It all started with a pizza split. A few friends, a dinner bill, and the awkward dance of settling who owes what. Out of this everyday moment emerged a new kind of economy, one that values speed, simplicity, and digital-first money movement. Venmo and Cash App have come a long way since those early days of peer-to-peer transfers. Today, these platforms are no longer just “send money” apps. They’ve grown into powerful financial ecosystems, influencing how millions manage their money, invest, shop, and even file taxes.

This article breaks down the latest statistics comparing Venmo and Cash App, revealing where each app excels, who’s using them, and how their business models are shaping modern finance.

Key Takeaways

- 1Cash App has surpassed 55 million monthly active users in the US, outpacing Venmo’s growth trajectory in 2025.

- 2Venmo processes over $325 billion in total annual payment volume, making it a key player in PayPal’s ecosystem.

- 3Cash App’s revenue hit $10.8 billion in 2025, a 19% year-over-year increase.

- 4Venmo’s user base stands at 62 million users in 2025, including both personal and business accounts.

Digital Payment Platforms Market Share Breakdown

- PayPal leads the market with a 32% share, maintaining a dominant position in the digital payments ecosystem.

- Stripe follows closely with a 20.54% market share, reflecting its popularity among online merchants and developers.

- Stripe Connect, a specialized product for marketplaces, holds 19.62%, highlighting its strong adoption in platform-based payment systems.

- Adyen captures 11.54% of the market, showing strength in global omnichannel payment solutions.

- Square Point of Sale has a 3.38% share, focusing primarily on in-person transactions for small businesses.

- Braintree, a PayPal service, accounts for 2.46%, catering to mobile and web payment solutions.

- Authorize.net holds a 1.51% share, widely used by small and medium-sized e-commerce platforms.

- QuickBooks has 1.29%, integrating accounting and payment processing for small business users.

- Venmo, despite its brand recognition, holds only 0.85% market share in this context.

- WorldPay rounds out the list with a 0.65% share, indicating limited usage in this digital payment comparison.

Demographics and User Base

- Cash App has a dominant user share among Gen Z, with 45% of users aged 18–29 in 2025.

- Venmo maintains a strong appeal among millennials, who make up 54% of its active user base.

- African American and Hispanic users make up over 48% of Cash App’s audience, highlighting its cultural reach and accessibility.

- Venmo’s gender split is relatively even in 2025, with 51% female and 49% male users.

- Cash App users tend to skew lower-income, with 39% earning under $50,000/year.

- Venmo’s student user base represents over 14% of its total users, driven by its college campus presence and integrations.

- Cash App adoption is higher in the southern and midwestern US states, with over 21 million active users across these regions.

- In contrast, Venmo leads in coastal cities, with San Francisco, New York, and Boston showing the highest usage per capita.

- Venmo is seeing increased adoption among users aged 40 and older, now comprising 28% of its base.

- Cash App has more than 7 million teen users through its Cash App for Teens program.

Revenue and Profit Figures

- Cash App’s total revenue for 2025 is reported at $10.8 billion.

- Venmo’s revenue reached $4.3 billion, with major growth in its monetized features and debit card usage.

- Cash App’s gross profit climbed to $3.5 billion, representing a 16% margin growth year-over-year.

- Venmo earns nearly $0.92 per user monthly through its financial products and merchant payments.

- Cash App’s subscription-based features now generate over $1.2 billion in annual revenue.

- Venmo’s merchant fees contributed $700 million in 2025, up 11% from the previous year.

- Cash App for Business accounts generated $900 million in revenue, primarily from small vendor and creator payments.

- Venmo’s parent company, PayPal, sees Venmo contributing to nearly 16% of its total revenue portfolio.

- Cash App continues to see gains from Bitcoin transactions, accounting for more than 50% of its overall revenue.

- Venmo saw a 12% increase in net profit from 2024 to 2025, largely attributed to debit card interchange fees.

How Consumers Use Cash App Card for Everyday Spending

- Big Box & Discount Retail tops the chart at 22%, making it the most common use case for Cash App cardholders.

- Restaurants account for 19% of everyday spending, highlighting food purchases as a major category.

- Other Retail follows with 15%, showing significant general shopping activity beyond specific retail formats.

- Travel & Entertainment and Gas & Auto are tied at 13% each, showing strong usage for mobility and leisure-related expenses.

