Tesla shares dropped more than 4 percent after the European Automobile Manufacturers’ Association (ACEA) reported a continuing slide in the company’s electric vehicle registrations across Europe. The decline is raising questions about Tesla’s competitive footing in its formerly strongest markets.

Key Takeaways

- In August 2025, Tesla registered just 14,831 vehicles across Europe, down about 22 to 23 percent year over year, even as overall EV registrations jumped

- August marked Tesla’s eighth consecutive month of declining sales in the region

- Tesla’s European market share slipped to 1.5 percent from 2.3 percent a year earlier

- Chinese EV maker BYD outsold Tesla in the EU in August, with registrations up 200 percent

- Despite weakness in Europe, analysts still expect Q3 global deliveries to beat expectations due to strong U.S. demand

What Happened?

Tesla’s European operations came under renewed pressure in August, according to ACEA’s latest data. While the broader European market for battery-electric and plug-in hybrid vehicles was on the rise, Tesla’s registrations continued to fall – a stark contrast that has alarmed investors and industry watchers.

The decline hit across key markets: France saw a 47 percent drop in registrations, Sweden fell 84 percent, and Denmark 42 percent. Norway stood out as a rare upside, with Tesla registrations rising nearly 22 percent. In total, Tesla’s European sales in the first eight months of 2025 fell to 133,857 units, down 32.6 percent from the prior year.

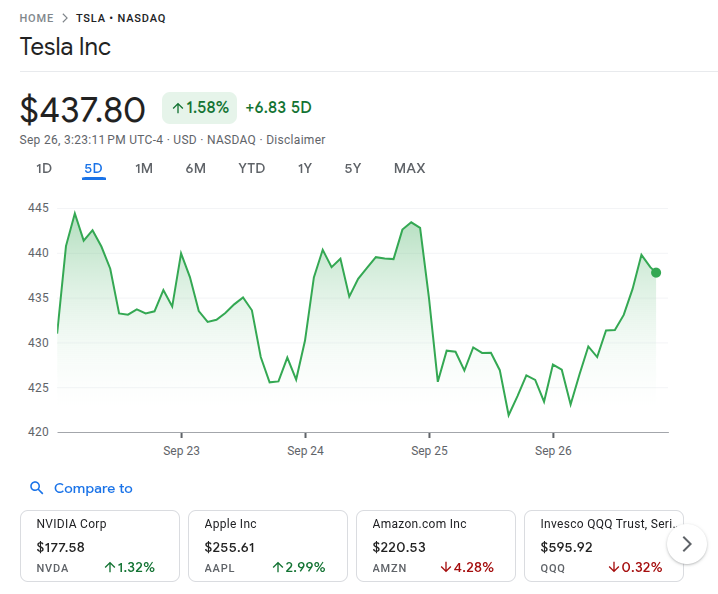

Investors reacted swiftly. Tesla’s stock dropped 4.38 percent, closing near $423.39, before modest gains in pre-market activity. The market’s sharp response underscores how regional sales performance is now directly affecting investor sentiment. As of writing this news, the stock has bounced to $437.

Competitive Pressure from Chinese Entrants

Tesla’s struggles come as Chinese EV makers surge in Europe. BYD, in particular, registered 9,130 vehicles in August compared to Tesla’s 8,220, an increase of over 200 percent year over year. This marks the second month in a row BYD outsold Tesla in the EU.

Meanwhile, EV and hybrid vehicle registrations across Europe are growing quickly. Battery EVs rose nearly 30 percent and hybrids by 54 percent, highlighting that Tesla is missing out on a growing market.

Consumer preferences are also shifting. A recent Escalent survey shows that 47 percent of European buyers would consider a Chinese EV, compared to 44 percent who prefer U.S. brands, a reversal from 2024.

Reputational Challenges and Brand Headwinds

Tesla is also suffering from CEO Elon Musk’s political controversies, especially in Europe. His public support for far-right parties and controversial appearances have drawn criticism and may be contributing to Tesla’s reputational decline in key markets.

In France, Tesla sales fell by 47 percent year over year, despite the broader auto market growing slightly. Similar patterns were seen in Sweden and Denmark, while Germany and the UK data are still pending.

Financials and Valuation Pressures

Despite the downturn, analysts remain split. Optimists point to Tesla’s investments in AI, autonomy, and robotics, with firms like Piper Sandler raising their price target to $500. Wedbush’s Dan Ives even sees a long-term path to a $2 trillion valuation if Tesla delivers on its tech roadmap.

Still, Tesla’s stock trades at a P/E ratio above 240, making it one of the most expensively valued companies in the world. That leaves little room for error, especially as margins decline due to aggressive price cuts.

Outlook and What to Watch

- Q3 delivery report is expected in early October. Forecasts range from 456,000 to 475,000 vehicles, potentially marking Tesla’s best quarter yet

- U.S. tax credit deadlines helped pull forward demand in Q3, but may leave a gap in Q4

- Tesla’s automotive gross margin has slipped to the low teens, raising concerns about profitability trends

- Germany and UK sales figures, still to be reported, will be crucial to see if the European slide continues

CoinLaw’s Takeaway

In my view, Tesla’s slump in Europe is no longer just a headline. It’s a serious red flag. This isn’t just a seasonal dip or a supply hiccup. Tesla is losing share in a market that is accelerating, while its competitors, especially BYD and Volkswagen, are pulling ahead.

That said, Tesla still has its U.S. and China strongholds, and if it can reignite growth with a new affordable EV or refreshed models, it may regain some of its European footing. But this is a pivotal moment. The company has to prove it’s more than just hype and past success. In my experience, when a brand loses trust and momentum, it takes more than good technology to turn things around.