Imagine you’ve planned the perfect vacation: destination set, tickets booked, itinerary ready. But what if something unexpected happens, an injury, a flight cancellation, or lost luggage? This is where travel insurance becomes crucial, offering a safety net that can transform travel mishaps into manageable inconveniences rather than expensive disasters.

In recent years, as travel becomes more accessible and global challenges such as the pandemic underscore the importance of health and safety, travel insurance has evolved from an optional luxury to an essential item for many travelers. This article explores the current state of the travel insurance industry, diving into key trends, market size, and consumer behaviors that shape this booming sector.

Editor’s Choice

- The global travel insurance market value hit approximately $30.77 billion in 2025 and is projected to grow at a 16.8% CAGR through 2029.

- Medical expense coverage adoption climbed to 80.8% in 2025, reflecting a sharp rise in consumer prioritization of health protection.

- Average U.S. travel insurance premium reached $311 per policy in 2025, averaging about $21 per day for a typical 15‑day trip.

- Gen Z and Millennials now make up 60% and 54% respectively of U.S. travel insurance buyers in 2025.

- Travelers increasingly buy insurance due to flight disruptions or accidents, with 31% citing that as the key motivator this summer.

- COVID‑19 influence remains, though not quantified recently; pandemic‑related coverage is still commonly included.

- Leading providers such as Allianz, AIG, and Berkshire Hathaway continue to dominate, though specific 2025 market share data is not available.

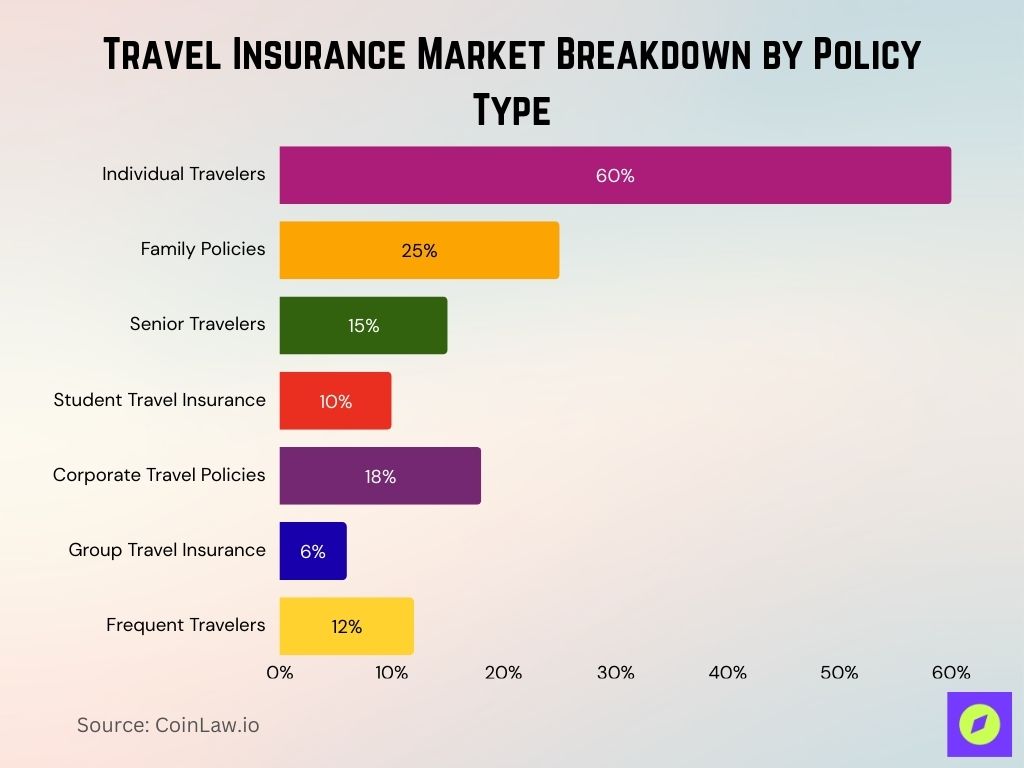

By End User

- Individual travelers remain the dominant segment, making up approximately 60 % of policies in 2025 as solo and business travel continue strongly.

- Family policies account for around 25 % of sales in 2025, often covering multiple members with child‑friendly provisions.

- Senior travelers represent about 15 % of policies purchased in 2025, highlighting their focus on comprehensive medical protection.