- Grocery purchases make up 8%, indicating frequent use for essential goods.

- Telecom & Utilities represent 7%, reflecting use for recurring monthly bills.

- Other spending categories account for the remaining 3%, covering miscellaneous uses outside the main sectors.

Transaction Volume and Frequency

- Venmo’s total payment volume (TPV) surpassed $325 billion in 2025, with consistent quarterly growth.

- Cash App’s TPV reached $248 billion, with notable increases from business and Bitcoin transactions.

- The average Venmo user makes 6.5 transactions per month, primarily for bill splits and small purchases.

- Cash App users average 8.1 transactions per month, with many using it for direct deposits and bill payments.

- Venmo Business Profiles facilitated over $42 billion in transactions in 2025.

- Cash App’s recurring payments feature now handles more than $4.1 billion annually.

- Instant transfer fees generated over $500 million in revenue for both apps combined.

- Venmo to bank transfer speeds are now under 30 minutes for most users with eligible banks.

- Cash App’s Instant Deposit feature has a 95% satisfaction rate, especially among gig economy workers.

- More than 80% of Cash App transactions are completed in under 5 seconds, ensuring real-time experiences.

Business Adoption and Merchant Acceptance

- Cash App for Business accounts surpassed 5.3 million active users, fueled by social sellers and freelancers.

- Venmo Business Profiles increased to over 3.8 million, a 22% year-over-year growth.

- Venmo’s merchant QR code feature is now accepted at over 1.1 million retail locations across the US.

- Cash App is widely used by creators and small vendors, with 34% of all small business sellers using it as a primary tool.

- Venmo’s merchant fee remains at 1.9% + $0.10 per transaction, competitive with Square’s own pricing model.

- Cash App Pay integrations with Square POS have enabled seamless checkout at more than 2.2 million SMB locations.

- Venmo Checkout now partners with over 60 major brands, including Uber, Amazon, and Chipotle.

- Cash App’s invoicing feature is used by over 400,000 freelancers, mostly in design and creative services.

- Venmo saw a 17% growth in food and beverage transactions year-over-year, especially in quick-service environments.

- Cash App’s partnerships with Shopify and Etsy help drive 13% of its monthly business transaction volume.

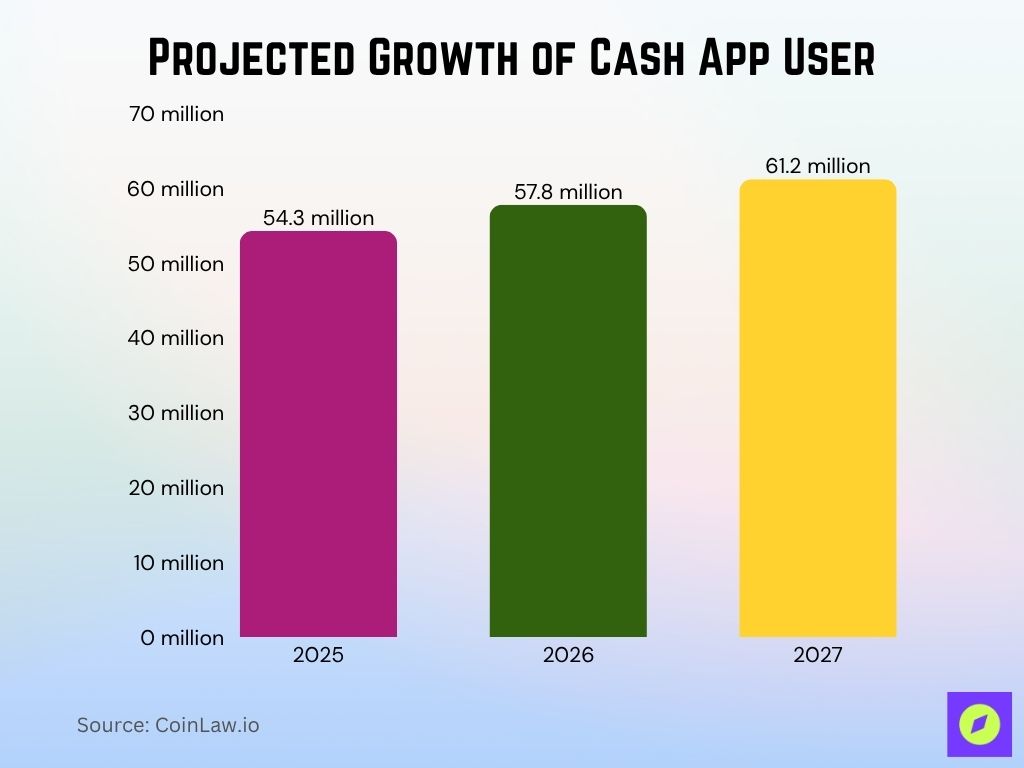

Projected Growth of Cash App Users

- In 2025, the number of Cash App users in the US is projected to reach 54.3 million, reflecting growing trust in peer-to-peer payment platforms.

