The Unified Payments Interface (UPI) has transformed digital payments in India, rising from a groundbreaking innovation to a fundamental part of everyday transactions. Since its inception, UPI has allowed millions to transfer money seamlessly with just a mobile number or QR code, removing the complexity of traditional banking. Today, UPI’s momentum continues, with billions of transactions happening monthly, redefining payment systems worldwide and setting new standards in the fintech landscape.

Editor’s Choice

- UPI Lite supports offline transactions up to ₹5,000 total limit in 2026, boosting low-connectivity access.

- UPI surpassed 500 million unique users in India by early 2026, spanning all demographics.

- RuPay credit cards on UPI reached widespread adoption in 2026, enabling credit payments at millions of merchants.

- UPI processed 21.63 billion transactions in December 2025, setting a record as the world’s leading digital payment system.

- UPI accounts for 80-90% of India’s retail digital payments, driving the cashless economy shift.

- UPI expanded to 12+ countries by 2026 target, including South Asia and beyond.

Recent Developments

- NPCI introduced UPI Circle full delegation in late 2025, enabling up to 5 secondary users with ₹15,000 monthly limits.

- UPI refunds typically process in 3-5 working days, with instant notifications for failed transactions.

- BHIM UPI Circle empowers older people and students for independent payments within set parental controls.

- Split bill features via UPI gained traction post-2025, reducing reliance on apps like Splitwise amid 21+ billion monthly volumes.

- NPCI sandbox supports fintech API testing for UPI 3.0+, accelerating innovation with mock transactions and mandate flows.

- UPI Autopay drives subscription growth, projected for 1 billion daily transactions by 2026-27.

- Enhanced UPI features include Aadhaar face authentication and real-time PIN reset for improved security.

- UPI user base targeted to exceed 1 billion by late 2026 from 400 million currently.

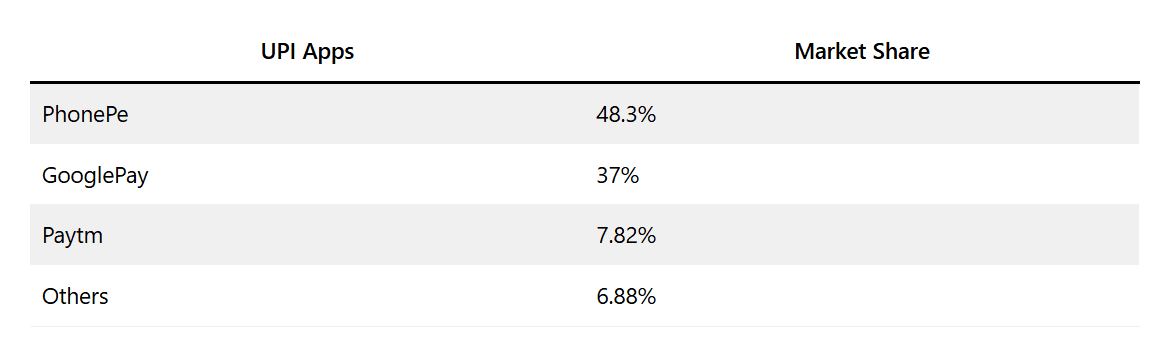

UPI App Market Share Highlights

- PhonePe dominates the UPI ecosystem with a 48.3% market share, making it the most widely used UPI app in India.

- Google Pay holds second place, capturing 37.0% of total UPI transactions, driven by strong Android integration and merchant adoption.

- Paytm accounts for 7.82% of the UPI market share, reflecting its continued presence despite intense competition from leading apps.

- Other UPI apps collectively contribute 6.88%, showing a highly concentrated market led by two major platforms.

- The top two apps control over 85% of UPI usage, highlighting limited fragmentation and strong network effects within India’s digital payments landscape.

Growth and Usage Statistics

- UPI transaction volume hit 21.63 billion in December 2025, up 29% YoY, with a daily average of 698 million.

- UPI value reached ₹27.97 trillion in December 2025, up from ₹26.32 trillion in November.

- UPI holds 84.8% share of retail digital payments volume in H1 2025.

- Rural UPI adoption stands at 38% preference, limited by 4G coverage in 45,000+ villages.

- UPI supports 13+ languages via BHIM, expanding to more regional vernaculars.

- UPI merchant coverage leaves 70% pincodes with under 500 active UPI merchants.