- Student travel insurance now comprises roughly 10 % of policies, reflecting growth among those studying or traveling abroad.

- Corporate travel policies make up about 18 % of the market, as more companies include insurance in employee benefits.

- Group travel insurance covers around 6 % of policies in 2025, particularly for education, sports teams, and leisure tours.

- Annual multi‑trip policies preferred by frequent travelers hold about 12 % of the market, offering unlimited trips throughout the year.

Market Size and Growth Projections

- Global market size reached about $30.77 billion in 2025 and is expected to grow at a 16.8% CAGR through 2029.

- Asia-Pacific revenue reached approximately $8.06 billion and is projected to expand at a 16.7% CAGR from 2025 to 2030.

- North America continues to grow steadily, with previous projections suggesting around 5.9% CAGR through 2028.

- Europe accounted for nearly 39% of the global market share and is expected to remain a leading region.

- Single-trip policies made up about 46% of the market while interest in annual multi-trip options continues to rise.

- Domestic travel insurance is still growing, though updated 2025 figures are not yet confirmed.

- Demand for specialized policies such as adventure and cruise insurance continues to increase globally.

Consumer Behavior and Trends

- Travelers prioritizing medical emergencies rose to 80.8% in 2025, with average medical-related premiums reaching $123.78 per person.

- Consumers’ purchasing of travel insurance increased to 76.0% in 2025, showing greater risk awareness.

- Demand for Cancel-For-Any-Reason (CFAR) policies surged by roughly 34% year-over-year by early 2025.

- Around 36.7% of U.S. travelers secured insurance for 2025 trips, with 25% buying directly and 11.7% covered through credit cards or memberships.

- Price transparency and ease of claim processing remained priorities, with about 65% of travelers considering insurance before their next trip.

- High-end policies like cruise-specific or automated payout insurance are gaining popularity among specialized travelers.

- Growing travel anxiety led to 65% of people considering insurance, even if only 10% had purchased it previously.

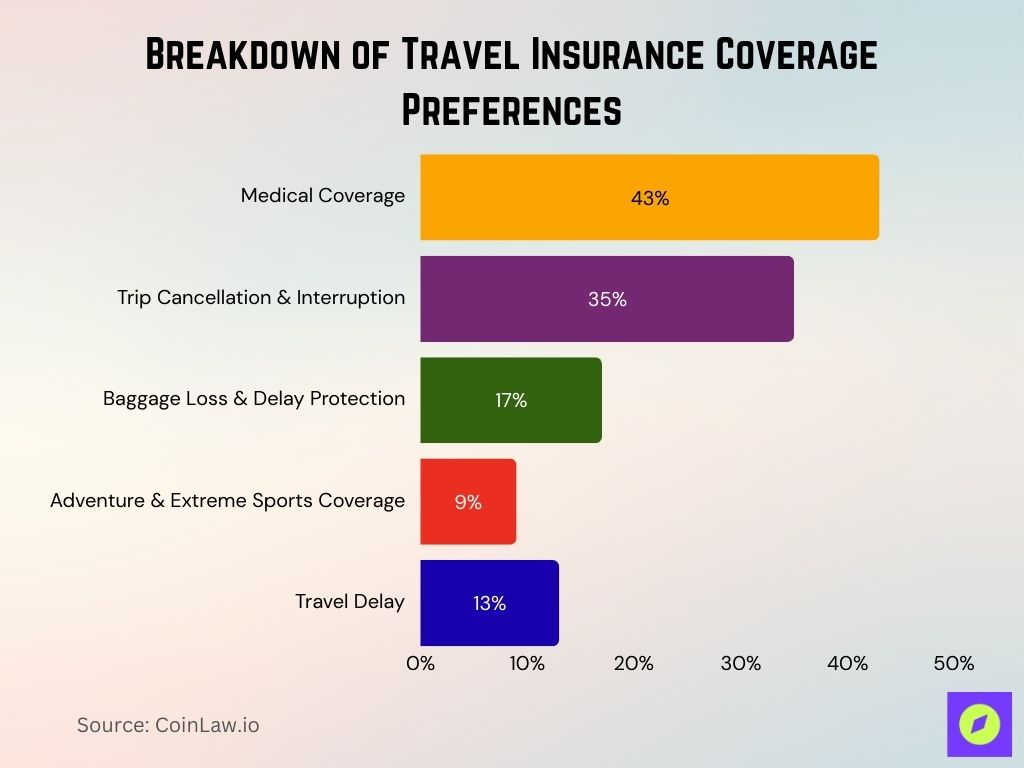

By Insurance Cover

- Medical coverage represents about 43% of policies in 2025 as travelers continue to prioritize health protection globally.