- By 2026, user adoption is expected to climb to 57.8 million, driven by increased integration with retail and banking services.

- In 2027, the user base is forecast to hit 61.2 million, showing a strong upward trend in digital wallet usage and mobile financial services.

Features and Functionalities Comparison

- Cash App supports stock trading with as little as $1, attracting over 12 million active investors in 2025.

- Venmo launched enhanced crypto trading with support for four major coins, including Ethereum and Litecoin.

- Cash App Taxes saw over 6 million filings in 2025, a 30% increase from the prior year.

- Venmo introduced a cash-back rewards program through its debit card, active among 3.5 million users.

- Cash App supports direct deposits with early access, and over 16 million users now receive paychecks via the app.

- Venmo Teen Accounts launched in 2024 have reached 1.9 million sign-ups, offering parental controls and budgeting.

- Cash App Cards now support Apple Pay and Google Wallet, increasing compatibility across mobile ecosystems.

- Venmo added “split rent” and recurring request features, used by over 5 million households.

- Cash App Boosts remain a popular perk, with 40% of users redeeming at least one deal monthly.

- Venmo’s app redesign in 2025 included a simplified dashboard and clearer transaction sorting.

Transfer Speeds and Fees

- Cash App’s standard bank transfers take 1–3 business days, while instant transfers cost 1.75% (capped at $15).

- Venmo’s instant transfer fee is now 1.75%, aligned with industry standards, and capped at $17.50 per transfer.

- Over 72% of Cash App users opt for instant deposits over standard ones.

- Venmo’s average transfer completion time improved to under 30 seconds for peer-to-peer transactions.

- Cash App’s same-day settlement feature for business users helped process over $2.4 billion in 2025 alone.

- Venmo maintains zero fees for sending money from a linked bank account or debit card.

- Cash App’s cardless withdrawal through ATMs is now available at 19,000+ locations, offering better access to funds.

- Venmo transfer failures dropped to under 0.6%, showcasing improved infrastructure reliability.

- Cash App international transfers (US to UK) account for $240 million in volume since launch in 2023.

- Venmo’s customer-reported transfer error rate is below 0.4%, its lowest ever.

Venmo Marketing Channel Breakdown

- Direct traffic accounts for a dominant 69%, showing strong brand recognition and user loyalty.

- Search-based marketing drives 22.5% of Venmo’s traffic, indicating high discoverability via search engines.

- Social media contributes 5%, reflecting moderate engagement through platforms like Facebook and Instagram.

- Referrals make up 1.8%, suggesting minimal reliance on partner or affiliate links.

- Email (Mail) accounts for the smallest share at 1.7%, highlighting limited dependence on email campaigns for user acquisition.

Security and Fraud Statistics

- Cash App implemented device-level encryption and multi-factor authentication, reducing fraud claims by 27% year-over-year.

- Venmo’s fraud detection system flagged over 1.2 million suspicious transactions in Q1 2025 alone.

- Cash App maintains a fraud refund rate of 93% for confirmed scams reported within 48 hours.

- Venmo offers purchase protection for eligible transactions, now covering items up to $2,500.

- Cash App account takeovers declined by 19%, thanks to enhanced biometric verification.

- Venmo added email and push verification layers, decreasing unauthorized access incidents by 35%.

- Cash App compliance programs meet the latest SOC 2 Type II standards, strengthening enterprise security.

- Venmo disputes are resolved in an average of 3.2 days.

- Cash App customer support wait times decreased to an average of 7.5 minutes in 2025.

- Venmo and PayPal’s joint risk unit helped prevent over $58 million in attempted fraud in the first half of 2025.

Mobile App Downloads and Engagement

- Cash App has been downloaded over 420 million times globally, with 14 million new installs in 2025 alone.