- UPI targets 90% of India’s mobile payments by 2026-27.

Transaction Volume and Value

- UPI recorded ₹27.97 trillion ($336 billion) transaction value in December 2025, up from ₹26.32 trillion in November.

- UPI processed 21.63 billion transactions in December 2025, the highest monthly volume on record.

- Annual UPI volume reached 228.3 billion transactions in 2025, surging from 172.2 billion in 2024.

- Annual UPI value hit ₹299.7 lakh crore in 2025, up from ₹246.8 lakh crore in 2024.

- P2M transactions dominated with 63% volume share in May 2025, versus 37% P2P.

- Average UPI transaction size dropped to ₹1,293 in December 2025, signaling small-ticket growth.

- UPI captured 84.8% of retail digital payments volume in H1 2025.

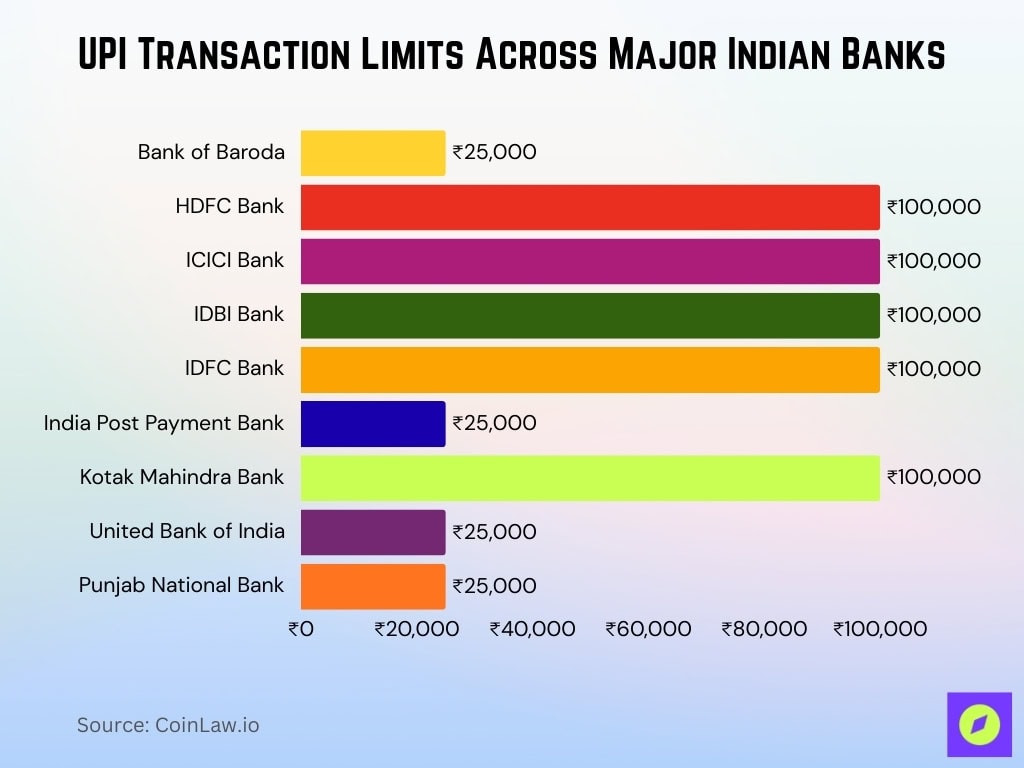

UPI Transaction Limits Across Major Indian Banks

- ₹100,000 is the most common UPI transaction limit, offered by leading private and public banks such as HDFC Bank, ICICI Bank, IDBI Bank, IDFC Bank, and Kotak Mahindra Bank.

- Four major banks cap UPI transfers at ₹25,000, including Bank of Baroda, Punjab National Bank, United Bank of India, and India Post Payment Bank.

- Private sector banks generally provide higher UPI limits, supporting larger daily transfers for retail and business users.

- Public sector and payment banks tend to impose lower limits, reflecting stricter risk controls and a focus on basic digital transactions.

- The gap between ₹25,000 and ₹100,000 limits highlights uneven UPI access, which can directly impact high-value peer-to-peer and merchant payments.

Technological Developments in UPI

- UPI AutoPay transactions exceeded 1.27 billion in November 2025, up over 10x from January 2024.

