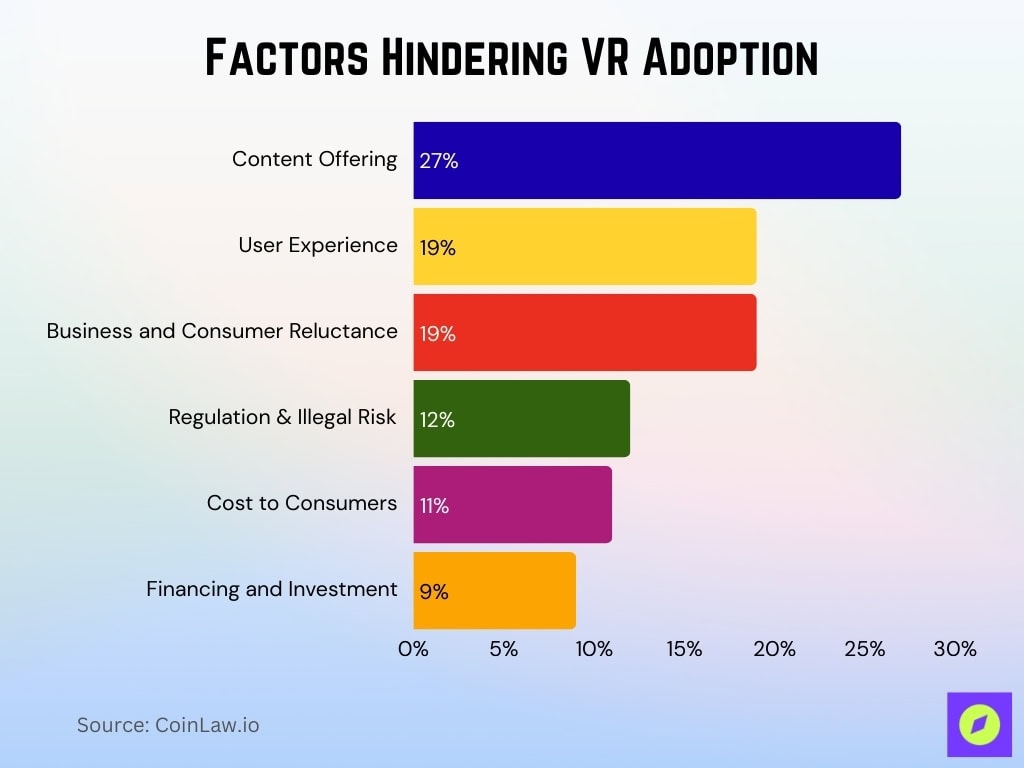

Factors Hindering VR Adoption

- Content offering is the biggest barrier at 27%, showing a lack of diverse and engaging VR experiences.

- User experience issues account for 19%, reflecting concerns about comfort, usability, and technical glitches.

- Business and consumer reluctance also stands at 19%, highlighting hesitation to adopt immersive technologies.

- Regulation and illegal risk make up 12%, pointing to compliance and legal uncertainties.

- Cost to consumers is 11%, underlining affordability challenges that slow mainstream adoption.

- Financing and investment barriers at 9%, signaling limited funding for VR innovation and scaling.

Benefits of Virtual Reality Insurance Training Programs

- VR training boosts long-term knowledge retention to 75%, significantly improving program effectiveness.

- Claims adjusters trained via VR reach competency 60% faster, reducing onboarding time and early-stage errors.

- 82% of employees prefer VR modules for immersive, hands-on learning over traditional formats.

- VR-based compliance training has led to a 25% reduction in errors, improving understanding of regulations.

- Companies save up to $1.2 million annually through VR training by eliminating travel and physical resource costs.

- Soft skills training in VR raises trainee confidence by 275%, improving customer-facing interactions.

- Claims processing accuracy improves by 12% with VR training, streamlining evaluation and documentation.

Recent Developments in Virtual Reality for Insurance

- VR-based customer portals have grown in 2025, letting policyholders manage policies, initiate claims, and access support virtually.

- Allianz introduced a VR claims processing system that cut assessment time by 30%, accelerating claim settlements.

- Lloyd’s of London piloted VR simulations for risk assessment, achieving a 20% improvement in accuracy over traditional methods.

- Several insurers are exploring AR‑VR hybrids to overlay real-time data for property assessments, enhancing precision.

- Swiss Re implemented VR for policyholder training, reporting a 32% boost in satisfaction due to immersive, hands-on education.

- AI-enhanced VR has improved fraud detection rates by 26%, with simulations helping verify incident scenarios more accurately.

- 12% of U.S. insurers now offer VR headsets to enable interactive tutorials on policy benefits and coverage options.

Conclusion

Virtual Reality is rapidly transforming the insurance landscape, offering innovative solutions that improve efficiency, reduce costs, and enhance customer engagement. By adopting VR, insurers are not only streamlining their operations but also providing a more interactive and informative experience for policyholders.

With the increasing adoption of VR technology, insurers worldwide are better equipped to meet the evolving needs of modern customers. As more companies integrate VR across various aspects of their operations, the future of insurance looks more immersive, efficient, and customer-centric than ever before.