- Venmo reached 380 million lifetime downloads, with 11 million installs in the first half of 2025.

- Cash App’s average session time is 6.7 minutes, reflecting higher user engagement across finance tools.

- Venmo sees about 4.9 minutes per session, focused primarily on P2P transfers and group splits.

- Cash App’s app rating on the App Store is 4.8 stars from over 2.1 million reviews.

- Venmo holds a 4.6-star rating, with more than 1.8 million reviews in 2025.

- Cash App ranks in the top 10 free apps in the Finance category across both iOS and Android.

- Venmo user retention rate after 30 days is 62%, while Cash App’s is 68%.

- Cash App usage spiked by 22% during tax season and stimulus disbursements in Q1.

- Venmo’s most-used feature remains “split bill,” followed by direct deposits and debit card transactions.

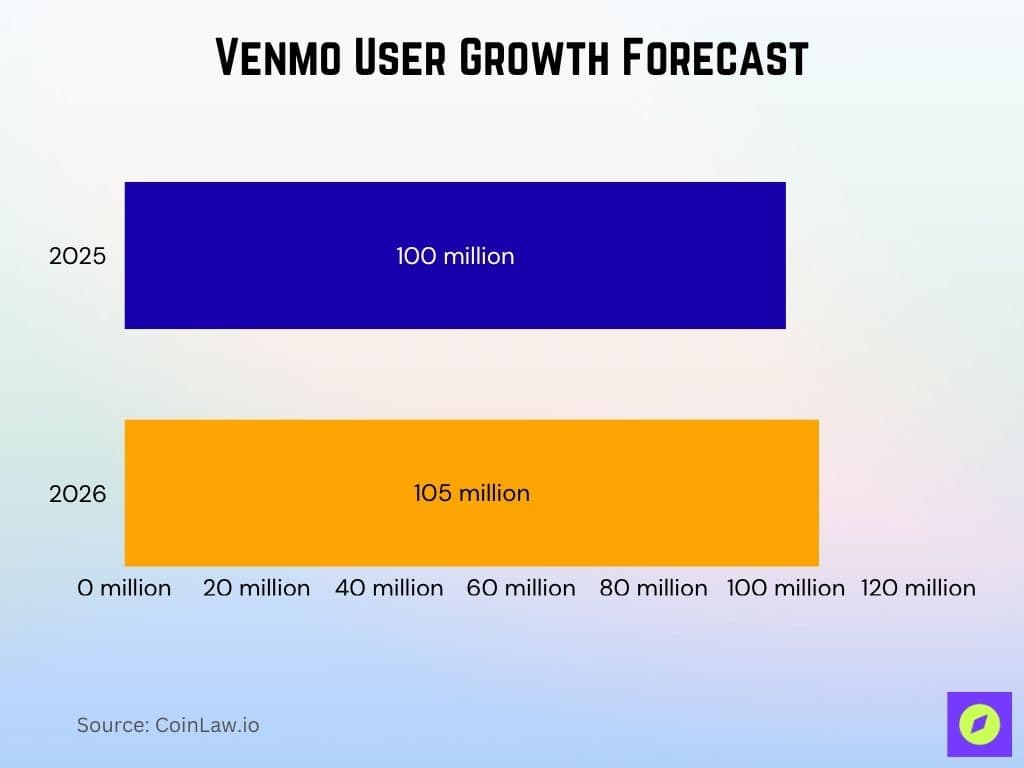

Venmo User Growth Forecast

- In 2025, Venmo is expected to reach 100 million users, marking a significant milestone in its nationwide adoption.

- By 2026, the user base is projected to grow further to 105 million, reflecting continued momentum in peer-to-peer payments and mobile finance.

Customer Satisfaction and Ratings

- Cash App’s NPS (Net Promoter Score) sits at 63, showing strong user loyalty and recommendation intent.

- Venmo’s NPS slightly trails at 59, still above average for the fintech industry.

- Cash App user satisfaction with its investing tools rose to 88% in 2025.

- Venmo saw a 12% rise in satisfaction with its business profiles among merchants.

- Cash App’s customer service score improved to 4.3 out of 5, up from 4.0 last year.

- Venmo customer ratings show particular strength in app usability and payment speed, scoring 4.6/5.

- Cash App debit card users report a satisfaction rate of 91%, driven by Boost savings and ATM access.