- UPI Lite wallet limit raised to ₹5,000, with per-transaction cap at ₹1,000 for offline low-connectivity use.

- UPI soundbox supports 10+ Indian languages for voice confirmation, aiding merchants and accessibility.

- UPI Autopay recurring mandates share rose to 60% of total, surpassing card-based options.

- AI-driven fraud detection leverages anomaly analysis, cutting false positives and adapting to new threats like deepfakes.

- UPI Autopay processed 926 million transactions for the top 10 banks in November 2025, doubling YoY.

- Geo-fencing adoption hit 62% among users for location-based transaction restrictions.

- Multi-bank UPI linking enables 34% adoption for single-handle multi-account management.

Blockchain Integration in UPI

- NPCI sponsored India Blockchain Week 2025, exploring UPI-blockchain for settlements and cross-border remittances.

- Blockchain-UPI pilots target 18% cut in cross-border remittance costs via direct peer-to-peer transfers.

- UPI upgrade slashed API response from 30 seconds to 15 seconds, boosting throughput 66%.

- Falcon Hyperledger project enables blockchain audit trails for high-value UPI compliance tracking.

- Programmable UPI pilots integrate with CBDC for smart contract-based payments by end-2025.

- Blockchain interoperability testing advances via hackathons for cross-chain UPI global systems.

- Decentralized KYC on blockchain reduces verification time from days to 5-10 minutes.

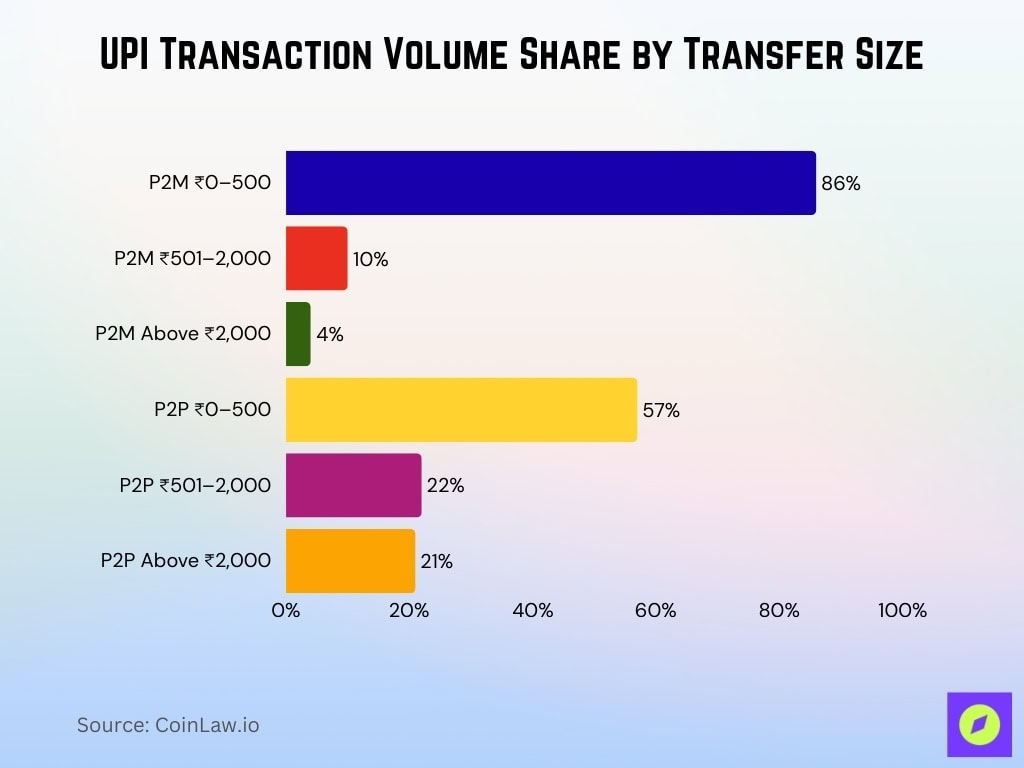

UPI Transaction Volume Breakdown

- Low-value P2M (₹0-₹500) transactions held 86% share within merchant payments.

- Mid-range P2M (₹501-₹2000) accounted for 10% of merchant transaction volume.

- High-value P2M (above ₹2000) represented just 4% of merchant payments.

- Small P2P transfers (₹0-₹500) dominated with 57% volume share.