- Trip cancellation and interruption recently accounted for approximately 35% of policies, notably in international travel.

- Baggage loss and delay protection held around 17% share, responding to traveler concerns over delayed or lost luggage.

- Cancel-for-any-reason (CFAR) policies surged by about 30% in 2025, underscoring demand for travel flexibility.

- Adventure and extreme-sports coverage expanded to cover roughly 9% of travel insurance plans, reflecting interest in activities like diving and trekking.

- Pandemic-specific coverage is now included in around 65% of policies, highlighting ongoing attention to unforeseen health risks.

- Travel delay insurance accounted for about 13% of purchased policy types, showing sustained demand for smoother travel experiences.

Geographic Market Insights

- The United States maintained its position as the largest regional market with an estimated $7.71 billion in 2025 revenue, driven by strong outbound travel and renewed risk awareness.

- Europe continued to hold the largest regional share at around 35 %, with the market projected to grow at a 14.3 % CAGR from 2025 forward.

- Asia-Pacific remained the fastest-growing region with an estimated 39 % global share, reflecting rapid expansion in markets like India and China.

- Latin America saw continued growth, with insurance adoption increasing by approximately 5 % in 2025 as awareness and travel activity rose.

- The Middle East accounted for roughly 4 % of global policies, sustained by demand among high-net-worth travelers seeking premium coverage.

- Africa’s travel insurance market grew at about 2.5 % annually, as more Africans travelled for tourism, education, and business.

- Canada saw increasing engagement, with over 65 % of international trips insured, reflecting growing concerns around health and trip disruptions.

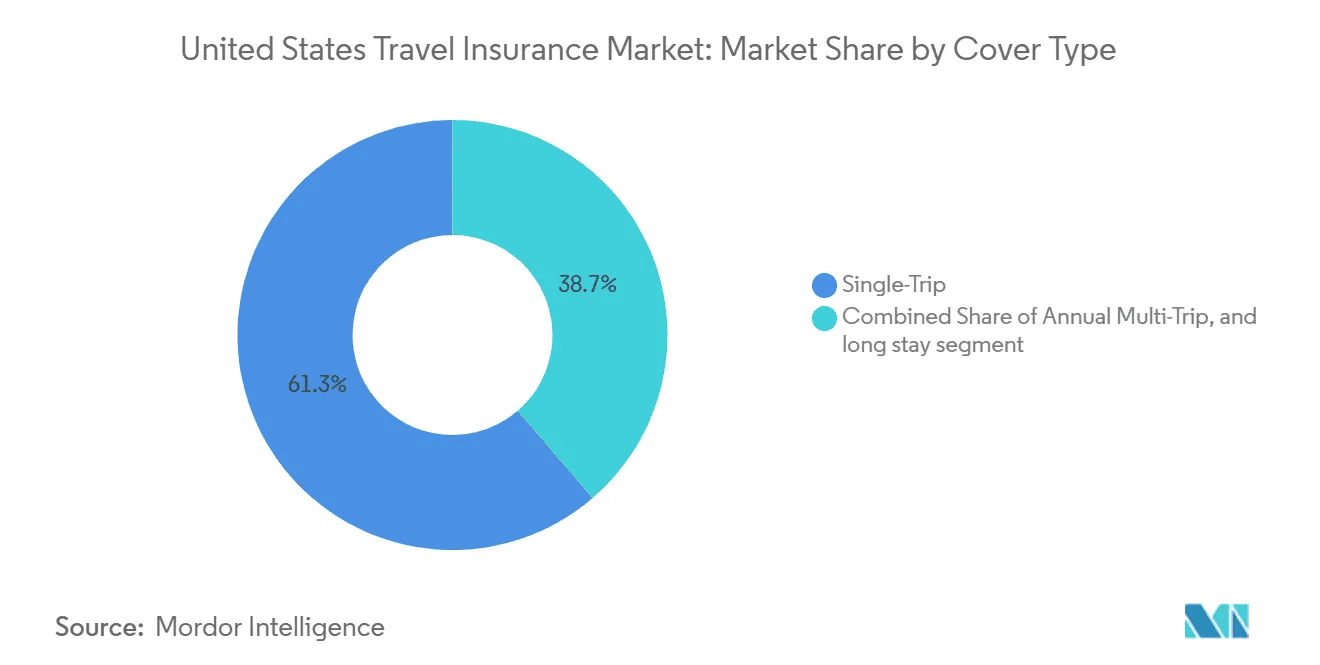

United States Travel Insurance Market Share by Cover Type

- Single-trip policies dominate the market with a 61.3% share, highlighting their popularity among occasional travelers.