- Venmo debit card satisfaction increased to 87%, largely due to new cashback offers.

- Cash App maintains a customer resolution rate of 94%, with most issues addressed within 72 hours.

- Venmo’s most requested feature in user surveys was deeper financial insights and budgeting tools.

Social and Community Features

- Venmo social feed remains a signature feature, with 65% of users engaging with public payments weekly.

- Cash App avoids a full social feed but has introduced creator tipping, used by 2.1 million users.

- Venmo’s emoji-based notes are added to over 70% of transactions, reinforcing its social identity.

- Cash App Fridays, the platform’s weekly social giveaway campaign, reaches over 1.4 million participants weekly.

- Venmo launched Venmo Groups in 2025, letting users track shared expenses across roommates, friends, or events.

- Cash App users under 25 are 3x more likely to share referral codes than users over 40.

- Venmo’s charity donation feature helped raise over $9.7 million for nonprofits directly from in-app transactions.

- Cash App integrated live event tipping, mainly used during livestream shopping and music events.

- Venmo now supports payment tagging, which helps users track payments by activity type (e.g., “groceries” or “rent”).

- Cash App social mentions increased 28% year-over-year, driven by campaigns on TikTok and Twitter.

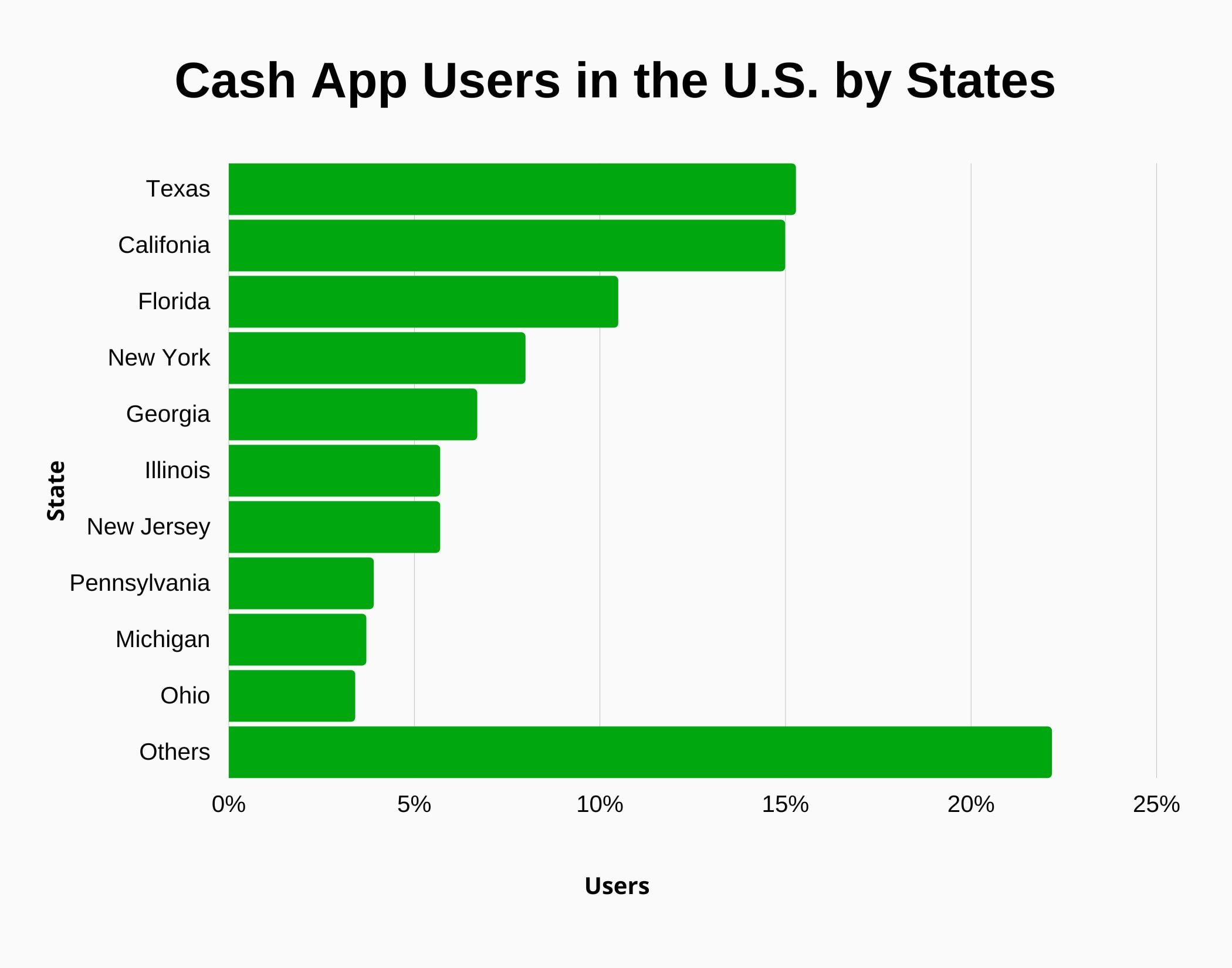

Cash App Usage by State in the U.S.

- Texas and California lead Cash App usage, each contributing nearly 15% of total users.

- Florida accounts for just over 10%, indicating strong regional adoption.

- New York follows with close to 9%, driven by dense urban usage.

- Georgia, Illinois, and New Jersey each contribute between 5% to 7% of users.

- Pennsylvania, Michigan, and Ohio make up the lower tier, each with 3% to 4% usage.

- The “Others” category represents the largest share at over 22%, highlighting the app’s wide distribution across smaller states.

Integration with Other Platforms

- Cash App integrates directly with TurboTax, helping over 2.8 million users file taxes in-app.

- Venmo’s partnership with Amazon continues, with over 9 million transactions processed in 2025.

- Cash App is embedded within Square POS, driving seamless business and consumer integration.

- Venmo integrates with PayPal’s ecosystem, enabling cross-platform funds management.

- Cash App partnered with Shopify, offering in-cart payment for over 300,000 eCommerce sellers.

- Venmo supports direct billing from apps like Splitwise, Uber, Grubhub, and Domino’s.

- Cash App integrated with Apple Watch, allowing glance-based transfers and quick payments.

- Venmo supports recurring billing, which now powers over $12 billion in subscription transactions annually.