- Moderate P2P (₹501-₹2000) made up 22% of peer-to-peer transactions.

- Large P2P transfers (above ₹2000) captured 21% of P2P volume share.

- Total UPI volume hit 21.63 billion transactions in December 2025, up 29% YoY.

- P2M transactions captured 63% of total UPI volume, dominating retail payments.

- P2P transactions comprised 37% of total volume, powering personal transfers.

Cyber-safety in UPI Transactions

- UPI fraud cases reached 6.32 lakh in FY25, totaling ₹485 crore losses, up 85% from prior trends.

- 1 in 5 UPI users faced fraud in the past 3 years, with 51% victims not reporting incidents.

- Digital payment frauds hit 13,516 cases worth ₹520 crore in FY25, 56.5% of all banking frauds.

- Biometric UPI authentication eliminates PIN risks, expected to significantly reduce fraud versus shareable PINs.

- 2FA mandatory for all UPI transactions via PIN, OTP, or biometrics.

- Pull UPI transactions (3% of volume), discontinued October 2025 to curb unauthorized approvals.

- Dynamic QR codes enable precise amount encoding, used widely for error-free merchant payments.

- NPCI real-time monitoring flags unusual patterns like rapid payments or new beneficiaries.

UPI and Fintech Innovations

- India’s BNPL market reached $24.86 billion in 2025, projected to reach $30.45 billion in 2026 at 22.5% growth.

- UPI-linked BNPL GMV grew at 34.2% CAGR from 2022 to 2025, forecast 15.5% CAGR from 2026 to 2031.

- UPI credit line cash withdrawal capped at ₹10,000 daily, P2P up to 20 transactions.

- UPI high-value limit raised to ₹10 lakh for insurance premiums and capital market funding.

- UPI AutoPay mandates hit 1.27 billion in November 2025, up 10x from January 2024.

- UPI AutoPay enhanced to ₹1 lakh for insurance, mutual funds, and credit cards.

- UPI Lite introduces auto top-up mandates for seamless balance reloads up to ₹5,000.

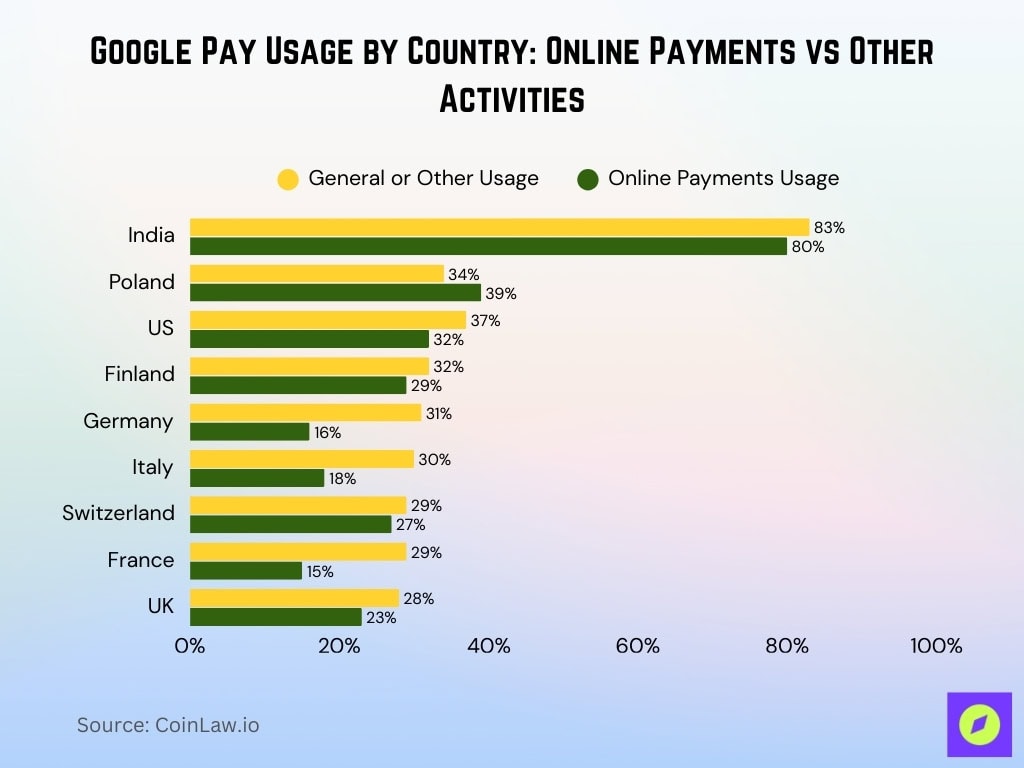

Global Usage of Google Pay for Online Payments vs Other Activities

- India leads with 83% general usage and 80% for online payments via Google Pay.