- Annual multi-trip and long-stay policies account for 38.7%, reflecting demand from frequent or extended travelers.

- The single-trip segment leads due to ease of purchase, affordability, and suitability for one-off vacations or business trips.

- The combined segment (multi-trip + long-stay) is gaining traction among digital nomads, corporate travelers, and students on extended programs.

- This split suggests insurers may focus on customizing single-trip offerings while also expanding features in multi-trip and long-stay products.

Technological Innovations in Travel Insurance

- AI-driven underwriting and claims processing cut settlement and handling times by up to 50% in 2025, while reducing operational costs by 20–50%.

- Only 11% of insurers have fully adopted AI in 2025, though an additional 49% are implementing it at scale.

- Telemedicine is now included in around 35% of travel insurance policies, offering insured travelers access to online medical consultations.

- AI-powered fraud detection and automation continue to save insurers billions, though the exact 2025 numbers are not yet available.

- On-demand insurance, covering day-by-day or hourly travel, accounts for approximately 15% of new travel insurance offerings.

- Geolocation services are now used by over 25% of providers to assist travelers during delays or emergencies.

- Digital claims processing platforms expanded greatly in 2025, with leading providers offering full-service mobile apps for instant claims handling.

Australian Travel Insurance Behavior: Survey Insights

- 73% of Australians purchase standalone travel insurance through agents, airlines, or providers for overseas protection.

- 27% do not buy a standalone policy, opting instead for alternative coverage or none at all.

- 13% choose to travel completely uninsured, risking exposure to massive medical bills.

- 14% rely on credit card travel insurance, which often includes limited coverage, high annual fees, and spending requirements.

- Among the uninsured, 8% gave reasons for skipping coverage:

- 3% said they “weren’t worried” about getting insurance.

- 5% believed “nothing bad would happen.”

- These insights reflect a growing need for education on travel risk, especially for those depending solely on credit card benefits or skipping coverage altogether.

Top Impacting Factors

- Pandemic-related concerns still drive choices for about 65% of travelers in 2025, showing lingering caution among globetrotters.

- Political instability elevated demand by approximately 12% for policies offering evacuation and crisis response in 2025.

- Climate-related disruptions remain key, with about 5% of policies now including extreme weather coverage for hurricanes, floods, and wildfires.

- Rising medical costs continue to push travelers toward plans with enhanced health benefits for high-expense destinations.

- Eco-conscious travelers are fueling growth in green policies with carbon offset options and incentives for low-impact travel.

- Economic pressures pushed basic coverage sales up by about 18% in 2025, reflecting budget-conscious consumer behavior.

- Older people over 65 are increasingly purchasing travel insurance, especially policies with advanced medical coverage and assistance features.