- Cash App APIs are now used by over 5,000 fintech developers, enabling creative financial applications.

Usage by Businesses vs Individuals

- Cash App Business accounts make up 14% of total users, showing steady growth in side-gig and creator segments.

- Venmo Business Profiles serve nearly 11% of the platform’s user base, mainly local shops and service providers.

- Cash App reported $900 million in revenue from business use in 2025 alone.

- Venmo merchant use remains lower but steadily growing, particularly with wellness, events, and retail vendors.

- Cash App is often used for freelance payments, representing 28% of all business-related transfers.

- Venmo leads among food trucks and pop-up vendors, especially on the West Coast.

- Cash App for Teens has been used by over 1.1 million small business owner parents to manage allowances or sales.

- Venmo’s payment links are commonly used on platforms like Instagram and Facebook Marketplace.

- Cash App invoices and QR codes are favored by creative professionals and consultants.

- Venmo’s business-to-consumer usage saw a 14% YoY increase, particularly in the beauty and event industries.

Recent Developments

- Cash App launched instant virtual cards for new users in 2025, reducing wait time for spending.

- Venmo introduced “Pay Later” split-pay options, now used by over 1.6 million people.

- Cash App beta-tested AI budgeting tools, already been adopted by 9% of users in the early access program.

- Venmo’s real-time fraud alerts became the default for all accounts in Q1 2025.

- Cash App opened two new support hubs in Phoenix and Detroit, improving user response times.

- Venmo announced an exclusive collaboration with Spotify, allowing artists to accept tips directly via Venmo.

- Cash App added identity verification via facial recognition, boosting account security.

- Venmo’s B2B pilot program with medium-sized retailers began in June 2025.

- Cash App integrated a small business loan product, currently in limited release.

- Venmo introduced “Verified Merchant” badges, helping users distinguish trusted business profiles.

Conclusion

Venmo and Cash App have evolved into much more than simple P2P payment apps. Today, they’re driving the future of digital finance, investing, merchant solutions, and social commerce. Venmo leads in social engagement and brand familiarity, while Cash App outpaces in user growth, revenue diversification, and financial tools. Both platforms serve distinct user groups but share a common mission, making money movement accessible, instant, and integrated into daily life.

As competition tightens and new features emerge, both platforms will continue to redefine how we spend, save, and interact with our money, one transaction at a time.