- Poland shows 39% online payment usage versus 34% general, favoring e-payments.

- United States records 37% for other purposes and 32% online payment usage.

- Finland usage at 32% general and 29% online payments, nearly balanced.

- Germany sees 31% general tasks versus 16% online payments usage.

- Italy reports 30% other tasks, but only 18% for online payments.

- Switzerland’s usage stands at 29% general and 27% online payments.

- France has 29% other activities and 15% online payments.

- United Kingdom shows 28% other tasks and 23% online payments usage.

Credit Lines Through UPI

- UPI credit lines available up to ₹5 lakh based on credit score for select users.

- UPI credit transactions exceed ₹10,000 crore monthly, growing steadily.

- 62% of UPI credit users represent first-time borrowers, aiding inclusion.

- Pre-approved UPI loans process in under 6 minutes for digital users.

- Average UPI credit line disbursed at ₹17,200, suiting micro-entrepreneurs.

- UPI credit interest rates are 10-18% annually, often lower than 12-18% cards.

- 7.4 million users accessed UPI credit by mid-2025, up 41% YoY.

- New-to-credit loans grew 4% in high-UPI areas, with ≤2% default rates.

UPI Vouchers and Rewards

- UPI prepaid vouchers capped at ₹10,000 each, redeemable at designated merchants nationwide.

- eRUPI P2P vouchers range from ₹1 to ₹10,000, launched for the food category with expanding use cases.

- Festival UPI volumes surged to 20.7 billion transactions worth ₹27.28 trillion in October 2025.

- BHIM-UPI small merchant incentive revised to 0.15% for transactions up to ₹2,000.

- UPI cashback credit cards offer a minimum 1.5% on offline transactions, auto-credited to accounts.

- Loyalty market projected at $3.58 billion in 2025, doubling to $6.40 billion by 2029 via UPI-AI.

- 74.2% of UPI users reported increased spending due to convenience and rewards.

UPI’s Role in International Expansion

- UPI lives in 8 countries: Bhutan, Singapore, Qatar, Mauritius, Nepal, UAE, Sri Lanka, and France.

- Talks are underway with 7-8 more countries, including East Asia, for UPI acceptance.

- Cross-border UPI transactions grew 20-fold in one year to mid-2025.

- Malaysia finalized the UPI agreement in 2025 for the Kuala Lumpur merchant rollout.

- Cyprus and Qatar added UPI in June/September 2025 for EU and Gulf expansion.

- 30+ countries in discussions for UPI pilots by end-2025.

Regulatory Updates and Security Enhancements

- Daily UPI limit set at ₹1 lakh for general users, up to ₹10 lakh for P2M sectors like insurance.

- Biometric authentication enables payments up to ₹5,000 without PIN entry.

- 20 maximum UPI transactions allowed per day across apps.

- AI-driven alerts warn users of suspicious transactions, reducing scams via shared fraud intelligence.

- Dynamic QR codes are recommended for P2M to cut erroneous transfers, mandatory where feasible.

- Chargeback rules streamlined with strict TATs, enabling faster genuine claim reprocessing.

- 50 daily balance checks permitted per UPI app via manual requests.

Frequently Asked Questions (FAQs)

In December 2025, UPI recorded a monthly high of 21.6–21.63 billion transactions.

UPI processed approximately 228 billion transactions in 2025.

PhonePe held over 45 % share by volume among UPI apps in late 2025.

Conclusion

UPI’s trajectory has redefined digital payments, transforming everyday transactions and promoting financial inclusivity on an unprecedented scale. With new features like international payments, enhanced security, and continuous technological upgrades, UPI’s ecosystem is evolving to meet the diverse needs of millions. As it continues to expand globally and integrate with emerging fintech innovations, UPI stands as a benchmark in digital payment systems. The future looks promising for UPI, as it empowers users, businesses, and governments alike with safe, efficient, and universal access to digital payments.