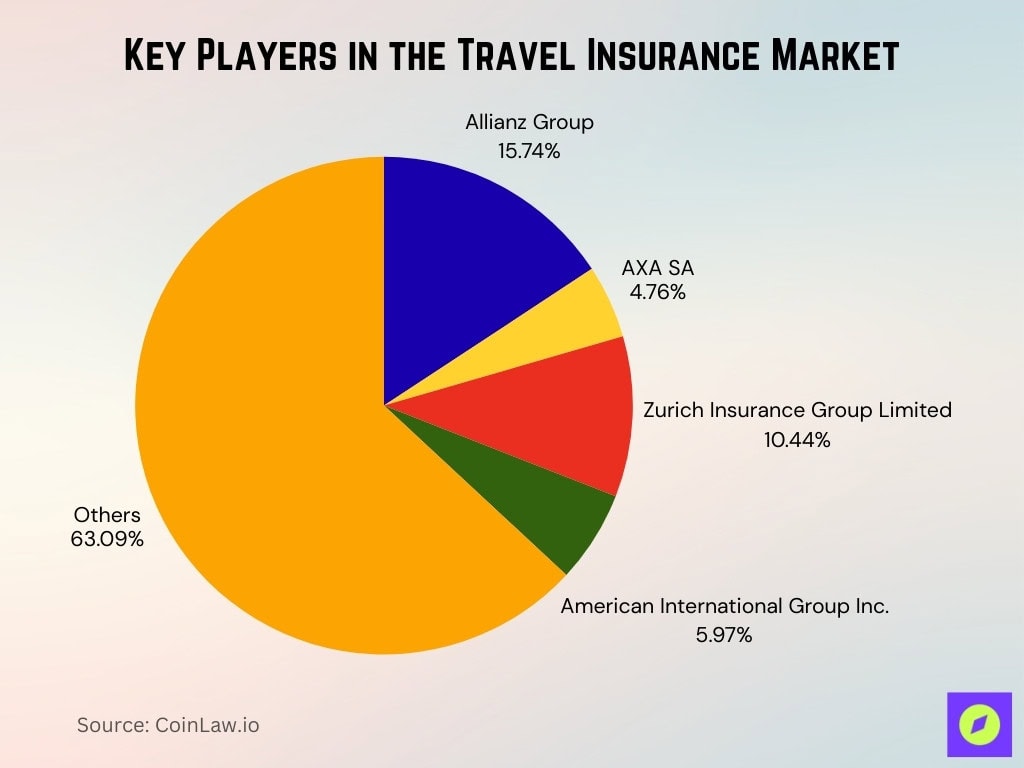

Key Players in the Travel Insurance Market

- Allianz Group holds 15.74% of the market, making it the leading individual provider in the travel insurance space.

- Zurich Insurance Group captures 10.44%, ranking as the second-largest player among branded insurers.

- American International Group (AIG) controls 5.97% of the global market share.

- AXA SA accounts for 4.76%, with a solid presence in both Europe and global travel corridors.

- The “Others” category dominates with 63.09%, indicating a highly fragmented market filled with regional and niche providers.

- This distribution highlights the competitive landscape and the opportunity for consolidation or innovation-led growth among smaller players.

US Travel Insurance Industry Overview

- US travel insurance premiums rose to about $5.5 billion, maintaining strong momentum into 2025 amid growing domestic and international demand.

- Trip cancellation coverage remains highly popular, accounting for roughly 40% of US policies, driven by travelers’ concerns over last-minute disruptions.

- Emergency medical coverage is crucial, with about 80.8% of policies in 2025 now including medical benefits to offset high healthcare costs overseas.

- Online and mobile sales dominate the market with an estimated 70% of US travel insurance purchased via digital platforms.

- Cruise-specific policies continue to hold about 13% of the US market, reflecting the need for tailored coverage.

- Domestic-only travel insurance now represents over 25% of US policy sales, as more Americans choose to explore closer to home.

- The Cancel-for-Any-Reason (CFAR) add-on remains in demand, included in approximately 18% of US policies, offering flexibility without stated cause.

Recent Developments

- Allianz Partners rolled out the Allyz TravelSmart app, offering enhanced AI-powered assistance, digital claims, geolocation, and safety alerts.

- Zurich completed its $600 million acquisition of AIG’s Travel Guard portfolio in late 2024, creating a combined entity with about $2 billion in annual premiums.

- AXA introduced its Bronze Travel Protection Plan for summer 2025, featuring essential medical coverage, evacuation benefits, and starting from $37 per policy.

- AXA Partners US enhanced policies in 2025 by incorporating 24/7 non-insurance travel assistance and a 10-day free look period for added flexibility.

- Travelex expanded its policy suite with enhanced plans offering up to $250,000 medical, $50,000 trip cancellation, and $75,000 trip interruption coverage.

- Insurtech players like Seven Corners maintained strong positioning for 2025, ranking among the top picks for large-group travel plans.

Conclusion

In a world where travel presents both endless opportunities and potential risks, travel insurance has become a cornerstone of smart planning. From covering medical emergencies and cancellations to responding to global trends like sustainable travel, the industry has adapted to meet evolving demands. As technology shapes the industry through AI and blockchain, and new types of coverage emerge for eco-friendly and flexible travelers, the travel insurance market is set for dynamic growth. Whether it’s a family vacation, a solo adventure, or a business trip, securing the right coverage can make all the difference in navigating the unexpected on your journey.